1. Introduction

As an essential part of the global entertainment industry, the game industry has been developing rapidly in recent years, and the market scale has been expanding. GPC and Gamma Data jointly announced that the global game market scale in 2023 will be about $184 billion and the user scale will be about 3.38 billion people, of which the Chinese game market scale will be 302.964 billion yuan and the user scale will be 668 million people. According to Newzoo's data forecast, the number of global players will continue to grow, with a compound annual growth rate of 3.7% from 2021-2026, reaching 3.68 billion players by the end of 2026. With technological advances and the popularization of the Internet, the gaming industry has not only continued to innovate in content creation and platform operation but has also demonstrated strong vitality in business models and market expansion. Especially in the context of globalisation, to obtain broader market space, advanced technology and management experience, as well as rich IP resources, overseas mergers and acquisitions (M&A) have become an important means of corporate internationalization strategy, helping enterprises to quickly enter new markets and achieve optimal allocation of resources and integration of the industry chain.

In the TMT market where the game industry is located, M&A behaviour is still a hot topic. According to an analysis report by PWC, the number of mergers and acquisitions (M&A) in the TMT industry hit a new high in the first half of 2023, with a total of about 8,500 deals announced, which is 100 more than the record 8,400 deals in the first half of 2021. Although the overall deal value of the TMT M&A market has declined due to the uncertainty of macroeconomic and geopolitical issues, along with the digitalization of services, AI and other technology's rapid development, future M&A in the TMT industry can still unleash more investment potential and opportunities.

Tencent Holdings, a leading game company in China and even in the world, set up a specialized investment department in 2008 and collated the data disclosed on its official website and mainstream media information to find that from 2005 until May 7, 2024, Tencent has invested in 1,175 mergers and acquisitions and has completed about 1,512 investment events, so it is selected Tencent for cross-border mergers and acquisitions in the game industry to analyse the performance of cross-border mergers and acquisitions in the game industry with stronger representativeness.

This paper uses a multi-case study method to refine the research object to the cross-border M&A performance research in the game industry. The main research objectives of this paper are: to combine the M&A-related literature and combine specific theories to analyse Tencent's three important M&A cases in the game market. According to the research logic of "motive - process - result", this study uses the event study method to analyse the short-term performance of Tencent's three game industry M&A (Riot Games, Supercell and Sumo Group), combined with the accounting index analysis to analyse the long-term performance of the mergers and acquisitions, and enriched the relevant literature, hoping to provide some reference for the M&A of other enterprises in the game industry[1].

2. Literature review

Mergers and acquisitions (M&A) have a broader meaning, generally referring to mergers and acquisitions. M&A is a specialised investment activity that is both complex and technical, involves a great deal of knowledge, and has therefore been described as "an advanced combination of financial and intellectual resources".

2.1. Motivation for mergers and acquisitions

Piesse et al. argue that in the context of globalisation, mergers and acquisitions (M&A) are an important method for enterprises to seek external growth and a strategic choice to enhance core competitiveness[2]. What kind of impact does M&A have on enterprises, and whether the results are positive or negative, scholars have studied the motivation for enterprises to engage in M&A from different research perspectives.

Executives are the decision-making body of listed companies to initiate M&A behaviour. From the management perspective, academics have launched a series of studies on the influencing factors of corporate M&A behaviour, which are mainly subdivided into the following research directions: the first is to examine the irrational characteristics of executives and to study the important influence of subjective factors such as executives' overconfidence and risk preference on corporate M&A behaviours[3,4]. The second is to combine the higher-order theory to study the influence of executives' demographic characteristics and executives' personal experiences on corporate M&A behaviour[5,6,7]. Third, it examines the role played by factors such as political promotion and compensation incentives in corporate M&A behaviour[8,9].

When exploring the motives of successive M&A based on the experience learning perspective, some scholars believe that the occurrence of enterprises' future M&A behaviours is caused by and influenced by the experience accumulated in the previous successive M&A, and scholars such as Fu, Q. and Fang, W., through empirical research on the sample data of the China Stock Exchange for the four years of 2003-2008, found that the existence of the M&A behaviours of the enterprise in the past three years has accumulated M&A experience, which positively promotes the occurrence of M&A behaviour of enterprises in the future[10]. Chen S. H. et al. combined the theory of failure learning, social cognitive theory and other theories to conduct empirical analysis and concluded that different degrees of M&A failure experience will produce differences in learning behaviours and effects, which in turn have different impacts on subsequent M&A performance[11].

Specifically studying the cross-border M&A behaviour of enterprises, the more representative theoretical analysis of transaction cost theory, market advantage theory and resource base theory, etc. Hennart and Park first used transaction cost theory to study the motivation of the M&A behaviour of multinational corporations, and researched the M&A behaviour of 558 Japanese subsidiaries in the U.S., and found that multinational corporations in unrelated industries can reduce investment risk, reduce the risk of investment, and reduce the risk of investment, and reduce the risk of investment, and reduce the risk of investment[12]. It was found that MNCs' M&A in unrelated industries can reduce investment risks and transaction costs. Chen Y. Z. and Li S. M. classified transaction costs into explicit costs incurred directly and implicit costs incurred indirectly and found that these two types of costs are related to the frequency of M&A and show a positive correlation[13]. Based on the theory of market dominance, Barton and Sherman showed that M&A is beneficial to the main merging firms to expand their market share and thus enhance their market power, but Focarelli and Panetta conducted an empirical study by using the data of the firms in the banking industry, and the results showed that the firms' M&A behaviours hurt their market power[14,15]. negative impact. Liang T. analyses the market reaction before and after announcing M&A events by empirically comparing 238 samples of Chinese A-share listed companies in eight industries and concludes that the market effect of overseas M&A plays a guiding role, which can bring excess returns to investors[16]. In the perspective of resource-based theory, the creation of cross-border M&A value comes from the M&A party's own ownership advantage, location advantage and internalisation advantage: of which the ownership includes tangible assets and intangible patents, technology and other aspects of the unique resources, i.e., the resources are immobile and difficult to replicate among enterprises, and different enterprises have different combinations of resources, and these unique resources and ability is the source of lasting competitive advantage of enterprises; location advantage emphasizes the cross-border mergers and acquisitions selected mergers and acquisitions subject to consider the most advantageous cost and income of the country to carry out; internalisation advantage that cross-border mergers and acquisitions through the internal administrative order communication to reduce the international pieces of the high transaction costs[17].

2.2. M&A Performance and Evaluation Methods

The assessment of corporate M&A performance is a research hotspot in the field of Western corporate finance, and scholars have tried to use different methods to argue whether M&A behaviour achieves positive results. Kumar found that M&A can produce long-term synergies and bring certain benefits to enterprises through financial ratio analysis[18]. Rani used a sample of 305 M&A samples in 2003-2018 financial data to calculate the indicators related to profitability, operational capacity, solvency, and development capacity of enterprises, and used DuPont analysis to compare the M&A performance of enterprises, and found that the profitability of enterprises has increased[19].

However, in reality, there may be listed companies in the financial statements after the reorganization of financial performance has improved but the quality of assets did not improve the problem, if the use of traditional accounting research methods is contrary to the fact of the conclusions, the application of the event study method can be effective to avoid this problem. The event analysis method is conducive to analyzing the short-term performance of corporate mergers and acquisitions, Yun X. took Youku Tudou M&A as an example, the application of event analysis and accounting indicators analysis method from the short-term and medium-to-long-term respectively, the impact of mergers and acquisitions on corporate performance, found that mergers and acquisitions in the short term to create positive value for the stockholders, in the medium and long term, the merger and acquisition of this merger and acquisition of events make the performance of the Youku present a steady upward trend[20]. In addition, there are various methods such as EVA and non-financial indicator methods. At this stage, scholars mostly use financial accounting indicators to consider the performance of corporate mergers and acquisitions, but with the advent of the era of the rise of the Internet, a single financial indicator method cannot be accurately analysed, so combined with the nature of the gaming industry to which the study case belongs in this paper, choose the appropriate research method to conduct a short-term and medium- and long-term analysis of a more comprehensive.

3. Methodology

3.1. Case Selection and Data Sources

This paper applies the event study method and the accounting indicator method to explore the impact of Tencent's three major cross-border mergers and acquisitions (M&A) in the gaming industry since 2010 on its short- and medium- to long-term performance, and the specific M&A events are summarized in Table 1:

Table 1: Overview of Tencent's three cross-border mergers and acquisitions in the game industry

Merged company | Date | Country | Transaction value ($ billion) | Percentage of shareholding |

Riot Games | 2011-02-18 | USA | 2.31 | 92.78% |

Supercell | 2016-06-21 | FI | 86 | 84.30% |

Sumo Group | 2021-07-19 | UK | 12.7 | 100.00% |

Source: Based on relevant public information.

The Tencent stock price data and Hang Seng Index data used in the event study method are calculated from the public information of the Stock Exchange of Hong Kong and the data from CSMAR, the financial information used in the accounting indicator method is from the public annual report of Tencent's official website, and the results of t-tests are calculated and output by STATA.

3.2. Methodological choices

3.2.1. Event Study Method

The event analysis method was first used by Dolley to analyse the impact of stock splits on stock price changes[21], and subsequently further refined by Ball and Brown, Fama, and Brown and Warner, it is one of the most common applications of the Capital Asset Pricing Model (CAPM), which is mainly used to determine whether the occurrence of a specific event in capital markets or corporate operations affects the market performance of a company's stock[22,23,24]. The event approach is one of the most common applications of the CAPM, which is used to determine whether the occurrence of a specific event in the capital market or a company's operations affects the market performance of a company's stock, i.e., by analyzing and calculating the change in the stock price before and after the disclosure date of the M&A event, and by assessing the extent to which a specific event affects the stock's abnormal return, to determine the capital market's or the company's reaction to the event. By applying this method, a specific M&A event can be separated from industry or market events (e.g., driven by a general market upturn, etc.), and then determine whether the M&A event causes changes in the returns of shareholders on both sides of the merger and acquisition[25].

The event analysis method mainly consists of four main steps: identifying the event, defining the event window and estimation period, selecting an appropriate model to calculate the expected return and excess return, and analyzing the excess return[20].

STEP 1: This paper is formulated to explore Tencent's three typical cross-border M&A events in terms of the main gaming industry, as shown in Table 1 above.

STEP 2: Giving full consideration to the impact of relevant policies as well as other neighbouring events of the enterprise on the research results, this paper takes the announcement date of Tencent's first M&A event as t=0, and selects a total of 21 days as the event window of 10 trading days before and after the event date (excluding blackout days and holidays), i.e., [-10,10]; and selects the 80 trading days as the estimation window of the event beforehand, i.e., [-90,-11], as shown in the following Table 2 ;

Table 2: Definitions of the event study method window

Merged company | Event date | Estimation window | Event window |

Riot Games | 2011-02-18 | 2010-10-11 to 2011-02-01 | 2011-02-02 to 2011-03-04 |

Supercell | 2016-06-21 | 2016-02-04 to 2016-06-03 | 2016-06-06 to 2016-07-06 |

Sumo Group | 2021-07-19 | 2021-03-05 to 2021-07-02 | 2021-07-05 to 2021-08-02 |

STEP 3: Based on the CAPM model, the expected return and excess return of Tencent's three M&A activity event windows are calculated with the following formulas:

\( {R_{it}}={α_{i}}+{β_{i}}{R_{mt}}+{ε_{it}}\ \ \ (1) \)

In equation (1), Rit is the real rate of return of stock i at day t, and Rmt is the real rate of return of the market at day t (the return of the Hang Seng Index is chosen as the market rate of return), and εit is the random disturbance term. The values of parameters αi and βi in equation (1) are estimated using STATA analysis to find the three cross-border M&A activity time windows to calculate the excess return based on the expected return with the following formula:

\( {AR_{it}}={R_{it}}-{\hat{R}_{it}}={R_{it}}-({α_{i}}+{β_{i}}{R_{mt}})\ \ \ (2) \)

STEP 4: The cumulative excess return of Tencent in the event window [-10,10] is calculated with the following formula:

\( {CAR_{it}}=\sum _{t=t1}^{t2}{AR_{it}}\ \ \ (3) \)

3.2.2. Accounting Indicator Approach

The Accounting Indicator Method is a method of assessing a company's value, performance or the impact of specific economic events based on the company's accounting data. This method is usually used in the fields of financial analysis, company evaluation, investment decision-making and policy assessment, etc. Specifically, it uses the accounting statements issued by the company regularly and calculates the company's accounting indicators such as solvency, profitability, development ability, cash flow and capital structure as the basis of judgment, it compares and analyses the changes of the indicators before and after the M&A act from multiple dimensions, emphasizing the long-term synergistic effect of the M&A.

Financial indicators are important factors to measure the performance of a company's M&A, which can reflect the success or failure of the company's M&A strategy and better grasp the company's operation[26]. In this paper, four indicators of solvency, operating ability, development ability and profitability are selected for analysis.

4. Results of Event Study Methods

4.1. Abnormal Returns (AR)

According to the CAPM model, the daily return data of the Hang Seng Index during the estimation window period is downloaded from the website of British Financial Intelligence as the market return Rmt, and the parameter estimation of Tencent's three cross-border M&A behaviours is derived through calculations, and the specific data pieces are shown in Table 3. According to the β-value, it can be found that there is a highly positive correlation between Tencent's stock return and market return in the three M&A activities, and the positive correlation between the two is even more significant in the third acquisition of Sumo Group, in which the β-value of the first M&A of Riot Games is higher than that of the M&A of Supercell may be since Tencent experienced the "3Q War" in 2010. The first acquisition of Riot Games has a higher beta than the acquisition of Supercell, probably because in 2010, Tencent experienced the "3Q War", carried out a comprehensive transformation and upgrade of its strategy, and launched the influential social platform software "WeChat".

Table 3: Parameter regression results of CAPM model for Tencent cross-border M&A event

Merged company | Estimation window | α | β |

Riot Games | 2010-10-11 to 2011-02-01 | 0.0017 | 0.9967 |

Supercell | 2016-02-04 to 2016-06-03 | 0.0013 | 0.9483 |

Sumo Group | 2021-03-05 to 2021-07-02 | -0.0016 | 1.4001 |

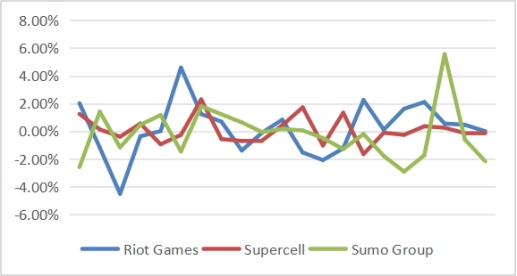

According to the parameter results shown in the above table find the expected return of Tencent stock in the event window [-10,10] for the three M&A events, and further calculate according to formula (2) to get the excess return of Tencent stock, the trend of the three M&A behaviours within the event window is shown in Figure 1 below: the excess return of Tencent stock on the day of the merger and acquisition of Riot Games and Supercell is positive, and the excess return on the day of the time occurrence of merger and acquisition of Sumo Group is negative on the day of the event.

Figure 1: Tencent's AR during the Window of Three Cross-border M&A Events

4.2. Cumulative Abnormal Return (CAR)

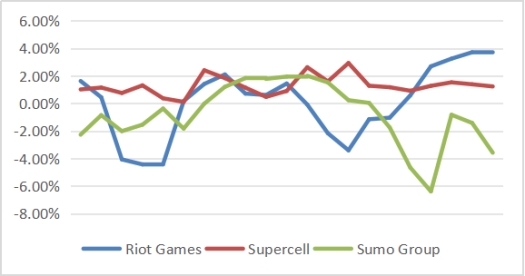

Carrying over the excess returns of the three M&A events within the event window [-10,10] derived above, this study calculates the CAR within the window [-10,10] by applying Equation (3), and the trend of the AR of the three M&A events is shown in Figure 2.

Figure 2: CAR during the Window of Tencent's Three Cross-border M&A Events

The CAR of Tencent's acquisition of Riot Games in the first phase of the window period (i.e., pre-announcement t=-10 to t=-1) shows a downward and then upward trend, and in the second phase (i.e., post-announcement t=1 to t=10) shows a rapid upward trend after t=3. The CAR during the event window of Tencent's acquisition of Supercell stays positive ex-ante. The CAR of Tencent's acquisition of Sumo Group shows a large decline in the second stage, which may hurt the company's performance.

4.3. Summary of the results of the event analysis method

Comprehensively organizing Tencent's three cross-border mergers and acquisitions in the gaming industry occurring from 2010 to 2021 to get Table 4. This study found that: the mergers and acquisitions of Riot Games and Supercell make Tencent’s shareholders obtain an average daily abnormal return and an average cumulative abnormal return (ACAR) greater than 0 within the event window [-10,10], which shows that the two mergers and acquisitions events have to a certain degree enhanced the shareholder value. While Tencent's merger and acquisition of Sumo Group within the event window [-10,10], the average daily AR obtained is -0.1853% less than 0, and the ACAR is -0.8081%, from the short-term performance analysis, Tencent's merger and acquisition of Sumo Group within the event window [-10,10] is a comparative failure, and this merger caused Tencent's shareholders to experience a significant drop in value and did not have a positive effect.

In conclusion, among Tencent's three cross-border M&A activities in the gaming industry, the M&A of Riot Games and Supercell had a positive effect on the company's short-term performance, but the M&A of Sumo Group had a negative effect on the company's short-term performance.

5. Results of Accounting Index Analysis

Combined with the time points of the three M&A occurrences, the period of 2009-2023 was selected as the analysis period. Relevant data were obtained and calculated from the Choice database and annual reports disclosed on Tencent's official website.

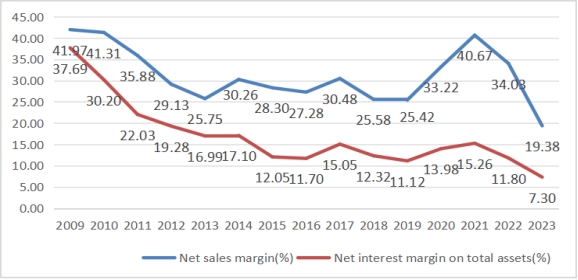

5.1. Analysis of Profitability

As can be seen from Figure 3, from 2009 to 2016 Tencent's net sales margin and net interest rate on total assets showed a downward trend and began to steadily rebound from 2016, the merger and acquisition of Supercell for Tencent's profitability enhancement has a certain positive impact. In 2021, the two indicators have a relatively large increase, in which the net sales margin from 2019 25.42% to 2021 40.67%, although there is a certain decline in the subsequent 2023, it can be shown that the Sumo Group wholly-owned merger and acquisition occurred in 2021 for Tencent's profitability to bring not a small improvement, combined with the impact of the event of Tencent's part of the game version number suspension in March 2022, the decline in the subsequent indicators in 2021 can be understood.

Figure 3: Trend of Tencent's Profitability, 2009-2023

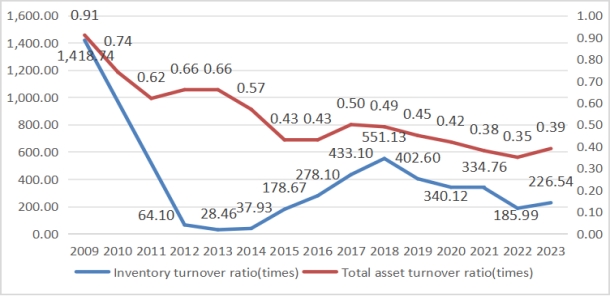

5.2. Analysis of Operating Capacity

Combined as shown in Figure 4, inventory turnover ratio and total asset turnover ratio were selected as indicators to measure the changes in Tencent's operating capacity. The inventory turnover ratio has been steadily increasing since 2011, and the increase in the inventory turnover ratio has further increased after 2016, suggesting that Tencent may have strengthened its inventory management through the acquisitions of Riot Games and Supercell. Similarly, the total asset turnover ratio showed a small increase in all three time points of 2011, 2016 and 2021, suggesting that Tencent may have strengthened asset integration and accelerated asset turnover through mergers and acquisitions.

Figure 4: Trend of Tencent's Operating Capacity, 2009-2023

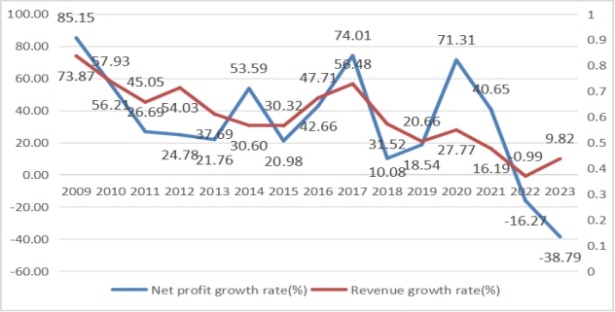

5.3. Analysis of Development Capability

Enterprise development ability is an important analytical method for understanding the development trend and development potential of the enterprise's future production and operation activities, which is usually reflected through the growth of sales revenue, the expansion of the asset scale, etc. This study selected two indicators, namely, the growth rate of total assets and the growth rate of operating income, for analysis.

Affected by market competition, in the 2009-2011 phase Tencent's development capacity indicator showed a downward trend, through the Riot Games merger and acquisition activities in 2011, Tencent actively explored the overseas game market, realizing the growth rate of operating income to achieve about 10% growth. 2016 the indicator also showed a similar trend of change. Although the operating income growth rate indicator declined in 2022, a period-on-period comparison of the same industry found that Tencent's indicator still shows a better state. It shows that the Sumo Group M&A event brings better technical support for Tencent and achieves certain synergies, and Tencent can realize faster recovery and development in the face of the impact of the epidemic and other macro-unstable factors.

Value creation brought by mergers and acquisitions has a certain lag, Tencent's net profit growth rate in 2011 and 1-3 years after 2016 has achieved a more significant increase, indicating that Tencent's mergers and acquisitions of Riot Games and Supercell integrated the subject party's resource advantages, and strengthened its competitiveness in the gaming market within a certain period, which has a positive effect on the growth of net profit in the long term. 2021 The Sumo Group merger that occurred in 2021 did not bring a significant rise in net profit, which may involve the negative impact of a longer return on investment cycle, higher integration costs, and intensified competition in the external market, of which it is worth noting that the adjusted net profit in 2023 was 157.7 billion yuan, a year-on-year increase of 36%, and Tencent's development capacity is still showing an overall positive trend.

Figure 5: Trend of Tencent's Development Capacity, 2009-2023

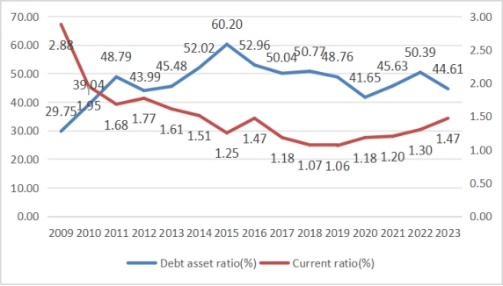

5.4. Analysis of Solvency

As a measure of the company's short-term solvency, the current ratio indicator, in 2009-2015, showed a general downward trend, of which the current ratio was slightly improved in 2012 and 2016. Since 2019, Tencent's current ratio has been improving, from 1.06 to 1.47. The gearing ratio, which is mostly used to measure the long-term solvency of the company, increased from 29.75% to 48.79% from 2009 to 2011, achieving significant improvement, and then showed an overall growth trend, reaching a maximum value of 60.20% in 2015, and then followed by a downward trend, but generally maintained at around 50%. It reached a maximum value of 60.20% in 2015, followed by a downward trend, but generally maintained at a relatively safe level of around 50%. All in all, after three typical cross-border M&A cases, Tencent's financial risk has generally shown a safe trend of decreasing.

Figure 6: Trend of Tencent's Solvency, 2009-2023

6. Discussion and Conclusion

6.1. Research Conclusion

Among the three cross-border mergers and acquisitions in the gaming industry, the mergers and acquisitions of Riot Games and Supercell achieved more obvious short-term performance improvement, while the merger and acquisition of Sumo Group harmed short-term performance.

The reasons for the short-term performance growth of the first two mergers and acquisitions may be as follows: first of all, for the first merger and acquisition, Tencent had already held about 22.34% of the shares of Riot Games before the merger and acquisition and obtained the agency right of "League of Legends" in mainland China, and carried out cooperation and communication for a longer period, and when carrying out the subsequent mergers and acquisitions, the investors in the capital market held a more positive attitude towards it; when the second merger and acquisition took place. Tencent experienced the end game for hand tour in 2014 and WeChat advertising traffic digging in 2015, its revenue and profit slowed down after entering 2016, out of the merger and acquisition of Supercell into the statement, re-enabling Tencent's financial data to enter into a state of high-speed growth, the merger and acquisition of the largest amount of a merger and acquisition case in the Chinese market at that time, attracting more investor attention, and the short-term performance may show Short-term performance may show positive growth.

Sumo Group M&A's short-term performance negative trend may be affected by the macroeconomic downturn in the past three years, the capital market showed weakness, and Sumo Group itself is not Riot Games such as the famous game IP company, to take the merger and acquisition behaviour of its motivation is more out of the company's medium- and long-term investment, Tencent's own in the game market, the long-term sustainable development.

In the long run, the three cross-border mergers and acquisitions have made Tencent's profitability and solvency more obvious progress, with a certain increase in operating capacity indicators and a lag in development capacity due to the impact of macro instability. Overall, Tencent's three cross-border M&A activities in the game industry have enhanced Tencent's market competitiveness, expanded market influence through mergers and acquisitions, and created value through the integration of related resources and advantages, which is conducive to Tencent's sustainable development in the game market in the long run.

6.2. Practical Insights

(1)Enterprises in the gaming industry should make sufficient preparations before M&A, and apply a dynamic perspective to form a comprehensive and in-depth understanding of their own and target enterprises' situations and the general environment in which they are located.

(2) Pay close attention to risk control in the process of M&A, set up a good risk response program and risk early warning system in advance, supplement and update the information promptly in the process of specific promotion, and start the relevant procedures to stop loss in time when problems are found.

(3) Enterprises carry out effective resource integration after M&A. When it comes to cross-border mergers and acquisitions, pay attention to the integration problems that are easy to ignore, such as corporate culture integration, and design relevant programs to solve them. After the merger and acquisition, both sides of the merger and acquisition of active resource integration to create value, and realize the medium- and long-term sustainable development of enterprises.

6.3. Shortcomings and Prospects

Firstly, this paper selects the more traditional event analysis method and accounting analysis method for short-term and medium- to long-term performance measurement respectively when Tencent carries out cross-border M&A performance analysis in the game industry, but considering the effectiveness of China's capital market, it can be exchanged for other methods to further control the measurement in the subsequent research to make the results more accurate. Second, there are fewer subordinate indicators selected for the analysis of the four capabilities by the accounting analysis method, which can be further supplemented with relevant indicators for the analysis. Third, the change in M&A performance is affected by many factors, according to the traditional theory can't explain the change in enterprise M&A performance comprehensively, future study need to collect and organize other information to supplement the analysis of M&A performance.

References

[1]. Jensen, M. C. and Ruback, R. S. (1983). The market for corporate control. Journal of Financial Economics. 11(1-4), 5-50.

[2]. Piesse, J, Cheng-Few Lee, Lin Lin and Hsien-Chang Kuo. (2022), Merger and Acquisition: Definitions, Motives, and Market Responses, Cham: Springer International Publishing.

[3]. Jiang, F. X., Zhang, M. and Lu, Z. F. (2009). Managerial Overconfidence, Firm Expansion and Financial Distress. Economic Research Journal. 44(01), 131-143.

[4]. Pan, A. L., Liu, W. K. and Wang, X. (2018). Managerial Overconfidence, Debt Capacity and Merger & Acquisition Premium. Nankai Business Review. 21(03), 35-45.

[5]. Malmendier, U. and Tate, G. (2008). Who makes acquisitions? CEO overconfidence and the market's reaction. Journal of Financial Economics. 89(1), 20-43.

[6]. Bernile, G., Bhagwat,V. and Rau, P. R. (2014). What Doesn't Kill You Will Only Make You More Risk-Loving: Early-life Disasters and CEO Behaviour. The Journal of Finance. 72(1), 167-206.

[7]. He, Y., Yu, W. L. and Yang, J. Z. (2019). CEOs with Rich Career Experience, Corporate Risk-taking and the Value of Enterprises. China Industrial Economics. (09), 155-173.

[8]. Lin, C., Officer, M. S. and Shen, B. (2018). Managerial Risk-taking Incentives and Merger Decisions. Journal of Financial and Quantitative Analysis. 53(2), 643-680.

[9]. Wang, S. Z. and Dong, Y. (2020). Stock Option Incentives and Firms’ M&A Behaviours. Journal of Financial Research. (03), 169-188.

[10]. Fu, Q. and Fang, W. (2008)An empirical study on managers' overconfidence and M&A decisions. Journal of Business Economics and Management. (04):76-80.

[11]. Chen, S. H., Zhang, Z. and Song, B. S. (2020). What Kind of Failure is the Mother of Success? Evidence from the Impact of M&A Failure on Subsequent M&A Performance. Business and Management Journal. 42(04), 20-36.

[12]. Hennart, J. F. and Park, Y. R. (1993). Greenfield vs. Acquisition: The Strategy of Japanese Investors in the United States. Management Science. 39(9), 1054-1070.

[13]. Chen, Y. Z. and Li S. M. (2007). Predictability of merging companies in M&A: a study from the perspective of transaction costs. Economic Research Journal. (04), 90-100.

[14]. Barton, D. M. and Sherman, R. (1984). The Price and Profit Effects of Horizontal Merger: A Case Study. Journal of Industrial Economics. 33(2), 165-177.

[15]. Focarelli, D. and Panetta, F. (2003). Are Mergers Beneficial to Consumers? Evidence from The Market for Bank Deposits. American Economic Review. 93(4), 1152-1172.

[16]. Liang, T. (2016). Comparative study on the market effect of overseas M&A of China's A-share listed companies. Journal of Maritime Business College. 17(03), 92-100.

[17]. Dunning, J. (1988). The Eclectic Paradigm of International Production: A Restatement and Some Possible Extensions. Journal of International Business Studies. 19(1), 1-31.

[18]. Kumar, M. and Bansal, L. (2008). The impact of mergers and acquisitions on corporate performance in India. Management Decision. 46(10), 1531-1543.

[19]. Rani, N., Yadav, S. and Jain, P. K. (2015). Impact of Mergers and Acquisitions on Shareholders' Wealth in Short Run: An Event Study Approach. Social Science Electronic Publishing. 40(3), 293-312.

[20]. Yun, X., Xin, L. and Liu, Y. (2015). Case Study of the M&A between Youku and Tudou--Based on Event Study Methodology and Accounting Index Analysis. Management Review. 27(09), 231-240.

[21]. Dolley, J. C. (1933). Characteristics and Procedures of Common Stock Split-Ups. Harvard Business Review. 11(3), 316-26.

[22]. Ball, R. and Brown, P. (1968). An empirical evaluation of accounting income numbers. Journal of Accounting Research. 6(2), 159-178.

[23]. Fama, E. F., Fisher, L. and Jensen, M. C., Roll, R. (1969). The adjustment of stock prices to new information. International Economic Review. 10(1), 1-21.

[24]. Brown, S. J. and Warner., J. B. (1980). Measuring security price performance. Journal of Financial Economics. 8(3), 205-258.

[25]. Zhang, X. (2003). Do Mergers and Acquisitions Create Value: Evidence from Chinese Listed Companies. Economic Research Journal. (06), 20-29+93.

[26]. Liu, J. X. (2021). Research on the performance of transnational mergers and acquisitions of Chinese enterprises. Co-Operative Economy & Science. (05), 132-133.

Cite this article

Shi,H. (2024). Research on Overseas M&A Performance of Enterprises in the Game Industry—Taking Tencent as an Example. Advances in Economics, Management and Political Sciences,90,180-191.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Jensen, M. C. and Ruback, R. S. (1983). The market for corporate control. Journal of Financial Economics. 11(1-4), 5-50.

[2]. Piesse, J, Cheng-Few Lee, Lin Lin and Hsien-Chang Kuo. (2022), Merger and Acquisition: Definitions, Motives, and Market Responses, Cham: Springer International Publishing.

[3]. Jiang, F. X., Zhang, M. and Lu, Z. F. (2009). Managerial Overconfidence, Firm Expansion and Financial Distress. Economic Research Journal. 44(01), 131-143.

[4]. Pan, A. L., Liu, W. K. and Wang, X. (2018). Managerial Overconfidence, Debt Capacity and Merger & Acquisition Premium. Nankai Business Review. 21(03), 35-45.

[5]. Malmendier, U. and Tate, G. (2008). Who makes acquisitions? CEO overconfidence and the market's reaction. Journal of Financial Economics. 89(1), 20-43.

[6]. Bernile, G., Bhagwat,V. and Rau, P. R. (2014). What Doesn't Kill You Will Only Make You More Risk-Loving: Early-life Disasters and CEO Behaviour. The Journal of Finance. 72(1), 167-206.

[7]. He, Y., Yu, W. L. and Yang, J. Z. (2019). CEOs with Rich Career Experience, Corporate Risk-taking and the Value of Enterprises. China Industrial Economics. (09), 155-173.

[8]. Lin, C., Officer, M. S. and Shen, B. (2018). Managerial Risk-taking Incentives and Merger Decisions. Journal of Financial and Quantitative Analysis. 53(2), 643-680.

[9]. Wang, S. Z. and Dong, Y. (2020). Stock Option Incentives and Firms’ M&A Behaviours. Journal of Financial Research. (03), 169-188.

[10]. Fu, Q. and Fang, W. (2008)An empirical study on managers' overconfidence and M&A decisions. Journal of Business Economics and Management. (04):76-80.

[11]. Chen, S. H., Zhang, Z. and Song, B. S. (2020). What Kind of Failure is the Mother of Success? Evidence from the Impact of M&A Failure on Subsequent M&A Performance. Business and Management Journal. 42(04), 20-36.

[12]. Hennart, J. F. and Park, Y. R. (1993). Greenfield vs. Acquisition: The Strategy of Japanese Investors in the United States. Management Science. 39(9), 1054-1070.

[13]. Chen, Y. Z. and Li S. M. (2007). Predictability of merging companies in M&A: a study from the perspective of transaction costs. Economic Research Journal. (04), 90-100.

[14]. Barton, D. M. and Sherman, R. (1984). The Price and Profit Effects of Horizontal Merger: A Case Study. Journal of Industrial Economics. 33(2), 165-177.

[15]. Focarelli, D. and Panetta, F. (2003). Are Mergers Beneficial to Consumers? Evidence from The Market for Bank Deposits. American Economic Review. 93(4), 1152-1172.

[16]. Liang, T. (2016). Comparative study on the market effect of overseas M&A of China's A-share listed companies. Journal of Maritime Business College. 17(03), 92-100.

[17]. Dunning, J. (1988). The Eclectic Paradigm of International Production: A Restatement and Some Possible Extensions. Journal of International Business Studies. 19(1), 1-31.

[18]. Kumar, M. and Bansal, L. (2008). The impact of mergers and acquisitions on corporate performance in India. Management Decision. 46(10), 1531-1543.

[19]. Rani, N., Yadav, S. and Jain, P. K. (2015). Impact of Mergers and Acquisitions on Shareholders' Wealth in Short Run: An Event Study Approach. Social Science Electronic Publishing. 40(3), 293-312.

[20]. Yun, X., Xin, L. and Liu, Y. (2015). Case Study of the M&A between Youku and Tudou--Based on Event Study Methodology and Accounting Index Analysis. Management Review. 27(09), 231-240.

[21]. Dolley, J. C. (1933). Characteristics and Procedures of Common Stock Split-Ups. Harvard Business Review. 11(3), 316-26.

[22]. Ball, R. and Brown, P. (1968). An empirical evaluation of accounting income numbers. Journal of Accounting Research. 6(2), 159-178.

[23]. Fama, E. F., Fisher, L. and Jensen, M. C., Roll, R. (1969). The adjustment of stock prices to new information. International Economic Review. 10(1), 1-21.

[24]. Brown, S. J. and Warner., J. B. (1980). Measuring security price performance. Journal of Financial Economics. 8(3), 205-258.

[25]. Zhang, X. (2003). Do Mergers and Acquisitions Create Value: Evidence from Chinese Listed Companies. Economic Research Journal. (06), 20-29+93.

[26]. Liu, J. X. (2021). Research on the performance of transnational mergers and acquisitions of Chinese enterprises. Co-Operative Economy & Science. (05), 132-133.