1. Introduction

On 29 January, after seven postponements of the court hearing, China Evergrande ushered in its most critical court petition hearing. This time, however, China Evergrande did not escape the fate of being liquidated, and the Hong Kong court issued a winding-up order against China Evergrande.

On the same time, Hong Kong Evergrande listed company Evergrande Automobile (00708. HK) and Evergrande Property (06666.HK) faced suspension. the China Evergrande reported HK$0.163 per share before the suspension, but it is was down over 20.87% recently. Moreover, the Evergrande Property reported HK$0.39 per share, was down to over 2.5%, and Evergrande Automobile reported HK$0.229 per share, was down to over 18.21%. In addition, Evergrande's bonds and stocks have continued to depreciate, the market price of Evergrande Group's overseas bonds has fallen to about $2, and the stock prices of Evergrande's listed companies in Hong Kong have also fallen below HK$1 and become "penny stocks" [1].

According to the perspectives of some experts, there is no direct relationship between the liquidation of China Evergrande and the size of the company nor the complexity of the debt. Yet the key reason should be that the company has been exposed since the debt crisis and has been exposed to major financial and management problems such as illegal occupation of funds and illegal guarantees. Especially in the case that public opinion has also paid close attention to its long-term false exaggeration of hundreds of billions of incomes in the company. In addition, another possible reason should be the large-scale of advance recognition of revenue, which means that the company will report more revenue in advance than the revenue actually received by the company. While the advantages of this action may include increasing book assets, leveraging higher leverage, promoting faster turnover, and obtaining more dividends, has also made the bubble of false prosperity of enterprises blow bigger and bigger, and planted a "timing bomb" for today's major debt crisis early.

According to the high-debt and high-leverage model, it may be beneficial in seeking short term growth in the rewards. However, in the long run Evergrande Group's financing activities of borrowing new debts to repay old debts have become unsustainable, and with the maturity of debts, there is not enough funds to repay debts, and the potential risk of default is high. This should also be the root cause of the liquidation. The aim of writing this article is to discuss what effect will the liquidation of the Evergrande company be put on different stakeholders. To begin with the most obvious effect, which is homebuyers' confidence in private developers would severely decrease and this will require a long time to recover. The market shares continue to shift towards the state-owned counterparts even though some measurements are announced by the government to boost private developers’ funding access [2].

Some experts expect that China’s 2024 new-home sales to decline 0%-5% year over year. Significant downside risk would arise if there were a large-scale suspension of home construction, as it would have a knock-on impact on already weak homebuyer sentiment. The Evergrande group has filed for bankruptcy protection in America in the August of 2023. According to Chapter 15 of the U.S. Bankruptcy Code, this can protect debtor from the mandatory debt repayment and the lawsuits from creditors. If the group successfully applied the bankruptcy protection, then this would probably allow them to gain more time for restructuring their debts. The theme of this article would be focused on the development of the China Evergrande group and the causes of the liquidation action. Finally, THIS PAPER would briefly give some prediction of the future development of the group and provide some possible suggestion that may benefit them as well. The literature review method will be used in this article to demonstrate and compare different perspectives and finally draw a possible solution to improve the situation of the Evergrande group [3].

2. Case Description

China Evergrande group was founded in 1996 by Xu Jiayin headquartered in the Houhai Financial Center in Nanshan District, Shenzhen, Guangdong Province, China. It focuses mainly on selling apartments mostly to upper- and middle-income dwellers. The slogan of the firm is ‘create specialty and launch the brand’ [4].

An important threshold for the group is in February 2017, when the strategic transformation was launched. In terms of development model, it has changed from "scale-based" to "scale+ efficiency-oriented" model. Moreover, in terms of business model, it has changed from the "three highs and one low" model of high debt, high leverage, high turnover and low cost to the "three low and one high" model of low debt, low leverage, low cost and high turnover [5].

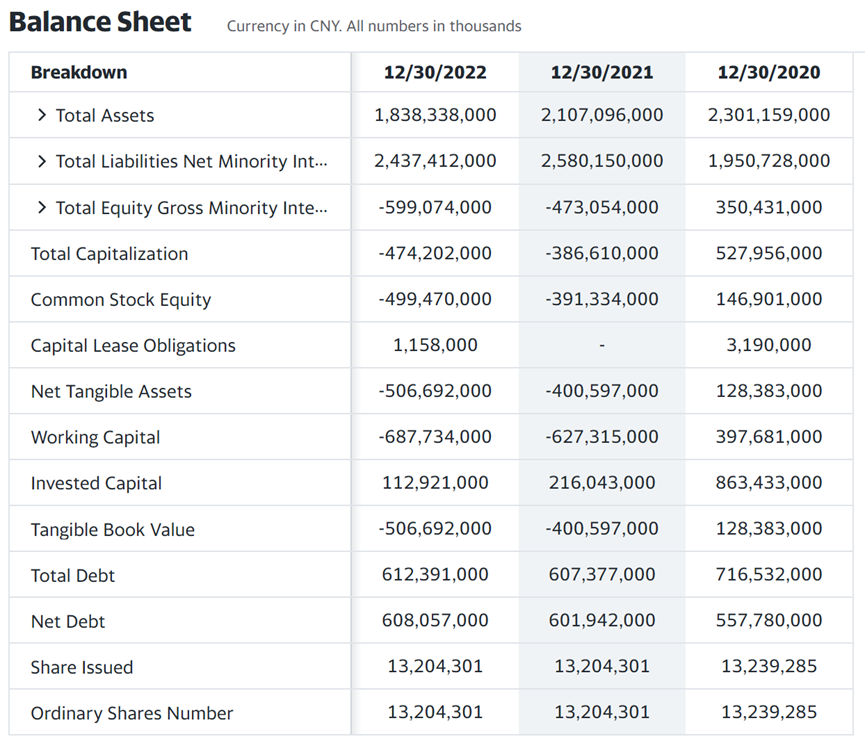

However, from May 2021, due to the rupture of the capital chain, the expired commercial bills could not be paid. There for, many projects in many places around China was suspended, this leads to a further anxiety in the public in figure 1.

Figure 1: The balance sheet of the Evergrande Group [2]

3. Analysis on the problem

There are a few reasons that might lead to this final liquidation action. First of all, one significant reason should be that the managers in the companies are not aware of the harm brought by the highly leveraged position. According to the overall objectives of the firm, lowering the debt ratio was first proposed by Xu Jiayin in 2016 and insist by Xia Haijun in 2017 that the ratio should be decreased to 70%. However, over a few years the objective were still far to be achieved. In the past few years, the firm are still solving the problem of liabilities by selling marginal assets in a low-key manner. Secondly, the group actually had set a debt reduction strategy, but they failed to carry out the plan. The Evergrande group has claimed that they would cut the debt since 2017 but take nonactual actions. By contrast, Vanke had heavily dedicated on their development of the mew project and the slogan "stay alive" was put forward which turned out should be a wise objective. Thirdly, the Evergrande group insist on cross-border diversified development (apart from the real estate, the group also invested in culture sports and finance sector) which means there would be a significant amount of cost. Some of the sellers also leaded to s serious deficit in the account. For example, Evergrande Ice Spring, which invested 6 billion yuan, lost a total of 4 billion yuan in 2013 and 2015, and was finally divested in 2016; Evergrande has invested nearly 30 billion yuan in new energy vehicles, which have not yet been mass-produced, and continue to net investment. Last but not least, up to December 31, 2020, Xinxin (BVI) Co., Ltd. and Junrong Holdings Co., Ltd. respectively held 70.78% and 5.98% of the shares of Evergrande Group, and the actual controllers behind them were Xu Jiayin and his wife. Xu Jiayin and his wife indirectly held more than 76% of Evergrande's shares through controlling these two companies, which is a typical single-share monopoly [6-10].

4. Recommendations

In resents days, the Evergrande group are dedicating itself in the offshore reorganization progress. In this stage, we really need to make it clear that there is a big difference between the foreign "bankruptcy protection" system and the domestic concept of "bankruptcy". In China, "bankruptcy" usually refers to "bankruptcy liquidation", and bankruptcy liquidation refers to the liquidation of assets of bankrupt enterprises. Some experts further pointed out that the foreign bankruptcy protection system means that during the bankruptcy protection period, creditors are not allowed to force debt repayment. in other word, this means bankrupt companies can still operate as usual, the company management continues to be responsible for the company's daily business, and its stocks and bonds also continue to trade in the market, but all major business decisions must be approved by a bankruptcy court. However, according to the provisions of the Civil Code and relevant judicial interpretations, the debt repayment order of housing enterprises is as follow: the consumption-type homebuyers'> construction project price> secured creditor's> ordinary creditor's> stock equity. Under the mainstream US dollar bond issuance method, domestic housing enterprises can only return the debt of overseas controllers in the form of residual equity if they repay all the debt and still have a surplus. Hence the bankruptcy protection application does not affect the domestic investors and shareholders. After analyzing and understanding their problem, THIS PAPER can now provide some possible recommendation for regulatory improvements to prevent similar occurrences. First of all, they can focus on Core Business which means they need to narrow the focus to core profitable areas, reducing diversification that does not align with the company’s strategic advantages. Apart from that, they need the implement Stricter Oversight which means to enhance the role of the board in overseeing financial and operational activities to prevent excessive risk-taking. By doing so, they can encourage two side communications in order encourage employees to talk freely about their worries about the operation of the firm and therefor to make the managers more aware of the problems appearing in the firm [11].

5. Conclusion

The article mainly outlines the events leading to its court-ordered winding-up and the subsequent impacts on its stakeholders, including stock and bondholders, other companies under its umbrella, and the broader real estate market. Key factors contributing to Evergrande's downfall include financial mismanagement, high leverage, a complex debt structure, and ambitious diversification efforts that strained its capital and operational efficiency. Despite efforts to transform and reduce debt, Evergrande's financial strategies proved unsustainable, culminating in a liquidity crisis that forced it into liquidation.

The liquidation has had far-reaching implications, notably diminishing confidence among homebuyers towards private developers and potentially shifting market shares towards state-owned entities. The event also underscores the fragility of high-debt business models and the critical need for sound financial and operational management in the real estate sector. Moreover, Evergrande's bankruptcy protection filing in the US highlights the differences between bankruptcy systems internationally and the strategic maneuvers companies can employ to navigate financial distress.

The Evergrande group serves as a stark reminder of the systemic risks that can emanate from the collapse of a major player in the economy, the importance of corporate governance, and the potential consequences of aggressive expansion without a solid foundation.

However, there are still some existing insufficiencies in this study. For example, it is very hard to get the access of the precise operational structure of the Evergrande group. Hence, it can be very hard to evaluate the causes of the bankruptcy. There for, the future studies can focus more on the operation strategy of the firms and the propriate expansion strategy.

References

[1]. Fu Shanshan. “How Significant Is Evergrande’s Liquidation?”. China Real Estate News, 2024-02-05, p. 011, Company1.

[2]. Du Qingqing. “Chinese Evergrande Faces ‘Liquidation Order’: Legal Experts Say Domestic Business Impact Is Limited, Liquidation Work Is ‘Complex and Arduous’”. First Financial Daily, 2024-01-30, p. A03, Major Event2.

[3]. Zhang Xiuquan. “Insights into Crisis from Massive Financial Reductions”. China Accounting News, 2023-10-20, p. 0013.

[4]. Zhang Xinye. “Exploring the Causes of Evergrande Group’s Debt Default and Its Implications”. 2023. MA Thesis, Hebei University4.

[5]. Ven Yue. “Causes and Remedies for Evergrande Group’s Financial Crisis”. 2023. MA Thesis, Xihua University.

[6]. Xu Ying. “Impact of Diversification Strategies on Funding Chain Risks: A Managerial Cognitive Perspective”. 2023. MA Thesis, Jiangxi Normal University.

[7]. Yu Shuaiqing and Xu Qian. “Why Evergrande’s Bankruptcy Filing in the U.S.? Evergrande Clarifies: No Involvement in Bankruptcy”. China Real Estate News, 2023-08-28, p. 006, Company.

[8]. Ye Zhifeng and Dan Qian. “The Question of Evergrande’s Debt”. Enterprise Management, 07(2022), pp. 40-45.

[9]. Zhang Xinchen and Zheng Na. “Evergrande’s Fifth Delayed Liquidation Hearing: Crucial Moment for Overseas Debt Restructuring”. First Financial Daily, 2023-08-02, p. A10, Industry Depth.

[10]. “How to Tidy Up Evergrande’s ‘Mess’”. China Economic Weekly, 16(2023), p. 11.

[11]. Cheng Dan. “No Major Adverse Impact on Domestic Debt Disposal and Delivery of Buildings”. Securities Times, 2023-10-09, p. A02, Comprehensive.

Cite this article

Li,R. (2024). The Impact of the Liquidation of Evergrande Group. Advances in Economics, Management and Political Sciences,86,214-218.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Fu Shanshan. “How Significant Is Evergrande’s Liquidation?”. China Real Estate News, 2024-02-05, p. 011, Company1.

[2]. Du Qingqing. “Chinese Evergrande Faces ‘Liquidation Order’: Legal Experts Say Domestic Business Impact Is Limited, Liquidation Work Is ‘Complex and Arduous’”. First Financial Daily, 2024-01-30, p. A03, Major Event2.

[3]. Zhang Xiuquan. “Insights into Crisis from Massive Financial Reductions”. China Accounting News, 2023-10-20, p. 0013.

[4]. Zhang Xinye. “Exploring the Causes of Evergrande Group’s Debt Default and Its Implications”. 2023. MA Thesis, Hebei University4.

[5]. Ven Yue. “Causes and Remedies for Evergrande Group’s Financial Crisis”. 2023. MA Thesis, Xihua University.

[6]. Xu Ying. “Impact of Diversification Strategies on Funding Chain Risks: A Managerial Cognitive Perspective”. 2023. MA Thesis, Jiangxi Normal University.

[7]. Yu Shuaiqing and Xu Qian. “Why Evergrande’s Bankruptcy Filing in the U.S.? Evergrande Clarifies: No Involvement in Bankruptcy”. China Real Estate News, 2023-08-28, p. 006, Company.

[8]. Ye Zhifeng and Dan Qian. “The Question of Evergrande’s Debt”. Enterprise Management, 07(2022), pp. 40-45.

[9]. Zhang Xinchen and Zheng Na. “Evergrande’s Fifth Delayed Liquidation Hearing: Crucial Moment for Overseas Debt Restructuring”. First Financial Daily, 2023-08-02, p. A10, Industry Depth.

[10]. “How to Tidy Up Evergrande’s ‘Mess’”. China Economic Weekly, 16(2023), p. 11.

[11]. Cheng Dan. “No Major Adverse Impact on Domestic Debt Disposal and Delivery of Buildings”. Securities Times, 2023-10-09, p. A02, Comprehensive.