1.Introduction

Under the common influence of many factors, such as economic development, scientific and technological progress and changes in concepts, the global average human life expectancy continues to rise, while people's fertility intention shows a downward trend, and the population structure is shifting towards aging. Population aging has become a major challenge that we must face in the 21st century. In 2000, China initially entered the aging society, and will continue to maintain this state for several decades. "Getting old before getting rich" has brought about a decline in the proportion of China's working-age population year by year, weakening China's human capital advantage, which will also pose a severe challenge to China's economic growth model driven by "demographic dividend" for a long time in the past. This paper takes various countries and regions in the world from 1960 to 2019 as samples to empirically test the impact of population aging on economic growth, aiming to provide relevant suggestions for effectively coping with the impact of population aging on economic development through research, alleviate the adverse impact of population aging on China's social and economic development, and maintain a reasonable and high growth rate of China's economy, to achieve the economic development target of 2035 as scheduled.

2.Literature Overview

The problem of population aging can be traced back to the last century, and the causes are the same. Huijing Li showed that population aging in Japan is mainly due to a combination of declining birth and death rates, with birth rate being the main influence [1]. Guest pointed out that the increase in the old age dependency ratio due to declining birth and death rates is the main reason for the accelerated rate of population aging in Australia [2].

However, scholars hold different attitudes about the impact of population aging on economic development. Most scholars are pessimistic about it. Guixin Wang and Yihui Gan predicted that China's population aging will harm regional economic growth in the future when China's aging deepens [3]. Jian Su pointed out that the rising population aging will cause China's economic growth rate to show a decline in the medium and long term [4]. Yang Du and Yonggang Feng argued that China's economic growth rate will decline by an average of 1.07 percentage points per year from 2020-2025 due to the effects of aging [5]. Maestas et al. found that a 10% increase in the share of the population over the age of 60 will lead to a 5.5% decline in GDP per capita [6]. Bloom et al. calculated that the development of population aging is likely to lead to a slow decline in the country's economic growth rate [7]. Further, different scholars have conducted specific analyses on the impact of population aging on various factors affecting socio-economic development, for example, Bo Zhang et al. argued that population aging shows a significant positive correlation with the stickiness of labor costs, which will increase the labor costs of enterprises [8]. Haiming Tan et al. found that aging will cause China's economic growth rate to step down in 2021-2025, which will lead to a downward trend of house prices and “reverse urbanization” [9]. Taifeng Xie et al. argued that the rise in population aging will significantly lead to a decline in the level of household leverage [10]. Shengqi Li and Minlong Xu empirically analyzed the relationship between demographic structure and household consumption, and pointed out that population aging has a dampening effect on household consumption [11].

It is worth noting that some scholars believe that population aging has a certain positive impact on economic development, and that population aging should be scientifically utilized to create value, such as Wei Wang et al. who proposed that population aging has a facilitating effect on the optimization of China's industrial structure, and that it has an optimizing effect within the manufacturing industry, service industry and other industries, and that it should be positive to the aging trend of the population, and to promote the upgrading of industrial structure[12]. Feifei Wu et al. suggested that population aging can enhance the export relative advantage of “age-added” industries through the H-O and Ricardian mechanisms [13]. Gradstein & Kaganovich proposed a model consistent with the above cross-sectional regression but predicted that the life expectancy of the population will increase in the future and the overall positive effect of increased longevity on public education funding and economic growth [14].

3.Theoretical Analysis

The main paths of GDP growth include demand-driven growth and supply-driven growth. Based on the classical theory that economic growth involves population factors, this section analyzes the impact of population aging on the potential and vitality of economic development from both sides of supply and demand.

From the perspective of the demand side, the "troika" driving economic growth is consumption, investment and net export. In terms of consumption, according to the Franco Life Cycle theory, the aggregate consumption rate is lower when the working-age population in a household is larger. However, the theory does not take into account the effect of precautionary saving motivation. According to Samuelson's hypothesis of household savings demand, the reduction of the child dependency ratio will reduce the consumption rate of households at the present stage. At the same time, the low consumption desire of the elderly group, coupled with the elderly's demand for pension will squeeze their children's other consumption space, which also plays an inhibitory role in China's overall consumption level. In terms of investment, Solow economic growth theory points out that capital accumulation is the basic element of economic growth. When the economy reaches equilibrium, the change of capital stock per capita is equal to the difference between new investment per capita and depreciation of capital per capita. When a country's labor supply is abundant, further investment is needed to maintain a constant capital stock per capita. It can be seen that the aging population will have an impact on the scale of investment in a country. In addition, changes in the age structure of the population will also have a certain impact on the direction of investment. On the export side, based on a balanced national income identity, the change in the balance of the current account of import and export trade is equal to the subtraction of domestic saving and domestic investment. Further, according to the dependency burden hypothesis (Coale and Hoover), the dependency ratio is inversely proportional to the saving rate. When the dependency ratio increases, the saving rate decreases, and external capital inflow is needed to meet the domestic investment demand. The aging population also leads to the weakening of China's export trade advantages such as low labor costs, which brings about the transformation of export trade.

On the supply side, the impact of population aging on the macro economy mainly comes from three dimensions: labor supply, technological innovation and total factor productivity. In terms of labor supply, the aging population has reduced the size of the working-age population, and the contradiction between labor supply and demand has surged. At the same time, the elderly population is usually at a disadvantage in terms of mental and physical strength, coupled with the increasing support burden of middle-aged workers brought by the aging population, some middle-aged workers are forced to withdraw from the labor market, which has led to a significant decline in the labor participation rate. Population aging increases the average age of the labor force, and labor productivity decreases accordingly. In the aspect of technological innovation, endogenous growth theory holds that technology is an endogenous factor affecting economic growth. Population aging will lead to a decrease in the level of human capital in the field of technology, which will harm technological progress. The social level leads the government to increase spending on social security, which forms a certain crowding out effect on national technological research and development investment that hinders the scientific and technological innovation of the society as a whole. In terms of total factor productivity, at the individual level, the increase of age will bring about the decline of human function, which will lead to the decrease of individual labor productivity. At the overall level, according to existing theories, the effect of age on the overall productivity of an organization presents an "inverted U-shaped" feature.

4.Empirical Analysis

4.1.Model Construction

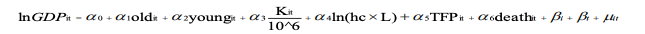

Taking each country and region in the world from 1960 to 2019 as a sample, We choose to select the individual and time two-way fixed-effects regression model. Then we comprehensively examines the process and mechanism of the impact of the change in the age structure of the population on China's GDP and its composition through empirical analysis. The specific econometric models are as follows:

The subscripts i and t represent different countries and time, respectively, and β is the coefficient of the variable; βi and βt denote the fixed research object and the fixed research period, respectively, and μit denotes the random error term.

The old-age dependency ratio is selected as the core explanatory variable, and GDP level is the explanatory variable. The juvenile dependency ratio, capital stock, the product of the number of labor force and the level of human capital (the level of labor force with additional human capital), the level of total factor productivity, and the mortality rate are used as control variables.

Table 1: Definition of variables.

|

Name |

Label |

Explanation |

|

GDP |

lnGDP |

Logarithmic value of GDP. |

|

Elderly dependency ratio |

old |

Ratio of population aged 65 and over to working-age population. |

|

Juvenile dependency ratio |

young |

Ratio of the number of persons aged 0-14 to the number of persons of working age. |

|

Population mortality rate |

death |

Deaths per 1,000 population. |

|

Total factor productivity |

lnTFP |

Logarithm of total factor productivity. |

|

Level of capital stock |

lnK |

Logarithm of the level of capital stock. |

|

Level of manpower |

HC |

Cross-country comparable index of human capital levels based on limited education and returns to education across countries. |

|

Labour force size |

L |

Population aged 15-64. |

All data used in this paper are from the World Bank and PWT database (Penn World Table), with a sample of cross-country panel data from 1980-2019. Considering the issues of data availability, outliers and missing information, the paper removes samples with missing data.

4.2.Descriptive Statistics

The sample size of our paper is 9432. Among them, the mean value of the explanatory variable lnGDP is 10.44, and the extreme deviation is 13.79, reflecting the obvious economic differences among countries in the world. The mean value of the core variable old-age dependency ratio (Old) is 10.56, and the extreme difference is 49.73, reflecting that the global aging problem is serious and there are some differences.

Table 2: description of variables.

|

variable |

N |

mean |

p50 |

sd |

min |

max |

range |

|

lnGDP |

9432 |

10.44 |

10.37 |

2.215 |

3.062 |

16.85 |

13.79 |

|

Old |

9432 |

10.56 |

7.630 |

6.641 |

0.200 |

49.92 |

49.73 |

|

Young |

9432 |

60.21 |

61.61 |

25.12 |

15.74 |

114.4 |

98.64 |

|

Death |

9432 |

10.44 |

9.200 |

5.457 |

0.795 |

103.5 |

102.7 |

|

TFP |

9432 |

0.340 |

0.385 |

0.288 |

0 |

1.547 |

1.547 |

|

K |

9432 |

1.377 |

0.111 |

4.943 |

0 |

99.61 |

99.61 |

|

HCL |

9432 |

1.805 |

1.659 |

1.543 |

0 |

7.676 |

7.676 |

4.3.Benchmark regression Analysis

We consider the impact of aging on both supply and demand and thus on changes in a country's GNP. The results of the benchmark regression show that population aging has a significant impact on GDP. The aging of a country's population has an inverse effect on its GDP, with GDP declining by 2.4% for every 1% increase in the aging of the population worldwide, suggesting that aging is a significant impediment to GDP growth. Further, we control the variables based on the results of the baseline regression. After the last three columns of the regression results, it is found that population aging still maintains an inverse effect on GDP, i.e. the more serious a country's population aging is, the worse its GDP performance will be. Specifically, one percent increase in the old-age dependency ratio significantly reduces the level of GDP by 0.006 percent, in line with the theoretical analysis.

Table 3: Benchmark regression result.

|

(1) |

(2) |

(3) |

(4) |

|

|

GDP |

GDP |

GDP |

GDP |

|

|

Old |

-0.024*** |

-0.011*** |

-0.010*** |

-0.006*** |

|

(0.005) |

(0.002) |

(0.002) |

(0.002) |

|

|

Young |

-0.018*** |

-0.017*** |

-0.016*** |

|

|

(0.001) |

(0.001) |

(0.000) |

||

|

Death |

-0.015*** |

-0.011*** |

-0.019*** |

|

|

(0.002) |

(0.002) |

(0.001) |

||

|

TFP |

1.316*** |

1.416*** |

0.750*** |

|

|

(0.038) |

(0.039) |

(0.031) |

||

|

K |

0.000*** |

0.000*** |

0.000*** |

|

|

(0.000) |

(0.000) |

(0.000) |

||

|

HCL |

1.057*** |

1.048*** |

0.076*** |

|

|

(0.008) |

(0.008) |

(0.014) |

||

|

Constant |

5.834*** |

9.456*** |

9.162*** |

7.538*** |

|

(0.170) |

(0.055) |

(0.109) |

(0.062) |

|

|

N |

9693 |

9432 |

9432 |

9432 |

|

R2 |

0.855 |

0.821 |

0.824 |

0.980 |

|

Year/Id |

Yes |

No |

No |

Yes |

4.4.Robustness Test

4.4.1.Instrumental Variable Method

To address endogeneity issues such as omitted variable bias and reverse causality, this paper employs the instrumental variable (IV) method. Following the research of Su Jian since the first-order lag of the independent variable is highly correlated with the variable itself and weakly correlated with the current period's disturbance term, this paper selects the first-order lag of the elderly dependency ratio as the instrumental variable. The results of 2SLS are presented in Table 5, columns (1) and (2).

The first-stage regression, as shown in column (1), has a coefficient of 0.9744 for F.Old on Old, significant at the 1% level, meeting relevance criteria. Diagnostics reveal an adjusted R-squared of 0.9994, a Kleibergen-Paap rk LM P-value of 0.000, and a Wald F-value of 220,000, passing weak instrument and non-identification tests, validating the instrument's effectiveness. The second-stage regression in column (2) shows a coefficient of -0.0063 for Old on lnGDP, significantly negative at the 1% level, with other independent variables' coefficients and significance remaining consistent, confirming the paper's conclusions hold after controlling for potential endogeneity.

Table 4: Robustness Test

|

(1) |

(2) |

(3) |

|

|

Old |

lnGDP |

lnGDP |

|

|

Aging |

-0.009*** |

||

|

(0.003) |

|||

|

F.Old |

0.9744*** |

||

|

(0.001) |

|||

|

Old |

-0.0063*** |

||

|

(0.002) |

|||

|

Control |

Yes |

Yes |

Yes |

|

Constant |

-0.2076*** |

7.5355*** |

7.547*** |

|

(0.031) |

(0.061) |

(0.063) |

|

|

N |

9,252 |

9,252 |

9432 |

|

R2 |

0.999 |

0.980 |

0.980 |

|

Year/Id |

Yes |

Yes |

Yes |

4.4.2.Replace the Explanatory Variable

This paper substitutes the measure of aging with the proportion of the population aged 65 and above (Aging) across countries. The regression results, as shown in Table 4, column (3), indicate that all independent variables' coefficients and their significance levels are largely consistent, demonstrating the robustness of the findings.

4.5.Sub-regression Analysis

The composition of GDP can be divided into consumption, investment, government purchases and net exports based on the expenditure method, and this paper conducts sub-tests on these three items to study the impact of population aging on the composition of GDP.

We take the logarithm of final consumption expenditure per capita resident, gross capital formation, and total net exports of goods as proxy variables to measure the level of consumption, investment, and exports respectively, and the test results are shown in the table below.

In the column of consumption, the regression coefficients of Old on lnGDP before and after adding control variables are -0.051 and -0.038 respectively, the coefficients are negative and significant at 1% confidence level, that is to say, the problem of population aging reduces the level of per capita consumption, and this effect is more sensitive. In the column of investment, the regression coefficients of Old on GDP before and after the control variable are -0.043 and -0.024 respectively, and both are significant at 1% confidence level. It is easy to know that population aging can significantly reduce the level of investment and thus inhibit economic development. In the column of export, the regression coefficients of Old on GDP before and after adding control variables are -0.039 and -0.049 respectively, and both are significant at 1% confidence level, i.e., population aging can significantly reduce the level of net export, thus inhibiting economic development.

Table 5: Sub-regression analysis results

|

Consumer |

Investment |

Exportation |

||||

|

lnC |

lnC |

Capital |

Capital |

Net export |

Net export |

|

|

Old |

-0.051*** |

-0.038*** |

-0.043*** |

-0.024*** |

-0.039*** |

-0.049*** |

|

(0.001) |

(0.001) |

(0.003) |

(0.003) |

(0.015) |

(0.018) |

|

|

Control |

No |

Yes |

No |

Yes |

No |

Yes |

|

Constant |

11.037*** |

11.165*** |

19.652*** |

20.197*** |

16.830*** |

17.272*** |

|

(0.026) |

(0.025) |

(0.383) |

(0.373) |

(0.736) |

(0.783) |

|

|

N |

9432 |

9432 |

4307 |

4307 |

1906 |

1906 |

|

R2 |

0.995 |

0.996 |

0.973 |

0.975 |

0.786 |

0.792 |

|

Year&Id |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

5.Conclusion

To summarize, population aging has impacts on both the demand and supply sides, both of which together inhibit economic development. Through the benchmark regression and further research, we find that a 1% increase in the old-age dependency ratio will lead to a significant decline in GDP by 0.6%, per capita final consumption expenditure by 3.8%, gross capital formation by 2.4%, and total net exports by 4.9%. It can be expected from the current state of social development that China's aging will continue to deepen in the future, and the impact on GDP will continue to increase, with supply and demand influencing each other in a vicious cycle. Further, aging will lead to a decline in household income, a lower willingness to consume, and a lower average level of social consumption. The internal structure of the labor force will also be skewed toward “aging,” leading to a decline in the overall rate of technological progress in society, which will inhibit economic development in the long term. To respond positively to the difficult challenges posed by population aging to China's economic development, it is necessary to take proactive reform measures to promote economic and social development through both supply- and demand-side expansion.

References

[1]. Huijing Li. Population aging in Japan[J]. A study of the planned economy, 1985(Z2):53-55. (In Chinese)

[2]. Guest R. Superannuation, Population aging and Living Standards in Australia [J].Economic Analysis and Policy,2002,32(1):19-33.

[3]. Guixin Wang, Yihui Gan.Population Aging in China and Regional Economic Growth[J]. Chinese Journal of Population Science,2017,(03):30-42+126-127.

[4]. Jian Su. Impact of Population Aging on Economic Growth Based on Perspective of Aggregate Supply and Aggregate Demand Analysis[J]. Journal of Beijing Technology and Business University(Social Sciences),2021,36(5) : 14-23.

[5]. Yang Du,Yonggang Feng. The Shock of Accelerating Population Aging on Economic Growth[J]. Economic Research Journal,2021,56(02):71-88.

[6]. Maestas N, Mullen K J, Powell D. The effect of population aging on economic growth, the labor force, and productivity[J]. American Economic Journal: Macroeconomics, 2023, 15(2): 306-332.

[7]. Bloom D E, Canning D, Fink G. Implications of population aging for economic growth[J]. Oxford review of economic policy, 2010, 26(4): 583-612.

[8]. Bo Zhang, Limei Yang ,Tao Tao. Population Aging and Labor Cost Stickiness[J]. Accounting Research 2022,(01):59-69.

[9]. Haiming Tan, Yudong Yao, Shuqiang Guo, Chen Ning. Population Aging, Migration, Financial Leverage and the Economic Long Swing[J]. Economic Research Journal,2016,51(02):69-81+96.

[10]. Taifeng Xie,Wei Lu,Ying Liu. The Impact of Population Structure on the Level of Household Leverage [J]. Finance Forum,2022,27(10):3-12.

[11]. Shengqi Li ,Minlong Xu. Population Structure, Fertility Policy and Household Consumption [J]. Northwest Population Journal,2022,43(04):15-31.

[12]. Wei Wang,Yufei Liu,Dongdong Peng. An investigation into the enhancement of industrial structure due to an aging population. [J]. China Industrial Economics 2015,(11):47-61. (In Chinese)

[13]. Feifei Wu, Tong Zhang, Wei Wang. Population aging, labor price distortion, and the evolution of export advantage [J]. Industrial Economics Research,2022,(03):41-55.

[14]. Gradstein M, Kaganovich M. Aging population and education finance[J]. Journal of Public Economics, 2004, 88(12): 2469-2485.

Cite this article

Liu,X.;Zhang,W.;Wang,W.;Wang,X. (2024). Impact of the Extent of Population Aging on Economic Development and Countermeasure . Advances in Economics, Management and Political Sciences,103,232-239.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 8th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Huijing Li. Population aging in Japan[J]. A study of the planned economy, 1985(Z2):53-55. (In Chinese)

[2]. Guest R. Superannuation, Population aging and Living Standards in Australia [J].Economic Analysis and Policy,2002,32(1):19-33.

[3]. Guixin Wang, Yihui Gan.Population Aging in China and Regional Economic Growth[J]. Chinese Journal of Population Science,2017,(03):30-42+126-127.

[4]. Jian Su. Impact of Population Aging on Economic Growth Based on Perspective of Aggregate Supply and Aggregate Demand Analysis[J]. Journal of Beijing Technology and Business University(Social Sciences),2021,36(5) : 14-23.

[5]. Yang Du,Yonggang Feng. The Shock of Accelerating Population Aging on Economic Growth[J]. Economic Research Journal,2021,56(02):71-88.

[6]. Maestas N, Mullen K J, Powell D. The effect of population aging on economic growth, the labor force, and productivity[J]. American Economic Journal: Macroeconomics, 2023, 15(2): 306-332.

[7]. Bloom D E, Canning D, Fink G. Implications of population aging for economic growth[J]. Oxford review of economic policy, 2010, 26(4): 583-612.

[8]. Bo Zhang, Limei Yang ,Tao Tao. Population Aging and Labor Cost Stickiness[J]. Accounting Research 2022,(01):59-69.

[9]. Haiming Tan, Yudong Yao, Shuqiang Guo, Chen Ning. Population Aging, Migration, Financial Leverage and the Economic Long Swing[J]. Economic Research Journal,2016,51(02):69-81+96.

[10]. Taifeng Xie,Wei Lu,Ying Liu. The Impact of Population Structure on the Level of Household Leverage [J]. Finance Forum,2022,27(10):3-12.

[11]. Shengqi Li ,Minlong Xu. Population Structure, Fertility Policy and Household Consumption [J]. Northwest Population Journal,2022,43(04):15-31.

[12]. Wei Wang,Yufei Liu,Dongdong Peng. An investigation into the enhancement of industrial structure due to an aging population. [J]. China Industrial Economics 2015,(11):47-61. (In Chinese)

[13]. Feifei Wu, Tong Zhang, Wei Wang. Population aging, labor price distortion, and the evolution of export advantage [J]. Industrial Economics Research,2022,(03):41-55.

[14]. Gradstein M, Kaganovich M. Aging population and education finance[J]. Journal of Public Economics, 2004, 88(12): 2469-2485.