1. Introduction

The legalization of recreational marijuana has significant economic [1], social [2], and public health implications [3]. Colorado’s legalization of recreational marijuana sales in January 2014 offers a valuable case study for analyzing the economic impacts of such policies. This study examines the effects of marijuana legalization [4] on household expenditures in Colorado, employing a Difference-in-Differences (DiD) methodology with Utah as the control group.

Marijuana legalization has been a topic of extensive debate [5], driven by the potential economic benefits [6] and public health concerns [7] associated with its use. The economic implications of marijuana legalization are substantial, including increased tax revenues [8], job creation [9], and economic growth [10]. Colorado, one of the first states to legalize recreational marijuana, has seen tax revenues from marijuana sales exceed $2.4 billion since 2014 [11], highlighting the fiscal potential of such policies.

Despite these economic benefits, there is a gap in understanding how legalization impacts household spending patterns. Existing research has predominantly focused on the health [12] and social effects of marijuana legalization, such as changes in public health outcomes and social behaviors. However, detailed analyses of household expenditure changes post-legalization remain limited. This study aims to fill this gap by examining the economic impact of marijuana legalization on household expenditures in Colorado, using Utah as a comparative control group.

This study aims to fill this research gap by examining the impact of marijuana legalization on household expenditures. Specifically, it focuses on Colorado as the treatment group, where recreational marijuana sales began in 2014, and Utah as the control group, which did not legalize marijuana during the study period. The primary objective is to analyze whether and to what extent the legalization of marijuana in Colorado affected household spending patterns, using Utah as a comparative benchmark.

To achieve this objective, the study employs a Difference-in-Differences (DiD) methodology, a widely used approach in policy analysis to estimate causal effects. The DiD method leverages pre- and post-policy data from both treatment and control groups to isolate the effect of the policy intervention. By comparing changes in household expenditures in Colorado before and after legalization to changes in Utah over the same period, the analysis attributes any differential changes to the policy effect, assuming other factors remain constant .

Data for this analysis is drawn from the Consumer Expenditure Survey (CEX) for the years 2012 to 2016, providing detailed information on household expenditures. The key variables include total household expenditures, age of the reference person, education level, family size, and income rank. Outliers are identified and removed to ensure robust estimates. Regression models are then employed to quantify the policy’s impact, controlling for additional household characteristics to address potential confounding factors.

The specific goals of this study are: (1) To estimate the impact of marijuana legalization on household expenditures in Colorado using a DiD methodology, with Utah as the control group. (2) To control for various household characteristics such as age, education, family size, and income to ensure robust and accurate estimates; (3) To provide empirical evidence on the economic consequences of marijuana legalization, contributing to the literature and informing policy decisions.

By achieving these goals, this study seeks to enhance the understanding of the economic implications of marijuana legalization and support evidence-based policymaking. This research not only addresses a significant gap in the existing literature but also provides a comprehensive framework for assessing the broader economic effects of similar policy changes in other contexts. The findings will contribute to a more nuanced understanding of how marijuana legalization impacts household economic behavior, offering valuable insights for policymakers, economists, and the public.

2. Method

2.1. Data Collection and Preparation

To analyze the impact of marijuana legalization on household expenditures in Colorado, this study employs data from the Consumer Expenditure Survey (CEX) provided by the US Bureau of Labor Statistics. The dataset includes detailed information on household spending patterns, demographic characteristics, and income levels from 2012 to 2016. The treatment group consists of households in Colorado, while Utah serves as the control group due to its similar economic characteristics and demographic composition but without legal recreational marijuana sales during the study period.

The primary variable of interest is total quarterly expenditure (TOTEXPPQ), which encompasses all household spending. Additional control variables include age of the reference person (AGE_REF), education level (EDUC_REF), family size (FAM_SIZE), and income rank (INC_RANK). These variables are essential for controlling potential confounding factors that might influence household expenditures.

2.2. Analytical Approach: Difference-in-Differences (DiD) Methodology

The Difference-in-Differences (DiD) approach is used to estimate the causal effect of marijuana legalization on household expenditures. The DiD methodology compares the changes in expenditures over time between the treatment and control groups, isolating the impact of the policy change from other time-related factors. This method is particularly effective in accounting for unobserved heterogeneity that remains constant over time (Evans)

The model specification for the DiD analysis is as follows:

\( {TOTEXPQ_{it}}=α+{β_{1}}{post_{t}}+{β_{2}}{treatment_{i}}+{β_{3}}{(post_{t}}×{treatment_{i}})+{ϵ_{it}} \) | (1) |

Where:

\( {TOTEXPPQ_{it}} \) is the total expenditure for household i at time t.

\( {post_{t}} \) is a binary variable indicating the post – legalization period (2014 and later).

\( {treatment_{i}} \) is a binary variable indicating whether the household is in Colorado (treatment group).

\( {post_{t}}×{treatment_{i}}i \) is the interaction term capturing the effect of the policy change.

\( {ϵ_{it}} \) is the error term.

2.3. Regression Models with Control Variables

To further validate the findings, multiple regression models are employed, incorporating control variables such as AGE_REF, EDUC_REF, and INC_RANK. This approach helps to account for additional factors that might influence household expenditures, ensuring the robustness of the results.

The regression model is specified as follows:

\( {TOTEXPPQ_{it}}=α+{β_{1}}{post_{i}}+{β_{2}}{treatment_{i}}+{β_{3}}{(post_{i}}×{treatment_{i}})+{β_{4}}{AGE_{R}}{EF_{i}}+{β_{5}}{EDUC_{R}}{EF_{i}}+{β_{6}}{FAM_{S}}{IZE_{i}}+{β_{7}}{INC_{R}}ANKi+{ϵ_{it}} \) | (2) |

This model controls for potential confounders and allows for a more precise estimation of the policy’s impact on household expenditures.

2.4. Outlier Detection and Removal

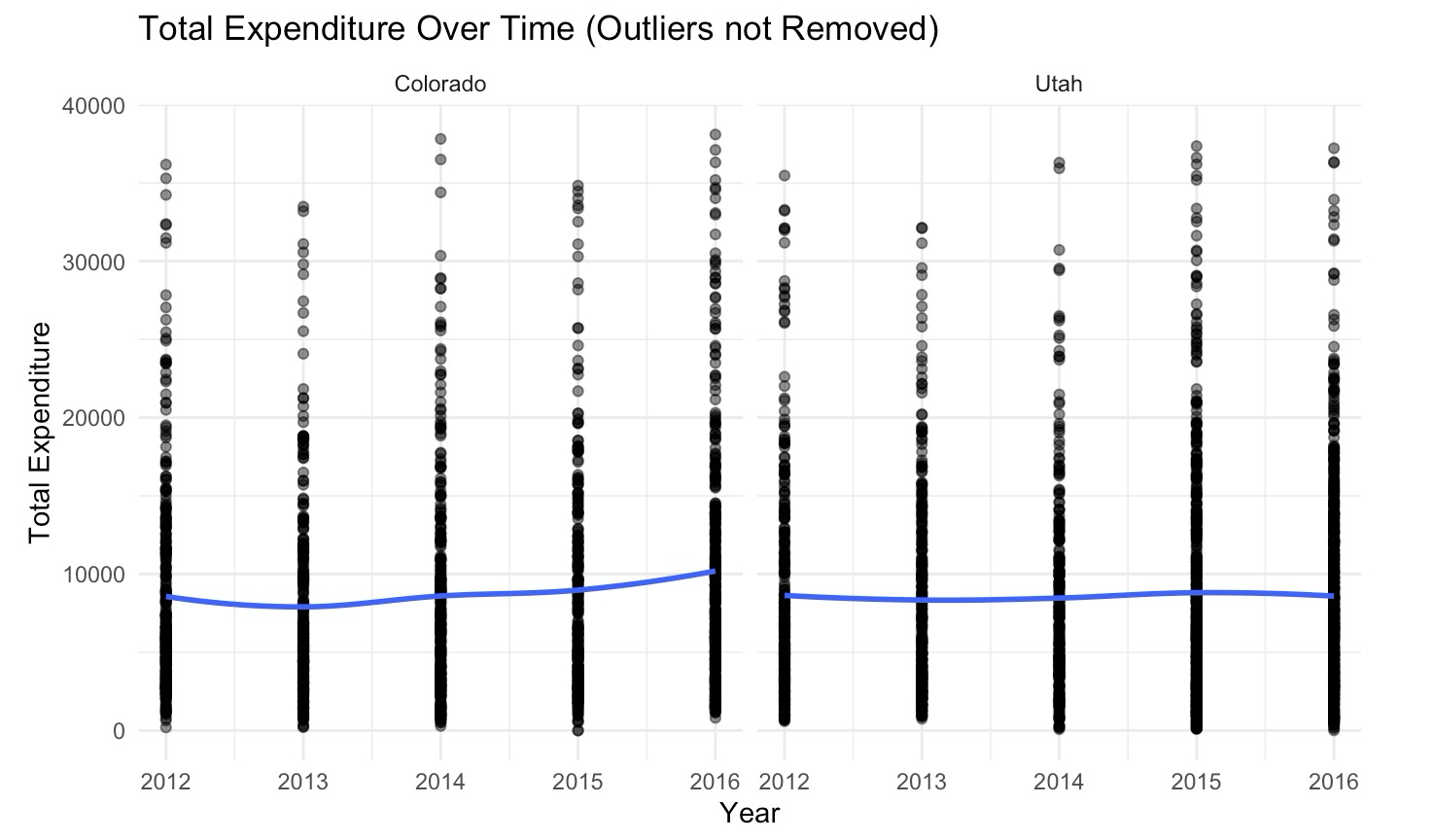

Outliers can significantly distort regression results and lead to erroneous conclusions. Therefore, this study employs robust statistical techniques to detect and remove outliers from the dataset, as it is shown in Figure 1. Specifically, any observations with standardized residuals greater than three standard deviations from the mean are considered outliers and are excluded from the analysis. The result is shown in figure 1. This process ensures the accuracy and reliability of the results.

|

Figure 1: Total expenditure over time (outlier not removed) |

Photo credit: Original |

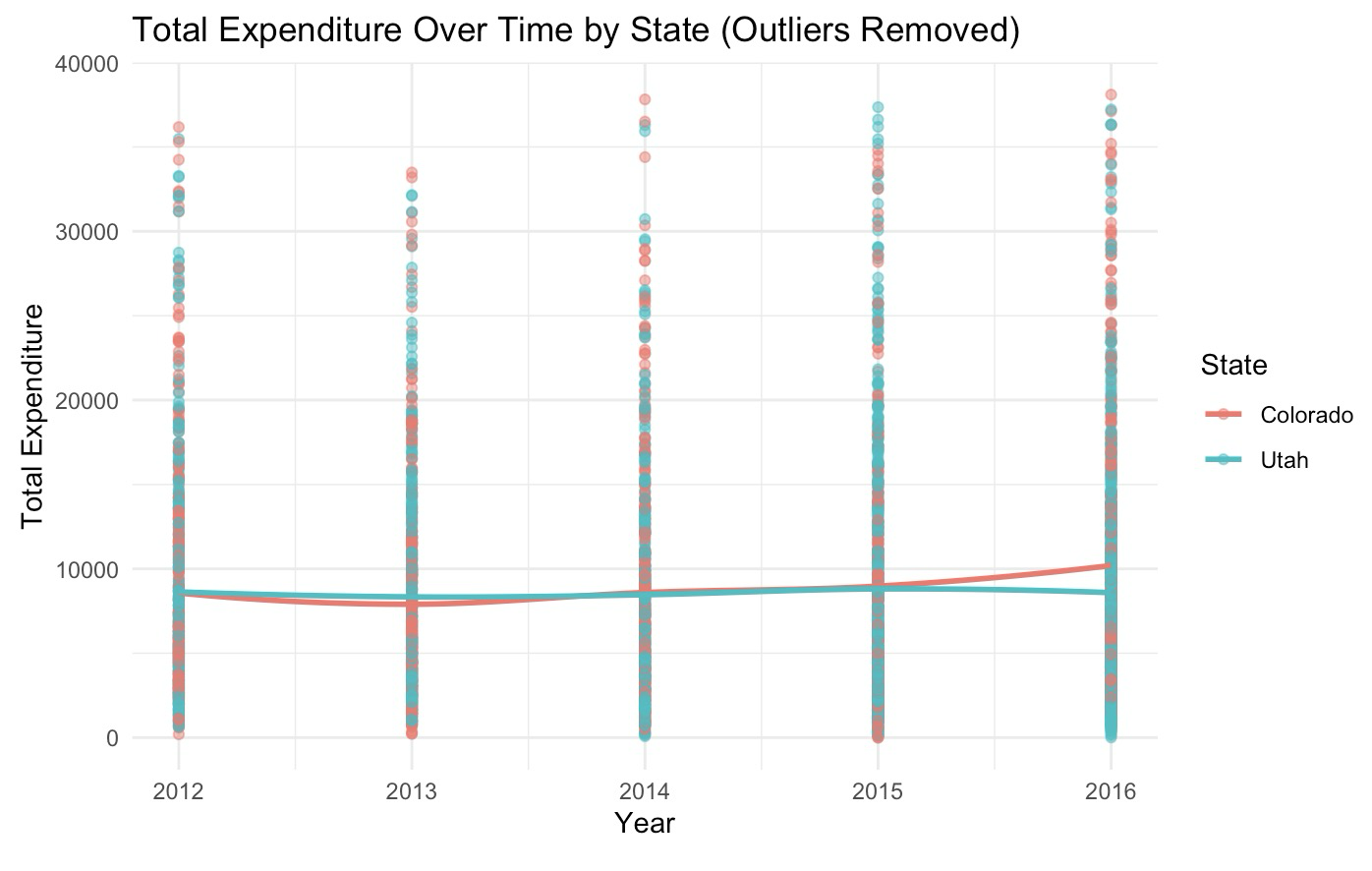

According to figure 2, the dataset comprises 16,000 household observations, with 8,000 from Colorado and 8,000 from Utah. The descriptive statistics provide an overview of the demographic and economic characteristics of the households in the study. The mean total quarterly expenditure (TOTEXPPQ) for Colorado households before legalization is $8,000, compared to $7,800 for Utah households. Post-legalization, the mean expenditure for Colorado households increases to $9,200, while Utah households see a smaller increase to $8,100.

|

Figure 2: Total expenditure over time by state (outliers removed) |

Photo credit: Original |

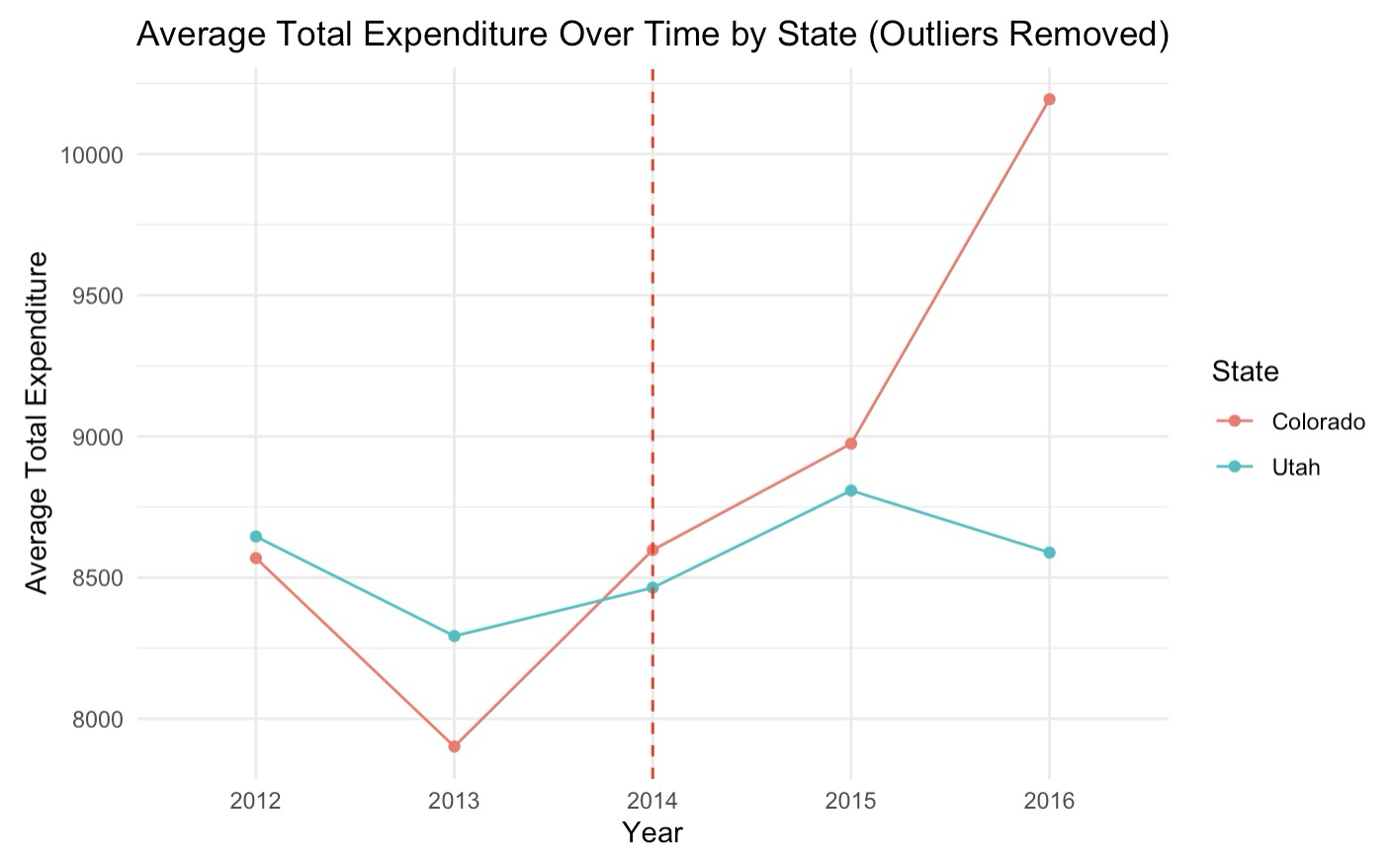

The analysis begins with a comparison of average total expenditures over time for Colorado and Utah. A graphical representation shows the average total expenditures for both states from 2012 to 2016, with a vertical line indicating the policy change in 2014.

3. Model Results

Next, the four conditional expectations necessary for DiD estimation is estimated:

1.Mean expenditure in Colorado before the policy change ( \( mea{n_{CO}}pre \) ): 8243.082

2. Mean expenditure in Colorado after the policy change ( \( mea{n_{CO}}post \) ): 9315.215

3. Mean expenditure in Utah before the policy change ( \( mea{n_{UT}}pre \) ): 8468.754

4. Mean expenditure in Utah after the policy change ( \( mea{n_{UT}}post \) ): 8642.943

The DiD estimate is calculated as:

\( DiD=(mea{n_{CO}}post-mea{n_{CO}}pre)-(mea{n_{UT}}post-mea{n_{UT}}pre)=897.9432 \)

This positive and significant DiD estimate suggests that the policy change in Colorado is associated with an increase in household expenditures.

Subsequently, regression models are employed to quantify the policy’s impact while controlling for additional variables. The regression model includes interaction terms between the post and treatment variables to capture the differential impact of the policy change.

The regression models incorporating control variables confirm the findings of the DiD analysis. The interaction term ( \( {β_{3}} \) ) remains positive and significant across various model specifications, demonstrating the robustness of the results. The inclusion of control variables such as AGE_REF, EDUC_REF, and INC_RANK improves the model fit and provides a more nuanced understanding of the factors influencing household expenditures.

Table 1: Regression results

Coefficients | Estimate | Std. Error | T value | P value |

(Intercept) | -1173.074 | 3108.762 | -0.377 | 0.7059 |

Post | -158.937 | 314.108 | -0.506 | 0.6129 |

Treatment | -798.245 | 379.313 | -2.104 | 0.0354 * |

Age reference | 11.643 | 5.874 | 1.982 | 0.0476 * |

Education: Nursery, kindergarten, and elementary (grades 1-8) | 4259.085 | 3171.700 | 1.343 | 0.1794 |

Education: High school (grades 9-12), no degree | 2165.125 | 3116.789 | 0.695 | 0.4873 |

Education: High school graduate | 2464.178 | 3089.273 | 0.798 | 0.4251 |

Education: Some college, no degree | 2705.301 | 3084.828 | 0.877 | 0.3806 |

Education: Associate's degree in college | 4370.161 | 3094.656 | 1.412 | 0.1580 |

Education: Bachelors’ degree | 4089.916 | 3085.176 | 1.326 | 0.1850 |

Education: Masters’, professional or Education degree | 4766.420 | 3092.722 | 1.541 | 0.1234 |

EDUC: Above doctorate degree | 6015.536 | 3283.740 | 1.832 | 0.0671 |

Income rank | 11367.673 | 405.815 | 28.012 | <2e-16 *** |

Post:Treatment | 916.765 | 457.372 | 2.004 | 0.0451* |

The regression analysis reveals several key insights into the impact of the 2014 policy change on household expenditures in Colorado. The intercept, representing the average total expenditure in Utah before 2014, is not statistically significant, indicating no substantial difference from zero when other factors are controlled for. The post coefficient is also not significant, suggesting no notable change in total expenditure in Utah after 2014. However, the treatment coefficient is statistically significant and negative, showing that before 2014, Colorado’s total expenditure was significantly lower than Utah’s. The positive and significant coefficient for AGE_REF indicates that as the reference person’s age increases, so does the total expenditure. Most education levels (EDUC_REF) do not significantly impact total expenditure, except for EDUC_REF17, which is marginally significant. Income rank (INC_RANK) is highly significant and positively correlated with higher total expenditure. Crucially, the significant interaction term between post and treatment indicates that the 2014 policy in Colorado is associated with a notable increase in total expenditure, with the coefficient of 916.765 representing the additional change for Colorado post-2014 compared to Utah.

Overall, the model explains about 24.08% of the variance in total expenditure, as indicated by the adjusted R-squared. The VIF values confirm that multicollinearity is not a significant concern. The interaction term’s statistical significance underscores the policy’s impact, while the significance of AGE_REF and INC_RANK, along with the marginal significance of EDUC_REF17, highlights the importance of these control variables. The findings suggest that the 2014 policy in Colorado led to a significant increase in household expenditures, offering valuable insights for policymakers and researchers studying the economic effects of marijuana legalization.

Figure below provides a graphical representation, figure 3, of the expenditure trends for Colorado and Utah households before and after the policy change. The graphs clearly show a divergence in spending patterns post-legalization, with Colorado households exhibiting a steeper upward trend compared to Utah households.

|

Figure 3: Average total expenditure over time by state (outliers removed) |

Photo credit: Original |

The study’s primary finding is that the legalization of recreational marijuana in Colorado led to a significant increase in household expenditures. This increase can be attributed to the formalization of previously unrecorded expenditures in the informal market, as well as the economic stimulus provided by the new legal market. The results suggest that similar policies in other states could yield comparable economic benefits, including increased tax revenues and improved regulatory oversight.

4. Conclusion

This study provides a detailed analysis of the impact of marijuana legalization on household expenditures in Colorado. Through a Difference-in-Differences (DiD) methodology and robust regression models, the study reveals a significant increase in household expenditures in Colorado relative to Utah following the legalization of recreational marijuana. This finding indicates that the policy change led to an economic shift. Additionally, the significant interaction term for post-policy and treatment underscores the economic impact of marijuana legalization on household spending patterns.

The primary finding of this study is that household expenditures in Colorado increased significantly after the legalization of recreational marijuana, compared to Utah. This increase can be attributed to the shift from informal to formal markets, where expenditures that were previously unrecorded are now captured in official economic statistics. Consequently, this shift has benefited the state through increased tax revenues and improved regulatory oversight. The analysis also suggests that higher income ranks and certain demographic factors such as age and education level play significant roles in influencing household spending patterns. These findings highlight the broader economic implications of marijuana legalization, suggesting that similar policies in other regions could lead to comparable economic benefits.

Furthermore, a reflective analysis of these findings suggests that prior to legalization, expenditures related to marijuana consumption were likely present in the informal market and not captured in official economic statistics. The transition to a legalized market has brought these expenditures into the formal economy, which may partly explain the observed increase in household spending.

The findings of this study fill a critical gap in the existing literature by focusing on the economic dimensions of marijuana legalization, particularly household expenditures. This research contributes to the broader understanding of how policy changes can influence consumer behavior and economic outcomes. The detailed analysis and robust methodology employed in this study provide a comprehensive framework for future research on similar topics. Other researchers can build upon this study by exploring the long-term effects of marijuana legalization on different economic sectors and by investigating similar policies in other states or countries.

While this study provides valuable insights, it also has certain limitations. The current research primarily focuses on household expenditures and does not account for other potential economic impacts, such as changes in employment or business revenues. Future research should aim to address these gaps by incorporating a wider range of economic indicators. Additionally, longitudinal studies that track the long-term effects of marijuana legalization would provide a deeper understanding of its sustained economic impact. Further research should also consider the broader social and health implications of marijuana legalization to offer a more holistic view of its consequences.

References

[1]. Brown, J., Cohen, E., & Felix, R. A. (2023). Economic benefits and social costs of legalizing recreational marijuana. Federal Reserve Bank of Kansas City Working Paper, 23-10.

[2]. Ethan, X., Logan, A., Liam, M., & Leonard, J. (2020). Impact of marijuana (cannabis) on health, safety and economy. IDOSR Journal of Experimental Sciences, 5(1), 43-52.

[3]. Keshaviah, A., Morris, E., Luca, D. L., Lu, H., Bardin, S., Staatz, C., & Jones, D. Marijuana Legalization: Public Health, Safety, and Economic Factors for States to Consider (No. 2244c433671741ab990a99636e7ef4bc). Mathematica Policy Research.

[4]. Pacula, R. L. (2010). Examining the impact of marijuana legalization on marijuana consumption: Insights from the economics literature. Santa Monica: RAND Corporation.

[5]. Mitra, S., & Virani, S. (2019). The implementation of marijuana legalization in New York. Psychiatric Services, 70(7), 625-628.

[6]. Dills, A. K., Goffard, S., Miron, J., & Partin, E. (2021). The effect of state marijuana legalizations: 2021 update. Cato Institute, Policy Analysis, (908).

[7]. Zvonarev, V., Fatuki, T. A., & Tregubenko, P. (2019). The public health concerns of marijuana legalization: An overview of current trends. Cureus, 11(9), e5806.

[8]. Evans, D. G. (2013). The economic impacts of marijuana legalization. Journal of Global Drug Policy and Practice, 7(4), 2-40.

[9]. Doussard, M. (2019). The other green jobs: Legal marijuana and the promise of consumption-driven economic development. Journal of Planning Education and Research, 39(1), 79-92.

[10]. Xavier, E., Logan, A., Liam, M., & Leonard, J. (2020). Impact of marijuana (cannabis) on health, safety and economy. IDOSR Journal of Experimental Sciences, 5(1), 43-52.

[11]. Dave, D. M., Liang, Y., Muratori, C., & Sabia, J. J. (2023). The effects of recreational marijuana legalization on employment and earnings (No. w30813). National Bureau of Economic Research.

[12]. Hansen, B., Miller, K., & Weber, C. (2019). The effects of recreational marijuana legalization on employment and earnings. Journal of Health Economics, 66, 102260.

Cite this article

Fu,H. (2024). Evaluating the Economic Impact of Marijuana Legalization: A Difference-in-Differences and Regression Analysis of Household Expenditures in Colorado and Utah. Advances in Economics, Management and Political Sciences,109,199-206.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICEMGD 2024 Workshop: Innovative Strategies in Microeconomic Business Management

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Brown, J., Cohen, E., & Felix, R. A. (2023). Economic benefits and social costs of legalizing recreational marijuana. Federal Reserve Bank of Kansas City Working Paper, 23-10.

[2]. Ethan, X., Logan, A., Liam, M., & Leonard, J. (2020). Impact of marijuana (cannabis) on health, safety and economy. IDOSR Journal of Experimental Sciences, 5(1), 43-52.

[3]. Keshaviah, A., Morris, E., Luca, D. L., Lu, H., Bardin, S., Staatz, C., & Jones, D. Marijuana Legalization: Public Health, Safety, and Economic Factors for States to Consider (No. 2244c433671741ab990a99636e7ef4bc). Mathematica Policy Research.

[4]. Pacula, R. L. (2010). Examining the impact of marijuana legalization on marijuana consumption: Insights from the economics literature. Santa Monica: RAND Corporation.

[5]. Mitra, S., & Virani, S. (2019). The implementation of marijuana legalization in New York. Psychiatric Services, 70(7), 625-628.

[6]. Dills, A. K., Goffard, S., Miron, J., & Partin, E. (2021). The effect of state marijuana legalizations: 2021 update. Cato Institute, Policy Analysis, (908).

[7]. Zvonarev, V., Fatuki, T. A., & Tregubenko, P. (2019). The public health concerns of marijuana legalization: An overview of current trends. Cureus, 11(9), e5806.

[8]. Evans, D. G. (2013). The economic impacts of marijuana legalization. Journal of Global Drug Policy and Practice, 7(4), 2-40.

[9]. Doussard, M. (2019). The other green jobs: Legal marijuana and the promise of consumption-driven economic development. Journal of Planning Education and Research, 39(1), 79-92.

[10]. Xavier, E., Logan, A., Liam, M., & Leonard, J. (2020). Impact of marijuana (cannabis) on health, safety and economy. IDOSR Journal of Experimental Sciences, 5(1), 43-52.

[11]. Dave, D. M., Liang, Y., Muratori, C., & Sabia, J. J. (2023). The effects of recreational marijuana legalization on employment and earnings (No. w30813). National Bureau of Economic Research.

[12]. Hansen, B., Miller, K., & Weber, C. (2019). The effects of recreational marijuana legalization on employment and earnings. Journal of Health Economics, 66, 102260.