1. Introduction

Game theory is an important part of modern economics. It uses logical framework and mathematical models to analyze the psychology of game participants, making it possible to predict individual decisions. Game theory is mainly reflected in the oligopoly market in economic theory: usually several companies with market power and interdependent (interdependent) supply goods. The characteristics of this market make it a type of repeated game. In the special oligopoly of duopoly, there are two main model explanations: the Cournot model with output as the variable and the Bertrand model with price as the variable. This paper focuses on clarifying the pricing strategy derived from the Bertrand model in the case of approximate duopoly, hoping to prove that it has a high accuracy in fitting actual business competition cases. This study helps to determine the guiding significance of the classical model in modern business decision-making, and also provides pricing ideas for companies in a duopoly environment. This paper also uses literature analysis, case study and comparative analysis to conduct research and investigation on Didi and Asda. The full article first derives the optimal price solution based on the Portland model, then discusses Didi's successful practice of the theory, and then analyzes the counterexample of the business failure of the British supermarket Asda. Finally, by comparing the differences between the two cases, it points out that decision makers should pay attention to the market environment when applying theoretical strategies in practice and identify their own core advantages.

2. Concept and illustration of Bertrand model

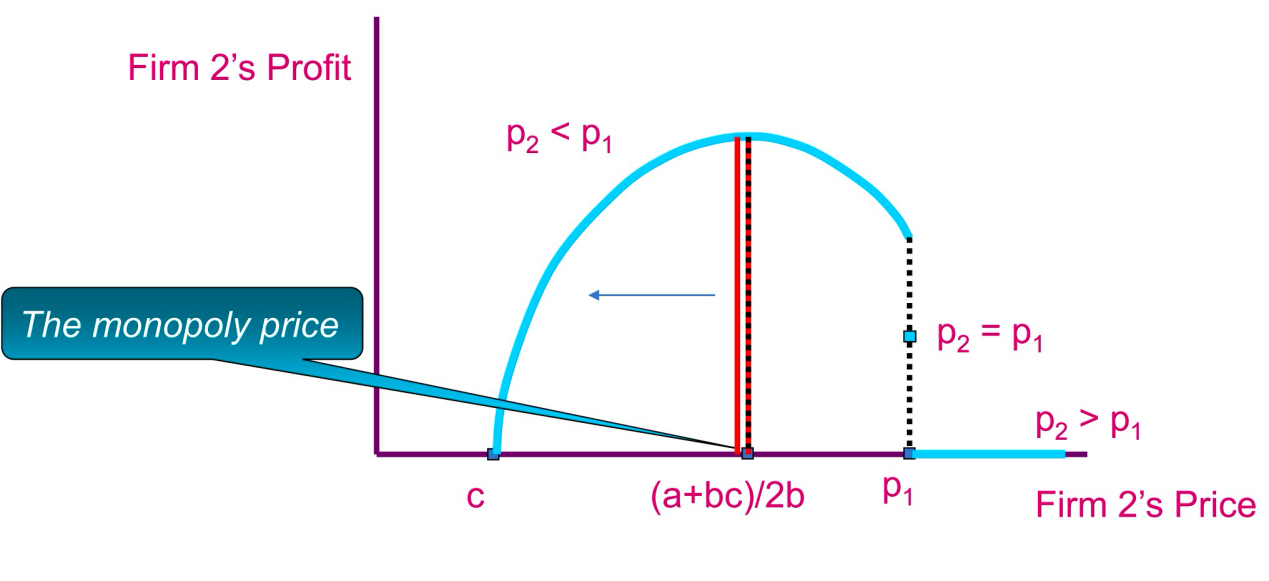

First, let's briefly introduce the Bertrand model. The Bertrand model is a typical decision-making model for pricing strategies in game theory. Its core lies in reacting and balancing according to the opponent's pricing strategy. It simulates the mutual game between two oligopolistic enterprises for market share in mathematical language. First, assume that when an enterprise sets its price, it believes that the prices of other enterprises will not change due to its decision. The prices of A and B are P1 and P2 respectively, and the marginal costs are equal to C. Assuming that the two products have strong substitutability, the two products share the corresponding market equally. Therefore, when one party reduces the price, the best way for the other party to deal with it is to reduce the price accordingly, which eventually leads to the prices of the two companies tending to be equal. In addition, for an individual company, the profit is the largest when the price is equal to the marginal cost, so the market pricing will eventually reach p1=p2=mc. Therefore, in modern commercial competition, the corresponding substitute oligopoly market, the consequence of this pricing strategy is the corresponding zero economic profit. In addition, for customers, the products on the market and the corresponding pricing are exactly the same. At the same time, the pricing is at the lowest price that the manufacturer can offer, so it is beneficial society.

Figure 1: Diagram of the Nash equilibrium point of the Bertrand model

3. A Successful Use: The Battle Between Didi and Uber in China

3.1. The Background of the Price War

Here we give an example of the successful application of the Bertrand model, which is about the war between Didi Dache and Uber in the Chinese market. In October 2013, since the taxi platform was still a blue ocean market in China, there were only two major platforms competing. One was Kuaidi and the other was Didi. Didi Dache's market share at the time accounted for 68.1% [1]. In 2014, Uber entered the Chinese market, threatening Didi Dache's market share in China. He gained some market share with better service, privacy protection, and a more complete booking system.

3.2. Didi’s Reaction and Its Final Success

In this case, Didi decided to cut prices to prevent its market share from being stolen. So Didi decided to charge $0.2 less per kilometer than Uber. Not only that, Didi also gave drivers a higher commission fee, which was 21.88% + 0.5 yuan per order [2]. Compared with Uber's 20%, this measure attracted many drivers to Didi Dache's platform. At such a price, Didi continued to maintain its price advantage by increasing the demand for its platform and increasing the number of drivers. As a result, in 2015, Uber's market share was only 11.5% while Didi Chuxing's reached 80.2% [3]. With such a huge disparity in market share, Uber was eventually completely swallowed up by Didi Chuxing in 2016 and left the Chinese market. Didi's price advantage eventually caused Uber to lose all its market share. This happens to fit the Bertrand model, where the party with the lower equivalent price gets all the market share.

4. Asda’s Failure in Reducing Price

4.1. The Strategy to Resist Competition

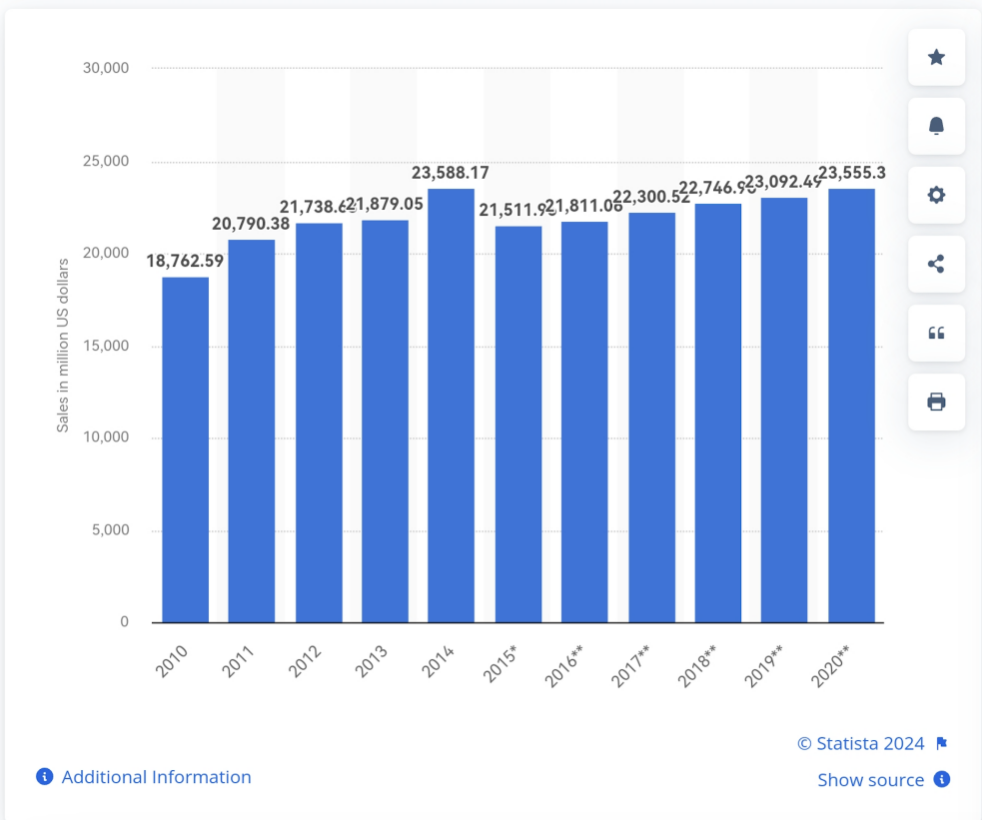

In 2014, the British supermarket Asda ignited a price war in the FMCG (fast-moving consumer goods) market. Facing increasing competition from other grocery chains like Tesco, Sainsbury’s, and Morrisons, as well as discounters, Asda launched a bold campaign, promising to be 10% cheaper than its competitors [4]. The goal was to attract cost-conscious consumers and regain market share. Under the pressure given by their competitors, the rest of the major players in the store shop industry has been on a fast lane of competition in the price declining, at the first few month of 2014 , the sales of the Asda actually increased with the attractive price and discount. As the diagram shows, the sales revenue of the company made a massive growth which form 21879 million toward 23588 million.

Figure 2: The change in total sales of Asda from 2010 to 2020 (in USD) [5].

4.2. An Unexpected Consequence That Contradicts the Theory

However, after a short run prosperity according to the Bertrand theory, its competitors soon made a change in their own pricing strategy which made a greater sacrifice on their revenue and price, which took the consumers that Asda grab through price war, as a result the sales of Asda experienced a sharp fall of 2077 million. But soon it realized that the fact that the price war is not the best strategy for the company. So, they start to focus on the services offered and developing other addition earning method instead of the changing in price. "Printing 5-pound notes (vouchers) is a short-term strategy," Asda CEO Andy Clarke told reporters. "We're in this strategically for the long haul and that means taking a long-term view." Asda stopped issuing money off vouchers over a year ago and was the first of Britain's leading grocers to cut prices to try to stem the flow of shoppers to the discounters. So according to the Bertrand model, of course, responding to the change in the competitor's price and a price could be efficient, but at the same time, it might be less efficient.

5. Comparison: Suggestions on Implementing Pricing Strategy

5.1. Possible Causes to the Differences in The Two Cases

Didi’s success and Asda’s failure form an interesting contrast: Why did a similar price reduction strategy allow Didi to defeat Uber, but Asda to continue to lose market share? The first factor to be considered is the difference in market structure. As mentioned above, when Didi and Uber started the war in the emerging Chinese market, Didi already had a market share of about 59.4%. At this time, the online car-hailing market was close to the duopoly market in classical theory, which was more in line with the competition scenario described by the Portland model. In contrast, the British retail market where Asda is located faces more complex competitive pressure: Tesco, Sainsbury’s and Morrisons all have considerable customer groups, and Asda itself only had 17.1% of the market when it launched a price war [6]. It can be seen that the supermarket industry, unlike the online car-hailing market, is a more ordinary oligopoly market. It has a lower market concentration level (more dispersed market power) and more intensive players, which violates the duopoly characteristics focused on by the Portland model. Therefore, it is not appropriate to regard this market as a two-player game and fit it into the Portland model analysis. Another explanation is the influence of government intervention and consumer psychology. In the case of Didi, as a representative of local enterprises, it naturally received a lot of support from the Chinese government in its competition with the foreign power Uber. Such preferential treatment is mainly reflected in two aspects: legal implementation and financial guarantee. For example, in 2016, the Ministry of Transport of China issued the "Interim Measures for the Administration of Online Taxi Booking Services", which strictly regulates the operation mode of the online taxi industry, the qualifications of car owners, vehicle standards and platform responsibilities. From the actual effect, Didi, which is rooted in China, adapted quickly, while Uber, headquartered in the United States, faced more administrative and compliance challenges in the process of conducting business in China [7]. Not to mention that the state-owned China Investment Corporation (CIC) and the state-owned China Life Insurance Company have played an important role in Didi's financing. State-owned financial support helps Didi maintain sufficient capital reserves in the face of Uber and remain competitive in price wars and technology research and development [8]. Compared with Didi, Asda is in a more traditional industry, and its main competitors are all local brands. It does not have the favorable factors of being supported by policies and can only build competitive advantages by reducing prices. Finally, consumer psychology is also a potential reason for the difference: most Chinese consumers live in a "patriotic" public opinion orientation, and they tend to support domestic companies under the guidance of the media [9]. British consumers do not have a prominent tendency to protect their own country.

5.2. Reflection on the Application of Bertrand Model

The very different endings of Didi and Asda prove the applicability and limitations of the Bertrand model in the real business world. On the one hand, the price reduction strategy predicted by the model accurately appears in a market close to a duopoly. On the other hand, it cannot fully match the most common monopolistic competition or general oligopoly market in modern business. Based on this, the author gives three suggestions to corporate decision makers who plan to expand market share by reducing prices: 1. Position the market structure of their own company and determine whether it belongs to the duopoly type (critical to whether it can match the Bertrand model) 2. Strive for potential government policy or financial support to gain additional advantages 3. Accurately grasp the psychology of the target consumer group and adopt media advertising and other means to win customer support. For companies involved in price wars, only by taking comprehensive measures can they maximize their chances of winning.

6. Conclusion

In summary, the Bertrand model can accurately describe the optimal pricing strategy in a duopoly situation (P=MC). In modern times, this pricing strategy is still the best choice for companies in a duopoly market. However, it also exposes limitations in the wider modern business war. For example, the different market feedback of this strategy applied to Didi, a Chinese company, and Asda, a British company, are due to a variety of factors, including the complexity of the market structure, the government's macro-intervention, and the differences in consumer psychology in different regions. Therefore, entrepreneurs should not be bound by theoretical frameworks when making decisions but should make flexible choices based on the actual situation of the company and the external factors of the market. Certainly, there will be some limitations exist which in this model it is assumed that the consumers are rational which they don’t usually do so, their decisions will be affected by the personalities of consumers so their decisions will changes based in some non-price sectors. The competition and games on this can only be dependent on the variety on the products. Also, some other overall economic conditions can be kept in the same level and controlled, factors like the level of income and the variety of consumers preference changes time to time, the investigation is on the game theory and game competition under some certain situations, and in the next level, and future investigation, more variables should be considered, for instant, the government regulations and some policies preferences also have the impact on the companies’ strategy. And the further discovery should be on more complicated situations with more variables involved in.

Authors Contribution

All the authors contributed equally, and their names were listed in the alphabetical order.

References

[1]. Fu, Y. (2019, February 25). The Mutual Impacts Between Rules and Ride-hailing: Rules and the Giant DiDi. EqualOcean.

[2]. Jiang, K. (2016, August 4). Uber and Didi Chuxing Merger Threatens Traditional Taxis. SPEEDA.

[3]. Chen, G. (2016, October 1). Uber vs. Didi: The Race for China’s Ride-hailing Market ^ IN1306. HBR Store.

[4]. Hegarty, R. (2021, April 29). Asda pricing strategy paying off as it posts third consecutive G33 win. The Grocer.

[5]. Sales Forecast for Asda United Kingdom 2010-2020. (2024). Statista. https://www.statista.com/statistics/618252/sales-forecast-for-asda-united-kingdom-uk/

[6]. Grocery Market Share - Kantar. (n.d.). Www.kantarworldpanel.com. Retrieved September 28, 2024, from https://www.kantarworldpanel.com/en/grocery-market-share/great-britain/snapshot/05.01. 14/

[7]. Wang, Lin and Zhang, Qian. (2017). Government Regulation and Platform Competition: The battle between Didi and Uber China. Chinese Administration, (3), 58-63.

[8]. Bloomberg News. (2016). Didi raises $7 billion to battle Uber in China. Bloomberg.

[9]. Euromonitor International. (2021). China: Domestic brands winning over international brands. Euromonitor.

Cite this article

Cong,C.;Si,J.;Wu,C. (2025). Research on the Application and Variation of Bertrand Model in Modern Business Pricing Strategy. Advances in Economics, Management and Political Sciences,148,82-87.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICFTBA 2024 Workshop: Human Capital Management in a Post-Covid World: Emerging Trends and Workplace Strategies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Fu, Y. (2019, February 25). The Mutual Impacts Between Rules and Ride-hailing: Rules and the Giant DiDi. EqualOcean.

[2]. Jiang, K. (2016, August 4). Uber and Didi Chuxing Merger Threatens Traditional Taxis. SPEEDA.

[3]. Chen, G. (2016, October 1). Uber vs. Didi: The Race for China’s Ride-hailing Market ^ IN1306. HBR Store.

[4]. Hegarty, R. (2021, April 29). Asda pricing strategy paying off as it posts third consecutive G33 win. The Grocer.

[5]. Sales Forecast for Asda United Kingdom 2010-2020. (2024). Statista. https://www.statista.com/statistics/618252/sales-forecast-for-asda-united-kingdom-uk/

[6]. Grocery Market Share - Kantar. (n.d.). Www.kantarworldpanel.com. Retrieved September 28, 2024, from https://www.kantarworldpanel.com/en/grocery-market-share/great-britain/snapshot/05.01. 14/

[7]. Wang, Lin and Zhang, Qian. (2017). Government Regulation and Platform Competition: The battle between Didi and Uber China. Chinese Administration, (3), 58-63.

[8]. Bloomberg News. (2016). Didi raises $7 billion to battle Uber in China. Bloomberg.

[9]. Euromonitor International. (2021). China: Domestic brands winning over international brands. Euromonitor.