1. Introduction

The report of the 20th National Congress of the Communist Party of China proposed that the focus of economic development should be on the real economy. The growth of the capital market needs to focus on the real economy, adhere to the purpose of financial services to the real economy, comprehensively carry out institutional reform of the stock market, improve the multi-level market system, improve the functions of the capital market, and increase the proportion of direct financing [1].

On February 2, 2023, the China Securities Regulatory Commission held the 2023 System Work Conference. The meeting pointed out that under the leadership of the China Securities Regulatory Commission in the past five years, a new round of capital market system reform has been promoted, focusing on the registration system reform [2]. At the same time, fundamental system reforms such as transactions, delisting, refinancing, mergers and acquisitions, and reorganizations will be promoted.

On February 17, 2023, the China Securities Regulatory Commission issued 57 rules and regulations for fully implementing the stock issuance registration system. The China Stock Exchange, China National Equities Exchange and Quotations, China Securities Depository and Clearing Co., Ltd., China Securities Finance Corporation, and the Asset Management Association of China issued 108 supporting systems and rules simultaneously for implementation. This marks the finalization of the institutional arrangements for the registration system, and it keeps the official launch of the comprehensive performance of the registration system for stock issuance, a milestone in the reform and development process of China's capital market.

This registration system reform is mainly reflected in five aspects:

The first is to streamline and optimize issuance and listing conditions. Adhere to information disclosure as the core and convert the issuance conditions under the approval system into information disclosure requirements as much as possible. Each market sector sets diverse and inclusive listing conditions.

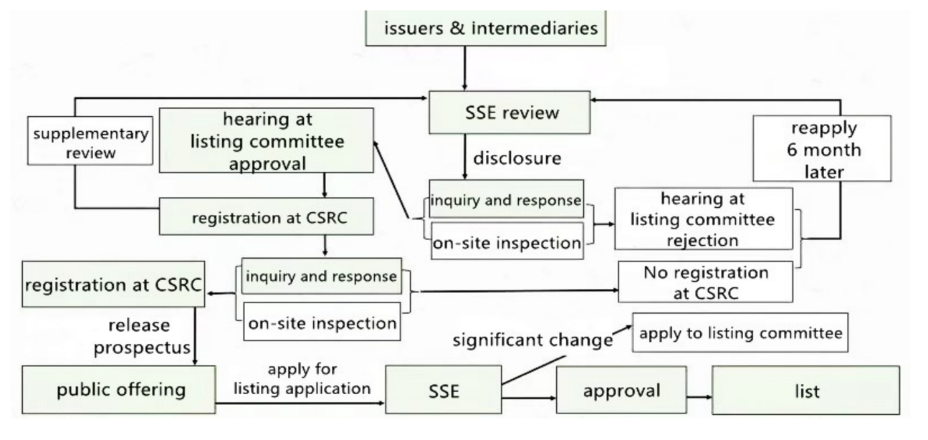

The second is to improve the review and registration procedures. Adhere to the basic structure of stock exchange review and China Securities Regulatory Commission registration with separate focuses and interconnection, and further clarify the division of responsibilities between stock exchanges and China Securities Regulatory Commission. The China Securities Regulatory Commission’s Issuance Review Committee and the Listed Company’s M&A and Reorganization Review Committee will be abolished. The stock exchange is responsible for reviewing significant issuance matters, and the China Securities Regulatory Commission simultaneously pays attention to whether the issuer complies with national industrial policies and sector positioning.

The third is to optimize the issuance and underwriting system. There will be no administrative restrictions on the price and scale of new stock issuances, and mechanisms such as inquiry, pricing, and allotment will be improved with institutional investors as participants.

The fourth is to improve the significant asset restructuring system of listed companies. Listed companies in various market sectors implement a unified registration system for issuing shares and purchasing assets, improving the standards and pricing mechanisms for reorganization identification, and strengthening supervision during and after the reorganization activities.

The fifth is to strengthen regulatory enforcement and investor protection—a strict crackdown on illegal activities in securities issuance, sponsorship, and underwriting following the law [3].

Figure 1: The difference between the approval and registration systems.

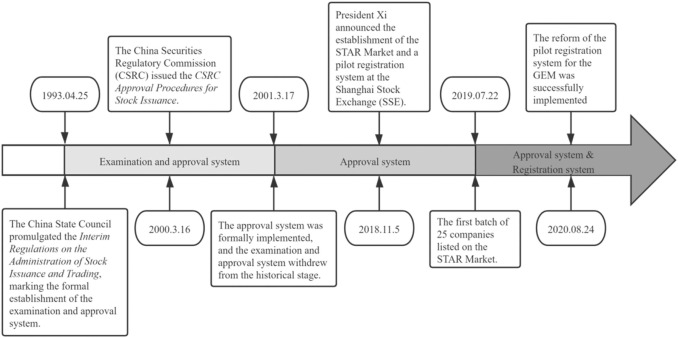

Figure 2: Demonstrates the difference between the approval and registration systems.

2. The Difference Between Approval System and Registration System

In addition, has the Chinese stock market announced that the approval system will be completely changed to a registration system? Why? It can be analyzed from four aspects:

Substantially optimize listing and issuance conditions.

Comply with the review system.

Control the quality of information disclosure.

Adhere to the combination of open policy and management policy.

2.1. Greatly Optimize the Listing Conditions

The registration system only retains the qualification and compliance conditions for enterprises to issue shares. The substantive threshold under the approval system will be transformed into information disclosure as much as possible, and the regulatory authorities will no longer judge enterprises' investment value.

2.2. Adhere to the Audit System

The audit registration system's standards, procedures, contents, processes, and results are open to the public. The whole method of power operation is transparent, has strict requirements, and is subject to social supervision, which differs considerably from the verification system.

2.3. Control the Quality of Information Disclosure

Implement the registration system, improve quality requirements, and audit more stringently. The audit is mainly done through inquiries to urge the issuer to make a valid, accurate, error-free, and complete disclosure.

2.4. Adhere to the Combination of Liberalization Policies and Management Policies

We will strengthen supervision of all links in the whole chain of issuance and listing. Adhere to the principle of "declaration should bear responsibility” and consolidate the responsibility of the issuer and the actual controller. Supervise and supervise the duties of various stock or securities institutions. Strengthen the linkage between issuance supervision and continuous supervision of listed companies and standardize the governance of listed companies. Crack down on fraudulent issuance, financial fraud, and other illegal activities, and effectively protect investors' legitimate rights and interests.

After the official release of the registration system, the approval of listed stocks will have an impact. Has the approval system changed to a registration system completely? Why? Compared with the approval system, the registration system involves the change of audit subjects and, more importantly, fully implements the concept of information flaws as the core. The IPO process is more standardized, transparent, and predictable.

3. The Impact of the Formal Implementation of the Registration System on the Stock Market

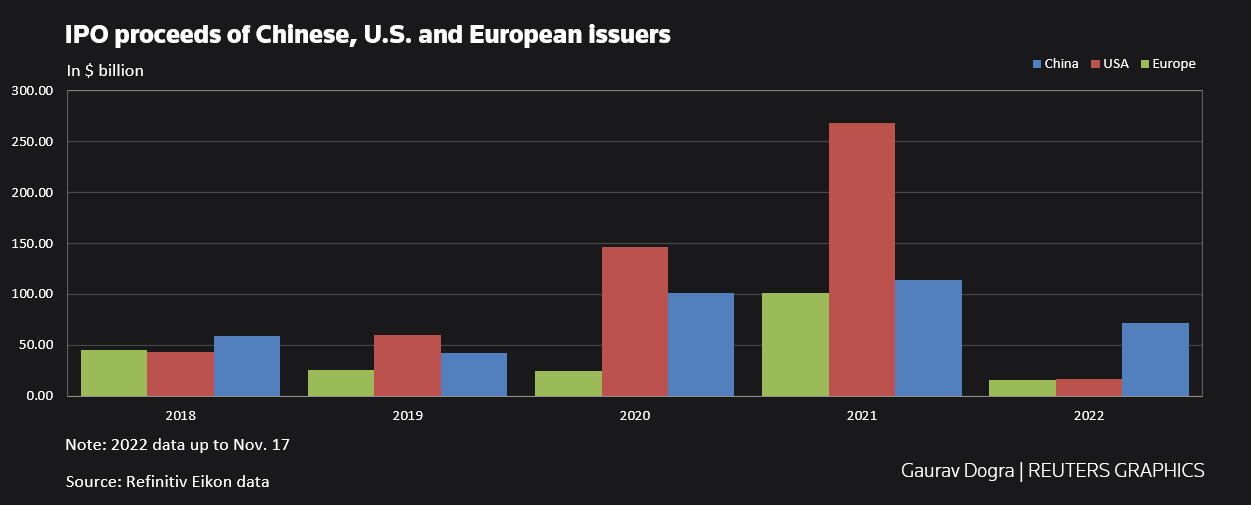

After officially implementing the registration system, will the financing situation of US and Hong Kong stocks be good or bad?

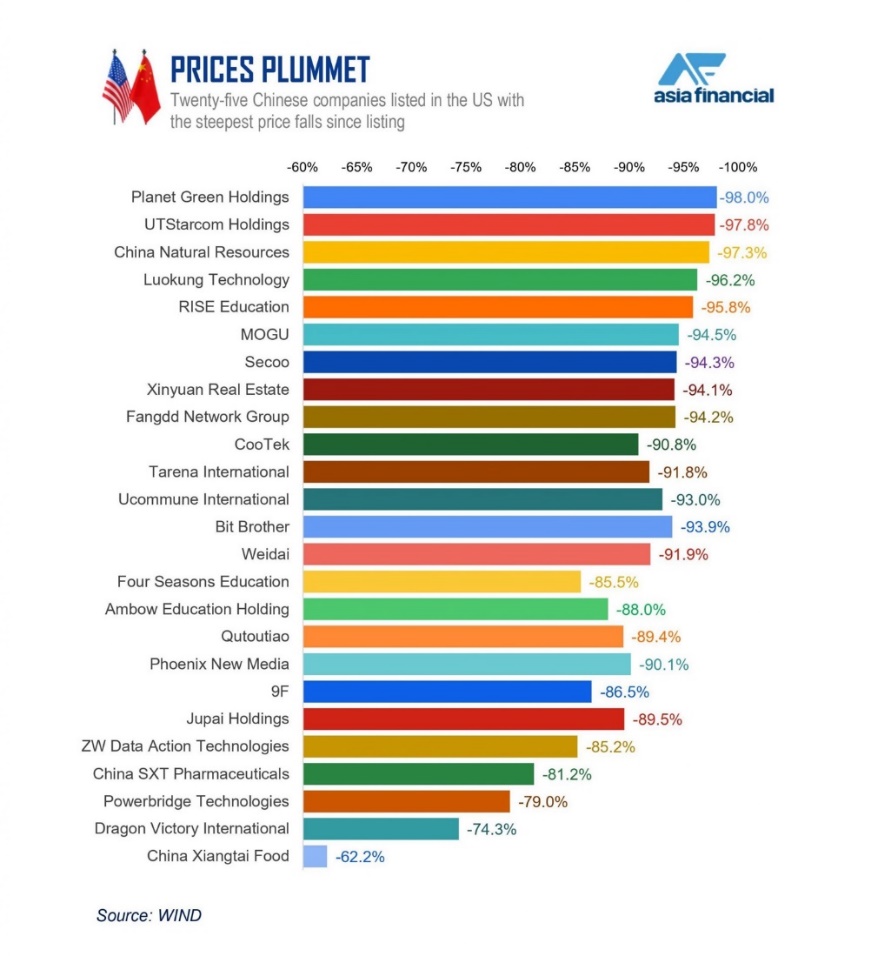

According to statistics, since implementing the experimental version of the registration system in 2019, the number of Chinese concept stock IPOs in the U.S. and Hong Kong stock markets has decreased yearly [4]. Especially after the Beijing Stock Exchange was established in 2022 and the experimental version of the registration system was promoted, the U.S. stock market will be listed in 2022. There are only 18 Chinese concept stocks, and the total amount raised is only 582 million US dollars, which is only 6.25% of the total amount raised in 2018, the lowest value since 2016.

Figure 3: How many stocks are issued and compared with other countries.

Furthermore, data statistics show that since implementing the experimental version of the registration system in 2019, the number of A-share listed companies delisting has increased yearly. As of December 31, 2022, the number of companies delisted from A-shares has reached a historical peak, and the number of delisted companies has reached a record high. Forty-two companies, an increase of 162% compared with the whole year of 2021, the total number of companies delisted in the previous three years. Similarly, delisted companies illustrate an essential phenomenon - some listed companies that committed financial fraud had to delist or even declare bankruptcy. The comprehensive registration system will use market-oriented issuance and pricing mechanisms, diversified delisting standards, and normalized delisting tools to shape a new market ecology while accelerating the liquidation of risky companies.

Figure 4: The number of stocks delisted from the Chinese market.

4. Analysis of A-share IPO Development Trends

The report of the 20th National Congress of the Communist Party of China mentioned that we should improve the functions of the capital market and increase the proportion of direct financing. It took only 16 days from the consultation draft to the official release of the comprehensive registration system reform, and the progress exceeded expectations.

With the start of the comprehensive registration system, the capital market will further assist the development of the real economy, and the multi-level capital market system will become more apparent. In line with the GEM and the Science and Technology Innovation Board, the main board will also support the listing of red-chip and notable voting rights companies and support large overseas companies. The domestic listing of enterprises and the return of Chinese concept stocks to A-shares will further release the dividends of reform and improve the quality of listed companies, which is expected to promote a long-term upward trend.

Registration-based reform is an essential part of high-quality economic development. Following the idea of supporting the real economy and improving efficiency through reform, it focuses on critical areas such as strategic emerging industries and state-owned enterprise reform.

The IPO issuance review is normalized, and there is a high probability that IPO suspension will not occur. From a long-term perspective, the number of newly listed companies in the market is expected to remain at 400-500 every year. In ten years, the number of listed companies in Shanghai and Shenzhen A-shares is expected to peak.

In ten years, will it be as easy to list A-shares as in overseas markets?

The "high quality and good price" trend has become more prominent, undermining normalization. The newness rate will no longer be a risk-free arbitrage. In the future, the market will give it a matching issuance valuation based on the company's quality and development prospects.

Technology-based and innovative enterprises will become an emerging force in the capital market, connecting the virtuous cycle of "technology-industry and finance."

Relying on the high-quality development of China’s economy, China’s capital market continues to snowball. Will A-share valuations still be the highest in the world?

The diversified listing conditions and favorable financing environment will attract overseas high-quality Chinese concept stocks to return to A-shares or Hong Kong stocks. They may realize the secondary listing of A-shares or Hong Kong stocks.

The internationalization process of China's capital market is accelerating, and high-quality foreign-owned companies will choose to be listed on A-shares, especially foreign-funded companies with domestic business.

IPO listing is not the end but the starting point. Facing market value pressure, companies must consider comprehensively and continue to forge ahead.

In the era of a comprehensive registration system with smooth IPO channels, the M&A and reorganization market has become increasingly cautious in selecting targets. High-quality targets will be more listed companies. "A for A" is more likely to be the main form of the next round of M&A bull market.

The capitalization rate increases, the value of shell resources decreases, and delisting becomes normalized. With the unblocking of IPO channels, high-quality companies have chosen IPO first, backdoor listings have been significantly reduced, and the value of shell resources has declined.

Large state-owned enterprises will further enhance state-owned asset securitization by acquiring private listed companies with operating difficulties and injecting high-quality assets.

It is still a trend for listed companies to spin off high-quality assets and list them on A-shares. Diversified large state-owned enterprises or large private companies will spin off and list on A-shares to obtain financing.

5. Financial Strategies of State-owned Enterprises and High-quality Development of the Real Economy

In the era of an entire registration system, the financial departments of large state-owned enterprises can make use of the capital market through the following measures to do an excellent job in the operation of the capital market:

5.1 Capital raising: Attract investors from the capital market to participate through the issuance of stocks, bonds, etc., and the financing is used for corporate expansion, technological upgrading, R&D innovation, etc., to promote corporate development.

5.2 Capital allocation: Allocate and optimize capital through the trading platform of the capital market, invest corporate funds in projects and fields with potential and returns, and improve the efficiency of capital use.

5.3 Capital operation: Use the tools and mechanisms of the capital market to carry out capital operation and management, including investment portfolio management, risk management, capital liquidity management, etc., to improve the enterprise's capital return rate and risk control capabilities.

5.4 Acquisition and reorganization: Through the merger, acquisition, and reorganization mechanism of the capital market, mergers, acquisitions, and reorganizations between enterprises are carried out to achieve resource integration and scale effects and improve the competitiveness and market position of enterprises.

5.5 Capital market supervision and compliance: Strengthen the oversight and submission of the capital market to ensure that the operations of enterprises in the capital market comply with laws, regulations, and market rules, protect the rights and interests of investors, and maintain market stability and fairness.

5.6 Investor relations management: Establish a sound system and promptly and transparently disclose the company's financial status, operating conditions, and development strategies to investors to enhance investors' trust and support.

Through the above methods, the financial departments of large state-owned enterprises can make full use of the opportunities and resources of the capital market to achieve effective allocation and optimization of capital and promote high-quality development of the real economy. At the same time, it is necessary to pay attention to compliance operations, protect the rights and interests of investors, and maintain market order to ensure the stability and sustainable development of the capital market.

6. Stock Trend Analysis: Outlook for the Science and Technology Innovation Board and GEM

6.1. Technology Innovation Board Stocks

At the celebration meeting for the third anniversary of the opening of the Science and Technology Innovation Board stocks, the Shanghai Stock Exchange held a symposium for companies on the Science and Technology Innovation Board stocks. The congratulatory meeting mainly put forward the following views: profoundly understanding the tremendous strategic significance of setting up the Science and Technology Innovation Board stocks, developing the Science and Technology Innovation Board stocks better in the new stage, accelerating the improvement of the innovation service system, creating a vibrant innovation ecosystem, and better Support companies with stocks on the Science and Technology Innovation Board to conduct new innovative research.

The establishment of Science and Technology Innovation Board stocks on the Shanghai Stock Exchange and the experiment with the registration system are major institutional innovations in China's capital market [5]. Strengthen the better development of local innovative enterprises and promote more high-quality enterprises to issue stocks on the Science and Technology Innovation Board. At the same time, it can also attract better IPOs from large state-owned enterprises or foreign-funded enterprises.

The Chairman of the China Securities Regulatory Commission said: The China Securities Regulatory Commission will adhere to the positioning of stocks on the Science and Technology Innovation Board, continue to carry out institutional reform and innovation, and strive to enhance the stock technology leadership and international competitiveness of the Science and Technology Innovation Board.

For example: First, we will improve and support the innovation and advancement of the "high-tech" system, accelerate the implementation of the market maker system, enrich the Science and Technology Innovation Board index and product system, introduce more medium and long-term funds, and promote the stocks on the Science and Technology Innovation Board to become better and stronger.

The second is to improve the implementation of the experimental version of the registration system, accelerate the regulatory transformation, and prepare for the full performance of the registration system for stock issuance.

The third is to continue strengthening the supervision of stocks on the Science and Technology Innovation Board, implement the responsibilities of stock issuers and intermediaries, and severely punish illegal issuances, financial fraud, and other illegal activities following the law.

6.2. GEM Stock

The launch of the registration system for GEM stocks puts forward the following points:

The first is to create an inclusive and efficient innovation support market system. Focus on serving key areas such as advanced manufacturing, digital economy, green and low carbon, forming a diverse and inclusive market access system, and expanding bond financing channels in scientific and technological innovation.

The second is to create a market mechanism that supports the sustainable growth of innovative enterprises. Improve the system that promotes the high-quality development of listed companies, optimize the price discovery mechanism, enrich investment and financing docking products, and create an investment environment for medium- and long-term funds.

The third is to create a market ecology with orderly advancement and retreat, survival of the fittest, meeting the requirements for delisting if necessary, and promoting a virtuous cycle of innovative capital.

The fourth is to create an institutional high-level two-way opening model. Deepen capital cooperation between Shenzhen and Hong Kong and promote the two-way domestic and international flow of innovative capital.

The fifth is to create a precise and effective self-discipline supervision system. Promote the standardized operation of innovative enterprises and guide the orderly development of innovation capital.

Sixth, create a comprehensive and effective risk prevention and control system. We will continue to improve the prevention and control of various risks and adhere to the bottom line of preventing systemic risks.

Seventh, create an internationally leading digital system. Increase the construction of the digital infrastructure and comprehensively build an "intelligent" exchange.

7. Advantages of Domestic A-share Listing under the Registration System

Higher price-to-earnings ratio: The overall price-to-earnings ratio of the domestic securities market is higher than that of overseas markets. The best example is the return of many Chinese concept stocks to the domestic securities market.

Government support: There are no obstacles for companies to list in China regarding listing conditions, laws, regulations, etc. Local governments generally provide firm support. They can use social relations resources to offer various conveniences for companies to go public and obtain the approval of local government subsidies.

Advertising value: When a company is listed in China, the prospectus will introduce the company's business, competitive advantages, industry status, etc., in detail. It is free advertising for the company itself, allowing investors to understand the company better and ultimately win Investors' recognition of corporate value.

8. Discussing Pre-listing Financial Regulations from Two Angles

Standardization of accounting: The issuer’s essential accounting work is standardized. The preparation and disclosure of financial statements comply with the provisions of the accounting standards for enterprises and relevant information disclosure rules and fairly reflect the issuer’s financial status, operating results, and cash flow in all material aspects. A certified public accountant shall issue the financial accounting report for the past three years with an unqualified audit report.

Standardization of internal control: The issuer’s internal control system is sound and effectively implemented, which can reasonably guarantee the company’s operating efficiency, legal compliance, and reliability of financial reports, and a certified public accountant issues an internal control assurance report with unqualified conclusions.

9. Analysis of Stock Market Refinancing under the Registration System: Private Placement, Convertible Bonds, Rights Issue

Private offering: A company issues shares to specific investors rather than the public through a stock exchange. This method is usually used when the financing is small or needs to be completed quickly.

Convertible Bond: A company issues a bond-like security that investors can choose to convert into company shares upon purchase. Compared with direct issuance of shares, this method can reduce the company's financing costs and give investors more choices.

Rights issue: A company issues new shares to existing shareholders to raise funds. This approach avoids diluting existing shareholders' interests and allows them to subscribe first.

Figure 5: Shows the number of private placement shares.

10. The Impact of Spin-offs on Company Valuation under the Registration System

First, increase the equity value of listed companies and achieve asset preservation and appreciation. For listed companies with multiple main businesses, the valuation given by the capital market cannot fully reflect the value of one of the business areas. At this time, independently spinning off the business in this area and listing it can invest more wholly and transparently in the market. It is helpful for the company to obtain a higher valuation premium for its business in this field, realize the revaluation of assets, promote the strengthening and expansion of corporate capital, and achieve the preservation and appreciation of corporate assets.

Second, the financing channels of subsidiaries should be broadened, and their development potential should be enhanced. Listed companies can spin off their subsidiaries to go public. The subsidiaries can directly connect with the capital market, open direct financing channels, raise funds for the development of the enterprise through public issuance of stocks, additional issuance, and other means, maximize the use of the financing function of the capital market, and improve the subsidiary's funds are insufficient. It can effectively reduce capital costs and provide a sufficient financial guarantee for the subsidiary's subsequent development.

Third, highlight the main business of the parent company and enhance independence. Listed companies that undergo spin-offs and listings generally have dual or multi-main business operating structures. After the product is completed, it will help the listed company focus on developing its original advantageous main business, growing businesses other than the spin-off subsidiaries, and refining the industry further. Strengthen the main business, consolidate the company's operating and sustainable development capabilities, and enhance the company's independence.

This comprehensive registration-based reform reflects four primary characteristics: First, in terms of the positioning of the main board, it focuses on "big blue chips" and develops misalignment with other sectors. Second, regarding issuance standards, the primary board listing standards and processes should be optimized, and market capitalization indicators should be added to increase the number of listed companies in the future. Third, in terms of the trading mechanism, there is no price limit for the first five trading days of listing, a new temporary trading suspension system is added, and new stocks can be included in margin trading targets on the first day of listing. Fourth, regarding regulatory mechanisms, we will accelerate the formation of a normalized delisting tool, combine decentralization and regulation, and ensure information disclosure's authenticity, accuracy, and completeness.

11. Conclusion

The comprehensive reform of China’s capital market registration system is an essential step in connecting with the real economy and enhancing market functions. It shifts from administrative approval to market-based supervision, improving transparency and efficiency. This shift bodes well for direct financing, which is expected to support economic growth sectors and state-owned enterprise reforms.

In short, this reform will improve the quality of listed companies and promote the long-term positive trend of China's capital market. It highlights China's commitment to internationalizing capital markets and high-quality economic development and provides a robust framework for large state-owned enterprises to utilize capital operations effectively.

References

[1]. China to Introduce Registration-Based IPO System in Securities Market, Yurou Yin, Mon, 06 Mar 2023, P3/P4, https://www.globaltimes.cn/page/202303/1287552.shtml#:~:text=China%20launched%20the%20new%20listing,and%20the%20Beijing%20Stock%20Exchange.

[2]. Xinzhen, L. . (2023). Taking stock of the market. Beijing Review: English, 66(7), 1.

[3]. Registration based on IPOs and how they will shape in China’s capital market, April 26, 2023, by Chenran Tian, https://www.acuitykp.com/blog/registration-based-ipos-shaping-china-capital-market/#:~:text=The%20approval%2Dbased%20IPO%20process%20centralises%20the%20CSRC's%20authority%20by,and%20reduce%20risk%20to%20investors.

[4]. Mandiratta, P. , & Bhalla, G. S. . (2023). Analyzing the stock market performance of central public sector enterprises disinvested through public offering mode: indian evidence. Benchmarking: An International Journal.

[5]. Die, W. , & Yi, T. . (2023). Can option trading volume forecast volatility? evidence from shanghai stock exchange 50etf option. Systems engineering theory and practice, 43(3), 755-771.

Cite this article

Zhou,M. (2024). Impacts of China's Stock Market Registration System and Future Insights. Advances in Economics, Management and Political Sciences,106,24-33.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. China to Introduce Registration-Based IPO System in Securities Market, Yurou Yin, Mon, 06 Mar 2023, P3/P4, https://www.globaltimes.cn/page/202303/1287552.shtml#:~:text=China%20launched%20the%20new%20listing,and%20the%20Beijing%20Stock%20Exchange.

[2]. Xinzhen, L. . (2023). Taking stock of the market. Beijing Review: English, 66(7), 1.

[3]. Registration based on IPOs and how they will shape in China’s capital market, April 26, 2023, by Chenran Tian, https://www.acuitykp.com/blog/registration-based-ipos-shaping-china-capital-market/#:~:text=The%20approval%2Dbased%20IPO%20process%20centralises%20the%20CSRC's%20authority%20by,and%20reduce%20risk%20to%20investors.

[4]. Mandiratta, P. , & Bhalla, G. S. . (2023). Analyzing the stock market performance of central public sector enterprises disinvested through public offering mode: indian evidence. Benchmarking: An International Journal.

[5]. Die, W. , & Yi, T. . (2023). Can option trading volume forecast volatility? evidence from shanghai stock exchange 50etf option. Systems engineering theory and practice, 43(3), 755-771.