1. ESG Background

1.1. Origin and Development of ESG

The modern concept of ESG originated in the 1970s. It emerged as a broad notion developed to address social moral issues and environmental pollution arising from economic development. This concept led companies and capital markets to adopt fairer and more sustainable fundamental principles. Financial institutions, including investment banks, began integrating these issues into their investment considerations. The specific term "ESG" first appeared in the investment initiative "Who Cares Wins," jointly published by financial institutions at the invitation of the United Nations. Scholars believe that it wasn't until 2006, when the United Nations released the Principles for Responsible Investment (UN-PRI), that the ESG concept and evaluation system were formally proposed. This initiative aimed to understand the investment impact of Environmental, Social, and Governance (ESG) factors and supported the international network of investor signatories in incorporating these factors into their investment and ownership decisions [1].

In recent years, an increasing number of institutions have utilized ESG to make improvements toward sustainable development. As of August 25, 2023, the top ten companies by ESG scores are listed in Table 1. The data is based on ESG ratings for U.S.-listed companies provided by Dow Jones® [2].

Table 1: Top 10 Companies by ESG Score in August 2023

Rank | Company | Industry | ESG score |

1 | Microsoft | Computer Software - Desktop | 72.76 |

2 | Applied Materials | Electronics - Semiconductor Equipment | 71.71 |

3 | Woodward | Aerospace/Defense | 71.69 |

4 | Verisk Analytics | Commercial Services - Market Research | 71.58 |

5 | Mastercard | Finance - Credit Card/Payment Processing | 71.57 |

6 | Caterpillar | Machinery - Construction/Mining | 70.66 |

7 | Marathon Petroleum | Oil & Gas - Refining/Marketing | 69.42 |

8 | Nvidia | Electronics - Semiconductor Mfg | 69.4 |

9 | Dover | Machinery - General Industrial | 68.65 |

10 | Motorola Solutions | Telecom - Consumer Products | 68.54 |

The trend of institutional investors using ESG for analysis has been steadily increasing. According to a 2023 survey by BNP Paribas of 420 asset owners, managers, hedge funds, and private equity firms, 41% of organizations stated that their current top priority is committing to net-zero targets in terms of decarbonization (S). Additionally, 48% of these organizations expect to achieve this commitment within the next two years. In 2021, only 18% of investors had made net-zero commitments, with 33% indicating that they were considering making such commitments, demonstrating that institutional investors are increasingly focusing on steering corporate operations toward ESG .

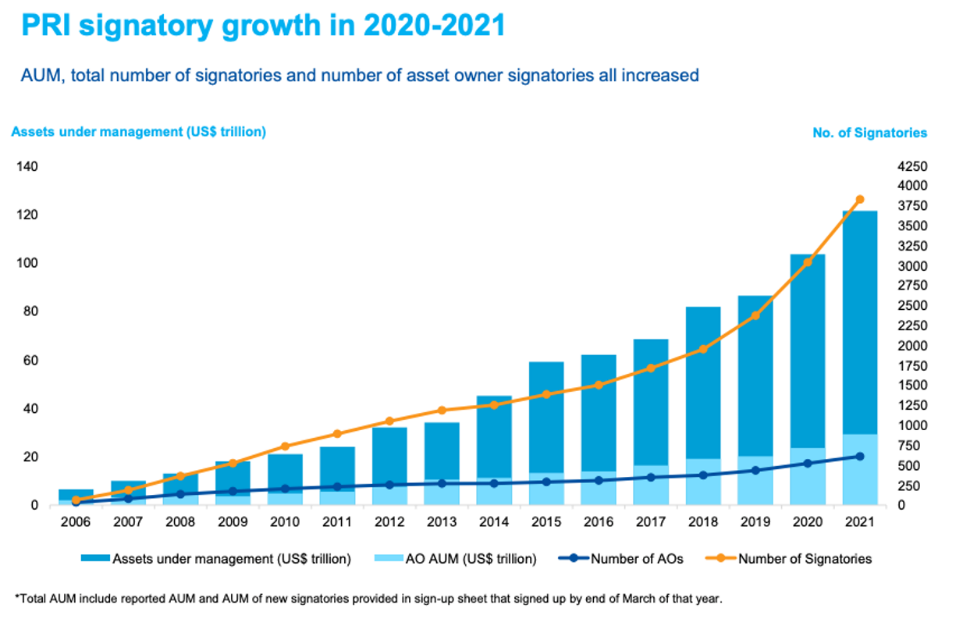

In recent years, ESG has been increasingly mentioned at both corporate and societal levels. According to the Signatory update report released by PRI, as of April 2024, there were 1,046 ESG signatories in the United States, an increase of 105 from 2023, representing a year-on-year growth of 11.15%. As of April 2024, China had 141 ESG signatories, an increase of 22 from 2022, representing a year-on-year growth of 18.48%. The increase in AUM (Assets Under Management), the total number of signatories, and the assets of asset owner signatories from 2020 to 2021 is shown in Figure 1, which depicts the trend of ESG signatories during that period .

Figure 1: Trends of ESG Signatories from 2020 to 2021

1.2. ESG Disclosure and Regulation in the United States

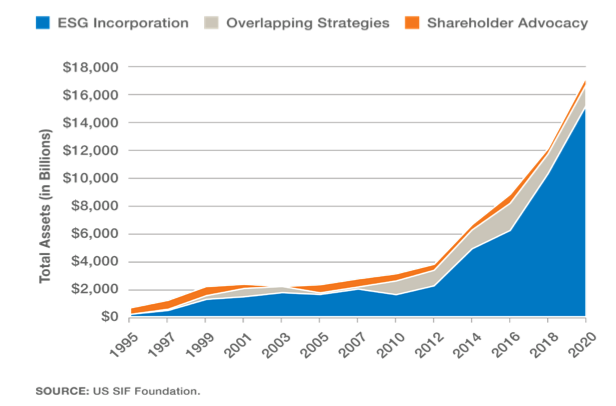

According to the 2020 Report on US Sustainable and Impact Investing Trends published by US SIF[3]: The Sustainable Investment Forum, the total investment using ESG analysis by US financial institutions, fund managers, and community investment service providers reached $16.6 trillion, a 42% increase from the 2018 report. The amount of shareholder resolutions filed using ESG criteria reached $1.98 trillion, and the net total of sustainable investments managed at the beginning of 2020 was $17.1 trillion. The increase in ESG assets from 1995 to 2020 is shown in Figure 2, depicting the growth of ESG assets over the past 35 years.

Figure 2: Growth of ESG Assets Over the Past 35 Years

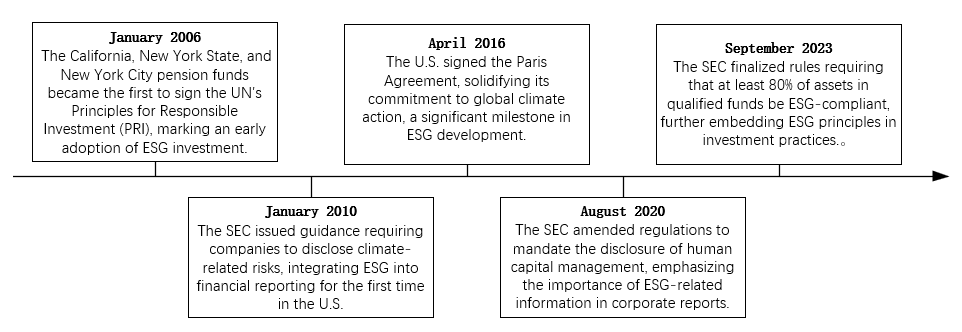

Various organizations have been increasingly applying ESG, but without clear benchmarks, this can lead to misuse and confusion. Therefore, government regulation is needed to standardize the principles and benchmarks for ESG application. From January 2006, when pension plans first used ESG concepts for analysis, to the end of September 2023, the US Securities and Exchange Commission (SEC) implemented ESG standards for institutional investments. During this period, a total of 15 related regulations and standards were proposed by federal independent agencies or local governments. Figure 3 presents the timeline of recent ESG regulations in the United States.

Figure 3: Timeline of Recent ESG Regulations in the United States

As of May 2024, according to data from the Global Sustainable Investment Alliance, the total global investment in ESG-related funds reached approximately $41 trillion, a 79.82% increase from $22.8 trillion in 2016. It is projected to exceed $50 trillion by 2025, indicating a significant rise in investment intentions and visions toward ESG in the past five years. Before 2018, the European Union led the ESG market, accounting for 40% of the global share. In 2022, the EU introduced the "Fit for 55" plan, and in 2023, the European Commission proposed a regulatory framework for ESG rating activities. These steps have progressively standardized ESG within the EU, guiding many companies to adopt it. However, challenges remain, including inconsistent rating standards, subjective industry evaluations, and a lack of clear policy directives. This article will provide a detailed explanation of these issues and offer suggestions and guidance for addressing them.

2. Definition of ESG

Environmental, Social, and Governance (ESG) form a broad concept, with each component addressing specific areas: environmental degradation and sustainable development, social moral issues, and internal corporate governance structures. This necessitates defining and regulating which environmental, social, and governance issues need to be managed and how social regulatory agencies and governments can use this management method to coordinate and unify various solutions.

2.1. Themes and Key Issues of ESG

As major global economies increasingly emphasize the functions and applications of ESG, the concept has become more mature, and its operational and management principles have gradually unified. However, there are significant differences in its specific manifestations, business nature, and operational characteristics across different economies. The specific operational manifestations are shown in Table 2.

Table 2: Subpoints of ESG

First Level | Environmental | Soical | Governance |

Aspect | Natural Resources | Social Manpower\Ethics, takeholders, Social Responsibility | Social Governance\ Business Behavior |

Subpoints | 1.Waste resource 2.Climate change 3.Biodiversity | 1. Implement Fair Compensation 2. Supply Chain Pricing 3. Donations, Volunteering | 1. Internal Governance: Organizational Structure, Financial Management 2. External Behavior: Taxation |

It is widely recognized that environmental impacts significantly affect a company's profitability and sustainability. As shown in Table 2 "Subpoints of ESG," natural resources can be divided into waste, climate change, and biodiversity, all of which have major impacts on the environment. Companies that generate large amounts of waste or mishandle waste disposal contribute to environmental pollution, which can, in turn, lead to climate change, resulting in rising temperatures, extreme weather, and sea-level rise. Such issues also cause ecosystem disruption and loss of biodiversity, leading to the destruction of biological resources. Overexploitation of natural resources results in resource depletion and ecological destruction. These external environmental changes can cause business interruptions, increase compliance costs, pose social reputation risks, and create instability in the supply of resources, severely impacting a company's supply chain and operational costs.

In the social category, fair compensation policies, supply chain bargaining measures, and participation in donations and volunteer services are included. Implementing these strategies increases employee productivity and enthusiasm, ensures mutual benefit between suppliers, supports social welfare and regional development, enhances corporate production efficiency and sustainability, and promotes supply chain fairness and economic sustainability. These actions improve the company's social reputation and credibility. Through improved social governance and business practices, companies engage in social governance, enhance external relations, create a transparent business environment, and reduce the bullwhip effect. Meanwhile, by adopting sustainable business practices, companies improve overall governance levels. Internally, by optimizing organizational structures and strengthening financial management, decision-making efficiency and financial transparency are improved, ensuring effective resource allocation and risk control. Externally, implementing reasonable tax policies enhances compliance and social responsibility while improving public image and reputation.

Internal and external governance are both important topics within governance. Companies must effectively manage these environmental factors through ESG innovation and sustainable development to reduce negative impacts, create new market opportunities, and enhance competitiveness and brand value. Social governance measures collectively promote improvements in social governance, creating a more just and inclusive social environment, which in turn benefits business development, as a stable and harmonious social environment contributes to long-term business interests and sustainable development. Good corporate governance promotes sustainable development, strengthens investor confidence, attracts more capital and resources, and ultimately enhances market competitiveness and long-term value.

2.2. Current Status of ESG in the World's Three Major Economies

The three major economies of the world are at the forefront of implementing ESG. The European Union is known for its stringent regulations and comprehensive balance, the United States for its market-driven and innovation-focused ESG practices, and China for its government-led and rapidly developing approach. The varying attitudes and policies towards ESG among these three are not solely due to differences in research investment but are also deeply rooted in their distinct industrial structures and economic conditions.

2.2.1. Current Status of ESG Policies in the EU

The EU is currently leading the world in the development and regulation of ESG. Over the past five years, the EU has successively introduced several key regulations, such as the Non-Financial Reporting Directive (NFRD), the Corporate Sustainability Reporting Directive (CSRD), and the EU Green Bond Standard, mandating companies to engage in environmental and social governance. These regulations aim to address welfare and livelihood issues and expand sustainable development strategies within society[4] The EU coordinates regional policies, setting specific compliance requirements for member states, and establishing corresponding standards, frameworks, and targets. Member states are required to establish relevant legal frameworks and regulatory mechanisms, creating a comprehensive ESG disclosure framework that mandates companies and financial institutions to disclose ESG information to achieve the 2050 carbon neutrality goal. For example, the NFRD requires publicly listed companies, banks, and insurance companies in the EU to disclose information on environmental protection measures, social and employment affairs, anti-corruption, and bribery. The CSRD, which was implemented last year, expands the scope to all large companies and publicly listed small and medium-sized enterprises and introduces additional requirements such as double materiality assessments and external audits. EU legislation has promoted sustainability across the EU, ensuring consistent implementation of ESG provisions and regulations.

2.2.2. Current Status of ESG Policies in the U.S.

In contrast to the EU's legislative mandate for financial institutions and companies to manage ESG, the U.S. and China use relatively moderate policies, each with its unique characteristics. U.S. ESG policies are primarily market-driven, relying on pressure and demand from investors and consumers on companies and institutions[5]. These pressures mainly come from investors and consumers demanding companies disclose more information on environmental and social risks to assess the returns and risks of specific investments, thereby pushing companies to improve their ESG practices. As a result, the U.S. Securities and Exchange Commission (SEC) plays a leading role in U.S. ESG regulation, focusing mainly on voluntary disclosure, with an emphasis on corporate governance and board diversity, primarily serving the interests of investors and consumers.

2.2.3. Current Status of ESG Policies in China

China's ESG policies are primarily government-led, with the government acting as the policy maker, executor, and regulator, playing a decisive role in promoting environmental protection and sustainable development. These policies are driven by national development strategies and aim to advance environmental protection and resource management within Chinese markets. For example, the "Guidelines for Establishing a Green Financial System," implemented in 2016, the "Guiding Opinions on Strengthening Green Financial Services to Help Achieve Carbon Peak and Carbon Neutrality," implemented in 2021, and the "Management Measures for Environmental Information Disclosure of Listed Companies (Draft for Comment)" all point towards the ESG concept, even though the term "ESG" is not explicitly mentioned. These policies emphasize that companies must disclose the types, concentrations, and total amounts of major pollutant emissions[6], as well as the measures taken for pollution control and their effectiveness. Thus, it can be concluded that China's primary ESG objectives are sustainable development and environmental protection.

2.2.4. Analysis of ESG Policies in the Three Major Economies

The differences in ESG regulations and objectives among the three major economies are largely determined by their distinct socio-economic structures, corporate governance cultures, and development stages. The EU has a highly integrated economic system, exemplified by the Single Market, financial market integration, and unified transport policies, which reflect the EU's emphasis on uniform market rules and standards. The systemic and mandatory regulatory culture leads the EU to prefer legislative measures to regulate disclosures, thus driving member states to take compulsory and consistent actions in areas such as environmental protection and social responsibility. This has enabled the EU to formulate multiple globally influential regulations and standards, placing it at the forefront of ESG sustainability, and driving corporate performance and outcomes in ESG.

The U.S. economy, on the other hand, is primarily market-driven, with its strong domestic capital market and numerous private enterprises shaping its economic structure. As a result, investors and consumers wield significant influence over companies, and policies are largely adjusted to serve their interests. The U.S. values free markets and corporate autonomy, and as a mature developed economy, it already has a well-established market mechanism and regulatory system. Although the SEC has recently strengthened the regulation of corporate ESG information disclosure, the overall trend remains focused on market-driven and voluntary disclosure by companies, primarily influenced by investors and consumers.

China's economy is government-led, with state-owned enterprises (SOEs) playing a significant role in the economic structure. Policies and regulations are initiated by the state, with SOEs being the first to implement disclosure requirements. SOEs, based on government standards, require themselves and other companies in the supply chain to meet these disclosure standards. China is still in the development stages of its secondary and tertiary industries, facing challenges such as environmental pollution, ecological damage, and resource unsustainability. Therefore, ESG policies in China focus on environmental protection and sustainable development, promoting companies to gradually align with international standards, ensuring that domestic products meet export requirements and attract international investment, thereby driving social development.

2.3. Summary

ESG is committed to improving various aspects such as the natural environment, social ethics, and corporate governance. By coordinating and managing issues related to the natural environment, society, and internal and external corporate management, ESG directly or indirectly influences various factors in the external environment, promoting the sustainable development of social resources. This, in turn, enhances corporate operational levels, enabling long-term, efficient development. In the process of implementing and regulating ESG standards, the EU mandates corporate disclosure of operational information, the US adopts a voluntary disclosure approach, while China requires heavy industrial enterprises to disclose their information. These differences stem from the EU's highly integrated economic system and carbon neutrality goals, the US's sophisticated market and regulatory system, and the Chinese government's leading role in the economy and the impact of industry on the environment.

3. The Role and Impact of ESG

The global attention and adoption of ESG by various economies are not solely due to its theoretical sustainability but more so due to its multiple benefits in socio-economic development. According to data from Linklaters , the EU has continuously promoted ESG green securities over the past decades. In the first half of 2023, the EU issued 448 green bonds, raising $190 billion, accounting for 54.13% of the global green bond total of $351 billion for the same period. The funds are mainly concentrated in areas such as energy efficiency, clean energy, and climate change adaptation. According to a report by Eurostat, the share of renewable energy in the EU's total final energy consumption reached 23.0%, an increase of 1.1% compared to 2022. Additionally, EU green bonds support energy efficiency in buildings, such as energy renovations of buildings and public infrastructure improvements. These green renovation measures are expected to reduce the EU's total energy consumption by 20% by 2030.

The significant achievements of ESG in promoting renewable energy development and improving energy efficiency have enhanced energy security and economic sustainability. Moreover, in the EU alone, ESG has also been applied in areas such as the Sustainable Finance Action Plan and the EU Emissions Trading System (EU ETS), aiding in economic development, investment attraction, and innovation. This helps increase corporate compliance and transparency, driving sustainable development of natural resources, socio-economic conditions, and industries.

3.1. Corporate Sustainability

Corporate sustainability refers to a company's ability to achieve long-term stable development and continuously realize its vision in terms of environmental, social, and financial aspects. Maintaining this sustainability requires not only focusing on the company's short-term business performance and financial status but also envisioning the positive impact the company can have on the environment and society over the coming decades.

In the short term, companies need to quickly adapt to constantly changing market demands and policy requirements while maintaining profitability. Business performance impacts financial status, which in turn controls the level and scale of business operations. Together, these factors determine whether a company can continue to operate in the short term. From the perspective of meeting market demand, economic risk is the most direct risk for companies[7]. Supply risks and cash flow risks in business and finance determine whether a company can stably provide products. For instance, Apple Inc. heavily relies on Chinese suppliers, manufacturers, and the Chinese consumer market. Most Apple components are supplied by Chinese suppliers and manufactured by Chinese manufacturers. In 2022, due to China's pandemic policies, major supplier Foxconn halted production, and related suppliers stopped supplying, severely disrupting Apple's supply chain. This led to production limitations for the iPhone 14 Pro and iPhone 14 Pro Max, directly impacting fourth-quarter performance. From the perspective of meeting policy requirements, products manufactured according to policy must meet sustainability criteria. For example, in 2021, Swedish automaker Volvo was forced to recall approximately 50,000 plug-in hybrid cars as they did not meet the new EU Regulation No. 2019/631, resulting in direct recall costs and damage to Volvo's environmental reputation. However, short-term supply chain choices and environmental policy improvements require substantial capital investment and business adjustments, impacting corporate profit levels.

In the long term, a series of external factors promoting environmental and social sustainability, as well as internal factors promoting innovation and operations, need to be considered. From the perspective of external corporate environment control, regularly publishing corporate environmental impact and social responsibility reports to the public and stakeholders demonstrates the company's efforts in environmental sustainability and social responsibility, enhancing information transparency and external credibility, thereby improving corporate reputation and market competitiveness. Additionally, focusing on employee welfare, promoting diversity and inclusion, and safeguarding basic human rights improve employee satisfaction and productivity. Actively participating in community development and public welfare activities helps establish good community relations and enhances the company's social image and influence[8]. From the perspective of internal corporate structure improvement, optimizing governance structures, enhancing transparency and accountability mechanisms, and establishing robust risk management systems can optimize internal resource utilization and reduce environmental risks, ensuring stability and sustainability in long-term investments. Furthermore, by comprehensively implementing and focusing on the ESG framework, companies can achieve integrated improvements in environmental, social, and governance aspects, ensuring long-term stability and sustainable development.

3.2. Corporate Risk Management

In the course of their operations and sustained development, companies often face risks in various areas such as strategy, operations, and finance. Corporate risk management involves using tools, techniques, and implementing strategies within the organization to ensure that risks are promptly identified, assessed, responded to, and monitored. This reduces operational vulnerabilities, ensures continuity, allows the company to gain profits, and achieves a competitive advantage in the market. The specific manifestations, causes, and traditional solutions of strategic, operational, and financial risks are shown in Table 3: Overview of Strategic, Operational, and Financial Risks.

Table 3: Overview of Strategic, Operational, and Financial Risks

Risk Type | Risk Manifestation | Cause | Traditional Mitigation Measures |

Strategic Risk | Product diversification failure | Overexpansion into unfamiliar markets | Conduct market research and small-scale trials |

Technological lag | Insufficient R&D investment or incorrect R&D direction | Increase R&D investment, seek technological partnerships or acquisitions | |

Brand image damage | Negative publicity or PR crisis | Strengthen brand management and PR crisis response capabilities | |

Operational Risk | Equipment failure | Equipment aging or inadequate maintenance | Regular maintenance and upgrading of equipment |

Labor disputes | Unfair employee treatment or poor management | Improve employee treatment, strengthen internal communication | |

Information leakage | Inadequate cybersecurity measures | Enhance cybersecurity measures, provide employee security training | |

Financial Risk | Interest rate risk | Interest rate fluctuations affecting financing costs | Use interest rate hedging tools, such as interest rate swaps |

Financial fraud | Weak internal controls and insufficient supervision[9] | Strengthen internal controls, conduct regular audits |

In the past, companies often focused only on what could go wrong or what risks might arise, the likelihood of these risks occurring, and their potential impact. They rarely considered aspects of risk management. For example, in 1985, Coca-Cola introduced a product called "New Coke" to replace the original formula without fully understanding consumer preferences. This led to approximately 40,000 consumer complaint letters within a few months, while Pepsi's market share increased from 24.3% to 25.2%, and Coca-Cola's market share dropped from 60.9% to below 60%. Two months after changing the formula, Coca-Cola reverted to the original recipe, and its market share gradually recovered.

Nowadays, companies often use vulnerability risk management methods, focusing more on the series of threats and impacts in future business operations. They also assess whether they have sufficient resources to mitigate these risks and restore the system to a new stable state, including the duration of disruption before establishing this new stable state and its impact on the company. For instance, Amazon's risk management strategy involves establishing multiple data center regions globally. This ensures that if one data center encounters an issue, the system can automatically switch to another region. Amazon has detailed disaster recovery plans (DRP) for each region, including data backup, system recovery, and business continuity strategies. When a system disruption occurs, the DRP can be quickly activated to minimize downtime and business impact. Additionally, Amazon invests in backup hardware, networks, and power facilities to ensure system operation even in the event of a single point of failure. Consequently, during a major service disruption in March 2017, Amazon's emergency system swiftly responded[10], maintaining system operation and ensuring uninterrupted customer service.

4. Risk and Challenge Analysis

4.1. Challenges in Implementing ESG

During the implementation of ESG, there are issues both within the company's operations and from social regulatory bodies.

Companies, especially small and medium-sized enterprises (SMEs), primarily focus on their profits. When participating in projects or implementing new policies, they are more concerned about whether these decisions can yield profits and ensure healthy financial conditions. This leads to challenges such as unclear return on investment (ROI) for ESG initiatives and high initial implementation costs.

(1) Unclear ROI: This is a significant challenge for companies implementing ESG. In some countries and industries, traditional financial metrics still dominate, and there is no unified, standardized data to reflect the value of ESG investments. Although more investors are now paying attention to ESG, some stakeholders may not fully understand it, indicating that ESG has not been completely recognized or reflected by the market. Therefore, before implementing ESG, it is necessary to persuade external investors and various levels within the company.

(2) High Initial Implementation Costs: This is the second challenge for ESG implementation. First, there are financial costs. For instance, if there is a lack of technology and professionals during implementation, companies need to purchase external solutions and hire experts in new fields to train or recruit relevant talents. Additionally, complying with various regional ESG standards and policies to improve existing products may require upgrading production lines and ISO standards, necessitating industry leaders to lead these updates. Second, there are time costs. When companies update solutions, technologies, and products, they do not directly replace them. Instead, each improvement plan requires trial runs, and the trial duration may not be proportional to the capital investment, making it unpredictable. For SMEs, the costs of implementing ESG may far exceed the benefits, potentially leading to losses or even bankruptcy.

The inconsistency of standards and ratings among social regulatory bodies increases the product management costs for multinational companies and reduces the frequency and opportunities for inter-regional exchanges.

(1) Different ESG Management Standards Between Countries: As mentioned earlier, there are differences in ESG implementation among the world's three major economies, but this does not cover the entire globe. Different regulatory requirements between countries may force companies to adopt different product standards to comply with varying national ESG standards and regulations. These discrepancies make it challenging for companies to uniformly manage products across different markets and fully standardize production, increasing compliance costs and complexity[11].

(2) Varied Internal ESG Standards Within Countries: For example, in China, when the government issues new regulations and policies, state-owned enterprises must fully comply and enforce mandatory disclosure, whereas private companies only need to partially comply. Additionally, numerous ESG rating agencies exist in the market, each with different scoring methods, weights, and evaluation standards. This discrepancy can lead to a company receiving a high score from one rating agency but a low score from another, lacking comparability.

(3) Industry Differences Increasing ESG Implementation Challenges: For example, Australia's TMS mineral sustainability policy strictly applies ESG standards to mining. However, when selling minerals to other industries, such as the energy sector, the standards shift from mining to energy, reducing the level of strictness.

4.2. Improvement Measures for Risk

This article proposes improving stakeholders' awareness and unifying regulatory mechanisms to address issues in ESG implementation.

Clarifying the ROI of ESG investments helps stakeholders make better judgments. Implementing policies to reduce costs and increase benefits can also aid in achieving better sustainability.

(1) Establishing an ESG Performance Evaluation System: Define ESG investment returns by constructing evaluation standards, collecting internal or industry historical data for analysis and long-term tracking, and setting standard ESG performance evaluation indicators based on actual circumstances[12]. Continuous communication of ESG investment returns to investors, internal managers, and employees, along with disclosing the progress and results of ESG projects, can enhance investors' understanding and trust in ESG.

(2) Reducing Implementation Costs and Enhancing Sustainability: For industry leaders or large enterprises, implementing ESG aims to meet market standards and ensure sustainability. They need to use existing resources efficiently, avoid redundant investments, and reduce waste during ESG implementation. When companies need to hire experts for employee training or recruit new talent, they can seek help from upstream and downstream supply chain companies to see if there are relevant talents, reducing search costs. For technical and standard upgrades, companies can share development and implementation costs with supply chain partners. When upgrading production lines, companies can first check if supply chain or friendly companies have more advanced production lines or outsource initial production plans, reviewing market responses before deciding on large-scale production or upgrading their lines. For SMEs focusing on short-term profits, competing with old standards in the existing market may be more beneficial for their development.

Unifying Regulatory Mechanisms Internationally or Domestically: Requires the leadership and participation of governments. To promote international cooperation and strengthen business activities, governments can work to unify ESG standards and rating systems. Regulatory bodies can sign international agreements, establish unified ESG standards and evaluation methods, or create a multinational coordination committee, such as the WTO, to manage ESG standards. This approach optimizes and simplifies the ESG compliance process, reduces administrative burdens, and provides a one-stop service platform for companies to understand and comply with various ESG regulations, lowering compliance costs and enhancing international exchanges. Additionally, governments should strengthen coordination among rating agencies, establish unified rating standards, and enhance oversight to ensure fair and comparable ratings, fostering domestic industry exchanges.

5. Summary and Conclusion

ESG (Environmental, Social, and Governance) is a set of standards used to measure a company's performance in environmental protection, social responsibility, and governance structure. It is an important indicator for investors to assess a company's sustainability and social impact. The reason for studying ESG lies in its ability to enhance business transparency and social responsibility, help reduce internal and external risks, attract long-term investments, thereby improving a company's competitiveness and market recognition, and fostering sustainable development. This paper primarily examines multiple dimensions, including environmental protection measures, social responsibility practices, and corporate governance structures, aiming to comprehensively evaluate a company's performance in ESG.

The analysis revealed that ESG's contributions are mainly reflected in enhancing corporate reputation, boosting investor confidence, reducing operational risks, attracting high-quality talent, and promoting long-term sustainable development among various operational factors. However, at this stage, companies face challenges in implementing ESG, including unclear investment returns, high implementation costs, differing stakeholder demands for ESG, and a lack of unified execution standards.

To address these challenges, companies should formulate clear ESG strategies, establish applicable ESG performance evaluation systems, communicate with stakeholders, enhance employee awareness of ESG, and seek sustainable development solutions through innovation and collaboration. By scientifically and effectively implementing ESG, companies can achieve a win-win situation of economic and social benefits, truly achieving sustainable development.

Although this paper provides a detailed description of the roles of ESG, implementation challenges, and measures, it lacks practical cases and quantitative analysis and data support, making it difficult to comprehensively assess the specific impact of ESG on corporate development. Furthermore, this paper lacks a comparative analysis of different companies, industries, or regions in the actual implementation of ESG, failing to fully reflect the broadness and diversity of ESG implementation.

Therefore, for future research, it is necessary to include case studies, incorporate specific companies' ESG practices, and conduct expert interviews, along with statistical data and quantitative analysis, to demonstrate the actual effects of ESG on corporate performance and investment returns, as well as the application effects and practical challenges of theory in reality. Additionally, comparative studies of different projects should be included, such as exploring the similarities and differences in ESG implementation under different national policy backgrounds, to reveal its universality and particularity.

References

[1]. Liu (2023-12-14), Research on the Development of ESG Information Disclosure System in China, BUSINESS MANAGEMENT, 220

[2]. Investor’s Business Daily, (2024, September 2), ESG stocks: List of 100 best ESG companies, Investor’s Business Daily, https://www.investors.com/news/esg-stocks-list-of-100-best-esg-companies/,

[3]. Bloomberg, (2022), ESG may surpass $41 trillion assets in 2022, But not without challenges, Finds Bloomberg Intelligence, Bloomberg, https://www.bloomberg.com/company/press/esg-may-surpass-41-trillion-assets-in-2022-but-not-without-challenges-finds-bloomberg-intelligence/

[4]. Spataro, L., Quirici, M. C., & Iermano, G. (Eds.). (2023). ESG Integration and SRI Strategies in the EU: Challenges and Opportunities for Sustainable Development.

[5]. Singhania, M., & Saini, N. (2023). Institutional framework of ESG disclosures: comparative analysis of developed and developing countries. Journal of Sustainable Finance & Investment, 13(1), 516-559.

[6]. Shen, H., Lin, H., Han, W., & Wu, H. (2023). ESG in China: A review of practice and research, and future research avenues. China Journal of Accounting Research, 100325.

[7]. Camilleri, M. A., Troise, C., Strazzullo, S., & Bresciani, S. (2023). Creating shared value through open innovation approaches: Opportunities and challenges for corporate sustainability. Business Strategy and the Environment, 32(7), 4485-4502.

[8]. Kankam-Kwarteng, C., Donkor, G. N. A., Osei, F., & Amofah, O. (2024). Do corporate social responsibility and corporate image influence performance of the financial sector?. Journal of Financial Services Marketing, 29(2), 306-317.

[9]. Boulhaga, M., Bouri, A., Elamer, A. A., & Ibrahim, B. A. (2023). Environmental, social and governance ratings and firm performance: The moderating role of internal control quality. Corporate Social Responsibility and Environmental Management, 30(1), 134-145.

[10]. Harasheh, M., & Provasi, R. (2023). A need for assurance: Do internal control systems integrate environmental, social, and governance factors?. Corporate Social Responsibility and Environmental Management, 30(1), 384-401.

[11]. Ellegaard, C. (2008). Supply risk management in a small company perspective. Supply Chain Management: An International Journal, 13(6), 425-434.

[12]. Ricardianto, P., Lembang, A., Tatiana, Y., Ruminda, M., Kholdun, A., Kusuma, I. G. N. A. G. E. T., ... & Endri, E. (2023). Enterprise risk management and business strategy on firm performance: The role of mediating competitive advantage. Uncertain Supply Chain Management, 11(1), 249-260.

Cite this article

Zhao,W. (2024). Research Trend in the Development of Environmental, Social, and Governance (ESG). Advances in Economics, Management and Political Sciences,122,183-194.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 8th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Liu (2023-12-14), Research on the Development of ESG Information Disclosure System in China, BUSINESS MANAGEMENT, 220

[2]. Investor’s Business Daily, (2024, September 2), ESG stocks: List of 100 best ESG companies, Investor’s Business Daily, https://www.investors.com/news/esg-stocks-list-of-100-best-esg-companies/,

[3]. Bloomberg, (2022), ESG may surpass $41 trillion assets in 2022, But not without challenges, Finds Bloomberg Intelligence, Bloomberg, https://www.bloomberg.com/company/press/esg-may-surpass-41-trillion-assets-in-2022-but-not-without-challenges-finds-bloomberg-intelligence/

[4]. Spataro, L., Quirici, M. C., & Iermano, G. (Eds.). (2023). ESG Integration and SRI Strategies in the EU: Challenges and Opportunities for Sustainable Development.

[5]. Singhania, M., & Saini, N. (2023). Institutional framework of ESG disclosures: comparative analysis of developed and developing countries. Journal of Sustainable Finance & Investment, 13(1), 516-559.

[6]. Shen, H., Lin, H., Han, W., & Wu, H. (2023). ESG in China: A review of practice and research, and future research avenues. China Journal of Accounting Research, 100325.

[7]. Camilleri, M. A., Troise, C., Strazzullo, S., & Bresciani, S. (2023). Creating shared value through open innovation approaches: Opportunities and challenges for corporate sustainability. Business Strategy and the Environment, 32(7), 4485-4502.

[8]. Kankam-Kwarteng, C., Donkor, G. N. A., Osei, F., & Amofah, O. (2024). Do corporate social responsibility and corporate image influence performance of the financial sector?. Journal of Financial Services Marketing, 29(2), 306-317.

[9]. Boulhaga, M., Bouri, A., Elamer, A. A., & Ibrahim, B. A. (2023). Environmental, social and governance ratings and firm performance: The moderating role of internal control quality. Corporate Social Responsibility and Environmental Management, 30(1), 134-145.

[10]. Harasheh, M., & Provasi, R. (2023). A need for assurance: Do internal control systems integrate environmental, social, and governance factors?. Corporate Social Responsibility and Environmental Management, 30(1), 384-401.

[11]. Ellegaard, C. (2008). Supply risk management in a small company perspective. Supply Chain Management: An International Journal, 13(6), 425-434.

[12]. Ricardianto, P., Lembang, A., Tatiana, Y., Ruminda, M., Kholdun, A., Kusuma, I. G. N. A. G. E. T., ... & Endri, E. (2023). Enterprise risk management and business strategy on firm performance: The role of mediating competitive advantage. Uncertain Supply Chain Management, 11(1), 249-260.