1. Introduction

The current world of economic integration, globalization, informatization, and financialization are continuously deepening and developing. The international product linkage is increasing. Energy trade is one of the most important parts of international trade, and energy is one of the important input factors for economic growth. Sufficient energy is an important condition for ensuring economic development and social stability. As an essential raw material in industrial production, coal has been widely used in various industries, and is in high demand. Coal trading is a very common part of energy trading. Therefore, the fluctuations in coal prices not only affect the company's stock price, but also the entire national economy. With the outbreak of the COVID-19 pandemic and the normalization of the epidemic, the economy has also transitioned from recession to recovery. Global energy prices have experienced significant declines and fluctuations, but currently remain on an upward trend, and coal prices are no exception. During the COVID-19 epidemic, the world economy was in a period of depression. Industry has also been significantly affected, resulting in a significant decrease in demand for coal. Therefore, the price of coal is also continuously decreasing. After the impact of the epidemic gradually decreased, the economy began to recover. The demand for energy such as coal in various countries also began to increase, leading to an increase in coal prices. In June 2022, the price of thermal coal in China increased by about 45% year-on-year, and the price of thermal coal has fluctuated sharply in the past year, reaching 2400 RMB per ton in October 2021. In this environment of frequent fluctuations in coal prices, it is bound to have an impact on relevant enterprises in China.

This article selects BYD, the company with the highest sales and production of new energy vehicles in China, as the research object to study the impact of changes in coal prices on industrial enterprises like BYD. This article uses the VAR model to study the relationship between coal prices and BYD stock prices. This study can provide reference for investors, BYD managers and relevant government departments, helping them to have an estimate of BYD's stock price changes when coal prices change. So, they can make corresponding adjustments in response to the fluctuations in BYD's stock price as soon as the coal price changes. Therefore, the research in this article has certain significance for maintaining the stability of the stock market and the financial market.

2. Literature Review

Gong et al. found through the research on the dynamic impact of energy price changes on industrial enterprises that when energy prices rise, it affects the output and cost of industrial enterprises by affecting the special demand for energy [1]. James used the VAR model to study the impact of rising energy prices on the US economy from 2008 to 2009, and found that when energy prices rise, it will have a negative impact on the overall consumption level [2]. When consumption levels decline, people's demand for new energy vehicles may decrease, which in turn affects BYD's stock price. When studying the impact of energy price fluctuations on unemployment rates in Canada and the United States, Nusair found that energy price fluctuations do not have an impact on unemployment rates in the short term, but have a significant long-term positive impact [3]. Therefore, changes in coal prices may not be a bad thing for BYD in the long run.

Chevallier demonstrated the mutual influence between the EU's coal market and other energy markets by constructing a bivariate var model. [4] The research has shown that there are close connections between various energy materials in the energy market, and coal prices can also affect BYD's stock price by influencing the prices of other energy sources. Meanwhile, Otero found that fluctuations in energy prices can have a significant impact on demand through studying Colombia's economic data, which does not occur in all sectors, and is primarily targeted to have a significant impact on the manufacturing industry[5]. As a manufacturing-oriented enterprise, BYD is highly likely to be impacted by fluctuations in energy prices such as coal. Hotteling studied the impact of traditional energy natural gas, coal, and electricity prices on the new energy stock markets in the United States and the European Union, and the research results showed that all three factors will affect the stock market, in which the impact of electricity prices on the stock market being more significant [6]. China's power system is mainly based on thermal power generation, and coal is an important raw material for thermal power generation. As a manufacturer of electric vehicles and batteries, BYD requires a large amount of electricity in its production process. When coal prices rise, electricity prices will also rise, which will increase BYD's production costs. According to cost transfer theory, BYD will pass on these increased costs to consumers, resulting in an increase in product prices. The increase in costs will definitely affect BYD's sales volume and profit margin, thereby affecting the company's stock price. Chen simulates the impact of coal prices on China's economic inflation from three perspectives: actual regulation, unregulated regulation, and strong regulation of coal prices [7]. The research results show that, under actual regulatory conditions, an increase in coal prices will increase the inflation rate. In 2019, Chen conducted another study on the impact of energy prices on China's inflation rate, and the results showed that energy prices still have an impact on the inflation rate [8]. When the inflation rate increases, it will affect the monetary policy of the central bank. The central bank may raise interest rates to curb inflation, which will increase the financial costs of enterprises and may lead investors to turn to safer investment channels, thereby affecting the overall performance of the stock market, including BYD's stock price. Kumar explored the mutual influence between crude oil prices and new energy stock prices based on the VAR model, and the results showed a positive correlation between crude oil prices and new energy stock prices [9]. Guo used a var model to explore the impact of coal price fluctuations on China's CPI and PPI, and the study showed that coal prices have a significant positive impact on both [10].

Changes in coal prices have an impact on BYD's stock price, while fluctuations in coal prices have a negative impact on China's overall consumption level, thereby affecting BYD's sales. In addition, the price fluctuations of coal can also affect the prices of other energy sources, increasing BYD's production costs. In similar studies, many literature materials have chosen to use the var model to verify the relationship between energy prices and the stock market.

3. Research design

3.1. Data source

This article selects the thermal coal index from January 1, 2019 to January 29, 2024 and the closing price of BYD Shenzhen Stock Exchange to reflect the price of coal and BYD's stock price. The price data for thermal coal comes from the Wind database, and the stock price data for BYD comes from the Shenzhen Stock Exchange. Before conducting empirical analysis, in order to reduce the sequence correlation of time series data for better data analysis, this article performed logarithmic processing on the original data. Ln_index1 represents BYD's stock price and ln_index2 represents coal prices. Table 1 shows the results of descriptive statistics. From the results of descriptive statistics, it can be seen that the standard deviation of coal prices is significantly larger than that of BYD's stock price, indicating that the volatility of the coal market is more intense.

Table 1: Descriptive statistical results

Variable | Obs | Mean | Std. dev. | Min | Max |

Ln_index1 | 1234 | 181.5371 | 97.20715 | 43.83 | 353.5 |

Ln_Index2 | 1234 | 2000.146 | 778.1533 | 1045.419 | 3639.365 |

3.2. Empirical analysis process

3.2.1. Stationarity test

The prerequisite for constructing a var model is that the time series order must have stationarity, so, ADF unit root test was performed on two time series. From the test results in Table 2, it can be seen that ln_index1 and ln_index2 are not stationary time series data. After performing first-order difference on these two sets of data, the ADF unit root test is performed again, and the difference data is named ln_index1r and ln_index2r.

Table 2: ADF stationarity test

Variable | Test Statistic | 1% Critical Value | 5% Critical Value | 10% Critical Value | P-value |

Ln_index1 | -0.362 | -3.960 | -3.410 | -3.410 | 0.9880 |

Ln_Index2 | -2.408 | -3.960 | -3.410 | -3.120 | 0.3755 |

From the results in Table 3, it can be seen that there is no unit root in the data after differential processing. Both time series data are stationary, which means that the statistical patterns of the time series will not change with the passage of time.

Table 3: ADF stationarity test

Variable | Test Statistic | 1% Critical Value | 5% Critical Value | 10% Critical Value | P-value |

Ln_index1r | -24.877 | -3.960 | -3.410 | -3.120 | 0.0000 |

Ln_index2r | -25.184 | -3.960 | -3.410 | -3.120 | 0.0000 |

3.2.2. VAR Model Setting

Before constructing the var model, the optimal lag order of the var model needs to be confirmed first. This paper chooses to use the Akaike Information Criterion to confirm the lag order. Table 4 shows the values of AIC.

Table 4: Lag order of VAR

Lag | LL | LR | FPE | AIC | SC | HQ |

1 | 5702.59 | 13869 | 3.1e-07* | -9.32338* | -9.2983* | -9.31394* |

2 | 5704.87 | 4.5746 | 3.1e-07 | -9.32058 | -9.27878 | -9.30485 |

3 | 5705.36 | 0.9706 | 3.1e-07 | -9.31483 | -9.2563 | -9.2928 |

4 | 5707.7 | 4.6901 | 3.1e-07 | -9.31212 | -9.23687 | -9.2838 |

5 | 5710.89 | 6.3623 | 3.1e-07 | -9.31078 | -9.21881 | -9.27617 |

6 | 5712.05 | 2.3382 | 3.1e-07 | -9.30615 | -9.19746 | -9.26524 |

7 | 5718.54 | 12.973* | 3.1e-07 | -9.31022 | -9.18481 | -9.26302 |

It can be seen that the optimal lag order is first order, so the model that should be used is VAR(1). The var model used in this paper contains two variables, so a binary var model should be used. The model settings are as follows:

\( {Y_{t}}={C_{1}}+\sum _{1}^{n}{α_{i}}{Y_{t-i}}+\sum _{1}^{n}{β_{i}}{X_{t-i}}+{ε_{1}},t=1.2…,n \)

\( {X_{t}}={C_{2}}+\sum _{1}^{n}{α_{i}}{X_{t-i}}+\sum _{1}^{n}{β_{i}}{Y_{t-i}}+{ε_{2}},t=1.2.…,n \)

In the equation, \( {Y_{t}} \) and \( {X_{t}} \) are \( 2×1 \) order time series column vector, \( {C_{1}} \) and \( {C_{2}} \) are \( 2×1 \) order constant term column vector, \( ε \) 1 and \( ε \) 2 are \( 2×1 \) order random error column vector, \( \sum _{1}^{n}{α_{i}} \) and \( \sum _{1}^{n}{β_{i}} \) are \( 2×2 \) order parameter matrix.

Table 5 shows the fitting result of the VAR model. At a significant level of 5%, a lagged lnindex1 will have a positive impact on the current lnindex1 and a lagged lnindex2 will also have a positive impact on the current lnindex2.

Table 5: Fitting result of VAR

Coef. | Std. Err | t | P>|t| | ||

Ln_index1_L1. | 1.00087 | 0.0019491 | 1.00469 | 0.000 | |

Ln_index1 | Ln_index2_L1. | -0.0057585 | 0.003553 | -0.0127223 | 0.105 |

cons | 0.0400182 | 0.196444 | 0.0785205 | 0.042 | |

Ln_index1_L1 | 0.0024162 | 0.0013656 | 0.0050927 | 0.077 | |

Ln_index2 | Ln_index2_L1 | 0.995572 | 0.0024893 | 1.000451 | 0.000 |

cons | 0.0222189 | 0.0137629 | 0.0491937 | 0.106 |

3.2.3. Granger causality test

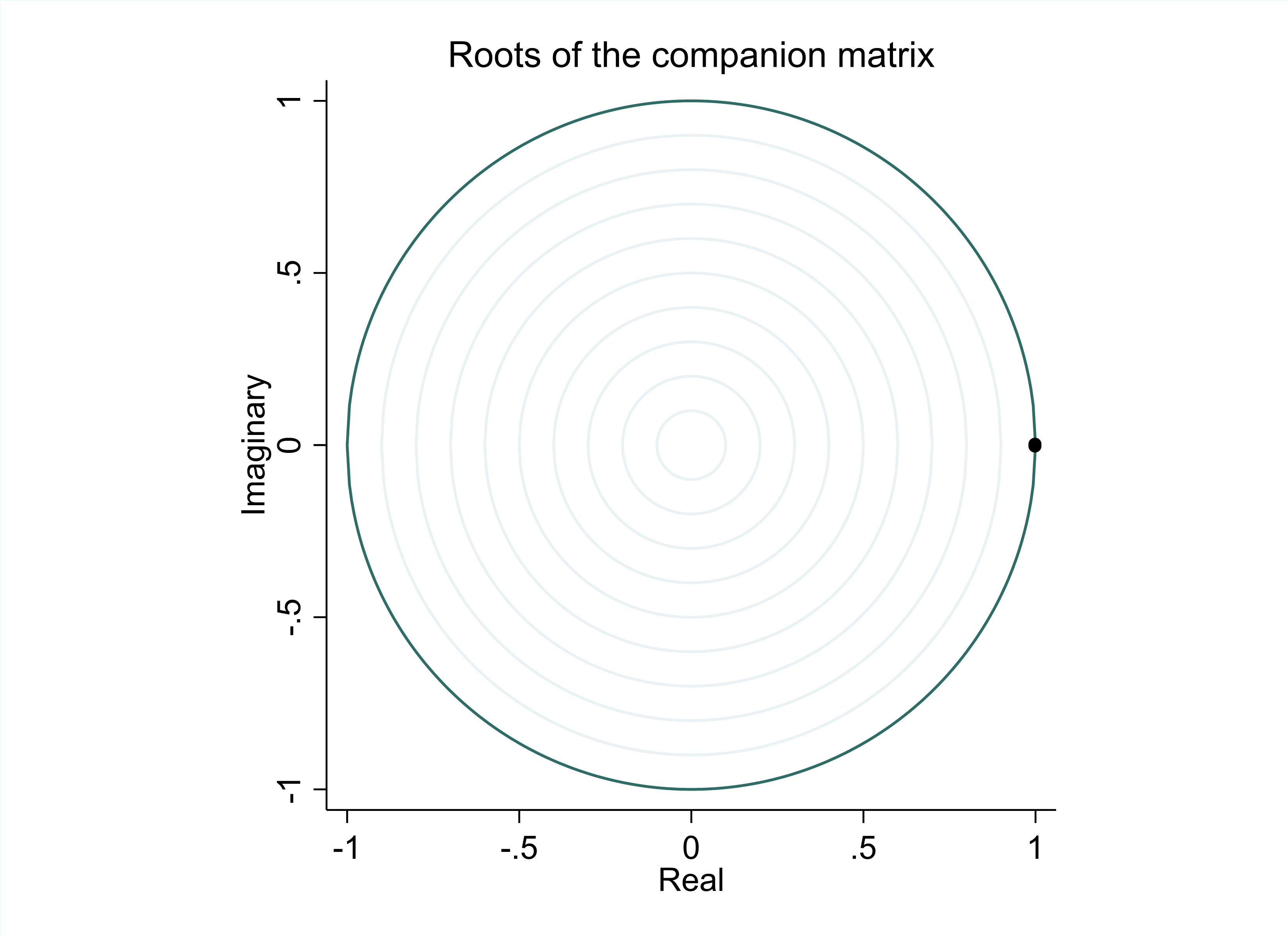

To confirm the relationship between two sequences, this paper uses the Granger causality test to investigate whether there is a causal relationship between these two sequences. Before conducting the Granger causality test, it is necessary to confirm that the model is stationary. After confirming the results of joint significance, use the unit circle test to confirm whether the var model is stationary. From Figure 1, it can be seen that all feature roots of the VAR (1) model fall within the unit circle, so this VAR (1) model is stationary. Next, the Granger causality test can be performed.

Figure 1: unit circle test

Table 6: Granger causality test

equation | excluded | F | df | Prob>F |

Ln_index1 | Ln_index2 | 7.8804 | 1 | 0.0105 |

Ln_index2 | Ln_index1 | 0.31307 | 1 | 0.77 |

Table 6 show the result of Granger causality test. According to the results of Granger causality test, ln_ Index2 is the Granger cause of ln_index1, ln_index1 is not the Granger cause of ln_index2. Changes in coal prices will have an impact on BYD's stock price.

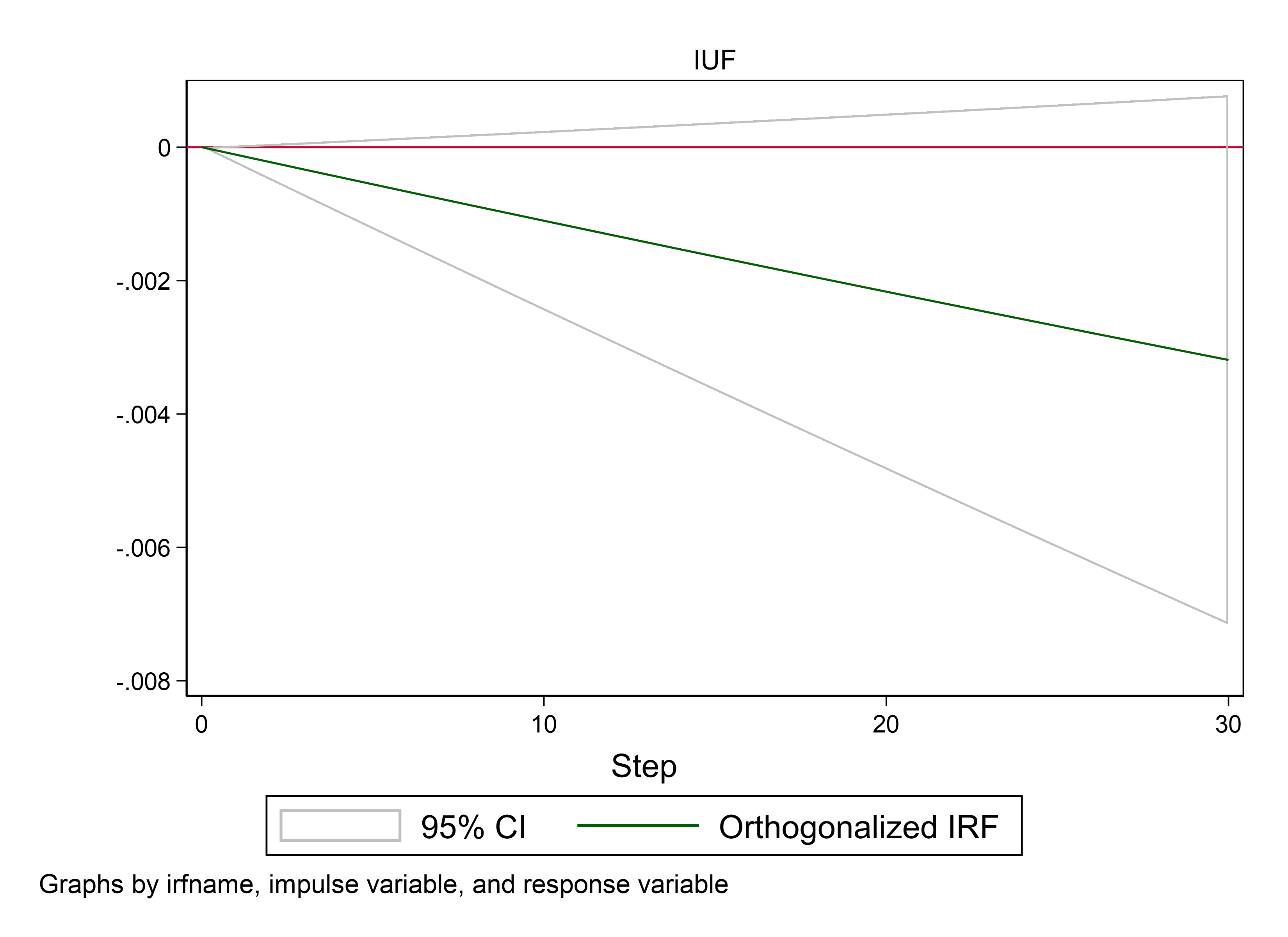

3.2.4. Impulse Response

Impulse response analysis can determine the response of each variable to residual shocks. The figure 2 shows the pulse response of BYD's stock price after being impacted by one standard deviation of coal prices. It can be seen that the impact response of ln_index1 to ln_index2 rapidly decreases to a negative value in the first step. There is a significant downward trend in both the medium and long term, and this negative impact is very significant. Every unit increase in ln_index2 during the current period will have a negative impact on ln_index1. When coal prices rise, it will lead to a decrease in BYD's stock price.

Figure 2: impulse response

4. Discussion

BYD, as the top new energy vehicle company in terms of sales and market share in China, is highly representative in the entire new energy market. Studying the impact of changes in coal prices on BYD's stock price can also to some extent reflect its impact on the entire new energy market. When the price of coal rises, the cost of electricity also increases. BYD needs to use a large amount of electricity in production, which will increase production costs. In addition, the price of raw materials required to produce new energy vehicles is also affected by the rise in coal prices, which will further increase production costs. Therefore, the increase in coal prices will definitely lead to an increase in BYD's production costs, thereby affecting the stock price. Investor sentiment is also an important factor that cannot be ignored. When coal prices rise, the new energy market will be hit. When investors believe that BYD's profitability will decrease due to the rise in coal prices, they will develop negative investment emotions, thereby causing the market and investors to lose confidence in BYD, which will also lead to a decline in BYD's stock price.

However, the rise in coal prices also has a positive impact on BYD's stock price. In the long run, fluctuations in coal prices may prompt the government and market to accelerate the transformation of energy structure. The Chinese government has been vigorously promoting new energy vehicles, and in this situation, the government will issue a series of favorable policies for new energy vehicles to alleviate the pressure on enterprises. Furthermore, as coal and oil belong to a substitution relationship, coal prices will rise at the same time as price. The gap between the cost of driving a fuel vehicle and the cost of driving a new energy vehicle will gradually increase. Consider that the price of electricity for households will not rise because of the increase in the cost of power generation. The market demand for new energy vehicles is therefore increasing.

5. Conclusion

This article studies the impact of coal prices on BYD's stock price. The model used is the var model, and the research result shows that an increase in coal prices will lead to a decrease in BYD's stock price. The rise in coal prices can affect BYD's stock price by affecting its production costs. As a leading enterprise in China's new energy industry, maintaining stable stock prices is crucial for the entire new energy market and even China's stock market. Therefore, when coal prices rise, BYD's management should take timely measures to cope with the decline in stock prices and maintain a stable growth state.

There are also limitations in this article. The price of stocks is influenced by many factors, and the fluctuation of coal prices is just one of them. However, this article considers fewer factors and only considers the impact of coal prices on BYD's stock price. However, this article considers fewer factors and only considers the impact of coal prices on BYD's stock price. This cannot exclude the influence of other factors on BYD's stock price. Therefore, in future research, I will consider more factors and establish appropriate models to study the factors that affect the stock price. In addition, the impact of coal prices on stock prices is not limited to the points mentioned in this article. In future research, I will also consider the impact of more factors on stock prices. Strive to make the prediction of stock prices more accurate and provide more assistance in maintaining the stability of the stock market.

References

[1]. Gong X.L., Liu J.M., Xiong X., etc. The dynamic effects of international oil price shocks on economic fluctuation[J]. Resources Policy, 2021.

[2]. James D.H. Causes and consequences of the oil shock of 2007~2008[J]. Brookings Papers on Economic Activity, 2009: 215-2.

[3]. Nusair S.A. The asymmetric effects of oil price changes on unemployment: Evidence from Canada and the U.S[J]. The Journal of Economic Asymmetries, 2020, 6(21).

[4]. ChevallierJulien.A model of carbon price interactions with macroeconomic and energy dynamics[J]. Energy economics,2011,33(6):1295-1312.

[5]. Otero, J. D. Q. Not all sectors are alike: Differential impacts of shocks in oil prices on the sectors of the Colombian economy[J]. Energy Economics, 2020, 86: 104691.

[6]. Hotteling, H.The economics of natural resources[J].Journal of Political Economy, 1931,39(2):137-175.

[7]. chen Z.M. Inflationary effect of coal price change on the Chinese economy[J]. Applied Energy, 2014, 114: 301-309

[8]. Chen Z.M., Chen P.L., Ma Z.M., etc. Inflationary and distributional effects of fossil energy price fluctuation on the Chinese economy[J]. Energy, 2019, 18.

[9]. Kumar S, Managi S, Matsuda A. Stock prices of clean energy firms, oil and carbon markets: A vector autoregressive analysis [J].Energy Economics, 2012,34(1):215-226.

[10]. Guo J., Zheng X., Chen Z. M. How does coal price drive up inflation? Reexamining the relationship between coal price and general price level in China[J]. Energy Economics, 2016.

Cite this article

Yu,J. (2024). Research on the Impact of Coal Prices on BYD's Stock Price. Advances in Economics, Management and Political Sciences,93,37-43.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Gong X.L., Liu J.M., Xiong X., etc. The dynamic effects of international oil price shocks on economic fluctuation[J]. Resources Policy, 2021.

[2]. James D.H. Causes and consequences of the oil shock of 2007~2008[J]. Brookings Papers on Economic Activity, 2009: 215-2.

[3]. Nusair S.A. The asymmetric effects of oil price changes on unemployment: Evidence from Canada and the U.S[J]. The Journal of Economic Asymmetries, 2020, 6(21).

[4]. ChevallierJulien.A model of carbon price interactions with macroeconomic and energy dynamics[J]. Energy economics,2011,33(6):1295-1312.

[5]. Otero, J. D. Q. Not all sectors are alike: Differential impacts of shocks in oil prices on the sectors of the Colombian economy[J]. Energy Economics, 2020, 86: 104691.

[6]. Hotteling, H.The economics of natural resources[J].Journal of Political Economy, 1931,39(2):137-175.

[7]. chen Z.M. Inflationary effect of coal price change on the Chinese economy[J]. Applied Energy, 2014, 114: 301-309

[8]. Chen Z.M., Chen P.L., Ma Z.M., etc. Inflationary and distributional effects of fossil energy price fluctuation on the Chinese economy[J]. Energy, 2019, 18.

[9]. Kumar S, Managi S, Matsuda A. Stock prices of clean energy firms, oil and carbon markets: A vector autoregressive analysis [J].Energy Economics, 2012,34(1):215-226.

[10]. Guo J., Zheng X., Chen Z. M. How does coal price drive up inflation? Reexamining the relationship between coal price and general price level in China[J]. Energy Economics, 2016.