1. Introduction

With the rapid development of technology, the medium of social media and live-streaming platforms have become vital resources for entertainment and information acquisition, reshaping the entertainment industry. Nowadays, more and more companies are developing and customizing different strategies to attract users to become their subscribers. Among these competitors, Netflix and Disney+ are two oligopolies that have significantly affected the way content is distributed, completely changing the entertainment industry.

Netflix was first established in 1997 as a DVD rental service company at the beginning, then transformed into streaming in 2007. Consumers prefer it for its worldwide streaming service, which excels in content, global coverage, personalized content, multi-device support, advertisement service, and original productions, such as “Stranger Things” and “The Crown”.

The Walt Disney Company owns Disney+, a subscription-based streaming platform. It was established in November 2019 and quickly became a competitive video provider because of its classics, original Disney series, Marvel movies, and Star Wars franchises. A representative example was the exclusive streaming of Taylor Swift's movie "The Eras Tour" on Disney+ on October 13th, 2023, which highlights the fierce competition for exclusive content.

2. Objectives

The primary purpose of this essay is to analyse the competitive interactions between Disney+ and Netflix using game theory concepts based on their recent actions. Understanding the competitive actions between Disney+ and Netflix is facilitated by employing game theory concepts such as grim-trigger and end-game effects. This helps clarify how each platform’s decisions regarding pricing, marketing, and content offerings impact their respective market positions and profitability. Through game theory analysis, the study aims to give suggestions to streaming platforms like Disney+ and Netflix.

The second objective is to understand how Disney+ and Netflix acquire content and secure resources by monopolizing or cooperating. Content acquisition and exclusivity are two critical factors that influence their competitive strategies. The study will investigate the content acquisition strategies of both platforms, particularly their bidding behaviors for popular shows and movies.

3. Literature Review

The fierce competition among streaming giants like Netflix and Disney+ for acquiring content and securing exclusive streaming rights is an intricate matter that can be efficiently dissected through game theory, especially by utilizing mixed strategy methods. This review comprehensively consolidates existing research on the rivalry among streaming services, content strategies, and the application of game theory to offer a comprehensive perspective for grasping the intricate competitive interplay between these two platforms.

3.1. Streaming Service Competition

The research conducted by Gonçalves-Dos Santos, Martinez, and Sánchez-Soriano deeply delves into revenue distribution mechanisms on streaming platforms. It underscores how these platforms deliberately allocate resources to maximize their content offerings and entice subscribers. This study underscores the crucial need to comprehend revenue models and competitive strategies within a multi-platform competition [1].

The Congressional Research Service report on video streaming service competition offers a comprehensive insight into the industry's competitive background, highlighting the emergence of key players such as Netflix and Disney+ and the regulatory hurdles they encounter. This report emphasizes the crucial role of market dynamics and strategic content acquisition in maintaining a competitive advantage [2].

3.2. Content Strategy and Exclusive Rights

Netflix's strategic focus on original content, mentioned in its 2023 Annual Report [3], clearly demonstrates its dedication to reducing dependency on external content by investing significantly in original productions. This action enables Netflix to establish a unique brand identity and maintain complete control over its content library. Similarly, Disney's 2023 Annual Financial Report underscores its extensive utilization of its existing catalog and strategic acquisitions of exclusive rights to bolster its competitive edge [4].

Li and Yu directly delve into the cooperation and competition dynamics within duopoly online video websites, offering valuable insights into how platforms such as Netflix and Disney+ skillfully navigate content acquisition and competitive strategy. Their comprehensive analysis of strategic interactions firmly establishes a solid foundation for applying game theory to deeply understand platform behavior [5].

3.3. Game Theory Applications

Game theory, particularly its focus on mixed strategies, serves as a highly effective framework for comprehending competitive behaviors within streaming platforms. The in-depth study conducted by Andreoni and Varian in 1999[6], exploring pre-play contracting in the prisoner's dilemma, aptly demonstrates how players can employ mixed strategies to navigate through challenging decision-making landscapes and compete with utmost efficiency.

Maihami, Ghalehkhondabi, and Ahmadi directly apply game theory to pricing challenges in the entertainment supply chain, clearly showing how platforms utilize mixed strategies to strike a balance between pricing and competitive maneuvers [7]. This straightforward method offers a profound understanding of how streaming services could flexibly adjust their pricing and content acquisition strategies in response to changing market conditions.

Li and Li undertake an exhaustive analysis of revenue management within network video platforms using game theory as the theoretical framework [8]. They strongly recommend the implementation of mixed strategies in order to gain a profound understanding of how platforms such as Netflix and Disney+ meticulously orchestrate their content acquisitions and exclusivity agreements. Their study provides a meticulous breakdown of the probabilistic decision-making mechanisms that constitute the foundation of strategic content management.

3.4. Platformization and Market Dynamics

AuColbjørnsen directly examines the instances of Joe Rogan and Spotify to clearly demonstrate wider concepts related to platformization and strategic content acquisition [9]. This study explicitly shows how platforms handle content rights and exclusivity, drawing parallels to the competitive strategies utilized by Netflix and Disney+ in their market interactions.

Zhihong Li's research on duopoly online video website strategies enhances our comprehension of competitive techniques by thoroughly examining how cooperation and competition jointly influence platform strategies in content acquisition and exclusivity [10].

4. Analysis of Problem

4.1. Main concepts in game theory

Zero-sum game and non-zero-sum game are two fundamental concepts in the field of game theory. In a zero-sum game, the total payoff for all players sums up to zero, while in a non-zero-sum game is that where the collective gains and losses of interacting parties can exceed or fall short of zero. Within this specific context, two competing entities engage in decision-making processes concerning whether to bid higher or lower prices for content; these choices exert influence not only on their individual profitability but also on that of their adversary.

A mixed strategy allows each pure strategy to have the same probability, meaning a player can randomly choose any of the pure strategies. Due to the continuous nature of possibility, a player can use an endless number of mixed strategies, even if their strategy set is finite. According to applied game theory, defining the strategy sets is a crucial aspect of making a game that can be solved and has value simultaneously. Game theorists can reduce potential strategies and help to solve the problem.

4.2. Overall conditions

According to the Netflix 2023 Annual Report [3], the total revenue was $33,723,297 thousand, with a net income of $5,407,990 thousand, which was a significant increase compared with the 2022 total revenue of $31,615,550 thousand and a net income of $4,491,924 thousand. In 2023, Netflix spent $21,713,349 thousand for total content obligations.

In the Walt Disney Company fiscal year 2023 annual financial report, from Disney’s direct-to-consumer segment, Disney+’s total revenue was $19,886 million ($19,886,000 thousand), and its subscription fees were $16,420 million ($16,420,000 thousand) [4]. Disney+ reported an operating loss of $2.496 billion($2,496,000thousand) due to increased operating expenses, decreased advertising revenue, and a significant drop in Disney+ Hotstar subscribers.

It is not likely that the managers of the two companies have complete information concerning the properties of the other platforms. The costs and revenues of the competitor are not perfectly known. The mixed strategy frequencies are, however, observed. Each company continuously observes the frequency of the other companies’ actions. The expected marginal profits are predicted based on this information.

4.3. Application of Mixed Strategies in Subscription and Pricing Models

All these make sure that Netflix and Disney+ are competitive with their diverse user groups, which in turn augments users and grows revenue with multi-tiered subscription models, dynamic pricing strategies, free trial periods, promotional activities, bundled packages, and personalized recommendations and pricing.

4.3.1. Multi-tiered Subscription Models

Netflix offers a variety of tiered subscriptions to its customers: Basic, Standard, and Premium. These tiers cater to users with different paying capabilities and needs. Essential is ad-supported and costs $6.99 monthly; Standard is ad-free and costs $15.49 monthly, supporting HD streaming; Premium supports 4K Ultra HD streaming at $22.99 monthly and supports multiple device downloads. With such a multi-tier subscription model, Netflix can attract price-sensitive users, but on the other hand, it can offer premium options for the best viewing experience for the users; in other words, it increases both user numbers and revenue.

4.3.2. Dynamic Pricing Strategies

Netflix and Disney+ can adjust prices for subscribed customers based on market demand and user behavior. For instance, they can increase subscription prices temporarily when launching popular series or during holidays to capitalize on high demand and increase the revenues realized. In addition, they can also create personalized pricing plans for customers who log in more often or tend to watch a specific type of content genre.

4.3.3. Free Trial Periods and Promotional Strategies

Free trial periods and promotion activities during some holidays can attract new users to the platforms and make them paid subscribers. For example, in a free one-month trial, Netflix or Disney+ would allow customers to experience its premium content. Additionally, launching subscription discounts for Black Friday or Christmas will give room for more users.

4.3.4. Bundled Offers

Disney+ has offered its service bundled with Hulu and ESPN+ to increase users by value-providing a one-stop-shop subscription package. Netflix could also bundle the services with internet service providers or mobile carriers for users, creating more volume. The bundling approach not only increases the number of users and thus enhances stickiness but also significantly improves subscription revenues.

4.3.5. Personalized Recommendations and Pricing

In this manner, the use of big data and AI technologies by Netflix and Disney+ for personalization in the nature of content recommendations and corresponding subscription pricing can be offered to individual users according to their viewing history and preferences. For example, Netflix uses its powerful content recommendation algorithms to suggest relevant premium subscription options based on users' viewing habits and offers personalized discounts.

4.4. Exclusive and Collaborative Strategies in the Streaming Industry

The exclusivity of content investments has been achieved by both Netflix and Disney+, with an exponential increase in stickiness for their respective platforms. For example, Netflix, with its exclusive streaming rights for Sony films and many others that it acquires at regular intervals, can ramp up its original content with blockbuster favorites such as the Marvel series, thus decreasing dependence on third-party content while increasing subscribers. The company, for instance, closed a deal to get exclusive streaming rights to "Spider-Man: Far from Home," gaining almost 5 million subscribers in the quarter and increasing total revenue by nearly 10% [11]. Total revenues for the company are $33.7 billion as of 2023, with a net income of $5.4 billion [12].

On the other hand, Disney+ made its service more appealing to viewers by purchasing exclusive rights to the "The Eras Tour" concert film, which set records by reaching a viewership of 4.6 million and being watched for 16.2 million hours during just the opening weekend [13]. This exclusivity strategy skyrocketed Disney+'s subscription base by an estimated 2 million new sign-ups, and its overall revenue increased by roughly 8% [14]. By acquiring exclusive rights to the movie for $75 million, Disney+ managed to secure new users and increase its audience numbers [15].

4.4.1. Zero-Sum Game

The competition for exclusive content between Netflix and Disney+ becomes a zero-sum game. If one of them has the exclusive right to a top-rated series, it directly diminishes the attractiveness of the other. For instance, with the purchase by Netflix of exclusive streaming rights to the "Spider-Man" franchise, Netflix should expect to experience more user engagement and, hence, a more significant competitive advantage in that particular field [11]. On the other hand, competitive pressure was set by the exclusive rights that Disney+ had.

4.4.2. Collaborative Streaming Strategies

Besides having exclusive content, the two platforms add collaborative strategies to extend their accessibility in the market. Co-production by Netflix with BBC on "The Night Manager" brought in about 2 million subscribers and grew total revenue by almost 5% [12]. In this way, Netflix provides variety in content without much rise in costs. Disney+ has implemented this type of approach by teaming up with both Hulu and ESPN+ to deliver entertainment in unison, thereby increasing the scope of services that Disney+ offers in the market and thereby expanding user growth [6].

4.4.3. Non-Zero-Sum Game

In a cooperative streaming strategy, it is a non-zero-sum game where both players benefit from cooperation. With the help of bundling and access to other platforms, costs can be reduced for Disney+, and market power can also be gained, while both companies are also looking for large-market-level benefits rather than fighting for the market share of one another [16].

4.4.4. Long-term Collaboration and Market Signaling

After a couple of interactions that result in favorable outcomes, Netflix and Disney+ can have long-term collaborative relations based on trust. Signaling games play an essential role in their strategic choices, where large-scale investments by Netflix give out strategic signals to the market about investing in original content, thereby putting in place responses for Disney+ and taking a competitive advantage [12].

4.5. Case Description

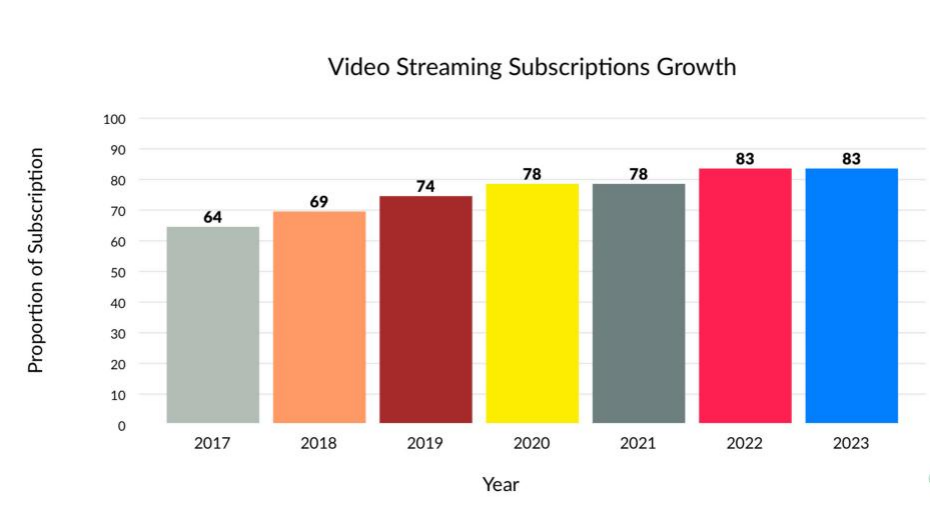

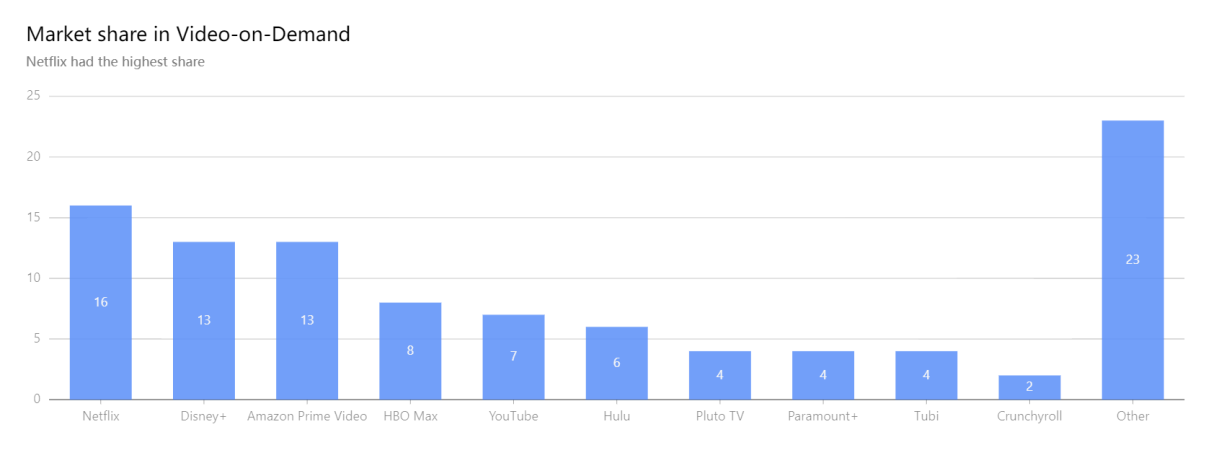

The global Video-on-Demand (VoD) market grew significantly in 2023, with Netflix and Disney+ leading the market. Netflix expanded its library of original content, while Disney+ strengthened its position with exclusive content and strategic acquisitions in the figure 1 and figure 2.

Figure 1: Video Streaming Subscriptions Growth [17]

Figure 2: Video Streaming Market Share in 2023 [18]

Disney+'s content acquisition strategy has been distinguished by significant milestones over the years. Disney's 2019 purchase of 21st Century Fox for $71 billion resulted in a significant increase in its entertainment and media resources. This contained a wide range of renowned films like X-Men, The Simpsons, and Avatar, which dramatically enhanced the programming availability on Disney+. Additionally, Disney+ has obtained exclusive streaming privileges for Marvel Studios, the Star Wars franchise, and Disney and Pixar movies…… This includes original series like Vendetta Vision, The Falcon and the Winter Soldier, Rocky, and The Mandalorian, which guarantees the distinctiveness and attractiveness of the platform's content. Disney allocates significant funds to develop unique content in order to consistently engage new members and maintain current subscribers by producing top-notch episodes and movies. Disney+ offers a complete entertainment package by combining memberships with Hulu and ESPN+ to reach a larger audience. Additionally, it introduced the Star brand to overseas regions to deliver more material targeted at adult consumers. In addition, Disney+ employs a Premier Access strategy that allows users to pay an extra fee to watch new movies in theaters at the same time and maintains long-term subscription interest by updating episodes weekly. Marvel's content has significantly increased on Disney+ through cooperation and licensing arrangements with Sony. This collaboration allows for the inclusion of upcoming movies and other massive successes from Sony. These actions have not only improved Disney+'s content catalog but also strengthened its competitive advantage in the streaming sector, establishing it as the preferred platform for numerous popular movies and TV shows.

In recent years, Netflix has made significant progress in several key aspects of its content acquisition strategy. In comparison to Disney+, Netflix has constantly been building its international content library by developing and releasing locally made original works, like "Money Heist," "Squid Game," and "Dark." For instance, Netflix ensured the constant supply of high-quality content by signing long-term collaboration contracts with leading producers and directors such as Shonda Rhimes and Ryan Murphy. Also, Netflix bought rights for popular IPs to transform them into long-running series, such as "The Stranger Things" series and "The Three-Body Problem." Furthermore, Netflix enhances user engagement and satisfaction by making data-driven content decisions that accurately capture audience preferences. Netflix continuously enhances its streaming technology to deliver exceptional user experience, offering features such as 4K HDR video and efficient content recommendation algorithms. Netflix has also introduced a dedicated low-cost mobile package to cater to different market demands, thereby further expanding its user base. These strategies have not only enriched Netflix's content library but also solidified its leading position in the global streaming industry, allowing it to maintain an advantage in the world streaming industry.

5. Theoretical Applications and Extensions

In analyzing the cooperative strategic choices of Netflix and Disney+, three important concepts called “End-Game Effect,” “Grim Trigger,” and “Shadow of the Future” may affect the collaboration. These theories can explain the behavioral patterns of two platforms in long-term collaboration.

5.1. End-Game Effect: Last-Round Betrayal

Definition: If the number of games is definite, the player may deviate in the last cooperation in order to maximize his payoff, as the last betrayal will not affect future cooperation.

5.1.1. Applications:Expiration of the Contract

Suppose Netflix and Disney make a 3-year agreement on content sharing. In the final cooperation, both competitors may consider shifting their choice in exclusive broadcast rights to maximize the market share and subscriber growth rate.

5.1.2. Applications:Market exit strategy

If one of them decides to exit the market, it is profitable for it to adopt an aggressive strategy to get a larger payoff quickly. The optimal solution for the other company is to reduce dependence on another platform during the cooperative process by investing in original content, which is powerful enough to counteract the effect.

5.2. Grim Trigger

Definition: In an infinite game, if a player is betrayed by another player, they will permanently withdraw from collaborating and will not work together forever to punish the betrayer and maintain the stability of cooperation.

5.2.1. Applications: Long-term cooperation maintenance

The long-term cooperation of Netflix and Disney+ on content acquisition can be maintained by harsh grim trigger strategies. For example, if either of them chooses to betray, the other player would stop the cooperation forever and switch to intense cooperation status (e.g., permanent exclusive broadcast rights). Any betrayal will lead to serious long-term consequences, thus maintaining the willingness of both parties to continue working together. If any rival chooses strategies that are not in keeping with the cooperation strategy (default the contract), the total revenue will reach a lower point. Then, the other party may decide to withdraw all content on its platform permanently.

5.3. Shadow of the Future

Definition: “Shadow of the Future” refers to the fact that potential future interaction and forecast will have an impact on current behavior. In infinite repeated games or long-term cooperative relationships, current decisions will affect not only current gains but also future interactions and payoffs. Therefore, competitors will take future opportunities into account when making current strategy choices.

Due to the presence and anticipation of future interactions, players are more likely to choose cooperation rather than betrayal to ensure that future long-term gains are maximized. This typically prevents betrayal in the short term, as cooperation helps to maintain future payoff streams.

5.3.1. Applications:Incentives for long-term cooperation: Future Market Potential

When analyzing the partnership and considering the potential for future growth in streaming subscribers, maintaining the partnership will help the two companies realize greater revenue by sharing market share and content resources.

Netflix and Disney+ expect the streaming market to continue to grow in the future. Therefore, they will choose to keep the partnership in order to share a bigger market popularization and revenue. The potential for future market expansion makes the current partnership even more secure.

Collaboration analysis should include potential new collaborative projects and technology development, emphasizing the long-term mutual benefits of maintaining the relationship.

5.3.2. Applications:Risks of short-term betrayal- Reputational damage

A current betrayal (e.g., early withdrawal of content or non-renewal of the update) may damage the reputation of the company and jeopardize future opportunities for collaboration with each other or other potential partners. Both parties prefer to maintain cooperation in the present to ensure long-term future benefits.

Collaboration analysis should consider the possible reactions of users and the market to a break in the collaboration and show that maintaining the collaboration will help ensure user satisfaction and market stability, thus supporting long-term gains for both parties.

6. Suggestions

In digital media and streaming industries like Netflix and Disney+, long-term partnerships and strategic stability are critical. Therefore, future practitioners are advised to not only focus on short-term gains but also consider building and maintaining long-term partnerships. By adopting a strategy similar to the "Grim Trigger," which includes strict collaboration guidelines and limits with partners, they can ensure continuity and long-term mutual benefit. Short-term defections can seriously affect a company's reputation and future cooperation opportunities. Future practitioners are,therefore, advised to consider long-term consequences when developing strategies to avoid short-sighted actions. Maintaining a good industry reputation and partnerships is essential for long-term growth. Given the rapid evolution of the digital media industry, investing in technology and innovation is critical to staying competitive. Future professionals are advised to constantly monitor the technological progress of the industry, actively invest in content innovation, and enhance user experience to ensure their company's leading position in the market. In addition, when it comes to contract design, competitors can consider designing contract terms to avoid last-minute defections, such as setting up automatic renewals or extending partnerships. In addition, by establishing a clear punishment mechanism and cooperation incentive mechanism, the possibility of betrayal can be reduced, and long-term stable market cooperation can be ensured.

7. Conclusion

In conclusion, the fierce competition strate between Netflix and Disney+ within the streaming industry have been thoroughly analyzed through the lens of game theory. This study has underscored how these two giants strategically navigate content acquisition and exclusive streaming rights to gain market dominance and sustain subscriber loyalty.

Game theory, particularly concepts like Nash equilibrium and mixed strategies, has provided a robust framework for understanding the complex interactions between Netflix and Disney+. Netflix, with its extensive library of original content and global reach, has capitalized on its first-mover advantage in streaming technology to continuously expand its subscriber base and solidify its market leadership. Conversely, Disney+ has leveraged its rich catalog of classic Disney, Marvel, and Star Wars content to quickly establish itself as a formidable competitor, attracting a loyal fan base and expanding its content offerings through strategic acquisitions.

The paper also delved into the critical role of exclusive content in shaping competitive strategies. Both Netflix and Disney+ have invested heavily in securing exclusive rights to popular movies, series, and franchises, using these assets not only to differentiate themselves but also to retain subscribers amid intensifying competition. This strategy highlights their recognition of content as a key driver of subscriber acquisition and retention in the streaming landscape.

Furthermore, the study explored theoretical extensions such as the End-Game Effect, Grim Trigger, and Shadow of the Future, which illuminate the long-term strategic behaviors of Netflix and Disney+. These concepts underscore the importance of maintaining cooperative relationships and avoiding short-term defections that could damage the reputation and future prospects for collaboration.

Looking forward, the digital media and streaming industry is poised for continued evolution and disruption. Both Netflix and Disney+ must remain agile in responding to shifting consumer preferences, technological advancements, and competitive maneuvers from emerging players. Strategies focused on innovation in content creation, enhancing user experience through advanced streaming technologies, and forging strategic partnerships will be crucial for sustaining growth and retaining leadership in the highly competitive streaming market.

In conclusion, while Netflix and Disney+ continue to vie for market supremacy, their strategic interplay, as depicted through game theory concepts, provides valuable insights for industry practitioners and scholars alike. Understanding these theories not only sheds light on their competitive strategies but also offers lessons for navigating complex market environments in the digital age. As the streaming landscape evolves, leveraging insights from game theory will be essential for shaping future strategies that drive sustained success and innovation in the dynamic world of digital entertainment.

References

[1]. Gonçalves-Dosantos, J. C., Martinez, R., & Sánchez-Soriano, J. (2024). Revenue distribution in streaming platforms. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.4762536

[2]. Congressional Research Service. (2020). Competition Among Video Streaming Services. (No. R46545). Retrieved June 17, 2024, from https://crsreports.congress.gov/product/pdf/R/R46545

[3]. Netflix. 2023 Annual Report. (n.d.). Retrieved June 18, 2024, from https://s22.q4cdn.com/959853165/files/doc_financials/2023/ar/Netflix-10-K-01262024.pdf

[4]. The Walt Disney Company. THE WALT DISNEY COMPANY FISCAL YEAR 2023 ANNUAL FINANCIAL REPORT. (n.d.). Retrieved June 18, 2024, from https://thewaltdisneycompany.com/app/uploads/2024/02/2023-Annual-Report.pdf

[5]. Li, Z., Yu, C., & Wu, Y. (2015). Cooperation and Competition: The Analysis of Strategy in Duopoly Online Video Websites. Science Journal of Business Management, 3, 109.

[6]. Andreoni, J., & Varian, H. (1999). Preplay contracting in the prisoners’ dilemma. Proceedings of the National Academy of Sciences, 96(19), 10933–10938. https://doi.org/10.1073/pnas.96.19.10933

[7]. Maihami, R., Ghalehkhondabi, I., & Ahmadi, E. (2020). Game Theory Approach for Pricing Problem in Entertainment Supply Chain. In IIE Annual Conference. Proceedings(pp. 550-555). Institute of Industrial and Systems Engineers (IISE).

[8]. Li, B., & Li, H. (2022). Research on the Revenue Management of network video platform based on Game Theory. Mathematical Problems in Engineering, 2022, 1–16. https://doi.org/10.1155/2022/8516961

[9]. Colbjørnsen, T. (2024). Joe Rogan v. Spotify: Platformization and worlds colliding. Convergence: The International Journal of Research into New Media Technologies. https://doi.org/10.1177/13548565241253909

[10]. Zhihong, L. (2015). Cooperation and competition: The analysis of strategy in duopoly online video websites. Science Journal of Business and Management, 3(4), 109. https://doi.org/10.11648/j.sjbm.20150304.13

[11]. Engadget. (2021). Netflix will get exclusive streaming rights to future Sony films. Retrieved from www.engadget.com

[12]. Investopedia Team. (2023). How Netflix Is Changing the TV Industry. Retrieved from www.investopedia.com

[13]. The Wrap. (2024). Taylor Swift’s ‘Eras Tour’ Movie Sets Disney+ Record With 16.2 Million Hours Viewed in First Weekend. Retrieved from www.thewrap.com

[14]. The Walt Disney Company. (2024). Taylor Swift | The Eras Tour (Taylor’s Version) to Debut Exclusively on Disney+ on March 15. Retrieved from https://thewaltdisneycompany.com/taylor-swift-eras-tour-film-disney/

[15]. The Wrap. (2024). Disney Paid Taylor Swift $75 Million to Stream ‘The Eras Tour’: Bob Iger Wanted ‘Big Announcement’ for Earnings Call. Retrieved from www.thewrap.com

[16]. Business of Apps. (2024). Disney Plus Revenue and Usage Statistics. Retrieved from www.businessofapps.com

[17]. Duarte, F. (2024b, June 6). Video Streaming Services Stats (2024). Exploding Topics. https://explodingtopics.com/blog/video-streaming-stats

[18]. Video-on-Demand: market data & analysis. (2023). In Statista. statista. Retrieved June 25, 2024, from https://www.statista.com/study/68959/global-video-streaming-market/

Cite this article

Liu,H. (2024). Game Theory Analysis of Competitive Dynamics in the Streaming Industry: A Comparative Study of Netflix and Disney+. Advances in Economics, Management and Political Sciences,105,229-239.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Gonçalves-Dosantos, J. C., Martinez, R., & Sánchez-Soriano, J. (2024). Revenue distribution in streaming platforms. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.4762536

[2]. Congressional Research Service. (2020). Competition Among Video Streaming Services. (No. R46545). Retrieved June 17, 2024, from https://crsreports.congress.gov/product/pdf/R/R46545

[3]. Netflix. 2023 Annual Report. (n.d.). Retrieved June 18, 2024, from https://s22.q4cdn.com/959853165/files/doc_financials/2023/ar/Netflix-10-K-01262024.pdf

[4]. The Walt Disney Company. THE WALT DISNEY COMPANY FISCAL YEAR 2023 ANNUAL FINANCIAL REPORT. (n.d.). Retrieved June 18, 2024, from https://thewaltdisneycompany.com/app/uploads/2024/02/2023-Annual-Report.pdf

[5]. Li, Z., Yu, C., & Wu, Y. (2015). Cooperation and Competition: The Analysis of Strategy in Duopoly Online Video Websites. Science Journal of Business Management, 3, 109.

[6]. Andreoni, J., & Varian, H. (1999). Preplay contracting in the prisoners’ dilemma. Proceedings of the National Academy of Sciences, 96(19), 10933–10938. https://doi.org/10.1073/pnas.96.19.10933

[7]. Maihami, R., Ghalehkhondabi, I., & Ahmadi, E. (2020). Game Theory Approach for Pricing Problem in Entertainment Supply Chain. In IIE Annual Conference. Proceedings(pp. 550-555). Institute of Industrial and Systems Engineers (IISE).

[8]. Li, B., & Li, H. (2022). Research on the Revenue Management of network video platform based on Game Theory. Mathematical Problems in Engineering, 2022, 1–16. https://doi.org/10.1155/2022/8516961

[9]. Colbjørnsen, T. (2024). Joe Rogan v. Spotify: Platformization and worlds colliding. Convergence: The International Journal of Research into New Media Technologies. https://doi.org/10.1177/13548565241253909

[10]. Zhihong, L. (2015). Cooperation and competition: The analysis of strategy in duopoly online video websites. Science Journal of Business and Management, 3(4), 109. https://doi.org/10.11648/j.sjbm.20150304.13

[11]. Engadget. (2021). Netflix will get exclusive streaming rights to future Sony films. Retrieved from www.engadget.com

[12]. Investopedia Team. (2023). How Netflix Is Changing the TV Industry. Retrieved from www.investopedia.com

[13]. The Wrap. (2024). Taylor Swift’s ‘Eras Tour’ Movie Sets Disney+ Record With 16.2 Million Hours Viewed in First Weekend. Retrieved from www.thewrap.com

[14]. The Walt Disney Company. (2024). Taylor Swift | The Eras Tour (Taylor’s Version) to Debut Exclusively on Disney+ on March 15. Retrieved from https://thewaltdisneycompany.com/taylor-swift-eras-tour-film-disney/

[15]. The Wrap. (2024). Disney Paid Taylor Swift $75 Million to Stream ‘The Eras Tour’: Bob Iger Wanted ‘Big Announcement’ for Earnings Call. Retrieved from www.thewrap.com

[16]. Business of Apps. (2024). Disney Plus Revenue and Usage Statistics. Retrieved from www.businessofapps.com

[17]. Duarte, F. (2024b, June 6). Video Streaming Services Stats (2024). Exploding Topics. https://explodingtopics.com/blog/video-streaming-stats

[18]. Video-on-Demand: market data & analysis. (2023). In Statista. statista. Retrieved June 25, 2024, from https://www.statista.com/study/68959/global-video-streaming-market/