1. Introduction

In the complex interplay between global economics and political decision-making, institutional frameworks serve as the backbone, influencing both the stability and efficiency of markets worldwide. This paper explores the pivotal role of political stability and institutional integrity in shaping economic landscapes, asserting that the quality of governance significantly impacts economic development and international trade. Political decisions and institutional settings create the regulatory environment within which businesses operate, influencing everything from investment flows to the stability of global markets[1].

The dynamics of trade agreements and protectionism are central themes of this analysis, showcasing how these policies not only affect bilateral and multilateral relations but also dictate the pace and nature of economic globalization. This study examines how trade agreements like NAFTA and its successor, the USMCA, have reshaped economic relations in North America, impacting sectors ranging from agriculture to manufacturing. Similarly, the rise of protectionist sentiments in major economies such as the United States and China demonstrates the complex negotiation between protecting domestic industries and engaging in free trade.

This paper further delves into the effects of political stability—or the lack thereof—on economic growth, drawing on empirical research that links governmental continuity with robust economic performance. Unstable political climates are shown to deter investment and accelerate capital flight, which can devastate local economies and have ripple effects in the global market.

Institutional frameworks are analyzed for their role in establishing the rules and norms that govern economic interactions, both domestically and internationally. Strong legal systems and clear property rights are highlighted as essential for fostering environments conducive to economic growth and innovation, while weak institutions are critiqued for breeding inefficiency and corruption, thereby stalling development.

Through a synthesis of theoretical frameworks and real-world examples, this introduction sets the stage for a comprehensive exploration of how political decisions and institutional frameworks are intertwined with economic outcomes. The study aims to provide a granular understanding of these dynamics, offering insights into how better governance could potentially lead to more sustainable economic policies and practices in an increasingly globalized world. This paper positions itself as a crucial resource for policymakers, economists, and academics seeking to understand and navigate the challenges and opportunities presented by global economic interdependencies.

2. Governance and Policy-Making

2.1. Institutional Frameworks

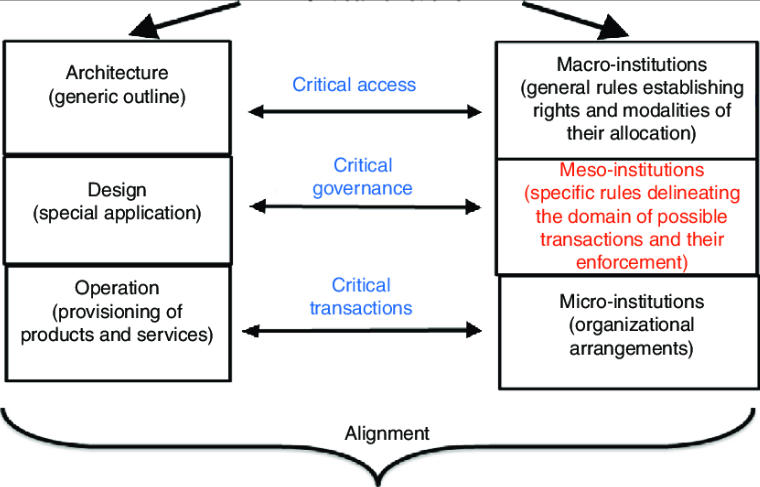

Institutional frameworks form the backbone of economic and political governance, providing a structured set of rules and norms that govern interactions within and between states. These frameworks are crucial in shaping economic policies because they define how authority is exercised, the accountability mechanisms in place, and the degree of transparency expected in government actions. A robust institutional framework, such as those characterized by strong legal systems, clear property rights, and efficient bureaucratic functioning. As figure 1 showing below, it tends to promote economic stability and growth by fostering an environment conducive to investment and trade [2]. On the other hand, weaker institutions often struggle with corruption, inefficiency, and political instability, leading to economic policies that are erratic and often detrimental to economic development. For instance, countries with weak rule of law may experience higher rates of corruption which can deter foreign investment, as businesses may perceive higher risks and lower potential returns on their investments.

Figure 1: A General Institutional Framework (Source: Kunneke, Menard.com)

2.2. Political Stability and Economic Growth

Political stability is intrinsically linked to economic growth as it affects investment decisions and economic planning. Stable governments are capable of implementing long-term economic policies without the fear of disruption from political unrest or government overhauls. This stability attracts investment, both from domestic and international sources, as investors have a clearer understanding of the political landscape and can forecast economic returns with greater certainty. Empirical studies have shown that countries with frequent government changes tend to have lower rates of investment and slower economic growth. In contrast, politically unstable regions often witness capital flight, where both human and financial capital move to more stable environments. This outflow of resources hampers economic development and further exacerbates the instability, creating a vicious cycle of underdevelopment.

2.3. Policy Impact Analysis

Analyzing the impact of government policies on economic outcomes is vital for understanding the efficacy and repercussions of political decisions. For instance, an increase in corporate taxes might be intended to raise government revenues but could inadvertently lead businesses to reduce investments, cut jobs, or shift operations to countries with more favorable tax regimes [3]. Similarly, regulatory measures such as minimum wage laws aim to raise the standard of living for workers but might lead to higher unemployment if businesses reduce their workforce to cut costs. A nuanced understanding of these dynamics can be achieved through econometric modeling and analysis, which provides insights into the causal relationships between policies and economic variables. Tools such as regression analysis can isolate the effects of a particular policy from other variables, offering a clearer picture of its impact on economic indicators like GDP growth, employment rates, and investment levels[4].

3. Market Dynamics and Regulation

3.1. Regulatory Policies

Regulatory policies are crucial for ensuring that markets function efficiently and fairly. They are designed within the political framework to manage and supervise market activities, ensuring that no entity has undue dominance that can hinder competition. For instance, regulations controlling anti-competitive practices, such as monopolies and cartels, play a critical role in ensuring that the market remains open and competitive [5]. These policies can include enforcing antitrust laws, monitoring price fixing, and regulating mergers and acquisitions to prevent large conglomerates from dominating the market. As table 1 providing below, such regulations not only protect consumers from exploitative practices but also foster an environment where small and medium enterprises can thrive alongside larger corporations. For example, the European Union's strict antitrust laws have been instrumental in breaking up monopolistic practices by major firms, ensuring that the market remains dynamic and competitive.

Table 1: The Effects of Antitrust Enforcement on Market Competitiveness Within a Hypothetical Scenario in the European Union.

Year | Number of Antitrust Cases Filed | Major Firms Affected | Reduction in Market Dominance (%) | SME Growth Rate (%) |

2015 | 10 | 5 | 20 | 5 |

2016 | 15 | 7 | 25 | 6 |

2017 | 12 | 6 | 18 | 7 |

2018 | 18 | 8 | 30 | 8 |

2019 | 20 | 10 | 35 | 9 |

3.2. Market Efficiency

Market efficiency is directly impacted by the transparency of information and the regulatory environment. Efficient markets are those where prices reflect all available information, and political decisions play a pivotal role in this process. By implementing policies that enhance transparency, such as laws requiring companies to publish accurate financial reports, governments help reduce information asymmetry among investors, which is essential for the proper functioning of capital markets. Moreover, reducing bureaucratic procedures can lower transaction costs, thus enhancing overall market efficiency. For example, streamlined processes for business registration and licensing reduce the barriers to entry for new firms, which increases competition and drives innovation. These measures are vital for maintaining an active marketplace where resources are allocated efficiently and where economic output is optimized [6].

3.3. Economic Sanctions and Market Access

Economic sanctions are significant political tools that can reshape market landscapes by limiting or preventing trade with targeted nations, entities, or individuals. The decision to impose or lift sanctions affects global markets by altering trade routes, disrupting global supply chains, and changing resource availability. For example, sanctions imposed on a country can block its businesses from accessing international banking systems, thereby severely affecting its ability to trade internationally [7]. These restrictions can lead to shortages of goods in the sanctioned country and oversupply in others, impacting global prices and economic stability. Conversely, the removal of sanctions can lead to a surge in market activity, as previously restricted resources become available, and trade relationships are restored. This was evident when sanctions were lifted against Iran in 2016, leading to an increase in oil exports and more active trade relations with other countries, thereby influencing global oil prices and market dynamics.

These detailed explorations highlight how regulatory policies, market efficiency, and economic sanctions underpin and are influenced by political decisions, showcasing the interplay between politics and economic outcomes.

4. International Trade and Economics

4.1. Trade Agreements

Trade agreements play a crucial role in shaping global economic policies and national economic strategies. These agreements involve complex negotiations where countries come together to decide on tariffs, quotas, and other trade barriers that will govern their trade relationships. For instance, the North American Free Trade Agreement (NAFTA), replaced by the United States-Mexico-Canada Agreement (USMCA), significantly altered trade dynamics between these countries by reducing most trade barriers, which in turn affected sectors from agriculture to automotive manufacturing. These agreements often aim to increase market access for exporters by reducing the trade barriers that restrict imports and exports. However, the economic impact of these agreements varies. While they can stimulate economic growth by opening up new markets, they can also lead to job losses in industries that are exposed to increased foreign competition. The complex interplay of economic interests in such negotiations reflects the influence of various domestic industries and lobbying efforts, which can shape the outcome of the agreements to benefit certain sectors over others.

4.2. Globalization and Political Economy

Globalization has significantly influenced the political economy by integrating economies and cultures more closely than ever before. This integration has facilitated not only economic growth and technological innovation but also cultural exchange and political cooperation on a global scale. However, globalization has also introduced challenges such as job displacement and wage stagnation in developed economies. For example, as manufacturing jobs move to lower-wage countries, workers in higher-wage countries may find themselves either unemployed or forced to accept lower wages [8]. Moreover, globalization has led to increased economic inequality both within and between countries. As table 2 showing below, the political responses to these challenges, including policies aimed at education and re-skilling workers, are crucial for mitigating the negative effects of globalization. Additionally, the spread of information technology has made the global economy more susceptible to rapid shifts in capital and jobs, highlighting the need for policies that can adapt quickly to changing global conditions.

Table 2: Changes in Employment, Wages, and Inequality Due to Globalization in Selected Developed Economies

Country | Year | Manufacturing Jobs Loss (%) | Average Wage Change (%) | Economic Inequality Index (Gini) | Policy Initiatives |

USA | 2015 | -4 | -2 | 0.45 | Reskilling Programs |

Germany | 2015 | -3 | -1.5 | 0.30 | Educational Subsidies |

Canada | 2015 | -2 | -1 | 0.33 | Job Transition Aid |

France | 2015 | -5 | -2.5 | 0.29 | Wage Support Policies |

4.3. Protectionism and its Economic Implications

Protectionist policies, such as tariffs and quotas, are implemented by governments to protect domestic industries from foreign competition. These policies can lead to short-term gains such as increased employment and higher production levels in protected industries. However, they also tend to lead to inefficiencies and higher costs for consumers. For example, tariffs on imported goods can increase the price of these goods, which not only affects consumers but can also increase costs for domestic producers who rely on imported materials. Additionally, protectionism can provoke retaliatory measures from other countries, leading to a tit-for-tat escalation that can harm the global economy. An example of this is the recent trade war between the United States and China, where both countries imposed tariffs on billions of dollars' worth of each other's goods, affecting global supply chains and increasing prices for consumers and businesses. In the long run, such policies can stifle innovation and economic growth by insulating industries from the pressures of global competition.

5. Conclusion

The study underscores the significant impact of political decisions and institutional frameworks on the global economic environment. It reveals that while political stability and robust institutions can foster economic growth and enhance market efficiency, protectionism and poor governance can lead to economic inefficiencies and instability. The analysis highlights the need for balanced economic policies that consider both domestic priorities and international implications. By understanding the complex interactions between political decisions and economic outcomes, policymakers and scholars can better navigate the challenges of globalization and foster sustainable economic development in an interconnected world.

This comprehensive analysis offers critical insights into the mechanisms by which political and institutional factors shape economic policies and outcomes, serving as a valuable resource for policymakers, economists, and academics interested in the intersections of governance, economics, and global trade dynamics.

Contribution

Both Chengyuan Tang and Wenchong He have made equally significant contributions to the work and share equal responsibility and accountability for it.

References

[1]. Cavero Belda, A. M. (2024). Power Dynamics In The South Pacific: Influences On Island Alliances, Economic Partnerships, And Diplomatic Decisions Amidst Global Polarization.

[2]. Ozili, P. K. (2024). Global economic consequences of Russian invasion of Ukraine. In Dealing With Regional Conflicts of Global Importance (pp. 195-223). IGI Global.

[3]. Zhang, Y., He, M., Wang, Y., & Liang, C. (2023). Global economic policy uncertainty aligned: An informative predictor for crude oil market volatility. International Journal of Forecasting, 39(3), 1318-1332.

[4]. Bobasu, A., Quaglietti, L., & Ricci, M. (2023). Tracking global economic uncertainty: implications for the euro area. IMF Economic Review, 1-38.

[5]. Rimmer, D. (2023). Elements of the political economy. In Soldiers and Oil (pp. 141-165). Routledge.

[6]. Hartmann, J., Schwenzow, J., & Witte, M. (2023). The political ideology of conversational AI: Converging evidence on ChatGPT's pro-environmental, left-libertarian orientation. arXiv preprint arXiv:2301.01768.

[7]. Roos, M., & Reccius, M. (2024). Narratives in economics. Journal of Economic Surveys, 38(2), 303-341.

[8]. Jelveh, Z., Kogut, B., & Naidu, S. (2024). Political language in economics. The Economic Journal, ueae026.

Cite this article

He,W.;Tang,C. (2024). Navigating the Complex Landscape of Global Economics: The Role of Political Decisions and Institutional Frameworks. Advances in Economics, Management and Political Sciences,100,35-40.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Cavero Belda, A. M. (2024). Power Dynamics In The South Pacific: Influences On Island Alliances, Economic Partnerships, And Diplomatic Decisions Amidst Global Polarization.

[2]. Ozili, P. K. (2024). Global economic consequences of Russian invasion of Ukraine. In Dealing With Regional Conflicts of Global Importance (pp. 195-223). IGI Global.

[3]. Zhang, Y., He, M., Wang, Y., & Liang, C. (2023). Global economic policy uncertainty aligned: An informative predictor for crude oil market volatility. International Journal of Forecasting, 39(3), 1318-1332.

[4]. Bobasu, A., Quaglietti, L., & Ricci, M. (2023). Tracking global economic uncertainty: implications for the euro area. IMF Economic Review, 1-38.

[5]. Rimmer, D. (2023). Elements of the political economy. In Soldiers and Oil (pp. 141-165). Routledge.

[6]. Hartmann, J., Schwenzow, J., & Witte, M. (2023). The political ideology of conversational AI: Converging evidence on ChatGPT's pro-environmental, left-libertarian orientation. arXiv preprint arXiv:2301.01768.

[7]. Roos, M., & Reccius, M. (2024). Narratives in economics. Journal of Economic Surveys, 38(2), 303-341.

[8]. Jelveh, Z., Kogut, B., & Naidu, S. (2024). Political language in economics. The Economic Journal, ueae026.