1. Introduction

Finance serves as an extremely necessary role in enterprises. It controls the economic lifeline and core data of enterprises and leads the construction of enterprise informatization. It should serve as a crucial engine for the digital transformation of enterprises. As an important tool and strategic support platform for the digital transformation of enterprises, the application of financial shared service centers in China has become stable. The professional efficiency improvement and financial value creation brought by them have been recognized by many entrepreneurs [1]. The application of technologies and 5G has opened the prelude to the digital finance era. The core of digital finance is to use big data technology to model and analyze and use artificial intelligence technology to optimize the process from business end to financial end and then to management decision-making end, and improve management and decision-making efficiency, and promote the application of digital finance from the three levels of perception ability, computing ability and cognitive ability [2]. Accordingly, the digital financial shared service center uses big data to focus on empowering individuals and implementing efficient decision support, forming an end-to-end intelligent sharing, value sharing, and value-added sharing model for the entire business process [3].

After systematically combing through the existing literature, this paper found that scholars have achieved certain research results in the digital transformation of corporate finance, and these literatures offer hints for the research of this paper. The existing research progress mainly reflects three research directions. With the deepening of research on corporate finance digitalization, scholars have gradually realized that corporate digital finance transformation is not just a technical development. Its core is the non-technical enterprise full process reengineering, which reshapes the business model, organizational structure, corporate culture and corporate strategy of the enterprise around the existing digital technology [4]. This research understanding has led more scholars to focus on the integration and reengineering of different digital technologies and different organizations. Theoretical basis of corporate digital finance transformation. Previous literature introduced the resource-based view (RBV), dynamic capability theory and stakeholder theory to study corporate digital finance transformation. The RBV believes that digital technology resources can bring competitive advantages to enterprises and create value and added value for enterprises [5]. Dynamic capability refers to "the ability to build, integrate and reorganize and allocate resources" [6]. Enterprises ensure the implementation of digital finance transformation by establishing dynamic capabilities, which is the key to enterprise digital transformation. Stakeholder theory, considering the scope and impact of it, the participation of external and internal stakeholders can promote the implementation of digital finance transformation of enterprises and benefit from it [7]. One can also place digital finance transformation in the larger framework of enterprise digital transformation for research [8]. Some scholars have proposed digital finance transformation paths from the perspective of financial sharing and service digitization, such as FSSC as the starting point of digital finance transformation, and the application of intelligent FSSC and intelligent financial management tools as the end point of digital finance transformation [9]. However, it is further emphasized that the application of new technologies does not represent the whole of digital finance transformation. Digital finance transformation should start from the overall situation and apply profound organizational changes [10].

In addition, according to the query of CNKI database, there are 236 articles studying "digital finance transformation path", but most of them analyze and study the implementation path of digital finance transformation from a specific industry. This article consults a large number of literature and collects typical enterprise practice case analysis, combines the research results of predecessors, and analyzes the specific digital finance transformation path and future development trend, in order to provide more specific reference and lessons for the enterprises in various industries. This article describes the digital finance transformation and analyzes the digital finance transformation of Haier Group’s FSSC to provide inspiration and suggestions for subsequent digital finance transformation of enterprises.

2. Description of Digital Finance Transformation

Digital finance transformation is based on the FSSC and uses technology to achieve financial automation and intelligence. According to the three-stage model of enterprise digital transformation proposed by Verhoef et al. [11], and based on the professionalism of the enterprise's financial function, this study believes that the basic strategy of enterprise digital finance transformation should be: to meet business needs according to the business essence of the enterprise, integrate technical characteristics and reshape enterprise value. This strategy determines that the path of digital finance transformation is divided into three layers as follows. According to business essences and needs, establish the enterprise's financial shared service center and establish financial process reengineering to better serve each functional department of the enterprise. On the basis of the FFSC, use technologies such as A (artificial intelligence), B (blockchain), C (Cloud computing), D (big date), E (Internet-of-Everything) and 5G to achieve financial automation and intelligence, that is, digital finance. The enterprise's financial department is transformed into the central nervous system of the enterprise, and by collecting small data from various departments of them and transforming it into the big data center, it will eventually achieve the digital transformation of the entire enterprise.

Digital finance transformation is a complex and systematic project. Its implementation steps and methods generally need to be promoted from the consciousness level, strategic level and execution level [12]:

• Consciousness level. First of all, the concept of platform, connection, sharing and collaboration should be possessed at the consciousness level. The management and decision-making level of the enterprise should believe that through the collaborative platform, real-time data exchange can be achieved, data can be accurately collected, customer needs can be accurately understood, supplier dynamics can be mastered, a digital supply chain can be established, stakeholders can be better served, and business data can be realized.

• Strategic level. The digital finance transformation strategy is a complex systematic project. Enterprises need to build an exclusive digital ecosystem based on the essences and pain points of their business. At the same time, enterprises need to open internal and external boundaries, connect and share, and jointly establish standardized data with employees, partners and customers to provide real-time intelligent decision-making and analysis, and build core competitiveness.

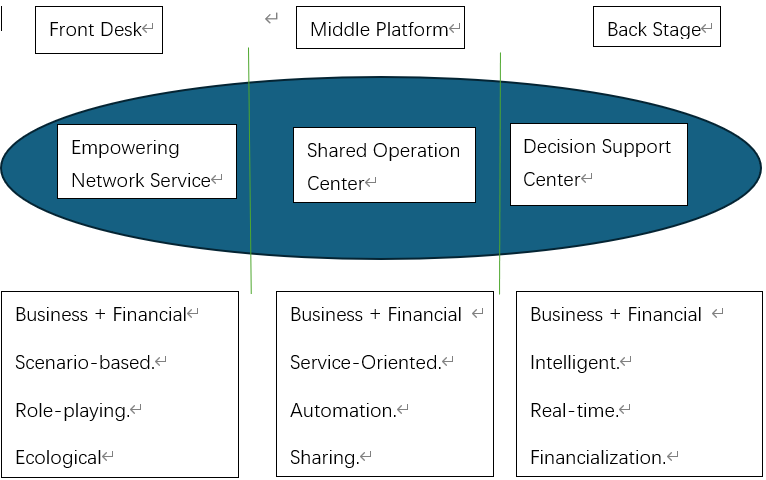

• Execution level. Enterprises need to restructure their financial structure and establish a flat front-end, middle-end and back-end model (depicted in Fig. 1). The flat financial structure can break boundaries and achieve end-to-end links. This architecture can achieve agile response and rapid response at the front end; business source triggering and automatic data sharing at the middle end; data collection modeling at the back end and business decision support at the front end [13]. On the other hand, robotic process automation is applied to replace large-scale manual operations, strengthen the deep integration of business and finance, and create an intelligent digital financial shared service center. Furthermore, in terms of talent training and management, enterprises need to focus on cultivating cross-border talents with digital knowledge reserves, establish flat and interconnected job channels within the enterprise, promote the comprehensive improvement of employees, and then deeply empower digital finance transformation. At the same time, it is necessary to keep the enterprise's digital finance ecosystem in an open, connected and symbiotic state always to better respond to uncertain internal and external needs of the enterprise.

Figure 1: Flat front, middle and back pattern.

3. Case Background

Haier Group is one of the first enterprises in China to implement the financial sharing model. Founded in 1984, it is a giant home appliance brand. Haier Group’s business consists of five major sectors: white appliance platform, service investment incubation platform, financial holding platform, real estate platform and cultural industry platform [14]. In the era of Internet economy, digitization and globalization are inevitable trends. For this reason, Haier Group took the lead in establishing a corporate FSSC. The establishment of the FSSC ensures the agreement of corporate financial reporting standards, saves the financial costs of different branches of the enterprise, and significantly reduces the operating costs of the enterprise, reducing the burden on the enterprise and creating a scale effect. In addition, through the establishment of a FSSC, the financial management process and service standards are reconstructed, and a new financial management model is formed, that is, the optimization and unification of financial management processes and financial service standards, the standardization and Process processing improves work efficiency and service quality, thereby enhancing the overall strength of the enterprise [15].

Through the review and analysis of previous literature, it was found that the digital finance transformation problems of enterprises usually appear in three aspects. In terms of personnel, most corporate executives usually do not have the ability to judge changes in digital finance transformation needs and to move digital strategies from high-level plans to specific actions. This requires the enterprise's top managers to make role changes based on the needs of digital finance transformation, strengthen collaboration among managers, design the power distribution of the top management team, and then start or change the digital transformation process. In terms of organizational, with the application and development of digital technology, most companies are unable to change their organizational forms in a timely manner, causing digital finance transformation to stagnate and fail to work. Digital finance transformation is a rebalancing action. Enterprises should adjust or rebuild the enterprise's organizational structure accordingly based on the current digital finance transformation strategy and current enterprise resources, thereby promoting the process of enterprise digital finance transformation. In terms of industry, digital finance transformation has changed the original business model and value chain structure of each industry. In the sharing economy model, the inherent business model thinking of enterprises limits the innovation of business models and the reconstruction of value chains, thereby restricting the development of digital finance transformation of enterprises. Enterprises should use digital technology to unify and improve data standards, carry out cross-industry and cross-platform business model innovation, and create a value chain beyond products and services, thereby improving the transformation of enterprise digital finance [16].

4. Analysis

4.1. Process

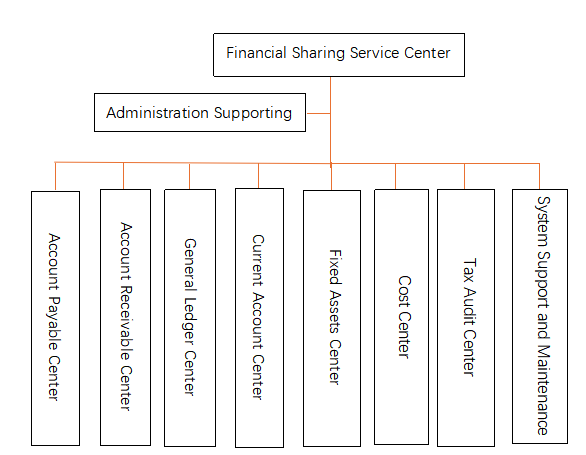

As a home appliance manufacturing enterprise, Haier Group, based on its own business essences and supply chain characteristics, first proposed the " employees and orders are one" model in 2005. This model transformed Haier Group from the traditional enterprise-paid salary model to the customer-paid salary model. Through the " employees and orders are one" model, the enterprise, employees and customers are connected to maximize the interests of the three parties [17]. In 2007, Haier Group took "SPORTS" (i.e., site selection, process, organization, regulations, technology and service level agreement) as the strategic path and began to implement the financial shared service center model in Qingdao, China. Under the FSSC model, Haier Group transferred the financial departments and financial functions of each branch to the Financial Shared Service Center, as shown in Figure 2 [18]. In 2015, under the trend of digital development, Haier took the creation of an "ecosystem" platform as its strategic orientation and created the "1+7" interconnected factory platform. The "1" represents the smart life platform, which provides smart solutions based on user needs; the "7" represents interactive customization, open innovation, virtual marketing, modular procurement, smart manufacturing, smart logistics, and smart connection services.

Haier's interconnected factory integrates different digital technologies, pushing the enterprise's production supply chain to lean and flexible, greatly improving the enterprise's manufacturing capabilities, promoting the digital transformation of the enterprise's business activities, and improving the enterprise's digital finance capabilities. In 2017, Haier further upgraded its "ecosystem" platform and created the "COSMOPlat" industrial Internet platform. Based on the " employees and orders are one" and "1+7" models, the platform further breaks the boundaries between Haier's internal departments and between Haier and external stakeholders. The platform is divided into four levels: resource layer, platform layer, application layer, and model layer. The platform further strengthens the enterprise's smart manufacturing capabilities and strengthens the value sharing capabilities of the enterprise, customers, and employees. The application of this platform further strengthens Haier's digital finance upgrade and processing capabilities.

Figure 2: Shared Financial Service Center Structure.

4.2. Performance Analysis

In the process of implementing digital transformation, Haier Group established a FSSC and eliminated the financial departments and financial business of each branch. This move improved the efficiency of Haier Group's financial work processing and reduced Haier's labor costs [15]. With the evolution and application of digital information technology, the information and data processing capabilities of Haier Group's Financial Shared Service Center have been greatly improved. Compared with manual processing, it reduces information and data errors and ensures the accuracy of financial data and the real-time nature of information [15].

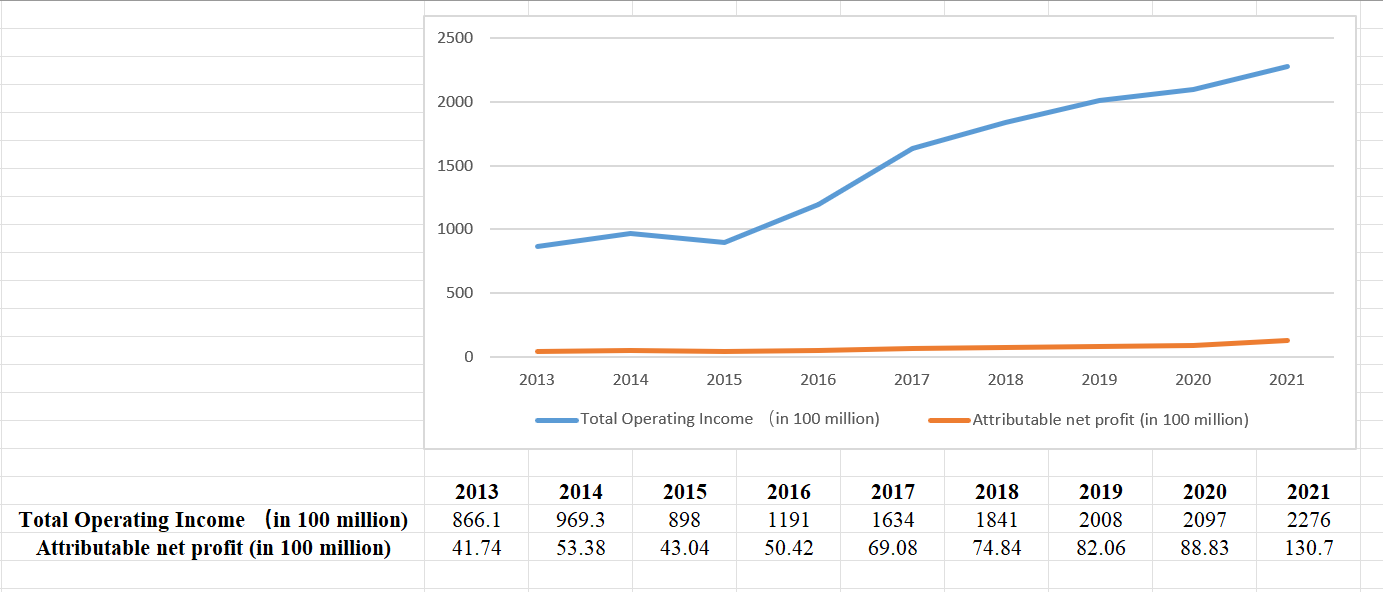

The establishment of Haier Group's Financial Shared Service Center has strengthened the enterprise's financial risk control and supervision capabilities. By formulating unified business standards for the group, eliminating communication and process differences between the enterprise and its branches, unifying financial data and information, and strengthening the ability to control financial risks and implement financial adjustments and improvements [16]. The establishment of Haier Group’s Financial Shared Service Center laid the foundation for the enterprise's comprehensive digital transformation. As a result, Haier Group was able to successfully implement the “7+1” ecosystem platform and the “COSMOPlat” industrial Internet platform, improving overall operational efficiency, which was significantly reflected in the increase in total operating income and attributable net profit, as shown in Figure 3 [17].

Figure 3: 2013-2021 Operating income and net profit.

4.3. Problems Encountered in Digital Transformation

The main problems encountered by Haier Group in the process of digital finance transformation are as follows:

• Organizational structure problems. The establishment of the FSSC changed the original communication mechanism between departments within the enterprise. At the same time, due to the unreasonable adjustment of the organizational structure and system, communication between departments was not smooth and conflicts of interest occurred between departments [18].

• Personnel problems. On account of the misunderstanding of the FSSC by senior managers of Haier Group, they failed to establish a management system and process that truly adapted to the FSSC model, which triggered Haier employees' confusion about work processes and career advancement paths, resulting in a high employee turnover rate [18].

• Information security issues. When Haier Group implemented the FSSC, due to insufficient information and digital technology application design, the financial management information system was unreasonable and imperfect, which threatened the enterprise's information and data security [18].

5. Suggestions and Implications

By analyzing the corporate background of Haier Group, the general path of digital transformation and the problems encountered during the transformation process, this article believes that the digital transformation can bring enterprises the ability to diversify their operations, and with the development and application of the technology, it can help enterprises strengthen their diversified operation advantages and reduce overall operating risks. The digital transformation of enterprises enhances the information collection ability of enterprises, reduces the organizational level and shortens the management chain, and improves the information dissemination and work coordination efficiency within and between enterprise organizations. These advantages provide favorable conditions for the diversified operation of enterprises.

With the development of the Internet economy today, competition among enterprises is becoming increasingly fierce. Enterprises should focus on the adjustment and change of the business operation model. The business operation model should be customer-oriented, link the interests of customers, employees and enterprises, and use this model as a strategic guide for the enterprises. In view of the role and status of finance in enterprises, the digital finance transformation leads the overall process. Enterprises should first carry out digital finance transformation, establish a shared financial service center, and promote the comprehensive digital transformation of enterprises with digital finance transformation as the center. Digital finance transformation is a cross-domain project. When carrying out digital finance transformation, enterprises should focus on cultivating compound talents. Compound talents should have internet and digital knowledge reserves, as well as financial management expertise. On this basis, they should strengthen the service awareness of talents, full give to the role of shared financial service centers, promote the reconstruction of various business processes of enterprises, strengthen the application and design of digital and information technology, and promote the smooth progress of digital transformation of enterprises. By implementation of the internet and digital technology, the boundaries between internal organizations of enterprises are constantly being broken, and the communication methods between organizations are constantly changing. Enterprises need to continuously reorganize and optimize their organizational structures, and continuously adjust the management systems of enterprises to adapt to the application of new technologies, and enhance the internal control of enterprises to ensure the security of digital and information. To ensure the strategic direction of digital transformation, senior managers of enterprises should improve their digital knowledge and strengthen their understanding of the needs of digital finance transformation of enterprises, so that managers can accurately judge all the resources required for digital finance transformation of enterprises.

6. Conclusion

The digital finance transformation and enterprise digital transformation of Haier Group are successful and representative. This paper reviews the previous literature and takes the digital transformation of Haier Group as a case to deeply understand the main problems encountered by Haier Group at each stage of digital transformation, and finally analyses the specific transformation path and suggestions of Haier Group. Therefore, the digital background and management model innovation ability of enterprise managers and financial managers are very important for the digital finance transformation, and play a very critical role in the overall process. The success of Haier Group's digital finance transformation has enabled Haier Group to adapt to the trend of global development in advance, and will provide complete research materials for Chinese enterprises to carry out digital finance transformation and overall digital transformation in the future. Based on the analysis of the Haier Group case, this paper provides relatively specific suggestions for subsequent enterprises to carry out digital finance transformation and overall digital transformation from the perspective of enterprise business model, personnel, organizational framework, management system and technology application management, to provide examples and lessons for the digital finance transformation of enterprises in the era of intelligent.

References

[1]. Fang, J,N. (2023) Exploration of the transformation of corporate financial management in the digital economy era. International Economics and Management, 4(5), 85-87.

[2]. Lv, W., He, R.R. and Liu Y. (2017) A brief discussion on the transformation of financial management of administrative institutions under the background of digitalization. Zhejiang Finance and Taxation and Accounting: 42-43.

[3]. Qin, R. (2018) A brief analysis of the digital transformation of financial companies under the background of big data Retrieved from: https://www.cnafc.org/cnafc/front/detail.action?id=BFB494B281B349B6B6BDFF4909125375

[4]. Zhou, J. (2020) Exploration of the digital transformation of financial management of traditional enterprises - taking PV company as an example, Accounting Monthly, First Series, 6-11.

[5]. Alam, K., Ali, M.A., Erdiaw-Kwasie, M.O., Murrary, P.A. and Wiesner, R. (2022) Digital transformation among SMEs: does gender matter?, Sustainability, 14(1), 535.

[6]. Adner, R. and Helfat, C.E. (2003) Corporate effects and dynamic managerial capabilities. Strategic Management Journal, 24(10), 1011-1025.

[7]. Prebanic, K.R. and Vukomanovic, M. (2021) Realizing the Need for Digital Transformation of Stakeholder Management: A Systematic Review in the Construction Industry”. Sustainability, 13(22), 12690.

[8]. Abou-Foul, M., Ruiz-Alba, J.L. and Soares, A. (2021) The impact of digitalization and servitization o the financial performance of a firm: an empirical analysis. Production Planning & Control, 32(12), 975-989.

[9]. Chen, H, Zhao, Y. and Dang, M. (2015) ZTE's global financial sharing informationization practice. Finance and Accounting, 15, 24-26.

[10]. He, X., Sun, J. and Liang, L. (2021) Digital transformation empowers financial transformation and upgrading - a case study based on Sinopec Northwest Oilfield Branch, Management Accounting Research, 1, 27-34.

[11]. Verhoef, P.C., Broekhuizen, T., Bart, Y., Bhattacharya, A., Dong, J.Q., Fabian, N., and Haenlein, M. (2021) Digital transformation: A multidisciplinary reflection and research agenda, Journal of Business Research, 122, 889-901.

[12]. Yu, J. (2020) Research on the path of financial digital transformation based on sharing model in the intelligent era. Academic Forum, 7, 21-25.

[13]. Zhang, Z.L. (2020) Analysis of the transformation trend of group financial organizational structure under the background of digital economy. Accounting Monthly, 14, 10-14.

[14]. Dong, X. (2017), Haier Group: Global Financial Shared Services under "People-Order Integration" | FSSC Typical Cases. Finance China | China Fashion, 17.

[15]. Zhang, S. (2020) Research on the Impact of Haier Group's Financial Shared Center Model on Enterprises, Finance and Market, 18.

[16]. Zeng, D.L., Cai, J.W. and Ouyang, T.H. (2021) Research on Digital Transformation: Integration Framework and Future Prospects. Foreign Economics and Management, 43(5), 63-76.

[17]. Guo, X.Y. and Ma, Q.H. (2022). Enterprise Digital Transformation - A Case Study Based on Haier Smart Home, Finance and Market, 188-189.

[18]. Li, X. (2022) Research on Enterprise Internal Control under the Financial Sharing Model - Taking Haier Group as an Example, Finance and Taxation Research, 1, 151-153.

Cite this article

Liu,J. (2024). Analysis of Digital Finance Transformation for the Haier Group. Advances in Economics, Management and Political Sciences,105,253-260.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Fang, J,N. (2023) Exploration of the transformation of corporate financial management in the digital economy era. International Economics and Management, 4(5), 85-87.

[2]. Lv, W., He, R.R. and Liu Y. (2017) A brief discussion on the transformation of financial management of administrative institutions under the background of digitalization. Zhejiang Finance and Taxation and Accounting: 42-43.

[3]. Qin, R. (2018) A brief analysis of the digital transformation of financial companies under the background of big data Retrieved from: https://www.cnafc.org/cnafc/front/detail.action?id=BFB494B281B349B6B6BDFF4909125375

[4]. Zhou, J. (2020) Exploration of the digital transformation of financial management of traditional enterprises - taking PV company as an example, Accounting Monthly, First Series, 6-11.

[5]. Alam, K., Ali, M.A., Erdiaw-Kwasie, M.O., Murrary, P.A. and Wiesner, R. (2022) Digital transformation among SMEs: does gender matter?, Sustainability, 14(1), 535.

[6]. Adner, R. and Helfat, C.E. (2003) Corporate effects and dynamic managerial capabilities. Strategic Management Journal, 24(10), 1011-1025.

[7]. Prebanic, K.R. and Vukomanovic, M. (2021) Realizing the Need for Digital Transformation of Stakeholder Management: A Systematic Review in the Construction Industry”. Sustainability, 13(22), 12690.

[8]. Abou-Foul, M., Ruiz-Alba, J.L. and Soares, A. (2021) The impact of digitalization and servitization o the financial performance of a firm: an empirical analysis. Production Planning & Control, 32(12), 975-989.

[9]. Chen, H, Zhao, Y. and Dang, M. (2015) ZTE's global financial sharing informationization practice. Finance and Accounting, 15, 24-26.

[10]. He, X., Sun, J. and Liang, L. (2021) Digital transformation empowers financial transformation and upgrading - a case study based on Sinopec Northwest Oilfield Branch, Management Accounting Research, 1, 27-34.

[11]. Verhoef, P.C., Broekhuizen, T., Bart, Y., Bhattacharya, A., Dong, J.Q., Fabian, N., and Haenlein, M. (2021) Digital transformation: A multidisciplinary reflection and research agenda, Journal of Business Research, 122, 889-901.

[12]. Yu, J. (2020) Research on the path of financial digital transformation based on sharing model in the intelligent era. Academic Forum, 7, 21-25.

[13]. Zhang, Z.L. (2020) Analysis of the transformation trend of group financial organizational structure under the background of digital economy. Accounting Monthly, 14, 10-14.

[14]. Dong, X. (2017), Haier Group: Global Financial Shared Services under "People-Order Integration" | FSSC Typical Cases. Finance China | China Fashion, 17.

[15]. Zhang, S. (2020) Research on the Impact of Haier Group's Financial Shared Center Model on Enterprises, Finance and Market, 18.

[16]. Zeng, D.L., Cai, J.W. and Ouyang, T.H. (2021) Research on Digital Transformation: Integration Framework and Future Prospects. Foreign Economics and Management, 43(5), 63-76.

[17]. Guo, X.Y. and Ma, Q.H. (2022). Enterprise Digital Transformation - A Case Study Based on Haier Smart Home, Finance and Market, 188-189.

[18]. Li, X. (2022) Research on Enterprise Internal Control under the Financial Sharing Model - Taking Haier Group as an Example, Finance and Taxation Research, 1, 151-153.