1. Introduction

The economic changes in Africa have gradually become the focus of global attention as Africa is one of the fastest economic growing continents in the world in current years and this position is mainly caused by the large number of investments that had been flowing into Africa.

The African economy mainly relies on output from exporting raw materials and a cheap labour force to the world, it has vast natural resources which makes it an agriculture and raw material export base continent. However, Africa was defined as the world’s poorest habitational continent in March 2013 due to its extremely low-level economic foundation, which made increasing economic growth Africa’s most pressing challenge. But despite this, Africa holds vast resources, rich agriculture, and cheap labour forces which result in high investment inflows into the African economy. And in the economic development of Africa, the impact of Chinese investment on its overall environment occupies a significant position. In the same year 2013, China proposed and implemented the Belt and Road Initiative, one of the actions was to invest forthrightly in Africa to develop the exchanges of benefits and engagements with Africa. Regarding the importance of that, the main focus of this paper is to investigate the African long-run economic growth affected by Chinese investments following the Solow Model.

Economic growth can be defined as the increase in production capacity, but the concept varies between long-run and short-run. When looking at the long run it can be conceptualized as an average over a year while in the short run focusing on the deviations from that average. Therefore economists can make comments and prospects for the economy by using the long run. So in general, the long-run site prospects are more important than the short-run for social welfare, as it looks at a sustainable growth of output, and the short-run looks at the fluctuations of output. Therefore, it is worth investigating the economic growth of Africa in the long run.

The Solow Model, also known as the Solow Swan Growth Model is a neoclassical economic model used to analyze long-run economic growth and productivity, can be used in analyzing the long-run economic growth of Africa as the model provides insights into the factors that determine a country’s steady-state level of output per capita over time.

After 2013, China overtook the US and became the fourth largest investor in Africa as measured in Foreign Direct Investment (FDI) [1]. The Chinese investment as well as assistance into Africa continued to augment since the China-Africa Corporation was built, driving Africa into the position of the world’s fastest economic growing continent.

But referring to the delay of progress in ending extreme poverty caused by the COVID-19 pandemic, it is estimated that 6.7 percent of the global population will remain living under the international poverty line and most of them are located in Africa. Moreover, the incidence of poverty in South Africa is overtop the world’s average level [2]. This means the capacity to reduce poverty is not phase-matched with Africa's economic growth speed.

This raises the thinking of how the enormous investment China put into Africa influences the African economy and whether it is beneficial.

2. Overview of the Solow Model

2.1. Assumptions and Properties

The Solow Model begins with the production function and its properties are foundamented by the three points of background assumptions which are first,

F [ λK , λL , A ] = λF[ K , L , A ](1)

\( \frac{dF}{dK} \) > 0, \( \frac{{d^{2}}F}{d{K^{2}}} \) < 0(2)

\( \underset{K→0}{lim}{\frac{dF}{dK}} \) = ∞ (3)

\( \underset{K→∞}{lim}{\frac{dF}{dK}} \) = 0 (4)

which is called the Inada Condition. As long as the Inada Condition is satisfied, it means that the stable economic growth is satisfied in the neoclassical economic growth. The components K, L and A represent capital, labor, and technology. These assumptions then develop into the four properties for the Solow Model, it begins with MPK [ λK, λL, A ] = MPK [ K, L, A ], which means that as the components increase by a factor of λ, the output increases by the factor of λ as well. Next is that F [ KL, A ] = K · MPK + L· MPL. The third one is that as long as one component inside the function equals zero, the output equals zero as well because when any component is zero the function will not be able to work in reality. This can be written as F [ K, 0·A ] = 0 and F [ 0, L, A ] = 0. The final one comes with a theory called Unboundness that can be written as \( \underset{k→∞}{lim}{F[ K, L, A] } \) .

Assessing the contribution that Chinese investment gave to Africa’s economic growth includes GDP growth separated into respective sources [3]. And as the Solow Model looks at the output in a per capita form, which is accounting the output produced by individual inputs prospectively. Therefore the variables will also be rewrote into per capita form and represented by lowercase letters such as \( {k_{t}}=\frac{{K_{t}}}{{L_{t}}}, {y_{t}}=\frac{{Y_{t}}}{{L_{t}}} \) , \( {i_{t}}=\frac{{I_{t}}}{{L_{t}}} and {c_{t}} \) = \( \frac{{C_{t}}}{{L_{t}}} \) . The production function then can be developed into four equations. First is the total output equation \( {y_{t}} \) = \( {c_{t}} \) + \( {i_{t}} \) + \( {g_{t}} \) , but for the basic Solow Model there won’t be any government interventions therefore the African government spending per capita \( {g_{t}} \) can be cancelled out. Refering to the saving rate gives out the second equation which is the total consumption equation \( {c_{t}} \) = (1-s) \( {y_{t}} \) . Third, because \( {c_{t}} \) will be used in investment to capitals, the investment equation is being carried out as \( {i_{t}} \) = s \( {y_{t}} \) . Finally, according to the four endogenous variables \( {y_{t}} \) , \( {c_{t}} \) , \( {i_{t}} \) and \( {k_{t}} \) superadds the application of the Law of Motion into the production function. The fourth equation can be found as \( {k_{t+1}} \) = \( {k_{t}} \) + sf( \( {k_{t}} \) ) - δ \( {k_{t}} \) . δ is the depreciation rate of the capital. Result in the GDP output of Africa is mainly determined by its capital, saving rate, and capital depreciation rate.

Saving and investment per capita play a crucial role in the Solow Model. Savings are used to reinvest in new capital which is accounted in the capital stock. Therefore there is a characteristic called capital accumulation for the Solow Model. The rate of capital accumulation is an important determinant of the rate of African economic growth in the model.

Whereas there is a diminishing return to capital in the Solow Model, which means that if there were little capital investment originally, the marginal benefit would be large. But if there were already loads of investments in the capital, the marginal benefit would be relatively less. It follows from this property that the capital input for the African economy has a negative relationship with the Chinese investment into African capital at a certain point in the future.

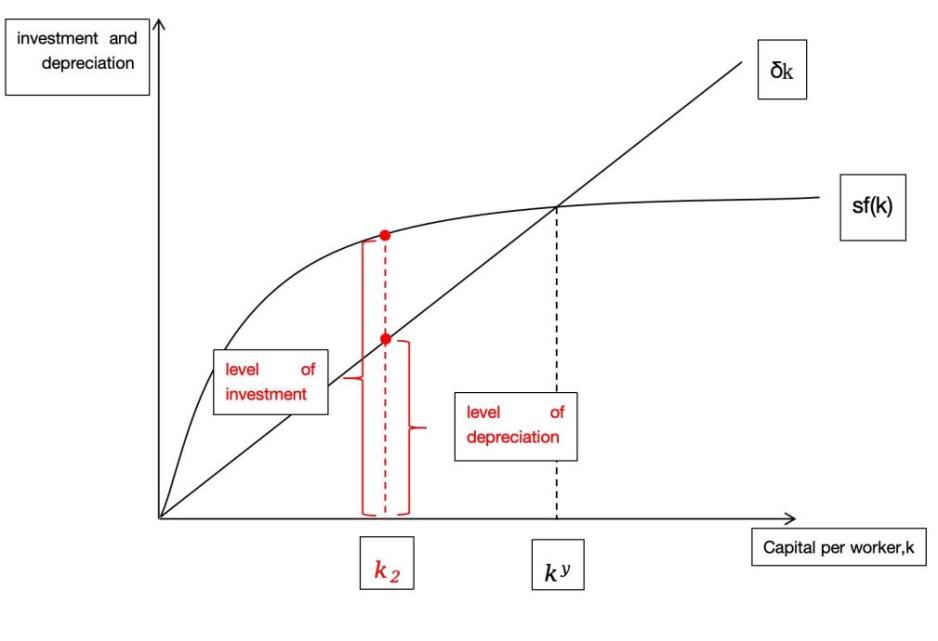

The main study of this essay focuses on the sustainable economic growth of Africa, therefore the steady-state suggested by the Solow Model can be discussed. The steady state is the long-run equilibrium of the economy. The previous equation can be derived into sf( \( {k_{t}} \) ) = δ \( {k_{t}} \) from assuming change in capital in Africa is zero.

When △k = 0, \( {k_{t+1}} \) - \( {k_{t}} \) = 0 and \( {k_{t}} \) +sf( \( {k_{t}} \) )-δ \( {k_{t}} \) - \( {k_{t}} \) =0, then sf( \( {k_{t}} \) )-δ \( {k_{t}} \) =0 and finally developed into sf( \( {k_{t}} \) )=δ \( {k_{t}} \) . Which sf( \( {k_{t}} \) ) represents how much new capital has been added to the market through investment and δ \( {k_{t}} \) means how much capital the economy of Africa is losing, in order words, the depreciation. This improvement can declare that the capital investment will balance the depreciation in capital when there is no change in capital and give the African economy a steady state.

The steady state can also be illustrated in Figure 1.

Figure 1: Steady-state diagram

The function of the Solow Model can be interpreted by one of the implications which is convergence, it suggests that countries with similar characteristics such as saving rates and population growth rates, will converge to the same steady-state level of output per capita over time. This convergence is caused by the increase in productivity and output levels due to capital accumulation. This implication helps economists to have optimistic long-term living standard prospects for the African economy. It also shows that poor countries tend to grow faster than rich ones, which made the fact that Africa was the fastest-growing continent in the world reasonable.

3. Constrains to the African Economic Growth

The mismatch between the high investment that Africa received and the low rate of poverty reduction is caused by the constraints to the economic growth of Africa which explains why Africa needs that much Chinese investment and also states some of the reasons for the investment focus. Africa is a developing continent that has the common limitation of economic growth as the others. Poverty and inequality come first, as people have less savings in developing countries, and there is limited access to basic services. Which makes it hard for Africa to increase consumption. As for inequality, the unequal distribution of wealth and resources can lead to hierarchy competition in the population bring social tensions, and undermine long-term growth prospects. What comes next is the human capital constraints, Africa struggles to build human capital including education, healthcare, and skills development. As it has weak infrastructures and does not have enough government funds to spend. What’s more, Africa has high opportunity costs as well. The third one is the limited access to finance as Africa has limited banking services, low levels of financial literacy, and insufficient credit availability. This limitation restricts investment, innovation, and the creation of jobs. Which will drag African economic growth slower. In addition, the energy shortages and economic turmoil caused by the conflict between Russia and Ukraine are also factors that limit Africa’s economic growth. The implications of these constraints then draw forth the orientation of Chinese investment into Africa.

4. General Situation of Chinese Investment into Africa

The investment inflows into Africa have accumulated massively in recent years. And since the Belt and Road Initiative began, the interaction between China and Africa based on investment has gone further driven by the Forum on China-Africa Cooperation (FOCAC). For instance, the FDI inflows to Africa reached a record of $83 billion by 2022, up from the previous $39 billion in 2020, which accounted for 5.2 percent of the global FDI [4]. Currently, the African economy consists of mining, manufacturing, human resources, and agriculture. Based on the three components in the Solow Model that affect the output, China’s major investments are in mining, manufacturing, and infrastructure building which account for more than 70 percent of China’s investment stock in Africa. By 2021, the China-Africa export volume went up to $2542.9 billion an increase of 36 percent on a year-on-year basis. Then it hit a record high of $2820 billion moving on to 2022 [5]. The distribution of Chinese investment into Africa can be divided into four aspects. The contribution to infrastructure building is essential, as Africa cannot carry out plans to develop the economy due to its low economic basic level. China’s help in building railways, roads, bridges, and power stations as well as networks and ports influenced the African economy significantly. Since the establishment of the FOCAC, Chinese firms have helped African countries to build or upgrade nearly 100 thousand kilometers of roads, more than 10 thousand kilometers of railways, 66 thousand kilometers of power transmissions, and approximately 1000 bridges by using various funds [6]. The next Chinese investment orientation is education and human resource development which includes skill training. China supported the African government to build up schools and foster urgently needed talents. These were achieved by setting up the platform for exchanges and cooperation between Chinese and African universities which is one of the strategies included in the “20 plus 20 Cooperation Plan for Chinese and African Institutions of Higher Education”. The third and essential one is that China issued large amounts of low or even zero-interest loans to Africa. This has made China Africa’s largest creditor. As an example, between 2000 and 2019, Chinese financial institutions signed 1,141 debt agreements with Africa, amounting to $153 billion. Last but not least, China supported Africa with its agriculture and industrialization by introducing new technology, providing efficient capital, and setting a good example of how to operate the programs.

But always, these investments will have motivations behind them. First of all, China has an aging problem while Africa today is inhabited by 1.3 billion people, with a median age of 19.7 years which is a massive young and low-cost labour force who are eager to learn and desperate for the pursuit of a better life, therefore this is the valuable foreign labor force for China in the long-run. Because China no longer has a low-cost market anymore, using Africa’s labor force will be more labor cost-efficient. Second, building up the cultivation with Africa is an important diplomatic step for China to break the deadlock of international isolation. Making Africa rely on Chinese investment is an effective way for China to gain global influence and help China master the international discourse right. Third, Africa has 30 thousand and 5 hundred coastlines and vast resources as well as rich agriculture, therefore investing in Africa can make those resources available to be used by China. As China has shifted from an agrarian economy to the world’s largest agricultural importer due to its change of a lot of rural areas into urban areas, it has led to an increase in demand for agricultural products from Africa.

5. Impact of Chinese Investment on Africa’s Economic Growth

5.1. Macroeconomic Implications for African Countries

The impacts that Chinese investment brought to Africa are relatively complicated. These can be divided into two parts, positive and negative effects. Potentially for the benefits that Africa received, the most significant one is the impact on reducing unemployment in Africa. Because China contributed to the establishment of a large number of infrastructures such as schools, hospitals power stations, etc, it created millions of job opportunities for Africa due to the increase of government needs for workers to operate and manage those infrastructures. In addition, Chinese investment in the education field increases the number of skilled workers in Africa. This increases the demand for labour as they are now having high-quality productivity.

The second beneficial effect is that the Chinese investment increases Africa’s exports. On account of investment based on a trading exchange, China bought abundant raw materials and labor from Africa, which increased Africa’s exports and improved Africa’s trade balance. Besides, trade balance is one of the essential determinants for aggregate demand, so the increase in exports also increased the African aggregate demand.

Concurrently, while ensuring the wellness of African workers, the funding in healthcare also enhanced life expectancy and job satisfaction. These all contributed to the increase in productivity of Africa and eventually boosted output, pushing economic growth further.

It is also important to mention that Chinese investment is changing the original economic structure of Africa by introducing China’s way of operating the economy. From industrial structure to capital formation and institutional change [2]. By bringing new technology in and allowing African students to study in Chinese universities.

Additionally, China was lending loans that were low-interest rates or even non-interest rates to Africa, which helped cancel a good deal of debts that Africa was having. Lighten the burden on the African government.

Nevertheless, there are also some drawbacks caused by the Chinese investments. As Africa cultivates with China deeper and deeper, Africa’s economic growth will become increasingly dependent on China. Once China stops its aid and investment in Africa somehow in the future, Africa’s economy will stagnate or even move into a recession.

In addition, the massive investment from China will limit internal and external exports as well as trade with other countries which might lead Africa into an isolated position among the world.

What’s more, Africa imports more capital and goods from China within the close relationship, the intervention from Chinese companies would block the development of African companies due to the competition between local and foreign businesses. As Africa’s domestic products are not as highly qualified as Chinese products, people will be more willing to purchase imported products [7]. This has the allegations of corruption of African firms associated and makes Africa rely furthermore on China which is not good for Africa’s sustainable economic growth.

Besides, China built large amounts of infrastructure and factories in Africa, while producing profits to drive economic growth, they also created environmental pollution or even potential abuse of resources in Africa. If Africa does not strike a proper balance between economic growth and environmental protection, its strength of abundant natural resources and fertile soil will be lost due to accumulated pollution.

There are also some constraints to the effectiveness of Chinese investment. First of all, Africa has been inherently stymied by intra-continental barriers to trade therefore their free trade area is limited so whether the investment of China can be replicated by Africa successfully depends on how Africa’s free trade area is being processed.

Then the Chinese investment focuses heavily on extracting natural resources that do not align with the other sectors, this reduces the contribution to Africa’s broader economic growth which violates the steady-state in the Solow Model. As the change in capital will be affected by factors other than saving and investment, not obeying the equation △k= sf(k)-δk.

There is a theory called the Golden Rule, which is when the saving and capital in the steady-state equation maximise the consumption and help the economy to reach the sustainable development. It developed an equation of c= (1-s)f(k*), achieving the Golden Rule requires the policymakers to adjust saving. Therefore if the political stability is low, the saving then won’t be managed well and the consumption will result in flunctuate. Which is not benefiting the long-run economic growth.

5.2. Compare and Analyze the Impacts of Chinese Investment in Africa Using Two Cases: Mauritius and Sub-Saharan Africa

5.2.1. Mauritius

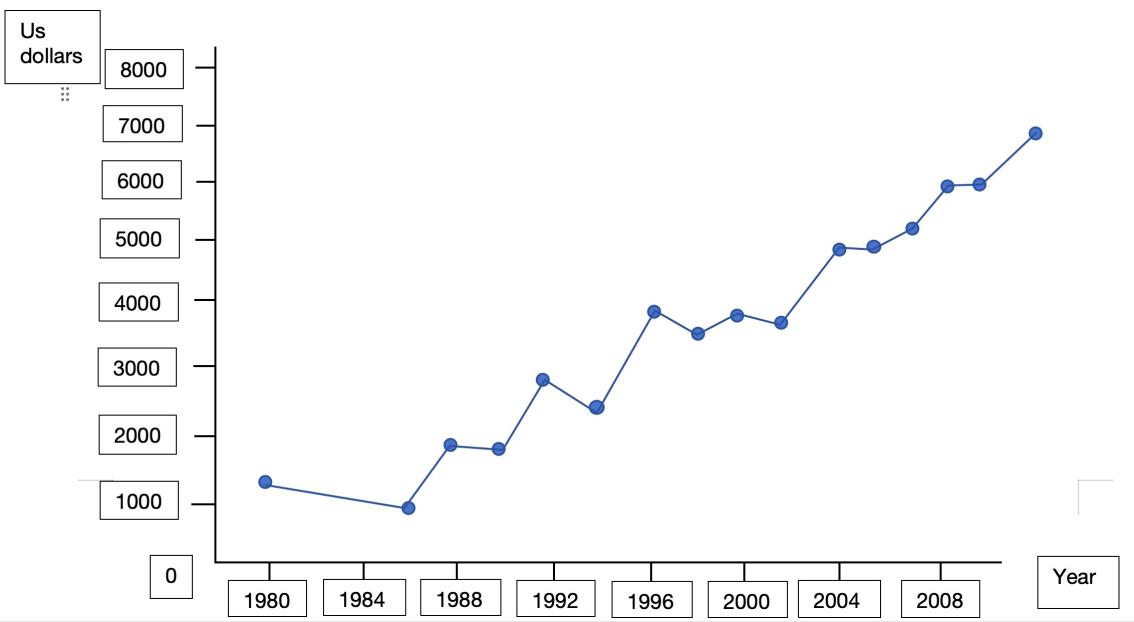

Mauritius is a country that relies on the sugar sector, and economists made a prediction of a passive future for Mauritius’s economy. Due to single economic base brings limited progress, for instance, lack of job opportunities leads to unemployment, and the economy is restricted totally by the weather. The economy of Mauritius began its revolution in the 1980s by introducing open-trade policies which switched it from a sugar sector base to more likely manufacturing and tourism. Mauritius attracted a mass of foreign investment owing to its relatively high political stability, cheaper labor force, and strong inclusiveness economy with diversification. The introduction of the policy also allowed Mauritius’s domestic enterprises to assimilate how to operate their businesses as well as acquire new technology. The exports and imports of Mauritius then boosted significantly and when focusing on Chinese investments, there was a specific effort to attract HongKong investment [8]. Which brought a reduction in unemployment along with low inflation to Mauritius. Because of the low or even zero-interest loans that China gave to Africa, the debt of Mauritius had been issued more easily. The real GDP of Mauritius went up by 5.1 percentage points on average between the period of 1977 to 2009 annually. And is undisputed, that Mauritius experienced an acceleration of economic growth rate since the 1980s [9]. By applying the Solow Model, GDP per capita is included. For this consideration, Figure 2 illustrates that the overall trend of GDP per capita for Mauritius from 1980 up to 2008 emerged rising.

Figure 2: Mauritius’s GDP per capital, 1980-2008

Accounting for the derivatives in the Solow Model, the increase in capital investment and the number of technologies involved increase in the output also productivity. And rise in GDP per capita is increasing income per capita. So in addition, Chinese investment in Mauritius drove the Mauritius economy into an unemployment rate decline situation. The unemployment rate fell by nearly 17 percentage points of the total labor force from 1980 to 2000. This contributed to the rise in productivity and GDP per capita which increased long-run economic growth. Making Mauritius one of the most incredible growing countries in the world. But meanwhile, the capital accumulation was diminishing as there were more and more investment inflows.

5.2.2. Sub-Saharan Africa Nations

In contrast, Sub-Saharan African nations who also received loads of Chinese investment didn’t have as much growth as Mauritius did. China gave out 9.7 percent of its total FDI to Sub-Saharan Africa, but during the time 1980 to 2008 Sub-Saharan Africa’s economic growth only increased 0.17 percent each time the FDI from China increased by one percent [10]. Therefore, Sub-Saharan African countries are still facing a formidable mission of developing sustainable economic growth through either raising productivity or reducing poverty.

There are diverse reasons for Sub-Saharan Africa’s current situation, what comes first is that while Mauritius is focusing on manufacturing development which includes the targets on secondary and tertiary sectors, the Sub-Saharan Africa administration’s agenda is to achieve urbanization [11]. This compromises the efficiency of Sub-Saharan Africa. Secondary is the political instability in Sub-Saharan Africa. The fluctuation in Sub-Saharan Africa persuades some of the Chinese private companies to quit investing in Sub-Saharan Africa countries. Then the investment incentive will decrease, leading to a reduction in output in the Solow Model.

Thirdly, Sub-Saharan Africa has a serious political instability. That causes albeit some of the nations in Sub-Saharan Africa had an economic uptrend, most of the countries are still mired in place. In addition, not like Mauritius, Sub-Saharan Africa is not sufficiently using the fiscal policy, which is the government managing the economy by adjusting government spending and taxation. This led to an unstable government budget in Sub-Saharan Africa and governments do not have enough funds for future economic interventions, this is dragging the economic growth of Sub-Saharan African nations back and causing fluctuations within Sub-Saharan African countries. These will all reduce the fit measure for the steady state and bad for sustainable economic growth.

Fourthly, the sky-high natural population growth in Sub-Saharan Africa brought a lot of pressure on the governments in reducing inequality also poverty. The speed of economic growth in Sub-Saharan Africa can meet the imperative demand for housing, jobs, healthcare, education, and so on. Causing Sub-Saharan Africa failed to overcome inequality and poverty. This decreases the confidence of either producers or consumers and leads to a rise in the possibility for firms who have received Chinese investments to embezzle the funds privately. Then the investment will not be counted into the Solow Model therefore reducing long-term economic growth.

5.2.3. Comparisions and Analysis

So, in general, the reasons for the difference in economic growth between the two regions while receiving Chinese investment can be summarised into the following aspects.

The first aspect is policy. The difference between the types of policies applied in the regions will influence the development of the area differently as various policies bring disparate impacts and focus on diverse sectors.

The second difference is the population growth. Different rates of population growth in a region within a year will put multiple levels of pressure on the governments, which affect the speed of economic growth after Chinese investment.

Thirdly are the different levels of political stability. If the region has an unstable economy the development environment will be flunctuated making it hard for the government to promote economic growth. But if the economy has a relatively stable political environment, the pressure for the government to intervene in the market will be released.

Finally, is the different focus that the region imposed. The disparate agenda of the two areas’ governments lead to different progress in economic growth after getting invested by China. Which is equivalent to how the government and domestic firms allocate the use of the total investment they receive.

6. Conclusion

In conclusion, according to the above series and data comparison, this paper finds out that Chinese investment provides an important driving force for Africa’s sustainable economic growth, without which Africa’s economic development is hard to begin. Therefore, investment cultivation is a guide for the future vision of China-Africa cooperation. But while investment brings many benefits, it also has many drawbacks that are detrimental to Africa’s long-run economic growth. These disadvantages are mainly dependency, pollution, market competition, and restrictions.

Simultaneously, there is a diminishing return from the Solow Model when accounted for.

Based on these drawbacks this paper suggests that Africa should implement corresponding restrictive policies to protect domestic industry. For instance, increase import duties and impose import quotas etc.

The primary contribution of this paper is to provide an objective analysis of the outcomes of receiving large Chinese investment in Africa as it seeks to achieve sustainable economic growth, as well as giving out suggestions. This article will be able to help economists to study how Africa can achieve long-term economic growth while also building well international relations.

When looking at expectations, the research in this paper has a certain amount of information gap, as the real Africans must know more about their situation. At the same time, it will also bring serial calculation errors. All of these can lead to uncertainties in the final result. Field visits should be added to future investigations to truly understand the feelings of the people so that the research can reach a more definitive conclusion.

References

[1]. Shirley, Z.Y. (2021) Why substantial Chinese FDI is flowing into Africa | Africa at LSE. Retrieved from https://blogs.lse.ac.uk/africaatlse/2021/04/02/why-substantial-chinese-fdi-is-flowing-into-africa-foreign-direct-investment/

[2]. Wen, C.H., Guo, Q.Q., Xu, H.T. (2022) Empirical analysis of the effect of China's investment in Africa on promoting economic growth and poverty reduction in Africa. Economic Geography, 11, 19-27.

[3]. Weisbrod, A., Whalley, J. (2012) The contribution of Chinese FDI to Africa’s pre crisis growth surge. Global Economy Journal, 12(4), 1850271.

[4]. TEconomic and Commercial Office of the Embassy of the People's Republic of China in the Republic of Sierra Leone. (2022) Analysis of the situation of attracting foreign investment in Africa in the 2022 World Investment Report. Retrieved from http://sl.mofcom.gov.cn/article/ztdy/202208/20220803340491.shtml.

[5]. Huang, L.F. (2023) China-Africa Economic and Trade Relations Report.

[6]. Xin Hua News Agency. (2021) China-africa cooperation in the new era. Retrieved from http://www.xinhuanet.com/2021-11/26/c_1128101798.htm?from=timeline.

[7]. Tull, D.M. (2016) China’s engagement in Africa: Scope, significance and consequences. The Jornal of Modern African Studies, 44(3), 459-479.

[8]. Kivyiro, P., Arminen, H. (2014) Carbon dioxide emissions, energy consumption, economic growth, and foreign direct investment: Causality analysis for Sub-Saharan Africa. Energy, 74, 595–606.

[9]. Yes Africa can: success stories from a dynamic continent. (2012) Choice Reviews Online, 49(06), 49–3380.

[10]. Meara, J. G., Leather, A., Hagander, L. (2015) Global Surgery 2030: evidence and solutions for achieving health, welfare, and economic development. The Lancet, 386(9993), 569–624.

[11]. Global, regional, and national age–sex specific all-cause and cause-specific mortality for 240 causes of death, 1990–2013: a systematic analysis for the Global Burden of Disease Study 2013. (2015) The Lancet, 385(9963), 117–171.

Cite this article

Liang,Z. (2024). The Long-term Economic Growth Impact of Chinese Investment in Africa. Advances in Economics, Management and Political Sciences,103,79-87.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 8th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Shirley, Z.Y. (2021) Why substantial Chinese FDI is flowing into Africa | Africa at LSE. Retrieved from https://blogs.lse.ac.uk/africaatlse/2021/04/02/why-substantial-chinese-fdi-is-flowing-into-africa-foreign-direct-investment/

[2]. Wen, C.H., Guo, Q.Q., Xu, H.T. (2022) Empirical analysis of the effect of China's investment in Africa on promoting economic growth and poverty reduction in Africa. Economic Geography, 11, 19-27.

[3]. Weisbrod, A., Whalley, J. (2012) The contribution of Chinese FDI to Africa’s pre crisis growth surge. Global Economy Journal, 12(4), 1850271.

[4]. TEconomic and Commercial Office of the Embassy of the People's Republic of China in the Republic of Sierra Leone. (2022) Analysis of the situation of attracting foreign investment in Africa in the 2022 World Investment Report. Retrieved from http://sl.mofcom.gov.cn/article/ztdy/202208/20220803340491.shtml.

[5]. Huang, L.F. (2023) China-Africa Economic and Trade Relations Report.

[6]. Xin Hua News Agency. (2021) China-africa cooperation in the new era. Retrieved from http://www.xinhuanet.com/2021-11/26/c_1128101798.htm?from=timeline.

[7]. Tull, D.M. (2016) China’s engagement in Africa: Scope, significance and consequences. The Jornal of Modern African Studies, 44(3), 459-479.

[8]. Kivyiro, P., Arminen, H. (2014) Carbon dioxide emissions, energy consumption, economic growth, and foreign direct investment: Causality analysis for Sub-Saharan Africa. Energy, 74, 595–606.

[9]. Yes Africa can: success stories from a dynamic continent. (2012) Choice Reviews Online, 49(06), 49–3380.

[10]. Meara, J. G., Leather, A., Hagander, L. (2015) Global Surgery 2030: evidence and solutions for achieving health, welfare, and economic development. The Lancet, 386(9993), 569–624.

[11]. Global, regional, and national age–sex specific all-cause and cause-specific mortality for 240 causes of death, 1990–2013: a systematic analysis for the Global Burden of Disease Study 2013. (2015) The Lancet, 385(9963), 117–171.