1. Introduction

In the 1980s, the concept of venture capital entered China, and now private equity investment has a history of 40 years in China, during which it has experienced many upsurges. In recent years, China's private equity investment fund industry has developed rapidly, and the scale of funds under management has continued to grow, from 1.73 trillion yuan in 2015 to more than 10 trillion yuan in 2021 [1].

As an important investment tool, private equity investment fund plays a very significant role in the capital market. With the continuous development and improvement of the theory and method of financial instrument valuation, valuation becomes more and more important in the whole process management of private equity investment funds. As the scale of private funds increases, investors are increasing, and the money-making effect is gradually decreasing, when the accuracy of valuation plays a crucial role. China's domestic private equity investment valuation methods generally use cash flow method, relative ratio method and other traditional valuation methods, which may have problems in the accuracy of private equity valuation [2]. In 2020, the novel coronavirus epidemic swept the world, dealing a major blow to the world economy, and the global financial market shook sharply. Personnel flow control will seriously affect the fund raising, fund registration and project investment of early investment funds, and have a bad impact on the private equity industry [3]. As the world's first currency, the US dollar has naturally become an important tool for international financial intermediaries to deal with redemptions, and the US dollar liquidity has been run. The Federal Reserve kept cutting interest rates, but it did not change the fact that interest rates continued to rise, and private valuations fell sharply. The existing literature only studies the impact of the epidemic on the financial sector unilaterally, and does not start with private valuation. Therefore, this paper will start with private equity valuation and analyze some typical private equity valuation during the epidemic to find out the impact of special events on private equity valuation.

2. Research Background and Literature Review

2.1. Private Equity Development Background

Private equity investment first originated in the United States in the 1940s and was a "tool" for the wealthy at that time. In 1984, the concept of venture capital was introduced to China, and private equity investment was only known to the Chinese market. In the 1990s, after the reform and opening up, many foreign private equity investment funds chose to enter China, which produced a wave of private equity investment in this emerging economy at that time. In the late 1990s, the Chinese government issued a series of policies to encourage the development of private equity investment, such as the Decision of the Central Committee of the Communist Party of China on Strengthening Technological Innovation, Developing High Technology, and Realizing Industrialization, and Several Opinions on Establishing China's Venture Capital Mechanism. China has also set up a number of government-led venture capital institutions, such as Shanghai Chuanglian and Zhongke Merchants, which have also set off a second wave of private equity investment. The development of private equity investment in China has begun to take shape, and China has gradually become one of the most dynamic markets for private equity investment [4]. The COVID-19 pandemic that swept the world in 2019 and 2020 has severely affected financial markets around the world. Previous research has suggested that more closed private equity investments are less affected by market fluctuations than other public market investments. Private equity valuation methods in China are relatively simple, and most private equity management institutions adopt traditional valuation methods such as cash flow method and relative ratio method [2]. When it comes to major special events such as the COVID-19 pandemic, traditional valuation methods affect the valuation of the company, which in turn affects the investment decisions of investors.

2.2. COVID-19 Pandemic Background

The impact of the COVID-19 epidemic on the financial market has been so great that many investors have to re-evaluate the value of their investment projects. In past studies, global markets have been affected to varying degrees. In a sample of mainly North American and Western European companies, the epidemic has caused about 40% of invested companies to be moderately negatively affected, 10% to be severely negatively affected, and 50% of companies have not been significantly affected [5]. Faced with the impact, private equity investors are still looking for new investment opportunities and pay more attention to creating value through revenue growth [5]. Looking at fund manager expectations, private equity firms generally expect the performance of existing funds to decline. In the long term, the epidemic has also accelerated the adjustment of private equity companies' operating models and crisis management capabilities, demonstrating the adaptability and resilience of the private equity industry in adversity [5].

In another study focusing on the European market, after the outbreak (taking March 1, 2020 as the split time), the proportion of PE MM fund managers who expected their portfolios to deteriorate sharply increased from 8% to 40%. However, when considering long-term growth prospects, private equity fund managers are generally optimistic [6].

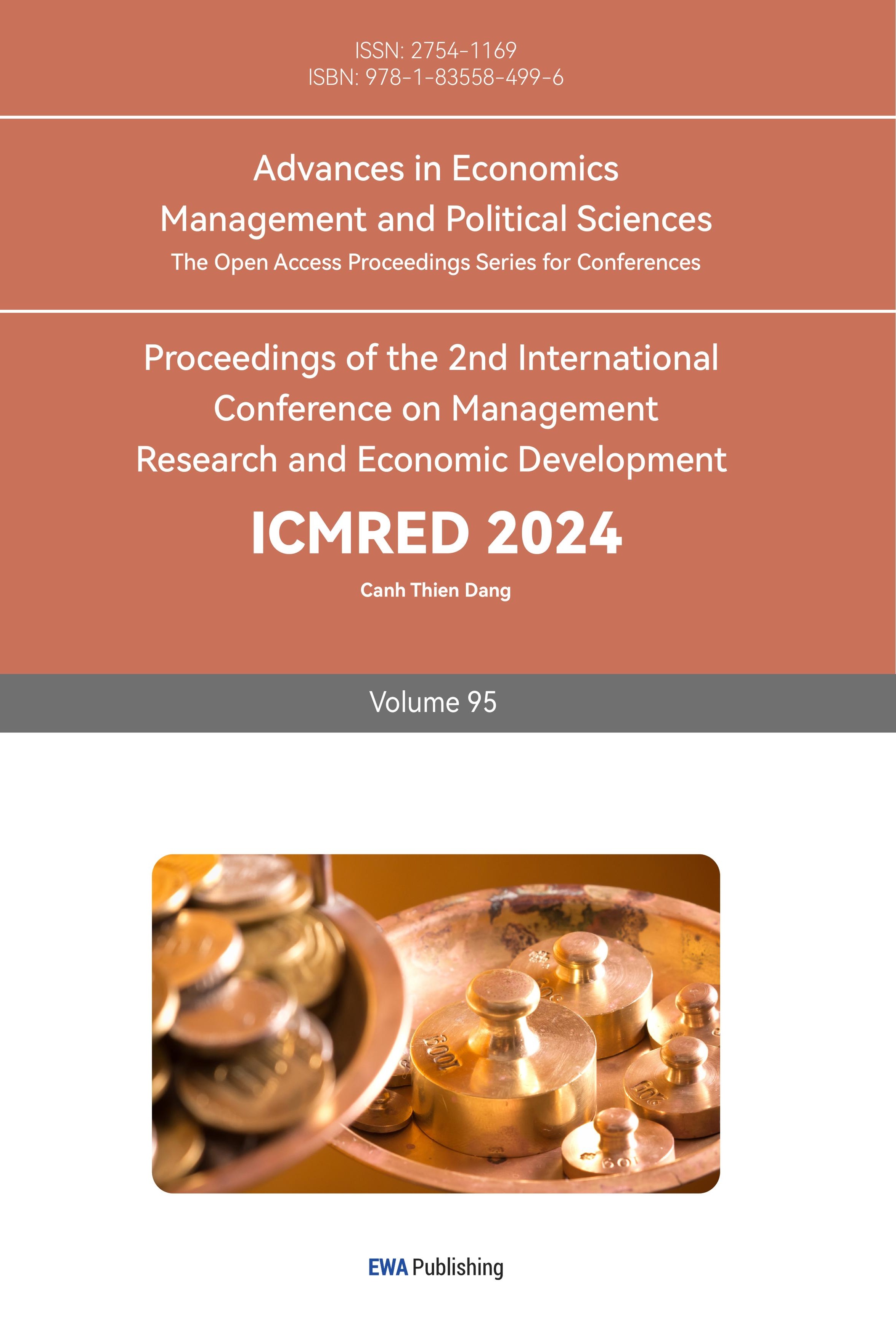

From a Chinese perspective, China was the first country to be hit by the COVID-19 pandemic. However, thanks to its early control of the epidemic and the lifting of internal travel restrictions, China became the only major economy in the world to achieve positive GDP growth in 2020. The increase in the number of investors and their purchasing power makes mainland China continue to be regarded as one of the best investment locations by emerging market investors [7]. In view of the recovery of China's consumer market and the improvement of economic conditions, it is believed that although China's private equity market has suffered a certain impact in the short term, the market has a strong ability to recover and develop in the long term. Figure 1 below shows the process of China's economic recovery after the impact of the epidemic in 2020. Although China's economy suffered negative growth in the early stages of the epidemic, the growth rate quickly returned to normal levels after rapid control.

Figure 1: China GDP real growth rate in 2020 (Photo/Picture credit: Original).

Generally speaking, based on previous research, various markets around the world were severely hit in the early stages of the epidemic. However, as the means to deal with the epidemic have increased, production has recovered, and the financial confidence market has improved, people's overall long-term expectations for private equity valuations are still optimistic.

2.3. Private Equity Valuation Model

Private equity investment valuation refers to the reasonable valuation of various asset portfolios in private equity investment to determine the net present value of the asset portfolio, so that private investors and private investment institutions can make relevant choices. At present, the mainstream valuation methods in the world can be roughly divided into three categories: income method, market method and cost method. The income method is the most common, and the most widely used is DCF (Discounted Cash Flow), and DCF can be subdivided into FCFF (Free Cash Flow to Firm). FCFE (Free Cash Flow to Equity) and DDM (Dividend Discount Model) [8]. Market method includes Comparable Company Analysis and Precedent Transactions Analysis. Comparable Company Analysis is to evaluate the target company by comparing similar companies with the target company in terms of industry, customers, products, terminals, etc., and referring to their main financial ratios. Precedent Transactions Analysis is based on the same industry as the target company, and in the recent investment or merger of the company, based on its financing amount or merger pricing as a reference, to value the target company. Private investment companies usually adopt more than two valuation methods to evaluate, and the various methods confirm each other, and the conclusion is often not a definite value, but a valuation range.

3. The Impact of COVID-19 on Private Equity Valuation Models

This paper believes that the impact of COVID-19 on private valuation models lies in the discounted cash flow method on the one hand. Although DCF is widely used, it also has its drawbacks. The input in the DCF model is the prediction of the target company's future, and the accuracy of this prediction is highly dependent on the investment company's understanding of the target company's industry, as well as the in-depth investigation and research of the target company. Due to the impact of the epidemic, the Chinese government has taken a series of measures to prevent and control the epidemic out of concern for people's lives. One is restricted mobility, which makes it impossible for investors to conduct site visits and assess target companies. In order to stimulate the economy, China will adopt a certain interest rate reduction policy, which may lower the discount rate. Coupled with the impact of the epidemic on global financial markets, the future is full of instability, and investment institutions have to act prudently. The above is not conducive to DCF's data collection, but also affects the accuracy of its evaluation results. However, most investment institutions still choose to use DCF for valuation because there is no better method.

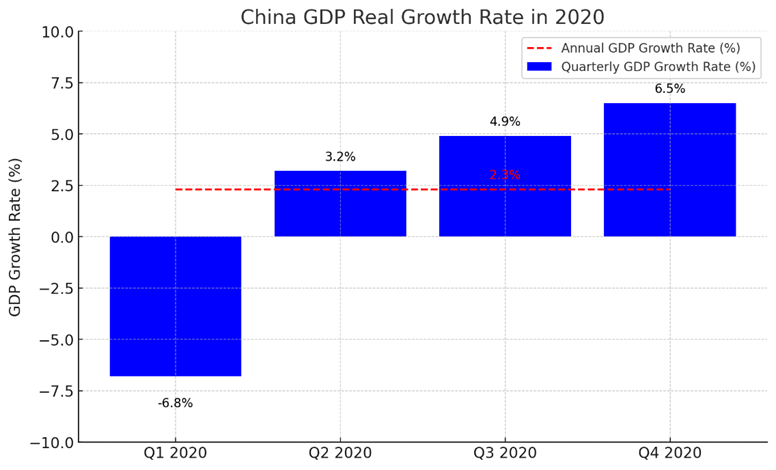

Figure 2: Secondary market pricing by vintage year (Photo/Picture credit: Original).

On the other hand, the COVID-19 pandemic has also affected market-based valuation models. Market methods rely primarily on market data, some of which are updated daily, such as market capitalization. However, most of the required forecast data and the historical financial data of the target company will be affected by the release mechanism, and the update will be delayed, which leads to the failure of the valuation model using market method to evaluate the target company in time. Timeliness is particularly important in private equity, where many investment opportunities are fleeting. Using pre-COVID-19 historical data for valuation results in an undervaluation of market multiples (Since the numerator in the formula is updated in time, such as market capitalization, but the denominator may not be updated after the pandemic, such as net profit), in turn, the fair value is undervalued. For example, during the epidemic, many private investment management institutions thought it was a good opportunity for bargain-hunting, similar to the SARS period before, many companies have a low valuation, undervaluing the value of about 8% to 12%, as Figure 2 shown.

4. The Impact of COVID-19 on Private Equity Market

In addition to valuation models, the impact of the COVID-19 epidemic on private equity valuations is also reflected in its direct impact on the private equity market itself. From an investor's perspective, due to the economic uncertainty and market volatility caused by the epidemic, investors tend to be less tolerant of risks, which will lead to more conservative valuations of investment projects in the short term, as mentioned above.

From the perspective of companies receiving investment, the impact or opportunities brought by the epidemic on various industries are different. This extremely important and rare "black swan" event will cause huge changes in the value of different industries themselves, thus triggering valuation changes. value changes. The impact on different industries in the private equity market shows significant differences. Some industries have been severely impacted by the epidemic and need to reconsider and adjust their business models, while other industries have shown strong resistance to risks and have been less affected.

Industries such as real estate, hotel tourism and logistics have been severely affected by the COVID-19 epidemic. The epidemic has restricted travel, leading to a rebound in demand in the tourism and hospitality industries. Likewise, the housing market has been rocked by economic uncertainty causing people to delay purchase decisions. Although the logistics industry has temporarily survived the epidemic due to increased demand for essential goods, it is also facing challenges due to disruptions in global supply chains and transportation restrictions.

On the contrary, industries such as fintech, healthcare, pharmaceuticals and biotechnology have shown their resilience during the epidemic. The demand for services and products in these industries has not decreased but increased during the epidemic. For example, fintech companies benefit from the potential to facilitate risk-free contact payments and online financial services; the healthcare and biotech industries are growing rapidly due to pandemic needs and the urgency of vaccination.

This industry heterogeneity requires private equity firms to re-evaluate their investment portfolios during the epidemic, optimize resource allocation, and increase their focus on potential growth industries. At the same time, for those industries that have been impacted and expanded, private equity companies need public attention on how to help these industries adapt to the new normal, accelerate digital transformation, and optimize operational efficiency.

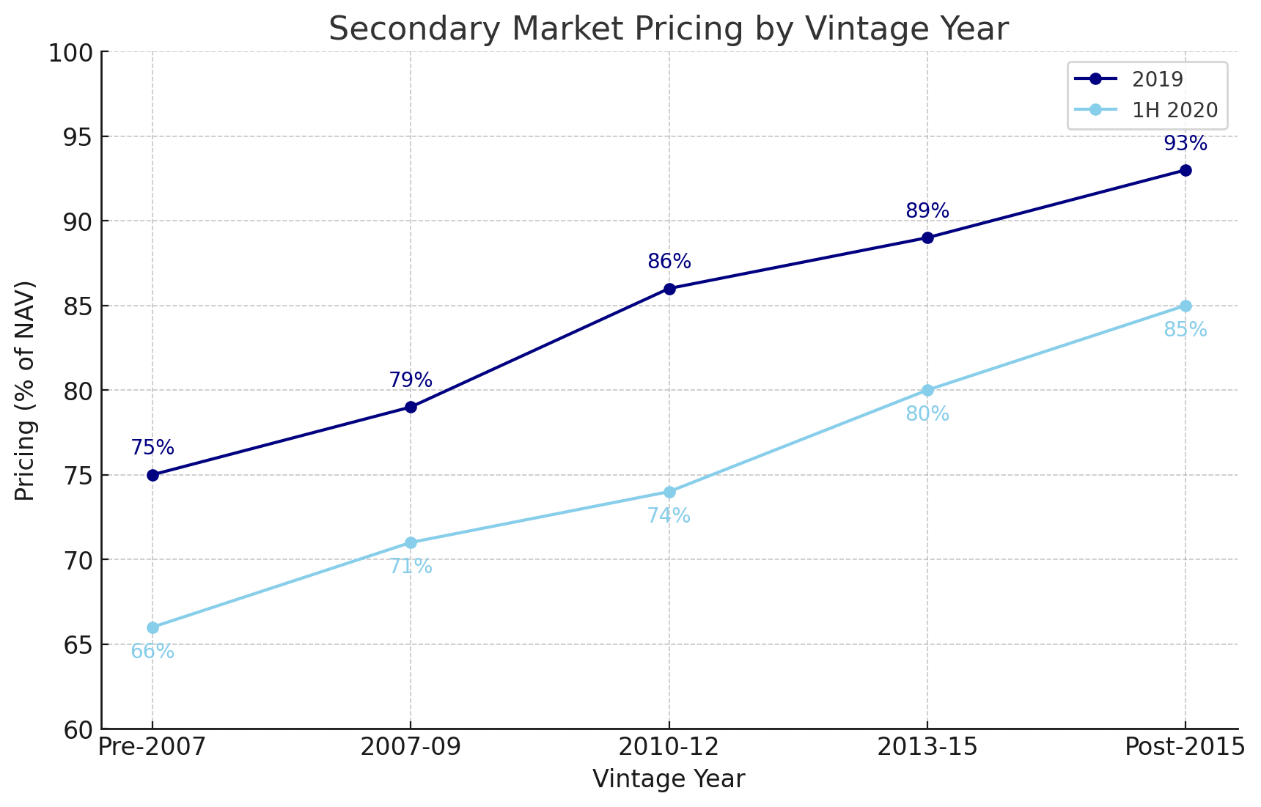

The publicity of private equity valuation data is often low, and changes in valuations of listed companies in the industry can also reflect changes in private equity valuation prices to a certain extent. It has displayed two groups of representative companies to demonstrate the impact of the epidemic on different industries in the private equity market. Impact:

As shown in Figure 3, the market value of Pfizer Pharmaceuticals in the biological field rose rapidly during the epidemic, because the epidemic led to a surge in demand for Pfizer vaccines or other corresponding medical products; and in Figure 4, the market value of Hilton Group in the Chinese tourism and hotel industry increased significantly in the early stages of the epidemic. The decline may be due to the impact of the epidemic on the tourism industry. People tend to reduce travel and stay in hotels. After the epidemic stabilizes, the market value rebounds. These changes reflect the impact of COVID-19 on consumer and investor confidence in the industry. That is, there is an overall impact on the market. Some industries have suffered a greater negative impact due to restrictions, while a small number of related industries have developed due to the increased demand caused by the epidemic.

Figure 3: Pfizer historical market capitalization (Photo/Picture credit: Original).

Figure 4: Hilton historical market capitalization (Photo/Picture credit: Original).

During the epidemic, the valuation of the private equity market was affected by many aspects such as market environment and confidence. Investors need to evaluate investment opportunities more prudently and pay more attention to long-term market trends and industry changes.

5. Case Analysis and Suggestions

5.1. Suggestions for Improving Valuation Methods

Regarding the future uncertainty caused by the COVID-19 epidemic, investment companies should increase the frequency of valuations and use updated data to determine whether the impact of the epidemic on the target company is permanent, and if not, how long it will take for the target company to recover. At the same time, investment companies should add sensitivity analysis and correlation analysis to determine the impact of the epidemic on relevant data. The company's life cycle theory should also be taken into consideration, and corresponding valuation methods should be used according to the different stages of the target company to improve the accuracy of the valuation.

5.2. Case Analysis: Spring Airlines

During the COVID-19 epidemic, the regulations imposed by various governments and the decline in people's willingness to travel have had a huge impact on airlines, and the overall operation of the aviation industry has been difficult [9]. Many airlines need to significantly reduce or cancel flights to cope with the problem of reduced passengers and cost control. A large number of aircraft are idle on the ground, with excess capacity, and flight operations are severely restricted. From a financial perspective, the sharp drop in passenger numbers has directly led to a significant drop in revenue, while airlines still have to bear high fixed costs. These have put great pressure on airlines, and when it is unknown whether the epidemic situation will improve, these negative blows may seriously affect the valuation of airlines. Investors, combined with risks, may generally significantly reduce airline valuation expectations.

Spring Airlines is one of China's largest airlines and China's first low-cost airline. Since its establishment, the company has provided cost-effective services through strict cost control and efficient operating models, becoming a competitive domestic airline. Company [9]. During the epidemic, the aviation industry as a whole has been hit, and even low-cost airlines that are more attractive to consumers are facing losses. After the outbreak, Spring Airlines flexibly adjusted its route network and launched the "Fly as You Want" campaign, covering all domestic and Hong Kong, Macao and Taiwan routes, stimulating customers' consumption desire. With its low-cost model and flexible operation strategy, in the third quarter of 2021 Becoming the only profitable airline, its passenger load factor is much higher than other airlines [9]. On the other hand, the epidemic has led to lower expected incomes and lower spending levels for some people. These new price-sensitive groups are also more likely to become Spring Airlines’ target customers [10]. In the subsequent development, Spring Airlines has also demonstrated better development space and investment value.

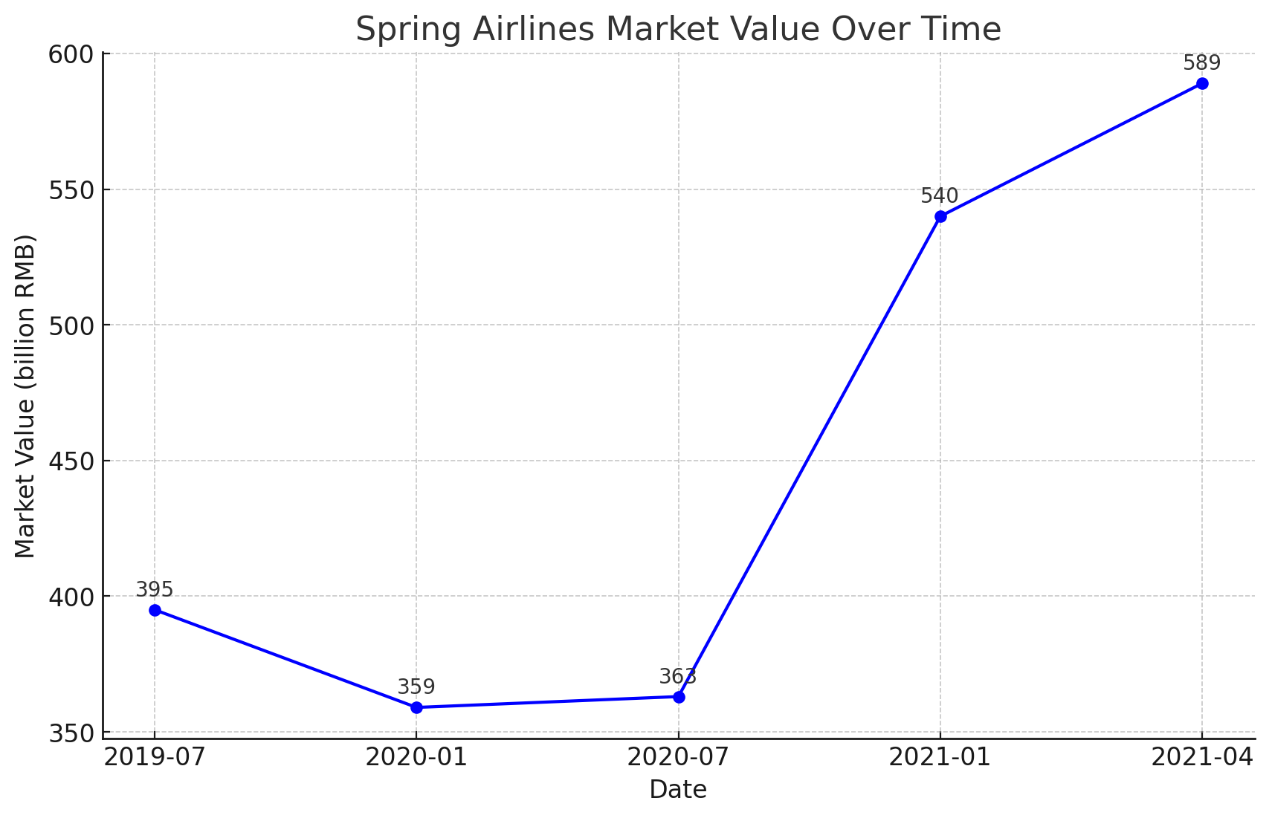

As shown in Figure 5, due to the widespread impact of the epidemic, Spring Airlines' market value also declined in early 2020. However, due to its excellent operating strategies, the development of the low-cost airline market after the epidemic and other factors, Spring Airlines has escaped the atmosphere of decline in the domestic aviation market. The market value is rising rapidly. According to the traditional market law model, since Spring Airlines and other airline companies have suffered similar impacts in terms of turnover, passenger flow, etc. During the epidemic, the degree of decline in their valuations according to the model will be similar; and free cash In the discounted flow method, since it is difficult to consider when the epidemic will end and to predict the fixed expenses of airlines to maintain idling daily operations. It is also difficult to accurately estimate the impact on the company's future free cash flow when the epidemic ends, which will cause problems such as Spring Airlines and other companies. Companies with excellent strategies and development prospects are undervalued.

Figure 5: Spring airlines historical market value (Photo/Picture credit: Original).

When faced with such a situation, investment companies should increase the frequency of valuations, always maintain judgments on changes in the epidemic situation, and reasonably reflect them in valuations. For example, when the government strengthens control and the number of new cases decreases, it should increase the frequency of valuations for airlines. expectations. In addition, judge the particularity of the valuation target in terms of operating strategies and market segments, and look for hidden aspects that may have a greater impact on corporate operations, rather than just relying on corporate cash flow data and comparisons with peers. For example, note that Chunqiu The airline's low-cost airline attributes that distinguish it from other airlines and the possible impact of the joint airline consumer group, as well as the positive impact of Spring and Autumn's unique business strategy. Only in this way can obtain the most reasonable valuation of the enterprise and increase the return on investment.

6. Conclusion

Through research, this paper finds that the COVID-19 pandemic has a greater impact on discounted cash flow method and market method. After the impact of the COVID-19 pandemic, the discounted cash flow method and the market method in the valuation model have exposed their shortcomings. The former relies too much on investment firms' research on target companies, so it is hampered by the epidemic and the accuracy of its valuation is greatly reduced. The latter requires accurate market data, which cannot be updated in a timely manner due to the epidemic, resulting in lower valuations. Therefore, it understands that the COVID-19 pandemic has had a considerable impact on the global private equity market. But from another perspective, the shock has also brought new opportunities to the private equity market, with fintech, healthcare, pharmaceuticals, and biotechnology industries not declining, but increasing. Starting from the impact of COVID-19 on the private equity market, this study is the first to study the relationship between COVID-19 and private equity valuation, so that investors can make timely adjustments when similar major events occur in the future. It is also hoped that scholars and researchers of all parties can take this experience to study a more reasonable private valuation model to cope with more challenges in the future. This article does not address the impact of COVID-19 on other valuation models. The impact of the epidemic on the private equity market is comprehensive, so other valuation models will also be affected to a certain extent, and other valuation models can be analyzed in the future to further deepen the research on this topic.

Authors Contribution

All the authors contributed equally and their names were listed in alphabetical order.

References

[1]. Guanyan Baogao Wang. (2022). Scale of China's Private Equity Investment Funds, Business Exit Methods, and the Proportion of Top Companies' Management Scale from 2015 to 2021. Retrieved from https://www.chinabaogao.com/data/202208/605763.html.

[2]. Fan, C. (2023). Research on Valuation Methods of Start-up Enterprises in Private Equity Investment. Shangxun, (21), 101-104.

[3]. Dong, G. X. (2020). Analysis of the Development Trend of China's Private Equity Fund Industry in the Post-Epidemic Era. Guoji Rongzi, (09), 6-12.

[4]. Sun, W. Y. (2014). An Analysis of the Development History and Current Situation of Private Equity Funds in China. Zhongguo Shangmao, (25), 128-129.

[5]. Gompers, P. A., Kaplan, S. N., & Mukharlyamov, V. (2022). Private equity and COVID-19. Journal of Financial Intermediation, 51, 100968.

[6]. Kraemer-Eis, H., Botsari, A., Lang, F., et al. (2020). The market sentiment in European private equity and venture capital: Impact of COVID-19, EIF Working Paper.

[7]. King & Wood Mallesons. (2021). Impact of COVID-19 on Private Funds – One Year On. Retrieved from https://www.kwm.com/hk/en/insights/latest-thinking/impact-of-covid19-on-private-funds-one-year-on.html.

[8]. Yao, Y. (2013). Research on Enterprise Valuation Methods in Private Equity Investment, Nanjing University.

[9]. Wei, Y. S. (2023). Exploring the Reasons for the Profit Phenomenon of Spring Airlines in the Epidemic. Qin Zhi, (05), 157-159.

[10]. Chen, Y. Y. (2022). Analysis of Spring Airlines' Profit Model. Modern Marketing, (15), 62-64.

Cite this article

Guo,Y.;Li,P. (2024). The Impact of COVID-19 Pandemic on the Private Equity Valuation. Advances in Economics, Management and Political Sciences,95,132-140.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Guanyan Baogao Wang. (2022). Scale of China's Private Equity Investment Funds, Business Exit Methods, and the Proportion of Top Companies' Management Scale from 2015 to 2021. Retrieved from https://www.chinabaogao.com/data/202208/605763.html.

[2]. Fan, C. (2023). Research on Valuation Methods of Start-up Enterprises in Private Equity Investment. Shangxun, (21), 101-104.

[3]. Dong, G. X. (2020). Analysis of the Development Trend of China's Private Equity Fund Industry in the Post-Epidemic Era. Guoji Rongzi, (09), 6-12.

[4]. Sun, W. Y. (2014). An Analysis of the Development History and Current Situation of Private Equity Funds in China. Zhongguo Shangmao, (25), 128-129.

[5]. Gompers, P. A., Kaplan, S. N., & Mukharlyamov, V. (2022). Private equity and COVID-19. Journal of Financial Intermediation, 51, 100968.

[6]. Kraemer-Eis, H., Botsari, A., Lang, F., et al. (2020). The market sentiment in European private equity and venture capital: Impact of COVID-19, EIF Working Paper.

[7]. King & Wood Mallesons. (2021). Impact of COVID-19 on Private Funds – One Year On. Retrieved from https://www.kwm.com/hk/en/insights/latest-thinking/impact-of-covid19-on-private-funds-one-year-on.html.

[8]. Yao, Y. (2013). Research on Enterprise Valuation Methods in Private Equity Investment, Nanjing University.

[9]. Wei, Y. S. (2023). Exploring the Reasons for the Profit Phenomenon of Spring Airlines in the Epidemic. Qin Zhi, (05), 157-159.

[10]. Chen, Y. Y. (2022). Analysis of Spring Airlines' Profit Model. Modern Marketing, (15), 62-64.