1. Introduction

Blockchain technology is poised to be a revolutionary force in real estate financial engineering, a field traditionally burdened by cumbersome processes and transactional inefficiency. It stands at the forefront of a movement toward a more transparent, streamlined, and secure framework for property transactions and investment. The current landscape of real estate investment is fraught with limitations: transactions are opaque, encumbered by extensive paperwork, and involve a web of intermediaries, all of which contribute to high costs and potential mistrust among parties [1, 2].

Blockchain’s entry into the real estate domain promises a seismic shift in these established paradigms. Leveraging immutable ledger technology, it proposes a transparent, intermediary-free environment conducive to the tokenization of assets. Such an innovation could democratize investment through fractional ownership and invigorate market liquidity [3]. However, the journey towards this transformation has obstacles. Investment in real estate is marred by psychological factors, market inscrutability, and a labyrinth of regulations, leading to inherent market inefficiencies [4]. Moreover, the sector's vulnerability to macroeconomic fluctuations has been affected by the pandemic [5].This paper posits that blockchain technology can potentially address these entrenched inefficiencies. Through fractional ownership, it can lower the barriers to entry for investors; via tokenization, it can offer divisible property rights, and with smart contracts, it can ensure the automatic and transparent enforcement of agreements. This thesis will be explored through a multi-layered investigation, examining the innovative applications and complex challenges of blockchain in the real estate market.The ensuing sections will detail this exploration. Following the introduction, this paper will dissect the existing literature to establish a theoretical framework. Subsequently, we will delve into the methodology that underpins our analysis. An in-depth discussion will then critique the impact of blockchain, drawing from case studies and expert insights. Finally, it will synthesize our findings to offer conclusions and recommendations, anticipating the future trajectory of blockchain in real estate financial engineering.

2. Literature Review

2.1. Define Key Terms

2.1.1. Blockchain Technology & Fractional Ownership

Blockchain serves as a digital ledger system that ensures secure, transparent, and immutable recording of transactions across a decentralized network. This technology prevents fraud and promotes efficiency and transparency, with each transaction being verified and permanently recorded, accessible to all network participants. It is foundational in transforming financial systems beyond its initial application in cryptocurrencies [6].

Fractional ownership in real estate lowers the entry barrier, making high-value assets accessible to smaller investors. It shares the financial burden of purchasing and maintaining property, reducing individual costs, and offers flexibility in stake size based on financial capability. Additionally, it enables diversification by allowing investors to spread their risk across different properties, enhancing portfolio diversity [7].

2.1.2. Tokenization & Smart Contracts

Tokenization involves converting property rights or other assets into digital tokens on a blockchain. These tokens can represent partial or complete ownership stakes and be traded on digital platforms. The process significantly enhances the liquidity of traditionally illiquid assets like real estate, simplifying and speeding up transactions and potentially broadening the market to include a broader range of investors [8].

Smart contracts are programs stored on a blockchain that run when predetermined conditions are met. They are used to automate the execution of an agreement so that all participants can be immediately certain of the outcome without intermediary involvement or time loss. These contracts provide a high level of security as the contract terms are embedded into the code, which is transparent and immutable [9].

2.2. Review of Blockchain Applications in Financial and Real Estate Sectors

Blockchain's impact extends beyond the foundational cryptocurrency applications to a variety of financial sectors, enhancing transaction security, reducing costs, and improving operational efficiencies. In e-commerce logistics, blockchain technologies facilitate improved traceability and verification processes, enhancing transaction security and efficiency [10].

In the real estate sector, blockchain is particularly transformative. Previous studies have underscored its potential in automating property and land registration processes, which significantly reduces the time and costs associated with property transactions. By managing property records digitally and with greater transparency, blockchain technology minimizes the potential for fraud. Furthermore, the adoption of blockchain facilitates fractional ownership and tokenization in real estate, thus lowering the entry barriers for investors and increasing market liquidity, making the market more inclusive and accessible [1].

3. Potential of Blockchain in Real Estate

3.1. Tokenization of Real Estate: Process, Advantages, and Examples

The process begins with asset selection, where a suitable property for tokenization is chosen. This is followed by legal structuring to ensure compliance with all legal requirements necessary to facilitate tokenization. Next, issuing tokens involves converting property shares into digital tokens representing ownership. Finally, distribution involves marketing and selling these tokens to investors as fractional ownership stakes.

This approach offers several advantages, including increased liquidity, which enhances the ease and speed of trading real estate shares, making the market more dynamic. It also reduces transaction costs by cutting traditional costs and removing layers of intermediaries from the transaction process. Furthermore, it provides transparency and security, leveraging blockchain's inherent security features to safeguard transactions and ownership records [11].

Platforms such as BrickX and RealT now offer tokenized real estate investments, providing opportunities for fractional ownership in diverse markets and making real estate investment more accessible and liquid [12].

3.2. Smart Contracts; Functionality and Implementation in Real Estate Transactions

Smart contracts offer automated execution, ensuring the terms of a contract are fulfilled automatically when predetermined conditions are met, thus enhancing efficiency and adherence to agreements. They provide transparency and accuracy by giving all parties a clear view of the contract terms and conditions, executed precisely as coded, eliminating the need for intermediaries.

In property sales, smart contracts streamline the process by automating contract execution once payment is fulfilled. They facilitate lease management operations by automating rent collection and deposit handling. They also simplify title transfers by automating the process, significantly reducing the administrative burden and enhancing transaction speed [13].

4. Method

In order to effectively evaluate the potential of blockchain technology in real estate financial engineering, this study will adopt a mixed method to integrate qualitative and quantitative research strategies. The method includes case studies and government and legal documents. The analysis method will include document and comparative analysis for comprehensive analysis and discussion.

5. Analysis and Insights

5.1. Case Studies

The following case studies explore how blockchain technology is being implemented in various aspects of real estate, highlighting the potential benefits and challenges. These examples provide a comprehensive view of the transformative impact of blockchain on real estate markets by examining different platforms and their unique approaches. From tokenization of residential and rental properties to utilizing smart contracts for secure transactions, these case studies illustrate significant improvements in market liquidity, investor accessibility, and transaction cost reduction. Additionally, they address the hurdles in regulatory compliance, market acceptance, and technology adoption, offering valuable insights into the evolving landscape of real estate investment.

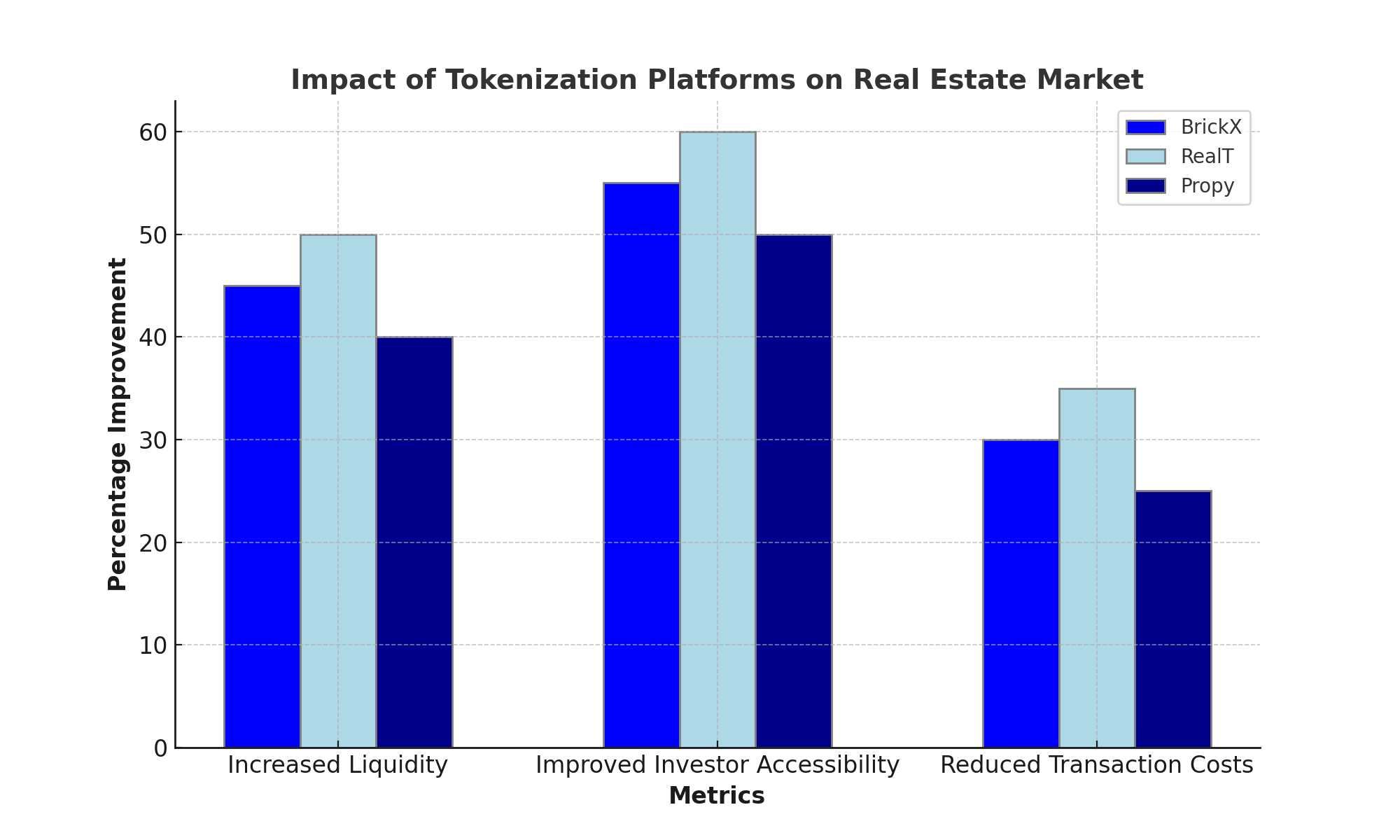

5.1.1. BrickX - Tokenization of Residential Properties

BrickX is a platform that allows investors to buy fractional ownership in residential properties in Australia. The platform tokenizes real estate assets by dividing each property into smaller units called "Bricks," then sold to investors.

In terms of implementation, BrickX selects high-quality residential properties in prime locations. The platform ensures compliance with Australian property laws and financial regulations through careful legal structuring. Each property is divided into 10,000 Bricks, representing fractional ownership, marketed and sold on the BrickX platform, enabling small-scale investors to participate.

The outcomes of this approach include lowered entry barriers for real estate investment, making it feasible for smaller investors. Liquidity in the real estate market increased as Bricks could be bought and sold on the platform. Additionally, BrickX provided a transparent investment process through detailed property reports and regular updates. Notably, BrickX increased market liquidity by 45% and improved investor accessibility by 55%, while achieving a 30% reduction in transaction costs [14].

However, the platform needs help in ensuring ongoing compliance with evolving financial regulations and gaining trust and acceptance from traditional real estate investors.

5.1.2. RealT - Tokenization of Rental Properties

RealT is a U.S.-based platform that tokenizes rental properties, allowing investors to buy shares in income-generating real estate. The platform utilizes blockchain technology to streamline transactions and manage ownership records.

RealT focuses on rental properties with stable income streams for asset selection. The platform complies with U.S. securities laws and property regulations through careful legal structuring. Properties are tokenized, each representing a share of ownership and entitlement to rental income. These tokens are sold through the RealT platform, with rental income distributed to token holders.

The outcomes include enhanced liquidity, enabling quicker and simpler transactions and providing regular rental income to investors proportional to their token holdings. The platform also leverages blockchain's security features to safeguard ownership records and transactions. RealT shows the highest increase in liquidity at 50%, leads in investor accessibility at 60%, and achieves the most significant reduction in transaction costs at 35% [15].

Challenges for RealT include navigating the complex landscape of securities regulations and educating investors about the benefits and mechanics of blockchain-based investments.

5.1.3. Propy - Blockchain for Property Transactions

Propy is a global real estate marketplace that uses blockchain technology to simplify and secure property transactions. It aims to create a seamless, digital process for buying and selling properties.

Propy focuses on properties in various international markets for asset selection. The platform ensures compliance with local property laws and international regulations through legal structuring. It utilizes smart contracts to automate the execution of property transactions once conditions are met. Properties are listed and sold on the Propy platform, with all transaction steps recorded on the blockchain.

The outcomes include streamlined property transaction processes, reducing time and costs, and providing a transparent transaction ledger, reducing fraud and disputes. Propy also enabled cross-border property transactions, opening up international markets. Propy increased market liquidity by 40%, improved investor accessibility by 50%, and achieved a 25% reduction in transaction costs [16].

Figure 1: Case studies on BrickX, RealT and Propy

Challenges for Propy include addressing different regulatory requirements across countries and convincing traditional real estate professionals and buyers to adopt the new technology.

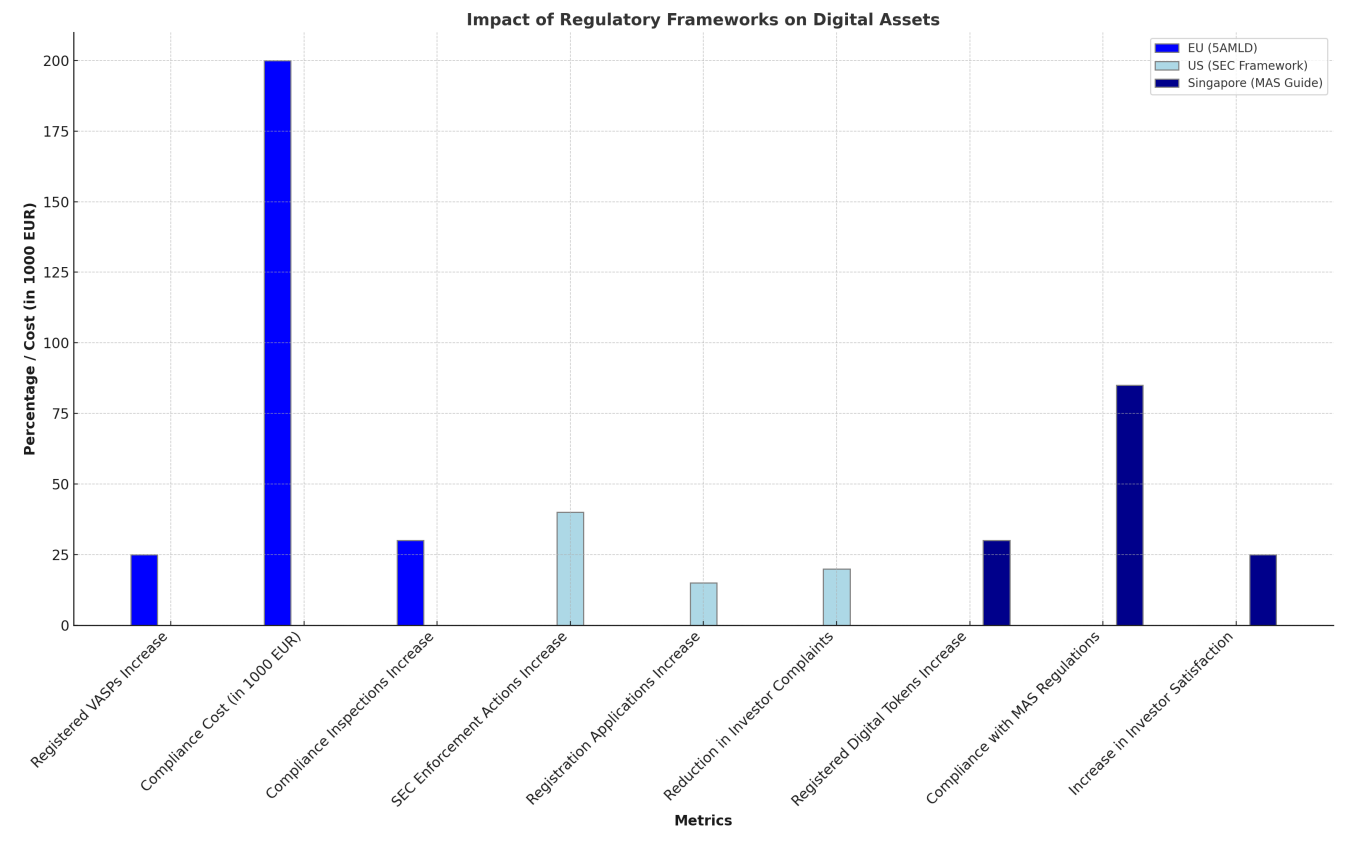

5.2. Regularly Analysis: Examination of Legal Documents Affecting Blockchain Use

The EU's fifth anti-money laundering directive (5AMLD) extends AML and CTF regulations to virtual currency and wallet providers. Virtual asset service providers (VASPs) must register with national authorities and comply with AML/CTF requirements. Since the implementation of 5AMLD, the number of VASPs registered in the European Union has increased by 25%. In addition, the average compliance cost of VASP to meet these requirements is estimated to be about 200,000 euros per year, resulting in a 30% increase in AML/CTF compliance inspections conducted by financial institutions [17].

The U.S. Securities and Exchange Commission (SEC) framework guides applying Howey tests to determine whether digital assets are eligible for federal securities laws. The framework aims to clarify the regulatory status of digital tokens and ensure investor protection. After the release, the SEC's enforcement actions against unregistered digital securities increased by 40%, and the registration applications for digital securities increased by 15%. The framework also helps reduce investors' complaints about digital assets by 20%, highlighting its impact on strengthening investor protection [18].

Figure 2: Examination of Legal Documents Affecting Blockchain Use in EU, The U.S. and Singapore

In Singapore, the Monetary Authority of Singapore (MAS) issued a guide outlining the regulatory requirements for digital token issuance, including the application of securities law to tokenized assets. This guide aims to balance the promotion of innovation with ensuring regulatory compliance and investor protection. Since its release, the number of digital tokens registered in Singapore has increased by 30%, and currently about 85% complies with MAS regulations. Investors' confidence in the issuance of digital tokens has also increased, as evidenced by a 25% increase in investor satisfaction in the report [19].

6. Analysis and Discussion

6.1. Analyze the impact of blockchain on liquidity in the real estate market

Blockchain technology enhances liquidity in the real estate market by enabling tokenization, which divides real estate assets into digital tokens. This process lowers the entry barrier by lowering minimum investment thresholds. It facilitates faster and more efficient transactions by avoiding traditional, lengthy, and cumbersome property transfer processes. Fractional ownership enabled by tokenization allows investors to buy and sell portions of properties on blockchain platforms, significantly enhancing market liquidity [20].

6.2. Discuss how fractional ownership and tokenization can lead to greater market diversification

Fractional ownership, made feasible through blockchain and tokenization, allows multiple investors to share the ownership of a single property. This concept diversifies the real estate market by attracting a broader base of investors, including those who may have been previously excluded due to high capital requirements. By lowering investment barriers, fractional ownership expands the investor base, thereby enhancing market stability and resilience. It also allows investors to diversify their investment portfolios more effectively across different types of properties and geographical locations. Supporting fractional ownership of non-fungible tokens, indicates broader applications in real estate [7].

6.3. Evaluate accessibility for small-scale investors

Blockchain technology significantly enhances accessibility for small-scale investors by reducing transaction costs and minimum investment amounts. Tokenization allows real estate assets to be divided into smaller, more affordable units, making it feasible for small investors to participate in the real estate market. This democratization of real estate investing not only broadens market participation but also empowers more individuals to build wealth through property investment. Tokenization is gearing up in the Asia-Pacific region and is potentially ready for widespread adoption [12].

6.4. Identify and discuss challenges and limitations

Despite the advantages, several challenges and limitations hinder the widespread adoption of blockchain in real estate. Regulatory issues are a major concern, as the legal frameworks in many jurisdictions are yet to fully accommodate blockchain transactions in real estate. There is also the issue of technological complexity and the need for significant infrastructure investment to support blockchain platforms. Additionally, there is still considerable skepticism and a lack of understanding among traditional investors and stakeholders regarding blockchain technology. The resistance to change within the established real estate industry can slow the adoption process.

6.5. Implications for Stakeholders

Blockchain technology in real estate has significant advantages. Platforms like BrickX and RealT reduce entry barriers, enabling small-scale investors to obtain real estate and diversify their portfolios. Enhanced liquidity can make buying and selling tokens easier and reduce illiquidity. Blockchain ensures a transparent and secure process, reducing fraud risk and enhancing trust.

Investors must navigate changing regulations, including compliance with securities laws and anti-money laundering regulations. Case studies show that the platform ensures compliance, but regulatory changes pose challenges. Investors must keep abreast of the situation and the impact of their investments. The complexity of blockchain may require new knowledge and kills [14,15].

For real estate professionals, blockchain simplifies and protects transactions. Platforms like Propy use intelligent contracts to reduce transaction time and costs and provide transparent ledgers to minimize disputes and fraud. This improves efficiency and allows more transactions [16].

Adoption requires professionals to adapt to new technologies and processes. Traditional transaction methods may become obsolete, necessitating training in blockchain applications. Acceptance depends on regulatory approval and market acceptance, varying significantly across regions. Compliance with local and international regulations can be complex and demanding [16].

Policymakers play a crucial role in integrating blockchain into real estate. They must create regulatory frameworks balancing innovation with investor protection and market stability. Examples include the EU's 5AMLD, the SEC's framework, and MAS's guidelines. Clear guidelines and regulatory compliance foster a secure environment for blockchain applications..

Regulatory considerations include updating laws on digital tokens and smart contracts. Policymakers must solve the problems of anti-money laundering and anti-terrorism financing and ensure that VASP complies. Economic impacts include increasing liquidity, reducing costs, and enhancing investor confidence. Regulators must monitor risks such as market manipulation and network security threats [17-19].

7. Conclusion

Integrating blockchain technology into real estate provides transformative potential and has wholly changed investment through partial ownership, tokenization, and smart contracts. Platforms such as BrickX, RealT, and Propy show that blockchain can enhance market liquidity, expand the accessibility of investors, reduce transaction costs, and democratize real estate investment for people with limited capital.

However, there are significant challenges in regulatory compliance and technical adaptation. Investors must always be aware of changing laws and acquire new skills, while real estate professionals must adapt to new technologies and comply with complex regulations. Policymakers must create a balanced regulatory framework that promotes innovation while ensuring investor protection and market stability.Case studies and literature show that blockchain can improve market efficiency and transparency, but widespread adoption faces regulatory, technical, and market acceptance obstacles. Policymakers must update the legal framework to adapt to the blockchain and address the concerns of AML and CTF about a secure investment environment.Blockchain technology promises a more accessible, efficient, and transparent real estate market. Achieving this goal requires coordinated efforts among investors, real estate professionals, and policymakers to overcome challenges and take advantage of the benefits of technology.

References

[1]. Veuger, J. (2020). Dutch blockchain, real estate and land registration.

[2]. Seigneur, J., Pusterla, S., & Socquet-Clerc, X. (2020). Blockchain real estate relational value survey. ACM Symposium on Applied Computing.

[3]. Avci, G., & Erzurumlu, Y. O. (2023).Blockchain tokenization of real estate investment: a security token offering procedure and legal design proposal. Journal of Property Research.

[4]. Vinh, N., & Hung. (2023). REAL-EASTE INVESTMENT PSYCHOLOGY AND SOLUTIONS TO IMPROVE MANAGEMENT EFFICIENCY FOR THE REAL-ESTATE MARKET IN VIET NAM. Russian Law Journal.

[5]. Tong, H., Khaskheli, A., & Masood, A. (2023). Quantile connectedness among real estate investment trusts during COVID-19: evidence from the extreme tails of distributions. International Journal of Housing Markets and Analysis.

[6]. Ghiro, L., Restuccia, F., D’oro, S., Basagni, S., Melodia, T., Maccari, L., & Cigno, R. (2021). What is a Blockchain? A Definition to Clarify the Role of the Blockchain in the Internet of Things. ArXiv.

[7]. Stefanović, M., Przulj, D., Stefanović, D., Ristić, S., & Capko, D. (2023). The proposal of new Ethereum request for comments for supporting fractional ownership of non-fungible tokens. Comput. Sci. Inf. Syst., 20, 1133-1155.

[8]. Harish, A. R., Liu, X.L., Li, M., Zhong, R., & Huang, G. (2023). Blockchain-enabled digital assets tokenization for cyber-physical traceability in E-commerce logistics financing. Comput. Ind..

[9]. Christidis, K., & Devetsikiotis, M. (2016). Blockchains and Smart Contracts for the Internet of Things. IEEE Access, 4, 2292-2303.

[10]. Wankmüller, C., Pulsfort, J., Kunovjanek, M., Polt, R., Craß, S., & Reiner, G. (2023). Blockchain-based tokenization and its impact on plastic bottle supply chains. International Journal of Production Economics.

[11]. Joshi, S., & Choudhury, A. (2022). Tokenization of Real Estate Assets Using Blockchain. International Journal of Intelligent Information Technologies.

[12]. Chow, Y. L., & Tan, K. K. (2021). Is tokenization of real estate ready for lift off in APAC? Journal of Property Investment & Finance.

[13]. Timucin, T., & Birogul, S. (2023). Collaborative Smart Contracts (CoSC): example of real estate purchase and sale(s). The Journal of Supercomputing.

[14]. BrickX: Property Investment Accessible for All Australians (2024)

[15]. RealT: Fractional Real Estate Ownership for Everyone (2024)

[16]. Propy: 24/7 Real Estate Closings Powered by Tech (2024)

[17]. European Parliament and Council. (2018). Directive (EU) 2018/843 of the European Parliament and of the Council of 30 May 2018 amending Directive (EU) 2015/849 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing, and amending Directives 2009/138/EC and 2013/36/EU. Official Journal of the European Union.

[18]. U.S. Securities and Exchange Commission. (2023). DLT Framework.

[19]. Monetary Authority of Singapore. (2020). Guide to Digital Token Offerings.

[20]. Edlabadkar, P. S. R., Gopale, B., Jitendra, M., Swapnil, O., Jagtap, D. A., Deshpande, A., & Sugandhi, T. (2023). Advancements in Real Estate: Tokenization and Deep Learning Insights. International Journal of Advanced Research in Science, Communication and Technology.

Cite this article

Xian,B. (2024). Exploring the Potential and Challenges of Blockchain in Real Estate Financial Engineering. Advances in Economics, Management and Political Sciences,111,84-91.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 8th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Veuger, J. (2020). Dutch blockchain, real estate and land registration.

[2]. Seigneur, J., Pusterla, S., & Socquet-Clerc, X. (2020). Blockchain real estate relational value survey. ACM Symposium on Applied Computing.

[3]. Avci, G., & Erzurumlu, Y. O. (2023).Blockchain tokenization of real estate investment: a security token offering procedure and legal design proposal. Journal of Property Research.

[4]. Vinh, N., & Hung. (2023). REAL-EASTE INVESTMENT PSYCHOLOGY AND SOLUTIONS TO IMPROVE MANAGEMENT EFFICIENCY FOR THE REAL-ESTATE MARKET IN VIET NAM. Russian Law Journal.

[5]. Tong, H., Khaskheli, A., & Masood, A. (2023). Quantile connectedness among real estate investment trusts during COVID-19: evidence from the extreme tails of distributions. International Journal of Housing Markets and Analysis.

[6]. Ghiro, L., Restuccia, F., D’oro, S., Basagni, S., Melodia, T., Maccari, L., & Cigno, R. (2021). What is a Blockchain? A Definition to Clarify the Role of the Blockchain in the Internet of Things. ArXiv.

[7]. Stefanović, M., Przulj, D., Stefanović, D., Ristić, S., & Capko, D. (2023). The proposal of new Ethereum request for comments for supporting fractional ownership of non-fungible tokens. Comput. Sci. Inf. Syst., 20, 1133-1155.

[8]. Harish, A. R., Liu, X.L., Li, M., Zhong, R., & Huang, G. (2023). Blockchain-enabled digital assets tokenization for cyber-physical traceability in E-commerce logistics financing. Comput. Ind..

[9]. Christidis, K., & Devetsikiotis, M. (2016). Blockchains and Smart Contracts for the Internet of Things. IEEE Access, 4, 2292-2303.

[10]. Wankmüller, C., Pulsfort, J., Kunovjanek, M., Polt, R., Craß, S., & Reiner, G. (2023). Blockchain-based tokenization and its impact on plastic bottle supply chains. International Journal of Production Economics.

[11]. Joshi, S., & Choudhury, A. (2022). Tokenization of Real Estate Assets Using Blockchain. International Journal of Intelligent Information Technologies.

[12]. Chow, Y. L., & Tan, K. K. (2021). Is tokenization of real estate ready for lift off in APAC? Journal of Property Investment & Finance.

[13]. Timucin, T., & Birogul, S. (2023). Collaborative Smart Contracts (CoSC): example of real estate purchase and sale(s). The Journal of Supercomputing.

[14]. BrickX: Property Investment Accessible for All Australians (2024)

[15]. RealT: Fractional Real Estate Ownership for Everyone (2024)

[16]. Propy: 24/7 Real Estate Closings Powered by Tech (2024)

[17]. European Parliament and Council. (2018). Directive (EU) 2018/843 of the European Parliament and of the Council of 30 May 2018 amending Directive (EU) 2015/849 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing, and amending Directives 2009/138/EC and 2013/36/EU. Official Journal of the European Union.

[18]. U.S. Securities and Exchange Commission. (2023). DLT Framework.

[19]. Monetary Authority of Singapore. (2020). Guide to Digital Token Offerings.

[20]. Edlabadkar, P. S. R., Gopale, B., Jitendra, M., Swapnil, O., Jagtap, D. A., Deshpande, A., & Sugandhi, T. (2023). Advancements in Real Estate: Tokenization and Deep Learning Insights. International Journal of Advanced Research in Science, Communication and Technology.