1. Introduction

Understanding human decision-making is crucial in behavioral finance, a field that investigates the impact of psychological factors on economic choices, and one of the key concepts is loss aversion, which describes the tendency for people to prefer avoiding losses over acquiring equivalent gains. Introduced by Kahneman and Tversky in the context of prospect theory, loss aversion suggests that the negative emotional impact of losses is more pronounced than the positive impact of gains of the same magnitude. This principle challenges the traditional economic assumption of rational decision-making, which holds that losses and gains have equal impacts, and it has significant implications for various aspects of decision-making, particularly in marketing and financial markets. In marketing, loss aversion affects consumer behavior, driving individuals to make purchases to avoid missing out on anticipated discounts or offers. Marketers often exploit this bias through promotional strategies to boost sales. In financial markets, loss aversion manifests in the disposition effect, where investors tend to sell assets that have increased in value too early while holding onto losing investments in anticipation of a recovery, leading to suboptimal investment decisions and increased financial risk. Therefore, this paper explores the impact of loss aversion on decision-making in these two areas, offering both empirical and theoretical insights. Moreover, the pervasive impact of loss aversion, as well as strategies to mitigate its negative effects, are highlighted through an analysis of marketing practices and financial market behavior.

2. Loss Aversion in Marketing

2.1. Application of Loss Aversion in Marketing Strategies

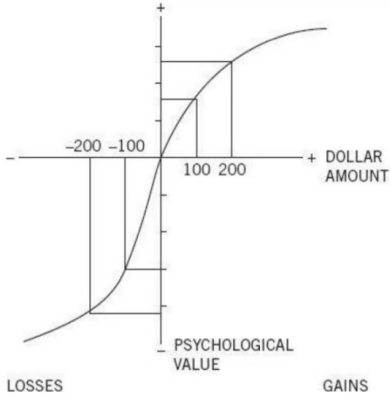

Loss aversion, a pivotal concept in behavioral economics, significantly influences consumer behavior by highlighting the asymmetric impact of losses compared to gains [1]. This principle posits that individuals experience the disutility of losses more intensely than the utility of equivalent gains. Consequently, marketers leverage this psychological bias to shape consumer decisions, often creating a sense of urgency and potential regret to drive action. In marketing, loss aversion is strategically applied through various promotional tactics that emphasize the risk of missing out rather than the potential benefits of a deal. Promotional strategies like “30% off,” “last one available,” and “buy one get one free” are designed to exploit this cognitive bias by framing the offer in terms of avoiding a loss. Specifically, presenting sales promotions in loss terms (“buy or lose”) tends to encourage higher purchase rates than framing the same promotions in “save” terms (“buy or save”) [2]. This sense of urgency and fear of missing out compels consumers to act swiftly to avoid perceived losses, thereby increasing the likelihood of purchase. The psychological values of losses and gains are shown in Figure 1 [3], indicating that the pain associated with a loss is much greater than the pleasure derived from an equivalent gain. The steeper loss curve in the graph compared to the gain suggests that the loss of a given amount of money elicits a stronger negative emotional response than the gain of the same amount of money elicits a positive emotional response. This visual representation emphasizes the principle of loss aversion, which states that the emotional impact of a loss outweighs the pleasure of an equivalent gain [4]. By effectively applying these principles, marketers can drive consumer behavior and maximize sales.

Figure 1: Thinking, Fast and Slow[3]

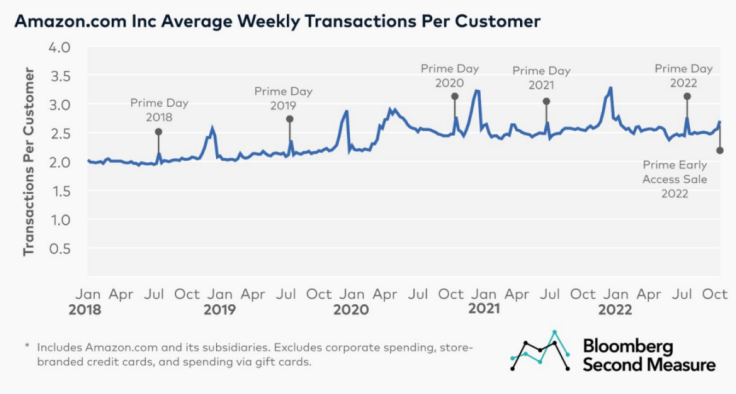

In order to prove this point, the change in consumer behavior on Amazon during discount periods will be examined. Figure 2 illustrates the mean weekly transactions per customer on Amazon.com Inc. from 2018 to 2022 [5]. Each July, Amazon hosts “Prime Day,” during which consumers can purchase items at significantly discounted prices. The graph shows a distinct peak on each Prime Day, indicating a substantial increase in purchases. This phenomenon can explain loss aversion; consumers perceive paying full price after Prime Day as a loss, prompting them to buy more during the sale to avoid this perceived loss. In order to avoid the loss, they purchase more on the prime day to save more money. Furthermore, loss aversion is a good strategy for sellers. By knowing that people will buy more if there is a discount, advertisers craft promotions based on the fear that shoppers will lose out if they fail to act quickly, thereby enabling sellers to increase profits through strategic discounting.

Figure 2: Average Weekly Transactions Per Customer of Amazon

2.2. Negative Consequences of Overusing Loss Aversion

Though loss aversion can be an effective strategy for influencing consumer purchasing decisions, its excessive or improper use can result in significant adverse outcomes. For example, Secoo Holding Limited, which is positioned as the foremost online platform for premium products and services in Asia, serves to illustrate these risks. Despite its initial success in utilizing promotional discounts to attract customers, Secoo faced serious repercussions as a result of its over-reliance on this strategy, and received a delisting notice from the NASDAQ Stock Market on February 8, 2024, partly due to its financial instability and failure to file required reports. The company used aggressive discounting strategies, such as offering substantial coupons (e.g., saving 100 yuan on purchases over 1,000 yuan), which played a crucial role in the situation. However, these promotions proved unsustainable given the company’s financial situation. Moreover, it struggled to fulfill orders and handle refunds, leading to a significant decline in customer trust and satisfaction. Financial pressures, coupled with operational challenges, eventually led the company into financial distress, with its profitability plummeting to -9,443,023.11%. This figure reflects the extreme losses incurred and highlights the severe consequences of overusing loss aversion strategies. While the discounts were initially successful in boosting sales, the financial and operational burdens they placed on the company proved to be detrimental, further exacerbating the company’s financial woes. The potential pitfalls of using loss aversion strategies without adequate consideration of long-term impacts are emphasized. In short, while loss aversion can be effective in increasing short-term sales and driving consumer behavior, overuse can result in significant financial and reputational losses. Enterprises must strike a balance between leveraging such tactics and maintaining a sustainable business model to ensure long-term viability and avoid unfavorable outcomes.

3. Loss Aversion in Financial Markets

3.1. Loss Aversion and Disposition Effect in Financial Markets

Loss aversion also applies to the stock market and affects individual investment decisions in various ways. It is closely related to the disposition effect, a concept introduced by Shefrin and Statman. The disposition effect describes the tendency of investors to hold on to losing stocks for too long and to sell winning stocks prematurely [6]. This behavior leads to realizing gains more frequently compared to the number of available gains and realizing fewer losses compared to the number of available losses. To empirically investigate this phenomenon, Terrance Odean analyzed trading records from 1987 to 1993 for 10,000 accounts. He calculated two key metrics: the Proportion of Gains Realized (PGR) and the Proportion of Losses Realized (PLR). The former represents the ratio of realized gains to the sum of realized gains and unrealized gains, while the latter denotes the ratio of realized losses to the sum of realized losses and unrealized losses [7].

\( \frac{Realized Gains}{Realized Gains + Paper Gains}=Proportion of Gains Realized \) (1)

\( \frac{Realized Losses}{Realized Losses + Paper Losses}=Proportion of Losses Realized \) (2)

Table 1: Are Investors Reluctant to Realize Their Losses? TERRANCE ODEAN*

Entire Year | December | Jan.-Nov. | |

PLR | 0.098 | 0.128 | 0.094 |

PGR | 0.148 | 0.108 | 0.152 |

Difference in proportions | -0.050 | 0.020 | -0.058 |

t-statistic | -35 | 4.3 | -38 |

Table 1 illustrates the aggregate PGR and PLR [7]. It reveals that, throughout the year, investors are more likely to sell stocks that have appreciated in value compared to those that have depreciated. Specifically, the PGR to PLR ratio exceeds 1.5, indicating that stocks with gains are over 50% more likely to be sold than those with losses. This finding aligns with Weber and Camerer’s (1995) experimental studies, which similarly found that stocks with gains are approximately 50% more likely to be sold than those with losses.

Table 2: Are Investors Reluctant to Realize Their Losses? TERRANCE ODEAN*

Jan.-Nov. | December | Entire Year | |

Return on realized gains | 0.275 | 0.316 | 0.277 |

Return on paper gains | 0.463 | 0.500 | 0.466 |

Return on realized losses | -0.208 | -0.366 | -0.228 |

Return on paper losses | -0.391 | -o.417 | -0.393 |

Further analysis, presented in Table 2, compares the mean returns on stocks sold for gains versus losses and those not sold [7]. The data shows that realized losses in December are significantly larger compared to other months, while the returns on paper gains in December are notably higher. This suggests that retaining winning stocks rather than selling them could potentially yield greater future returns. The phenomenon of loss aversion, characterized by a strong aversion to realizing losses, often leads investors to hold onto losing investments in the hope of recovery, while prematurely selling winning stocks. This behavior frequently results in suboptimal investment decisions, as selling losing stocks could be a more advantageous strategy than holding onto them.

3.2. Impact during Financial Crises

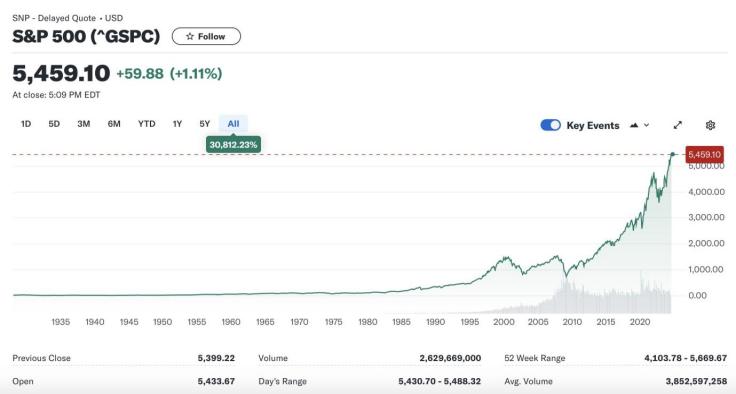

To further understand how loss aversion affects investor decision-making, an examination of the 2008 financial crisis provides insight. This crisis was precipitated by a housing bubble that began inflating around 1997 and reached its peak around 2006. Several factors contributed to the crisis: loose lending standards allowed banks to issue mortgages with minimal verification; speculative buying drove up housing prices; subprime mortgages were increasingly extended to borrowers with poor credit histories; and securitization bundled mortgages into mortgage-backed securities (MBS), which obscured the quality of underlying loans. As housing prices began to decline sharply in 2007, the market collapse ensued. Homeowners defaulted on their mortgages, leading to a surge in foreclosures. Financial institutions holding significant amounts of MBS faced enormous losses, resulting in bank failures and bailouts. This collapse also triggered a severe credit crunch as banks became wary of lending. Figures 3 and 4 illustrate the market dynamics during this period [8]. Figure 3 shows the S&P 500 index, highlighting the sharp drop in stock prices around 2008 and the significant increase just before the downturn. Figure 4 presents trading volumes in 2008, with increased selling activity evident prior to the market drop in October. This panic selling, driven by fear of further losses, led many investors to hastily liquidate their holdings. The study demonstrates that loss aversion can lead to negative outcomes, as investors' fear of loss often results in poor decision-making and missed opportunities for future gains.

Figure 3: S&P 500 index

Figure 4: Trading volumes during 2008

4. Response Strategies to Mitigate Loss Aversion

4.1. Cognitive Reframing of Outcomes

Modifying the cognitive processes by which individuals evaluate gains and losses can effectively circumvent loss aversion strategies. Cognitive reframing involves changing the way people perceive ideas, events, or situations [9]. By viewing setbacks as opportunities for growth or necessary steps toward long-term goals, individuals can shift their focus from immediate negative outcomes to potential long-term benefits, which can help reduce the emotional impact of losses and encourages a more balanced evaluation of gains and losses. Strategies within cognitive reframing include positive reappraisal, where setbacks are seen as opportunities for improvement; mental simulation of successful outcomes to divert attention from potential losses; and loss-gain comparisons, where potential gains are highlighted to alter the perception of risk.

4.2. Emphasizing Long-Term Investment Strategies

The impact of loss aversion can be mitigated by adopting a long-term perspective. By focusing on the overall trajectory of investments rather than short-term fluctuations, investors can better align their decisions with long-term financial goals. Long-term strategies help to smooth out short-term volatility and reduce the immediate emotional responses associated with losses. These strategies include diversification to spread risk and minimize the impact of short-term volatility; goal setting to provide a clear framework for evaluating performance beyond immediate losses; and regular reviews to reinforce the benefits of a sustained investment approach.

4.3. Reducing Emotional Bias in Decision-Making

The hypothesis that emotions can affect higher cognition and overt behavior has received extensive attention and experimental confirmation in recent years. This is particularly evident in decision-making, where choices based on emotions and intuition have been fully recognized [10]. Emotional biases, especially fear, can cause individuals to overestimate risks and avoid favorable opportunities, thus severely distorting decision-making. Fear can exacerbate a state of risk aversion, prompting individuals to make overly cautious decisions or to avoid necessary risks. This emotional response can overshadow objective evaluations and skew judgment, making it difficult to assess situations rationally. To mitigate the influence of emotional biases, several techniques are recommended. The implementation of positive thinking exercises has been shown to help individuals regulate their emotional responses by helping them shift from fearful thoughts to more constructive perspectives. This approach offers a more balanced view of potential outcomes and reduces the emotional impact of fear. Moreover, structured decision-making processes utilize objective criteria and systematic frameworks to guide choices, ensuring that decisions are based on rational assessments rather than emotional impulses. Also, educating individuals about cognitive biases can increase self-awareness, enabling them to recognize when their decisions are being influenced by emotional factors.

5. Conclusion

Loss aversion plays a crucial role in shaping human decision-making processes, with significant implications for both marketing strategies and financial investment behaviors. In marketing, loss aversion drives consumer decisions, often leading to increased purchases during sales due to the fear of missing out on discounts. However, over-reliance on discount strategies can lead to significant negative outcomes for sellers, such as financial instability and damaged reputations. In the financial markets, loss aversion manifests through the disposition effect, where investors are inclined to sell profitable investments prematurely and hold onto losing ones in the hope of a rebound. This behavior can lead to suboptimal financial decisions and missed opportunities for gains. Understanding and mitigating the effects of loss aversion is essential for improving decision-making. By reframing outcomes to focus on potential gains, considering long-term benefits, and managing emotional responses, individuals can make more balanced and informed choices. Addressing loss aversion effectively can enhance decision-making quality, ultimately leading to better outcomes in both consumer behavior and investment strategies.

References

[1]. Bleichrodt, H., Abdellaoui, M. and Paraschiv, C. (2007) Loss Aversion under Prospect Theory: A Parameter-Free Measurement. Management Science, 53(10): 1659-1674.

[2]. Gamliel, E. and Herstein, R. (2011). To save or to lose: does framing price promotion affect consumers’ purchase intentions? Journal of Consumer Marketing, 28(2): 152-158

[3]. Kahneman, D. and Tversky, A. (1992). Advances in prospect theory: Cumulative representation of uncertainty. Journal of Risk and Uncertainty. 5(4): 297-323

[4]. Kahneman, D. and Tversky, A. (1979) Prospect Theory: An Analysis of Decision under Risk. Econometrica. 47(4): 263-291.

[5]. Bloomberg Second Measure. (2022) Amazon.com Inc Average Weekly Transactions Per Customer. https://secondmeasure.com/datapoints/nasdaq-amzn-amazon-prime-day-2022-results/

[6]. Hersh, S. and Statman, M. (1985) The disposition to sell winners too early and ride losers too long: Theory and evidence, Journal of Finance 40: 777-790.

[7]. Odean, T. (1998) The Journal Of Finance: Are Investors Reluctant to Realize Their Losses? 1782-1789

[8]. Yahoo!Finance. (2024) eBay Inc. (EBAY). https://finance.yahoo.com/quote/EBAY/

[9]. Robson, J.P. and Troutman-Jordan, M.L. (2014) A Concept Analysis of Cognitive Reframing.

[10]. Stocco, A. and Fum, D. (2008) Implicit emotional biases in decision making: The case of the iowa gambling task. Brain and Cognition, 66(3): 253-259.

Cite this article

Peng,K. (2025). The Impact of Loss Aversion on Decision-Making in Marketing and Financial Markets. Advances in Economics, Management and Political Sciences,149,157-163.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Bleichrodt, H., Abdellaoui, M. and Paraschiv, C. (2007) Loss Aversion under Prospect Theory: A Parameter-Free Measurement. Management Science, 53(10): 1659-1674.

[2]. Gamliel, E. and Herstein, R. (2011). To save or to lose: does framing price promotion affect consumers’ purchase intentions? Journal of Consumer Marketing, 28(2): 152-158

[3]. Kahneman, D. and Tversky, A. (1992). Advances in prospect theory: Cumulative representation of uncertainty. Journal of Risk and Uncertainty. 5(4): 297-323

[4]. Kahneman, D. and Tversky, A. (1979) Prospect Theory: An Analysis of Decision under Risk. Econometrica. 47(4): 263-291.

[5]. Bloomberg Second Measure. (2022) Amazon.com Inc Average Weekly Transactions Per Customer. https://secondmeasure.com/datapoints/nasdaq-amzn-amazon-prime-day-2022-results/

[6]. Hersh, S. and Statman, M. (1985) The disposition to sell winners too early and ride losers too long: Theory and evidence, Journal of Finance 40: 777-790.

[7]. Odean, T. (1998) The Journal Of Finance: Are Investors Reluctant to Realize Their Losses? 1782-1789

[8]. Yahoo!Finance. (2024) eBay Inc. (EBAY). https://finance.yahoo.com/quote/EBAY/

[9]. Robson, J.P. and Troutman-Jordan, M.L. (2014) A Concept Analysis of Cognitive Reframing.

[10]. Stocco, A. and Fum, D. (2008) Implicit emotional biases in decision making: The case of the iowa gambling task. Brain and Cognition, 66(3): 253-259.