1. Introduction

As the global temperature rises each year, the frequency of extreme weather events also increases. According to data summarized by the Global Disaster Data Platform, there were 3414 natural disasters from 2014 to 2024 [1]. These natural disasters have undoubtedly yielded huge losses for people and the environment. Among them, one kind of natural disaster is particularly worthy of people’s attention: storm disasters, such as typhoons and hurricanes. Based on the winds near the center, people usually classify typhoons into five categories, from lowest to highest: tropical storm, severe tropical storm, cyclone, severe typhoon, and super typhoon. The main reason storm disasters are worth attention is that they have a lower frequency but yield the most significant economic loss. Storm disasters accounted for 21% of the frequency in 2022, but they generated 59% of the direct financial loss and 53% of all deaths [2].

When Idalia made landfall in Florida, it exhibited terrible impacts in several areas. From a macro perspective, Idalia's economic losses are around $3.6 billion, accounting for 0.01316% of America's GDP in 2023 [3,4]. Idalia damaged or destroyed people's livelihoods and property. Additionally, water and power outages have caused significant difficulties in people's daily lives. After Idalia dissipated, the government began to restructure.

In the past, there have been many relevant studies about the relationships between natural disasters and the stock market. For instance, Wang and Kutan have applied the GARCH models to investigate the impacts of natural disasters on the insurance sector and composite stock in Japan and America [5]. Furthermore, U-Din et al. have estimated how extreme weather influences the Canadian stock market through a mix of accounting ratios and statistical tests [6]. Besides, Seetharam chose the daily stock price of US-published companies between 1984 and 2014 as the sample to explore which kinds of companies can flexibly respond to the influence of natural disasters on the United States [7].

Although there is much research to explore the relationship between natural disasters and the finance market, there has been less previous evidence for how storm disasters impact the insurance sector's stock market in the United States. Therefore, this research wants to fill the gap and investigate how typhoons and hurricanes affect insurance stocks. This work aims to clarify the specific extent, manner, and time frame of the impact of storms and hurricanes on insurance industry stocks. This information can help the government monitor and recover the insurance sector's stock, as well as assist individuals in making informed investment decisions. There are two reasons why this question needs to be explored. The first point is that the storm disaster has enormous destructive power, and the natural catastrophe yields the largest economic loss and the largest number of human casualties. The second point highlights the close relationship between the U.S. insurance industry and people's daily lives, which significantly impacts the country's economy.

In order to address the issue of how storm disasters affect the insurance sector stock market in the United States, this research focuses primarily on storm disasters. This paper has compiled a summary of pertinent literature that discusses the effects of natural disasters on financial markets, natural economic disaster models, and stock price volatility. Then, this paper uses the case of Idalia and collects relevant data to analyze using the LSTM model. Finally, a conclusion regarding this question can be reached.

2. Literature Review

2.1. Definition

In 2016, Hallegatte and his colleagues started a rigorous examination and evaluation of the economic notion of natural catastrophes [8]. There are several studies and approaches available for quantifying the financial impact of natural catastrophes, which might result in significantly divergent results. Typically, the expenses associated with a natural catastrophe can be categorized into direct and indirect components. Individuals should select appropriate methods for estimating indirect costs based on their specific objectives, as this can assist them in obtaining more precise figures [8]. People primarily apply this theory for assessing expenses following a disaster event. Advocates of this theory suggest that individuals should choose the technique that most closely matches their goals [8].

2.2. Important Result

Many researchers assert that the insurance sector's stock price will decrease due to typhoons and hurricanes, citing a relationship between disasters and stock markets. There are two main reasons to explain the phenomenon. Firstly, insurance companies need to pay huge fees, which causes profits to decrease. Secondly, insurance companies may choose to increase the price of products, which might lead to customer attrition or a decline in market share, impacting the company's long-term growth. Therefore, investors will not buy their stocks.

According to various studies, it is now well established that storm disasters lead to a decrease in insurance companies' stock prices. In 1995, Lamb gathered evidence to support this conclusion [9]. Lamb collected daily stock prices from 37 published insurance companies from 10 days before hurricanes to 30 days after hurricanes [9]. Finally, the study revealed a negative stock price response [9]. Furthermore, Angbazo and Narayanan's reports support the outcome. They used a modified event study methodology and a generalized least squares (GLS) methodology to analyze their extensive data [9]. Angbazo and Narayanan found that on the day of Hurricane Andrew, many insurance companies reported significant negative returns [10].

Other researchers have investigated how typhoons and hurricanes can benefit insurance companies. When insurance companies can pay off compensation quickly and effectively, it can indicate the stability of the insurance companies and increase people’s confidence in them. Wang and Kutan once executed the GRAHC models to determine the effects of hurricanes on the insurance sector in Japan, accounting for numerous control variables previously ignored before data analysis [5]. Finally, they came to the conclusion that three days after the tsunami, the insurance companies’ stocks’ daily gain was 0.73%, and the insurance companies’ stock returns rose 0.34% per day on the day of the tropical cyclone [6]. Shelor and others also used a multiple regression cross-sectional analysis technique to analyze daily return data from 47 property-liability companies and 32 multiple-line firms, as reported in [11]. These writers conclude that the share prices of profit-and-loss insurance companies and multi-line insurance companies had a significant positive reaction to the earthquake [11].

Additionally, some researchers have explored that the stock prices of different insurance firms will react differently to the same storm disaster, as each company has different response capabilities to disaster shocks. Those with more robust capabilities will have more minor shocks, and vice versa. For example, Hagendorff et al. demonstrated a positive correlation between the insurance company's Standard and Poor's rating and abnormal returns [12]. In addition, in 2017, Lanfear et al. examined the variations in stock price responses to hurricanes across different decile portfolios. They employed 34 hurricanes that made landfall in America from 1990 to 2014 as samples and stock prices from the NYSE and NASDAQ [13]. Then, Lanfear et al. sorted the data into two panels [13]. In terms of market equity, Panel A referred to decile portfolios, while Panel B referred to book-to-market equity [13]. The result of panel A was a negative correlation between abnormal returns and company size [13]. Specifically, the abnormal returns would be smaller if the firm had a more significant size [13]. According to Panel B, the growing stock suffered from more significant abnormal returns, while the value stock suffered from lighter abnormal returns [13].

2.3. Summary

A large and growing body of literature has investigated the relationship between natural disasters and insurance sector stock returns. These studies provide insights into how disasters affect insurance companies’ stock prices or returns. People can draw different, or even completely opposite, conclusions from different microscopic perspectives. Typhoons and hurricanes, for example, cause stock price increases in Japan, while windstorms and hurricanes cause stock returns to decrease in America. Moreover, different insurance firms will react differently to the same storm disaster. According to the paper, different storm disasters will affect insurance companies' stock prices or profits.

3. Methodology

3.1. Research Design

This study is quantitative and employs a regression model to explore the problem. In order to examine the impact of Hurricane Idalia on insurance sector stock prices, this paper aims to collect daily stock prices without Hurricane Idalia during the period from August 26th to September 8th. After that, compare the series of data A with the series of data B. Series A refers to anticipated data without Hurricane Idalia, and Series B refers to factual data with Hurricane Idalia. To explore whether there is a difference between the two series. Even better, the paper can generate a summary to determine whether there is a positive or negative correlation. The LSTM model is the most suitable to implement the goal because it handles and forecasts data based on time series. Moreover, the model can predict relative long-term data.

3.2. Data Collection

This study gathers data on daily closing stock prices for a period of approximately ten years from four insurance companies: Progressive in the automobile insurance industry, Universal Property & Casualty Insurance Company in the building insurance industry, Humana in the health insurance industry, and Travelers Insurance in the commercial insurance industry. The data is obtained from Yahoo Finance [14]. The subjects were chosen based on their high degree of homogeneity, namely since all four enterprises have considerable activities in Florida. Florida saw severe devastation from Hurricane Idalia. Hence, the daily stock values of the four firms over a span of three years are regarded as sample data. Furthermore, as stated by the National Hurricane Centre, a study documents significant information about Hurricane Idalia, including its duration, the financial impact of the tragedy, and the extremes in wind speed and pressure [3].

3.3. Data Analysis

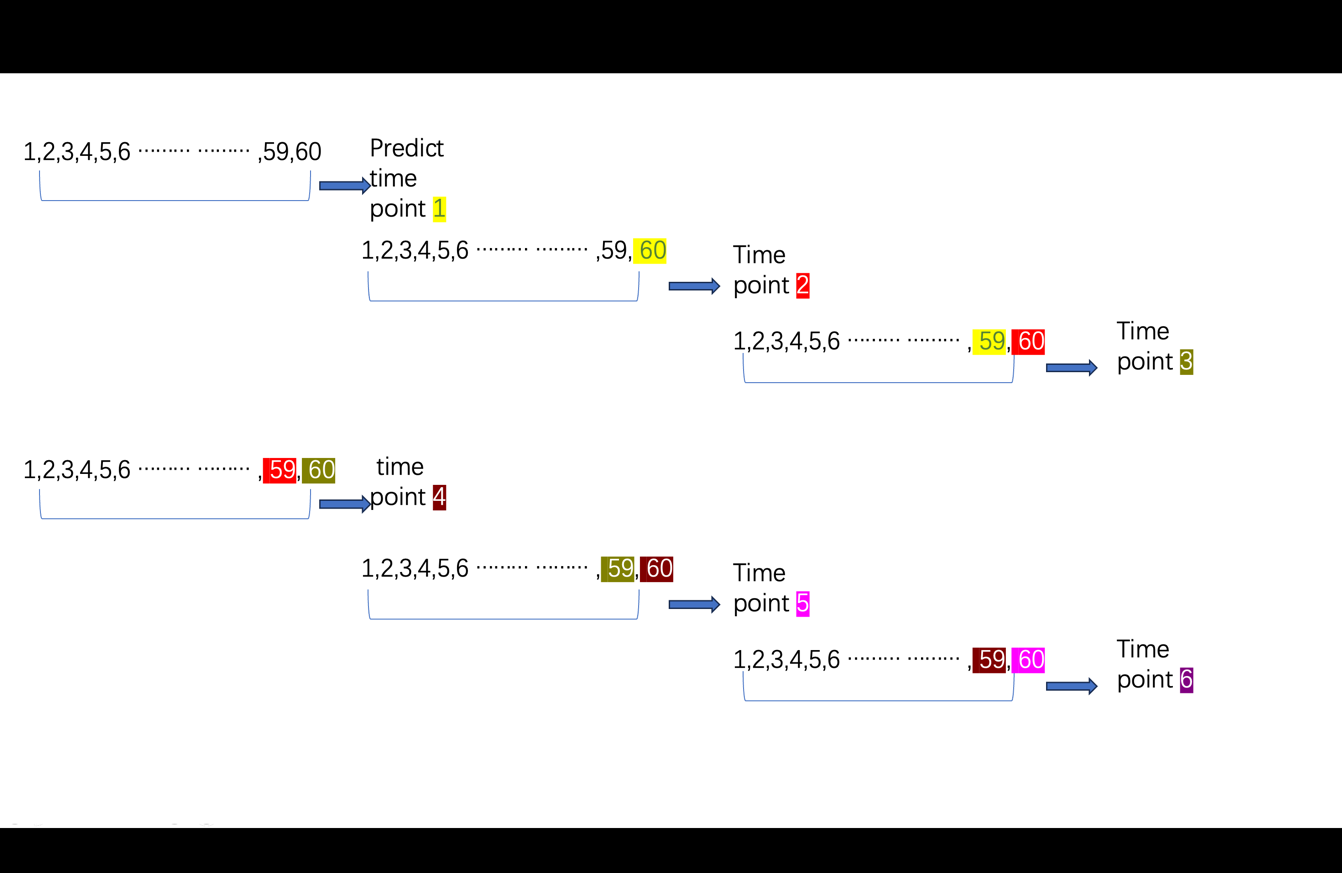

The data analysis uses a website called Kallge to run the data, as well as a model called LSTM. Before analyzing data, the LSTM model needs to be evaluated to determine if it can anticipate information correctly. To verify it, apply daily adjusted stock prices from the four insurance companies for ten years and normalize the dataset. Then, the data is divided into training and test sets, depending on a ratio of 8:2. The time step is 60. That means that the model employs 60 days of data before time point 1 to forecast the price of time point 1. Then, using 60 days of data before time point 2, forecast the price of time point 2, which refers to time point 1 and 59 days of data, and so forth (Figure 1).

Figure 1: The process of How to Forecast Stock Prices

(Data Source: Original)

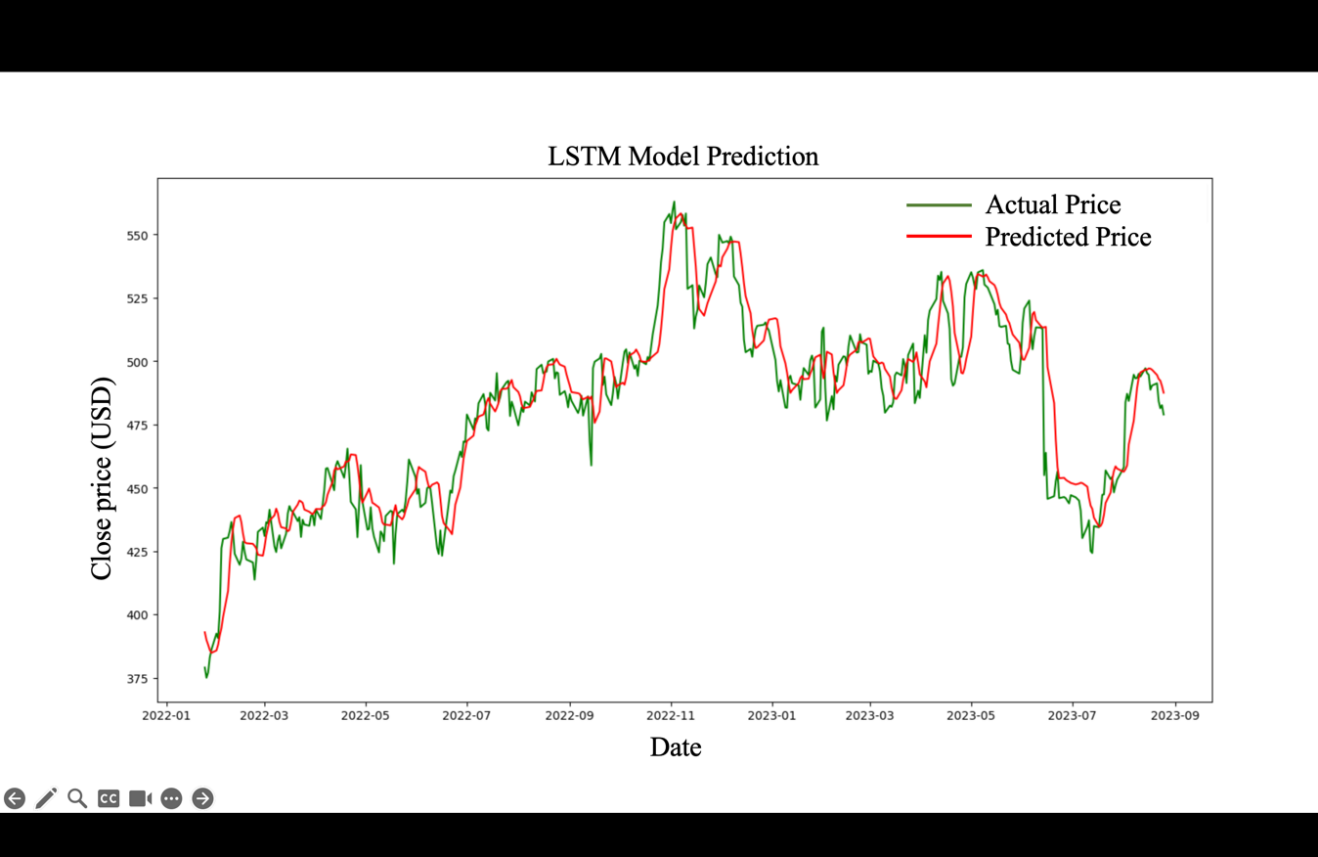

Moreover, adding a step dropout can avoid overfitting. The LSTM model can gain ten years of forecasted data. The regression evaluation index, MAE, is 7.673, and MAPE is 1.61%. The forecasted and actual data show no significant difference, allowing for the LSTM model to be used in the subsequent data study (Figure 2).

Figure 2: LSTM Model Prediction

(Data Source: Original)

As for the data analysis step, Firstly, input one insurance firm, Humana, daily stock prices from 2014 to 2024 in Yahoo [14]. The next step is to extract closing prices as a time series, and then normalize the dataset; since August 26th and 27th are weekends, there are no stock prices. Between August 26th and September 8th, there are nine trading days. Then, apply the same step to train the LSTM model to anticipate the closing price of the insurance company, Humana, for the next nine trading days. Input the time step 60, meaning each input sample x contains data from the previous 60-time steps as features. LSTM models expect three-dimensional input data, so they use the reshape method to transform x from two-dimensional to three-dimensional. Ultimately, each time step contains a single feature. The two-layer LSTM model is then successfully built, and in each layer, dropout is employed to reduce the possibility of overfitting.

The next step is configuring the model. First, the optimizer and loss function of the model are set. The Adam optimizer will adjust the model's weights based on the mean squared error (MSE) to gradually learn how to anticipate the target values from the input data. The LSTM model is then trained. Then, input data x, which refers to 60 days of data, and corresponding targets y, which relate to time step 1, are divided into multiple batches, each containing 32 samples. The model will go through the entire dataset 60 times, gradually reducing the error between the anticipated and actual values.

Since this paper wants the stock price on August 28th, extract the data from the last batch as initial input. The same step is used to evaluate the process of anticipating Humana's stock prices from August 26th to September 8th, which involves using actual data from 60 days prior to August 28th to determine the anticipated stock price. The next step involves adding the anticipated stock prices over the next 60 days to predict the subsequent stock price. After finishing these steps, the series data A can be obtained.

The last step is calculating the difference between Series A and Series B. Repeat the above steps for the remaining three insurance companies.

4. Result

Using the LSTM model, Figure 3 analyzes the difference between the forecasted stock price and the adjusted close stock prices of the four companies. The adjusted close is based on actual stock market data.

According to Figure 3, the percentages represent the percentage decrease in the actual price compared to the forecasted price. When Idalia made landfall in Florida, the stock prices had a slight decline of around -0.02%, but after that, Humana’s stock prices fell sharply, around -0.08%.

Figure 3: Humana's stock price change

(Data Source: Original)

According to Figure 4, the percentage has the same meaning as Figure 3. The stock prices at Progressive has a declining trend. Furthermore, when the typhoon first made landfall, the decline was the smallest, which was -0.05%, but the largest was -0.10% when the typhoon disappeared.

Figure 4: Progressive’s stock price change

(Data Source: Original)

According to Figure 5, the stock prices of Universal Property & Casualty Insurance Company have decreased, whereas the situation is the reverse for Progressive. The most significant decrease occurred on August 28th, with a loss of -0.12%. Nevertheless, when Idalia vanished, the magnitude of the change was extremely small, specifically -0.01792%.

Figure 5: Universal Property & Casualty Insurance Company's stock price change

(Data Source: Original)

Figure 6 indicates a decline in the stock price of Travelers Insurance. The company's stock price experienced a slight decline during the typhoon's arrival and departure period. In particular, the decline was -0.015% over five days, -0.02% over three days, and -0.0107% on one day. The entire process is rather unstable in comparison to the processes of the other three organizations.

Figure 6: Travelers Insurance’s stock price change

(Data Source: Original)

The stock prices of all four insurance companies have declined. However, there are differences between the four insurance firms. For Travelers Insurance, the difference between the most prominent and most minor declines is the smallest. Progressive's share price fell more and more each day. For Humana, the impact of the hurricane on stock prices is more significant in the late stages of hurricane landfall. Even though Universal Property & Casualty Insurance Company's stock price was falling, it did so at a rate that was almost less than that of the previous day.

The conclusion is clear: when Hurricane Idalia occurs, it immediately has adverse effects on the insurance sector. Furthermore, Idalia generates different kinds of declining trends in various types of insurance companies. This conclusion aligns with the initial outcome of the critical analysis.

5. Discussion

This paper summarizes the immediate negative impact of Idalia on the insurance sector, suggesting that a natural disaster will significantly lower the stock prices of the insurance industry. If insurance companies want to reduce their losses during natural disasters, they should demonstrate their confidence in their ability to handle crises effectively and promptly. This action can help insurance firms improve their reputation, resulting in lower losses. Unlike the previous articles, this one focuses on stock price fluctuations in the insurance industry rather than the overall stock market. However, this paper's conclusion also verifies that some previous research supporting typhoons and hurricanes will decrease the insurance sector's stock price. The paper's improvement is to focus on the immediate impact of natural disasters on the insurance stock market.

6. Conclusion

When comparing the stock prices of four different types of insurance firms with the prices predicted by the LSTM model, they have all declined. The results demonstrate that hurricane landfall can impede insurance companies' stock markets in the region where the disaster occurred. As previously mentioned in the first of the critical results, this may be due to the significant premiums that insurance companies must pay, leading to a decrease in investors' confidence in their future profitability. Insurance companies can immediately respond positively by showcasing their asset capacity and profitability, thereby restoring investors' trust in these companies.

This research covers the gap in storm disasters' impact on insurance companies' stock markets. On this basis, other researchers can further explore how hurricanes affect the insurance industry's stock price decline. The findings could assist insurers and investors in making better decisions before and during a storm.

However, there are some limitations to this paper. First, this paper does not exclude all irrelevant factors, such as COVID-19. Secondly, the paper solely examines positive or negative correlations, without delving into the extent of their impact on various types of insurance companies. Thirdly, the results show that the four figures have different trend variations, but this paper does not find the reason.

In future studies, humans can investigate the effect of hurricane severity and length on the stock market. Moreover, when different types of insurance companies face hurricanes, their stock prices will show different trends. More conclusions can be drawn from the relationship between natural disasters and the stock market, and the more it benefits investors, the better.

References

[1]. Global Disaster Data Platform. (2024) Retrieved from https://chatgpt.com

[2]. Ministry of Emergency Management International Federation of Red Cross and Red Crescent Societies, (2022). 2022 GLOBAL NATURAL DISASTER ASSESSMENT REPORT Retrieved from https://www.gddat.cn

[3]. Cangialosi, J.P. and Alaka, L. (2023). National Hurricane Centre Tropical Cyclone Report. National Hurricane Centre.

[4]. Bureau of Economic Analysis. (2023). Retrieved from https://www.bea.gov/

[5]. Wang, L., Kutan, A. (2013). The Impact of Natural Disasters on Stock Markets: Evidence from Japan and the U.S. Comp Econ Stud 55, 672–686.

[6]. U-Din, S., Nazir, M.S. & Sarfraz, M. (2022). The climate change and stock market: catastrophes of the Canadian weather. Environ Sci Pollut Res 29, 44806–44818.

[7]. Seetharam, I. (2017). Environmental Disasters and Stock Market Performance. Retrieved from https://web.stanford.edu

[8]. Hallegatte, S.P., and Valentin. (2010). The Economics of Natural Disasters: Concepts and Methods. World Bank Policy Research Working Paper No. 5507.

[9]. Lamb, R. P. (1998). An examination of market efficiency around hurricanes. The Financial Review, 33, 163–172.

[10]. Angbazo, L. A., & Narayanan, R. (1996). Catastrophic shocks in the property‐liability insurance industry: Evidence on regulatory and contagion effects. The Journal of Risk and Insurance, 63(4), 619–637.

[11]. Shelor, R. M., Anderson, D. C., & Cross, M. L. (1992). Gaining from loss: Property‐liability insurer stock values in the aftermath of the 1989 California earthquake. The Journal of Risk and Insurance, 59(3), 476–488.

[12]. Hagendorff, B., Hagendorff, J., & Keasey, K. (2015). The impact of mega‐catastrophes on insurers: An exposure-based analysis of the U.S. homeowners' insurance market. Risk Analysis, 35(1), 157–173.

[13]. Lanfear, M. G., Lioui, A., & Siebert, M. (2017). Are value stocks more exposed to disaster risk? Evidence from extreme weather events. SSRN Electronic Journal.

[14]. Yahoo Finance. (2024). Retrieved from https://finance.yahoo.com/

Cite this article

Mei,L. (2024). Exploring the Relationship Between Natural Disasters and Insurance Stock Market. Advances in Economics, Management and Political Sciences,98,216-224.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICFTBA 2024 Workshop: Finance in the Age of Environmental Risks and Sustainability

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Global Disaster Data Platform. (2024) Retrieved from https://chatgpt.com

[2]. Ministry of Emergency Management International Federation of Red Cross and Red Crescent Societies, (2022). 2022 GLOBAL NATURAL DISASTER ASSESSMENT REPORT Retrieved from https://www.gddat.cn

[3]. Cangialosi, J.P. and Alaka, L. (2023). National Hurricane Centre Tropical Cyclone Report. National Hurricane Centre.

[4]. Bureau of Economic Analysis. (2023). Retrieved from https://www.bea.gov/

[5]. Wang, L., Kutan, A. (2013). The Impact of Natural Disasters on Stock Markets: Evidence from Japan and the U.S. Comp Econ Stud 55, 672–686.

[6]. U-Din, S., Nazir, M.S. & Sarfraz, M. (2022). The climate change and stock market: catastrophes of the Canadian weather. Environ Sci Pollut Res 29, 44806–44818.

[7]. Seetharam, I. (2017). Environmental Disasters and Stock Market Performance. Retrieved from https://web.stanford.edu

[8]. Hallegatte, S.P., and Valentin. (2010). The Economics of Natural Disasters: Concepts and Methods. World Bank Policy Research Working Paper No. 5507.

[9]. Lamb, R. P. (1998). An examination of market efficiency around hurricanes. The Financial Review, 33, 163–172.

[10]. Angbazo, L. A., & Narayanan, R. (1996). Catastrophic shocks in the property‐liability insurance industry: Evidence on regulatory and contagion effects. The Journal of Risk and Insurance, 63(4), 619–637.

[11]. Shelor, R. M., Anderson, D. C., & Cross, M. L. (1992). Gaining from loss: Property‐liability insurer stock values in the aftermath of the 1989 California earthquake. The Journal of Risk and Insurance, 59(3), 476–488.

[12]. Hagendorff, B., Hagendorff, J., & Keasey, K. (2015). The impact of mega‐catastrophes on insurers: An exposure-based analysis of the U.S. homeowners' insurance market. Risk Analysis, 35(1), 157–173.

[13]. Lanfear, M. G., Lioui, A., & Siebert, M. (2017). Are value stocks more exposed to disaster risk? Evidence from extreme weather events. SSRN Electronic Journal.

[14]. Yahoo Finance. (2024). Retrieved from https://finance.yahoo.com/