Volume 187

Published on June 2025Volume title: Proceedings of ICMRED 2025 Symposium: Effective Communication as a Powerful Management Tool

Augmented reality (AR) is transforming luxury brands’ digital marketing by seamlessly merging physical and virtual experiences. This paper examines how AR technologies—including virtual try-ons, interactive storytelling, and immersive product displays—enhance customer engagement and reinforce exclusivity in luxury markets. Through case studies of leading brands, the study demonstrates AR’s role in crafting personalized, high-touch experiences that elevate brand perception, deepen emotional connections, and validate premium pricing. Key insights reveal AR’s effectiveness in addressing online shopping drawbacks, such as the inability to physically interact with products, by enabling virtual engagement that mirrors in-store experiences. Additionally, AR fosters intimate connections with luxury items, allowing consumers to explore intricate details and brand heritage digitally. The technology also resonates with younger, tech-savvy audiences who value innovation and interactivity. Ultimately, the research positions AR as a critical strategic tool for luxury brands to differentiate themselves, celebrate their legacy, and adapt to the digital future. By integrating AR, luxury marketers can future-proof their strategies, offering immersive experiences that blend tradition with cutting-edge technology, ensuring relevance in a competitive, evolving retail environment.

View pdf

View pdf

This paper investigates the factors contributing to the growing prominence of the Chinese luxury goods market on the global stage. By analyzing aspects such as market size, growth trajectories, consumer behavior patterns, and brand marketing strategies, it uncovers the internal dynamics driving China's increasing influence in the luxury sector. The study highlights how China's rapid economic expansion, the emergence of a vast and affluent consumer base, and the evolution of consumer values—from basic needs to identity and emotional expression—have synergistically positioned China as an indispensable market for global luxury brands. Additionally, the paper discusses challenges such as market saturation, shifting demographics, the rise of domestic luxury brands, and the impact of digitalization. Opportunities arising from technological innovation, diversified consumer preferences, and the integration of culture and luxury are also explored. Finally, the study offers a forward-looking perspective on future development trends, aiming to provide valuable insights and references for industry practitioners, researchers, and stakeholders interested in the evolution of the luxury goods industry within China and beyond.

View pdf

View pdf

This paper investigates the multifaceted nature of consumer behavior by integrating insights from classical utility theory and behavioral economics. While traditional models emphasize rational choice under budget constraints, empirical research highlights the role of cognitive biases, social norms, and digital influences in shaping real-world decisions. The analysis explores how income effects, cultural values, information accessibility, and algorithmic personalization jointly determine consumer preferences. Case studies on health-oriented and environmentally sustainable consumption illustrate the gap between stated intentions and actual behavior, underscoring the importance of trust, labelling clarity, and cognitive ease. The findings suggest that effective policy interventions must combine economic incentives with behavioral tools such as nudges and simplified information structures. By adopting a more holistic framework, this study contributes to a deeper understanding of how individuals make choices and how those choices aggregate into broader market and social outcomes. Implications for welfare policy, sustainable consumption, and personalized regulation are also discussed.

View pdf

View pdf

This paper systematically reviews the existing research on the relationship between investor sentiment and corporate innovation output, with a particular focus on the unique value of financial social media as a novel data source. By comparing traditional finance and behavioral finance theoretical frameworks, the evolution of the connotation of investor sentiment and innovative measurement methods are analyzed, especially the progress of social media sentiment analysis based on Natural Language Processing (NLP) techniques. The theoretical mechanisms of investor sentiment affecting corporate innovation output are elucidated from multiple perspectives, including information asymmetry, emotional contagion, and catering theory. Three types of empirical research paths, namely direct effect, mediation effect, and moderation effect, are summarized. The review highlights that social media sentiment data, characterized by real-time, broad coverage, and granular features, provides a new perspective for studying the relationship between investor sentiment and innovative activities. However, it also faces challenges such as text noise and algorithmic bias. Future research should focus on optimizing sentiment indicators, deepening the understanding of influence mechanisms, and integrating interdisciplinary methodologies to provide theoretical support for the healthy development of the capital market and corporate innovation decisions.

View pdf

View pdf

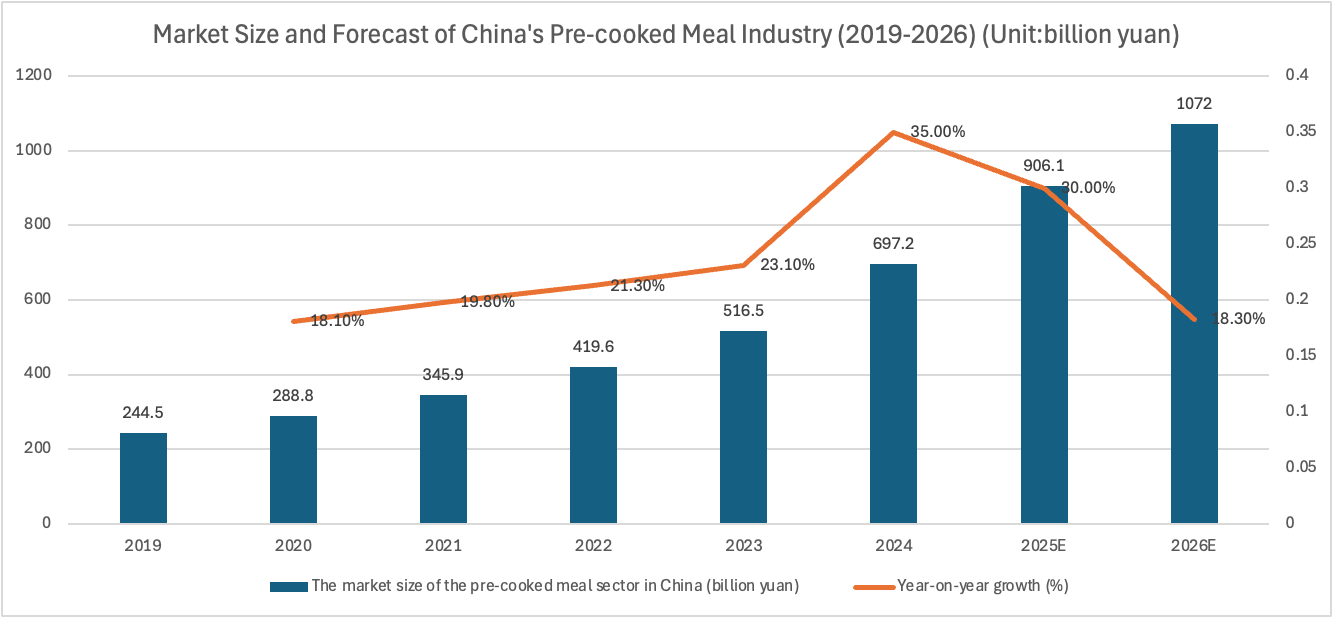

China’s pre-cooked meal kit industry is developing rapidly and has received increasing attention from the public. This study examines the industry from four key dimensions: policy support, technological background, supply chain structure, and consumer profiles. It then analyzes internationally leading meal kit enterprises, such as HelloFresh and Blue Apron, focusing on their strength in personalization, operational efficiency, ingredient transparency, and consumer engagement. Drawing on these insights, the study proposes five recommendations to support the sustainable development of China’s pre-cooked meal sector: (1) introduce dedicated regulations tailored to the characteristics of meal kits; (2) optimize supply chains through direct sourcing and digitalization; (3) enhance food safety via traceability systems and standardized nutrition labeling; (4) build consumer trust through transparent communication and participatory cooking experiences; and (5) expand personalized product offerings and accessibility in lower-tier markets.

View pdf

View pdf

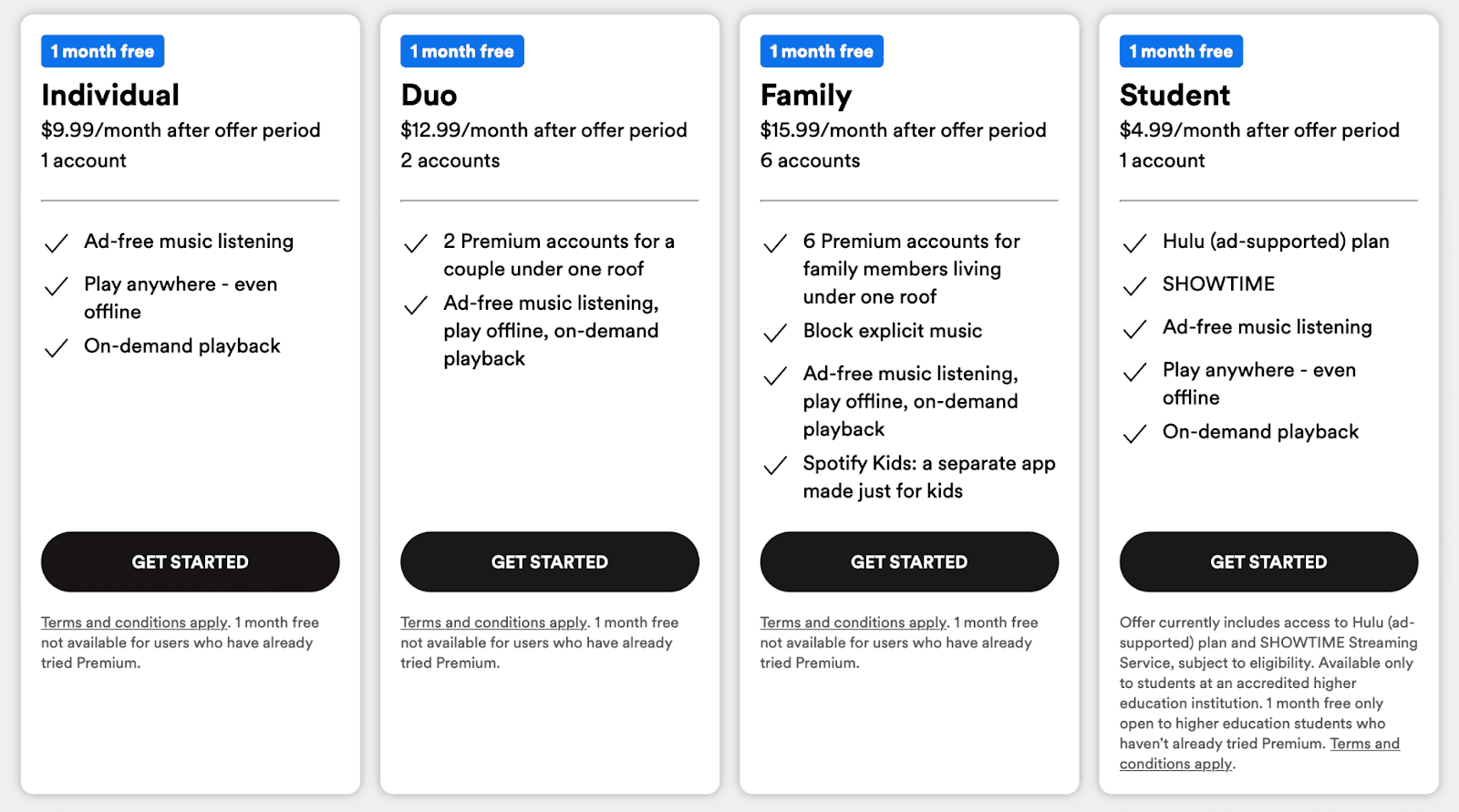

This study explores how behavioral economics principles can be effectively applied to optimize pricing strategies in the digital economy. It challenges the traditional assumption that consumers are always rational decision-makers and highlights how psychological tendencies such as the sunk cost effect, present bias, and loss aversion influence purchasing behavior. Taking Spotify as a representative case, the research shows how free trials, flexible subscription options, and promotional gifts can encourage users to convert to paid services and maintain long-term engagement. These strategies take advantage of consumers’ emotional responses, making them more likely to continue using the service after experiencing its benefits. While effective in boosting market performance and user loyalty, such strategies may also raise ethical concerns. If companies rely too heavily on psychological manipulation or fail to meet user expectations, it could result in consumer disappointment and a decline in brand trust. Therefore, the study emphasizes the importance of balancing commercial success with ethical responsibility. The research is limited by its focus on digital platforms, and future studies are encouraged to explore the impact of behavioral pricing in other sectors. Cultural and demographic factors should also be considered to better understand their role in shaping consumer responses.

View pdf

View pdf

Developing countries typically experience frequent inflation due to weak budgetary systems, fiscal deficits, and additional surprises. In recent years, digital currencies—including cryptocurrencies and central bank digital currencies ( CBDCs ) —have emerged as potential tools for addressing these challenges. This report investigates whether digital currencies substantially reduce inflation or increase monetary policy success in a growing economy. It discovered that digital currencies offer novel programmes for value transfer. However, they are not intrinsically anti-inflationary, based on economic theory, poetry, and case reports from Nigeria, Venezuela, Jamaica, and the Bahamas. Cryptocurrencies provide a hedge in deflationary settings but lack key control and stability. CBDCs have yet to significantly impact inflation outcomes despite their promise for financial inclusion and data collection. Ultimately, digital currencies may be a part of a more comprehensive system of good financial governance. This report argues for a careful yet strategic approach where modern technology complements, rather than replaces, standard fiscal and monetary policy tools.

View pdf

View pdf

China’s platform economy refers to the constituent system of digital platforms facilitating monetary transactions of goods, services, and information. This form of digital network economy has gradually turned into a large macroeconomic pillar of the current Chinese economy. It is shown that digital platforms facilitate the growth of China’s gross domestic product (GDP), alter the form of consumption, create new sources of employment, and promote industrial upgrading by deeply penetrating various sectors in society. It shows that platform-driven digital activity made up about 39 percent of China’s GDP as of 2021, which indicates deep economic penetration and a new engine for growth. At the same time, the rapid development of platforms brings about policy issues in fair competition, market regulation, and labor protection. The study explores these issues in market concentration and gig labor precarity and discuss regulatory measures taken recently. The significance of this research is to inform high-quality economic development and well-balanced policy in the digital era. The findings imply that the platform economy is a significant contributor to China’s economic expansion and structural change, yet it calls for prudent governance to maintain sustainable and inclusive development.

View pdf

View pdf

This paper studies the socio-economic challenges brought about by the rapid aging of the population in China, with particular attention to its impacts on economic sustainability, the labor market, and intergenerational equity. The study found that for every 1% decrease in the working-age population, GDP growth will decline by 0.3-0.5%. Additionally, the pension and healthcare systems are facing increasing financial pressure, and regional differences make thesise challenges more severe. Specifically, the aging of the population in coastal areas is faster than in inland areas. Meanwhile, housing inequality makes intergenerational relationships more tense, as 78% of urban assets are held by the elderly, while less than 40% of young people own homes. To solve these problems, three innovative solutions are proposed. The first is to develop an Al-driven dynamic pension system. The second is to carry out blockchain-based inter generational asset exchange. The third approach is to implement the green economy retraining program. These strategic priorities emphasize technological integration, resource flow, and policy adaptability.

View pdf

View pdf

Driven by the dynamic interplay of rapid technological innovation and heightened competition, companies increasingly turn to mergers and acquisitions (M&A) to expand market share, enhance innovation, and improve operational efficiency. This paper examines the impact of M&A on the performance of firms in the technology, media, and telecommunications (TMT) industry. Using a literature review approach, the study systematically analyzes and synthesizes the findings from existing empirical studies and theoretical frameworks. Financial indicators such as profitability and market capitalization are commonly used to assess post-merger performance; however, empirical results remain mixed. Strategic synergies, the effectiveness of knowledge integration, and the absorptive capacity of the acquiring firm are identified as key determinants of successful synergy realization. In fast-paced, high-tech environments, the timely absorption and application of newly acquired knowledge assets are critical for sustaining long-term value. Moreover, psychological and leadership factors also significantly influence M&A outcomes, with underestimation of these factors often leads to performance declines. This study highlights the critical role of both technological and human factors in achieving sustainable success in technology-driven M&As.

View pdf

View pdf