1. Introduction

1.1. Research Background and Significance

The global dialysis market is expected to grow from $74.2 billion in 2019 to $99.2 billion by 2024, at a CAGR of 6.0% during the forecast period. The growth of the market is largely driven by factors such as the increasing number of patients with chronic kidney disease (ESRD), diabetes, hypertension (the leading cause of kidney failure), and the preference for dialysis treatment due to lack of donors for kidney transplantation [1]. On the whole, the market activity of listed companies in pharmaceutical services is very high and the dialysis service industry has good investment prospects. This paper selects 4 listed companies as the research object, through the analysis of the financial status of the listed medical companies, predicts the future development potential of the listed companies, and judges whether the medical industry has the highest investment value.

1.2. Literature Review

The people affected by the COVID-19 pandemic have been found to have kidney disease and other chronic diseases. For instance, people infected with COVID-19 have been observed to show signs of kidney injury and a rapid increase in decreased kidney function during the pandemic [2]. And even those who did not previously have kidney problems contracted kidney disease [3].The rising risk of chronic kidney disease and severe kidney damage among patients is likely to enlarge the demand for hemodialysis, thereby driving the market growth.

1.3. Research Contents

The research picks four companies from the top of dialysis company. Then the author collects their current and forecast financial data from Nasdaq and Estimate websites. Critical statements are analyzed and made into charts to determine the investment potential of each company. Finally, by comparing companies in pairs, the study draw the investment conclude.

2. Introduction of Four Companies

DaVita, Medtronic, Fresenius and Baxter are leader companies in the hemodialysis industry. Their market share are closed to each other, which means that they are competing for the customers with similar demand.

2.1. DaVita

DaVita is an integrated provider of kidney care services dedicated to reinventing the approach to kidney health care to improve the quality of life for people with kidney disease worldwide. The company is among the top three providers of kidney care services in the United States and has been a leader in clinical quality and innovation for more than 20 years. Unlike Fresenius and Nipro, DaVita does not manufacture dialysis drugs and medical devices in-house, but only focuses on providing dialysis services [4]. It aims to help make every stage and step of the kidney care pathway more accessible to patients, from slowing the progression of kidney disease to streamlining the kidney transplant process, from acute in-hospital care to daily home dialysis.

2.2. Medtronic

Medtronic is a one of the biggest global medical technology company dedicated to providing lifelong treatment options for patients against chronic diseases. And its expertise in the R&D, manufacturing, sales and service of medical devices has been recognized and praised worldwide. Medtronic's leading position in the medical device industry is not only reflected in its size, but also in its ability to innovate in technology. Every year, Medtronic invests a lot of time and resources in research and development to continuously introduce products that keep pace with the times and have a leading edge.

2.3. Fresenius

Fresenius is a healthcare company that provides products and services related to dialysis, hospital and home medical care for patients. The Fresenius Group operates independently worldwide under three divisions: Fresenius Medical Care, Fresenius Kabi and Fresenius ProServe. Fresenius Medical Care is a global leader in dialysis products and services. The Company serves 122,000 patients worldwide through its 1,590 dialysis centers throughout the United States, Europe, Latin America and the Asia-Pacific region. Fresenius Kabi is a global company focused on the fields of infusion, blood transfusion and clinical nutrition.

2.4. Baxter

Baxter is a diversified multinational medical supply company focused on chronic diseases and critical care treatments. And it is the world's first commercial dialysis system. Baxter has two business segments: Drug Infusion and Nephrology. The Nephrology segment mainly provides products and treatments for end-stage renal disease or irreversible renal failure, and its peritoneal dialysis products include continuous ambulatory peritoneal dialysate and nighttime fully automated peritoneal dialysis equipment. In addition, Baxter's nephrology business sells hemodialysis products, which is a continuous form of renal replacement therapy that is usually performed in hospitals.

3. Comparative Analysis

Financial statement can help evaluate past business performance, measure current financial status, and predict future development trends, which are conducive to investors making investment decisions [5]. There are positive financial indicators growth ratio for all four companies, due to growing market. Among them, DaVita is attractive in terms of the highest expected growth rates in EPS and gross revenue, PEG ratio, and relatively high annual and quarterly gross margin, but with higher current (TTM) and forward (NTM) P/E ratios.

Table 1: Financial data

DaVita | Medtronic | Fresenius | Baxter | |

Ticker symbol | DVA | MDT | FMS | BAX |

Share price | 137.73 | 80.31 | 21.095 | 36.89 |

TTM EPS | 8.38 | 5.32 | 1.39 | 2.87 |

NTM EPS | 9.33 | 5.36 | 1.52 | 2.99 |

EPS growth rate | 11.34% | 0.75% | 9.35% | 4.18% |

Revenue growth rate | / | 2.60% | 0.48% | 2.27% |

TTM P/E | 16.44 | 15.10 | 15.18 | 12.85 |

NTM P/E | 14.76 | 14.98 | 13.88 | 12.34 |

PEG | 1.45 | 20.08 | 1.62 | 3.07 |

3.1. Current (TTM) and Forward (NTM) P/E Ratios

The price-to-earnings ratio is the ratio of the market price per share of a certain stock to its earnings per share, and is often used as an indicator to consider whether stocks of different prices are overvalued or undervalued. It is generally believed that if a stock has a high price-to-earnings ratio, then the stock has a bubble in price and is overvalued. However, although current P/E ratio of DaVita is the highest of all, it doesn’t mean DaVita Stock is overvalued. Because the stock price is the highest, thus price to earning ratio is larger even in the case of EPS being the same. At the same time DaVita EPS is relatively high and will increase in a constant rate in the future. Therefore, forward P/E ratio become lower, while still larger than Fresenius and Baxter.

3.2. Expected growth rates in EPS and gross revenue

Earnings per share is usually used to reflect the operating results of enterprises, measure the profitability of common shares and investment risks. DaVita has the highest EPS growth rate and gross revenue, also both of them have been maintaining a relatively high level without plunging and soaring. Based on data, DaVita undoubtedly has a strong and stable profitability. In terms of business, on the one hand, DaVita has achieved high profitability through the chain and scale of hemodialysis centers. DaVita's net profit margin and ROE (return on equity) were respectively much higher than the median net profit margin and ROE of the GICS (Global Industry Classification Standard) health care industry. DaVita's profitability is better than that of its peers. On the other hand, during recent years, the DaVita Dialysis Center has scale, high yields, and is constantly expanding through replication. Considering the expanding industry and market, Revenue growth ratio of DaVita is likely to keep positive and higher than Medtronic, Fresenius and THC revenue growth ratio.

3.3. PEG ratio

The PEG metric (P/E ratio to earnings growth ratio) is the company's P/E ratio divided by the company's earnings growth rate. DaVita has the lowest PEG ratio above the four stocks. In the U.S., the PEG level is about 2, which means that the U.S. P/E ratio is twice as fast as the company's earnings growth. PEG ratio of DaVita and Fresenius is lower than the average level, while Medtronic and Baxter are larger than 2. Based on earnings growth expectations, DaVita EPS growth rate is much higher than that of other companies, ensuring the PEG will keep low in the next future. It means that, compared to other companies, DaVita has less risk of being overestimated and greater upside potential.

3.4. Annual Gross Margin and Gross Profit-to-Asset Ratio

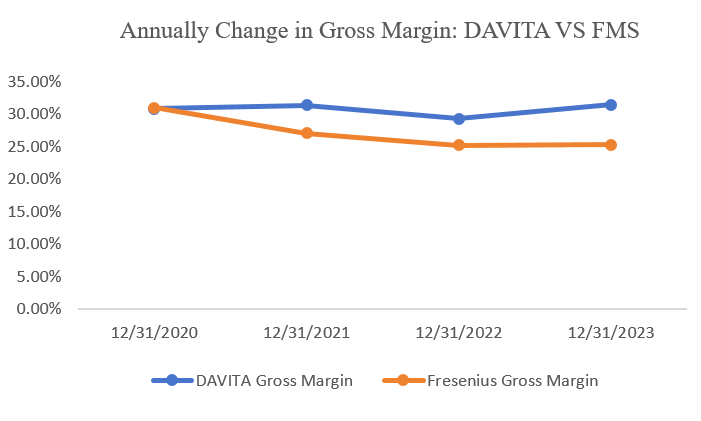

Based on the above indicators, PEG of Medtronic and THC means that both of them are not suitable to invest, while DaVita and Fresenius have their own advantages. DaVita has highest expected growth rates in EPS and gross revenue, PEG ratio, and relatively high annual and quarterly gross margin, while Fresenius has the most positive current (TTM) and forward (NTM) P/E ratios. Thus, annual gross margin and Gross Profit-to-Asset ratio should be analyzed to decide which is better.

Figure 1: Annually Change in Gross Margin: DaVita VS FMS

As the figure 1 shows, Gross margin refers to the amount of total sales revenue that a company retains after incurring direct costs associated with producing the goods and services sold by the company. DaVita gross margin was close to FMS in 2020. However, during recent 3 years, DaVita has a very stable gross margin, with small fluctuations around a fixed value. While FMS gross margin has a significant drop in 2021, and continued annually decline in 2022 to 2023, gradually widening the gap with DaVita. From the perspective of profitability, the higher the gross profit margin, the greater the profit of the enterprise, and it also indicates that DaVita’s products have better competitiveness than FMS in the same market.

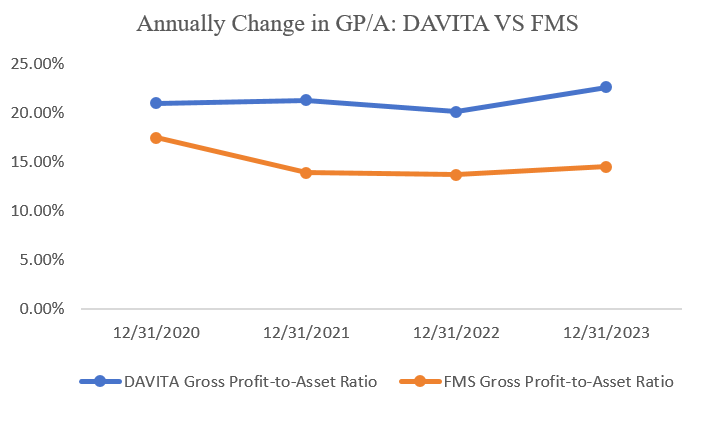

Figure 2: Annually Change in Gross Margin: DaVita VS FMS

As to Gross Profit-to-Asset ratio, according to the figure 2, DaVita GP/A is significantly greater than FMS by 5% to nearly 10%. And DaVita GP/A has developing trend while FMS keep fluctuating in recent years. DaVita GP/A ratio in 2023 is larger than that in 2020, and Fresenius GP/A ratio in 2023 is lower than 2020.The reason is that Fresenius also has dialysis products, including dialysis machines, dialyzers, disposable consumables, and dialysis dry powder and solutions for the whole industry chain. There are also numerous independent dialysis centers. However, DaVita’a dialysis product is purchased from other companies such as FMC and Baxter to focus on service, saving a lot of money on scientific research. The Gross Profits to Assets ratio is used as a indicator to help determine how efficiently a firm uses its assets to generate Gross Profits. Therefore, it indicates that the asset utilization efficiency is high, also shows that DaVita has achieved good results in increasing income and saving funds.

4. Suggestions

DaVita is a service provider which does not produce dialysis drugs and medical devices, and only focuses on providing dialysis services [6]. It has significant suppliers, however, which include, without limitation, suppliers of pharmaceuticals or clinical products that may be the primary source of products critical to the services DaVita provide. If any supplier is unable to meet demand or is disrupted by global events, the company may not be able to find adequate alternative sources at competitive prices. To address the problem, DaVita should have its own produce center, break the limitation of suppliers. Plus, the reason why Fresenius is currently the leader of hemodialysis in the world is that it also has dialysis products, including dialysis machines, dialyzers, disposable consumables, and dialysis dry powder and solutions for the whole industry chain. For enterprises with dialysis products, entering the dialysis service market can expand the sales of their own products, and they can enjoy the cake of service, open up new growth space, and achieve a win-win situation [7]. If DaViata wants to occupy a place in more abroad future hemodialysis market, the “product + service” strategy is the direction they need to consider.

Besides, due to the limitations of dialysis products and doctors/nurses, the current hemodialysis centers use almost the same dialysis time, flow rate, dialyzer and dialysate for different patients [8]. Patients are more likely to be treated as if they were on an assembly line, so the results are often not optimal [9]. In the future, which independent dialysis center can improve in this regard, improve the physical comfort of post-dialysis patients, and the convenience of geographical location will divert more patients. In addition, who can obtain and collect the big data of hypertension and diabetes patients as soon as possible and analyze them, make early diagnosis of these potential target patients, and provide treatment options and products at various stages, will greatly increase the possible selectivity and treatment stickiness of these patients in the future [10].

5. Conclusion

The hemodialysis industry continues to boom, and dialysis services are expected to become the next growth point. Among the four companies in the list, Davita does not produce dialysis drugs and medical devices, but only provides dialysis services. According to financial statements, DaVita is attractive in terms of the highest expected growth rates in EPS and gross revenue, PEG ratio, and relatively high annual and quarterly gross margin. It has less risk of being overestimated, greater upside potential and highest profitability. From a strategic point of view, together, DaVita and Medtronic will form an independent medical company with a focus on kidney care. The new kidney care company will combine Medtronic's strengths as a medical technology leader and DaVita's expertise as an integrated renal care provider to drive the development of differentiated therapies for patients against kidney failure. To sum up, investors should focus on the "equipment + service" full layout enterprises.

Because this study is focusing on the top companies in the dialysis industry, the author has access to a limited scale of financial standards, which may have affected the generality of companies of all sizes in the area. In the future, from the whole industry and the global market, researchers can use the judgment ideas provided in this paper to analyze financial data, and help investors make the best choice.

References

[1]. Bikbov, B., Purcell, C. A., Levey, A. S., Smith, M., Abdoli, A., Abebe, M., ... & Owolabi, M. O. (2020). Global, regional, and national burden of chronic kidney disease, 1990–2017: a systematic analysis for the Global Burden of Disease Study 2017. The lancet, 395(10225), 709-733.

[2]. Diamantidis, C. J., Cook, D. J., Redelosa, C. K., Vinculado, R. B., Cabajar, A. A., & Vassalotti, J. A. (2023). CKD and Rapid Kidney Function Decline During the COVID-19 Pandemic. Kidney Medicine, 5(9), 100701.

[3]. Geetha, D., Kronbichler, A., Rutter, M., Bajpai, D., Menez, S., Weissenbacher, A., ... & Luyckx, V. (2022). Impact of the COVID-19 pandemic on the kidney community: lessons learned and future directions. Nature Reviews Nephrology, 18(11), 724-737.

[4]. Nissenson, A. R. (2016). Delivering better quality of care: relentless focus and starting with the end in mind at DaVita. In Seminars in Dialysis, 29(2), 111-118.

[5]. Wahlen, J. M., Baginski, S. P., & Bradshaw, M. T. (2018). Financial reporting, financial statement analysis, and valuation: A strategic perspective. Cengage learning.

[6]. Molnar, M. Z., Mehrotra, R., Duong, U., Bunnapradist, S., Lukowsky, L. R., Krishnan, M., ... & Kalantar-Zadeh, K. (2012). Dialysis modality and outcomes in kidney transplant recipients. Clinical Journal of the American Society of Nephrology, 7(2), 332-341.

[7]. Himmelfarb, J., Vanholder, R., Mehrotra, R., & Tonelli, M. (2020). The current and future landscape of dialysis. Nature Reviews Nephrology, 16(10), 573-585.

[8]. Wetmore, J. B. et al. (2018). Insights from the 2016 peer kidney care initiative report: still a ways to go to improve care for dialysis patients. Am. J. Kidney Dis. 71, 123–132.

[9]. Mckeon, K., Sibbel, S., Brunelli, S. M., Matheson, E., Lefeber, N., Epps, M., & Tentori, F. (2022). Utilization of home dialysis and permanent vascular access at dialysis initiation following a structured CKD education program. Kidney Medicine, 4(7), 100490.

[10]. Thomas, B., Wulf, S., Bikbov, B., Perico, N., Cortinovis, M., de Vaccaro, K. C., ... & Naghavi, M. (2015). Maintenance dialysis throughout the world in years 1990 and 2010. Journal of the American Society of Nephrology, 26(11), 2621-2633.

Cite this article

Song,J. (2024). Investment Advice of Dialysis Companies: What’s the Trend of the Industry?. Advances in Economics, Management and Political Sciences,98,50-55.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICFTBA 2024 Workshop: Finance in the Age of Environmental Risks and Sustainability

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Bikbov, B., Purcell, C. A., Levey, A. S., Smith, M., Abdoli, A., Abebe, M., ... & Owolabi, M. O. (2020). Global, regional, and national burden of chronic kidney disease, 1990–2017: a systematic analysis for the Global Burden of Disease Study 2017. The lancet, 395(10225), 709-733.

[2]. Diamantidis, C. J., Cook, D. J., Redelosa, C. K., Vinculado, R. B., Cabajar, A. A., & Vassalotti, J. A. (2023). CKD and Rapid Kidney Function Decline During the COVID-19 Pandemic. Kidney Medicine, 5(9), 100701.

[3]. Geetha, D., Kronbichler, A., Rutter, M., Bajpai, D., Menez, S., Weissenbacher, A., ... & Luyckx, V. (2022). Impact of the COVID-19 pandemic on the kidney community: lessons learned and future directions. Nature Reviews Nephrology, 18(11), 724-737.

[4]. Nissenson, A. R. (2016). Delivering better quality of care: relentless focus and starting with the end in mind at DaVita. In Seminars in Dialysis, 29(2), 111-118.

[5]. Wahlen, J. M., Baginski, S. P., & Bradshaw, M. T. (2018). Financial reporting, financial statement analysis, and valuation: A strategic perspective. Cengage learning.

[6]. Molnar, M. Z., Mehrotra, R., Duong, U., Bunnapradist, S., Lukowsky, L. R., Krishnan, M., ... & Kalantar-Zadeh, K. (2012). Dialysis modality and outcomes in kidney transplant recipients. Clinical Journal of the American Society of Nephrology, 7(2), 332-341.

[7]. Himmelfarb, J., Vanholder, R., Mehrotra, R., & Tonelli, M. (2020). The current and future landscape of dialysis. Nature Reviews Nephrology, 16(10), 573-585.

[8]. Wetmore, J. B. et al. (2018). Insights from the 2016 peer kidney care initiative report: still a ways to go to improve care for dialysis patients. Am. J. Kidney Dis. 71, 123–132.

[9]. Mckeon, K., Sibbel, S., Brunelli, S. M., Matheson, E., Lefeber, N., Epps, M., & Tentori, F. (2022). Utilization of home dialysis and permanent vascular access at dialysis initiation following a structured CKD education program. Kidney Medicine, 4(7), 100490.

[10]. Thomas, B., Wulf, S., Bikbov, B., Perico, N., Cortinovis, M., de Vaccaro, K. C., ... & Naghavi, M. (2015). Maintenance dialysis throughout the world in years 1990 and 2010. Journal of the American Society of Nephrology, 26(11), 2621-2633.