1. Introduction

In recent years, China's entertainment apps have blossomed in many aspects, covering videos, movies, games, music, animation, live broadcasts, etc. The industries they involve are far more than culture and entertainment, but also extend to tourism, food, sports, technology and other industries. The diversification of online consumption and entertainment needs is strongly stimulating the growth of domestic demand and injecting vitality into the economic system [1]. According to data from China's National Bureau of Statistics, in 2023, cultural enterprises achieved operating income of 12951.5 billion yuan, an increase of 8.2% over the same period last year on a comparable basis, accounting for 10.3% of the annual gross domestic product (GDP) of 126058.2 billion yuan. It can be seen that the entertainment economy drives GDP growth and provides the core driving force for economic development to break through short-term pressure. In 2023, the profit growth of cultural enterprises was even more significant, increasing by 31% year-on-year to 1156.6 billion yuan.

This article analyzes data from various entertainment apps, aiming to outline the preferences and personalities of the main body of Chinese entertainment consumption groups, and thus to make a prospect for China's entertainment consumption economy.

The analyzed entertainment apps include several categories: video, movie and performance, game and music. In the following section 2, data from short video APPs, long video APPs, comprehensive video APPs, movie and performance apps, game APPs and music APPs will be respectively presented and analyzed. While in section 3, analysis of entertainment APP segmentation data is provided, and several case studies are presented. And thus section 4 gives out a conclusion.

2. Visualization of entertainment APP segmentation data

This section 2 begins with data from video APPs.

Long videos and short videos are two different content forms in two tracks, and they each have their own advantages. Short videos are the product of the fast-paced Internet era. The overall development of short videos is mainly based on UGC content, which is a product of the fast-paced Internet era. Their notable features are short, flat and fast, and content supply is increasing exponentially, which can effectively broaden the public's information reach and are more in line with the public's fragmented consumption habits in terms of duration [2]. In May 2023, short videos accounted for 28% of the total usage time of mobile Internet users [3], an increase of nearly 15pct compared to 2019, and it is the main mode of mass consumption. Long videos are mainly PGC content, and the length determines its advantage in content depth, which also makes it more ideological in its core [4].

From the perspective of commercial realization, the difference in the operating logic of the two also determines the difference in commercial realization models. Short videos are directly aimed at C-end users. In the early stage, they are full of UGC content, and the main realization model is live broadcast reward income. With the continuous accumulation of traffic pools and the expansion of diversified realization, the proportion of advertising and e-commerce revenue has gradually increased; and the essence of long videos is the operation logic of ToB. The platform direction, which occupies an important link in the long video industry chain, purchases professionally produced copyrighted content from upstream producers. The free traffic on the platform is realized in the form of advertising, and the paid traffic is realized in the form of membership and buyout content [5].

In terms of cost structure, there are also obvious differences between the two. Short video platforms mainly build online platforms, and the content is mainly produced by users. Therefore, they do not bear many cost items, including anchor costs, servers and bandwidth, and the gross profit margin is relatively high. For example, Kwai’s comprehensive gross profit margin can reach more than 50% [6]; long video platforms have to pay high copyright content costs, so the gross profit margin is relatively low. For example, iQiyi’s content cost accounted for 50.8% of its revenue in 2023, and its gross profit margin was less than 30% [7].

This article takes TikTok and Kwai as examples of short video APPs, and takes iQIYI, Tencent Video, Youku, and Mango TV as examples of long video APPs. There are also comprehensive video APPs that incorporate both long and short videos. For example, Bilibili (B Station) builds a PUGV content ecosystem based on UP master creation, creating a diversified cultural community.

2.1. Short Video Apps

With the continuous development of mobile Internet, short videos meet the diverse needs of users with their diverse content and social functions.

However, as the overall traffic dividend peaked, short video apps transitioned from a high-traffic growth stage to stock operations. In 2023, the short video market size will be close to 300 billion yuan, and the user scale will reach 1.012 billion, accounting for 94.8% of the total number of netizens, making it one of the most used applications in China's Internet applications [8].

From the perspective of the competitive landscape, a competitive landscape dominated by TikTok, Kwai, Tencent Video Account and related product matrices, and short videos has been formed. Although the main players TikTok and Kwai have operational differences in product positioning, GMV driving logic, and the relationship between anchors and users, both have chosen e-commerce as their commercialization path.

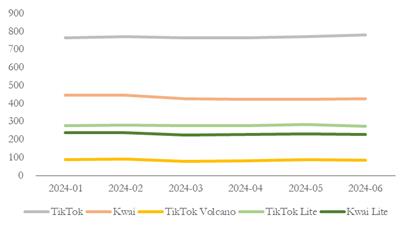

From the perspective of MAU (Monthly Active Users), as shown in Fig. 1, the monthly active user scale of TikTok, Kwai, TikTok Volcano Edition, TikTok Lite Edition, and Kwai Lite Edition has basically stabilized in the first half of 2024. In June 24, TikTok's MAU was 780 million, TikTok Lite Edition's MAU was 270 million, TikTok Volcano Edition's MAU was 90 million, Kwai's MAU was 430 million, and Kwai Lite Edition's MAU was 230 million.

Figure 1: The Monthly Active User Scale of Short Video APP during Jan.-Jun. 2024

Data source: Questmobile

Photo credit: Original

However, from the year-on-year change in MAU scale, TikTok and Kwai have diverged. Specifically, the year-on-year change in the average MAU of TikTok in the first half of 24 was 7.1%, the year-on-year change in the average MAU of TikTok Volcano Edition in the first half of 24 was 18.3%, and the year-on-year change in the average MAU of TikTok Lite Edition in the first half of 24 was 23.6%, while the year-on-year change of Kwai was -6.5%, and the year-on-year change of Kwai Lite Edition was -10.1%.

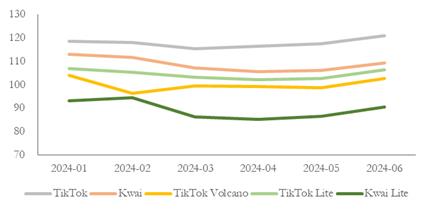

Figure 2: The Average Daily Usage Time per Person of Short Video APP during Jan.-Jun. 2024

Data source: Questmobile

Photo credit: Original

In terms of the average daily usage time per person, as shown in Fig. 2, in June 2024, the average daily usage time per person for TikTok was 121 minutes, the average daily usage time per person for TikTok Volcano Edition was 103 minutes, the average daily usage time per person for TikTok Speed Edition was 106 minutes, the average daily usage time per person for Kwai was 109 minutes, and the average daily usage time per person for Kwai Speed Edition was 90 minutes, indicating strong user stickiness overall.

2.2. Long Video Apps

As short video platforms compete for the attention resources of Internet users, long video platforms have faced great challenges in recent years. However, the demand for watching movies and TV series is relatively stable, and the development of the platform needs to return to content being king. Long video is essentially a high-threshold entertainment content supply platform, which can form a sufficiently dislocated competitive relationship with other entertainment forms. From the perspective of the industry competition landscape, the natural dispersion of content supply makes it difficult for the winner to take all. For example, the dispersion of streaming media channels in the United States is stronger than that in China. In addition, under the challenges of the external environment, including supervision, epidemics, economy and other factors, cost reduction and efficiency improvement have become the industry theme of long videos in the past [9].

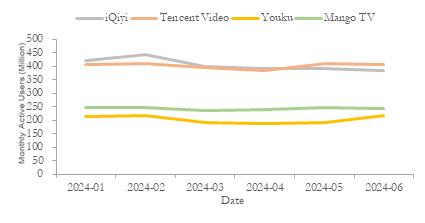

Figure 3: The Monthly Active User Scale of Long Video APP during Jan.-Jun. 2024

Data Source: Questmobile

Photo credit: Original

From the perspective of monthly active user scale, Figure 3 shows that the monthly active user scale of iQiyi, Tencent Video, Youku Video, and Mango TV fluctuated slightly in the first half of 24, but was generally stable. In June 24, the monthly active user scale of iQiyi was 390 million, the monthly active user scale of Tencent Video was 410 million, the monthly active user scale of Youku Video was 220 million, and the monthly active user scale of Mango TV was 240 million. The year-on-year change of the average MAU in the first half of the year was -19.6% for iQiyi, -0.5% for Tencent Video, -21.0% for Youku Video, and -3.9% for Mango TV, all of which showed a downward trend, but the degree of decline was different for different platforms.

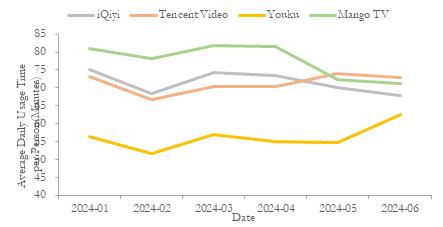

For the average daily usage time per person, according to Fig. 4, iQiyi and Mango TV showed an overall downward trend in the first half of 24. In June, the average daily usage time per person of iQiyi was 68 minutes, while the average daily usage time per person of Mango TV was 71 minutes (75 and 81 minutes in January, respectively), while Youku Video showed an upward trend, 62 minutes in June (57 minutes in January).

Based on the data, it can be considered that for long video APPs, the supply of high-quality content drives demand satisfaction more obviously, which is reflected in the fact that the fluctuations in users and duration are mainly affected by the current content scheduling. Popular content can bring obvious growth in the number of active users on the platform and increase the duration, while the content gap period has an adverse effect on the number of users and duration.

In the first half of 2024, Tencent Video and Youku Video had many high-profile and exclusive phenomenal dramas, such as Tencent Video's "Celebrating Yu Nian Season 2"(Qing Yu Nian Di Er Ji), "The Story of Roses"(Mei Gui De Gu Shi), "Hunting Ice"(Lie Bing) and other dramas, which contributed to its high popularity, thus facilitating the maintenance of the number of users and duration; Youku's "Mo Yu Yun Jian", "Hua Jian Ling", and "Xi Hua Zhi" broke through in the ancient idol creation circle with large traffic and large IP, showing the change of Youku's layout thinking and advanced content thinking.

In contrast, iQiyi lacks big hit dramas, and costume dramas have failed one after another. The popularity performance of "Fox Spirit Matchmaker: Moon Red" (Hu Yao Xiao Hong Niang Yue Hong Pian) and "Flame"(Lie Yan) is not as expected. Only the drama "Journey to the West" (Yu Feng Xing) co-broadcast with Tencent Video on Mango TV gained high popularity, while the popularity of other dramas was relatively unsatisfactory.

Figure 4: The Average Daily Usage Time per Person of Long Video APP during Jan.-Jun. 2024

Data Source: Questmobile

Photo credit: Original

2.3. Comprehensive video APPs

As social media and content sharing platforms that are popular among young people, Bilibili and Little Red Book have achieved significant influence in the fields of video entertainment and lifestyle, respectively.

Bilibili is based on the community and adopts the "OGV+PUGV" dual drainage strategy, forming a full link of "OGV content drainage-high-quality PUGV content to increase retention". In addition, the company continues to expand the content vertical category, achieving a breakthrough from two-dimensional users to pan-entertainment and pan-knowledge users, and creating a positive cycle ecology of "UP hosts produce high-quality video content-attract fans and get positive feedback-motivate UP hosts to produce more high-quality content" [10].

Little Red Book is currently one of the fastest growing platform companies in the content industry. Its operating mechanism is based on the daily actual needs of users and relies on a deep reserve of UGC content to become an effective life experience platform and tool-type application at the user's fingertips [11].

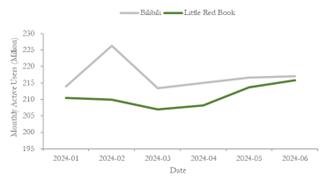

Figure 5: The Monthly Active User Scale of Comprehensive Video APP during Jan.-Jun. 2024

Data Source: Questmobile

Photo credit: Original

Based on Fig. 5, from the perspective of monthly active user scale, the MAU of Bilibili and Little Red Book in June 24 was comparable, both 220 million. In the first half of 2024, the average MAU of the two increased by 7.2% and 15.6% year-on-year, respectively, and the user growth trend was good.

In February 2024, as shown in Fig. 5, Bilibili's monthly active user scale fluctuated greatly. The reason for this is that Bilibili launched a series of special Spring Festival activities in February, including live broadcasts, lucky draws, and New Year's greetings, which attracted a large number of users to participate. For Little Red Book, the proportion of post-95 users among monthly active users is as high as 50%, mainly distributed in first- and second-tier cities. The platform is mainly based on user-generated content (UGC), with an average daily user search penetration rate of 70%, and has become a new generation of search engines and lifestyle encyclopedias.

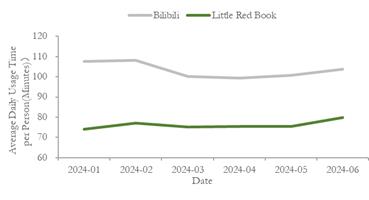

For the average daily usage time per person, according to Fig. 6, Bilibili was 104 minutes in June 2024 and Little Red Book was 80 minutes, with little change year-on-year.

Figure 6: The Average Daily Usage Time per Person of Comprehensive Video APP during Jan.-Jun. 2024

Data Source: Questmobile

Photo credit: Original

2.4. Movie and Performance APPs

Among the movie and performance apps, movie apps provide online ticket purchase services, as well as movie trailers, box office inquiries, movie rankings, film and television information and other information. Performance apps cover multiple fields such as concerts, dramas, musicals, sports events, music and entertainment, parent-offspring, exhibitions and leisure, and have a full-link layout for content, venues, ticketing, etc.

From the perspective of commercial realization, ticketing APPs mainly earn income by selling tickets to consumers and charging a certain percentage of service fees, which usually range from 3 yuan to 5 yuan. In addition, extending to the upstream and downstream of the industry chain has become another development trend of online ticketing platforms. For example, in addition to ticket sales, film reviews, related information, and real-time box office records, online movie ticketing platforms are also involved in film promotion and production.

At the upstream level of the industry chain, some ticketing platforms such as Damai.com participate in the investment, production and promotion of performances by developing self-operated performance brands and content, such as Mailive, to obtain box office revenue and other related income. Maoyan Entertainment also shares upstream production income by investing in films. At the downstream level of the industry chain, since ticketing platforms have a large amount of user traffic and viewing habits data, they can use user data for precision marketing. Therefore, ticketing platforms can provide user portraits and market analysis for film investors, optimize performance arrangements and marketing strategies, and participate in the distribution and marketing of films and performances. In general, the ticketing platform builds a full industry chain service system by integrating upstream and downstream industry chain resources, such as content production, publicity and distribution, to improve overall service efficiency and market competitiveness. The movie and performance apps in this article will take Maoyan and Damai as examples [12].

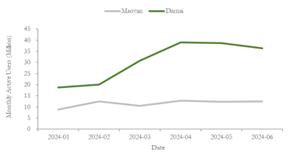

As well-known ticketing platforms, Damai and Maoyan occupy important market positions in the performance and film fields respectively. Driven by the development of the national economy and the upgrading of cultural consumption, people's demand for entertainment activities has also increased [13].

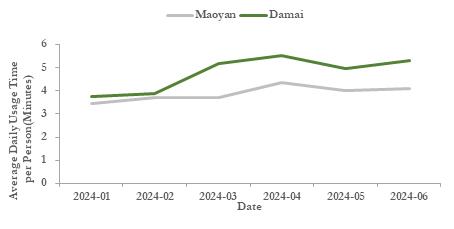

From the perspective of MAU (monthly active user scale), Fig. 7 shows that Damai's scale reached 36.35 million in June 24, and Maoyan's scale reached 12.5 million. In the first half of 24, Damai's MAU showed an overall upward trend, with an increase of 40% from January to June; Maoyan's MAU was stable and rising, with an increase of 94% from January to June, showing rapid growth driven by cultural consumption. From the perspective of average daily usage time per person, as shown in Fig. 8, Damai and Maoyan showed an overall upward trend in June 24, with year-on-year growth of 12.4% (reaching 4 minutes) and 8.8% (reaching 5 minutes) respectively.

Figure 7: The Monthly Active User Scale of Movie and Performance APP during Jan.-Jun. 2024

Data Source: Questmobile

Photo credit: Original

The user growth and time increase trend of the ticketing platform are mainly attributed to the gradual recovery of offline performing arts activities after the epidemic. The performance market has ushered in a strong outbreak, driving the high monthly activity growth and retention of the ticketing platform. According to data monitoring and research estimates from the ticketing information collection platform of the China Performing Arts Industry Association, there were 251,700 commercial performances (excluding performances in entertainment venues) nationwide in the first half of 2024, a year-on-year increase of 30.19%; box office revenue was 19.016 billion yuan, a year-on-year increase of 13.24%; the number of spectators was 79.1013 million, a year-on-year increase of 27.10%.

Figure 8: The Average Daily Usage Time per Person of Movie and Performance APP during Jan.-Jun. 2024

Data Source: Questmobile

Photo credit: Original

2.5. Game and animation apps

In the field of games, after years of development, the mobile game industry has basically formed a model of integrated research and development and operation, that is, large companies develop their own products and publish them by themselves, and research and development capabilities and channel traffic capabilities are more important. As a creative industry, the game industry is product-driven as the mainstream way of monetization in the industry. In particular, for research and development companies, the turnover often shows short-term pulse-like fluctuations, and the long-term turnover is driven by new products and the long-term operation of old products. Therefore, the diversified product matrix of research and development companies is more conducive to maintaining the stability of their performance [14]. From the perspective of the industrial chain, after a game is developed by an upstream developer, it is downloaded by players through a distribution operator and an app store, so the distribution capability is also relatively important. TapTap breaks the limitations of traditional game channels and gives benefits to game developers with a business model of "no joint operation, no profit sharing". The game apps in this article will take TapTap and Pixiv as examples.

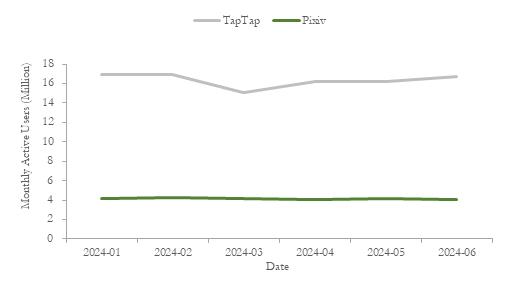

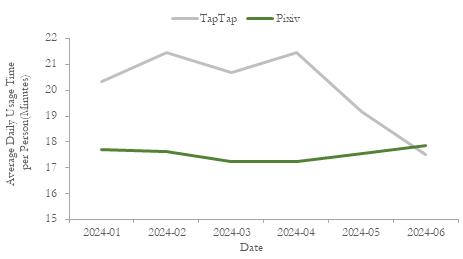

According to Fig. 9, in June 2024, the monthly active user scale of TapTap was 16.69 million, and the monthly active user scale of Pixiv was 4.07 million, with year-on-year growth of 9.2% and 6.2% respectively. Fig. 10 shows that in June 2024, the average daily usage time of TapTap was 17.5 minutes, and the average daily usage time of Pixiv was 17.9 minutes, with year-on-year changes of -5.5% and +2.1% respectively.

Figure 9: The Monthly Active User Scale of Game APP during Jan.-Jun. 2024

Data Source: Questmobile

Photo credit: Original

Figure 10: The Average Daily Usage Time per Person of Game APP during Jan.-Jun. 2024

Data Source: Questmobile

Photo credit: Original

2.6. Online Music APPs

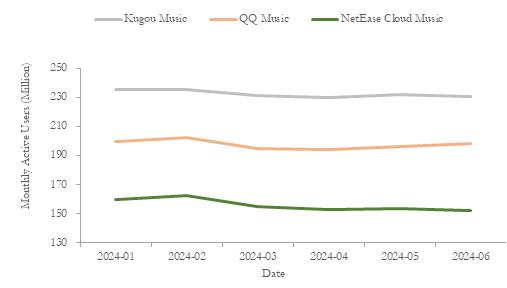

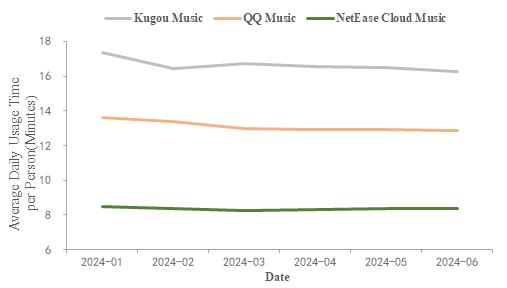

In the first half of 2024, the monthly active user scale and average usage time of online music APPs remained basically stable. In June 24, as shown in Fig. 11, the monthly active user scale of Kugou Music was 230 million, the monthly active user scale of QQ Music was 200 million, and the monthly active user scale of NetEase Cloud Music was 150 million, with year-on-year changes of -3.7%, +1.5%, and -0.3%, respectively. Based on Fig. 12, in June 24, the average daily usage time of Kugou Music was 16 minutes, the average daily usage time of QQ Music was 13 minutes, and the average daily usage time of NetEase Cloud Music was 8 minutes, down 8.6%, 7.9%, and 5.9% year-on-year, respectively.

Figure 11: The Monthly Active User Scale of Music APP during Jan.-Jun. 2024

Data Source: Questmobile

Photo credit: Original

Figure 12: The Average Daily Usage Time per Person of Music APP during Jan.-Jun. 2024

Data Source: Questmobile

Photo credit: Original

3. Analysis of entertainment APP segmentation data

3.1. Group analysis/user portrait of industry segmentation

3.1.1. Video APP

Long and short videos are two complementary content forms with huge differences in consumption scenarios and forms.[4] The video industry is currently in a period of transformation. The competition for traffic and user attention among Internet platforms has intensified. The rise of short video platforms has indeed impacted the original traffic pool of long videos. However, the competition for traffic between long and short video platforms is not either-or. It does not mean that once the public is used to watching short videos on TikTok, they will not watch long videos on Youku, iQiyi and Tencent Video.

When long video APPs first started, they focused on the young people market. In recent years, the genre structure of online dramas has undergone a transformation. iQiyi, Tencent Video and Youku have begun to re-examine the public's content needs and began to embrace national-level themes and mature content. They have achieved audience coverage of all ages and have moved towards middle-aged people and even the elderly in addition to young people. Whether in the TV era or the Internet era, themes that are close to reality and aimed at all-age audiences are the most recognized, influential and resonant with the audience. Video websites are beginning to focus on more scarce content, which is also good news for the long-term development of long videos. Exploring narrative scarcity, genre scarcity and core scarcity makes it possible to create long video content with scarce value and leading trends.

More than 60% of long video APPs are female, among which Mango TV has a high proportion of females, and Tencent Video and Youku Video users are relatively evenly divided in gender. In the past one or two years, some people outside believe that long videos will decline under the impact of short videos, but in fact, although short videos are efficient and convenient, people can only accept scattered and fragmented information in short videos, while in long videos, people's emotional experience is complete, immersive and profound, and this advantage is irreplaceable.

Short videos have the characteristics of "short", "show" and "chat". "Short" makes users see the essence and can make better use of their fragmented time; "show" allows users to have a stage to show themselves, show their value and significance; "chat" greatly improves users' social vision and ability. These characteristics have made the user scale of short video platforms increasingly large, and have also attracted capital from various fields of media and information to intervene.

Nowadays, people's pace of life is getting faster and faster, and the pressure they face is getting greater and greater. The pressure from work, life, study and other aspects needs to be released, and short videos just provide an outlet for emotional pressure. By browsing short videos, users can temporarily put down the pressure and achieve the effect of relaxation.

In 2023, there are more males than females among short video APP users, and nearly 70% are between the ages of 19 and 35; nearly half of users watch short videos multiple times a day; social positive energy and funny content are the content that short video users prefer to watch. Short video users have high acceptance, and creators have strong growth needs.

3.1.2. Movie and Performance APP

The proportion of female users in movie and performance ticketing apps has increased. As of July this year, female users accounted for 53% of movie and performance ticketing apps, and male users accounted for 47%.

The user age distribution results show that the user composition of movie and performance ticketing apps is relatively young. As of July, this year, users aged 25 and below accounted for 40%, an increase of 2.4% over the same period last year. At the same time, users aged 26-35 accounted for 46.6%, and users aged 36 and above accounted for 13.4%.

According to data from iiMedia Research, more than 90% of Chinese netizens have used online movie ticket purchases, and only 1.6% of netizens said they have not purchased and do not plan to purchase. 61.7% of Chinese netizens choose to buy movie tickets online because they save time. Online movie ticketing platforms should focus on creating convenient services and optimizing user experience [15].

3.1.3. Game APP

As time goes by, the age of game market users is undergoing structural changes. As of March 2022, users aged 31 and above accounted for 51%, exceeding users under 30 years old. Among them, users aged 36 and above accounted for 36.6%, also exceeding users under 24 years old. In contrast, in March 2019, users aged 30 and below accounted for 55.5%, and users aged 36 and above accounted for only 30.2%.

In February 2024, the number of active users in the mobile game APP industry reached 659 million, with a year-on-year growth rate of more than 12%. The scale of mobile industry panoramic traffic reached 940 million, and the industry showed a clear upward trend. On the one hand, thanks to the continuous issuance of version numbers, the speed and quality of new mobile games are stable; on the other hand, the small game market is growing rapidly. For example, the number of active users of WeChat mini-program games reached 750 million, accounting for 80.3% of the panoramic traffic.

3.1.4. Music APP

The stickiness of young users' music APP usage has increased significantly, and the increase in usage frequency is higher than the increase in usage time, mainly because: According to the Cloud Music user report and iResearch Consulting, the TGI of special categories such as ambient sound and long audio has increased among the post-90s and post-00s groups, and young users are good at exploring richer usage scenarios; With the popularization of functions such as audio live broadcast and karaoke, the functions of software have also developed from a single player to entertainment and social interaction around music, reshaping the usage habits of young users.

3.2. Case Analysis

Take Xiaohongshu as an example. According to relevant Nielsen survey data, more than 80% of users said that they have been successfully planted on Xiaohongshu.[16] The deep-seated reasons for this are: high-quality notes, direct response to pain points, and a strong community atmosphere. In addition, the information it presents is multi-dimensional, which facilitates rational decision-making in information comparison. Furthermore, Xiaohongshu users are more inclined to become opinion leaders in their own value attitudes, which means that content is easier to form a closed-loop dissemination, through users influencing users, and promoting further interaction and sharing.

As a result, Xiaohongshu has 200 million active users per month and 43 million+ sharers (creators). Judging from the user portrait data of Xiaohongshu in the past two years, young people and strong consumption power are still important characteristics of platform users. Its core users are 72% of post-90s users, and the more detailed age levels are: 16-24 years old: 46.39%; 25-34 years old: 36.08%.

In terms of gender distribution, female users account for 70%. Male users account for 30%. Among them, neutral content such as food and travel, as well as digital, sports events, etc., have developed rapidly, bringing about the growth of male users.

In terms of user stickiness, according to QuestMobile, Kuaishou's DAU/MAU reached about 45% in February 2024, significantly higher than long video platforms and lower than short video platforms.

In addition to improving the infrastructure of the content platform, Xiaohongshu has also accelerated its commercialization layout, mainly relying on advertising and e-commerce as two growth engines. According to New Retail Business Review, Xiaohongshu’s revenue will be approximately 30 billion yuan in 2022, of which advertising revenue will account for 80%, and the remaining 20% will be e-commerce revenue; in 2023, Xiaohongshu’s advertising revenue will decline year-on-year, with a slight decline in proportion, but still accounted for 70-80% of the total revenue, but the profit performance exceeded expectations. In terms of e-commerce, content cultivation drives e-commerce consumption, and a differentiated community e-commerce business model is formed with buyers as the core to promote the formation of a closed loop [16].

3.3. Analysis of preferences and personality of active people in Chinese entertainment apps

Based on the above data and case analysis, it can be seen that from entering the pit, seeding, experience to deep investment, in every interest field, young people are vying to be the "number one player". The preferences of active people in Chinese entertainment apps are diversified, driving a multi-category segmentation trend.

As the main force of active people in entertainment apps, young people's interests are highly integrated, their consumption behavior is both rational and emotional, they pay attention to products that are both classic and trendy, and they like and identify with rebellious, distinctive but talented idol representatives; they advocate multi-dimensional social interaction, care for themselves, and show their personality to the fullest. At the same time, they also care about the world, are willing to contribute their own opinions, and have a sense of justice.

As entertainment and related industries, dividing people based on basic portraits or consumption characteristics and conducting precision marketing based on the "interest circles" built by people with similar interests are necessary means for the refined operation of the entertainment consumption economy. Interest circles such as music, games, technology, and tourism already have a large user scale. People in the tourism, food, and sports circles have higher online activity and purchasing power. The scale of circles such as games and technology is still expanding, and the value potential is being released. Sports experts have a high degree of fit with music and professional sports brands. The technology crowd actively embraces various smart devices, including smart cars and smart home appliances. The game crowd is also highly active in other entertainment scenarios such as long and short videos and is the main group of e-sports viewers.

3.4. Current situation and prospects of China's entertainment consumption economy

According to data from the US consulting agency Grand View Research, from 2023 to 2030, the size of the social application market will grow from 60.8 billion to 310 billion US dollars. In other words, social pan-entertainment will still have considerable room for growth, with an optimistic annual compound growth rate of 26.2%. Of course, the overall positive projection to different markets and tracks will be different.

While some professional entertainment apps are developing towards the "small and beautiful" vertical track, comprehensive platform apps are undergoing an ambitious expansion of power. They are well aware that the multi-dimensional social interaction of active Chinese entertainment people has highlighted people's spiritual needs, and the development of the industry will undoubtedly show the integration of entertainment and technology, entertainment and food/sports, and entertainment and tourism.

Taking Alibaba Pictures as an example, its profitability in the film sector has steadily increased and entered a high-quality growth track. In fiscal year 2024, the film investment, production and publicity revenue was approximately RMB 2.072 billion, a year-on-year increase of 69%; the film ticketing and technology platform revenue was approximately RMB 920 million, a year-on-year increase of 76%; the IP derivatives and innovation business revenue was approximately RMB 1.053 billion, a year-on-year increase of 9%.

In the field of technology business, Alibaba Pictures has laid out its future and continued to enhance its advantages in the technology sector. Taomai VIP membership construction is being fully promoted, and the membership scale and loyalty continue to increase. During the fiscal year, there were more than 2 million high-frequency black diamond members, and the frequency of ticket purchases by members was 2.5 times that of non-members. Various rights and interests such as ticket purchase discounts, fast channels, and celebrity meet-and-greets have brought VIP users a "super value, super expectation" consumer experience; Yunzhi has steadily maintained the industry's first place in ticket-issuing theaters and ticket-issuing attendances, while actively expanding overseas business. During the fiscal year, it has signed cooperation agreements with theaters in Macau, China, Southeast Asia and other regions to accelerate its overseas expansion.

At the same time, AI business has been efficiently implemented to help the development of the film and television industry. The Lighthouse AI version of the intelligent publicity and promotion data product for the entertainment industry will be launched in 2023. It relies on four digital and intelligent functions: box office prediction, publicity and promotion intelligent query, public opinion analysis, and AI publicity and promotion materials, to help the industry's operational efficiency improve significantly. In addition, Alibaba Pictures has also laid out virtual shooting to explore the promotion and application of AI and new technologies in the film and television industry.

In the field of IP derivatives business, Ali Fish, an IP trading and innovation platform under Alibaba Pictures, has built a huge and rich IP matrix, with strong business growth. During the fiscal year, the revenue of Ali Fish's sub-licensing business increased by 77% year-on-year, and the five-year compound growth rate was nearly 60%; the trendy toy brand KOITAKE combined independent trendy toy IP with multiple film and television dramas to create trendy toy products with different styles. As of now, KOITAKE has accumulated more than 10 original trendy toy IPs and combined them with more than 40 film and television content.

Therefore, Alibaba Pictures implemented the "content + technology" dual-wheel drive strategy, continued to increase investment in high-quality content, comprehensively deployed film and television AI, completed the major acquisition of Damai, and steadily built a multi-scenario, full industrial chain, and group-style development pattern, and multi-sector business developed steadily.

4. Conclusion

Based on the above content, it can be seen that among the booming entertainment APPs, Bilibili, as a comprehensive video community, provides a wide range of video content consumption scenarios, centered on professional user-generated videos (PUGV), and supplemented by professional agency-generated videos. Video (OGV), etc., constitute a complete content ecosystem. Xiaohongshu, on the other hand, has gone a long way from “finding good things from all over the world” to “marking my life”, from single beauty to general life; both in terms of the growth of users and content, Xiaohongshu is accelerating to break out of the circle. While the movie and performance APPs have a full-link layout, the game APPs have formed a model integrating research and operation after years of development.

For China's entertainment economy to develop rapidly, it is undoubtedly necessary to carry out precise marketing based on the "interest circle" built by people with similar interests to achieve refined operations of the entertainment consumption economy, and also based on the spiritual needs and multi-dimensional social interaction of China's active entertainment population. It is important to focus on the integration of entertainment and technology, the integration of entertainment and food/sports, and the integration of entertainment and tourism, and seize the growth space of social pan-entertainment.

In the future, in economic activities, more attention should be paid to consider consumption formats, industrial structures and regional policies from the comprehensive needs of people, and even more attention should be paid to promote economic development with the freedom and comprehensive development of people. Especially under the current development trend, for China's cultural and entertainment industry, the layout of the entire industrial chain based on multi-dimensional needs, and the precise output supplemented by scientific and technological means, will inevitably lead China's cultural and entertainment consumption economy to a new stage of development.

References

[1]. Lou Yang (2024, Jul. ), “Insights into the digital economy and exploring the value curve - insights into online economic development in the second quarter of 2024”, the 13th China Financial Summit, 2-5

[2]. China Business Industry Research Institute (2024, Apr.), "2024-2029 China Short Video Industry In-depth Analysis and Development Trend Forecast Research Report", 8

[3]. Quest Mobile (2023, Jul.), “2023 Content Video and Commercialization Insight Report”,6

[4]. The Paper (2022, Mar.), "The ‘Collaboration Era’ of Long and Short Videos is Coming", 2

[5]. GF Securities, Kuang Shi (2023, Jan.), "In-depth report on the live streaming industry: Pursuing high-quality development and demonstrating economic and social value", 10-11

[6]. Guolian Securities (2023, Nov.), "2023 Kuaishou Research Report: The user base is solid, cost reduction and efficiency improvement are significant", 6-8

[7]. 36Kr (2024, Mar.), "iQiyi 2023 Annual Report: The boat has passed the Ten Thousand Mountains", 3-6

[8]. Mob Research Institute (2023, Jun.), "2023 Short Video Industry Research Report", 2-5

[9]. CITIC Securities, Sun Xiaolei and Cui Shifeng (2023, Feb.), "Research on Domestic Long-form Video Industry: Cost Reduction and Efficiency Increase are the Main Theme, and Content is the Core Competitiveness", 4-8

[10]. Changjiang Securities (2024, Jul.), "Bilibili Research Report: Prosperity of content and user ecology drives commercialization to accelerate, and profitability visibility significantly improves", 6-10

[11]. Huatai Securities (2024, May), "Special Research on the Internet Industry: Xiaohongshu leads the commercialization and prosperity of content communities", 3-8

[12]. iResearch (2024, Jan.), "2023 China Performance Ticketing Industry Research Report", 3-4

[13]. Economic Daily (2023, Aug.), "Accelerating the Release of Cultural Tourism Consumption Demand". Retrieved from http://paper.ce.cn/pc/content/202308/04/content_278501.html

[14]. Gamma Data (2023, Mar.), "2022-2023 China Game Enterprises R&D Competitiveness Report", 4-8

[15]. iiMedia Entertainment Industry Research Center (2022, Mar.), "2022 China Online Movie Ticket Purchase Market and Consumption Behavior Research Report", 2-6

[16]. GF Securities (2024, Feb.), "2024 Xiaohongshu Special Report: ‘Buyer E-commerce’ is rooted in community ecology, and the growth of native business systems is expected", 3-7

Cite this article

Zhu,M. (2024). Prospects of China's Entertainment Consumption Economy Based on Entertainment APP Data Analysis. Advances in Economics, Management and Political Sciences,123,134-148.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICEMGD 2024 Workshop: Policies to Enhance Sustainable Development through the Green Economy

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Lou Yang (2024, Jul. ), “Insights into the digital economy and exploring the value curve - insights into online economic development in the second quarter of 2024”, the 13th China Financial Summit, 2-5

[2]. China Business Industry Research Institute (2024, Apr.), "2024-2029 China Short Video Industry In-depth Analysis and Development Trend Forecast Research Report", 8

[3]. Quest Mobile (2023, Jul.), “2023 Content Video and Commercialization Insight Report”,6

[4]. The Paper (2022, Mar.), "The ‘Collaboration Era’ of Long and Short Videos is Coming", 2

[5]. GF Securities, Kuang Shi (2023, Jan.), "In-depth report on the live streaming industry: Pursuing high-quality development and demonstrating economic and social value", 10-11

[6]. Guolian Securities (2023, Nov.), "2023 Kuaishou Research Report: The user base is solid, cost reduction and efficiency improvement are significant", 6-8

[7]. 36Kr (2024, Mar.), "iQiyi 2023 Annual Report: The boat has passed the Ten Thousand Mountains", 3-6

[8]. Mob Research Institute (2023, Jun.), "2023 Short Video Industry Research Report", 2-5

[9]. CITIC Securities, Sun Xiaolei and Cui Shifeng (2023, Feb.), "Research on Domestic Long-form Video Industry: Cost Reduction and Efficiency Increase are the Main Theme, and Content is the Core Competitiveness", 4-8

[10]. Changjiang Securities (2024, Jul.), "Bilibili Research Report: Prosperity of content and user ecology drives commercialization to accelerate, and profitability visibility significantly improves", 6-10

[11]. Huatai Securities (2024, May), "Special Research on the Internet Industry: Xiaohongshu leads the commercialization and prosperity of content communities", 3-8

[12]. iResearch (2024, Jan.), "2023 China Performance Ticketing Industry Research Report", 3-4

[13]. Economic Daily (2023, Aug.), "Accelerating the Release of Cultural Tourism Consumption Demand". Retrieved from http://paper.ce.cn/pc/content/202308/04/content_278501.html

[14]. Gamma Data (2023, Mar.), "2022-2023 China Game Enterprises R&D Competitiveness Report", 4-8

[15]. iiMedia Entertainment Industry Research Center (2022, Mar.), "2022 China Online Movie Ticket Purchase Market and Consumption Behavior Research Report", 2-6

[16]. GF Securities (2024, Feb.), "2024 Xiaohongshu Special Report: ‘Buyer E-commerce’ is rooted in community ecology, and the growth of native business systems is expected", 3-7