1. Introduction

The intersection of technology and finance has ushered in a new era for the financial sector, particularly in the realm of sustainable finance. This paper delves into how artificial intelligence (AI), blockchain technology, and big data analytics are revolutionizing sustainable finance by enhancing decision-making capabilities, improving regulatory compliance, and identifying investment opportunities that align with Environmental, Social, and Governance (ESG) criteria. The urgency to address global environmental challenges and societal inequities has propelled sustainable finance to the forefront, with financial institutions seeking innovative ways to integrate sustainability into their operations and investment strategies. AI's capacity for processing vast datasets enables the discovery of patterns and insights at an unprecedented scale, optimizing investment strategies and ESG compliance. Blockchain technology offers a paradigm shift in transparency and efficiency, particularly in the execution of smart contracts, decentralized finance (DeFi), and carbon credit trading, fostering trust and streamlining transactions. Big data analytics, with its predictive risk management models and ability to uncover insights for financial inclusion, plays a critical role in identifying sustainable growth opportunities [1]. Together, these technologies not only facilitate operational efficiencies and compliance with sustainability standards but also open new pathways for investments that contribute to a sustainable and inclusive global economy. This introduction sets the stage for an in-depth analysis of each technology's role in sustainable finance, outlining the current landscape, challenges, and future potential for driving sustainable growth.

2. Artificial Intelligence in Sustainable Finance

2.1. Enhanced Decision-making and Predictive Analysis

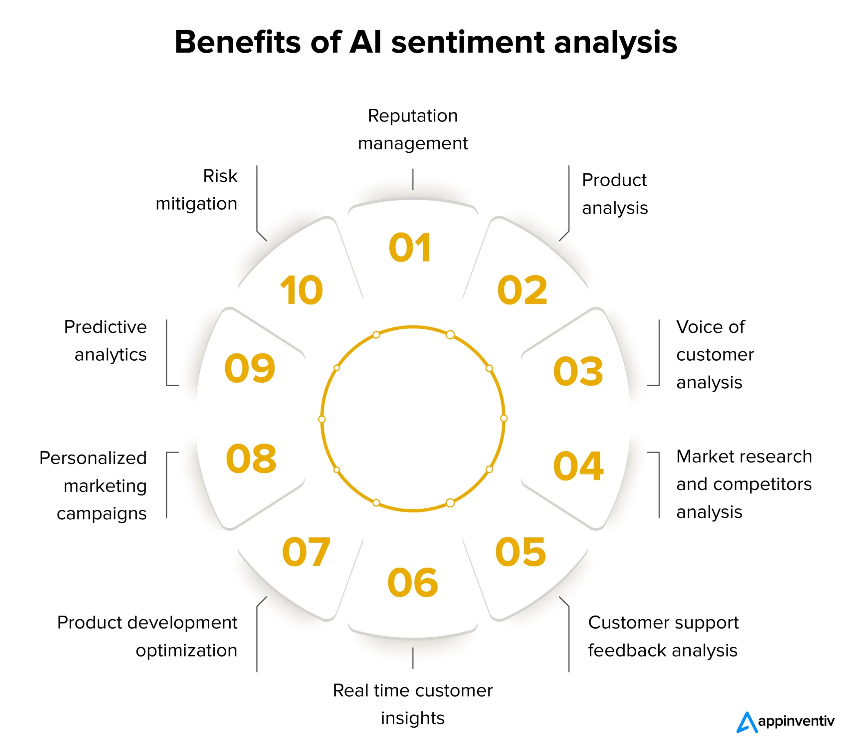

The incorporation of artificial intelligence into the financial sector has fundamentally altered the landscape of financial decision-making, especially in the realm of sustainable finance. AI's capability to analyze extensive datasets extends far beyond traditional analytics, leveraging complex machine learning algorithms and neural networks to unearth patterns and predictive insights with unprecedented accuracy. Specifically, these technologies enable the identification of investment opportunities and market trends that adhere to Environmental, Social, and Governance (ESG) criteria, which are crucial for sustainable investment strategies. For example, AI models are now capable of conducting sentiment analysis on vast amounts of unstructured data, such as news articles, social media posts, and company reports, to gauge public sentiment towards specific ESG practices. Figure 1 shows the benefits of AI Sentiment Analysis [2]. This capability allows financial institutions to predict market movements based on emerging trends in sustainability, such as shifts in consumer behavior towards greener products or regulatory changes impacting carbon-intensive industries.

Figure 1: The Impact of AI Sentiment Analysis: Benefits and Use Cases (Source: Appinventiv)

Additionally, neural networks, with their ability to learn and adapt to new data, can identify complex correlations between ESG factors and financial performance, offering insights into the long-term sustainability and profitability of investments. This sophisticated analytical approach not only enhances the decision-making process but also aligns financial investments with broader sustainability goals, contributing significantly to the development of a sustainable global economy.

2.2. Automating ESG Compliance

AI-driven tools have become instrumental in streamlining the compliance process with ESG standards, a task that traditionally required extensive manual labor and was prone to human error. Through the application of Natural Language Processing (NLP), AI systems can efficiently process and analyze large volumes of regulatory documents and ESG reports to extract pertinent information. This process includes the automatic categorization of data based on relevancy to specific ESG criteria, flagging potential compliance issues, and monitoring ongoing adherence to regulatory standards. A practical application of AI in automating ESG compliance involves the use of machine learning models to predict potential compliance risks by analyzing historical compliance data and identifying patterns that may indicate future breaches [3]. Furthermore, NLP can be employed to continuously monitor regulatory updates and ESG reporting standards globally, ensuring that financial institutions remain up-to-date with the latest requirements without the need for constant manual review. This not only reduces the operational burden on organizations but also significantly enhances accuracy and timeliness in ESG compliance, thereby mitigating the risk of regulatory penalties and reputational damage.

2.3. Socially Responsible Investing (SRI)

AI technologies have significantly empowered investors in the realm of Socially Responsible Investing (SRI) by providing advanced tools for integrating ESG factors into investment analysis and decision-making. Through AI-driven analytics, investors can obtain a granular assessment of a company's sustainability performance, encompassing environmental impact, social responsibility, and governance practices. This analysis is facilitated by AI's ability to process and interpret large datasets, including sustainability reports, environmental impact data, and social governance records, to score and rank companies based on their ESG performance. An innovative aspect of AI in SRI is the development of predictive models that forecast the future sustainability performance of companies based on current and historical data. This predictive capability enables investors to identify companies that are not only performing well in terms of ESG criteria but are also on a trajectory to improve their sustainability practices over time. Moreover, AI algorithms can analyze the correlation between ESG performance and financial indicators, helping investors to identify sustainable investment opportunities that do not compromise on financial returns [4]. By leveraging AI in SRI, investors can thus align their investment portfolios with ethical values and sustainability goals, while also ensuring that their investments contribute positively to addressing global environmental and social challenges.

3. Blockchain for Transparency and Efficiency

3.1. Smart Contracts in Sustainable Projects

The implementation of blockchain technology through smart contracts introduces a robust framework for enhancing both transparency and efficiency in the funding and management of sustainable finance projects. For instance, consider a smart contract designed for a reforestation project, which stipulates that funds will be released in increments as specific milestones, such as planting a certain number of trees or achieving a set reduction in CO2 levels, are verified. This verification is carried out through a combination of satellite imagery analysis and on-ground sensors, autonomously processed by the blockchain system [5]. Table 1 illustrates how funds are allocated and released upon the verification of specific environmental targets. Such a smart contract eliminates the need for manual verification, reduces administrative costs, and ensures that funds are allocated precisely as environmental targets are met, thereby significantly reducing the opportunity for mismanagement or fraud.

Table 1: Smart Contract Milestones and Fund Release Schedule for Reforestation Project

Milestone | Funds Released ($) | Verification Method | Outcome |

Planting 10,000 Trees | 50,000 | Satellite Imagery & On-Ground Sensors | Environmental Target Met |

Achieving 5% CO2 Reduction | 75,000 | Satellite Imagery & On-Ground Sensors | Environmental Target Met |

Planting 20,000 Trees | 100,000 | Satellite Imagery & On-Ground Sensors | Environmental Target Met |

Achieving 10% CO2 Reduction | 150,000 | Satellite Imagery & On-Ground Sensors | Environmental Target Met |

3.2. Decentralized Finance (DeFi) and Sustainability

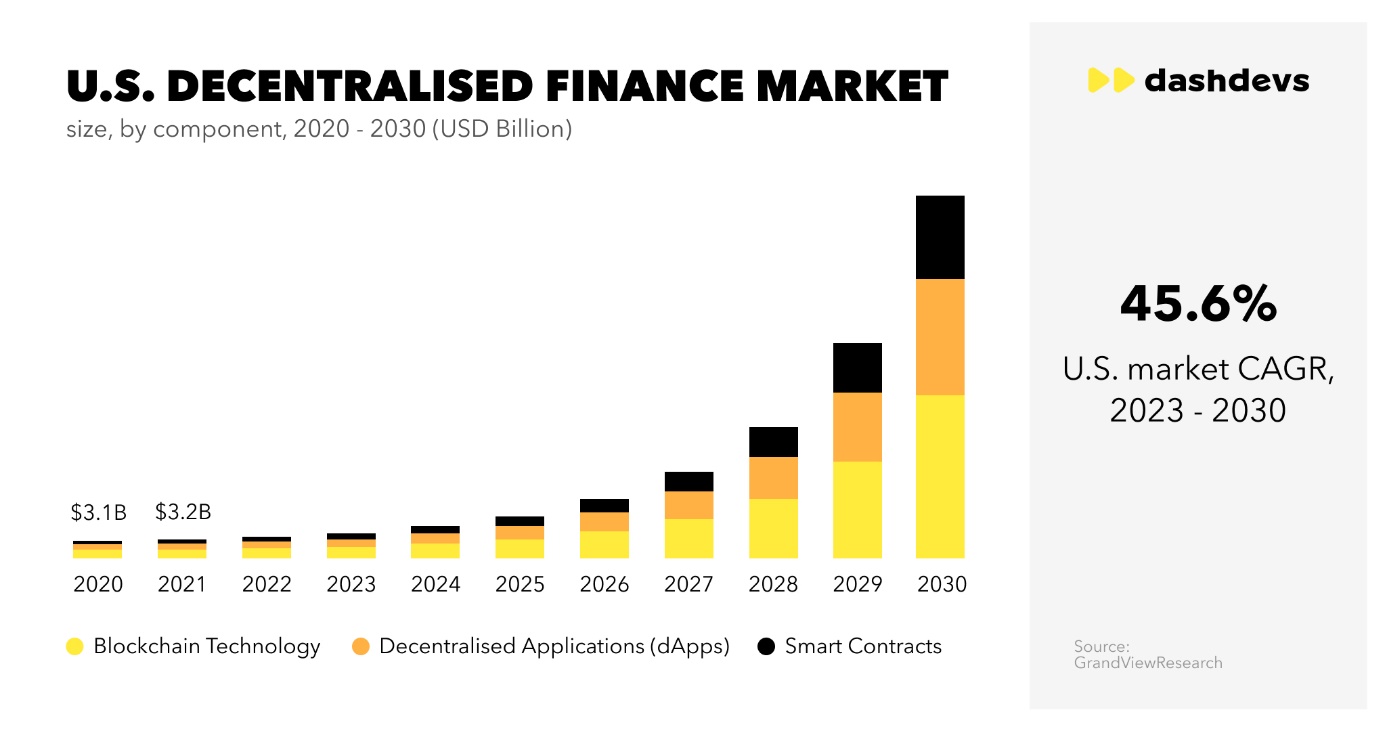

DeFi platforms leverage blockchain technology to create a decentralized ecosystem for financial transactions, which is particularly beneficial for funding sustainable projects. An illustrative example of this is a DeFi platform that enables direct investments into small-scale renewable energy projects in developing countries. By utilizing blockchain, the platform can offer a transparent record of energy production data and financial transactions, ensuring that investors can see the real-time impact of their investments. Additionally, smart contracts can be employed to automatically distribute profits based on energy production levels directly to investors' digital wallets, thereby streamlining the investment return process. This not only reduces the dependency on traditional banking infrastructure, which may be lacking in these regions, but also opens up investment opportunities to a global pool of investors, thus driving more funds towards sustainable development [6]. Figure 2 illustrates the forecasted expansion of the U.S. Decentralized Finance (DeFi) market from 2020 to 2030, broken down into three components: Blockchain Technology, Decentralized Applications (dApps), and Smart Contracts.

Figure 2: Projected Growth of the U.S. Decentralized Finance (DeFi) Market by Component (2020-2030) (Source: DashDevs)

3.3. Carbon Credit Trading on Blockchain Platforms

Blockchain platforms are uniquely positioned to revolutionize the carbon credit market by introducing a higher degree of transparency and traceability. An advanced application of this is the creation of a decentralized blockchain registry for carbon credits, where each credit is tokenized as a digital asset on the blockchain. This tokenization process provides a clear, immutable record of the origin, ownership, and retirement of each credit, making it easier to track and verify the impact of carbon offsetting efforts. Furthermore, the use of blockchain technology can facilitate cross-border trading of carbon credits, removing barriers and inefficiencies associated with traditional carbon markets. For example, a blockchain platform could enable a European company to invest directly in a forest conservation project in the Amazon, purchasing tokenized carbon credits that are verifiably contributing to carbon sequestration efforts [7]. Through such mechanisms, blockchain technology not only enhances the efficiency and integrity of carbon trading but also fosters a more interconnected and responsive global carbon market, driving forward the global agenda on climate action.

4. Big Data Analytics for Risk Management and Sustainable Growth

4.1. Predictive Risk Management Models

In the realm of sustainable finance, big data analytics are indispensable for constructing predictive risk management models that consider environmental, social, and governance (ESG) criteria. By integrating vast datasets from a multitude of sources, including climate models, supply chain information, and social media feeds, financial institutions can apply complex statistical methods and cutting-edge machine learning techniques, such as neural networks and decision trees, to forecast risks with unprecedented accuracy. These predictive models are tailored to identify and quantify the financial implications of various ESG factors, such as the risk of investment in areas prone to extreme weather events due to climate change, or in sectors with significant social governance issues. For instance, a financial institution might utilize regression analysis to determine the relationship between carbon emissions and the financial performance of companies in its investment portfolio. Similarly, sentiment analysis can be performed on social media data to gauge public perception regarding corporate social responsibility practices of these companies. The ESG-adjusted CAPM formula \( r={R_{f}}+{β_{i}}∙(β)+R{P_{ESG}}∙(1-{ESG_{i}}) \) quantitatively encapsulates the concept outlined in the passage, by integrating ESG criteria into the traditional risk-return profile, thus allowing financial institutions to forecast investment risks with enhanced precision by factoring in the financial implications of ESG factors. By combining these insights, the institution can develop a risk profile that highlights potential vulnerabilities and enables the proactive adjustment of investment strategies to mitigate these risks. Furthermore, scenario analysis can be employed to evaluate the resilience of investment portfolios under different climate change scenarios, helping institutions to align their investments with long-term sustainability goals while optimizing financial returns.

4.2. Enhancing Financial Inclusion through Data Insights

To advance financial inclusion within the framework of sustainable development, big data analytics are leveraged to unearth insights from an array of unconventional data sources. This includes analysis of mobile banking transactions to understand the spending habits and financial needs of users in remote areas, social media analytics to capture consumer sentiments and preferences, and satellite imagery to identify economic activities in underserved regions. By employing algorithms capable of processing and analyzing this data, financial institutions can identify gaps in the market where financial services are lacking and design products that address the specific needs of these communities. For example, through geospatial analysis of satellite images, a bank may identify rural areas with emerging agricultural activities but limited access to financial services [8]. Coupled with transactional data analysis from mobile platforms, the bank can tailor financial products such as microloans, insurance, and savings accounts that cater to the seasonal income patterns typical of agricultural workers. This not only promotes economic empowerment among underserved populations but also opens up new market opportunities for financial institutions.

4.3. Sustainable Growth and Investment Opportunities

Leveraging big data analytics to identify sustainable growth and investment opportunities involves the intricate analysis of market trends, consumer behavior towards sustainability, and the environmental impact of various industries. Financial institutions can utilize data analytics tools to scan the market for companies and projects with strong sustainability profiles, such as those involved in renewable energy production, sustainable agriculture, or green technology innovation. Predictive modeling can be employed to forecast the future performance of these sustainable investments based on trends in consumer preferences for green products and services, regulatory changes, and technological advancements. Time-series analysis, for example, can help in identifying patterns in the adoption rates of renewable energy technologies, while natural language processing (NLP) can be used to analyze news articles and reports for insights into regulatory changes affecting the green sector. Furthermore, impact analysis models can assess the environmental and social impact of potential investments, providing a comprehensive view of their sustainability credentials. By investing in projects and companies that not only promise attractive financial returns but also contribute positively to environmental and social objectives, financial institutions can drive the transition towards a low-carbon, sustainable economy, thereby fostering long-term economic growth and innovation in the green sector. Through these specific applications, big data analytics serve as a cornerstone in the pursuit of sustainable finance, enabling risk management, financial inclusion, and the identification of sustainable investment opportunities. As the financial industry increasingly integrates these technologies, the potential for fostering a sustainable and inclusive global economy becomes more tangible.

5. Conclusion

The integration of artificial intelligence (AI), blockchain technology, and big data analytics into sustainable finance represents a pivotal shift in how financial institutions approach investment, compliance, and risk management. These technologies have the potential to significantly enhance the sector's ability to contribute to a sustainable future. AI's advanced predictive analysis and automation capabilities streamline decision-making and ESG compliance, enabling more informed and responsible investment strategies. Blockchain technology's contribution to transparency and efficiency, especially through smart contracts and DeFi, revolutionizes the funding of sustainable projects and the trading of carbon credits. Big data analytics provide the backbone for sophisticated risk management and the identification of opportunities for sustainable growth and financial inclusion. Together, they form a powerful triad that can drive the financial sector towards more sustainable and inclusive practices. As this paper has illustrated, the adoption of these technologies is not without its challenges, including data privacy concerns, regulatory hurdles, and the need for significant investment in technological infrastructure. However, the benefits they offer in terms of advancing sustainable finance goals and contributing to global sustainability efforts are undeniable. As the financial industry continues to evolve, the integration of AI, blockchain, and big data analytics will play an increasingly critical role in shaping a sustainable and prosperous future for all.

References

[1]. Schütze, Franziska, and Jan Stede. "The EU sustainable finance taxonomy and its contribution to climate neutrality." Journal of Sustainable Finance & Investment 14.1 (2024): 128-160.

[2]. Setyowati, Abidah B. "Governing sustainable finance: insights from Indonesia." Climate Policy 23.1 (2023): 108-121.

[3]. Caplar R and Kulisic P 1973 Proc. Int. Conf. on Nuclear Physics (Munich) vol 1 (Amsterdam:North-Holland/American Elsevier) p 517

[4]. Starks, Laura T. "Presidential address: Sustainable finance and ESG issues—Value versus values." The Journal of Finance 78.4 (2023): 1837-1872.

[5]. Thompson, Simon. Green and sustainable finance: principles and practice in banking, investment and insurance. Vol. 7. Kogan Page Publishers, 2023.

[6]. Huynh-The, Thien, et al. "Blockchain for the metaverse: A Review." Future Generation Computer Systems 143 (2023): 401-419.

[7]. Han, Hongdan, et al. "Accounting and auditing with blockchain technology and artificial Intelligence: A literature review." International Journal of Accounting Information Systems 48 (2023): 100598.

[8]. Mourtzis, Dimitris, John Angelopoulos, and Nikos Panopoulos. "Blockchain integration in the era of industrial metaverse." Applied Sciences 13.3 (2023): 1353.

Cite this article

Zhao,Y. (2024). Empowering Sustainable Finance: The Convergence of AI, Blockchain, and Big Data Analytics. Advances in Economics, Management and Political Sciences,85,267-273.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Schütze, Franziska, and Jan Stede. "The EU sustainable finance taxonomy and its contribution to climate neutrality." Journal of Sustainable Finance & Investment 14.1 (2024): 128-160.

[2]. Setyowati, Abidah B. "Governing sustainable finance: insights from Indonesia." Climate Policy 23.1 (2023): 108-121.

[3]. Caplar R and Kulisic P 1973 Proc. Int. Conf. on Nuclear Physics (Munich) vol 1 (Amsterdam:North-Holland/American Elsevier) p 517

[4]. Starks, Laura T. "Presidential address: Sustainable finance and ESG issues—Value versus values." The Journal of Finance 78.4 (2023): 1837-1872.

[5]. Thompson, Simon. Green and sustainable finance: principles and practice in banking, investment and insurance. Vol. 7. Kogan Page Publishers, 2023.

[6]. Huynh-The, Thien, et al. "Blockchain for the metaverse: A Review." Future Generation Computer Systems 143 (2023): 401-419.

[7]. Han, Hongdan, et al. "Accounting and auditing with blockchain technology and artificial Intelligence: A literature review." International Journal of Accounting Information Systems 48 (2023): 100598.

[8]. Mourtzis, Dimitris, John Angelopoulos, and Nikos Panopoulos. "Blockchain integration in the era of industrial metaverse." Applied Sciences 13.3 (2023): 1353.