1. Introduction

In the rapidly evolving landscape of financial technology, robo-advisors have emerged as a prominent innovation in investment management. Robo-advisors, also known as automated investment platforms or digital advisors, are mechanized platforms that use automated algorithms to provide financial advice, such as personalized investment portfolio recommendations and asset management services, to investors [1].

The development of robo-advisors stems from the challenges and imperfections of traditional investment advisory models [2]. Historically, investors often sought the assistance of professional financial advisors to help them devise investment strategies and manage their assets. However, traditional advisory services often come with high fees since they are generally provided by senior financial professionals [3] and are constrained by factors such as time and the trust relationship between investors and financial specialists [2,4], making it difficult to provide personalized services to many investors. The issues can be improved through the application of robo-advisors: Robo-advisors reduce fees and can provide 24/7 access to financial forecasts and advice [5] without the influence of potential conflicts of interest [6]. By leveraging these advantages, robo-advisors are increasing their appeal to retail investors [7,8], thereby allowing more people to enter the investment market and opening a new track in the advisory field.

With the increasing demand for investment solutions and advancements in FinTech, robo-advisors have gradually become a formidable force in the financial markets in recent years. Data show that the worldwide robo-advisory market reached 4.51 billion USD in 2019 [3] and is expected to reach 2.76 trillion USD by the end of 2023 and 4.66 trillion USD by 2027 [9].

Despite the significant potential and prospects of robo-advisors in the FinTech arena, their development also faces challenges and obstacles. One typical issue lies in the user acceptance of robo-advisors: while theoretically robo-advisors lower the investment threshold, many researchers express concerns about the user acceptance of robo-advisors. Studies indicate a positive correlation between user acceptance of robo-advisors and users' experience in investment affairs, technological proficiency, and risk-taking [10,11,12,13]. In other words, users with long-term investment experience are more inclined to become the main investors in robo-advisory businesses, making it necessary to discuss how to effectively attract more retail investors who lack investment experience. Some research focuses on users' individual factors and has confirmed that users' individual factors such as personality traits, fear of financial fraud, and investment styles [9,14] influence the acceptance of robo-advisory, which makes limited contributions to product improvement since individual factors vary from person to person. Other research approaches this issue from the perspective of the product: user interaction factors such as usability and usefulness also have a proven impact on user acceptance [4,15,16]. This makes exploring improvements in the interaction interface of robo-advisor products to enhance their appeal to potential users a topic of practical significance. For example, Jung et al., [10] advocated solving the problem of designing robo-advisory solutions for risk-averse, low-budget, and inexperienced consumers by enhancing the interaction design of user interfaces and improving their usability and comprehensibility.

One possible way to enhance interaction capability is through the application of large language models (LLMs). A potentially strong piece of evidence comes from studies on whether users adopt robo-advisor recommendations: Hildebrand and Bergner suggest that investors are more likely to accept advice if it is presented by a conversational chatbot with "an advisory interface that possesses a dialogue-based process of financial advisory" [17]. This is a typical issue of interaction that can be improved through the powerful real-time language understanding and generation capabilities of GPT. It suggests that improvement of interaction can influence not only acceptance but also further decisions when using robo-advisors. This paper aims to explore whether the introduction of technology based on LLMs can enhance the user interaction attributes of robo-advisor products, thereby increasing the acceptance of robo-advisor products among users with low investment experience.

The first contribution of this paper is an exploration of the application of large language models in the robo-advisor field. As a newly emerging technology that has gradually matured and become popular in recent years, academic discussions on large language models in the robo-advisor field are limited. Current discussions on robo-advisors and large models mainly focus on performance comparisons [13,18]. For instance, studies like those by Oehler and Horn indicate that in a single investment advice scenario, GPT-4's performance has shown a trend of surpassing robo-advisors [13]. Considering factors such as commercialization, supporting functions, and professional domain databases, robo-advisors are not yet fully replaceable. However, such conclusions have certain guiding significance for the development of robo-advisor products. The focus of this paper is to optimize existing robo-advisor products through cutting-edge technologies like large language models to meet the expectations of expanding the investment market.

The second contribution of this paper is to supplement the exploration of interaction design for robo-advisor products. Existing literature touches on aspects such as user factors affecting acceptance, factors influencing the investment process, and decisions to continue using robo-advisors. More specifically, this includes aspects like users' investment experience [11,12] and personality traits [9,13]. However, there has been less exploration on how to further apply research on user behavior factors to improve products. This paper will discuss the interaction issues within the service processes of robo-advisor products and propose improvement suggestions.

Additionally, this paper will systematically review the service processes of current robo-advisor products. Most of the current research in the field of robo-advisors is based on theoretical discussions and rarely mentions the actual performance of robo-advisor products in practice. This is also one reason why there are few studies proposing specific product improvement methods based on the analysis of influencing factors. This is because the factors influencing user behavior are diverse and complex, making it difficult to develop universally applicable methodologies. For instance, Figa-Talamanca's study points out that user trade-offs between the usability and usefulness of robo-advisors are also influenced by generational difference [19]. Moreover, current analyses of user acceptance of robo-advisor products mainly rely on subjective data generated from surveys, with many studies mentioning limitations due to sample constraints [4,8,20]. This paper will investigate the mainstream robo-advisor products in the current Chinese market to identify the practical issues that arise during the service delivery process.

The rest of the paper proceeds as follows: Section 2 conducts a literature review, elucidating the theoretical basis for the subsequent business analysis and optimization process construction. Section 3 analyzes the current robo-advisory service processes based on representative robo-advisor products in China and attempts to identify issues within these processes. Section 4 proposes methods for product optimization based on the analysis of service processes. Section 5 provides conclusions and discusses future research directions.

2. Literature Review

2.1. Robo-advisors

Robo-advisors, as a form of automated investment service, provide wealth management for clients by combining modern technology and scientific algorithms [21]. The first robo-advisor company was established in the United States in 2008, and its tremendous success attracted billions of dollars in investment [22]. Research has demonstrated ample opportunities for reshaping the investment industry, leading to the entry of various enterprises, including startups, banks, and high-tech companies, into this market, giving rise to numerous branches of robo-advisors [23,24]. Therefore, in conducting a business analysis of robo-advisors, the first step is to differentiate between the types of robo-advisors [25].

According to Cardillo and Chiappini [9], there are three main methods for classifying robo-advisors. The first classification is based on the notion that the wealth management industry may adopt robo-advisors with different performance levels in active and passive management strategies. For investors seeking stable returns, low risk, and minimal intervention in investments, robo-advisors in passive investment strategies only need to assist investors in asset allocation, risk management, and proposing portfolio rebalancing strategies. In terms of active management strategies, robo-advisors employ fully automated investments based on artificial intelligence algorithms and propose automatic asset shifts in clients’ accounts [26].

The second classification of robo-advisors comes from the analysis of the different roles played by investors and robo-advisor owners. Garvía distinguishes four types: stand-alone robo-advisors, segregated robo-advisors, integrated robo-advisors, and robo-for advice [27]. According to Cardillo's summary of explanation, stand-alone robo-advisors operate independently of other financial institutions, managing the entire investment process internally. Segregated and integrated robo-advisors are both associated with financial institutions but differ in their level of integration. Segregated robo-advisors are part of financial holding companies, while integrated robo-advisors are included in the business model of financial institutions, such as banks. Finally, robo-for advice indicates a tool used by financial institutions for a fee [9].

The third classification is based on business models, namely the D2C model, the B2B model, and hybrid firms. In the D2C model, robo-advisors operate as online platforms providing automated algorithm-based portfolio management directly to investors without human intervention. This is also the most accessible form of robo-advisor for individual users, making it the primary type of robo-advisor discussed in this paper for expanding the retail investor market. In the B2B model, robo-advisors serve human wealth management advisors on the enterprise side. Hybrid firms provide personalized services and actively managed portfolios blended with computerized portfolio recommendations [28].

Due to the need to provide different investment strategies for investors with varying risk preferences, differences in business line status represented by different types of companies and institutions, and varying roles played throughout the investment chain, robo-advisors exhibit considerable flexibility. Therefore, a clear classification of robo-advisors is essential, facilitating decision-making and targeted analysis in practical business analysis processes.

Based on the primary target user group of this study—potential users with low investment experience—who are more likely to be risk-averse and have limited exposure to financial investment products, the study will focus on D2C (Direct-to-Consumer) products that predominantly use passive management strategies and are aimed at retail investors. These services might exist in the form of segregated or integrated robo-advisors provided by financial institutions, or as robo-advisory services offered through collaborations between internet companies and financial institutions.

2.2. Large Language Model

The term "large language model" refers to deep learning models capable of processing and generating natural language text. Specifically, according to data scientists, a language model assigns a probability to a piece of previously unseen text based on training data. These models employ neural network architectures and are trained on vast amounts of text data to learn semantic relationships and grammatical rules between words, phrases, and sentences. They can comprehend and produce coherent language, possessing robust language understanding and generation capabilities [29]. A typical example is the Chat Generative Pre-Trained Transformer (ChatGPT), which demonstrates remarkable flexibility and logical reasoning capabilities, enabling tasks such as conversational dialogues, email composition, poetry writing, code generation, and business proposal formulation.

Since OpenAI first introduced the chatbot ChatGPT to the public in November 2022, it has won admiration from technology enthusiasts, media practitioners, and the public for its human-like intelligence, potential applications, and societal impact. Global technology giants like Alphabet, Meta, Amazon, and NVIDIA have trained their own large language models, giving them names like PALM, Titan, Megatron, and Chinchilla, among others [30]. Experts across various industries are also conducting research on applications based on ChatGPT [31], including healthcare [32], education [33], and autonomous driving [34]. Integrating ChatGPT with intelligent systems and software within industries to provide natural language interaction and output validates its ability to effectively enhance the accuracy and intelligence of system output [35,36].

Recent research shows the significant potential and broad application prospects of large language models, particularly GPT, in the financial sector. Existing research demonstrates the importance of automatic processing and analysis of financial text: firstly, in trading markets, given the large volume of text data generated daily in financial markets, such as news reports, market analysis reports, and company financial reports, which contain information about market trends [37]. Large language models can effectively extract valuable information from these texts, providing support for predicting market trends. For example, analyzing sentiment and key information in financial report texts helps predict stock price movements. At the risk management level, the capabilities of large language models to analyze financial market and enterprise-related data, such as market reports, economic indicators, and corporate financial reports, are equally applicable to assessing market and credit risk scenarios [38].

Additionally, enhancing service quality at the product and platform interaction level is also an important direction for the application of large language models in the financial sector. According to Pandya, integrating chatbots into customer service platforms is beneficial for creating efficient, personalized, and responsive interactions, and it can even help improve customer retention, value extraction, and brand image [39]. This GPT-based customer service technology is equally applicable in the financial industry. For example, online customer service chatbots can communicate with users in real-time about specific situations and needs, providing more customized recommendations for financial products.

In conclusion, the application of large language models in the financial sector is becoming increasingly widespread, as they not only enhance the efficiency and quality of financial services but also provide powerful data support and analysis tools for financial decision-making. With continued technological advancements and the growing demand in the financial industry, the prospects for the application of large language models in the financial field are expected to become even broader. In the broader financial market and risk management domain, the capabilities demonstrated in data extraction and decision analysis can similarly be applied to the development of robo-advisory products to provide users with more customized investment advice. Moreover, intelligent customer service, which possesses real-time interaction capabilities with users, has enormous potential to enhance product interactivity and usability. In the subsequent sections, this paper will discuss in detail how these capabilities can be integrated with robo-advisory products

2.3. Robo-advisor Product Improvement Strategies

From a behavioral research perspective, literature has already demonstrated the impact of usability and availability on user acceptance [4,15,16]. Building on this, Jung summarized four design principles for modifying the front-end interaction of robo-advisors to further attract users with low-risk preferences and low net worth:

1. Ease of interaction — including navigability (how well the control elements of the robo-advisor are integrated and how easily users find them), controllability (the degree to which users control the conversation and behavior of the robo-advisor), structural consistency (the form layout and content structure of navigation, interaction, and control elements), and fault tolerance (the ability of the robo-advisor to handle errors caused by users or the system).

2. Work efficiency — comprising effectiveness and efficiency.

3. Information processing and cognitive load — expectations consistency (how dialogue and user interfaces relate to users' knowledge and experience, such as from work domains, education, or universally accepted guidelines), ease of understanding (the cognitive load associated with understanding and retrieving information), and social presence (the degree to which the communicator behind the robo-advisor is perceived as "present" or "real" during communication). These factors play an important role in this section.

4. Transparency of consultation. Cost transparency has two components: customers need to easily find information about costs, and they need to easily understand the cost structure. Process transparency is related to the ease or difficulty of tracking and understanding activities during the consultation process. Information transparency refers to clearly explaining to customers why certain information is needed during the consultation process, and the extent to which customers can monitor and understand the quality and relevance of the information used as the basis for decision-making [10].

Meanwhile, according to Huang's work, using Wealthfront as an example, the current process of robo-advisor services based on discriminative artificial intelligence can be roughly divided into five steps:

1. Assessing the current investment environment and determining the ideal asset classes.

2. Selecting low-cost ETFs representing each asset class.

3. Evaluating risk tolerance to create appropriate investment portfolios.

4. Applying Modern Portfolio Theory (MPT) to diversify risk.

5. Regularly monitoring and adjusting balanced investment portfolios [40].

Combining the design principles from Jung with the current robo-advisor service process can further demonstrate the potential of the generative ability of large language models in optimizing intelligent advisory products: for example, in assessing risk tolerance, current discriminative AI-based robo-advisors assess risk tolerance by presenting users with questionnaires containing several questions and options for users to answer. This approach varies in terms of expectations consistency and ease of understanding for users with different financial experiences, inadvertently increasing the loss of low-experience users during the information gathering phase. However, generative AI that does not rely on specific conditions to perform tasks can have higher flexibility in the process of user information gathering [40], integrating questioning, explanation, and information collection into dialogues with users. After the user dialogue collection, the large language model can integrate information according to the framework of subsequent tasks, helping to reduce situations where users make choices that do not meet their psychological expectations due to insufficient cognition, indirectly improving the conversion rate of subsequent product recommendations.

To achieve other design principles such as ease of interaction and transparency of consultation, based on Jung's research on current robo-advisors, many interaction modules need to be embedded: for example, for consultation transparency, providing interactive cost calculators and information on the business models and underlying assets of investment portfolios. By integrating large language models into the intelligent customer service of robo-advisors and adding inquiry prompts based on design principles, it is possible to replace additional information boards, optimize interface complexity, and enhance the efficiency of users obtaining specific information.

In summary, AI based on large language models can bring various improvements to the usability and usefulness of robo-advisor products. Integrating large language models into data processing and user engagement to optimize the overall process is the main optimization method proposed in this article, and ultimately it may be reflected in the improvement of services along the entire line of information collection methods, product recommendations and subsequent monitoring, and investment portfolio adjustments.

3. Current Robo-Advisor Service Workflow

Based on the previous classification selection, this paper, referencing existing literature on service stage divisions, analyses the service processes of mainstream robo-advisory products in the current Chinese market that target a broad user base (such as those offered by Bank of China, Ant Fortune, and E Fund).

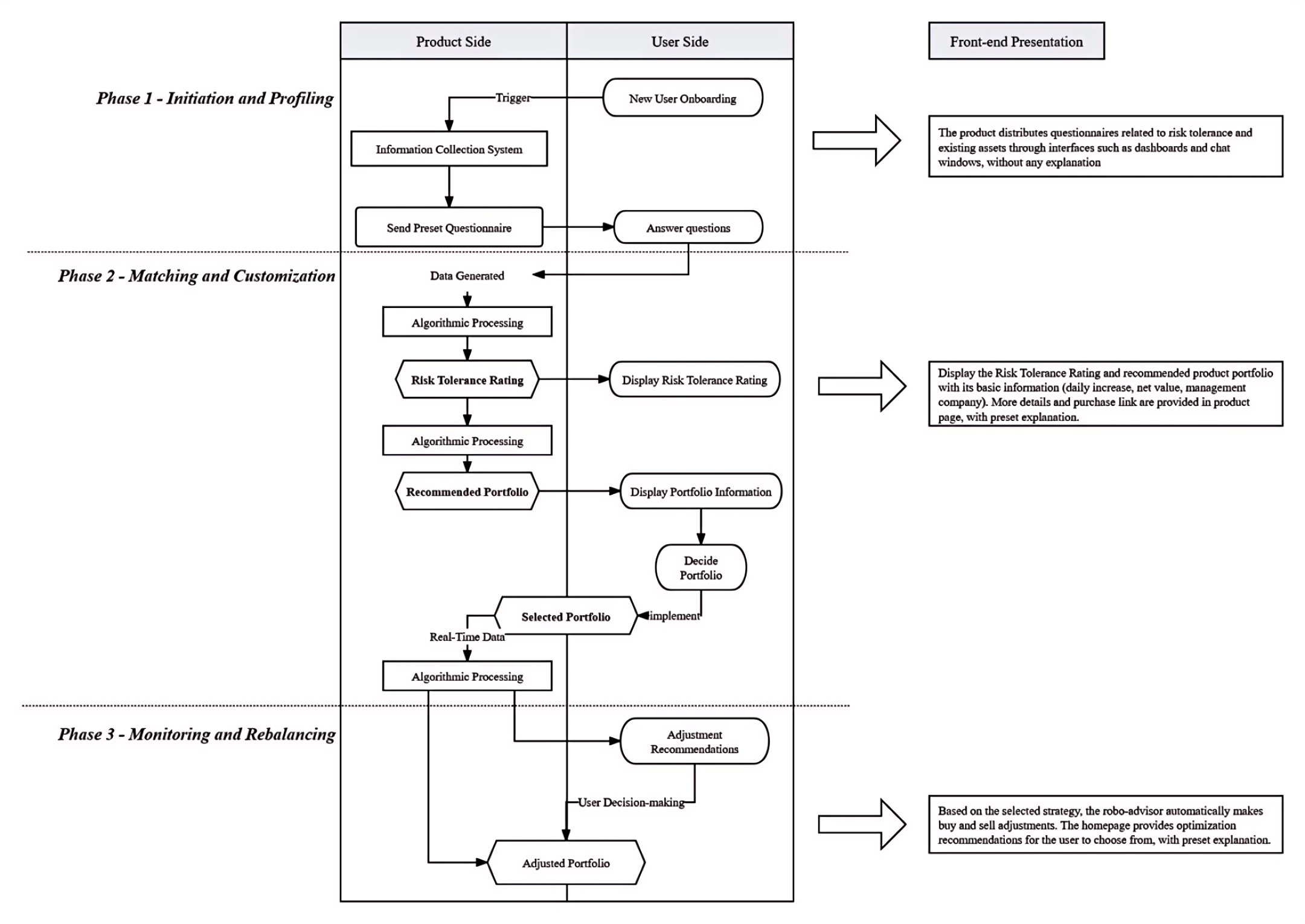

According to Torno [41], a typical robo-advisor service uses algorithms to link client information with suitable investment portfolios and implement its recommendations. This process can usually be divided into three stages corresponding to traditional financial advisory processes: (1) "Initiation and Profiling," (2) "Matching and Customization," and (3) "Monitoring and Rebalancing" (as shown in Figure 1).

Figure 1: Current Robo-Advisor Service Workflow

In the "Initiation and Profiling" stage, or what Jung [10] refers to as the product configuration stage, the primary goal in the advisory field should be to reduce information asymmetry between the client and the advisor. In a traditional consultation process, advisors initiate meetings to discuss and collect the client's needs and desires, determining the client's goals during the meeting (analysis). In robo-advisory, the corresponding product configuration process involves consumers transforming their objectives into product specifications by selecting and evaluating options within predefined product models. By collecting data on clients' financial situations and establishing a database of client inputs through robo-advisors, as well as actively informing clients about the robo-advisory process, information asymmetry can be reduced.

In contrast, the workflow of current robo-advisory products involves triggering an information collection system for new users after they come online. The system pushes a risk assessment questionnaire containing preset questions for users to answer through windows or the homepage UI. The complexity of the questionnaire varies depending on the robo-advisory product. The first issue in this stage is that the information collection process is too rigid, and customers feel compelled to complete it [42]. Additionally, each step of the current information collection process for robo-advisory products is undiscussed, which may lead to information overload and persistent information asymmetry [42]. Severe information asymmetry may make it difficult to accurately capture users' true intentions. Specifically, users with limited investment knowledge may make choices that deviate from their true intentions without explanations of the question scenarios and real case references. Another scenario is that the questionnaire of the robo-advisory product is too concise, which may lead users to perceive lower customization in product recommendations, potentially impacting user trust.

After the user information is collected, it enters the second stage, "Matching and Customization." The collected data is processed to generate recommendations, which are then presented to the client. In robo-advisors, algorithms calculate suggestions based on the inputs from the configuration stage. Clients then review these suggestions and decide to invest in one or more of them. On the product front end, this is presented by displaying the investor's risk tolerance level, based on the questionnaire results, and the recommended investment portfolio and products for that risk level. Typically, the recommended products include information like the seven-day annualized yield on the main interface, and users can access more detailed product information, such as recent performance curves, net value, and standardized risk indicators.

The main problem in this stage is when the recommendations do not align well with the client's needs [10], potentially leading to financial losses from missed opportunities or, more seriously, losses from investments that exceed the client's risk tolerance. There are several reasons for the mismatch, such as unexpected asset developments, inadequate capabilities of robo-advisory algorithms, and the inability of current algorithms to accurately extract users' true psychological expectations, as mentioned earlier. Additionally, this may be related to the lack of explanation of algorithm principles and standardized product information in product recommendations. Previous research has emphasized transparency in the robo-advisory process, which is one of the main concerns for (potential) clients.

Another important reason is the relatively low level of customization in current robo-advisory algorithms. The investment portfolio recommendations of current robo-advisors mainly rely on the "user risk tolerance rating" to generate recommendations. This service process leads to two main problems: Firstly, current robo-advisory products do not generate recommended products by processing user information through algorithms; instead, they preset several risk tolerance ratings and recommend investment portfolios matching those ratings. The algorithm of robo-advisors only matches user information to the corresponding risk tolerance rating, and users assigned to that rating will only receive recommended investment portfolios set for that rating. Secondly, the algorithm shows a conservative tendency in processing user information and exhibits a clear tendency to match users to low risk tolerance ratings.

Through the practical use of questionnaires in mainstream robo-advisory products in the Chinese market, this study found that for several robo-advisory products, if users choose a lower risk tolerance tendency in several risk assessment questions with the same purpose, they will be assigned a low risk tolerance rating. The psychological tendencies and decision-making behavior of users in real life are complex processes, which is also why human advisors need to communicate with users repeatedly. The current conservative mechanism of robo-advisory algorithms may have the ability to reduce user investment losses on a macro level, but it is clearly difficult to fully represent all users' true investment expectations.

Typically, the matching stage concludes with the client's acceptance and implementation of the investment portfolio. In the final stage of the process, robo-advisors monitor and rebalance their clients' portfolios. Trading algorithms automatically monitor and adjust investments based on consumer goals. During this stage, current robo-advisory products will recommend adjustments to investment portfolios to users based on certain strategies. Some robo-advisory services also autonomously make slight adjustments to the investment amounts in portfolios. For example, the Intelligent Regular Investment Service of the Bank of China adopts a "moving average strategy" to automatically adjust the amount of each investment. Jung [10] believes that communication and transparency are key factors in establishing and maintaining client trust in this stage. This presents a significant challenge in designing robo-advisors [43], as current efforts mainly focus on visually presenting portfolio performance.

4. Construction of LLM-based Robo-Advisor Service Workflow

Large language models, such as GPT-4, have demonstrated exceptional abilities in answering questions, primarily due to their complex architecture and extensive training data. LLMs can understand complex queries, whether they are long sentences, ambiguous questions, or inquiries requiring the synthesis of information from different sources. They can handle these queries and provide relevant answers. Additionally, LLMs can maintain context throughout a conversation, meaning they can understand and respond to follow-up questions based on previous interactions, offering more accurate and relevant information. Top-tier LLMs often have multilingual capabilities, enabling them to understand and answer questions in different languages [44]. This indicates their ability to facilitate seamless real-time communication with customers. Moreover, based on advanced named entity recognition [45] and sentiment analysis [44] capabilities, LLMs can extract essential information about a customer's current assets, financial investment capacity, and preferences for risk and strategy elements from real-time communications. This paper envisions fully leveraging the real-time communication and language analysis capabilities of large language models to serve as intermediaries in processing and refining information between intelligent investment algorithms and users. This aims to effectively enhance the precision of user information acquisition and the customization of product recommendations. Additionally, it proposes presenting this capability through an integrated intelligent customer service based on large language models (which will be referred to as "LLM-CUS" in the following sections of this paper), thereby enhancing the interactivity of robo-advisor products and addressing usability and accessibility issues from the user's perspective.

4.1. Improvement of Workflow Construction

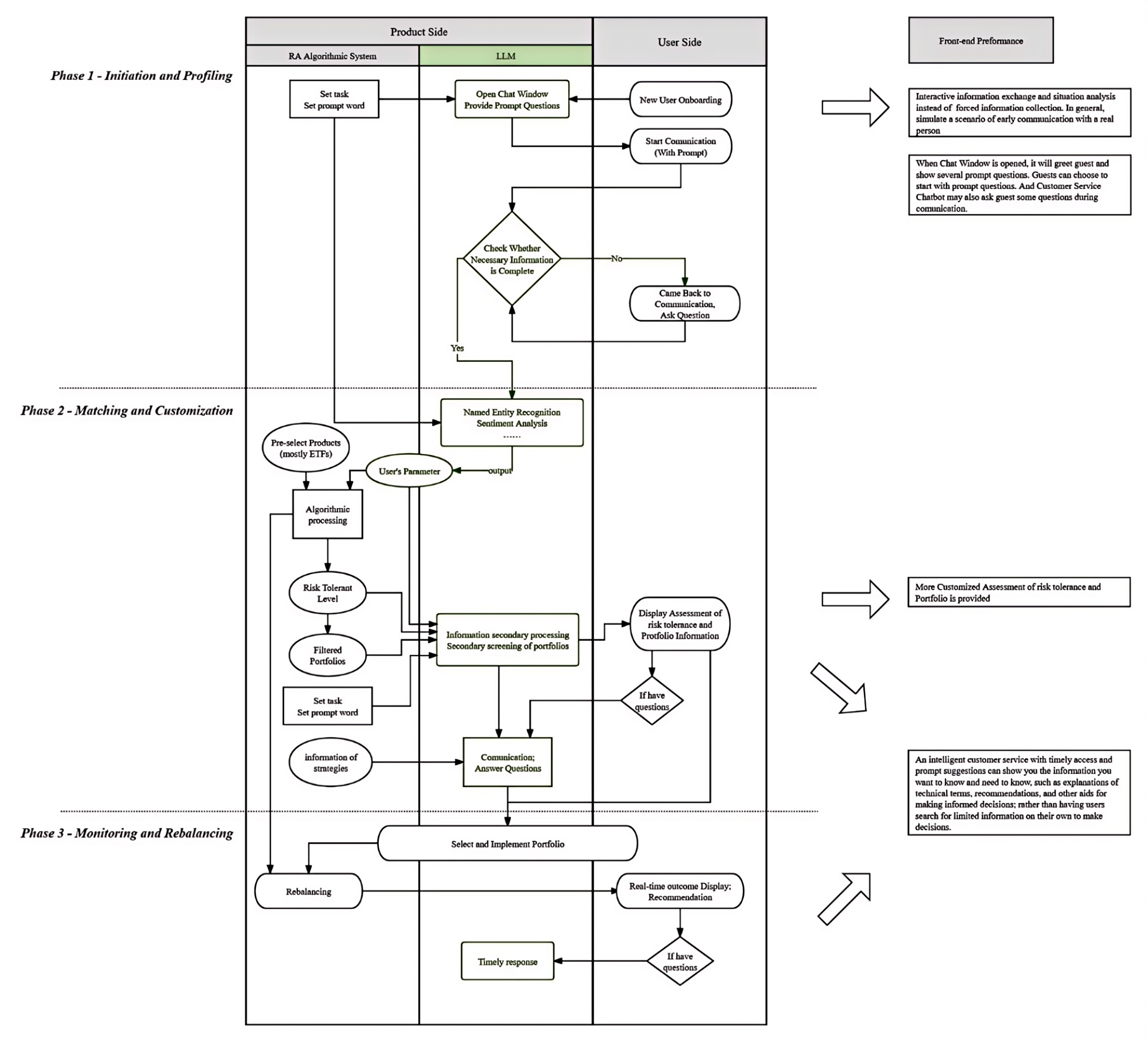

Traditional robo-advisors acquire relevant user parameters and risk tolerance ratings directly through preset questions and match them accordingly. Then, based on the matching results, they push product recommendations to users under the corresponding rating. Integrated with large language models, robo-advisors can engage with users through LLM-CUS, leveraging the analytical capabilities of large models, and undertaking functions such as data preprocessing and secondary processing (as illustrated in Figure 2, using a generic large model as an example).

In the "Initiation and Profiling" stage, considering the information update capabilities of financial professional models and large language models, the functions of assessing the investment environment, determining asset classes, and identifying available ETFs are still executed by the robo-advisor's own algorithms. Information gathering uses the LLM to engage in preliminary communication with users, replacing the traditional preset questionnaire format. According to Oehler [13], LLMs perform less stably without constraints and risk failing to capture complete information. However, with appropriate prompts, LLMs can be highly effective in providing financial advice. Therefore, during the user information collection stage, clear task presets are established for the LLM-CUS. This allows the LLM-CUS to conduct real-time detection of the collected user information while communicating with the user, confirming whether enough information has been collected, and determining whether to actively ask the user questions based on the results. To facilitate the information collection process, the large language model will provide users with prompts to initiate conversation topics when starting a conversation. An example of this could be seen in ChatPDF, where after importing an article, ChatPDF provides a basic summary of the article and lists three possible topics for inquiry based on the content, allowing users to click on a prompt to start a conversation on that topic.

On the user side, when a user initiates contact, the LLM-CUS will greet the user and provide several prompt questions for the user to choose from in the chat box. The user can click on one to directly start the conversation on that topic. For example:

"Before helping you start your intelligent investment journey, we need to understand some basic information about you and introduce our services to you. Would you like to:

1. Discuss your financial situation with us

2. Discuss your investment expectations with us

3. Learn about our services?"

When the user clicks an option, LLM-CUS will provide new prompt questions based on the user's choice. The user can click on these new prompt questions to get relevant explanations and delve deeper into the discussion. For example, if the user clicks "Discuss financial situation," LLM-CUS will provide the following prompts:

“To understand your financial situation, you can discuss with us:

1. How much money do you plan to invest?

2. What proportion of your total assets does this amount represent?

3. Understand why we need this information.”

Or if the user clicks "Discuss investment expectations," LLM-CUS will provide the following prompts:

“To understand your investment expectations, you can discuss with us:

1. How long do you plan to invest?

2. How much return do you expect annually?

3. What is the maximum loss you can tolerate?

4. Understand how we can help you achieve your expectations.”

When the user has doubts about the content of the conversation or the questions asked, the LLM-CUS will provide explanations and examples. In the latter part of the conversation, the LLM-CUS may actively ask the user questions, such as:

"In order to provide you with more accurate service, we also need to understand:

1. XXXX

2. XXXX"

and ask if the user has any additional thoughts or information to ensure comprehensive information collection from the user, overall simulating an early communication scenario with a human investment advisor as closely as possible.

Figure 2: LLM-based Robo-Advisor Service Workflow

After completing user information collection and entering the second stage, "Matching and Customization," the LLM processes user statements according to the preset task instructions, performing tasks like entity recognition and sentiment analysis to output user parameters for the robo-advisor's algorithms. According to Oehler [13]'s research, ChatGPT's portfolio recommendations are very similar to benchmark recommendations from academic literature and are more stable than those from financial institutions' robo-advisors. One possible reason is that, although the exact methods used by ChatGPT to generate recommendations are not known, one of its AI advantages over fixed algorithms from financial institutions seems to be its ability to gather information from a vast array of online resources. Thus, ChatGPT's recommendations may closely align with the consensus of all available sources, representing the market's consensus on recommendations. Based on this reasoning and considering the breadth of online resources collected by LLMs, under preset tasks, LLMs have the potential to optimize recommendations and information presentation for specific groups. This learning extensibility is not available to fixed algorithms of robo-advisors. Therefore, after the robo-advisor generates risk ratings and investment portfolio recommendations, the large language model can be utilized to further optimize the information and refine the investment portfolio selection based on the content of the communication with the user. This process aims to produce investment portfolio recommendations that are more customized and appealing to specific users. According to Oehler [13], ChatGPT can generate its recommendations and other investment information more easily and quickly, making it feasible to add the large language model for preprocessing in the information processing pipeline.

At the same time, eliminating information barriers and lowering the threshold for user information acquisition is another issue that needs attention throughout all stages of the improved process. In the new workflow, the algorithms, strategies, predefined product pools, and real-time industry information related to products (such as financial news) that the robo-advisor operates are all connected to the LLM. This allows the LLM to process and deliver the necessary information to the user. When users seek advice on investment recommendations or the results of their current investment portfolios, the LLM can explore the connected databases and, combined with its language generation capabilities, provide more dynamic and informative suggestions and interpretations for users with different needs. This contrasts with the current template-based, fixed and professional visual presentations offered by robo-advisor products, such as explaining the meaning of standard information like "performance benchmark return" and "SSE Composite Index return" to users lacking professional experience, or providing financial news to users who have a demand for real-time fund company trends. During this stage, the LLM-CUS will analyze the user's historical behavioral characteristics. When the user initiates a chat window and mentions keywords related to investment products, the LLM-CUS will assess the user's inquiry needs and provide prompt questions for the user to choose from, thereby further enhancing the efficiency of information acquisition for the user.

4.2. Theoretical Validation of Process Improvement

Due to limitations in experimental conditions, it is challenging to conduct real prototype development and recruit potential users for experiments involving the integration of LLM into robo-advisors. One approach to address this challenge is to leverage Jung [10]'s four design principles based on historical literature, which focus on low-risk preference and low-budget users. These principles can be used to assess whether building a robo-advisor based on LLM has a positive impact on the product in terms of these design principles.

The first principle is the ease of interaction principle, which includes four key points: navigability, controllability, structural consistency, and fault tolerance. Navigability primarily requires a high degree of integration of elements in the AI investment advisor and ease of discovery by users [10], depending on the interface design of the AI investment advisor and the integrated financial institution's app itself. However, LLM-CUS can effectively assist, especially in scenarios where users need to actively retrieve information. Controllability, as explained by Jung [10], is the user's ability to control the direction and speed of the process according to their needs (returning, retrieving additional information, etc.). Such demands can be directly met through repeated questioning or simple instructions in the process of interacting with LLM-CUS. Structural consistency and fault tolerance require more from multiple module functionalities, which cannot be achieved solely by LLM-CUS and algorithm optimization. For instance, if users need to interact with modules other than LLM-CUS, structural consistency relies on the overall interface design of the robo-advisor, while fault tolerance is related to the program design and service rules of the robo-advisor itself.

Regarding the efficiency principle, the usefulness of a robot advisor solution can be understood by how effectively and efficiently it supports users in achieving their goals, namely finding and investing in investment products that meet their needs and goals. An LLM-based robo-advisor has a more flexible and stronger learning recommendation decision-making process, and higher customization means a higher chance of finding investment products that meet users' psychological expectations.

The third principle, information processing and cognitive load, is one of the main interaction improvements brought by LLM to the robo-advisor. Based on LLM's emotional recognition and language generation capabilities, the expectation is that consistency and the user's cognitive load will be repeatedly analyzed and matched by LLM in the communication process until it aligns with the user's cognition. As a result of simulating communication with human advisors, the social presence of the robo-advisor will be effectively enhanced.

The fourth principle is transparency of consultation. It requires users to easily find information about costs, understand the cost structure, have transparent and understandable service processes, and explicitly explain to customers during the consultation process why certain information is needed, as well as enabling customers to monitor and understand the information used as the basis for decision-making [10]. Explanations regarding consultation transparency in current AI investment advisors are typically not included in the consultation process but presented in the form of additional explanations, requiring users to specifically search for them, making it difficult to understand during the consultation process. When there are no additional instructions restricting the information provided to customers, this issue can be improved through LLM-CUS.

In conclusion, although the integration of LLM cannot completely solve the interaction problems related to AI investment advisors mentioned above, it can improve current AI investment advisory products from the perspective of each principle. This theoretical perspective indicates that the development of LLM has the potential to drive AI investment advisory products forward.

5. Conclusion and Discussions

This study delves into the operational service processes of intelligent investment advisors in the current market and explores effective improvements through the integration of LLM technology. The aim is to attract potential users with low investment experience into the investment market through intelligent investment advisors. Previous research underscores the importance of accessibility, comprehensibility, and effectiveness in driving the adoption of IT innovations [22]. The emergence of LLM offers promising optimization solutions for these issues.

5.1. Limitations and Future Research

The focus of this study is primarily on users with low investment experience, who typically may also have characteristics of having relatively low investable funds. This choice is based on the cost advantage that robo-advisors possess. Additionally, the emphasis in process design is on how to attract users to use the service for the first time and generate retention over time. While theoretically, improvements in interaction and customization are beneficial for all user groups, and the learning ability of LLM theoretically supports its service to groups with any user characteristics, it's worth considering that potential users of robo-advisors are not limited to those with low investment experience. Moreover, low-experience users may gain investment experience over time and may develop different investment expectations than what is currently observed. In this scenario, it remains to be seen whether the customization patterns and user information collection methods expected by this portion of the user base can still be met by the design logic of this study, or if there will be a need for more universally applicable design logic. This would be a direction for future research.

Furthermore, the nature of this study is essentially theoretical exploration. From a logical standpoint, we can demonstrate that such improvement solutions are meaningful and provide theoretical support for the development of robo-advisors integrating LLM. However, it is foreseeable that in the process of actual product improvement, there may be more specific problems that need to be addressed. As mentioned earlier, the process of consumers forming psychological expectations and making decisions is complex. Therefore, another future research direction is to further analyze the actual impact of problems in the current service process and the effects of each change introduced by integrating LLM in a controlled experimental environment, which would be possible to support the development and testing of product prototypes and to split design elements to separately test their impact on subjects' decisions.

5.2. Practical Implications

Firstly, this paper's review of the current intelligent investment advisory service process demonstrates that for whatever reason, existing intelligent investment advisory products still have significant room for improvement in terms of interaction attributes and algorithmic mechanisms for product recommendations, at least not reaching the ideal conditions suggested by previous literature. This could be a major obstacle for intelligent investment advisory products in attracting new users. Although there is no direct evidence to suggest that interaction issues and low customization are directly correlated with users' choices to use the product, according to the common funnel analysis model theory used in market analysis, there are conversion rates between each behavior that users exhibit after becoming aware of the product, becoming interested, considering, using it for the first time, and deciding to actually invest assets. There is a considerable loss of users at each stage of this conversion process, and issues such as rigid information collection processes, information overload and asymmetry, and mismatched demands and recommendations could potentially be reasons why users abandon the product between the first use and actual asset investment. Compared to traditional advisory services, intelligent investment advisory services inherently have the advantage of lower service usage costs, making them more likely to attract potential clients with low investment experience and low investable funds attributes, implying that they have a broader market space than traditional advisory services. By improving the issues summarized in this paper, there is an opportunity for intelligent investment advisory products to realize greater potential in the market.

Secondly, this paper's exploration of the combination of LLM and intelligent investment advisory demonstrates the potential of LLM in optimizing intelligent investment advisory products. It not only has tremendous potential in optimizing interaction but also can provide users with higher customization and recommendations that are more in line with market consensus. Before the widespread application of LLM technology, individually optimizing one of these capabilities might require a significant amount of interface optimization resources or algorithmic resources. However, now, integrating large language models may be a more cost-effective choice. Especially since LLM's capabilities such as named entity recognition, sentiment analysis, question answering, time series forecasting, mathematical attribution, etc., have already been proven to have widespread applications in the financial industry's services and analysis, making LLM likely to become essential technology reserves for every financial institution in the future. At the same time, major Internet companies are highly motivated to develop and feed LLM, making it foreseeable that for large financial institutions and Internet companies, integrating some of LLM's functions into intelligent investment advisory products has become a foreseeable possibility. We hope that our work will provide practitioners and researchers with basic ideas and theoretical basis for designing intelligent investment advisory products with integrated LLM functionality.

References

[1]. Tao, R., Su, C. W., Xiao, Y., Dai, K., & Khalid, F. (2021). Robo advisors, algorithmic trading and investment management: Wonders of fourth industrial revolution in financial markets. Technological Forecasting and Social Change, 163, 120421.

[2]. Brenner, L., & Meyll, T. (2020). Robo-advisors: a substitute for human financial advice?. Journal of Behavioral and Experimental Finance, 25, 100275.

[3]. Tiberius, V., Gojowy, R., & Dabić, M. (2022). Forecasting the future of robo advisory: A three-stage Delphi study on economic, technological, and societal implications. Technological forecasting and social change, 182, 121824.

[4]. Yeh, H. C., Yu, M. C., Liu, C. H., & Huang, C. I. (2023). Robo-advisor based on unified theory of acceptance and use of technology. Asia Pacific Journal of Marketing and Logistics, 35(4), 962-979.

[5]. Faubion, B. (2016). Effect of automated advising platforms on the financial advising market.

[6]. Agnew, J., & Mitchell, O. S. (Eds.). (2019). The disruptive impact of FinTech on retirement systems. Oxford University Press.

[7]. Shanmuganathan, M. (2020). Behavioural finance in an era of artificial intelligence: Longitudinal case study of robo-advisors in investment decisions. Journal of Behavioral and Experimental Finance, 27, 100297.

[8]. Belanche, D., Casaló, L. V., & Flavián, C. (2019). Artificial Intelligence in FinTech: understanding robo-advisors adoption among customers. Industrial Management & Data Systems, 119(7), 1411-1430. Faubion

[9]. Cardillo, G., & Chiappini, H. (2024). Robo-advisors: a systematic literature review. Finance Research Letters, 105119.

[10]. Jung, D., Dorner, V., Weinhardt, C., & Pusmaz, H. (2018). Designing a robo-advisor for risk-averse, low-budget consumers. Electronic Markets, 28, 367-380.

[11]. Isaia, E., & Oggero, N. (2022). The potential use of robo-advisors among the young generation: Evidence from Italy. Finance Research Letters, 48, 103046.

[12]. Piehlmaier, D. M. (2022). Overconfidence and the adoption of robo-advice: why overconfident investors drive the expansion of automated financial advice. Financial Innovation, 8(1), 14.

[13]. Oehler, A., & Horn, M. (2024). Does ChatGPT provide better advice than robo-advisors?. Finance Research Letters, 60, 104898.

[14]. Oehler, A., Horn, M., & Wendt, S. (2022). Investor characteristics and their impact on the decision to use a robo-advisor. Journal of Financial Services Research, 62(1), 91-125.

[15]. Atwal, G., & Bryson, D. (2021). Antecedents of intention to adopt artificial intelligence services by consumers in personal financial investing. Strategic Change, 30(3), 293-298.

[16]. Seiler, V., & Fanenbruck, K. M. (2021). Acceptance of digital investment solutions: The case of robo advisory in Germany. Research in International Business and Finance, 58, 101490.

[17]. Hildebrand, C., & Bergner, A. (2021). Conversational robo advisors as surrogates of trust: onboarding experience, firm perception, and consumer financial decision making. Journal of the Academy of Marketing Science, 49(4), 659-676.

[18]. Niszczota, P., & Abbas, S. (2023). GPT has become financially literate: Insights from financial literacy tests of GPT and a preliminary test of how people use it as a source of advice. Finance Research Letters, 58, 104333.

[19]. Figà-Talamanca, G., Tanzi, P. M., & D’Urzo, E. (2022). Robo-advisor acceptance: Do gender and generation matter?. PloS one, 17(6), e0269454.

[20]. Cheng, X., Guo, F., Chen, J., Li, K., Zhang, Y., & Gao, P. (2019). Exploring the trust influencing mechanism of robo-advisor service: A mixed method approach. Sustainability, 11(18), 4917.

[21]. Sironi, P. (2016). FinTech innovation: from robo-advisors to goal based investing and gamification. John Wiley & Sons.

[22]. Epperson, T., Hedges, B., Singh, U., & Gabel, M. (2015). AT Kearney 2015 robo-advisory services study. Edited by AT Kearney.

[23]. C Lopez, J., Babcic, S., & De La Ossa, A. (2015). Advice goes virtual: how new digital investment services are changing the wealth management landscape. Journal of Financial Perspectives, 3(3).

[24]. Bussmann, O. (2017). The future of finance: Fintech, tech disruption, and orchestrating innovation. Equity Markets in Transition: The Value Chain, Price Discovery, Regulation, and Beyond, 473-486.

[25]. Fisch, J. E., Laboure, M., & Turner, J. A. (2019). The Emergence of the Robo-advisor. The disruptive impact of FinTech on retirement systems, 13, 13-37.

[26]. Tokic, D. (2018). BlackRock Robo‐Advisor 4.0: When artificial intelligence replaces human discretion. Strategic Change, 27(4), 285-290.

[27]. Garvía, L. (2018). Towards a taxonomy of robo-advisors. Jusletter IT.

[28]. Phoon, K. F., & Koh, C. C. F. (2018). Robo-advisors and wealth management. Journal of Alternative Investments, 20(3), 79.

[29]. XU, R. M., HU, L., DIAO, J. Y., DU, W. Z., & YU, W. Q. (2023). Technology application prospects and risk challenges of large language model. Journal of Computer Applications, 0.

[30]. Hu, Y., & Liu, C. Y. (2024). Data Ruling Large Language Models: The Values, Myths, and Challenges of Training Data in Future Digital Communications. Journal of Northwest Normal University (Social Sciences)(Vol. 6 No.3) in Chinese.

[31]. Zhang, F. & Tan, Y. (2024). GPT Robot and Its Potential and Challenges, China Mechanical Engineering in Chinese.

[32]. Sallam, M. (2023, March). ChatGPT utility in healthcare education, research, and practice: systematic review on the promising perspectives and valid concerns. In Healthcare (Vol. 11, No. 6, p. 887). MDPI.

[33]. Fuchs, K. (2023, May). Exploring the opportunities and challenges of NLP models in higher education: is Chat GPT a blessing or a curse?. In Frontiers in Education (Vol. 8, p. 1166682). Frontiers.

[34]. Fu, D., Li, X., Wen, L., Dou, M., Cai, P., Shi, B., & Qiao, Y. (2024). Drive like a human: Rethinking autonomous driving with large language models. In Proceedings of the IEEE/CVF Winter Conference on Applications of Computer Vision (pp. 910-919).

[35]. Balas, M., & Ing, E. B. (2023). Conversational AI models for ophthalmic diagnosis: comparison of ChatGPT and the Isabel Pro differential diagnosis generator. JFO Open Ophthalmology, 1, 100005.

[36]. Hill-Yardin, E. L., Hutchinson, M. R., Laycock, R., & Spencer, S. J. (2023). A Chat (GPT) about the future of scientific publishing. Brain, behavior, and immunity, 110, 152-154.

[37]. Liang, S. (2024). Opportunities and Problems Presented by ChatGPT to the Financial Industry. Highlights in Business, Economics and Management, 24, 1284-1289.

[38]. Zhou, R.R. (2023). The Value,Experience and Path of Ethical Governance of Fintech. Southwest Finance(2023-10) in Chinese.

[39]. Pandya, K., & Holia, M. (2023). Automating Customer Service using LangChain: Building custom open-source GPT Chatbot for organizations. arXiv preprint arXiv:2310.05421.

[40]. Huang, Z., Che, C., Zheng, H., & Li, C. (2024). Research on Generative Artificial Intelligence for Virtual Financial Robo-Advisor. Academic Journal of Science and Technology, 10(1), 74-80.

[41]. Torno, A., Metzler, D. R., & Torno, V. (2021). Robo-What?, Robo-Why?, Robo-How?-A Systematic Literature Review of Robo-Advice. PACIS, 92.

[42]. Kilic, M., Heinrich, P., & Schwabe, G. (2015, February). Coercing into completeness in financial advisory service encounters. In proceedings of the 18th ACM conference on Computer supported cooperative work & social computing (pp. 1324-1335).

[43]. Ruf, C., Back, A., Bergmann, R., & Schlegel, M. (2015, January). Elicitation of requirements for the design of mobile financial advisory services--instantiation and validation of the requirement data model with a multi-method approach. In 2015 48th Hawaii International Conference on System Sciences (pp. 1169-1178). IEEE.

[44]. Zhao, H., Liu, Z., Wu, Z., Li, Y., Yang, T., Shu, P., ... & Liu, T. (2024). Revolutionizing finance with llms: An overview of applications and insights. arXiv preprint arXiv:2401.11641.

[45]. Nasar, Z., Jaffry, S. W., & Malik, M. K. (2021). Named entity recognition and relation extraction: State-of-the-art. ACM Computing Surveys (CSUR), 54(1), 1-39.

Cite this article

Feng,Z. (2024). Can GPT Help Improve Robo-advisory? The Construction of Robo-advisor for Users with Low Investment Experience Based on LLM. Advances in Economics, Management and Political Sciences,90,26-41.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Tao, R., Su, C. W., Xiao, Y., Dai, K., & Khalid, F. (2021). Robo advisors, algorithmic trading and investment management: Wonders of fourth industrial revolution in financial markets. Technological Forecasting and Social Change, 163, 120421.

[2]. Brenner, L., & Meyll, T. (2020). Robo-advisors: a substitute for human financial advice?. Journal of Behavioral and Experimental Finance, 25, 100275.

[3]. Tiberius, V., Gojowy, R., & Dabić, M. (2022). Forecasting the future of robo advisory: A three-stage Delphi study on economic, technological, and societal implications. Technological forecasting and social change, 182, 121824.

[4]. Yeh, H. C., Yu, M. C., Liu, C. H., & Huang, C. I. (2023). Robo-advisor based on unified theory of acceptance and use of technology. Asia Pacific Journal of Marketing and Logistics, 35(4), 962-979.

[5]. Faubion, B. (2016). Effect of automated advising platforms on the financial advising market.

[6]. Agnew, J., & Mitchell, O. S. (Eds.). (2019). The disruptive impact of FinTech on retirement systems. Oxford University Press.

[7]. Shanmuganathan, M. (2020). Behavioural finance in an era of artificial intelligence: Longitudinal case study of robo-advisors in investment decisions. Journal of Behavioral and Experimental Finance, 27, 100297.

[8]. Belanche, D., Casaló, L. V., & Flavián, C. (2019). Artificial Intelligence in FinTech: understanding robo-advisors adoption among customers. Industrial Management & Data Systems, 119(7), 1411-1430. Faubion

[9]. Cardillo, G., & Chiappini, H. (2024). Robo-advisors: a systematic literature review. Finance Research Letters, 105119.

[10]. Jung, D., Dorner, V., Weinhardt, C., & Pusmaz, H. (2018). Designing a robo-advisor for risk-averse, low-budget consumers. Electronic Markets, 28, 367-380.

[11]. Isaia, E., & Oggero, N. (2022). The potential use of robo-advisors among the young generation: Evidence from Italy. Finance Research Letters, 48, 103046.

[12]. Piehlmaier, D. M. (2022). Overconfidence and the adoption of robo-advice: why overconfident investors drive the expansion of automated financial advice. Financial Innovation, 8(1), 14.

[13]. Oehler, A., & Horn, M. (2024). Does ChatGPT provide better advice than robo-advisors?. Finance Research Letters, 60, 104898.

[14]. Oehler, A., Horn, M., & Wendt, S. (2022). Investor characteristics and their impact on the decision to use a robo-advisor. Journal of Financial Services Research, 62(1), 91-125.

[15]. Atwal, G., & Bryson, D. (2021). Antecedents of intention to adopt artificial intelligence services by consumers in personal financial investing. Strategic Change, 30(3), 293-298.

[16]. Seiler, V., & Fanenbruck, K. M. (2021). Acceptance of digital investment solutions: The case of robo advisory in Germany. Research in International Business and Finance, 58, 101490.

[17]. Hildebrand, C., & Bergner, A. (2021). Conversational robo advisors as surrogates of trust: onboarding experience, firm perception, and consumer financial decision making. Journal of the Academy of Marketing Science, 49(4), 659-676.

[18]. Niszczota, P., & Abbas, S. (2023). GPT has become financially literate: Insights from financial literacy tests of GPT and a preliminary test of how people use it as a source of advice. Finance Research Letters, 58, 104333.

[19]. Figà-Talamanca, G., Tanzi, P. M., & D’Urzo, E. (2022). Robo-advisor acceptance: Do gender and generation matter?. PloS one, 17(6), e0269454.

[20]. Cheng, X., Guo, F., Chen, J., Li, K., Zhang, Y., & Gao, P. (2019). Exploring the trust influencing mechanism of robo-advisor service: A mixed method approach. Sustainability, 11(18), 4917.

[21]. Sironi, P. (2016). FinTech innovation: from robo-advisors to goal based investing and gamification. John Wiley & Sons.

[22]. Epperson, T., Hedges, B., Singh, U., & Gabel, M. (2015). AT Kearney 2015 robo-advisory services study. Edited by AT Kearney.

[23]. C Lopez, J., Babcic, S., & De La Ossa, A. (2015). Advice goes virtual: how new digital investment services are changing the wealth management landscape. Journal of Financial Perspectives, 3(3).

[24]. Bussmann, O. (2017). The future of finance: Fintech, tech disruption, and orchestrating innovation. Equity Markets in Transition: The Value Chain, Price Discovery, Regulation, and Beyond, 473-486.

[25]. Fisch, J. E., Laboure, M., & Turner, J. A. (2019). The Emergence of the Robo-advisor. The disruptive impact of FinTech on retirement systems, 13, 13-37.

[26]. Tokic, D. (2018). BlackRock Robo‐Advisor 4.0: When artificial intelligence replaces human discretion. Strategic Change, 27(4), 285-290.

[27]. Garvía, L. (2018). Towards a taxonomy of robo-advisors. Jusletter IT.

[28]. Phoon, K. F., & Koh, C. C. F. (2018). Robo-advisors and wealth management. Journal of Alternative Investments, 20(3), 79.

[29]. XU, R. M., HU, L., DIAO, J. Y., DU, W. Z., & YU, W. Q. (2023). Technology application prospects and risk challenges of large language model. Journal of Computer Applications, 0.

[30]. Hu, Y., & Liu, C. Y. (2024). Data Ruling Large Language Models: The Values, Myths, and Challenges of Training Data in Future Digital Communications. Journal of Northwest Normal University (Social Sciences)(Vol. 6 No.3) in Chinese.

[31]. Zhang, F. & Tan, Y. (2024). GPT Robot and Its Potential and Challenges, China Mechanical Engineering in Chinese.

[32]. Sallam, M. (2023, March). ChatGPT utility in healthcare education, research, and practice: systematic review on the promising perspectives and valid concerns. In Healthcare (Vol. 11, No. 6, p. 887). MDPI.

[33]. Fuchs, K. (2023, May). Exploring the opportunities and challenges of NLP models in higher education: is Chat GPT a blessing or a curse?. In Frontiers in Education (Vol. 8, p. 1166682). Frontiers.

[34]. Fu, D., Li, X., Wen, L., Dou, M., Cai, P., Shi, B., & Qiao, Y. (2024). Drive like a human: Rethinking autonomous driving with large language models. In Proceedings of the IEEE/CVF Winter Conference on Applications of Computer Vision (pp. 910-919).

[35]. Balas, M., & Ing, E. B. (2023). Conversational AI models for ophthalmic diagnosis: comparison of ChatGPT and the Isabel Pro differential diagnosis generator. JFO Open Ophthalmology, 1, 100005.

[36]. Hill-Yardin, E. L., Hutchinson, M. R., Laycock, R., & Spencer, S. J. (2023). A Chat (GPT) about the future of scientific publishing. Brain, behavior, and immunity, 110, 152-154.

[37]. Liang, S. (2024). Opportunities and Problems Presented by ChatGPT to the Financial Industry. Highlights in Business, Economics and Management, 24, 1284-1289.

[38]. Zhou, R.R. (2023). The Value,Experience and Path of Ethical Governance of Fintech. Southwest Finance(2023-10) in Chinese.

[39]. Pandya, K., & Holia, M. (2023). Automating Customer Service using LangChain: Building custom open-source GPT Chatbot for organizations. arXiv preprint arXiv:2310.05421.

[40]. Huang, Z., Che, C., Zheng, H., & Li, C. (2024). Research on Generative Artificial Intelligence for Virtual Financial Robo-Advisor. Academic Journal of Science and Technology, 10(1), 74-80.

[41]. Torno, A., Metzler, D. R., & Torno, V. (2021). Robo-What?, Robo-Why?, Robo-How?-A Systematic Literature Review of Robo-Advice. PACIS, 92.

[42]. Kilic, M., Heinrich, P., & Schwabe, G. (2015, February). Coercing into completeness in financial advisory service encounters. In proceedings of the 18th ACM conference on Computer supported cooperative work & social computing (pp. 1324-1335).

[43]. Ruf, C., Back, A., Bergmann, R., & Schlegel, M. (2015, January). Elicitation of requirements for the design of mobile financial advisory services--instantiation and validation of the requirement data model with a multi-method approach. In 2015 48th Hawaii International Conference on System Sciences (pp. 1169-1178). IEEE.

[44]. Zhao, H., Liu, Z., Wu, Z., Li, Y., Yang, T., Shu, P., ... & Liu, T. (2024). Revolutionizing finance with llms: An overview of applications and insights. arXiv preprint arXiv:2401.11641.

[45]. Nasar, Z., Jaffry, S. W., & Malik, M. K. (2021). Named entity recognition and relation extraction: State-of-the-art. ACM Computing Surveys (CSUR), 54(1), 1-39.