1.Introduction

On June 30, 2020, the 14th meeting of the Central Comprehensive Deep Reform Commission was convened, and the "State-owned Enterprise Reform Three-Year Action Plan (2020-2022)" was reviewed and adopted, officially commencing the three-year initiative for state-owned enterprise reform. The initiation of this action plan signifies a further deepening of state-owned enterprise reform and an enhancement of policy enforceability. The plan calls for prominent and influential state-owned enterprises to undergo strategic reorganizations and professional integrations, driving resources to converge towards advantageous and core enterprises. It aims to resolve issues of homogenized competition and redundant construction, thereby strengthening the market competitiveness and international influence of state-owned enterprises.

This paper examines the reorganization event of Ansteel Group and Benxi Steel Group within the context of the state-owned enterprise reform and the three-year action plan, providing empirical evidence on how central enterprise reorganizations can improve enterprise performance from operational, financial, and managerial synergy effects. It offers robust support for other central and state-owned enterprises to actively respond to policy requirements.

2.Theoretical Foundation - Synergy Effect Theory

The concept of synergy was first introduced by the American scholar Ansoff, who understood synergy as: "The ideal state of the matching relationship between the company and the acquired enterprise. Previous business literature often described synergy as '2+2=5', implying that the overall performance of a company after acquiring another company is better than the sum of the two companies' original performances." [1] Ansoff's interpretation emphasizes the economic significance of synergy, partly attributed to the benefits of economies of scale [2]. Weston further subdivided synergy effects into operational, financial, and managerial synergy effects. [3] Specifically, operational synergy refers to the increased efficiency of production and business activities under economies of scale following corporate mergers and reorganizations [4][5]; financial synergy pertains to the achievement of financial objectives post-merger and reorganization[6], mainly manifested in improvements in growth capacity, profitability, operational capability, and debt-paying ability [7][8]; managerial synergy is reflected in the enhanced management efficiency following corporate mergers and reorganizations [6].

3.Research Design

3.1.Research Method

The research method employed in this paper is the single-case study method, for the following reasons: (1) This study focuses on how Ansteel Group and Benxi Steel Group improved Ansteel's enterprise performance through mergers and reorganizations within the context of state-owned enterprise reform, which is a "how" type of question; (2) Compared with other research methods, the case study method is more targeted and suitable for studying relatively new phenomena; (3) The merger and reorganization event of Ansteel Group and Benxi Steel Group is typical, and an in-depth analysis of how Ansteel improved enterprise performance after the case is beneficial for reference and comparison by other state-owned enterprises undergoing mergers and reorganizations.

3.2.Case Selection

This paper follows the theoretical typical sampling principle [9], selecting Ansteel Group as the case study object for the following main reasons:

(1) Enterprise typicality. As a large state-owned enterprise directly managed by the central government, Ansteel Group is the first large-scale integrated iron and steel enterprise restored and constructed in New China and the earliest established steel production base. It plays an irreplaceable role in China's economic construction and the development of the steel industry, known as "the eldest son of the Republic's steel industry" and "the cradle of New China's steel industry." Ansteel, a Fortune Global 500 company, has nine major production bases across China, with large production scale, extensive area, and high level, making it an important and well-known supplier domestically and internationally. In enterprises with a long history, the effect of organizational inertia is more pronounced. Ansteel Group, established in 1916, has a long history, making it a typically representative enterprise for study.

(2) Case enlightening. As a typical case of central enterprise reorganization, studying the reorganization case of Ansteel Group and Benxi Steel Group not only proves that actively conforming to the advanced policies of the State Council can bring operational advantages to enterprises but also provides inspiration for other central and state-owned enterprises to carry out mergers and reorganizations.

3.3.Data Sources and Collection

This paper combines primary and secondary data sources and collection methods. Primary data sources include listed company annual reports, policy documents, etc. Secondary data sources include various public materials, such as reports from the State-owned Assets Supervision and Administration Commission website, policy interpretations, news reports, authoritative platform analysis reports, etc. In addition, this paper also uses materials from databases like CNKI and official public accounts that are considered reliable after screening as references.

4.Background and Motivation for the Reorganization of Ansteel Group and Benxi Steel Group

4.1.Operational Synergy Effects

With the continuous growth of China's economy, the scale of the national steel industry has been expanding and its industrial competitiveness has been continuously improving. However, at the same time, the international competitiveness of the steel industry urgently needs to be enhanced. At the beginning of 2021, the Ministry of Industry and Information Technology issued the "Guiding Opinions on Promoting the High-Quality Development of the Steel Industry," which further promoted the merger and reorganization between Ansteel Group and Benxi Steel Group. In addition to the requirements of the national macro environment, the reorganization of Ansteel Group and Benxi Steel Group is also a need for their own development. Both Ansteel Group and Benxi Steel Group are located in Liaoning Province and are the two major steel giants in the province, with similar product categories and roughly the same sales markets. Before the reorganization event, the product prices of the two companies were significantly lower than those in the Central and Southern China regions, and the reason for this situation was that the two companies were engaged in a "price war" in their respective regions, resulting in a negative competitive situation. Therefore, to respond to the national needs and improve the operating conditions of the two companies, on August 20 of the same year, the State-owned Assets Supervision and Administration Commission of Liaoning Province transferred 51% of the equity of Benxi Steel Group to Ansteel Group without compensation, making Benxi Steel Group a holding subsidiary of Ansteel Group.

4.2.Motivations for Reorganization

4.2.1.Requirements under the Background of State-Owned Enterprise Reform

On July 26, 2016, the State Council issued the "Guiding Opinions on Promoting Structural Adjustment and Reorganization of Central Enterprises." The purpose of issuing this "Opinion" is to implement the decision-making deployment of the Party Central Committee and the State Council on deepening the reform of state-owned enterprises, and to propose the promotion of structural adjustment and reorganization of central enterprises. The key tasks in the "Opinion" include "four batches," which are "consolidating and strengthening a batch," "innovating and developing a batch," "reorganizing and integrating a batch," and "cleaning up and exiting a batch." The reorganization of Ansteel Group and Benxi Steel Group belongs to the "reorganizing and integrating a batch," promoting the strong alliance of the steel industry and promoting the professional integration of the two.

4.2.2.Enhancing International Competitiveness

The reorganization of Ansteel Group and Benxi Steel Group is conducive to the overall planning and rational development of the most concentrated iron ore resources in China, enhancing the supply capacity of self-owned iron ore, and cultivating world-class enterprises with global competitiveness, achieving high-quality development of the new Ansteel.

5.Performance Evaluation of Ansteel Group and Benxi Steel Group Reorganization Based on Synergy Effects

5.1.Operational Synergy Effects

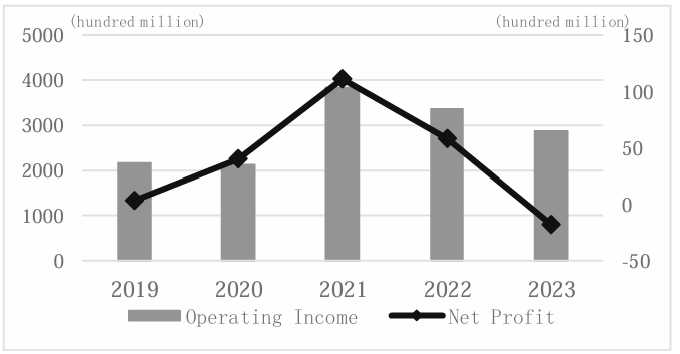

Following the merger and reorganization of Ansteel Group and Benxi Steel Group, both the operating income and net profit saw a significant increase in 2021 (Figure 1). Post-reorganization, Ansteel Group's operating income reached 383.057 billion yuan, ranking it second in the country and third in the world. This leapfrogged Ansteel Group to become a "star" in China's steel industry, enhancing its international influence and competitiveness.

Figure 1: Ansteel Group's Operating Income and Net Profit from 2019 to 2023

Data Source: Compiled based on the annual reports of Ansteel Group from 2019 to 2023.

After the successful reorganization, Ansteel Group boasts a crude steel output of 63 million tons, becoming the largest "aircraft carrier" in North China, following Baosteel Group. Concurrently, with the integration of Ansteel and Benxi Steel, the economies of scale will gradually emerge. The new Ansteel Group will evolve into a global enterprise with world-class scale, costs, and products, steadily progressing towards the goal of becoming a global iron ore resource company.

5.2.Financial Synergy Effects

5.2.1.Growth Capability

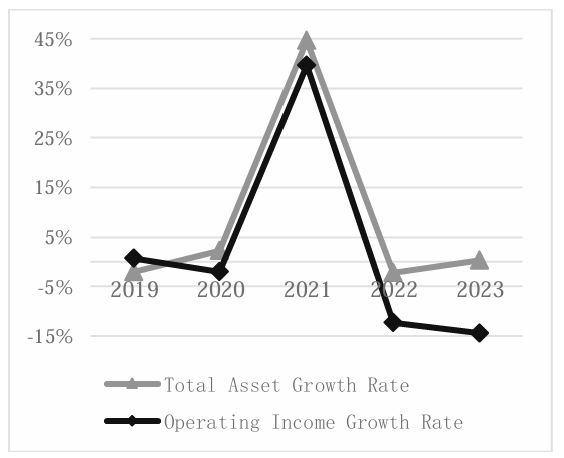

As depicted in Figure 2, following the merger and reorganization in 2021, Ansteel Group achieved peak levels in both total asset turnover rate and operating income growth rate. In 2021, the total asset turnover rate of Ansteel Group reached a high of 44.62%, and the growth rate of operating income reached 39.63%. From 2022 to 2023, there was a general trend of significant decline in both total asset growth rate and operating income growth rate. This is attributed to the exceptionally strong performance of the newly reorganized Ansteel Group post-2021. However, it is anticipated that the synergistic effects will continue to positively impact the new Ansteel Group, and overall, the growth capability is expected to show an upward trend post-reorganization.

Figure 2: Ansteel Group's Total Asset Growth Rate and Operating Income Growth Rate from 2019 to 2023

Data Source: Compiled based on the annual reports of Ansteel Group from 2019 to 2023.

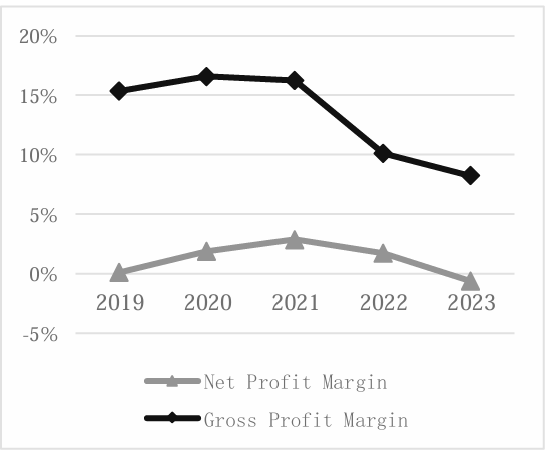

5.2.2.Profitability

As shown in Figure 3, Ansteel Group's net profit margin showed a stable upward trend from 2019 to 2021, indicating an enhancement in profitability following the merger and reorganization; the gross profit margin fluctuated slightly but overall trended upward during the same period, with the reorganization contributing to Ansteel Group's profitability in the short term. However, after 2022, both the net profit margin and gross profit margin of Ansteel Group exhibited a downward trend due to external environmental factors. In 2022, influenced mainly by the global economic downturn and a decrease in demand for steel products, steel prices plummeted, leading to an expanding loss across the steel industry and a weak cyclical market with low prosperity. Overall, this paper posits that Ansteel Group's profitability is expected to improve when the market outlook improves.

Figure 3: Ansteel Group's Net Profit Margin and Gross Profit Margin from 2019 to 2023

Data Source: Compiled based on the annual reports of Ansteel Group from 2019 to 2023.

5.2.3.Debt-Paying Ability

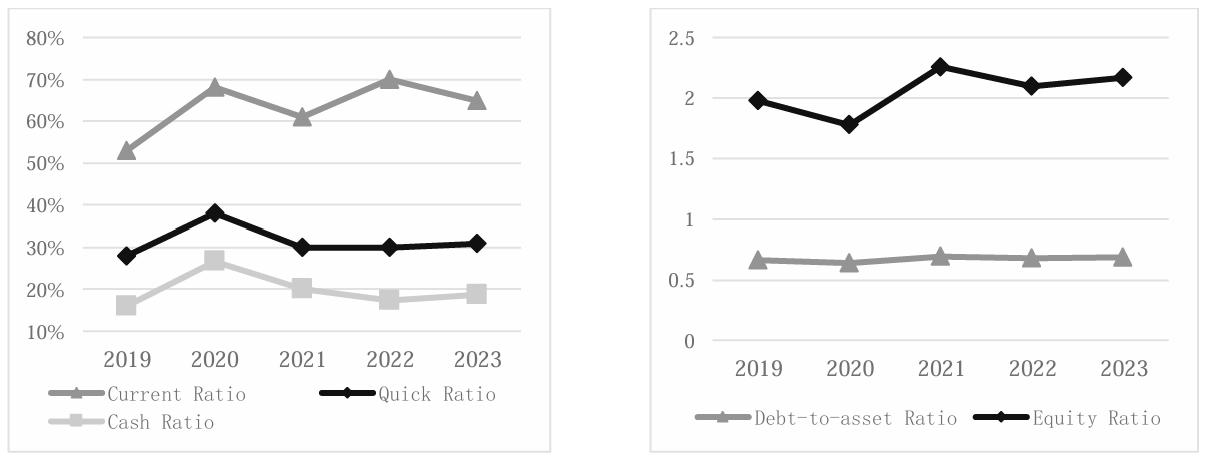

(1)Short-term Debt-Paying Ability

The optimal range for the current ratio is 1.5 to 2.0, and the quick ratio should be around 1. Figure 4 illustrates the changes in Ansteel Group's short-term debt-paying ability. Overall, Ansteel Group's current and quick ratios have been poor, showing low levels. From the perspective of the current ratio, although there was an increase after the merger and reorganization in 2021, it remains below the normal level. Regarding the quick ratio, there has been little change after the reorganization, and it remains at a low level. Considering both the current and quick ratios, the merger and reorganization between Ansteel Group and Benxi Steel Group did not improve Ansteel Group's low debt-paying ability. Additionally, the low cash ratio of Ansteel Group from 2019 to 2023 also confirms its poor short-term debt-paying ability.

(2)Long-term Debt-Paying Ability

Figure 5 shows the changes in Ansteel Group's long-term debt-paying ability from 2019 to 2023. In terms of the debt-to-asset ratio, Ansteel Group's overall debt-to-asset ratio has not fluctuated significantly, indicating that the merger and reorganization with Benxi Steel Group did not have a substantial impact on Ansteel Group's long-term debt-paying ability. Looking at the equity ratio, Ansteel Group's equity ratio has been fluctuating within a normal range, further confirming that the reorganization event had little overall impact on Ansteel Group's long-term debt-paying ability.

|

Figure 4: Changes in Ansteel Group's Short-term Debt-Paying Ability |

Figure 5: Changes in Ansteel Group's Long-term Debt-Paying Ability |

|

Data Source: Compiled based on the annual reports of Ansteel Group from 2019 to 2023. |

Data Source: Compiled based on the annual reports of Ansteel Group from 2019 to 2023. |

Considering both short-term and long-term debt-paying abilities, the merger and reorganization of Ansteel Group and Benxi Steel Group did not bring an improvement in Ansteel Group's debt-paying ability. This paper suggests that this may be due to the overall unremarkable debt-paying ability in the steel industry.

5.3.Managerial Synergy Effects

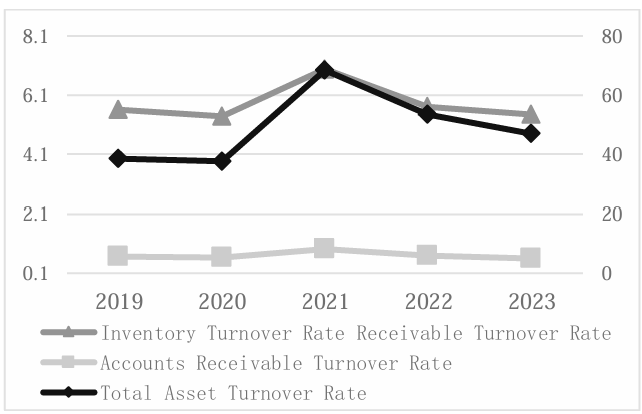

In this paper, the analysis of the managerial synergy effects mainly selects asset management capability indicators to analyze the merger and reorganization event of Ansteel Group and Benxi Steel Group. As shown in Figure 6, the inventory turnover rate, total asset turnover rate, and accounts receivable turnover rate of Ansteel Group all show a significant decline after 2021, indicating that the managerial synergy effect has been prominently realized after the merger and reorganization of Ansteel Group and Benxi Steel Group.

Figure 6: Changes in Ansteel Group's Inventory Turnover Rate, Total Asset Turnover Rate, and Accounts Receivable Turnover Rate from 2019 to 2023

Data Source: Compiled based on the annual reports of Ansteel Group from 2019 to 2023.

6.Research Conclusions and Implications

Driven by national requirements and their own needs, Ansteel Group and Benxi Steel Group completed a merger and reorganization on August 20, 2021, with Benxi Steel Group officially becoming a subsidiary of Ansteel Group. The analysis in this paper shows that after the reorganization event, Ansteel Group has effectively leveraged operational synergy, financial synergy, and management synergy. The merger between Ansteel Group and Benxi Steel Group has brought about a "1+1>2" effect for Ansteel Group, transforming the previous "disorderly confrontation" into a win-win situation of "mutual support." The reorganization event of Ansteel Group and Benxi Steel Group is a typical case of large-scale central enterprise reorganization, and the results of the synergy effect and the improvement of corporate performance have confirmed the advantages of state-owned enterprise reform in promoting the reorganization of central enterprises. This paper provides evidence for the improvement of corporate performance through central enterprise reorganization, and it is suggested that central enterprises and state-owned enterprises should actively respond to reorganization policies according to their own needs to achieve the goal of improving corporate performance.

References

[1]. Ansoff H I. Corporate Strategy: An Analytic Approach to Business Policy for Growth and Expansion [M]. New York: McGraw-Hill Companies, 1965.

[2]. Zhang Qiusheng, Zhou Lin. Research and Development on the Synergy Effects of Enterprise Mergers and Acquisitions [J]. Accounting Research, 2003(06): 44-47.

[3]. Weston J F, Chung K S, Hoag S. Mergers, Restructuring, and Corporate Control [M]. Upper Saddle River: Prentice Hall, 1990.

[4]. Wang Hongli, Zhou Xianhua. The Operational Synergy and Its Value Assessment in Enterprise Mergers and Acquisitions [J]. Contemporary Economic Research, 2003(07): 48-51.

[5]. Wang Xuefeng. A Brief Discussion on the Synergy Effects of Enterprise Mergers and Acquisitions [J]. Population and Economy, 2011(S1): 107-108. Hu Haiqing, Wu Tian, Zhang Lang, et al. Research on the Performance of Overseas Mergers and Acquisitions Based on Synergy Effects: A Case Study of Geely's Acquisition of Volvo [J]. Management Case Study and Review, 2016, 9(06): 531-549.

[6]. Hu Haiqing, Wu Tian, Zhang Lang, et al. Research on the Performance of Overseas Mergers and Acquisitions Based on Synergy Effects: A Case Study of Geely's Acquisition of Volvo [J]. Management Case Study and Review, 2016, 9(06): 531-549.

[7]. Zhang Baoqiang. Performance Evaluation of Financial Synergy in Enterprise Groups [J]. Friends of Accounting, 2013(01): 29-30.

[8]. Cao Cuizhen, Wu Shenyin. Empirical Analysis of Financial Synergy Effects in Enterprise Mergers and Acquisitions [J]. Friends of Accounting, 2017(24): 35-39.

[9]. Yin, R. K. Case Study Research: Design and Methods [M]. Los Angeles: Sage Publications, 2013.

Cite this article

Cai,Y. (2024). A Study on the Performance of Mergers and Acquisitions in the Context of State-Owned Enterprise Reform: The Case of Ansteel and Benxi Steel. Advances in Economics, Management and Political Sciences,95,149-156.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Ansoff H I. Corporate Strategy: An Analytic Approach to Business Policy for Growth and Expansion [M]. New York: McGraw-Hill Companies, 1965.

[2]. Zhang Qiusheng, Zhou Lin. Research and Development on the Synergy Effects of Enterprise Mergers and Acquisitions [J]. Accounting Research, 2003(06): 44-47.

[3]. Weston J F, Chung K S, Hoag S. Mergers, Restructuring, and Corporate Control [M]. Upper Saddle River: Prentice Hall, 1990.

[4]. Wang Hongli, Zhou Xianhua. The Operational Synergy and Its Value Assessment in Enterprise Mergers and Acquisitions [J]. Contemporary Economic Research, 2003(07): 48-51.

[5]. Wang Xuefeng. A Brief Discussion on the Synergy Effects of Enterprise Mergers and Acquisitions [J]. Population and Economy, 2011(S1): 107-108. Hu Haiqing, Wu Tian, Zhang Lang, et al. Research on the Performance of Overseas Mergers and Acquisitions Based on Synergy Effects: A Case Study of Geely's Acquisition of Volvo [J]. Management Case Study and Review, 2016, 9(06): 531-549.

[6]. Hu Haiqing, Wu Tian, Zhang Lang, et al. Research on the Performance of Overseas Mergers and Acquisitions Based on Synergy Effects: A Case Study of Geely's Acquisition of Volvo [J]. Management Case Study and Review, 2016, 9(06): 531-549.

[7]. Zhang Baoqiang. Performance Evaluation of Financial Synergy in Enterprise Groups [J]. Friends of Accounting, 2013(01): 29-30.

[8]. Cao Cuizhen, Wu Shenyin. Empirical Analysis of Financial Synergy Effects in Enterprise Mergers and Acquisitions [J]. Friends of Accounting, 2017(24): 35-39.

[9]. Yin, R. K. Case Study Research: Design and Methods [M]. Los Angeles: Sage Publications, 2013.