1. Introduction

Artificial intelligence (AI) is the technology that enables computers and machines to simulate human intelligence and problem-solving capabilities. Nowadays, almost all cutting-edge companies in all industries are interested in AI technology. For example, in education, there is a growing number of AI teachers. And in the car industry, the proportion of autonomous (smart) vehicles is increasing. AI technology will affect every aspect of people’s lives, having huge economic potential.

From 2019 on, the China’s AI industry has grown rapidly. However, the rate of growth tends to decline. This is caused by COVID-19 and the lack of confidence of consumers. In 2021, the year-on-year growth rate was 33.3%. In 2022, the year-on-year growth rate decreased to 18%; in 2023, the year-on-year growth rate decreased to 13.9% [1]. But still, it experienced rapid growth in the China’s economy. With its growing scale, it takes up a higher proportion of GDP and has an increasing impact on the economy. So it is also of increasing importance to analyze how it will affect economic growth.

Mark Purdy et al. found that artificial intelligence not only improves labor productivity, but also becomes a new factor of production, with the characteristics of both capital and labor, creating a new impetus for economic growth [2]. Seth G. Benzell and his partners call AI growth as "immiserating growth", which means that although the economy will grow and the price level fall, the falling employment and income may reduce the welfare of consumers [3]. However, this paper does not focus on the welfare that AI economic growth brings or AI as a new factor of production that can generate more GDP, but it concentrates on components of aggregate supply (AS) (for example, factors of production) and aggregate demand (AD) to analyse how they influences China’s economic growth. In the end, the paper provides some policies to deal with the problems of AI growth.

2. Aggregate supply analysis

AI technology increases the quality of factors of production (FOPs). This increases the productive potential and makes the PPC curve right shift. In general, the adoption of AI technology will increase the productivity, causing a high economic growth. Cao Jing and Zhou Yalin collated different documents and confirmed this point [4]. Specifically, FOPs will be influenced by AI in different ways.

2.1. AI as a substitute of labor

AI provides automation, which, like any technological advancement, will certainly replace and create job opportunities at the same time. Acemoglu and Restrepo investigated the issue by using data from the US labor market from 1990 to 2007. The result showed that as the proportion between robots and workers increases by 0.1%, the job vacancy reduces by 0.18%-0.34% and income declines by 0.25%-0.5% [5]. Frey and Osborne studied 702 job positions, and they estimated that around 47% of total US employment is in the high risk category (being replaced over the next decade or two)[6]. Yong Chen used the method of Frey and Osborne to estimate the job replacement rate in China. The result shows that in the next 20 years, 76.76% of the total employed people will receive a shock from AI [7].

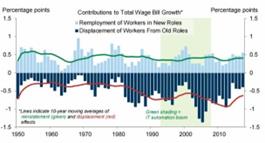

Figure 1: Effects of AI on job positions [8]

The Goldman Sachs’ graph (Figure 1), cited data from Daren Acemoglu and Pascual Restrepo, confirmed the aforesaid opinions. From 1980 on, the jobs replaced by new technology were greater than those it created. The greatest job replacement happened during the period of the IT automation boom. If the boom of generative AI is like the IT automation boom, it may lead to a similar employment result.

2.2. AI as a compliment of labor

A doctor can use an expert system to help him do the basic checkout. It shows that AI can help raise labor productivity. Considering the increase of labor productivity in China has decreased in recent 20 years, AI may help maintain the increase in productivity. Not only does AI take on the role of an assistant, but it also improves the area of education. A virtual teacher improves the efficiency of study. So companies find it easier and more cost-effective to train their employees. However, the accurate rate of labor productivity growth caused by AI is not clear.

2.2.1. Capital and knowledge

AI increases the productivity of capital. Through big data and AI, capital is able to produce higher quality and quantity of goods, satisfy more tailored requirements, and adapt to complicated environments. Together with the increasing competitiveness compared to labor, this may lead to a huge investment. Investment increases the capital stock, leading to future economic growth. Meanwhile, AI (especially generative AI) has the potential to engage in creative work and apply knowledge. It can combine knowledge to invent products and make plans according to individual demand, which is quite different from previous technological advancements. If AI can replace humans to apply knowledge to tasks, there is no reason why it can’t lead to a economic singularity. Interest will increase in the future, as the method of production will be more capital-intensive.

2.2.2. Land and enterprise

AI can help supervise the land and use automated systems to accomplish work. Taking agriculture as an example, it is estimated that automation can generate 200-800 dollars per acre, raising the productivity of land. It also increases the efficiency of pesticides and chemical fertilizers, which reduce the cost of production[9]. Higher quality land increases both supply and demand, so the price of rent depends. Finally, as AI provides better education, more people will be capable of being entrepreneurs. The quality of enterprise will increase. Meanwhile, as the AI develops, the return on capital increases. Profit may increase, so the quantity of entrepreneurs may increase.

2.2.3. Implementation and restructuring lags (retaining)

Solow Paradox argues that the advancement of computers and the internet does not have a relevant impact on the productivity of economic growth, based on the data he observed. But Brynjolfsson et al. did provide the idea of "implementation and restructuring lags", which they held was the reason why the Solow Paradox was generated by the data at the time [10]. AI is in the same situation. The investment of infrastructure, the training for workers, the adaptation to commercial purposes, and the emerging of accessory industries take time and cause time-lag.

3. Aggregate demand analysis

After COVID-19, the China’s demand has shown a slack status. Although it is expected that the economy will recover, the current situation seems not optimistic. The consumer confidence index and spending ratio are lower than before the pandemic.

3.1. Consumption

From 2017 to 2023, although the consumption increases, the proportion of consumption to income decreases (Table 1). The demand for housing market declines from 2021 to 2023, which decreases the price of house and therefore the value of asset decreases. This reduces the wealth of people and in return reduces spending.

Table 1: Proportion of consumption from income (unit:Yuan)

Year |

2023 |

2022 |

2021 |

2020 |

2019 |

2018 |

2017 |

Average consumption (AC) |

26796 |

24538 |

24100 |

21210 |

21559 |

19853 |

18322 |

Average income (AI) |

39218 |

36883 |

35128 |

32189 |

30733 |

28228 |

25974 |

AC/AI |

0.68 |

0.67 |

0.69 |

0.66 |

0.70 |

0.70 |

0.71 |

CPI (last year = 100) |

100.2 |

102 |

100.9 |

102.5 |

102.9 |

102.1 |

101.6 |

After adjustment for inflation |

|

|

|

|

|

|

|

Real average consumption |

26742.51 |

24056.87 |

23885.03 |

20692.68 |

20951.41 |

19444.67 |

18033.46 |

Real average income |

39139.72 |

36159.80 |

34814.67 |

31403.90 |

29866.86 |

27647.40 |

25564.96 |

Real AC/AI |

0.68 |

0.67 |

0.69 |

0.66 |

0.70 |

0.70 |

0.70 |

In 2022, consumers’ confidence index saw a cliff-like decline (more than 30 points). It definitely accounts for one reason for the declining consumption. In 2022, the unemployment rate reached 5.6%. This is because firms made redundant labors to lower costs in response to low demand. The high cyclical unemployment also reduces income, confidence, and consumption. It is true that the deposit reserve rate decreased from 2018 to 2024 to increase money supply, but it seems that the lowered interest rates and opening market operations may have an insufficient impact on stimulating consumption when confidence is low. China has also enforced an expansionary fiscal policy by lowering taxation, increasing spending and issuing national debt.

However, AI can provide new and higher quality products that attract consumers’ attention and encourage consumption, like the new versions of phones, earphones, cars, and fashion clothes. It can be proved by the recent rocketing demand for automated cars and ChatGPT. According to the White Paper on the Internet of Vehicles, it is estimated that in 2025, the automated car industry will reach one thousand billion yuan [11].

But for the influence of AI, as mentioned in 2.1, the rate of job replacement is high and the income will be lower. Increased unemployment will cause greater uneven distribution of income, which leads to unfairness and in turn reduces consumption.

3.2. Investment

The China’s return on capital has a declining tendency because of the law of diminishing marginal revenue of capital and perishing demographic dividends. However, AI raises the return on invested capital. AI decreases the cost of production and increases efficiency. Let’s take two examples. Firms can take greater advantage of economies of scale, as the managerial problems, conflicts, and poor relationships between workers and managers will be perished by AI.The adoption of AI models helps firms market. They can collect consumers’ information and enforce price discrimination to further increase their profit.

In recent years, the profitability of AI incentives investment in the US. The leading AI technology companies in the US have had increasing funds and revenue. However, that is not the case in China. Baidu, as the greatest and most well-known company in the IT area in China, has experienced almost the opposite direction in the stock market. The reason for this may be the time-lag of AI influences and the poorer condition of AI development. China’s economy need time to start the boom of AI technology. Generally, the boom of the stock market increases the wealth of the share holders, making them more confident about the future. If AI development can cause a stock market boom in China, both consumers’ and investors confidence and wealth may increase, which may increase AD. Currently, China’s economy is facing the problem of a lack of confidence. The consequent slack in demand makes it non-profitable to invest (in all area, as well as in AI). Firms are seeking for survive rather than invest for the future, which lowers the investment. Also, the prices of stocks in the stock market are irrationally low, because of the doubtful emotions that exist in the investment environment. The AI industry is underestimated, whose price cannot totally reflect its potential profit.

3.3. International competitiveness

On February 16, 2023, the CHIP4 alliance formed by the United States and Japan, South Korea and China Taiwan, held its first formal meeting, and the U.S. sanctions against China entered a new stage. According to IC insight data, the chip production capacity of the CHIP4 Alliance accounted for 70% of the world in 2021, while the China’s mainland accounted for only 15% [12]. Having considered the increasing demand for computing power (an index explosion), China has to invest in the chips to switch from imports.

However, the population advantage of China may be expressed in another way in AI. The huge population provides a bigger data set, which helps train AI models. Since the network’s availability is high in China, data collection is relatively easy. The China’s AI model may be more comprehensive, which increases its international competitiveness.

4. Policy suggestions dealing with problems of AI growth

In the short-run, the shortage of computing power cannot be overcome; still, China’s companies have to buy chips from the main chip export countries at a high price. However, the government can continue to subsidize those who buy chips to encourage the production. Brain drain is also a problem, a large proportion of people with doctorates in the US choose to stay there instead of coming back to China. So the government can set up an “AI career subsidy” to encourage AI experts to stay in China. It also encourages domestic laborers to choose an AI career. The parameters needed to calculate the amount of subsidy can be: (1) wage; (2) degree; (3) experience. The reason for using wages is to consider the market force. Companies will examine the worker’s performance and determine which worker is worth a high salary. However, this may discourage start-up firms, for profit-making and mature AI firms tend to pay higher salaries for workers, whereas start-up small firms’ positions are generally low-paid, because the revenue has to cover the cost. In the end, start-up small firms become increasingly less competitive for workers and find it harder to survive. This may cause a monopoly in the AI market and lead to unfairness. So it also considers degrees and experience to solve the problem.

5. Conclusion

This paper discusses the AD and AS sides of how the AI industries will affect the China’s economy. AI has global economic potential, not only in China. And indeed, some countries, like the US, have received huge rewards from the advancement of the AI industry. China is still on the way. The AI may boost China’s consumer confidence and stimulate consumption and investment. The productivity of FOPs will increase in the future, but they will experience a time lag. The most urgent "bottleneck" problem has been chips recently, but technological breakthroughs take time, so now the chips still rely on imports, and the government can continue to subsidize the firms using chips. The paper also suggests AI career subsidy. However, the analysis in this paper is descriptive rather than further statistical. Also, all the data is derived from the website, there is no field trip data collection. In the future, the author hopes that there are more statistical studies relating AI influences on economic growth and there are further models.

References

[1]. Prospective Industry Research Institute. (2024) Foreseeing 2024: Panorama of Chinese AI industry in 2024 (with market size, competitive pattern and development prospects, etc.) https://new.qq.com/rain/a/20240102A0778T00

[2]. Mark Purdy Qiu Jing, Xiaobing Chen. Accenture:Artificial intelligence helps China's economic growth[J].Robotics Industry, 2017(04):80-91.

[3]. Seth G. Benzell, Laurence J. Kotlikoff, Guillermo LaGarda, Jeffrey D. Sachs. (2015) Robots are us: Some economics of human replacement. NBER WORKING PAPER SERIES, NATIONAL BUREAU OF ECONOMIC RESEARCH, pp.1-57.

[4]. Cao Jing, Zhou Yalin. Economic Perspectives, 2018(01):103-115.

[5]. Daron Acemoglu, Pascual Restrepo. (2017) Robots and jobs: Evidence from us labor markets, NBER WORKING PAPER SERIES, NATIONAL BUREAU OF ECONOMIC RESEARCH, pp. 1-91.

[6]. Carl Benedikt Frey, Michael A. Osborne. (2013) The future of employment: How susceptible are jobs to computerisation? The Oxford Martin Programme on the Impacts of Future Technology. September 17, pp.1-72.

[7]. Yongwei Chen. (2018) Artificial intelligence and economics: A review of recent literature. Economic Review, March 21.

[8]. Goldman Sachs. (2023) The Potentially Large Effects of Artificial Intelligence on Economic Growth Picture name Globally, 18% of Work Could be Automated by AI, with Larger Effects in DMs than EMs Time, March 26. http://inews.gtimg.com/newsapp_bt/0/15788429836/641

[9]. Sheng Hong, Rob Bland, Vasanth Ganesan, Julia Kalanik. (2024) From field to future: Global implications for agricultural automation transformation. MeKinsey & company. https://www.mckinsey.com.cn/%E4%BB%8E%E7%94%B0%E9%97%B4%E5%88%B0%E6%9C%AA%E6%9D%A5%EF%BC%9A%E5%85%A8%E7%90%83%E5%90%AF%E7%A4%BA%E5%8A%A9%E5%8A%9B%E5%86%9C%E4%B8%9A%E8%87%AA%E5%8A%A8%E5%8C%96%E8%BD%AC%E5%9E%8B/

[10]. Erik Brynjolfsson, Daniel Rock, Chad Syverson. (2017) Artificial intelligence and the modern productivity Paradox: A Clash of Expectations and Statistics, National bureau of economic research, pp.8. DOI 10.3386/w24001

[11]. China academy of Information and Communications Technology. (2023) White Paper on Internet of Vehicles, January.

[12]. Fei Jiang. (2023) AI has started a wave of technology, and the competition between China and the United States has become more intense. https://www.eeo.com.cn/2023/0425/588130.shtml

Cite this article

Li,J. (2024). The Impact of Advancing AI Industry on Economic Growth -- Taking Chinese Economy as an Example. Advances in Economics, Management and Political Sciences,105,223-228.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Prospective Industry Research Institute. (2024) Foreseeing 2024: Panorama of Chinese AI industry in 2024 (with market size, competitive pattern and development prospects, etc.) https://new.qq.com/rain/a/20240102A0778T00

[2]. Mark Purdy Qiu Jing, Xiaobing Chen. Accenture:Artificial intelligence helps China's economic growth[J].Robotics Industry, 2017(04):80-91.

[3]. Seth G. Benzell, Laurence J. Kotlikoff, Guillermo LaGarda, Jeffrey D. Sachs. (2015) Robots are us: Some economics of human replacement. NBER WORKING PAPER SERIES, NATIONAL BUREAU OF ECONOMIC RESEARCH, pp.1-57.

[4]. Cao Jing, Zhou Yalin. Economic Perspectives, 2018(01):103-115.

[5]. Daron Acemoglu, Pascual Restrepo. (2017) Robots and jobs: Evidence from us labor markets, NBER WORKING PAPER SERIES, NATIONAL BUREAU OF ECONOMIC RESEARCH, pp. 1-91.

[6]. Carl Benedikt Frey, Michael A. Osborne. (2013) The future of employment: How susceptible are jobs to computerisation? The Oxford Martin Programme on the Impacts of Future Technology. September 17, pp.1-72.

[7]. Yongwei Chen. (2018) Artificial intelligence and economics: A review of recent literature. Economic Review, March 21.

[8]. Goldman Sachs. (2023) The Potentially Large Effects of Artificial Intelligence on Economic Growth Picture name Globally, 18% of Work Could be Automated by AI, with Larger Effects in DMs than EMs Time, March 26. http://inews.gtimg.com/newsapp_bt/0/15788429836/641

[9]. Sheng Hong, Rob Bland, Vasanth Ganesan, Julia Kalanik. (2024) From field to future: Global implications for agricultural automation transformation. MeKinsey & company. https://www.mckinsey.com.cn/%E4%BB%8E%E7%94%B0%E9%97%B4%E5%88%B0%E6%9C%AA%E6%9D%A5%EF%BC%9A%E5%85%A8%E7%90%83%E5%90%AF%E7%A4%BA%E5%8A%A9%E5%8A%9B%E5%86%9C%E4%B8%9A%E8%87%AA%E5%8A%A8%E5%8C%96%E8%BD%AC%E5%9E%8B/

[10]. Erik Brynjolfsson, Daniel Rock, Chad Syverson. (2017) Artificial intelligence and the modern productivity Paradox: A Clash of Expectations and Statistics, National bureau of economic research, pp.8. DOI 10.3386/w24001

[11]. China academy of Information and Communications Technology. (2023) White Paper on Internet of Vehicles, January.

[12]. Fei Jiang. (2023) AI has started a wave of technology, and the competition between China and the United States has become more intense. https://www.eeo.com.cn/2023/0425/588130.shtml