1. Introduction

Otome games are story-based romance video games targeted at women who seek to develop romantic relationships between one female player and multiple male leads. Initiated by Japan in the late 1990s, the popularity of otome games has gradually spread to neighboring countries such as Korea and China, even extending its reach to some western countries. Since the release of Love and Producer in 2017, China has experienced unprecedented prosperity in domestic otome games, drawing scholars to dig into this phenomenon. While research quantity remains limited in such an emerging area, researches on Chinese domestic otome games are primarily analysed from a social-cultural perspective, such as the awakening of feminism, identification of female identities, and compensation for women’s needs. However, as a growing type in the game market and an area with immense consumption potential, otome games have high business studying value waiting to be discovered. Also, existing research methods on domestic otome games are mostly studies of earlier otome game cases, but with the rapid development of the Chinese otome game industry, it’s essential to update new cases and compare them with previous ones to gain insights into the future development of domestic otome games.

This paper cites Love and Deepspace as a burgeoning yet strongly competitive Chinese otome game to analyze the reasons for its success, thereby reflecting the characteristics of contemporary domestic otome game consumers. This paper probes into Love and Deepspace’s distinct marketing strategy by using the 4P model and incorporating data to support its effectiveness. By discussing Love and Deepspace alongside other domestic otome games, this article aims at reaching a generalized conclusion on how marketing strategies are formulated based on features of domestic otome game consumers, thus assisting otome game companies in market planning with a better understanding of their target users.

2. The Status Quo of Chinese Domestic Otome Game

2.1. The Development of Chinese Domestic Otome Game

As a type of female-oriented game (games designed specifically for female users), otome games started relatively late in China, with merely a few years’ time to take root and sprout. Some researchers have categorized the development of female-oriented games in China into three periods, according to the release of certain phenomenal games [1].

During the earlier exploratory phase (2013-2016), games derivated from popular films and TV IPs unintentionally attracted the female audience. It was not until Nikki Up2U: A Dressing Story (2013), a game of fashion and dress-up, that domestic games started targeting female players. One of the representative female-oriented games in the second phase (2016-2017) is Onmyoj (2016), a card battle game with a female aesthetic visual presentation. Despite its large female player base, due to its overall intense competitiveness, Onmyoj’s initial female orientation faded into a gender-neutral one. In the current maturity stage (2017-now), following the Nikki series, Papergames released the first domestic otome game in China, Love and Producer (2017), bringing unforseeable changes to the market: not only have female-oriented games thrived unprecedently, but the number and proportion of otome games in the domestic female-oriented gaming market have grown to a predominant state.

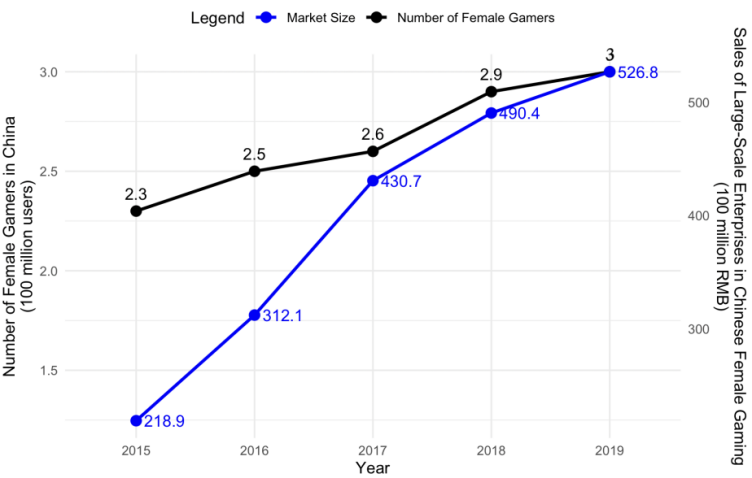

Take Love and Producer’s year of release as Chinese domestic otome game’s milestone, as a result of which, the Chinese female gaming market was significantly influenced. Figure 1 below demonstrates information on the Chinese female gaming market from 2015 to 2019, reflecting that not only did the year 2017 embrace the sharpest growth in female gaming sales revenue (increased by 38% from 2016 to 2017), but after 2017, when Chinese domestic otome games started to flourish, the number of female gamers climbed significantly (increased by 11.5% from 2017 to 2018).

Figure 1: Chinese Female Gaming Market Condition (2015-2019) [2]

2.2. The Current State of Chinese Domestic Otome Game Industry

On January 18th, Paper Studio and Netease launched Love and Deepspace and Beyond the World respectively, igniting a competition for female users in 2024. These two dark horses have shaken up the existing status of the “Big Four” (Light and Night, Love and Producer, Tears of Themis and Time-Limited Drawing Traveller) in the Chinese domestic otome game industry.

According to data compiled from Diandian Data and Qimai Data, up until the 1st quarter of 2024, Love and Deepspace and Beyond the World had surpassed the revenue of the “Big Four” established otome games, ranking first and second in the Chinese domestic otome gaming market. Moreover, revenue from Beyond the World in the first 3 months generated more revenue than the “Big Four” combined, and Love and Deepspace’s revenue was 1.5 times more than that amount. As a new entrant to the otome game market in early 2024, not only does Love and Deepspace boasts astonishing quarterly revenue, but also owns the highest number of servers and the highest overseas quarterly revenue among these six top domestic otome games. Hence, for its burgeoning and success, it would be beneficial to study the lightspots of Love and Deepspace’s marketing strategy. Moreover, this strategy, to some extent, accurately reflects the characteristics of contemporary consumers of Chinese domestic otome games, which is also worth summarizing.

3. Marketing Strategy of Love and Deepspace

Philip Kotler notes that marketing is a process of creating, communicating, and delivering values to customers in ways that benefit the organization and its stakeholders [3]. This definition is built upon Jerome McCarthy’s 4P marketing model in the 1960s, which stated Product, Price, Place, and Promotion as four aspects of a strategic framework for marketers to meet consumer needs effectively [4]. As participants in the gaming market, otome game companies aiming at satisfying female players should not be any different when framing their marketing strategy.

3.1. Product Strategy

Like any other Chinese domestic otome game, Love and Deepspace aligns with the general game theme of adventure and romance. What makes it unique, however, is its art style. Love and Deepspace is the first Chinese otome game to replace semi-anime 2D character design with semi-realistic 3D modeling. It currently has the highest level of female protagonists’ facial customization options: with 3D technology, female players are closer than ever to crafting their in-game characters to resemble their real-life appearance or ideal selves. Also, the game has incorporated dressing technology from its company’s Nikki series, dressing up characters in realistically detailed outfits, and enhancing the realism of in-game characters on top of the already exquisite human modeling.

The 3D art style has offered Love and Deepspace the opportunity to make common otome gameplay more appealing and to create new gameplay, for it further enhances immersion for female players by simulating reality. In the essential otome game companion system, players can freely adjust their viewing angle, observing male leads with no blind spots during daily interactive scenes such as exercising or studying. This level of realness gives them the illusion that such perfect men exist. Among Love and Deepspace’s innovative gameplay, Photo Studio would not have acheive its current popularity without 3D design because female players obtain a sense of real intimacy with the male leads and they can use their own 3D avatars in the photos taken. Additionally, owing to 3D art design, Love and Deepspace is able to introduce the first lightweight PVE combat system in domestic otome games. Players fight against enemies alongside a male leading companion on a semi-AR platform [5]. This combating system has been welcoming because it is more engaging than the simple mini-games of traditional otome games and easier to pick up than other mainstream competitive games.

3.2. Price Strategy

Love and Deepspace follows the typical free-to-play and in-app-purchase pattern. The mainstream Chinese domestic otome games on the market provide purchases usually in the form of tiered-priced gift packs and monthly cards, providing game items mainly for gacha draws, and these gacha pools have a guarantee system---how many draws guarantee reward acquisition. Love and Deepspace ’s gacha pool, called “wishes,” unlocks different memories (interactions with different variants of male leads) of the male leads. Although the game guarantees players a 5-star memory (the highest quality memory) per 70 wishes, for players who want to collect different memories of their preferred male leads, it is almost impossible for them to obtain every desired memory under the game’s 5-Star Limited Rate UP Pool’s rules without making any in-game purchases. This is how Love and Deepspace makes its earning from gacha draws.

Currently, the game has categorized 5-star memories into permanent and limited ones, among which limited ones can only be drawn in corresponding 5-Star Limited Rate UP Pools. The limited pools adopt a dual guarantee system: if the first 5-Star memory drawn is permanent, the next one guarantees limited, meaning that limited memories are actually guaranteed per 140 wishes. According to Table 1, in the first 3 months of its opening, Love and Deepspace has organized 8 limited pools, with intervals of mostly 2 days or less. The duration of these pools is positively correlated to the number of limited 5-star memories released. During the first quarter of 2024, the longest interval between one character’s two successive limited pools is 21 days (Xavier 2.19-3.11). On the premise of completing daily activities and subscribing to a monthly card, the collected game items, converted into wishes, would merely be around 37 draws. Compelled by a sense of urgency and exclusivity, players have no choice but to make more in-game purchases [6].

Table 1: 2024 1st Quarter Schedule of 5-Star Limited Rate UP Pool of Love and Deepspace

Character Date Number of Memories | Xavier | Zayne | Rafavel |

2024.1.18-2024.1.26 | 1 | ||

2024.1.27-2024.2.4 | 1 | ||

2024.2.5-2024.2.19 | 1 | 1 | 1 |

2024.2.21-2024.2.29 | 1 | ||

2024.3.1-2024.3.8 | 1 | ||

2024.3.11-2024.3.23 | 1 | 1 | 1 |

Another important source of revenue for Love and Deepspace is its exquisite yet exceptionally expensive male clothing. While the “Big Four’s ” male character costumes are priced at around 50 RMB, Love and Deepspace’s regular price is set at 128 RMB, doubling the regular price of other otome games’ costumes even during discount periods. However, players are willing to “pay” the price because instead of purchasing them directly through top-up payments like other otome games, they can pay in “crystals,” a type of in-game currency that the monthly card includes as a monthly bonuses. Generally, the crystals given with a 4-month subscription to the monthly card are enough to exchange one of set outfit. Hence, many players subscribe to this service for multiple months and find it very worthwhile, enjoying monthly resources and getting a set of clothing “for free” as a bonus. In turn, Love and Deepspace’s monthly card service not only generates revenue but also increases players’ retention.

3.3. Place Strategy and Promotion Strategy

Basically, Chinese domestic otome games support digital downloads through websites and application stores, available on both Android and iOS platforms. With the floushing of otome game market, these domestic games are gradually achieving data interoperability between Android and iOS platforms, expanding from mobile to PC, and stepping foot into the overseas market. The most significant feature of Love and Deepspace’s place strategy is its extensive coverage. Currently, the game has provided free data interoperability service, accomplished comprehensive coverage of mobile and PC platforms, and launched the most overseas servers among mainstream domestic otome games. Not only has Love and Deepspace achieved remarkable success domestically, as stated above, but also it has entered Tier 1 markets in various countries and regions overseas. According to Dataeye’s observation, as of March 2024, this game has topped multiple free charts and entered the Top 10 of best-seller charts in Taiwan, Canada, Japan, and other countries worldwide [7]. These remarkable global achievements are inseparable from Love and Deepspace’s strong promotion strategy.

The core of Love and Deepspace’s strategy is IP-based promotion. Based on the goals of building and utilizing a recognizable brand, strengthening connections with players, and driving revenue growth, IP-based promotion involves developing and promoting game-related contents that possess “inherent value and a dedicated fan base” [8]. Since the game’s global promotion strategies perform similarly across countries, its promotion in China will be analyzed as an example.

Table 2: 2024 1st Quarter Promoting Activities of Love and Deepspace in China

Date | Partner | Content | Promotion Type |

2024.1.8 | Sarah Brightman | Title Song Performance | Co-Branding |

2024.1.15-2024.2.13 | Changguang Satellite | Satellite Launch with Blessing | Cultural Integration |

2024.1.24 | ANAN Magazine | Inclusion of Game Illustrations | Co-Branding |

2024.1.18-2024.2.18 | Little Red Book, Tiktok, WeiBo, Bilibili | Content Creation Contests | Online-Media Propoganda |

2024.2.4 | Apple | Launch of Vision Pro Program | Co-Branding |

2024.2.5 | Sartoria Pirozzi | Male Leads’ Ties Design | Co-Branding |

2024.2 | Harbin | Zayne’s Snow Sculpture Show | Check-in Spots |

2024.2.3-2024.2.28 | Little Red Book | Unlock Male Leads’ Voices Through Topic Participation | Online-Media Propoganda |

2024.3.1-2024.3.30 | Little Red Book,WeiBo | Rafavel’s Birthday Themed Content Creation Contests | Online-Media Propoganda |

2024.3.6 | Xiyue Zhang | Preserved Shell Carving of Rafavel | Cultural Integration |

2024.3.6 | Bilibili | Rafavel’s Birthday’s Live Broadcast | Online-Media Propoganda |

2024.3.11-2024.4.21 | Little Red Book, Tiktok, WeiBo, Bilibili | Content Creation Contests | Online-Media Propoganda |

It can be observed from Table 2 that Love and Deepspace comprehensively utilized various approaches to promotion, and these activities are scheduled back-to-back with no brakes. While the game’s “inherent value” has been enriched by collaborating with renowned institutes and incorporating elements of local culture, Love and Deepspace has rapidly cultivated its fan base through cross-media expansion, broadening its impact through online propaganda and offline check-ins [8].

Specifically, Love and Deepspace takes great importance in building and running the game’s online communities, especially Little Red Book and Weibo, which are where the game’s most dedicated fans communicate and provide feedback to the game producer. In an era of customer advocacy and equal online expression, a well-managed gaming community is crucial for game promotion, as an active atmosphere is a major source of players' advertising, and their positive reviews enhance the credibility of such advertising, which is often more persuasive than advertisements issued by the game itself [9-10]. Besides, Love and Deepspace’s single-player combating system and no-chatting friend system shift the enthusiasm of players’ discussion from within the game to mainstream social media, increasing discussion and visibility of the game’s relative topics. On the other hand, the game increases positive reviews through frequent Content Creation Contests, while effectively collecting and addressing negative feedback in ways such as apologies and compensation, thus improving its reputation online.

4. Features of Chinese Domestic Otome Game Consumers

Love and Deepspace’s marketing strategy provides insights into its relationship with the characteristics of contemporary consumers of Chinese domestic otome games.

The game’s two emphasis on price strategy reveals female players’ willingness to consume visual stimulation and interactive bonds. For one thing, Love and Deepspace’s dress-up goods, combined with 3D modeling, satisfy players’ desire for sexual tensions in male bodies, attire, and movements. For another, owing to the general guarantee rule of domestic otome games, players who spend money on gacha drawing are filled with the mindset that spending money guarantees better service from the male leads.

Regardless of the spending they choose, many female players show no regrets about lavishing on virtual characters as long as they obtain emotional joy. Yet, this does not mean that otome game consumption is blind. Rather, female players are aware of their spending actions and they are supporting their favorite characters, not the game itself [11]. This clear awareness is manifested in how they express their requests through game communities and utilize such communities’s social attributes to unite and boycott spending when game producers keep going against their wishes [11]. Since female players are proactive in their spending, Love and Deepspace pays special attention to the operation of gaming communities in their promotion strategy. One of otome games’ major features, is capitalizing on players’ needs and continuously updating the contents that they are willing to consume.

Domestic otome game players’ willingness to spend is driven not only by immersive romantic experiences like most would expect but, more importantly, by a sense of control over the game. Love and Deepspace created in-game power for female players in its product strategy by setting the female protagonist’s role as someone who can influence the world built in the story with her great talent and intelligence. Also, the game reinforced her strength and independence through her leadership in the new combat system. Additionally, as has been mentioned before, female players possess the power to influence the game’s development even outside of it. Therefore, it can be concluded that female players of Chinese otome games are seeking to mitigate their real-life disadvantages by surpassing male leads in games and fighting for rights against game producers outside games.

5. Conclusion

After a comprehensive analysis of Love and Deepspace’s marketing strategy, it can be seen that this dark horse has carried forward and innovated the marketing strategies of the Chinese domestic otome game industry. In its product strategy, Love and Deepspace boldly uses 3D modeling as the main selling point, deepening the immersive romantic experience and designing new gameplay based on this technology. Owing to 3D modeling, the game’s pricing strategy promotes revenue and user retention primarily with its gacha draws and apparel commodies. The multifaceted, consumer-centric IP-based promotion strategy of Love and Deepspace serves as a key factor in its success in global positioning. This paper also emphasizes that such marketing choices are not without basis, they are instead founded on Love and Deepspace’s acute understanding of the majority of female consumers in Chinese domestic otome game market, such as players’ willingness to pay for emotional joy through visional stimulation and romantic bonds with male leads, as well as the awakening of female consciousness, resulting in an eager to winning control over virtual characters and game development.

Companies can borrow Love and Deepspace’s marketing strategy or learn about otome game’s target users from this case. Yet this does not interprets that the game’s strategy is not without its flaws. This paper has not discussed the issues of player dissatisfaction and operational missteps that actually occured after the Love and Deepspace’s release. Moreover, current analysis only concludes the game’s boom during its first 3 months, it is possible that its popularity is merely a hallmark of any newly released game. After the novelty wears off, the answer to how a large player base and their willingness to consume will be maintained, lies in future tests of Love and Deepspace’s marketing strategy.

References

[1]. Y.X., Xie, (2018). Interpretation of the female user group in the development process of Chinese female-oriented mobile games. Audiovisual, 5, 151-152.

[2]. LeadLeo Research Institute. (2020). Overview of the Chinese female gaming industry. LeadLeo. https://www.leadleo.com/pdfcore/show?id=6004ee8320410e67ca9557ec

[3]. Kotler, P. (1967). Marketing management: Analysis, planning, andcontrol. Prentice-Hall.

[4]. McCarthy, J. E. (1960). Basic marketing: A managerial approach. Richard D. Irwin, Inc.

[5]. Love and Deepspace Wiki. (2024, July 24). Combat. Fandom. Retrieved from https://loveanddeepspace.fandom.com/wiki/Combat

[6]. Lei, Q., Tang, R., Ho, H. M., Zhou, H., Guo, J., & Tang, Z. (2024, May). A Game of Love for Women: Social Support in Otome Game Mr. Love: Queen’s Choice in China. In Proceedings of the CHI Conference on Human Factors in Computing Systems (pp. 1-15).

[7]. DataEye Game Observation. (2024, March 7). "Love and Deepspace" Going Overseas: Revenue Exceeds 300 Million, Going Crazy in Japan, Can the Special Strategy Conquer the World? Weixin. Retrieved from https://mp.weixin.qq.com/s/wVPlcF9nVyHu5Gs-J2d7Sg

[8]. Feng, J., & Zhang, X. (2022). Analysis of Mobile Game Intellectual Property Marketing Strategy: A Case Study of Honor of Kings. Applied Economics and Finance, 9(4), 112-112.

[9]. Urban, G. L. (2005). Customer advocacy: a new era in marketing?. Journal of public policy & marketing, 24(1), 155-159.

[10]. Wen, C.,& Zhou, X. (2018). Love, games, and daydreams: An analysis of the psychological mechanisms in otome games. Art Criticism, 8.

[11]. Li, Y. D. (2021). From cognition to intention: A study on the consumption behavior of female-oriented video game players - A case study of the female-oriented game "Food Fantasy" (Master's thesis). Chongqing University, Chongqing.

Cite this article

Tang,C. (2024). Consumer-Oriented Marketing Strategy of Chinese Domestic Otome Games: A Case Study of Love and Deepspace. Advances in Economics, Management and Political Sciences,117,19-25.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Y.X., Xie, (2018). Interpretation of the female user group in the development process of Chinese female-oriented mobile games. Audiovisual, 5, 151-152.

[2]. LeadLeo Research Institute. (2020). Overview of the Chinese female gaming industry. LeadLeo. https://www.leadleo.com/pdfcore/show?id=6004ee8320410e67ca9557ec

[3]. Kotler, P. (1967). Marketing management: Analysis, planning, andcontrol. Prentice-Hall.

[4]. McCarthy, J. E. (1960). Basic marketing: A managerial approach. Richard D. Irwin, Inc.

[5]. Love and Deepspace Wiki. (2024, July 24). Combat. Fandom. Retrieved from https://loveanddeepspace.fandom.com/wiki/Combat

[6]. Lei, Q., Tang, R., Ho, H. M., Zhou, H., Guo, J., & Tang, Z. (2024, May). A Game of Love for Women: Social Support in Otome Game Mr. Love: Queen’s Choice in China. In Proceedings of the CHI Conference on Human Factors in Computing Systems (pp. 1-15).

[7]. DataEye Game Observation. (2024, March 7). "Love and Deepspace" Going Overseas: Revenue Exceeds 300 Million, Going Crazy in Japan, Can the Special Strategy Conquer the World? Weixin. Retrieved from https://mp.weixin.qq.com/s/wVPlcF9nVyHu5Gs-J2d7Sg

[8]. Feng, J., & Zhang, X. (2022). Analysis of Mobile Game Intellectual Property Marketing Strategy: A Case Study of Honor of Kings. Applied Economics and Finance, 9(4), 112-112.

[9]. Urban, G. L. (2005). Customer advocacy: a new era in marketing?. Journal of public policy & marketing, 24(1), 155-159.

[10]. Wen, C.,& Zhou, X. (2018). Love, games, and daydreams: An analysis of the psychological mechanisms in otome games. Art Criticism, 8.

[11]. Li, Y. D. (2021). From cognition to intention: A study on the consumption behavior of female-oriented video game players - A case study of the female-oriented game "Food Fantasy" (Master's thesis). Chongqing University, Chongqing.