1. Introduction

In traditional economics, consumers are viewed as rational decision makers who are able to make optimal decisions when faced with information and choices, thereby maximizing personal utility. However, the rise of behavioral economics has challenged this assumption. By integrating the perspectives of psychology and economics, behavioral economics reveals that consumers are often constrained by emotions, cognitive biases, and social influences in the decision-making process, causing their behavior to deviate from the rational model. For example, consumers often ignore long-term benefits due to short-term temptations, and are also easily influenced by “cheap talk” that lacks actual evidence, thus making irrational decisions [1]. The so-called "cheap promise" refers to self-promotional statements made by merchants in the absence of verifiable information. These statements often seem positive, but lack external evidence and are easy to mislead consumers who lack experience or information [1].

In the digital economy, companies are increasingly adopting diverse pricing strategies to attract and retain consumers. However, traditional economic models often fail to explain why consumers respond strongly to strategies such as "free trials", "limited-time discounts", and "charity promotions", even if these strategies are not optimal from a cost-effectiveness perspective. There is a growing need to understand the psychological drivers behind these consumer behaviors. This article will explore how to apply the core concepts of behavioral economics (such as bounded rationality, mental accounting, and loss aversion) to optimize pricing strategies in modern business environments. Through theoretical and case analysis, this article will further explore how behavioral economics can help companies optimize pricing strategies and improve market performance and user stickiness.

2. Theoretical framework

In the field of behavioral economics, several psychological mechanisms explain why consumers often deviate from fully rational decision-making. To begin with, the concept of bounded rationality, introduced by Herbert Simon, highlights how consumers face limitations in time, information, and cognitive capacity [2]. As a result, rather than conducting comprehensive evaluations, they rely on heuristics and simplified decision rules. For example, when choosing products, consumers may prioritize brand or price while ignoring long-term performance or total value. Therefore, businesses can increase conversions by offering simplified pricing, bundled packages, and easy comparison tools that align with consumers’ decision-making processes.

Moreover, mental accounting, proposed by Richard Thaler, further explains how consumers compartmentalize money based on its source or purpose [3]. People are especially more inclined to spend bonuses or discount coupons, which they perceive as extra or reward money, rather than their regular income. Consequently, marketers can design targeted promotions, such as limited-time discounts or cashback incentives, to trigger spending from these psychological “reward accounts,” thereby enhancing purchase motivation.

In addition, the concept of loss aversion, drawn from Kahneman and Tversky’s prospect theory, emphasizes that the pain of loss is psychologically more impactful than the pleasure of gain [4]. This means that consumers tend to react more strongly to price increases than to equivalent discounts. Thus, companies often create urgency and fear of missing out through tactics like limited-time offers, countdown timers, or “last chance” sales, which can effectively drive consumers to act quickly. Furthermore, return policies and satisfaction guarantees can mitigate perceived risk, increasing consumer confidence and likelihood of purchase.

Equally important is the psychology of “free,” which suggests that consumers often overvalue items or services offered at no cost. Even when the actual value of a free product is minimal, the perception of getting something for nothing can override rational thinking [5]. As a result, strategies like free trials, gift-with-purchase offers, and free shipping are widely used to attract attention and drive conversions. Notably, free trials often create a sense of commitment or habit formation, increasing the chance of consumers converting to paid users after the trial period ends.In summary, bounded rationality, mental accounting, loss aversion, and the psychology of “free” form a fundamental framework in behavioral economics that helps explain consumer behavior. When businesses understand and apply these psychological insights in pricing and marketing strategies, they can more effectively influence decision-making, increase engagement, and enhance their competitive edge in the market.

3. Comprehensive analysis of pricing strategies

3.1. Analyzing the "freebie" strategy

The "freebie" strategy is to use people's strong attraction to the concept of "free" to stimulate consumers' desire to buy. In behavioral economics, consumers' interest in "free" goods or services often exceeds their rational evaluation of goods of equal value [6]. People have a natural preference for zero-cost items, a phenomenon known as the "free effect". Even when consumers are aware that the actual value of the free gifts is minimal, the inclusion of such items can significantly enhance their willingness to purchase. This tactic leverages the concept of mental accounting by associating the idea of "free" with added value, thus triggering a stronger purchase intention. For instance, e-commerce platforms often implement promotions such as "buy one, get one free" or "spend a certain amount to receive a discount," effectively encouraging consumers to complete transactions by framing them as rewarding opportunities. When consumers feel that they are not just buying goods, but getting an extra "free" gift, they will have a higher sense of satisfaction. Even if the actual value of these gifts is relatively small, the psychological effect they bring can stimulate consumers to make more purchase decisions.

The "freebie" strategy also involves the principle of "loss aversion". When consumers think they can get free gifts, they usually think that "losing" these gifts is a loss, which leads to a stronger desire to buy [6]. For example, many electronic products offer free gifts, such as headphones and power banks. Consumers will be more likely to make purchase decisions because they think they have received additional gifts. The "free gift" strategy can effectively attract consumers' attention and stimulate their desire to buy. Through cleverly designed gift strategies, companies can make consumers feel that the purchase is "super value" psychologically, thereby increasing sales conversion rates.

3.2. Subscription strategy

Subscription strategy is a very popular pricing method in the modern digital economy, especially for content platforms, software as a service and various online platforms [7]. Subscription pricing can not only improve the stability of corporate revenue by dividing products or services into periodic payments, but also enhance customer loyalty and stickiness through continuous revenue streams. The subscription strategy effectively utilises present bias and the "sunk cost effect". "Present bias" refers to the tendency of consumers to make choices when faced with immediate rewards and ignore future benefits [7]. For example, after the free trial period ends, many consumers tend to choose automatic renewal based on their current emotions and the services they enjoy, even if their future usage needs may not be sufficient to support long-term subscriptions. The "sunk cost effect" makes consumers reluctant to cancel their subscriptions after paying for the subscription fee because they have already invested money, even if their actual usage frequency is far lower than expected.

By converting the free trial period into automatic renewal, merchants can take advantage of consumers' underestimation of future troubles and convert them from a free user to a long-term paying user. In addition, subscription pricing is often combined with a tiered pricing strategy to provide different levels of services or product packages. This approach allows consumers to choose the right subscription level based on their needs, while also encouraging them to choose higher-end, more expensive packages to get more value-added services. The "subscription-based" pricing strategy not only has a lasting impact on consumers, but also provides companies with a predictable revenue stream and reduces the uncertainty caused by price fluctuations.

4. Case analysis - taking spotify as an example

4.1. The power of behavioral economics in spotify's pricing strategy

Spotify's free trial and subscription design provides a classic case in analyzing how behavioral economics can be applied to business pricing strategies. Spotify successfully converted users from the free tier to paid subscribers through its free trial period strategy [8]. Spotify's strategy takes advantage of the "Present Bias" and "Sunk Cost Effect", that is, consumers underestimate the frequency of future use due to the immediate experience during the free trial period. Many users experience the instant gratification brought by the music platform during the trial period, so they tend to continue subscribing after the trial period ends, even if they may not use the service for a long time. In addition, once users subscribe to Spotify, they are prone to fall into the "sunk cost effect" and are reluctant to cancel their subscription, even if their usage frequency is lower than expected.

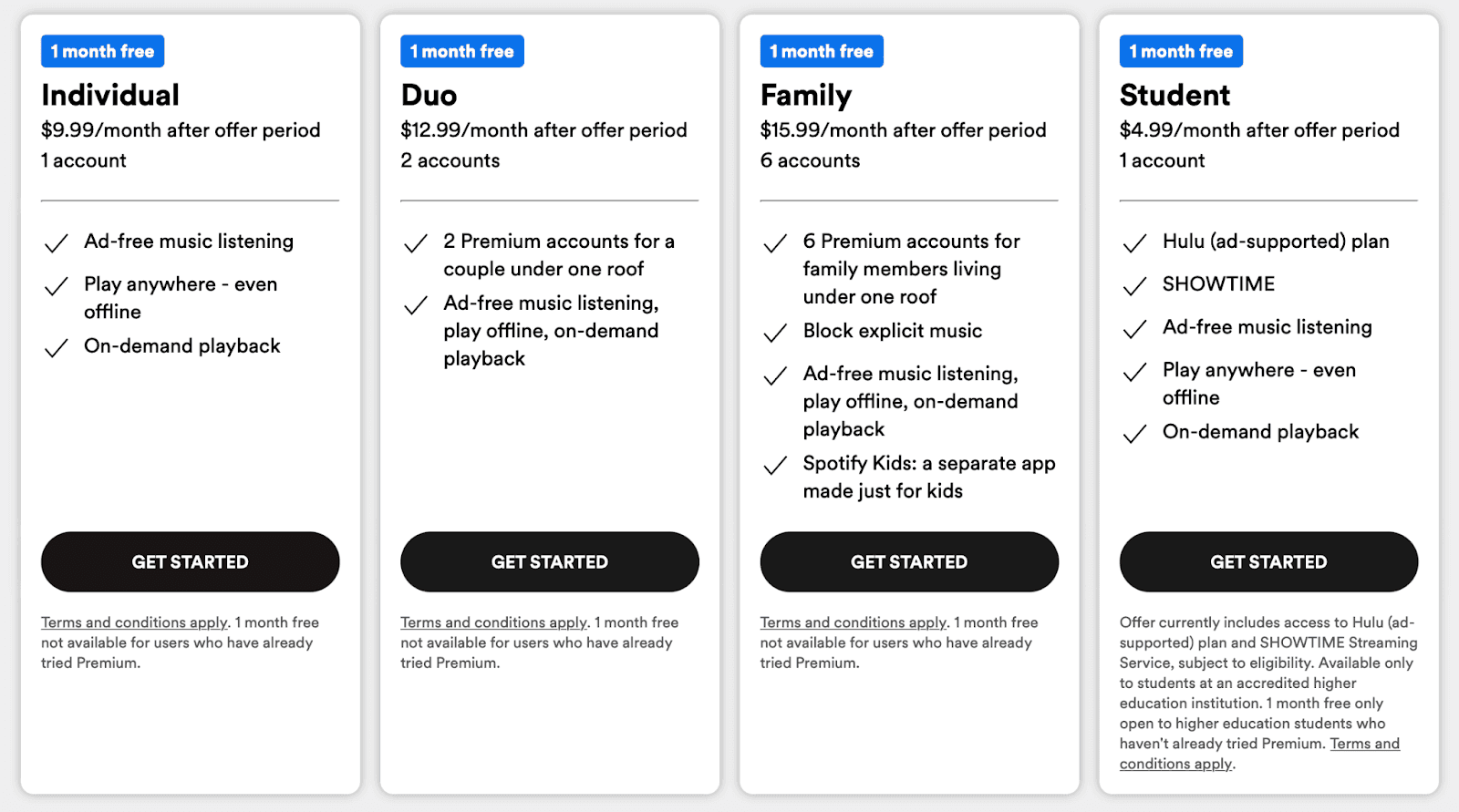

Unlike its competitors, Spotify offers a free subscription service to all users. This freemium pricing strategy has proven highly effective in expanding its user base, increasing revenue, and boosting paid subscription conversion rates [9]. Spotify’s pricing strategy cleverly incorporates the "free" mechanism by offering various subscription packages tailored to different user needs, each including a one-month free trial (as shown in Figure 1). This trial period allows users to experience premium features such as ad-free listening and offline playback before making a decision [9]. According to the theory of loss aversion, once users become accustomed to these benefits, they are less willing to give them up, which increases the likelihood of subscription conversion and enhances long-term user engagement. In addition, Spotify pushes personalized music recommendations to users through precise data analysis, which enhances user participation and loyalty, further improving subscription conversion rate [9]. Spotify's success proves that by deeply understanding consumer psychology, especially how to use core biases in behavioral economics, user conversion can be effectively improved and sustainable revenue can be increased.

Figure 1: Spotify offers four premium accounts based on customers’ individual needs [9]

4.2. Optimizing Spotify's pricing strategy

Although Spotify's subscription pricing strategy has achieved remarkable success, there is still room for improvement to further improve conversion rates and enhance user stickiness. First, more personalized reminders and incentives can be used to target "current bias". Spotify can remind users of the free content they have enjoyed and provide data analysis based on user behavior to remind them that they will be able to obtain greater value if they continue to subscribe. By doing so, Spotify can enhance users' sense of "instant rewards" while increasing the likelihood of converting them to paid subscribers at the end of the trial. Additionally, Spotify could introduce more flexible subscription options and exit strategies based on the "sunk cost effect." Many users abandon their subscriptions when they feel the long-term costs outweigh the value. To address this, Spotify could offer more adaptable subscription plans, such as adjusting content and pricing based on users' actual usage patterns or providing short-term subscription options. This would allow users to enjoy the service under more flexible terms and avoid the burden of "sunk costs" from high, fixed fees.

Spotify can attract more users by implementing additional "gift" strategies. For instance, offering free music albums, exclusive events, or other special incentives at the end of a new user's trial period can boost user satisfaction and create a sense of receiving great value for "free." This, in turn, can improve subscription conversion rates and enhance long-term user loyalty. By pairing these "free gifts" with regular reminders, Spotify can further fine-tune its pricing strategy to better align with consumer psychology and increase market share. While Spotify's pricing strategy has been successful, more personalized pricing options and a flexible user experience could further enhance its competitiveness and user retention.

5. Discussion

The application of behavioral economics has brought huge innovation space to business pricing strategies, but it has also triggered discussions about consumer rights and ethical boundaries. By understanding consumers' psychological biases, companies can design more effective pricing strategies, improve sales conversion rates and increase revenue. However, while this strategy brings economic benefits, it may also have adverse effects on consumers, especially when it relies too much on psychological manipulation. Behavioral economics pricing strategies may cause consumers to make decisions without being fully informed. Although this strategy leverages the "sunk cost effect," making it difficult for consumers to easily cancel the service, it could also harm their economic interests. Additionally, an over-reliance on consumer psychological biases to drive purchasing decisions may infringe on consumer rights. For instance, when offering "free gifts" or "free trials," companies may disappoint consumers if their expectations are set too high and the promises aren't fulfilled, potentially leading to a loss of brand trust. Therefore, companies must adhere to ethical standards when designing these strategies, avoiding excessive manipulation and ensuring that consumers have enough information and choices to make informed decisions. While behavioral economics holds significant potential in pricing strategies, companies must remain transparent and fair, using consumer psychological biases responsibly to safeguard long-term brand reputation and consumer trust.

6. Conclusion

In conclusion, this study explores the application of behavioral economics in pricing strategies, focusing on how companies like Spotify use basic principles of behavioral economics, such as the "sunk cost effect", "present bias", and "loss aversion", to influence consumer behavior and increase subscription conversion rates. The study found that behavioral economics principles play a vital role in shaping consumer purchasing decisions and help companies design effective strategies to increase engagement and loyalty. By leveraging mechanisms such as free trials, flexible subscription models, and "gifts", companies can significantly increase user conversion rates and long-term user stickiness. However, companies' reliance on consumer psychological biases generated by the application of behavioral economics may raise ethical issues, especially when these strategies are intended to over-manipulate consumer behavior. If expectations are too high or value propositions are not delivered, it may lead to consumer disappointment, reduced brand trust, and possible infringement of consumer rights. As such, companies should ensure their strategies align with ethical boundaries, while consumers should be more informed about models like free gifts and develop a stronger consumer awareness.

This study still has limitations. This study focuses on digital platforms such as Spotify and may not fully reflect the different impacts of these strategies in other industries or environments. Future research should explore how these behavioral pricing strategies can be applied to different retail, services, and entertainment sectors to better understand their broader impact on consumer trust and brand reputation.

Acknowledgements

I would like to express my sincere gratitude to my behavioral economics professor for his invaluable guidance and support throughout the course. The insights and theories I acquired during his teaching have greatly deepened my understanding of the intersection between psychology and economics. This intellectual inspiration ultimately led to the development of this paper.

References

[1]. Elfenbein, D. W., Fisman, R., & McManus, B. (2019). Does cheap talk affect market outcomes? Evidence from eBay. American Economic Journal: Applied Economics, 11(4), 305-326.

[2]. Cristofaro, M. (2017). Herbert Simon’s bounded rationality: Its historical evolution in management and cross-fertilizing contribution. Journal of Management History, 23(2), 170-190.

[3]. Cristofaro, M. (2017). Herbert Simon’s bounded rationality: Its historical evolution in management and cross-fertilizing contribution. Journal of Management History, 23(2), 170-190.

[4]. Jayawardena, A. M. A., & Nanayakkara, N. S. (2025). How Does Loss Aversion Mediate the Relationship Between Personality Traits and Efficiency of Skills in Investment Decision-Making?. International Review of Management and Marketing, 15(1), 293-301.

[5]. Skwara, F. (2023). Effects of mental accounting on purchase decision processes: A systematic review and research agenda. Journal of Consumer Behaviour, 22(5), 1265-1281.

[6]. Chukwu, G. C., & Dagogo, D. Free Sample Usage and Sales Performance of Selected Supermarkets in Port Harcourt Metropolis. International Journal on Integrated Education, 4(5), 148-165.

[7]. Gal-Or, E., & Shi, Q. (2022). Designing entry strategies for subscription platforms. Management Science, 68(10), 7597-7613.

[8]. Alodia, J. E., & Qastharin, A. R. (2024). The Impact Of Spotify Advertisements On Free Accounts To Purchase Decisions For Spotify Premium Accounts With Consumer Attitudes As The Mediating Variable. Journal Integration of Management Studies, 2(1), 140-147.

[9]. CoSchedule. (2023, April 24). Spotify marketing strategy: The sound of success. CoSchedule. https://coschedule.com/marketing-strategy/marketing-strategy-examples/spotify-marketing-strategy

Cite this article

Chen,J. (2025). Behavioral Economics and Pricing Strategy Optimization in the Digital Age---A Case Study of Spotify. Advances in Economics, Management and Political Sciences,187,33-38.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICMRED 2025 Symposium: Effective Communication as a Powerful Management Tool

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Elfenbein, D. W., Fisman, R., & McManus, B. (2019). Does cheap talk affect market outcomes? Evidence from eBay. American Economic Journal: Applied Economics, 11(4), 305-326.

[2]. Cristofaro, M. (2017). Herbert Simon’s bounded rationality: Its historical evolution in management and cross-fertilizing contribution. Journal of Management History, 23(2), 170-190.

[3]. Cristofaro, M. (2017). Herbert Simon’s bounded rationality: Its historical evolution in management and cross-fertilizing contribution. Journal of Management History, 23(2), 170-190.

[4]. Jayawardena, A. M. A., & Nanayakkara, N. S. (2025). How Does Loss Aversion Mediate the Relationship Between Personality Traits and Efficiency of Skills in Investment Decision-Making?. International Review of Management and Marketing, 15(1), 293-301.

[5]. Skwara, F. (2023). Effects of mental accounting on purchase decision processes: A systematic review and research agenda. Journal of Consumer Behaviour, 22(5), 1265-1281.

[6]. Chukwu, G. C., & Dagogo, D. Free Sample Usage and Sales Performance of Selected Supermarkets in Port Harcourt Metropolis. International Journal on Integrated Education, 4(5), 148-165.

[7]. Gal-Or, E., & Shi, Q. (2022). Designing entry strategies for subscription platforms. Management Science, 68(10), 7597-7613.

[8]. Alodia, J. E., & Qastharin, A. R. (2024). The Impact Of Spotify Advertisements On Free Accounts To Purchase Decisions For Spotify Premium Accounts With Consumer Attitudes As The Mediating Variable. Journal Integration of Management Studies, 2(1), 140-147.

[9]. CoSchedule. (2023, April 24). Spotify marketing strategy: The sound of success. CoSchedule. https://coschedule.com/marketing-strategy/marketing-strategy-examples/spotify-marketing-strategy