1. Introduction

In recent years, the advent of new technologies has revolutionized every aspect of life. The problem has long been the subject of debate in academic research, with governments have frequently making it a central topic in policy discussions and initiatives. With the continuous progress of technology, there is a growing focus on the practical application of emerging technologies to improve the quality of real life. Both society and companies are profoundly impacted. Contemporary firms, recognizing the significance of social and technical progress, now consider change and instability as the standard, and they prioritize the adoption of innovative technology. Therefore, it is imperative to understand the integration of emerging technologies and corporate governance. First, it is necessary to clarify the definition of emerging technologies. Emerging technologies have five characteristics, which are radical novelty, coherence, relatively rapid growth, prominent impact, and uncertainty [1]. Furthermore, there are additional reports about this area. For example, a study conducted by A. Kadir Varoglu, Soner Gokten and Burak Ozdogan explored the impact of emerging technologies on corporate governance from the perspective of technological advancement and its integration into business practices, arguing that these emerging technologies not only promoted corporate governance functions but also facilitated the transformation of other business functions. Meanwhile, they reveal the prospective consequences and the necessary measures required [2]. Moreover, Hugh Grove, Mac Clouse and Tracy Xu discuss the risks and challenges associated with applying emerging technology governance during a time when emerging technologies are widely adopted. They also explore the appropriate actions that boards and CEOs should take in response to these risks and challenges [3].

This essay uses the literature review method to research the ways to further integrate emerging technologies into corporate governance under the premise of adequate monitoring. It is conducive to further improving the corporate governance system and promoting the modernization of the company. At the same time, it provides reference suggestions for the application of emerging technologies.

2. Applications and Challenges

2.1. Application of emerging techonologies

One area of focus is the application field of emerging technologies in corporate governance. Artificial intelligence, block chain, and big data analytics are the three most common types of applications. The following is an overview of the current uses of these three emerging technologies.

2.1.1. Artificial Intelligence

Artificial intelligence, by definition, is not simply machine learning. Machine learning is the core technology of artificial intelligence, and complete artificial intelligence also needs automated data analysis, screening, and other functions. There is considerable evidence that the application of AI has a positive effect on decision-making and risk management. In 1994, Altman and his colleagues did the first comparison study of traditional statistical methods for predicting financial distress and insolvency with an artificial intelligence algorithm. They found that using both methods together made the predictions much more accurate. The increasing complexity of credit risk assessment due to The Times' development has further promoted the application of artificial intelligence. This is evident in the growing credit default swap (CDS) market,. Data from daily CDS of different maturities and different rating groups from January 2001 to February 2014 shows that non-parametric machine learning models involving deep learning outperform traditional benchmark models in predicting accuracy as well as proposing actual hedges. AI-driven credit evaluation system progress enhances the corporate governance system and provides guidance for the company's future development and cooperation.

In terms of detecting market risk, Woodall describes various use cases for machine learning currently used for model validation, including French investment firm Nataxis, which at the time of writing is running more than 3 million simulations per night using unsupervised learning to establish new connectivity patterns between assets and further investigate any simulations that emerge from tests. These simulations show patterns of "errors" compared to average estimates. Woodall also observed that Nomura employs machine learning to oversee internal transactions and ensure the absence of inappropriate assets in trading models. These are all driven by artificial intelligence and machine learning technologies that improve the efficiency and precision of corporate governance [4].

Moreover, in decision making, artificial intelligence and machine learning have also had certain applications and played a positive role. Through data mining, AI can capture details more quickly and accurately, providing a basis for decision making. To find the relationship between AI and corporate decision-making, Trunk et al. conducted a literature study. To outline the promise of existing research while connecting AI to corporate decision-making in a changing context, the authors sought out peer-reviewed publications and conducted content analysis. The findings are presented in a conceptual framework that first outlines how humans can use AI in decision-making in dynamic situations, and then outlines the challenges, prerequisites, and implications that should be considered. Furthermore, the Duan study aims to illustrate the application of AI in decision-making. According to the study, AI makes broad judgments to support or replace humans, such as AI participation and integration. This paper discusses the use and impact of AI-based dynamic frameworks. In addition, it provides some advice for those dealing with data frameworks on how to use them for decision-making [5].

2.1.2. Blockchain

Block chain is a distributed record of all transactions or digital events; it is a database, and they are processed and shared by participants. A majority of system participants verify each transaction. It is also a decentralized system that records the origin of digital assets. By intrinsic design, the data in the block chain is immutable [6], so it can offer unparalleled data transparency, strong security measures, and the highest level of data integrity. The emergence of block chain offers a transformative solution to the increasingly complex trust system, which is expected to bring a new sense of trust, accountability and transparency in the financial and economic fields and drive the building of corporate trust systems. With its decentralized and tamper-proof ledger, blockchain not only solves immediate challenges but also provides a compelling path for the future. In the future, transparency will be a cornerstone of economic resilience and trust [7].

For example, block chain acts as a distributed digital ledger in an interconnected network, which makes every transaction that enters the block chain immutable and irrevocable, forming an uninterrupted and unchanging transaction history that ensures the integrity of economic data. At the same time, this fundamental feature of block chain not only guarantees the authenticity of financial records, but also introduces strong accountability to the economic system. In terms of independence, the decentralized nature of the block chain means that no single entity has exclusive control over the ledger, preventing manipulation or tampering with the data. This increases the level of trust among participants in the economic ecosystem because they can rely on the transparency and integrity of the block chain. In addition, the transparency of block chain is enhanced by its accessibility. Participants in the network can access the block chain without intermediaries to view transaction history and verify the authenticity of the data. This accessibility democratizes information, empowers individuals, and makes economic processes more inclusive and participatory. Moreover, the traceability inherent in block chain technology allows for effective auditing and monitoring of economic activity. Auditors and regulators can track transactions in real time to ensure compliance with financial regulations and policies. This real-time monitoring reduces the potential for fraudulent activity and creates an atmosphere of compliance. Furthermore, block chain facilitates the development of smart contracts and self-executing protocols with predefined rules. These contracts automatically execute and enforce the terms of the agreement when predetermined conditions are met[7].

2.1.3. Big Data

In the contemporary business environment, big data has developed into a cornerstone of strategic decision-making. In today’s business context, big data refers to large amounts of data generated from a variety of sources, including traditional and digital platforms, that are too large or complex for traditional data processing software to handle effectively. This data contains a wide range of information types, from structured data (such as numbers and dates) to unstructured data (such as text and images). The importance of big data in business strategy stems from its potential to provide insights that were previously unavailable. As Gad-Elrab points out, big data analytics enables businesses to identify patterns, trends, and correlations in these massive data sets, enabling a more informed decision-making process. This analytical capability is particularly important in a business environment where data-driven decisions can significantly impact competitiveness and market positioning [8].

For instance, the study by Hendstein and Katsu proposes a new framework for strategic decision making using big data analytics methods. They use machine learning algorithms such as random forests and artificial neural networks to predict export volumes using a wide range of industry data. Their hypothetical case study results show that Bdas can make accurate trade forecasts and effectively assist in strategic industry assessments. Moreover, Akter and Haque studied the impact of BDA on the value of corporate decision making. Their study of 480 software companies in the United States shows that the implementation of BDA has a significant impact on decision value. They found that BDA plays a mediating role in the relationship between BDA use and decision performance, suggesting that enterprises should not only increase the use of BDA in business decision making but also improve their data analysis capabilities [8].

Furthermore, after understanding the current application of emerging technologies, it is also important to find out what changes the emerging technologies have caused to the corporate governance structure. There are two kinds of changes: one is the change in organizational structure and decision-making level, and the other is the difficulty in the application of emerging technologies.

The beginning is the change in organizational structure and decision-making level. In terms of organizational structure, digital transformation means adjusting organizational structures and practices to respond to the internal, technological, and environmental dynamics of the digital age. Despite earlier research acknowledging constant changes in organizational environments, the situational change model currently dominates the organizational structure of companies. Since such a model describes organizational change as an unfreeze-transition-refreeze sequence, in which the organization is required to operate in stable equilibrium for long periods of time, interrupted by discontinuities. However, this is not suitable for digital transformation. Emerging digital technologies and environmental upheaval require constant change to integrate with corporate governance. Still using scenario change models can lead to inertia structures and risky radical change plans that are not conducive to digital transformation. Therefore, digital transformation is conducive to promoting the innovation of the company's organizational structure and re-examining the established change model to meet the requirements of digital transformation. Not only that, digital transformation has also enriched the organizational structure, requiring companies to introduce new roles, organization entity and responsibilities, such as the chief digitalization officer and digital units [9].

In terms of corporate decision-making level, digital transformation is conducive to improving the informal decision-making level of the company. The process of digital transformation, which involves transitioning from the old to the new, will inevitably impact the interests of the upper board and encounter obstacles due to a certain level of formal decision-making. Improving of the informal decision-making level is conducive to balancing the formal decision-making level and promoting the implementation of digital transformation. This is a good cycle of mutual influence, digital transformation promotes the improvement of informal decision hierarchy, and the continuous improvement of informal decision hierarchy will also promote the process in digital transformation of the company [10].

2.2. Challenges and Risks

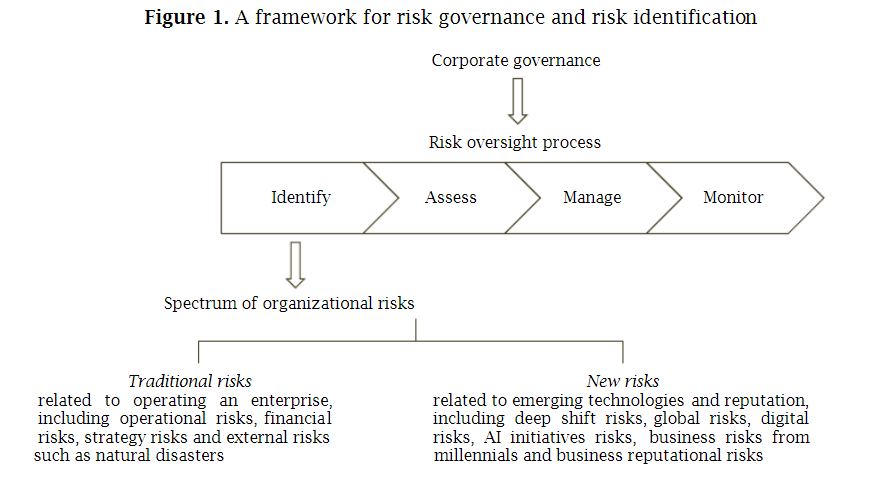

Next are the difficulties in the application of emerging technologies. As shown in Figure 1, there are still many challenges and risks that need to be addressed, such as deep transfer risk, global risk, business reputation risk, ethical influence risk etc.

Figure 1: A framework for risk governance and risk identification [3]

For deep shift risks, in 2016, the World Economic Forum's Global Agenda Committee on the Future of Software and Society spoke to more than 800 executives and experts in information and communication technologies and asked them to estimate when "tipping points" will be reached for 21 key technologies, such as brain-computer interfaces, the Internet of Things, and more, and when deep transformations will enter the mainstream. Deep change refers to large societal changes that "have profound effects on human health, the environment, global business, and international relations." These fundamental shifts are expected to fundamentally alter existing lifestyles, thereby significantly impacting corporate governance.

For global risk, Due to the emerging technology that has just been put into use, the experience of its use and crisis prevention measures are not mature. A 2019 survey found that, against the backdrop of a slowing economy and rapid technological change, companies that are more sensitive to volatility are less prepared for a crisis than at any time in 12 years.

For business reputation risk, as Warren Buffett has said, "It takes 20 years to build a reputation and five minutes to destroy it." The use of emerging technologies makes data security-related risks more likely. There are many recent examples highlighting such business reputational risks. On Sept. 7, 2017, U.S. credit monitoring company Equifax disclosed a data hack that may have stolen the personal information of 143 million Americans in one of the largest hacks ever. The company said it learned of the hack on July 29 but did not publicly disclose it until September 7. Following this, Equifax faced over 25 lawsuits and 40 U.S. states initiated investigations into its handling of the data breach. Senator Chuck Schumer of New York, the Democratic leader in the Senate, compared Equifax to Enron: "This is one of the most egregious cases of corporate malfeasance since Enron" and called Equifax's treatment of consumers in the aftermath "disgusting." Its failure to protect data is deeply troubling. Another U.S. senator, Elizabeth Warren of Massachusetts, called on Equifax executives to return some of their pay [3].

Finally, for ethical influence risk, since the previous technology would only mechanically execute the algorithm's instructions, it was objectively fair and unbiased. But the introduction of emerging technologies will be machines with the ability to learn and infer, which means that the potential bias will be extended from the human domain to the algorithmic program domain, and the company of the future will be at risk due to the potential bias in the algorithm. At the same time, corporate governance in the future will not only need to consider the ethical issues between people but also the ethical issues between machines and machines. Machines and people will also become part of the risks that need to be prevented [11].

2.3. Solutions

In response to the various risks mentioned above, companies can take the following steps to mitigate risks and enhance corporate governance:

In view of the risk of deep transformation, first of all, adhere to market monitoring and adaptation, and make adjustments to the changes in social mainstream trends in advance to ensure that enterprises can adapt to these deep changes in a timely manner.

Second, strengthen innovation and diversification by investing in emerging technologies and business models, as well as diversifying products and services to reduce dependence on a single technology or market.

Finally, it is to strengthen talent training and education, improve the employees’ knowledge and education in emerging technologies, and ensure that the company team has the ability and skills to cope with changes.

Global risks require comprehensive risk management frameworks and crisis response plans to ensure rapid response in the face of immature technology use and crisis preparedness measures.

At the same time, promote internal cross-departmental cooperation, ensure the flow of information and resource sharing, and improve flexibility and response speed within the company.

To address business reputation risks, it is necessary to strengthen data security and privacy protection measures in the technology sector, and establish strong security protocols and data processing policies to prevent data breaches and hacking attacks.

In addition, in the face of data breaches or other reputation-affecting events, it is necessary to adopt a transparent and proactive communication strategy, disclose information to the public and stakeholders in a timely manner, and clearly state solutions to maintain corporate credibility.

To address the risk of ethical impact, develop clear guidelines on technology ethics and establish a technology ethics steering committee to conduct ethical review and oversight of the use of emerging technologies (such as artificial intelligence). Finally, algorithms are audited regularly to detect and correct potential bias and ensure that the design and implementation of algorithms are as fair and unbiased as possible.

3. Conclusion

This essay explores the intricate connection between emerging technologies and corporate governance, emphasizing the simultaneous utilization of technology to improve governance and the handling of risks and ethical concerns related to its implementation. This paper highlights the profound impact of artificial intelligence, blockchain, and big data analytics on the process of making business decisions, managing risks, and improving efficiency. Through a method of literature review, this paper illustrates how these technologies are changing corporate governance structures, requiring adjustments to organizational models and decision-making processes to promote innovation and flexibility.

In addition, this essay identifies key risks associated with the implementation of emerging technologies, including profound transformation risks that may challenge existing lifestyles and corporate governance frameworks, global risks resulting from early adoption of the technology, reputational risks stemming from data security breaches, and moral hazard associated with potential biases in algorithmic decision-making. The paper suggests that organizations should adopt proactive strategies to reduce these risks, including continuous market surveillance, innovation, diversity, improved data security, and ethical supervision of technology utilization.

Integrating emerging technologies into corporate governance presents a multifaceted terrain of both opportunities and challenges. To successfully navigate this landscape, companies must adopt a well-rounded strategy that takes advantage of the benefits of technological advances while being vigilant in addressing the associated risks and ethical considerations. By adopting this strategy, the company will be able to attain long-term expansion, protect its standing, and guarantee adherence to ethical standards in a swiftly changing technology landscape.

However, there are still some shortcomings in this paper. The analysis mostly relied on textual examples and lacks empirical data for comparative analysis, thus the outcome may be slightly inconsistent with reality. At present, the field of emerging technology and corporate governance is brimming with opportunities and hopes. It is currently at the intersection of the digital era, with its gradual improvement, businesses will progressively develop and thrive in the digital age.

References

[1]. Rotolo, D., Hicks, D., Martin, B. (2015) What Is an Emerging Technology? Research Policy 44(10):1827-1843

[2]. Varoglu, K., A., Gokten, S., Ozdogan, B. (2021) Digital Corporate Governance: Inevitable Transformation. In: Hacioglu, U., Aksoy, T.(Eds.), Financial Ecosystem and Strategy in the Digital Era. Springer Nature Switzerland AG., Switzerland. pp.219-236.

[3]. Grove, H., Clouse, M., Xu, T. (2020). New risks related to emerging technologies and reputation for corporate governance. Journal of Governance and Regulation., 9: 64-74.

[4]. Aziz, S., Dowling, M. (2018). AI and Machine Learning for Risk Management. SSRN Electronic Journal., 1: 1-18.

[5]. Prasanth, A., Vadakkan, D., Surendran, P., Thomas, B. (2023). Role of Artificial Intelligence and Business Decision Making. International Journal of Advanced Computer Science and Applications., 14: 6.

[6]. Tp, K., Manickam, R., Ramu, K. (2024). Understanding a Recent Trends in Block Chain Technology., 1: 87-91.

[7]. Rijal, S., Saranani, F. (2023). The Role of Blockchain Technology in Increasing Economic Transparency and Public Trust. Technology and Society Perspectives (TACIT)., 1: 56-67.

[8]. Adaga, E., Okorie, G., Egieya, Z., Ikwue, U., Udeh, C., DaraOjimba, D., Oriekhoe, O. (2024). THE ROLE OF BIG DATA IN BUSINESS STRATEGY: A CRITICAL REVIEW. Computer Science & IT Research Journal., 4: 327-350.

[9]. Jöhnk, J. (2020). Managing Digital Transformation: Challenges and Choices in Organizational Design and Decision-Making. https://www.researchgate.net/publication/342379568_Managing_Digital_Transformation_Challenges_and_Choices_in_Organizational_Design_and_Decision-Making.

[10]. Yan, A., Mingtao, Y. (2023). Board Informal Hierarchy and Digital Transformation: Evidence From Chinese Manufacturing Listed Companies. SAGE Open., 13: 4.

[11]. Torre, F., Teigland, R., Engstam, L. (2019) AI leadership and the future of corporate governance. In: Larsson, A., Teigland, R.(Eds.), The Digital Transformation of Labor. Routledge., New York. pp. 116-146.

Cite this article

Wu,T. (2024). Exploring of the Integration of Emerging Technologies and Corporate Governance. Advances in Economics, Management and Political Sciences,87,90-96.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Rotolo, D., Hicks, D., Martin, B. (2015) What Is an Emerging Technology? Research Policy 44(10):1827-1843

[2]. Varoglu, K., A., Gokten, S., Ozdogan, B. (2021) Digital Corporate Governance: Inevitable Transformation. In: Hacioglu, U., Aksoy, T.(Eds.), Financial Ecosystem and Strategy in the Digital Era. Springer Nature Switzerland AG., Switzerland. pp.219-236.

[3]. Grove, H., Clouse, M., Xu, T. (2020). New risks related to emerging technologies and reputation for corporate governance. Journal of Governance and Regulation., 9: 64-74.

[4]. Aziz, S., Dowling, M. (2018). AI and Machine Learning for Risk Management. SSRN Electronic Journal., 1: 1-18.

[5]. Prasanth, A., Vadakkan, D., Surendran, P., Thomas, B. (2023). Role of Artificial Intelligence and Business Decision Making. International Journal of Advanced Computer Science and Applications., 14: 6.

[6]. Tp, K., Manickam, R., Ramu, K. (2024). Understanding a Recent Trends in Block Chain Technology., 1: 87-91.

[7]. Rijal, S., Saranani, F. (2023). The Role of Blockchain Technology in Increasing Economic Transparency and Public Trust. Technology and Society Perspectives (TACIT)., 1: 56-67.

[8]. Adaga, E., Okorie, G., Egieya, Z., Ikwue, U., Udeh, C., DaraOjimba, D., Oriekhoe, O. (2024). THE ROLE OF BIG DATA IN BUSINESS STRATEGY: A CRITICAL REVIEW. Computer Science & IT Research Journal., 4: 327-350.

[9]. Jöhnk, J. (2020). Managing Digital Transformation: Challenges and Choices in Organizational Design and Decision-Making. https://www.researchgate.net/publication/342379568_Managing_Digital_Transformation_Challenges_and_Choices_in_Organizational_Design_and_Decision-Making.

[10]. Yan, A., Mingtao, Y. (2023). Board Informal Hierarchy and Digital Transformation: Evidence From Chinese Manufacturing Listed Companies. SAGE Open., 13: 4.

[11]. Torre, F., Teigland, R., Engstam, L. (2019) AI leadership and the future of corporate governance. In: Larsson, A., Teigland, R.(Eds.), The Digital Transformation of Labor. Routledge., New York. pp. 116-146.