1. Introduction

Forecasting defaults and managing risks associated with personal loans stand as key concerns in finance. In the midst of financial market volatility and escalating risks, it becomes crucial for financial entities and private lenders alike to accurately forecast the default risk of personal loans and promptly implement appropriate risk management strategies.

As information technology evolves and data becomes widely applied, the study of personal loan default risk management, grounded in Bayesian game theory, has garnered significant focus in the paper [1]. Bayesian game theory, rooted in statistical probability, serves as a decision-making framework, aiding scholars in comprehending and forecasting the likelihood of personal loan defaults to formulate appropriate risk management approaches [2].

The objective of this research is to analyze the forecasting and handling of personal loan defaults through the application of Bayesian game theory in conjunction with big data technology. Our focus will be on examining the personal loan dataset, developing a Bayesian game model, pinpointing the risk elements associated with personal loan defaults, and creating a risk assessment model to enhance the precision and immediate accuracy in predicting personal loan defaults.

The research aims to advance both theoretical and practical aspects: firstly, by integrating Bayesian game theory into personal loan risk management, it seeks to broaden the scope of financial risk management research; secondly, by empirically confirming the precision and efficacy of predictions, it seeks to develop more dependable risk management instruments for both financial entities and individual lenders.

However, there are still several research gaps and limitations that need to be addressed. The research scope is confined to the realm of individual loans, excluding other varieties of loans or financial instruments. The emphasis is squarely placed on three primary categories: personal loans for consumer goods, personal housing, and personal vehicle loans. Different categories of loans such as business loans or corporate banking products are beyond the scope of this study. Second one is time duration limitations. The research is confined to a specific time period, namely the past few years or a specified time range. The study aims to analyze historical loan data and evaluate the effectiveness of Bayesian game theory in predicting individual loan defaults and managing associated risks within this limited time frame. Third one is data source limitations. This research relies on data from specific sources, such as banking institutions or lending platforms. The usage of loan data from these sources restricts the generalizability of the findings to other institutions or platforms. However, it provides valuable insights into the application of Bayesian game theory in individual loan default prediction and risk management within the context of the selected data sources. Last one is methodological limitations. It is important to acknowledge the limitations of the employed methods and models. The current research is focused on Bayesian game theory and may not comprehensively explore other potential models for loan default prediction and risk management. Consequently, alternative methodologies such as machine learning algorithms or statistical models remain unexplored and represent potential areas for future research.

In the following chapters, the author will specifically discuss data collection and processing, Bayesian game model construction, empirical analysis and results discussion, so as to comprehensively discuss the research of personal loan default prediction and risk management based on Bayesian game theory [3]. Finally, it is hoped that this study will provide better risk management strategies for the financial industry and promote the stable and healthy development of the financial market.

2. Literature Review

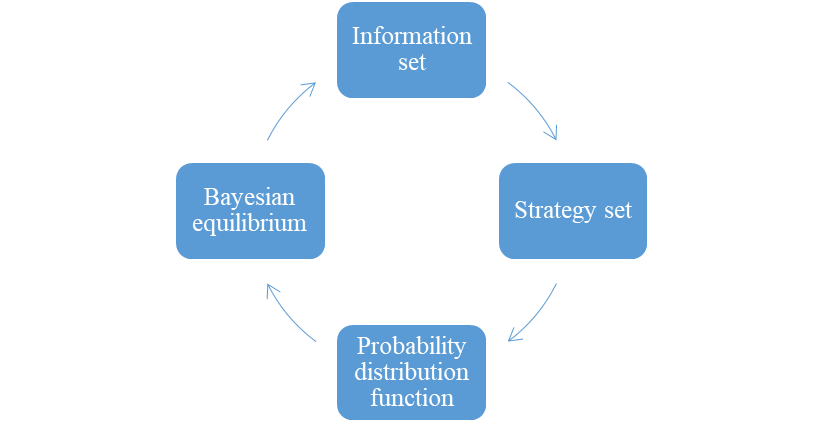

Figure 1: Bayesian game theory model structure

As an important game theory, Bayesian game theory is widely used in the research of default prediction and risk management in the field of personal loans. Bayesian game theory mainly studies the game process in which the participants make decisions according to the estimation of the opponent's information and the adjustment of their own strategies in the case of incomplete information. Predicting personal loan default and risk management, there is information asymmetry between lender and borrower. Bayesian game theory can help to accurately evaluate the information and interests of all parties, in order to increase the precision of default prediction and the effectiveness of risk management in Figure 1.

The model structure of Bayesian game theory mainly includes information set, strategy set, probability distribution function and Bayesian equilibrium. The information set refers to the information known to the participant and the estimation of the opponent's information; the participant's choice of action is the policy set; The participant's probability estimate of the opponent's actions is described by the probability distribution function; the Bayesian equilibrium means that the participant chooses the best strategy according to the optimal expected utility with incomplete information. By establishing the Bayesian game theory model, personal lenders can more accurately predict the default risk of borrowers, formulate reasonable risk management strategies, reduce the loan default risk, and improve the loan profit margin. Addressing the issue, this document suggested a dynamic defense strategy choice grounded in static Bayesian game theory, developed a static Bayesian game model. Utilizing a blend of strategies, the Bayesian balance of the attacker is considered as the defender's forecast of the attacker's actions perform a defense strategies selection algorithm [4].

Bayesian game theory has important application value in personal loan default prediction and risk management. By studying Bayesian game theory model, we can better understand and deal with the risk challenges in the field of personal loan. Within the realm of a high-cost, derivative-free black-box environment, the availability of algorithmic methods to achieve game equilibria is scarce suggest an innovative method based on Gaussian processes for resolving games in this scenario adheres to a traditional Bayesian optimization model [5], involving successive sampling choices reliant on acquisition functions. Assigning probabilities to various interacting agent types creates a strategic interaction akin to a Bayesian game presents a method for interval-oriented fuzzy Bayesian games, relying on interval-based fuzzy probabilities to model the various agents engaged in the interaction [6].

3. Methodology

3.1. Construction of Loan Default Forecast Model

In the study of personal loan default prediction and risk management based on Bayesian game theory, the construction of loan default prediction model is a very critical step: To construct an effective loan default prediction model, we need to first determine the input and output of the model. In this model, we take personal loan default as output variables, while personal information, credit record, financial status and other factors as input variables [7].

For constructing a predictive model, the author may employ traditional mathematical techniques like logical regression, decision tree, support vector machine, among others. Logistic regression stands out as a frequently employed algorithm for classification, with its mathematical formulation detailed in the model (1):

\( P(Y=1|X)=\frac{1}{1+{e^{-({β_{0}}+{β_{1}}{X_{1}}+{β_{2}}{X_{2}}+...+{β_{n}}{X_{n}})}}} \) (1)

YXβ In this formula, represents the probability of loan default, is the input variable, is the regression coefficient. Logical regression makes a categorical prediction by performing a sigmoid function transformation of linear combinations of input variables to obtain a probability value between 0 and 1.

By establishing appropriate mathematical models, the author can more accurately predict the probability of personal loan default, so as to conduct effective risk management and control. In practice, we can combine real data for model training and validation to improve the accuracy and reliability of prediction.

3.2. Risk Management Strategy Design

In the study of loan default prediction and risk management, it is crucial to design effective risk management strategies. The author can use big data and machine learning technology to analyze and model the borrower's basic information, credit records, repayment records and other data to predict its default probability. A risk assessment model can be established to classify the risk levels of different borrowers and formulate the corresponding loan amount and interest rate strategies. It is also crucial to establish sound risk control measures, including the establishment of a reasonable loan guarantee system, strengthening post-loan management and monitoring, and the establishment of risk reserves.

In the risk management, a timely risk early warning mechanism is also essential. By establishing an effective early warning model, the repayment situation of the borrower is monitored and early warning, and corresponding measures are timely taken to reduce the risk loss. At the same time, strengthen the information disclosure and communication of borrowers, guide them to standardize their behavior, and reduce the risk of default.

Bayesian game theory can be used as an important decision support tool in loan risk management. Bayesian game theory mainly considers the information incompleteness and uncertainty of the game participants and maximizes the loss by constantly learning and adjusting the strategies. With the help of Bayesian game theory, the behavior of borrowers can be evaluated and predicted more accurately, and the efficiency and accuracy of risk management can be improved.

The research on personal loan default prediction and risk management based on Bayesian game theory needs to comprehensively use big data analysis, machine learning, risk assessment, risk control and risk warning and other technologies and strategies aim at diminishing loan default risks and ensuring the consistent growth of financial entities [8]. In future studies, relevant models and methods can be further improved and refined to improve the accuracy and practicability of prediction and provide stronger support and guarantee for loan default prediction and risk management.

4. Empirical Analysis

4.1. Data Source and Description

Table 1: Source and description of loan default data

Data sources | Description |

Bank | Loan applicant's personal information, financial status, repayment record, etc. |

Fiduciary institution | Personal credit rating, credit report, etc. |

Credit information service | Personal repayment records, overdue circumstances, etc. |

Externality | Economic environment, industry development, etc. |

The source and description of the data is crucial in studying 'personal loan default prediction and risk management based on Bayesian game theory' in [9]. The author used loan data from several financial institutions, including personal information, financial status, repayment records, etc. For maintaining the data's precision and thoroughness, the data underwent cleansing and filtration, omitting any repetitions and absent elements.

There are multifaceted, including but not limited to data from banks, credit agencies and credit investigation agencies. The author also considered the impact of external factors on loan defaults, such as the economic environment, industry development, etc. By analyzing and modeling these data, we were able to more accurately predict the likelihood of personal loan default and develop corresponding risk management strategies.

In this study, the author will show in detail the source and description of the loan default data, and how to use these data for the research of personal loan default prediction and risk management. By thoroughly mining and analyzing the data, our aim is to develop more efficient risk management instruments and decision support for financial institutions, reduce the risk of personal loan default, and promote the stable and healthy development of the financial market.

4.2. Analysis of Model Results

After empirical analysis of the Bayesian game theory, the author obtains some important results. The author found that the model performed well in the prediction accuracy, and its prediction results were highly consistent with the actual observations, demonstrating the high predictive power of the model. The stability of the model was also verified. By verifying the data from different time periods, it was found that the model was relatively stable in different time periods and had good generalization ability.

Upon deeper examination of the model's forecasting capabilities and efficiency, the author concludes that it not only has capacity of precisely forecasting scenarios of personal loan defaults, but also provide an effective reference for risk management. Through the results of the model prediction, we can find out the potential default risk customers in time, and adopt the corresponding risk management strategies to minimize the loss of capital.

In addition, the model provides a new insight into the problem of personal loan default and provides strong support for relevant research and decision making. By analyzing the influence of different factors, the author can better understand the occurrence mechanism of personal loan default, formulate targeted preventive measures, and improve the risk management ability of lending institutions.

The personal loan default prediction and risk management research model based on Bayesian game theory performs well in forecasting ability and effectiveness, providing strong decision support for lenders [10]. In the future, the writer intends to enhance the model, boosting the precision and steadiness of the forecast, and contribute more value to the risk management work in the financial industry.

5. Conclusion

The research on personal loan default prediction and risk management based on Bayesian game theory predicts and manages the personal loan default risk, by using Bayesian game theory, big data analysis, machine learning and other technologies and methods, providing important decision support for the financial industry. In the study, the accuracy and real-time performance of the forecast can be improved to provide more reliable risk management tools for financial institutions and individual lenders. At the same time, through the establishment of risk assessment model and risk control measures to lower the likelihood of loan defaults and promote the consistent growth of financial entities. The application of Bayesian game theory can better evaluate and predict the behavior of borrowers and enhance the effectiveness and precision in managing risks. The research on personal loan default prediction and risk management based on Bayesian game theory is of great value in loan default prediction, risk management strategy formulation, etc. By further improving the model and method, it will provide more powerful support and guarantee for loan default prediction and risk management.

References

[1]. Wang Peng, & Xu Jianliang. (2022). Research on Bayesian Network Journal of Ocean University of China: Natural Science Edition (005), 052..

[2]. Lou Xinyi. (2021). Master's Thesis on Supply Chain Risk Strategy Research Based on Bayesian Update Model, Shanghai University of Finance and Economics).

[3]. Fu Xiao, Zhao Fang Fang, Shi Shiying, Zhou Yan, & Wang Shouqing. (2023). Study on revenue and risk sharing of ppp project based on Bayesian network. Construction economy, 44 (10), 96-104.

[4]. CHEN, Y., FU, Y., & WU, X. (2013, October 14). Active defense strategy selection based on non-zero-sum attack-defense game model. Journal of Computer Applications, 33(5), 1347–1349.

[5]. Picheny, V., Binois, M., & Habbal, A. (2018, July 12). A Bayesian optimization approach to find Nash equilibria. Journal of Global Optimization, 73(1), 171–192.

[6]. Asmus, T. C., Dimuro, G. P., & Bedregal, B. (2016, December 7). On Two-Player Interval-Valued Fuzzy Bayesian Games. International Journal of Intelligent Systems, 32(6), 557–596.

[7]. Xie Xueming. (2022). Establishment and application of building security index early warning model based on Bayesian network inference learning. Construction supervision, Testing and Cost (01), 32-38 + 43.

[8]. Wei Zengfan sound. (2021). Master's dissertation on Global Financial Risk contagion Pathway Research based on Bayesian Network, Beijing Jiaotong University).

[9]. Wang Rongxiang. (2023). Research on the risk identification of small, medium and micro enterprises based on Bayesian Network. Software and integrated circuits (05), 80-84.

[10]. Liu Hanbin. (2022). Master's dissertation on the sustainability of local government debt based on Bayesian model average, Dongbei University of Finance and Economics).

Cite this article

Fan,J. (2024). Investigation into Forecasting Personal Loan Defaults and Managing Risk Using Bayesian Game Theory . Advances in Economics, Management and Political Sciences,85,210-215.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Wang Peng, & Xu Jianliang. (2022). Research on Bayesian Network Journal of Ocean University of China: Natural Science Edition (005), 052..

[2]. Lou Xinyi. (2021). Master's Thesis on Supply Chain Risk Strategy Research Based on Bayesian Update Model, Shanghai University of Finance and Economics).

[3]. Fu Xiao, Zhao Fang Fang, Shi Shiying, Zhou Yan, & Wang Shouqing. (2023). Study on revenue and risk sharing of ppp project based on Bayesian network. Construction economy, 44 (10), 96-104.

[4]. CHEN, Y., FU, Y., & WU, X. (2013, October 14). Active defense strategy selection based on non-zero-sum attack-defense game model. Journal of Computer Applications, 33(5), 1347–1349.

[5]. Picheny, V., Binois, M., & Habbal, A. (2018, July 12). A Bayesian optimization approach to find Nash equilibria. Journal of Global Optimization, 73(1), 171–192.

[6]. Asmus, T. C., Dimuro, G. P., & Bedregal, B. (2016, December 7). On Two-Player Interval-Valued Fuzzy Bayesian Games. International Journal of Intelligent Systems, 32(6), 557–596.

[7]. Xie Xueming. (2022). Establishment and application of building security index early warning model based on Bayesian network inference learning. Construction supervision, Testing and Cost (01), 32-38 + 43.

[8]. Wei Zengfan sound. (2021). Master's dissertation on Global Financial Risk contagion Pathway Research based on Bayesian Network, Beijing Jiaotong University).

[9]. Wang Rongxiang. (2023). Research on the risk identification of small, medium and micro enterprises based on Bayesian Network. Software and integrated circuits (05), 80-84.

[10]. Liu Hanbin. (2022). Master's dissertation on the sustainability of local government debt based on Bayesian model average, Dongbei University of Finance and Economics).