1. Introduction

Corporate sustainability is a key issue in current economic development and corporate operations. The most common definition of sustainable development is "meeting the needs of the present without compromising the ability of future generations to meet their own needs", as proposed in the report "Our Common Future" published by WCED in 1987. The concept has been discussed over time, resulting in about 70 different definitions. [1] The concept is linked to corporate social responsibility (CSR), which refers to the environmental, social and ethical considerations in a company's business strategy and operations. [2] Sustainability is of great importance to enterprises: UN Secretary-General Antonio Guterres [3] believes that businesses can reap clear and tangible benefits by working to develop and scale up sustainable business solutions, addressing challenges with the SDGS in mind, developing strong growth strategies, and in the process opening new markets. Obviously, the degree of sustainable development of an enterprise is a comprehensive indicator, which is affected by many factors. Fu Shilian divides the factors affecting corporate sustainability into five parts: entrepreneurship, corporate performance, corporate external environment, internal control (such as corporate physical asset management [4]) and corporate social responsibility (i.e. environment-related). [5] Guo Hongjing and Zhao Yufen divided the influencing factors into four aspects: economy, society, natural environment and science and technology [6]. This study will focus on the environment-related content of corporate social responsibility, and use case analysis to study how green enterprises (defined as businesses that embrace the principles of sustainable development and incorporate environmental benefits and management into their overall operations, ultimately leading to positive outcomes) are established under the environmental protection policy with green finance (which involves creating a connection between economic activities and environmental protection through financial support for eco-friendly economic activities, thereby achieving coordinated development of the two [7]) as the strategy to achieve sustainable development. This paper points out the existing problems of environmental factors in enterprises and puts forward the solutions in order to provide a reference for related research.

2. Case study - Based on Tesla's ESG report

In order to gain a more intuitive understanding of the impact of green finance on the sustainable development of enterprises, this study conducts an analysis of the environmental sustainability practices of Tesla, a well-known leader in green enterprise.In terms of data selection, the research used Tesla's official disclosure of ESG reports from 2021 to 2023 (impact reports). The following analysis mainly focuses on carbon emission per unit vehicle, water consumption per unit vehicle, circular economy, biological conservation and new energy.

2.1. Carbon emissions per vehicle

Under the general trend of environmental protection, new energy vehicles have become the hope of replacing traditional fuel vehicles because they emit less or almost no pollutants during the driving process. Previously, scholars have studied the emission reduction potential of new energy vehicles: Brady et al. believe that the energy utilization efficiency of electric vehicles is more than 46% higher than that of traditional fuel vehicles, and it has 13% to 68% CO2 emission reduction potential [8].

Tesla Motors is famous for new energy vehicles, and its contribution to environmental sustainability can be explored from the changing trend of its annual carbon emissions per unit vehicle.

According to Table 1: In 2021, its total annual carbon emissions are 588000mt, and in 2022, its total carbon emissions are 610000mt, and the greenhouse gas emissions per unit vehicle are reduced by 29% compared with the previous year. In 2023, its total carbon emissions are 677000mt, and the greenhouse gas emissions per unit vehicle are reduced by 10% compared with the previous year.

It can be seen that under vertical comparison, Tesla's carbon emissions per vehicle have been on a downward trend.

Table 1: 2021-2023 Scope1 and Scope 2 GHG emissions(mtco₂e)

Scope1 | Scope2 | Total | |

2021 | 185000 | 403000 | 588000 |

2022 | 202000 | 408000 | 610000 |

mtco₂e/vehicle | -29% | ||

2023 | 211000 | 466000 | 677000 |

mtco₂e/vehicle | -10% | ||

Data from the Tesla 2023 Impact Report

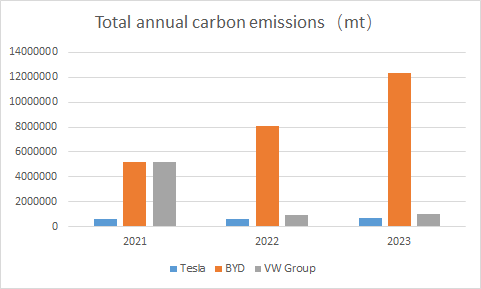

For cross-sectional comparisons, the study found similar relevant data for Tesla's competitors BYD Auto and Volkswagen. The data of BYD Auto 2023ESG report shows that its total carbon emissions in 2021 are 5219112mt, the total carbon emissions in 2022 are 8061970mt, and the total carbon emissions in 2023 are 12341455mt. According to the data of Volkswagen's 2021-2023 ESG report, its total carbon emission in 2021 is 5,210,000MT, its total carbon emission in 2022 is 984,000MT, and its total carbon emission in 2023 is 1,020,00MT. Through Fiugure1, we can clearly understand that Tesla's overall carbon emissions in the past three years are far lower than its two competitors. This shows that the environmental impact of Tesla cars is far less than that of other competitors, which also illustrates the green sustainability of Tesla cars.

Figure 1: 2021-2023 Total annunal carbon emissios of Tesla, BYD and VW Group

2.2. Water withdrawal per unit vehicle

Water is an indispensable life resource that meets people's basic daily needs, supports people's livelihood, promotes social and economic development, ensures food and energy security, and protects environmental integrity. However, according to the United Nations World Water Development Report 2024 [9], half of the world's population currently faces severe water scarcity for at least part of the year. A quarter of the world's population faces "extremely high" water scarcity stress. Improving the utilization rate of water resources and reducing industrial water use is the focus of the sustainable development of industrial science and technology.

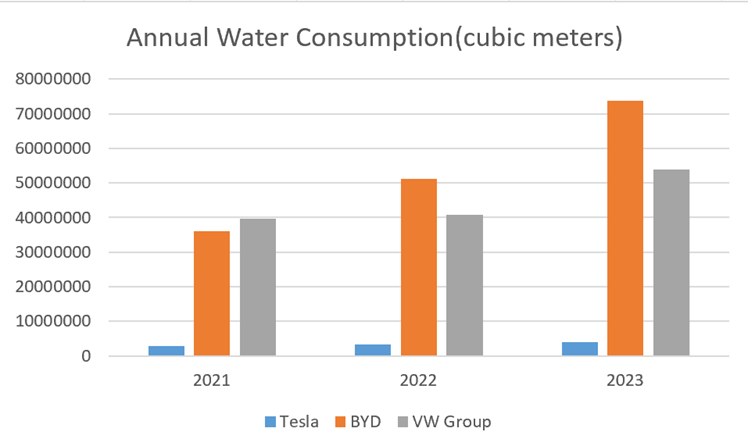

According to Table2, Tesla's production water withdrawal in 2021 is 2,874,904 cubic meters, and the production water withdrawal in 2022 is 3,363,398 cubic meters, which is 15% less than the previous year's production water withdrawal per unit vehicle, and the production water withdrawal in 2023 is 3871,927 cubic meters. Compared with the previous year, the water withdrawal per unit vehicle production decreased by 2.4%, showing a downward trend year by year. In 2018, Tesla used 3.27 cubic meters of water per unit of vehicle production, and as of 2023, this figure has been reduced to 2.48 cubic meters. These data all come from Tesla 2023 Impact Report

Table 2: 2021-2023 Water Withdrawal for Manufacturing(cubic meters) of Tesla

Water Withdrawal for Manufacturing(cubic meters) | 2023 | 2022 | 2021 |

Total Freshwater Withdrawl | 3871927 | 3363398 | 2874904 |

YoY reduction Total Water/vehicle | -2.4% | -15% |

These advances are driven by Tesla's New Standard for Water Use per Vehicle. In recent years, Tesla has optimized water-intensive industries: In 2023, Tesla introduced various efficiency processes in its water-intensive workshops to reduce the overall water consumption at the Gigafactory in Texas. They capture and reuse rainwater and condensates, and plan to collect at least 25% of the rooftop runoff in a central underground storage system in Texas for cooling manufacturing equipment, saving about 14 million gallons of municipal drinking water each year. In addition, Tesla also plans to replace ordinary industrial water with condensed water to conserve water resources.

Similarly, according to Figure 3 horizontally.

Figure 2: 2021-2023 Annual Water Consumption of Tesla, BYD and VW Group

It is not difficult to see that Tesla's water consumption is far lower than the other two car companies, combined with the previous analysis of its declining water consumption per unit of vehicles, Tesla has a strong sustainable development in environmental protection.

2.3. Unique circular economy

Tesla employs a unique circular economy strategy, which is a form of green finance. In particular, Tesla's battery recycling program drives recycling throughout the value chain. At the same time, Tesla strengthened its cooperation with external suppliers to enhance the accuracy of the cycle plan.

According to the 2023 Tesla Impact Report, Tesla recovered 2,431 tons of nickel, 117 tons of cobalt, 860 tons of copper and 329 tons of lithium through its battery recycling program. It greatly reduces the waste of resources and reduces the production cost. In 2023, according to Table3: Tesla recycled 90% of the manufacturing waste, and its industrial waste manufacturing volume in 2023 was 397,211 tons, compared with the data of 352,366 tons in 2022, the amount of industrial waste generated per unit of vehicle decreased by 6.3% year-on-year, and for 276,851 tons in 2021, The production of industrial waste per unit of vehicles in 2022 also decreased by 5.42% year-on-year. For the past three years, Tesla's production of industrial waste per unit of vehicles has been steadily decreasing, and this trend shows no sign of abating. It can be seen that the circular economy helps Tesla reduce costs while reducing the harm of industrial waste to the environment and promoting sustainable development.

Table 3: Waste generated in manufacturing of Tesla (metric tons)

Waste generated in manufacturing | 2023 | 2022 | 2021 |

Total | 397211 | 352366 | 276851 |

YoY Reduction total waste/vehicle | -6.3% | -5.42% |

2.4. Biodiversity conservation

Tesla is committed to protecting the natural environment around its production facilities and taking steps to improve the surrounding ecosystem. Tesla is prioritizing areas where the environment has been compromised. For instance, the land surrounding its Texas plant, which was previously utilized as a sand mine, will undergo extensive reclamation efforts to restore stable ecological functions. Gigafactory Texas' current projects are focused on cultivating diverse plants and animals and restoring ecological balance so that the site can recover naturally, and as of 2023, the Tesla Impact Report shows that the Gigafactory is growing more than 30 native plants. Meanwhile, the Nevada Gigafactory partnered with a team of ecologists from the University of Nevada, Las Vegas, to conduct a habitat survey to better understand and manage the biodiversity at the site. The implementation of Tesla's biodiversity conservation project has undoubtedly provided a strong boost to environmental sustainability.

2.5. Investments in clean energy: solar and storage

Tesla's investments in solar and energy storage are significant. In 2023, Tesla's energy storage deployment reached 14.7 GWh, a 125% increase over 2022. This growth is driven primarily by the expansion of the Megafactory in Laslop, California, which is moving toward 40 GWh of capacity. [10] Tesla's solar business is less affected by high interest rates and seasonal weakness than its energy storage business, but Tesla's long-term vision remains ambitious. According to the latest Master Plan, Tesla plans to deploy 3 TW of solar and 6.5 TWh of energy storage in the United States, which will contribute to 30 TW of renewable energy capacity worldwide. [11] These figures show that Tesla is committed to expanding its influence in the field of clean energy and continuously promoting its own green sustainable development.

3. Conclusion

In view of the above five points, Tesla's green finance strategy mainly includes large-scale investment in renewable energy, upgrading of emission reduction and consumption reduction products, ensuring a sustainable supply chain and so on. In addition, green financial strategies such as issuing green bonds and trading carbon credits [10] have also helped promote carbon emission reduction on a global scale. And from Tesla's current market value: As of 2024, Tesla's market capitalization exceeded $700 billion, making it one of the most valuable car companies in the world. The increase in market value reflects the market's confidence in Tesla's future growth potential and its dominant position in the electric vehicle market. Tesla's annual revenue and earnings continue to grow, with total revenue reaching about $100 billion in 2023 and net profit approaching $13 billion. It is a sign that it has maintained strong profitability while expanding its business. [10]

The case of Tesla can be extended to the entire green industry: green enterprises can improve their own corporate reputation and expand their visibility through the development of green finance, and at the same time promote the green and sustainable development of the entire industry. [12]

However, through the literature review, it is also found that there are still some problems in promoting the sustainable development of enterprises by green finance. Firstly, the scope of companies that can utilize green finance strategies is limited to sectors such as environmental protection, science and technology, and new energy enterprises. Other non-similar businesses may not be able to fully leverage the benefits of green finance. Secondly, the quality of ESG information disclosure is not high. ESG reporting is voluntary, and only a small number of companies are willing to disclose ESG data. These problems may be solved through the corresponding policies of the national system, the expansion of financial services and other methods and follow-up research.

References

[1]. ZHANG Xiaoling. Theory of Sustainable Development: Concept Evolution, Dimension and Prospect[J]. Bulletin of Chinese Academy of Sciences, 2018, 33(1): 10-19

[2]. Emily Greenfield.(2023). What is corporate Sustainability? Why is it necessary?. What is corporate sustainability? Why is it necessary? - Sigma Earth https://sigmaearth.com/zh-CN/%E4%BB%80%E4%B9%88%E6%98%AF%E4%BC%81%E4%B8%9A%E5%8F%AF%E6%8C%81%E7%BB%AD%E5%8F%91%E5%B1%95%E4%BB%A5%E5%8F%8A%E4%B8%BA%E4%BB%80%E4%B9%88%E6%9C%89%E5%BF%85%E8%A6%81/

[3]. António Quterres. What the SDGs mean for business. https://sdgessentials.org/what-the-sdgs-mean-for-business.html

[4]. WEI Ningbo.(2024). The role of physical asset management in the sustainable development of enterprises - Taking Longnan Power Supply Company of State Grid as an example. China's collective economy (16), 61-64. DOI:10.20187/j.cnki.cn/11-3946/f.2024.16.011.

[5]. FU Shilian.(2021).Research on Factors Affecting the Sustainable Development of Enterprises.Modern Business(35), 12-14. DOI:10.14097/j.cnki.5392/2021.35.004.

[6]. GUO Hongjing & ZHAO Yufen.(2009). Construction of enterprise sustainable development evaluation model. Northern economy (14), 54-55.

[7]. Cai Yang.(2024). Research on the Impact and Mechanism of Green Finance on the growth of green enterprise.Chinese market(06), 54-57. DOI:10.13939/j.cnki.zgsc.2024.06.014.

[8]. Brady J, O'Mahony M. Travel to work in Dublin. The po⁃ tential impacts of electric vehicles on climate change and urban air quality[J]. Transportation Research, 2011, 16(2): 188-193.

[9]. Qing Mu (2024-04-18). Join hands to pour "the water of prosperity and peace". Journal of Social Sciences, 2000.

[10]. Shahan, Z. (2024). Tesla Energy Storage & Solar Profits Nearly Quadrupled in 2023.[online]CleanTechnica. Available at: https://cleantechnica.com/2024/01/24/tesla-energy-storage-solar-profits-nearly-quadrupled-in-2024/.

[11]. pv magazine USA. (2023). Tesla Master Plan projects 3 TW of solar and 6.5 TWh of storage. [online] Available at: https://pv-magazine-usa.com/2023/04/06/tesla-master-plan-projects-3-tw-of-solar-and-6-5-twh-of-storage/ [Accessed 15 Aug. 2024].

[12]. Li Xiaoqian.(2023). Study on the influence path of green finance on the sustainable development of enterprises. Trade Show Economics (10), 93-95. DOI:10.19995/j.cnki.CN10-1617/F7.2023.10.093.

Cite this article

Qu,C. (2024). How Does Green Finance Exert an Influence on the Sustainable Development of Green Enterprises - With Tesla as a Case in Point. Advances in Economics, Management and Political Sciences,132,140-145.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 8th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. ZHANG Xiaoling. Theory of Sustainable Development: Concept Evolution, Dimension and Prospect[J]. Bulletin of Chinese Academy of Sciences, 2018, 33(1): 10-19

[2]. Emily Greenfield.(2023). What is corporate Sustainability? Why is it necessary?. What is corporate sustainability? Why is it necessary? - Sigma Earth https://sigmaearth.com/zh-CN/%E4%BB%80%E4%B9%88%E6%98%AF%E4%BC%81%E4%B8%9A%E5%8F%AF%E6%8C%81%E7%BB%AD%E5%8F%91%E5%B1%95%E4%BB%A5%E5%8F%8A%E4%B8%BA%E4%BB%80%E4%B9%88%E6%9C%89%E5%BF%85%E8%A6%81/

[3]. António Quterres. What the SDGs mean for business. https://sdgessentials.org/what-the-sdgs-mean-for-business.html

[4]. WEI Ningbo.(2024). The role of physical asset management in the sustainable development of enterprises - Taking Longnan Power Supply Company of State Grid as an example. China's collective economy (16), 61-64. DOI:10.20187/j.cnki.cn/11-3946/f.2024.16.011.

[5]. FU Shilian.(2021).Research on Factors Affecting the Sustainable Development of Enterprises.Modern Business(35), 12-14. DOI:10.14097/j.cnki.5392/2021.35.004.

[6]. GUO Hongjing & ZHAO Yufen.(2009). Construction of enterprise sustainable development evaluation model. Northern economy (14), 54-55.

[7]. Cai Yang.(2024). Research on the Impact and Mechanism of Green Finance on the growth of green enterprise.Chinese market(06), 54-57. DOI:10.13939/j.cnki.zgsc.2024.06.014.

[8]. Brady J, O'Mahony M. Travel to work in Dublin. The po⁃ tential impacts of electric vehicles on climate change and urban air quality[J]. Transportation Research, 2011, 16(2): 188-193.

[9]. Qing Mu (2024-04-18). Join hands to pour "the water of prosperity and peace". Journal of Social Sciences, 2000.

[10]. Shahan, Z. (2024). Tesla Energy Storage & Solar Profits Nearly Quadrupled in 2023.[online]CleanTechnica. Available at: https://cleantechnica.com/2024/01/24/tesla-energy-storage-solar-profits-nearly-quadrupled-in-2024/.

[11]. pv magazine USA. (2023). Tesla Master Plan projects 3 TW of solar and 6.5 TWh of storage. [online] Available at: https://pv-magazine-usa.com/2023/04/06/tesla-master-plan-projects-3-tw-of-solar-and-6-5-twh-of-storage/ [Accessed 15 Aug. 2024].

[12]. Li Xiaoqian.(2023). Study on the influence path of green finance on the sustainable development of enterprises. Trade Show Economics (10), 93-95. DOI:10.19995/j.cnki.CN10-1617/F7.2023.10.093.