1. Introduction

As AI and digital currencies evolve, the global demand for computing power has surged, with the number of GPUs owned becoming a key standard for measuring a company's computing capability. This presents a significant opportunity for manufacturers. However, risks often accompany opportunities, and having the chance does not guarantee success. Therefore, how producers can seize opportunities and achieve better development in this pivotal era has become a pressing issue.

This paper employs a literature review method to deeply explore how NVIDIA has achieved a dominant position in the global GPU market through technological innovation and brand building. The study finds that NVIDIA leverages its technological advantages in high-performance computing, graphics rendering, and AI acceleration, along with deep collaborations with several computer companies, to build a strong brand influence. Additionally, its flexible marketing strategies—including precise market segmentation, collaborative marketing, and strategies that adapt to market changes—provide robust support for the company's sustained growth.

The significance of this research lies in offering valuable insights for other enterprises regarding technological innovation, brand building, and marketing strategies through the analysis of NVIDIA's success case. At the same time, this paper also highlights the challenges NVIDIA may face in its development process and provides corresponding suggestions to offer a reference for its future growth.

2. Market situation and competitors

As the use of GPUs becomes increasingly prevalent in fields like gaming and AI, the overall trend in the global GPU market is positive. In 2023, the total scale of the AI market reached $16 billion, and the market size for GPUs related to autonomous driving has reached $4.389 billion. For companies in the GPU sector, the profit brought by the rising demand for their products due to technological advancements is significant [1].

In the current graphics processor market, NVIDIA has two main competitors—AMD and Intel—while also facing threats from emerging Chinese companies. These companies often possess more flexible market strategies and innovative technological approaches, posing a certain challenge to NVIDIA. However, due to their limited scale and brand influence, these companies are unlikely to pose a substantial challenge to NVIDIA in the short term, despite their growing presence, such as Bitmain, Moore Threads, and Core Motion.

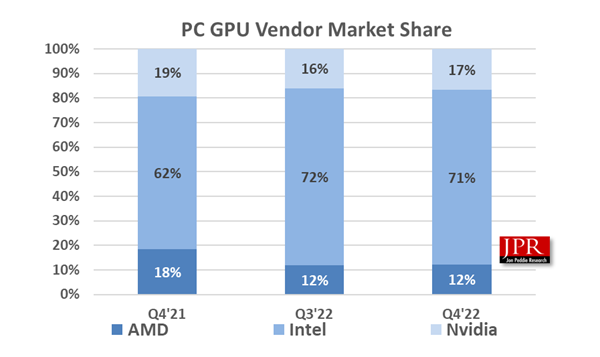

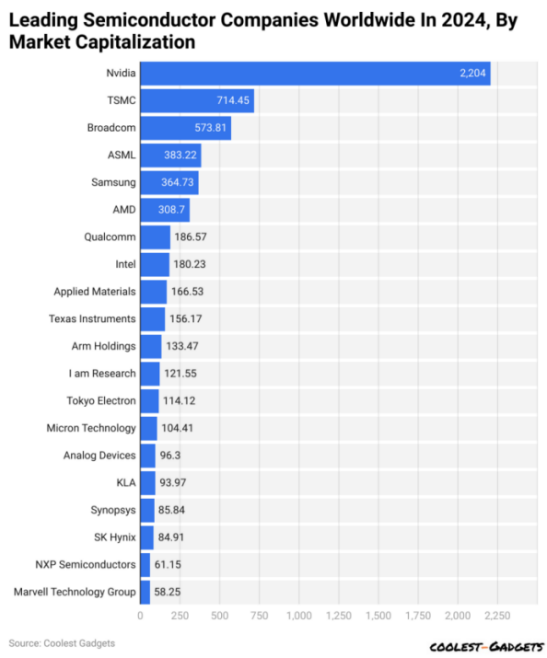

Despite the intense competition, NVIDIA still maintains an 80% market share in the GPU (discrete graphics card) sector (Figure 1). Clearly, NVIDIA holds a dominant position in this market (Figure 2), but whether this advantage can be sustained depends on its ability to leverage its R&D strengths to empower its products and continually attract more consumers [2].

Figure 1: Quarterly shipments, market share percentages, and year-to-year results.[2]

Figure 2: dominant position of Nvidia [3]

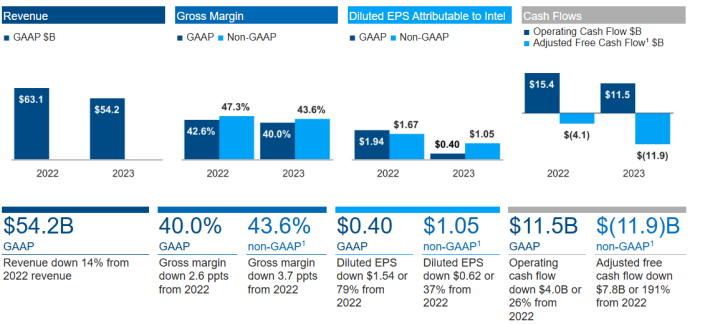

2.1. Intel

As a company established in 1968, Intel's research in the GPU field dates back to the release of the i740 in 1998, and it currently holds a certain market share in this area. However, its main business is focused on integrated graphics, which means its competition with NVIDIA in the discrete graphics card market is not direct. Nevertheless, Intel's technological strength and brand influence remain significant. As shown in Figure 1, its market share is still quite substantial (primarily from its integrated graphics business) and continues to show an upward trend (see Figure 3).

Figure 3: The fiscal report of Intel Corporation [4]

2.2. AMD

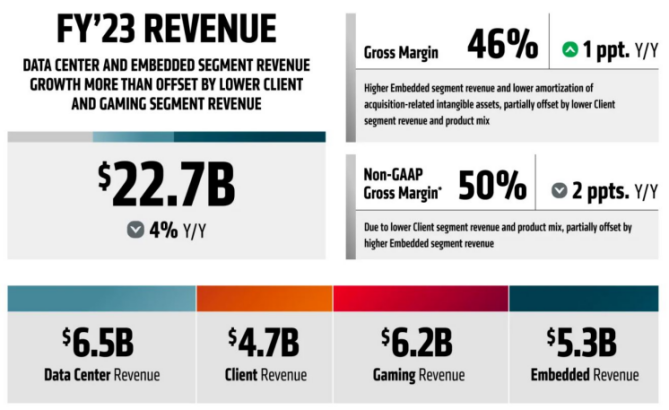

Advanced Micro Devices, Inc. (AMD) was founded in 1969 and specializes in providing various microprocessors for the computer, communications, and consumer electronics industries, as well as flash memory and low-power processor solutions. AMD is one of the few companies that can compete with NVIDIA in the discrete graphics card market (see Figure 2). Its business is primarily divided into data center, client, gaming, and embedded segments, mainly targeting enterprise consumers (B2B). In recent years, its business has also experienced rapid growth (see Figure 4) [5].

Figure 4: AMD's revenue by business segment [6]

3. SWOT Analysis

This section will provide a more comprehensive analysis and identification of NVIDIA's internal resources, capabilities, and skills that serve as competitive advantages through a SWOT analysis. It will highlight weaknesses that need improvement or should be avoided and analyze external environmental opportunities that could lead to growth and success. Additionally, it will assess the potential risks and threats from the external environment that may pose challenges to the organization. Based on the results of the SWOT analysis, recommendations for NVIDIA's future development will be proposed.

3.1. Strength: technological leadership and innovation capabilities

First, from the perspective of partnerships, NVIDIA's chip manufacturing is primarily handled by TSMC, which enables NVIDIA to have access to leading manufacturing processes, consistently meeting its innovation needs. Additionally, NVIDIA has deep partnerships with several computer companies, and most of the graphics cards on the global market are produced using technology licensed by NVIDIA. Furthermore, many high-performance laptops on the market are equipped with NVIDIA graphics cards, significantly increasing consumer trust in the brand.

NVIDIA holds a clear technological advantage in GPU technology, especially in high-performance computing, graphics rendering, and AI acceleration. The independently developed CUDA system allows NVIDIA's products to meet higher computational demands, better serving consumer needs.

Whether it's the 4090 series or other product lines, NVIDIA's offerings are seen by consumers as the pinnacle of technology at the time. This perception is indeed accurate, as NVIDIA, with its outstanding team and research capabilities, captures consumer interest with high-quality chips and products. By continuously updating and iterating its products, NVIDIA retains its customers—an enormous advantage that is difficult for its competitors to match.

3.2. Weakness: R&D Barriers & Supply Chain Issues

As a company, NVIDIA also has its own weaknesses and shortcomings. As mentioned in the advantages earlier, it must continuously innovate and launch new products to maintain its market position. However, what does this lead to? Continuous and substantial financial outflows. According to NVIDIA's financial report (see Table 1), by the end of the 2024 fiscal year, NVIDIA's R&D expenses amounted to a staggering $8.675 billion. Reducing this investment is clearly not feasible, but it also means that the actual profits the company earns do not always align with its sales revenue.

Secondly, there is the issue of the supply chain. NVIDIA's annual chip production numbers are enormous, so global supply chain uncertainties—such as shortages of raw materials or production disruptions—could impact NVIDIA's product supply and cost control.

Table 1: The fiscal report of Nvidia in 2024 [7]

GAAP | |||||

($ in millions, except earnings per share) | Q4 FY24 | Q3 FY24 | Q4 FY23 | Q/Q | Y/Y |

Revenue | $22,103 | $18,120 | $6,051 | Up 22% | Up 265% |

Gorss margin | 76.0% | 74.0% | 63.3% | Up 2.0 pts | Up 12.7 pts |

Operating expenses | $3,176 | $2,983 | $2,576 | Up 6% | Up 23% |

Operating income | $13,615 | $10,417 | $1,257 | Up 31% | Up 983% |

Net income | $12,285 | $9,243 | $1,414 | Up 33% | Up 769% |

Diluted earnings per share | $4.93 | $3.71 | $0.57 | Up 33% | Up 765% |

Non-GAAP | |||||

($ in millions, except earnings per share) | Q4 FY24 | Q3 FY24 | Q4 FY23 | Q/Q | Y/Y |

Revenue | $22,103 | $18,120 | $6,051 | Up 22% | Up 265% |

Gorss margin | 76.7% | 75.0% | 66.1% | Up 1.7 pts | Up 10.6 pts |

Operating expenses | $2,210 | $2,026 | $1,775 | Up 9% | Up 25% |

Operating income | $14,749 | $11,557 | $2,224 | Up 28% | Up 563% |

Net income | $12,839 | $10,020 | $2,174 | Up 28% | Up 491% |

Diluted earnings per share | $5.16 | $4.02 | $0.88 | Up 28% | Up 486% |

3.3. Opportunity: technology development

NVIDIA's rapid development has two peaks, mainly the surge in Bitcoin and the rapid development of AI in recent years. Their commonality is that they require huge computing power to support them, which has also led to a surge in demand in the market, but this may also bring a problem, such as the current Bitcoin explosion. If this wave passes, then demand may drop significantly, thus affecting the company's sales market potential. Nevertheless, the digital transformation of emerging markets and industries has also provided new growth points for NVIDIA's product sales.

Just like Sony and other companies, in the long-term development of NVIDIA, consumers have undoubtedly developed loyalty to the company. Many computer users think of NVIDIA first when buying graphics cards. This trust is undoubtedly closely related to NVIDIA's long-term excellent product quality and performance and marketing strategy. When consumers trust NVIDIA's products and services, this will form a good reputation in the market. This positive word-of-mouth communication can attract more potential consumers to pay attention to NVIDIA, thereby increasing its market share. At the same time, a trusted brand image can also help companies differentiate themselves from other competitors and form a unique brand recognition.

3.4. Threat: international turbulence and market competition

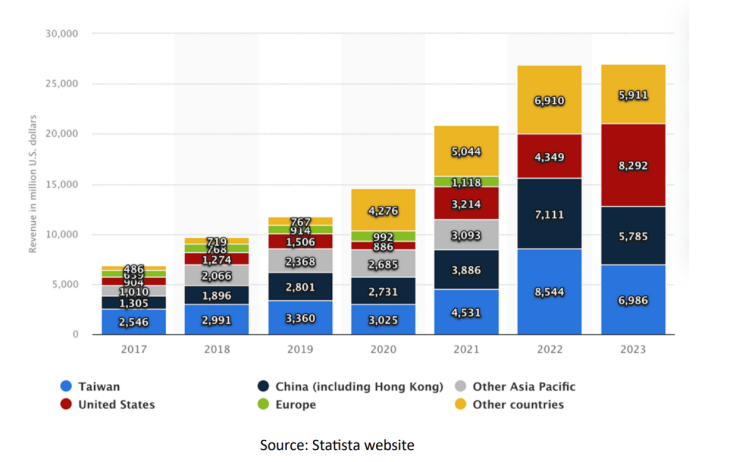

Trade frictions and policy uncertainties between countries may have an impact on NVIDIA's business, especially its operations and sales in the Chinese market. For example, the "graphics card ban" launched by the US government in 2023 (see Figure 3.4.1) has seriously affected the sales of its products among Chinese companies, which will undoubtedly greatly damage NVIDIA's interests. As shown in Figure 3.4.2, the Chinese market accounts for a large part of its business.

Figure 5: NVIDIA Revenue from 2017 to 2023 by region (in millions of US dollars) [8]

Competitive pressure from rivals such as AMD and Intel continues to increase, especially in the high-performance computing and integrated GPU markets. The emergence of new technologies, such as quantum computing or new semiconductor materials, may disrupt the existing market landscape.

4. Celebrity effects

Salesforce mentions that in today's information society, individuals have replaced traditional enterprises as the main body of marketing. In the information trend, it is very likely that the marketing methods of enterprises will not be transmitted to consumers at all [9]. At this time, the role of celebrities is particularly important. For example, Apple's Steve Jobs, Xiaomi's Lei Jun, Microsoft's Bill Gates, and even the now increasingly famous Zhou Hongyi of 360 are all so-called "celebrities". As leaders of enterprises, they establish direct contact with consumers through social platforms and other means. This is not only an excellent marketing method, but also can enhance brand loyalty. NVIDIA is also working in this direction. For example, on the Chinese Internet, people jokingly call Huang Renxun (CEO) "Lao Huang", which is undoubtedly a manifestation of affinity. Through consumers' understanding of the personal charm, talent, or insights of this corporate leader, consumers' understanding of the brand is indirectly enhanced.

The book Tipping Point puts forward the concepts of marketer and expert. These concepts can also be applied to NVIDIA’s marketing strategy. Nowadays, influence is not only affected by the single factor of investment in advertising or marketing, but also by the influence of individuals (even individuals who may have no connection with the company). For example, if a person feels unwell after eating a certain brand of food and posts it online, it will inevitably cause irreversible damage to the brand. Even if it is later proved that the person’s physical discomfort has nothing to do with the food, the company’s sales will still be affected [10].

So the question is, how to do this? First, take advantage of the wide coverage of social media. Like Lei Jun and others, actively interact with users on platforms such as Weibo, Bilibili, Xiaohongshu, X, Facebook, Tiktok, etc., and establish connections with fans and consumers by posting content and replying to comments. At the same time, we should also focus on shaping a unique personal brand. Through consistent image shaping and information dissemination, we can build a unique personal brand so that people can associate it with a specific celebrity when they mention the relevant field. Finally, we should continue to interact and update. By regularly updating content and maintaining continuous interaction with fans, we can maintain and enhance the celebrity effect. Through these methods, NVIDIA's managers will become more well-known on the Internet and expand their influence among those who don't understand this industry, which will undoubtedly have a positive impact on the company.

5. Advertisement marketing

NVIDIA's advertisements are mainly focused on introducing the performance of the products, so in most cases it is difficult to leave consumers with an overall impression of the company. Of course, this marketing method is also a desirable way to promote products, but for enterprises, the increase in the number of consumers will not bring greater results. When competing companies launch more advanced and high-end products, the original consumers may very likely turn to buy competing company products, which is not conducive to the long-term development of the company. At this level, NVIDIA can learn from NVIDIA, which is also in the chip field. This article divides its advertising methods into two types: memorability and localization. The first level is memorability. Consumers who are not familiar with computers may not know the specific products of Intel at all, but they can definitely remember the unique voice in its advertisements, and such advertisements can undoubtedly deepen people's impression of the brand, so that when consumers buy products, they subconsciously choose those brands with advertisements that impress them. The second level is localization. NVIDIA's advertisements in Japan cooperate with local anime works. This marketing strategy also coincides with the practice of Lay's, a food company, launching localized flavors of potato chips in China. This marketing strategy can help to open up the market in a specific country to a certain extent, thereby increasing sales in the local market.

6. Development suggestions

In view of NVIDIA's current market strategy and challenges, combined with the analysis of NVIDIA AI Revolution: A Comprehensive Strategic Analysis-Second Edition, this paper proposes the following suggestions in order to provide a useful reference for its future development [11].

First, continue to increase R&D investment and maintain technological leadership. From the paper, we can see that NVIDIA's remarkable achievements in the fields of AI and high-performance computing are inseparable from its continued high-intensity R&D investment. Therefore, it is recommended that NVIDIA continue to increase its investment in R&D in the future, especially in the fields of AI chips, high-performance computing and emerging technologies, in order to maintain its technological leadership in these fields.

Second, deepen cooperation with upstream and downstream companies in the industrial chain. As mentioned in this article, NVIDIA has established close cooperative relationships with many companies during its growth, and these collaborations have played an important role in its business expansion and market expansion. Therefore, it is recommended that NVIDIA continue to deepen cooperation with upstream and downstream companies in the industrial chain in the future, jointly promote technological innovation and product upgrades, and form a closer industrial chain ecosystem.

Secondly, strengthen market expansion and brand building. Although NVIDIA has achieved a certain degree of popularity in the global market, its brand influence needs to be improved in some regions and market areas. Therefore, it is recommended that NVIDIA strengthen market expansion and brand building in the future, and increase its popularity and influence in the global market through multi-channel marketing and brand promotion activities.

In addition, it is necessary to pay attention to emerging markets and segments. With the continuous development of technology and the continuous changes in the market, new opportunities and challenges will continue to emerge in emerging markets and segments. For example, the emergence of medical robots allows AI to be used in the medical industry, and AI is inseparable from GPUs, which brings benefits to technology companies such as NVIDIA. Therefore, it is recommended that NVIDIA pay attention to the development trends of these emerging markets and segments in the future, and adjust market strategies and product layouts in a timely manner to seize new market opportunities.

Finally, optimize internal management and improve operational efficiency. With the continuous expansion of the company's scale and the expansion of its business scope, the importance of internal management has become increasingly prominent. Therefore, it is recommended that NVIDIA optimize internal management processes in the future, improve operational efficiency, and ensure that the company can continue to develop steadily.

In summary, NVIDIA should continue to increase R&D investment, deepen cooperation with upstream and downstream enterprises in the industry chain, strengthen market expansion and brand building, focus on emerging markets and niche areas, and optimize internal management in its future development. These suggestions are expected to provide strong support for NVIDIA in future market competition and promote its more sustainable development.

7. Conclusion

Through an in-depth analysis of NVIDIA's market strategy, technological innovation, brand building and marketing methods, this paper reveals how NVIDIA maintains its leading position in the global GPU market. Through a SWOT analysis of NVIDIA, this paper identifies its advantages in terms of technological leadership, innovation capabilities, market opportunities and celebrity effect, while also pointing out its disadvantages and threats in terms of R&D barriers, supply chain issues, international turmoil and market competition.

NVIDIA's success story provides valuable reference for other companies, especially in terms of technological innovation and brand building. NVIDIA has successfully built a strong brand influence and market competitiveness through continuous R&D investment, close cooperation with upstream and downstream companies in the industrial chain, flexible marketing strategies and the use of celebrity effects.

However, NVIDIA still faces many challenges in its future development. It is recommended that NVIDIA continue to increase R&D investment to maintain its technological leadership; deepen cooperation with upstream and downstream companies in the industrial chain to jointly promote technological innovation and product upgrades; strengthen market expansion and brand building to enhance global visibility and influence; pay attention to opportunities in emerging markets and segments, and adjust market strategies and product layout in a timely manner; optimize internal management and improve operational efficiency.

In addition, NVIDIA should also pay close attention to changes in the international situation and flexibly respond to policy and market uncertainties. In terms of marketing, NVIDIA can further leverage the influence of celebrities and social media to enhance its brand image and consumer loyalty. At the same time, NVIDIA should also explore more diversified advertising and marketing strategies to enhance the brand's memorability and localization.

In short, as a leader in the global GPU market, NVIDIA's successful experience is worth learning from the industry. By continuously optimizing and adjusting its market strategy, NVIDIA is expected to continue to maintain its leading position in future market competition and achieve sustainable development.

References

[1]. Xueqiu. (2023). GPU industry in-depth: market analysis, competition landscape, industry chain and related companies. https://xueqiu.com/3966435964/246795070

[2]. Jon Peddie Research (JPR). (2024). Adjustment to Q422 JPR dGPU Market Report – Jon Peddie Research. https://www.jonpeddie.com/news/adjustment-to-q422-jpr-dgpu-market-report/

[3]. COOLEST GADGETS. (2024). Semiconductor Industry Statistics 2024 By Country, Demographics, Device, Import and Export. https://www.coolest-gadgets.com/semiconductor-industry-statistics

[4]. Intel corporation. (2023). The fiscal report of Intel Corporation. https://www.sec.gov/Archives/edgar/data/50863/000005086324000010/intc-20231230.htm

[5]. Božić, D., Buchberger, L., Bakotić, A., Andrešić, M., & Ančić, M. THE CASE STUDY OF INTEL CORPORATION (INTC). COMPANY ANALYSIS, 127.

[6]. Tradingview. (2024). AMD's revenue by business segment. https://cn.tradingview.com/#main-market-summary

[7]. NVIDIA Corporation. (2024). NVIDIA Announces Financial Results for Fourth Quarter and Fiscal 2024. https://investor.nvidia.com/news/press-release-details/2024/NVIDIA-Announces-Financial-Results-for-Fourth-Quarter-and-Fiscal-2024/

[8]. Statista. (2024). NVIDIA Revenue from 2017 to 2023 by region. https://www.statista.com/site/

[9]. Sweezey, M. (2014). Salesforce. Harvard Business Press.

[10]. Gladwell, M. (2024). Revenge of the tipping point:Overstories, Superspreaders, and the Rise of Social Engineering. Little, Brown and Company

[11]. Niero, B. NVIDIA's AI Revolution: A Comprehensive Strategic Analysis.

Cite this article

Song,Y. (2024). NVIDIA's Market Strategy and Innovation: The Fusion of Technological Leadership and Brand Building. Advances in Economics, Management and Political Sciences,137,143-150.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Xueqiu. (2023). GPU industry in-depth: market analysis, competition landscape, industry chain and related companies. https://xueqiu.com/3966435964/246795070

[2]. Jon Peddie Research (JPR). (2024). Adjustment to Q422 JPR dGPU Market Report – Jon Peddie Research. https://www.jonpeddie.com/news/adjustment-to-q422-jpr-dgpu-market-report/

[3]. COOLEST GADGETS. (2024). Semiconductor Industry Statistics 2024 By Country, Demographics, Device, Import and Export. https://www.coolest-gadgets.com/semiconductor-industry-statistics

[4]. Intel corporation. (2023). The fiscal report of Intel Corporation. https://www.sec.gov/Archives/edgar/data/50863/000005086324000010/intc-20231230.htm

[5]. Božić, D., Buchberger, L., Bakotić, A., Andrešić, M., & Ančić, M. THE CASE STUDY OF INTEL CORPORATION (INTC). COMPANY ANALYSIS, 127.

[6]. Tradingview. (2024). AMD's revenue by business segment. https://cn.tradingview.com/#main-market-summary

[7]. NVIDIA Corporation. (2024). NVIDIA Announces Financial Results for Fourth Quarter and Fiscal 2024. https://investor.nvidia.com/news/press-release-details/2024/NVIDIA-Announces-Financial-Results-for-Fourth-Quarter-and-Fiscal-2024/

[8]. Statista. (2024). NVIDIA Revenue from 2017 to 2023 by region. https://www.statista.com/site/

[9]. Sweezey, M. (2014). Salesforce. Harvard Business Press.

[10]. Gladwell, M. (2024). Revenge of the tipping point:Overstories, Superspreaders, and the Rise of Social Engineering. Little, Brown and Company

[11]. Niero, B. NVIDIA's AI Revolution: A Comprehensive Strategic Analysis.