1. Introduction

With the rise of climate change awareness and social responsibility demands, the concept of Environmental, Social, and Governance (ESG) has been widely disseminated globally. Particularly in the capital markets, ESG disclosure has become a vital tool for assessing corporate sustainable development, driving higher disclosure standards and quality. Principles of ESG disclosure released by various international organizations and evaluation systems by institutions like MSCI [1] have standardized ESG practices and enhanced global influence. Since 2012, the international ESG investment market has experienced significant growth, especially in Europe and the United States. As of 2021, the global ESG fund assets have reached $2.24 trillion [2], demonstrating the widespread recognition and importance of ESG investment. Currently, ESG disclosure, as a key indicator of measuring corporate social responsibility and sustainability, is gradually becoming a global focus.

In recent years, the Chinese government’s emphasis on sustainable development and ecological civilization construction has elevated the attention to the ESG field in China. The government has issued a series of policies and standards related to ESG, such as the “Green Bond Support Project Directory,” aimed at guiding and regulating corporate behavior in environmental, social, and governance aspects. The ESG investment market in China is also expanding gradually, with an increasing number of investors incorporating ESG factors into investment decisions [3]. ESG funds in China are showing promising development, offering investors more choices. Despite the increasing academic achievements in the ESG field in China in recent years, there still exists a significant gap in specific practices and effectiveness compared to Western countries, particularly in corporate governance and social responsibility. This is mainly manifested in: (1) Limited depth and breadth of research: Current research mainly focuses on the construction of ESG concepts, frameworks, and evaluation indicators, with relatively fewer studies on deeper issues such as ESG practices, policy impacts, and international comparisons. (2) Lack of innovation and forward-looking: Current research often follows international trends, lacking innovative and forward-looking studies tailored to China’s specific environment and challenges, thus limiting the development speed and international influence of the ESG field in China. (3) Insufficient interdisciplinary research integration: ESG involves multiple disciplinary areas, but interdisciplinary research on ESG in the Chinese academic community is relatively scarce, restricting the comprehensiveness and depth of ESG research. Therefore, this study aims to delve into the dynamics and frontiers of ESG disclosure, providing theoretical support and practical guidance for the normalization of global ESG disclosure.

The necessity of this study lies in comprehensively delineating the research status and development trends of the ESG field through visual analysis of ESG-related literature using the CiteSpace bibliometrics tool. By comparing the differences between China and the international community in terms of ESG research subjects, perspectives, methods, and practical applications, the study vividly illustrates the gap between China and the international advanced level, providing data support and directional guidance for improving ESG research in China. Theoretical significance lies in contributing to the improvement of the theoretical system in the ESG field, promoting the in-depth development of ESG research, and providing new ideas and directions for future theoretical research. In practical terms, this study offers valuable references and insights for the Chinese government in promoting ESG development and provides guidance for Chinese enterprises in ESG practices, assisting them in better fulfilling social responsibilities and enhancing sustainable development capabilities.

2. Research Methods and Data Source

2.1. Research Methods

This paper employs CiteSpace for bibliometric visual analysis to explore the progress and frontiers of ESG research. CiteSpace is a scientific literature metric analysis tool [4] jointly developed by Professor Chaomei Chen of Drexel University and the WISE Laboratory of Dalian University of Technology [5]. Through comprehensive metric and visual analysis, including publication volume, this paper summarizes the development trend and evolutionary context of research themes in the ESG research field, providing a comprehensive review of the current situation, research hotspots, and frontiers of this field.

2.2. Data Source

Domestic journal data in this paper are sourced from the CNKI China National Knowledge Infrastructure journal database, with the search criteria being the subject or keyword “ESG.” The journal source categories selected include SCI source journals, core journals, CSSCI, and CSCD. The time frame for journals is limited from January 1, 2010, to March 10, 2024, resulting in 752 relevant documents retrieved. Documents unrelated to this study, as well as conference papers, newspapers, books, and other types of documents, were manually excluded, resulting in 598 valid documents.

Foreign database selection for this paper includes the WOS core database, with the search criteria being the subject “ESG” and the same time frame for journals. A total of 3392 documents were retrieved, and after manually excluding documents unrelated to this study, as well as conference papers, newspapers, books, and other types of documents, 1399 valid samples were obtained.

3. Analysis of Research Results

3.1. Visual Analysis of ESG Research Publication Volume

Publication volume is an important indicator for measuring scholars’ attention to a specific field. Monitoring scholars’ publication volume can explore the dynamic development trends of the field and predict future directions. The publication volume of domestic and foreign literature related to ESG from 2010 to 2023 shows an upward trend, as shown in Figure 1.

Through visual analysis, it is observed that ESG research has continued to grow both domestically and internationally from 2010 to 2023, especially in China, where ESG research has shown rapid growth. This is closely related to China’s booming economy, increasing corporate social responsibility awareness, and government support for green development policies. The growth rate of ESG funds in China reached 184% from 2020 to 2022 [6], reaching a historic high in 2023, with a growth rate of 34.4% [7], fully demonstrating China’s activity and achievements in the ESG field.

Compared to domestic literature, the annual publication volume growth of foreign literature remains relatively stable without significant fluctuations. This may be attributed to foreign countries having a more profound research foundation in the ESG field and a larger group of research institutions and scholars. For example, the European ESG asset management scale is expected to expand to $19.6 trillion at a growth rate of 53% [8], demonstrating the maturity and huge development potential of foreign countries in the ESG field.

The gap between domestic and foreign publication volumes is gradually narrowing, indicating China’s increasing attention to ESG research. Both the government and enterprises recognize the critical importance of ESG to enhancing competitiveness and sustainable development. With China’s rapid economic growth and increasing openness, more and more companies are beginning to practice ESG principles. Therefore, although the annual publication volume of domestic literature is lower than that of foreign literature, the gap is narrowing year by year, indicating China’s rising status in the global ESG research field.

Figure 1: Annual Publication Volume of Domestic and Foreign Literature Related to ESG from 2010 to 2023

3.2. Analysis of Keywords in ESG Research

3.2.1. Co-occurrence Analysis of Keywords

Keywords, as refined symbols of academic research, not only capture the core topics of papers but also reflect the development trends and academic focuses of research fields. The keyword co-occurrence map constructed using CiteSpace software can intuitively reveal the interactions and connections between these keywords [9], thereby identifying the core content and research hotspots in the ESG research field.

The differences in centrality and quantity of keywords numerically reveal their different roles in ESG research. Keywords with high centrality, such as agency costs (0.47), green development (0.47), and corporate value (0.34), indicate that these concepts serve as critical connecting points in the research network, forming the core intersection of various studies. Keywords with high quantity, such as financing constraints (44 times), information disclosure (34 times), and corporate value (16 times), demonstrate the frequent appearance of these topics in actual research literature, reflecting the continuous attention and research enthusiasm of the academic and practical communities in these areas, as shown in Table 1.

Both domestic and foreign research in the ESG field share a common focus on ESG and sustainable development, reflecting concerns about companies’ environmental protection, social responsibility, and good governance. However, foreign research covers a wider range of keywords, with stronger correlations, and involves more diverse and rich research content. In contrast, domestic research is more focused on internal aspects of companies, such as internal control and agency costs, with fewer involvements in areas like value co-creation and social environment. Additionally, domestic research lacks consideration of social background factors. From the statistical data of centrality, Chinese research is more concentrated, while foreign research demonstrates stronger interdisciplinary characteristics.

In summary, both domestic and foreign ESG research emphasizes sustainable development and corporate responsibility, but there are differences in breadth, depth, and practical significance. In the future, domestic researchers can learn from foreign experiences, broaden their horizons, strengthen interdisciplinary cooperation, enhance the practicality and forward-looking nature of research, and increased communication with the international academic community can also help improve the quality and influence of domestic ESG research.

Table 1: Centrality Frequency Table of Keywords in Domestic ESG Research Field

Number | Keywords | Centrality | Count | Year |

1 | agent cost | 0.47 | 11 | 2021 |

2 | green development | 0.47 | 10 | 2022 |

3 | corporation value | 0.34 | 16 | 2019 |

4 | listed compamy | 0.32 | 12 | 2016 |

5 | financing restriction | 0.3 | 44 | 2023 |

6 | green innovation | 0.28 | 20 | 2023 |

7 | information disclosure | 0.25 | 34 | 2019 |

8 | green finance | 0.22 | 26 | 2018 |

9 | internal controls | 0.03 | 13 | 2023 |

10 | corporate governance | 0.03 | 11 | 2021 |

Data Source: Compiled based on the co-occurrence map of keywords in the ESG research field.

Table 2: Centrality Frequency Table of Keywords in Foreign ESG Research Field

Number | Keywords | Centrality | Count | Year |

1 | corporate governance | 0.25 | 116 | 2012 |

2 | company | 0.23 | 47 | 2014 |

3 | strategy | 0.17 | 39 | 2015 |

4 | investor | 0.16 | 42 | 2015 |

5 | legitimacy | 0.15 | 44 | 2016 |

6 | governance | 0.13 | 261 | 2012 |

7 | sustainability | 0.13 | 201 | 2011 |

8 | responsibility | 0.11 | 154 | 2015 |

9 | esg | 0.1 | 522 | 2011 |

10 | corporate social responsibility | 0.09 | 483 | 2011 |

11 | performance | 0.09 | 358 | 2010 |

12 | csr | 0.08 | 125 | 2016 |

13 | social | 0.08 | 72 | 2013 |

14 | information | 0.07 | 90 | 2015 |

15 | determinant | 0.07 | 84 | 2014 |

Data Source: Compiled from the co-occurrence map of keywords in the ESG research field.

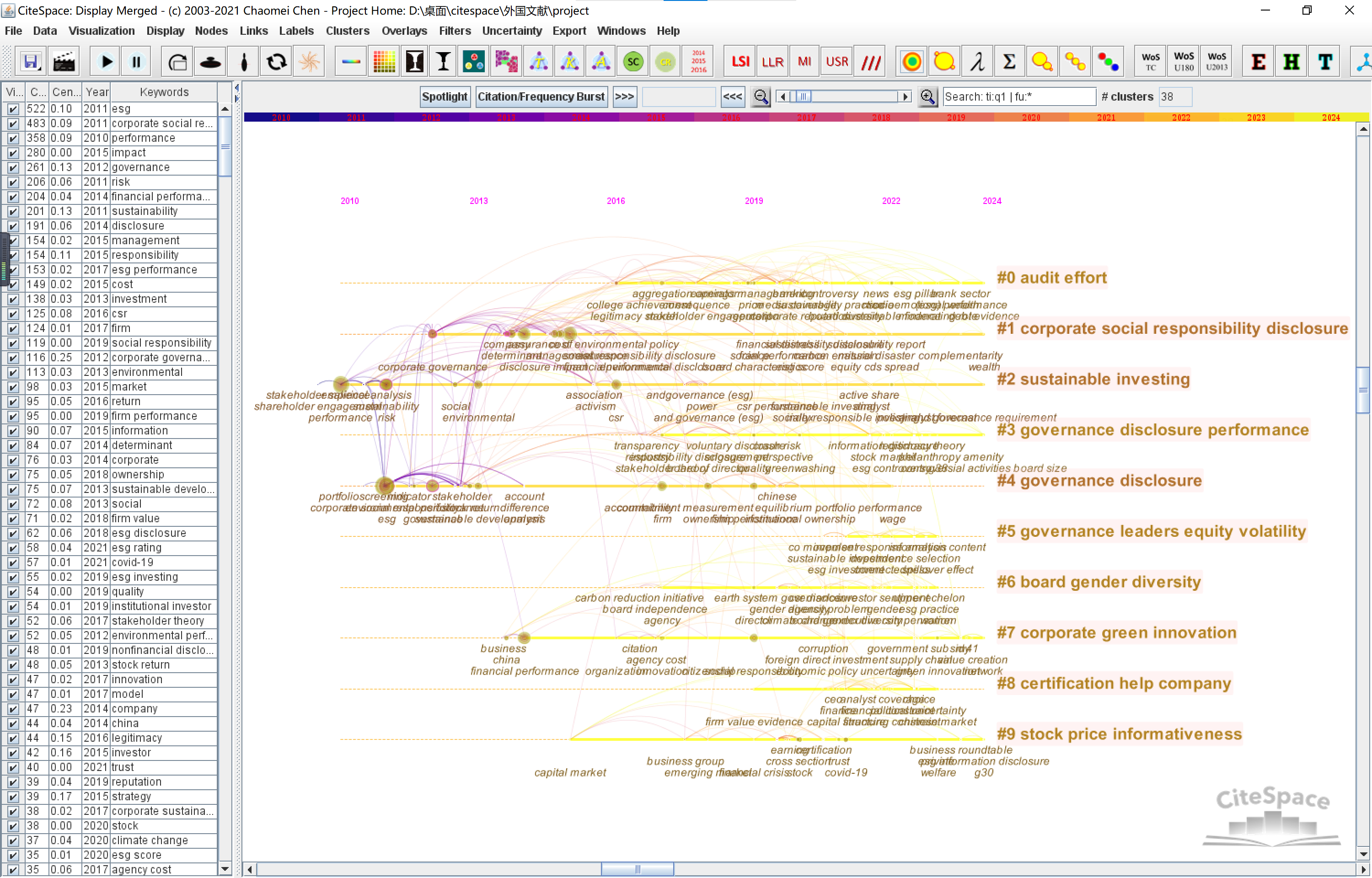

3.2.2. Keyword Cluster Analysis

Clustering refers to the aggregation of highly relevant topics within a certain period. Cluster analysis has wide applications in information retrieval, natural language processing, data mining, etc [10]. By conducting cluster analysis on a large amount of data, related data points with high relevance can be divided into different categories or clusters, helping people better understand the inherent structure and patterns of the data [11].

For Chinese journals, after importing 598 sample documents into CiteSpace and conducting keyword cluster analysis, the keywords were clustered, resulting in a total of 48 cluster categories. For this analysis, the top 7 cluster categories were selected. From the perspective of clustering modularity Q value, the clustering result of this map shows Modularity Q = 0.8592, indicating significant clustering results. From the average silhouette value S, Mean S value = 0.9757, indicating good clustering effectiveness. There are a total of 183 nodes and 187 edges in the graph, with a density of 0.0112. From the above indicators, it can be inferred that the clustering visualization effect of this graph is reasonable and feasible. For domestic research, the emphasis of ESG studies lies in the following areas: (1) Agency Costs: Domestic research focuses on strategies to reduce operational and management costs through ESG practices. (2) Green Innovation: Emphasis is placed on the impact of policies on corporate ESG performance and the role of green finance in promoting ESG practices. (3) Corporate Value: Analysis is conducted on the contribution of ESG practices to overall corporate value and the influence of corporate culture on ESG performance.

For foreign journals, after importing 1399 sample documents into CiteSpace and conducting keyword cluster analysis, the keywords were clustered, resulting in 38 cluster categories. In this map, the Q value is 0.7907, and the S value is 0.9158, also meeting the conditions for clustering effectiveness. There are 649 nodes and 1231 edges in the graph, with a density of 0.0059. From the above indicators, it can be inferred that the clustering quality of this analysis is good and highly reliable. The emphasis of foreign ESG research mainly lies in three areas: (1) Corporate Social Responsibility: Foreign research focuses on specific practices and performance evaluation of companies in areas such as environmental protection, employee welfare, and community engagement. (2) Corporate Governance: Research emphasizes the impact of governance structure, leadership, and gender diversity on corporate decision-making. (3) Stock Price Information Content: Investigating how ESG factors affect the stock market and their impact on investor decisions.

Areas of common concern for both domestic and foreign research: (1) Green Sustainable Development: Both domestic and foreign research emphasize the importance of green and sustainable development, as evidenced by clustering points such as “corporate green innovation” and “green innovation”. (2) ESG Information Disclosure: Both domestic and foreign research believe that information disclosure plays a key role in the financial market. For example, discussions on the application and impact of information disclosure are evident in terms such as “corporate social responsibility disclosure” and “green finance”. Through these analyses, the diversity and complementarity of ESG research both domestically and abroad can be observed, contributing to a more comprehensive understanding of the research dynamics and trends of ESG on a global scale.

Table 3: Detailed Clustering of Keywords in the Domestic ESG Research Field

Cluster Name | Size | Silhouette | Mean(year) |

green finance | 23 | 1 | 2020 |

information disclosure | 19 | 1 | 2019 |

agency cost | 15 | 0.965 | 2022 |

green innovation | 14 | 0.977 | 2022 |

enterprise innovation | 13 | 0.973 | 2022 |

enterprise value | 12 | 0.991 | 2022 |

Internal controls | 11 | 0.865 | 2023 |

Data Source: Compiled from the keyword clustering map of foreign ESG research field publications.

Table 4: Detailed Cluster Analysis of Keywords in the Foreign ESG Research Field

Cluster Name | Size | Silhouette | Mean(Year) |

audit effort | 44 | 0.911 | 2020 |

corporate social responsibility disclosure | 43 | 0.877 | 2017 |

sustainable investing | 42 | 0.813 | 2015 |

governance disclosure performance | 41 | 0.807 | 2020 |

governance disclosure | 35 | 0.957 | 2014 |

governance leaders equity volatility | 33 | 0.992 | 2022 |

board gender diversity | 33 | 0.924 | 2021 |

Corporate green innovation | 32 | 0.909 | 2020 |

certification help company | 31 | 0.956 | 2022 |

stock price informativeness | 31 | 0.968 | 2020 |

Data Source: Compiled based on the clustering map of keywords in the ESG research field.

3.2.3. Evolutionary Analysis of Research Themes

The Timeline View can illustrate the development trajectory of a research field and predict future trends. By showcasing clusters and keyword information from multiple dimensions, it arranges and gathers the hotspots of the same year in chronological order within a designated area. This facilitates the observation of key focus areas and research hotspots in the ESG research field over different time periods.

Initially, ESG research mainly concentrated on the construction of concepts and frameworks, as well as the establishment of evaluation indicator systems. This phase aimed to establish the basic principles and assessment methods of ESG, providing a foundation for subsequent research and practice. As the ESG concept gained popularity and the global ESG investment market experienced significant growth, research began to shift towards ESG practices and policy impacts. Particularly in Europe and the United States, the burgeoning ESG investment market spurred more empirical studies exploring the relationship between ESG factors, investment returns, and corporate performance. As shown in Figure 2, before 2016, foreign research primarily focused on environmental and governance aspects, investigating how companies could enhance their sustainability by improving environmental management and governance structures. From 2016 to 2019, the research focus shifted to corporate social responsibility and ESG performance, examining the impact of corporate social responsibility and ESG performance on financial performance. From 2019 to 2022, research themes expanded to include sustainability, social responsibility, and investment, emphasizing the importance of sustainable investment and the role of corporate social responsibility in attracting investment and enhancing corporate image. Since 2022, the latest research has concentrated on sustainable finance, sustainable investment, and information disclosure, focusing on how financial tools and transparent information disclosure can drive and achieve sustainable development goals.

In China, early research focused primarily on the integration of the ecological environment and financial markets, involving green financial institutions, climate risk management, fintech development, and green bonds, exploring the role of financial institutions in promoting environmentally friendly development. Subsequently, the research focus shifted to innovation development and the diversification of financing channels, particularly in terms of information disclosure and environmental assessment [12]. In 2020, the role of technological innovation in improving investment efficiency and reducing agency costs began to receive attention [13]. Entering 2022, research further deepened, focusing on the dual value and performance of enterprises in green transformation and sustainable development, as well as corporate performance in social responsibility, venture capital, and corporate governance [14]. These studies not only reveal the evolution of ESG issues over time but also reflect the emphasis placed on sustainable development by markets and policymakers. Future research may continue to explore the application of ESG in different industries and regions and investigate how effective policies and market mechanisms can promote sustainable development.

Figure 2: Timeline Spectrum of Evolution Trends in Foreign ESG Keywords

4. Conclusion and Key Insights

4.1. Conclusion

This study, based on data from the CNKI and WOS core databases from 2010 to 2024, conducted bibliometric visualization analysis using CiteSpace to summarize the trends in the number of publications related to “ESG” over 15 years. The main research conclusions are as follows:

Through in-depth analysis using the CiteSpace bibliometric visualization analysis tool, this study delved into the research dynamics and frontiers of Environmental, Social, and Governance (ESG) disclosure. The results show that the field of ESG disclosure research is receiving widespread attention from the global academic community, with the number of publications showing a steady growth trend. Meanwhile, it was found that research topics are evolving from single environmental information disclosure to more comprehensive social responsibility and governance structure disclosure, reflecting the comprehensiveness and depth of ESG concepts.

By comparing domestic and foreign ESG research, it was found that although China’s research in the ESG field started relatively late, it has developed rapidly in recent years, and the gap with foreign research is gradually narrowing. This is thanks to the Chinese government’s emphasis on sustainable development and ecological civilization construction, as well as the increasing awareness of corporate social responsibility. However, it should also be noted that China still faces many challenges in ESG practice and research, such as limitations in research depth and breadth, lack of innovation and foresight, and insufficient interdisciplinary integration. ESG disclosure research is in a stage of rapid development, with global recognition and practice of ESG concepts continually deepening. China has made significant progress in research and practice in this field, but further efforts are needed to enhance research depth and breadth, improve innovation and foresight, promote interdisciplinary integration research, and drive the continuous development and progress of the ESG field.

4.2. Key Insights

Based on the analysis results above, this paper proposes practical, innovative, and further research directions in the ESG (Environmental, Social, and Governance) field:

International Collaboration in Team Building: Seek international partners to build a network of global cooperation and enrich research content with contemporary hot topics. ESG issues are global challenges that require solutions through worldwide cooperation. International collaboration will provide broader perspectives and deeper resource support for ESG research, helping to form comprehensive and diversified research viewpoints, thus offering more effective solutions to global ESG challenges.

Combining ESG with Financial Innovation: Promote the integration of ESG with financial innovation to direct capital towards more responsible and sustainable enterprises and projects. As financial markets develop, ESG investment products and services are becoming increasingly diverse. Financial institutions can develop green bonds, green funds, and SDG-related investment products. Additionally, financial innovation can provide new tools to address ESG issues, such as using fintech to improve ESG data transparency and blockchain technology to ensure supply chain sustainability. Through these measures, ESG will become central to corporate strategy and operations, driving the sustainable development of Chinese enterprises and contributing Chinese insights to global ESG development.

Increasing Importance of ESG Principles: The importance of ESG principles is increasingly prominent, requiring enhanced attention and investment from enterprises, governments, and academia. Enterprises should actively fulfill social responsibilities and strengthen ESG information disclosure to enhance their sustainable competitiveness and social image. Governments should formulate and improve ESG-related policies and standards to guide and regulate corporate ESG behavior. Academia should continue to deepen ESG research to provide theoretical support for ESG practices.

References

[1]. Tayan, B. (2022). ESG Ratings: A Compass without Direction. https://corpgov.law.harvard.edu/2022/08/24/esg-ratings-a-compass-without-direction/#comments (Accessed March 7, 2024).

[2]. Zhao, L. (2023). Global ESG rating and investment analysis. First Finance and Economics. https://m.yicai.com/news/101734619.html

[3]. Zheng, C., Wu, G., & Wen, G. (2021). Can the performance of independent directors with accounting background improve the quality of accounting information under the ESG framework? Theoretical and Practical Finance and Economics, 2021(6), 89-95.

[4]. Abby, N. N., et al. (2019). Investigating the applications of artificial intelligence in cyber security. Scientometrics. https://link.springer.com/article/10.1007/s11192-019-03222-9 (Accessed March 7, 2024).

[5]. Chen, Y., Chen, C., Liu, Z., et al. (2015). Methodological functions of CiteSpace knowledge map. Studies in Science of Science, 33(2), 242-253.

[6]. Shanghai Securities Research. (2023). Report on the development of China’s ESG funds. Shanghai Securities News. https://stock.cnstock.com/stock/smk_jjdx/202307/5093161.html

[7]. Guo, P. Y. (2023). China’s ESG: A review of policy development in 2023 and outlook for 2024. Caixin Index. https://index.caixin.com/2023-11-13/102137504.html

[8]. Doe, J. (2023). European ESG Investment Trends Analysis. Sustainable Finance Review, 15(2), 112-120.

[9]. Chen, Z., & Xie, G. (2022). ESG disclosure and financial performance: Moderating role of ESG investors. International Review of Financial Analysis, 83, 102291. https://doi.org/10.1016/j.irfa.2022.102291 (Accessed March 6, 2024).

[10]. Guo, X., et al. (2023). ESG, financial constraint and financing activities: A study in the Chinese market. Accounting & Finance. https://doi.org/10.1111/acfi.13196

[11]. Li, T.-T., et al. (2021). ESG: Research Progress and Future Prospects. Sustainability, 13(21), 11663. https://doi.org/10.3390/su132111663 (Accessed March 7, 2024).

[12]. Wang, X., & Li, Y. (2022). Tracing the Trajectory of ESG Research: A Timeline View Analysis. Journal of Business Ethics. https://doi.org/10.1007/s10551-022-02467-7.

[13]. Smith, G. (2014). Green finance and environmental improvement: A review of the literature. Journal of Sustainable Finance & Investment, 4(3), 193-210.

[14]. Johnson, R. L., & Scholtens, B. (2016). A note on finance and sustainability: investment, corporate social responsibility and ethics. Journal of Business Ethics, 133(2), 259-273.

Cite this article

Ye,M.;Wang,Y. (2024). Research Dynamics and Frontiers of Environmental, Social, and Governance Disclosure: Bibliometric Visual Analysis Based on CiteSpace. Advances in Economics, Management and Political Sciences,119,35-44.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 8th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Tayan, B. (2022). ESG Ratings: A Compass without Direction. https://corpgov.law.harvard.edu/2022/08/24/esg-ratings-a-compass-without-direction/#comments (Accessed March 7, 2024).

[2]. Zhao, L. (2023). Global ESG rating and investment analysis. First Finance and Economics. https://m.yicai.com/news/101734619.html

[3]. Zheng, C., Wu, G., & Wen, G. (2021). Can the performance of independent directors with accounting background improve the quality of accounting information under the ESG framework? Theoretical and Practical Finance and Economics, 2021(6), 89-95.

[4]. Abby, N. N., et al. (2019). Investigating the applications of artificial intelligence in cyber security. Scientometrics. https://link.springer.com/article/10.1007/s11192-019-03222-9 (Accessed March 7, 2024).

[5]. Chen, Y., Chen, C., Liu, Z., et al. (2015). Methodological functions of CiteSpace knowledge map. Studies in Science of Science, 33(2), 242-253.

[6]. Shanghai Securities Research. (2023). Report on the development of China’s ESG funds. Shanghai Securities News. https://stock.cnstock.com/stock/smk_jjdx/202307/5093161.html

[7]. Guo, P. Y. (2023). China’s ESG: A review of policy development in 2023 and outlook for 2024. Caixin Index. https://index.caixin.com/2023-11-13/102137504.html

[8]. Doe, J. (2023). European ESG Investment Trends Analysis. Sustainable Finance Review, 15(2), 112-120.

[9]. Chen, Z., & Xie, G. (2022). ESG disclosure and financial performance: Moderating role of ESG investors. International Review of Financial Analysis, 83, 102291. https://doi.org/10.1016/j.irfa.2022.102291 (Accessed March 6, 2024).

[10]. Guo, X., et al. (2023). ESG, financial constraint and financing activities: A study in the Chinese market. Accounting & Finance. https://doi.org/10.1111/acfi.13196

[11]. Li, T.-T., et al. (2021). ESG: Research Progress and Future Prospects. Sustainability, 13(21), 11663. https://doi.org/10.3390/su132111663 (Accessed March 7, 2024).

[12]. Wang, X., & Li, Y. (2022). Tracing the Trajectory of ESG Research: A Timeline View Analysis. Journal of Business Ethics. https://doi.org/10.1007/s10551-022-02467-7.

[13]. Smith, G. (2014). Green finance and environmental improvement: A review of the literature. Journal of Sustainable Finance & Investment, 4(3), 193-210.

[14]. Johnson, R. L., & Scholtens, B. (2016). A note on finance and sustainability: investment, corporate social responsibility and ethics. Journal of Business Ethics, 133(2), 259-273.