1. Introduction

1.1. Macroeconomic Background

1.1.1. Policies of the government and financial institutions

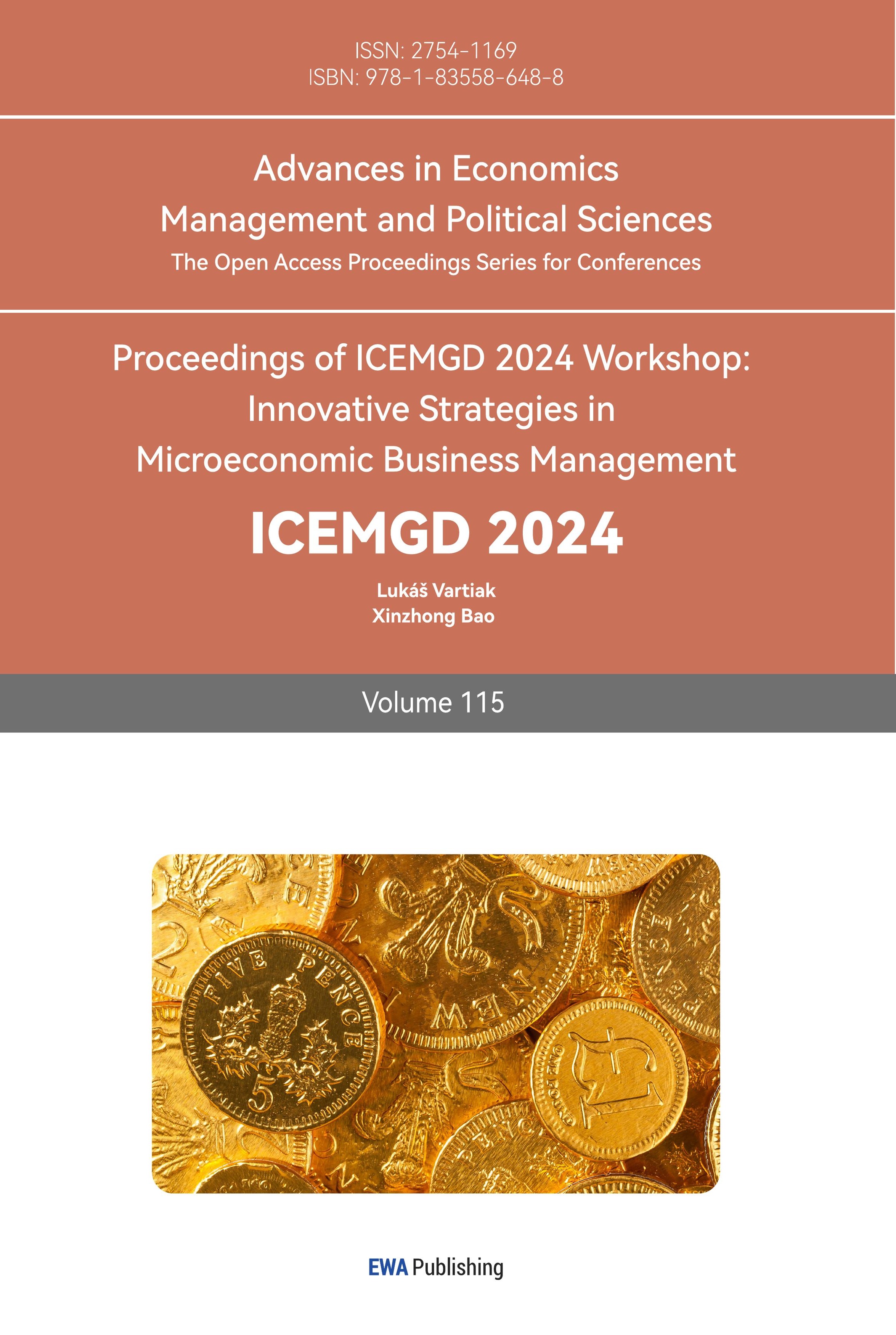

Before 2000, the United States was having the economic recession due to the economic downturn, which led to more economic recession in itself and its neighboring countries. Gordon H. Hanson analyzed in detail the causes of the economic recession and the economic recovery after the Internet economic bubble [1]. Therefore, the United States was eager to find a way to restore the economy in short term. However, it later led into more economic downturn, which made the national economy even more sluggish. From Figure 1, it shows that the US consumer index achieved a short-term growth after 2006 due to subprime loans, but then the US economy fell into a downturn again. It causes a huge economic lose due to the subprime loans. Its impact covers all aspects of macro, micro, policy and market reactions. As Gorton. G.B. said, the abuse of policies has led the government to strengthen supervision of the banking and financial industries, and people's investment confidence has also been frustrated [2].

The outbreak of the subprime mortgage crisis did not happen instantly but was the result of many years of problems in financial markets, policies and the global economy. In 2000, the United States was affected by the Internet economic bubble, and the stock prices of many technology companies fell sharply, investor confidence was frustrated, and a large amount of funds flowed out of the market. In order to deal with this problem, the government decided to implement a policy of lowering interest rates to help the country's economic growth, aiming to stimulate people's investment and consumption, so as to save the US market economy.

Figure 1: Consumer Confidence Index between 2006-2010

Data source: The Conference Board NBER

1.1.2. Global Market Impact

After 9/11, terrorist attacks in 2001 further exacerbated the uncertainty of the US economy. The US tourism, aviation and insurance industries were once again hit. As Slocum, J.W. McGill, M.E., & Hansen, R.W. mentioned, the US tourism industry had been affected, passenger traffic dropped sharply, flight frequencies continued to decrease, and many airlines once faced financial difficulties [3]. The Federal Reserve once again decided to lower interest rates in the hope of helping businesses and consumers regain confidence and promote economic recovery. In addition, the slowdown in economic growth of neighboring partners also had a negative impact on the United States itself. As Kaminsy. G.L, Reinhart, C.M., & Vegh, C.A. mentioned, the financial contagion factor between countries is linked to the financial market. If a country suffers a financial crisis, other countries or trading partners will also be affected [4]. Therefore, the United States promptly adjusted its low-interest financial policy to reduce the import and export deficit and support domestic economic growth. Although lowering interest rates boosted the economy in the short term, it also led to excessive borrowing and speculative behavior. Many financial institutions even began to provide loans to borrowers whose creditworthiness did not meet standards, called subprime loans, in the hope of getting a return in the short term. As Gorton mentioned in the article, the increase in subprime loans led to a real estate boom, and the continuous rise in housing prices also made people ignore the dangers of high-risk loans [2].

If the real estate industry stagnates and declines, many borrowers will not be able to repay their loans, resulting in a large number of defaults and foreclosures, causing huge losses to the financial capital chain. As Taylor, J.B. analyzed, the low interest rate policy of the Federal Reserve was one of the driving forces behind the subprime mortgage crisis, which gave financial institutions an opportunity to expand risky businesses. The low interest rate policy caused house prices and real estate investment to rise sharply, forming an asset bubble. Moreover, these high-risk loans were turned into securities and sold around the world, further expanding the scope of risk. [5] The subprime mortgage crisis had a far-reaching impact on the world. As the world's largest economy, the economic fluctuations of the United States affected many other countries. During the subprime mortgage crisis, the economies of many countries were forced to slow down. Because of the crisis and losses in the subprime mortgage market, banks and financial institutions in many countries faced huge losses.

1.2. Microeconomic Background

At the micro level, the subprime mortgage crisis has also caused immeasurable losses to individuals, families and businesses. Reinhart, C.M., & Rogoff, K.S. described the economic recession caused by the subprime mortgage crisis, which forced many companies to close down, and the unemployment rate rose sharply during this period. People's living costs also rose, and the economic burden became heavier. High unemployment and high inflation led to a decline in consumer confidence in the market, making them more reluctant to consume, further inhibiting economic recovery [6].

1.3. Purpose of this paper

This paper is an analysis of the macro and micro impacts of the subprime mortgage crisis, aiming to provide a clearer and more intuitive understanding of the overall picture of the US subprime mortgage crisis and a deeper understanding of the impact of the subprime mortgage crisis on the US economy.

2. Macro Impact

2.1. Financial Market

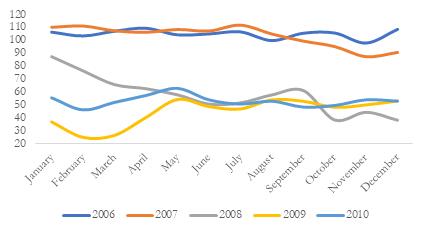

The financial panic caused by the subprime mortgage crisis continued to spread, and many financial institutions were once again pushed to the brink of bankruptcy. Investor confidence was once again hit, and the stability of the financial market dropped significantly. The subprime mortgage crisis not only hit the domestic financial sector, but also caused immeasurable losses to financial institutions around the world. The collateral effects of subprime mortgages caused financial institutions and investors in many countries around the world to suffer huge losses, and the market felling. Wiggins, R.Z., Piontek, T., & Merick, A. explained in detail in the book the crisis brought by subprime mortgages to the US financial industry. Lehman Brothers, a large financial institution, was unable to maintain its financial stability because it held a large amount of assets related to subprime mortgages. It eventually filed for bankruptcy in September 2008 [7]. The average wealth of all American households also dropped significantly after that. As shown in Figure 2, the total wealth held by households in 2008 was 1/4 lower than that in 2007. The financing and investment ideas of enterprises and individuals were constantly weakened, and the economic situation deteriorated.

Figure 2: Average Family Household Net Worth From (USD) 2007-2010

Data source: Federal Reserve, CNN Money, BI Intelligence, Money Morning Staff Research

Photo credit: Original

2.2. Global Economic Impact

The subprime mortgage crisis has led to a slowdown in global economic growth, a continuous decline in consumer power, and a complex and uncertain economic environment. The subprime mortgage crisis has made global economic recovery more difficult, with a significant decline in global trade and a slowdown in economic growth. The stability of the financial system has been seriously threatened, and many countries have had to introduce a series of policies to restore the economy, including large-scale economic stimulus and monetary easing policies, in order to alleviate the economic pressure brought about by the economic downturn. As John J. Kirton said, the subprime mortgage crisis not only led to a serious recession in the US economy, but also gradually spread this risk to the world. Central banks of various countries have introduced actions such as purchasing bonds and implementing economic assistance, but they still cannot solve the problem [8]. Mark Johnson, & Robinson Peter also mentioned that countries have increased reserves and strengthened bank supervision in order to cope with sudden financial risks. Banks have also raised lending standards, making it more difficult for companies to borrow [9].

3. Micro-influence

3.1. Personal and Family Financial Difficulties

The subprime mortgage crisis has led to an increase in subprime mortgage risks. Many individuals and countries are facing financial difficulties and are unable to repay on time, causing the financial chain to fall into a vicious cycle and a large number of defaults and foreclosures. The lack of repayment capacity has led to the financial crisis, which has further exacerbated the economic difficulties of individuals and families, making it difficult for them to protect themselves from the crisis. The sharp fluctuations in real estate have a significant impact on personal finances. Many families have fallen into negative assets after the decline in housing prices, further exacerbating economic difficulties. Gorton, Gary B mentioned the Johnson family in California. After experiencing the subprime mortgage crisis, the value of their house was halved from $500,000, but due to the increase in loan interest rates, the repayment pressure has increased, and the economics of the family has fallen into a state of negative growth. Due to the economic downturn, Johnson even lost his job and his family situation plummeted [10].

3.2. Closure of Businesses and Institutions

Many financial institutions and enterprises went bankrupt as a result, and massive unemployment and economic caused the entire financial market into trouble.

4. Policy Consequences and Market Reactions

4.1. Monetary Policy: Implementation of Subprime Lending Policy

The implementation of the subprime mortgage policy was the main reason for the outbreak of the subprime mortgage crisis. The established of the subprime mortgage policy allowed institutions to provide loans to people with poor credit, promoting their consumption and investment. It was also to expand the coverage of housing loans, so that more low-income people could afford real estate. More people bought houses, which could promote the rise of the real estate industry. Obviously, this policy was abused and used by the financial industry as a tool to pursue high profits. Johnson, S. & Kwak, J. mentioned that the loose of the subprime mortgage policy allowed large-scale loans to flow into the hands of those with poor credit and repayment ability. Many low-income people obtained a large amount of real estate loans, which promoted the prosperity of the real estate market. The financial market grew rapidly, housing prices continued to rise, and the market once reached its peak [11]. As shown in the market analysis chart of Figure 3, the real estate industry has experienced negative growth since 2007. It was growth significantly before the subprime mortgage crisis. But those are all economic bubbles. Regulators also underestimated the risks of subprime mortgages. Due to their mistaken underestimation of the subsequent risks of subprime mortgages, regulators did not predict the crisis. Similarly, they failed to effectively control the subprime mortgage market and continued to allow financial institutions to issue high-risk loans, which eventually led to uncontrollable risks.

Figure 3: S&P/Case-Shiller U.S. National Home Price Index

Data source: FRED, Federal Reserve Bank of St.Louis

Photo credit: Original

After the subprime mortgage crisis, the government and the market took a series of measures to make up for this strategic mistake. The financial industry was thoroughly reshuffled, and senior executives of regulatory departments were replaced and punished. The government strengthened supervision of the financial market and took a series of measures to control risks to allocate the consequences of the financial crisis, such as the promulgation of the Dodd-Frank Wall Street Reform and Consumer Protection Act, the establishment of the Financial Stability Oversight Council and the Consumer Financial Protection Bureau [12]. It also strengthened supervision of derivatives and raised the limitation to prevent the recurrence of the crisis. Strict loan plans were implemented, the number of high-risk loans in the market was reduced, and the market gradually stabilized.

4.2. Fiscal Policy

The government further lowered interest rates and increased fiscal spending to promote economic recovery. The government focused more on the long-term stability and healthy development of the market. The American Recovery and Reinvestment Act of 2009, ARRA[13] is a bill introduced by the United States to boost the domestic sluggish economic environment. It chose to provide $787 billion in economic stimulus to promote consumption, ease local finances and increase project investment.

5. Conclusion

This article focuses on the US economic downturn, namely the subprime mortgage crisis, and analyzes the causes, processes and consequences of the subprime mortgage crisis, including the impact of the subprime mortgage crisis on the world. The analysis shows that the US government has excessively let go of its lending rights in order to boost the domestic sluggish economic environment. Large financial institutions took advantage of this loophole and illegally lent loans to people who did not meet the repayment regulations. Although it did boost the domestic economy to a certain extent for a certain period of time. But what followed was a more serious economic negative growth, which also hit investor confidence. Although the subsequent policies and more stringent management agencies still brought an indelible impact to the world. Therefore, in the process of investment, people cannot blindly pursue rapid economic growth and ignore the potential crisis behind it. The government should pay more attention to the steady development of the economy, make adjustments in policies, be cautious in issuing loans, and have a clear division of loan borrowers. A large number of loans should be lent to enterprises to promote social and economic development, rather than to low-income people who do not meet the loan requirements. In the future, the investment scope of loans can be expanded to more small industries to promote the positive development of the social economy.

References

[1]. Hanson, G. H. (2003). After the Fall: The 2001 Recession and the American Economy’s Slow Recovery.

[2]. Gorton, G. B. (2009). Slapped by the Invisible Hand: The Panic of 2007. Oxford University Press.

[3]. Slocum, J. W., McGill, M. E., & Hansen, R. W. (2002). The Impact of Terrorism on Business. Journal of Business Strategy, 23(2), 32-37.

[4]. Kaminsky, G. L., Reinhart, C. M., & Vegh, C. A. (2003). The Unholy Trinity of Financial Contagion. Journal of Economic Perspectives, 17(4), 51-74.

[5]. Taylor, J. B. (2009). The Financial Crisis and the Policy Responses: An Empirical Analysis of What Went Wrong. National Bureau of Economic Research.

[6]. Reinhart, C. M., & Rogoff, K. S. (2009). This Time is Different: Eight Centuries of Financial Folly. Princeton University Press.

[7]. Wiggins, R. Z., Piontek, T., & Metrick, A. (2014). The Lehman Brothers Bankruptcy: Lessons Learned and Recommendations. Yale Program on Financial Stability Case Study. Available at: https://som.yale.edu/sites/default/files/files/02920140402%20Lehman%20A%20v1%204.pdf.

[8]. Kirton, J. J. (2010). The Global Financial Crisis: Impacts and Responses. Journal of International Economics, 80(1), 28-37.

[9]. Johnson, S., & Kwak, J. (2010). 13 Bankers: The Wall Street Takeover and the Next Financial Meltdown. Pantheon Books.

[10]. Financial Stability Oversight Council. (2010). Financial Stability Oversight Council 2010 Annual Report. U.S. Department of the Treasury. Available at: https://home.treasury.gov/system/files/261/FSOCAR2010.pdf.

[11]. U.S. Congress. (2009). American Recovery and Reinvestment Act of 2009. Pub. L. No. 111-5, 123 Stat. 115.

[12]. Financial Stability Oversight Council. (2023). Retrieved from https://home.treasury.gov/policy-issues/financialmarkets-financial-institutions-and-fiscal-service/fsoc

[13]. American Recovery and Reinvestment Act of 2009. (n.d.). Retrieved from https://www.fcc.gov/general/americanrecovery-and-reinvestment-act-2009

Cite this article

Bu,Y. (2024). The Impact of the US Subprime Mortgage Crisis. Advances in Economics, Management and Political Sciences,115,187-192.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICEMGD 2024 Workshop: Innovative Strategies in Microeconomic Business Management

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Hanson, G. H. (2003). After the Fall: The 2001 Recession and the American Economy’s Slow Recovery.

[2]. Gorton, G. B. (2009). Slapped by the Invisible Hand: The Panic of 2007. Oxford University Press.

[3]. Slocum, J. W., McGill, M. E., & Hansen, R. W. (2002). The Impact of Terrorism on Business. Journal of Business Strategy, 23(2), 32-37.

[4]. Kaminsky, G. L., Reinhart, C. M., & Vegh, C. A. (2003). The Unholy Trinity of Financial Contagion. Journal of Economic Perspectives, 17(4), 51-74.

[5]. Taylor, J. B. (2009). The Financial Crisis and the Policy Responses: An Empirical Analysis of What Went Wrong. National Bureau of Economic Research.

[6]. Reinhart, C. M., & Rogoff, K. S. (2009). This Time is Different: Eight Centuries of Financial Folly. Princeton University Press.

[7]. Wiggins, R. Z., Piontek, T., & Metrick, A. (2014). The Lehman Brothers Bankruptcy: Lessons Learned and Recommendations. Yale Program on Financial Stability Case Study. Available at: https://som.yale.edu/sites/default/files/files/02920140402%20Lehman%20A%20v1%204.pdf.

[8]. Kirton, J. J. (2010). The Global Financial Crisis: Impacts and Responses. Journal of International Economics, 80(1), 28-37.

[9]. Johnson, S., & Kwak, J. (2010). 13 Bankers: The Wall Street Takeover and the Next Financial Meltdown. Pantheon Books.

[10]. Financial Stability Oversight Council. (2010). Financial Stability Oversight Council 2010 Annual Report. U.S. Department of the Treasury. Available at: https://home.treasury.gov/system/files/261/FSOCAR2010.pdf.

[11]. U.S. Congress. (2009). American Recovery and Reinvestment Act of 2009. Pub. L. No. 111-5, 123 Stat. 115.

[12]. Financial Stability Oversight Council. (2023). Retrieved from https://home.treasury.gov/policy-issues/financialmarkets-financial-institutions-and-fiscal-service/fsoc

[13]. American Recovery and Reinvestment Act of 2009. (n.d.). Retrieved from https://www.fcc.gov/general/americanrecovery-and-reinvestment-act-2009