1.Introduction

Since the Spanish People's Party came to power in 1996, the country has undergone a remarkable economic transformation, characterized by the introduction of neoliberal market economic policies, accelerated privatization, and the relaxation of fiscal and tax restrictions on business. These measures have encouraged the growth of private enterprise, especially financial services, and, along with lower interest rates, steady economic growth.

In 1998, Spain enacted the Land System and Valuations Act 6/1998, which was intended to promote the privatization of the land market, a policy that was welcomed by regional governments but ultimately failed to achieve its intended goals. In 2002, the Aznar government further implemented labor reforms to reduce workers' rights in order to increase employment, which led to a surge in demand for labor, a large number of students dropping out of school to find jobs. In addition, Spain accepted a large number of immigrants. Together, these factors contributed to a housing boom, which was, however, followed by the formation and bursting of a housing bubble and the onset of the global financial crisis in 2008, which had a profound impact on the Spanish economy.

This paper aims to provide an in-depth analysis of the development of the real estate market in Spain between 1996 and 2008 and its impact on the economy, exploring the causes and effects of the real estate bubble. This paper also analyzes the connection between the real estate bubble and monetary policy, especially the impact of interest rate on housing prices and the impact of the real estate bubble burst on the Spanish financial system, job market, inflation rate, fiscal deficit and public debt through the income capitalization model. By studying the Spanish experience, this paper aims to provide empirical evidence for understanding the cyclical fluctuations of the real estate market and the transmission mechanism of the financial crisis, while providing lessons for other countries in real estate market regulation and macroeconomic policy making.

2.The Background of Spanish real Estate

2.1.Impact of Laws and Regulations

After the Spanish People's Party came to power in 1996, it implemented the neoliberal market economic policy, accelerated the privatization process, and relaxed the fiscal and tax restrictions on enterprises. Lower interest rates have been accompanied by steady economic growth and a boom in tourism, the construction of tourist hotels and a boom in the buying and renting of homes by foreigners in the west [1].

In 1998, Spanish Prime Minister Jose Manuel Aznar, influenced by neoliberalism, issued the New Land Law, which intended to privatize the land market and was welcomed by local governments [1]. In simple terms, if the government increases the size of urban land and make it profitable for businesses in the market, investment will increase and more houses will be owned. Besides, as the supply of houses increases, prices will fall and eventually young people will be able to buy their own homes. If successful, people's quality of life will be greatly improved. however, that was not the case.

In 2002, when the property sector was booming, Mr. Aznar introduced new Labour reforms. The idea is that reducing workers' rights will make it easier for companies to recruit workers and thus increase employment. Demand for labor soared and hundreds of thousands of students dropped out of school and went to work. At the same time, Spain received large numbers of immigrants. For a while, buying a house became fashionable. What was shocking was that the new land law did not produce the expected effect. When the demand for housing soared, the price of housing rose accordingly. The rising price of urban land and the expected price of real estate made the price of real estate even higher, and thousands of investors were attracted by the profit and invested in it. The result was that property prices took off within four years.

2.2.Actual House Price Trends and the Economic Environment

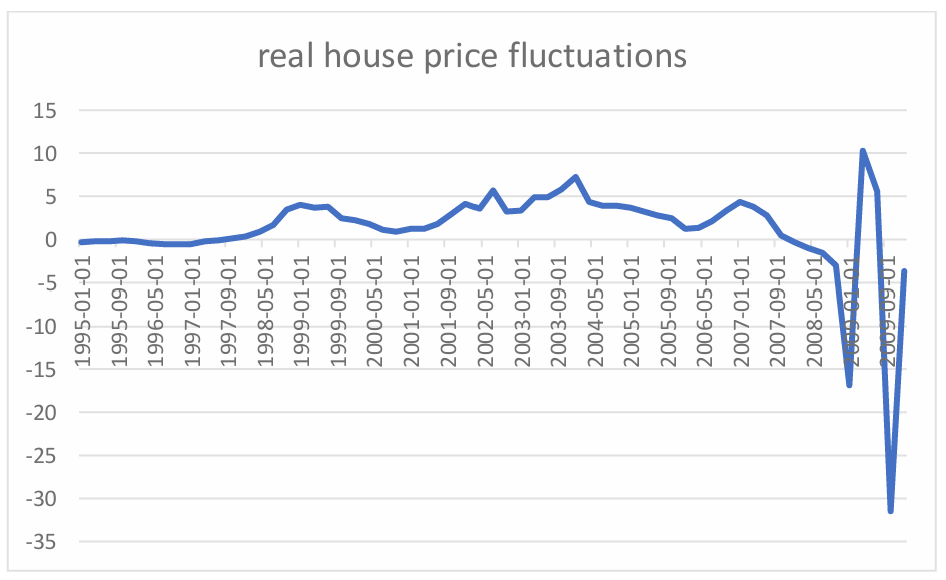

On the FRED instrument, this study obtained data on Real Residential Property Prices for Spain, but stripped out the effect of inflation on housing prices, By dividing the Real Residential Property Prices for Spain by the inflation rate, this study got a series of data shown in Figure 1. It can be seen that the house price was very stable until 1998, and then, although there were some twists and turns, the house price continued to rise until 2007.

Figure 1: The flow of real house price fluctuations

From 1995 to 2008, house prices in Spain increased by 190%. Especially since 2000, the housing price has increased rapidly, and from 1999 to 2005, the average annual increase was 15%. In 2007, Spanish housing prices were equivalent to seven times a worker's annual pre-tax salary. The stress index increased from 1.3% in 2000 to 33.4% in 2005, with household financial stress among the highest in the European Union [2].

3.Real Estate Bubble

3.1.Causes of the Real Estate Bubble

In Europe, since 2009, some European countries have fallen into a sovereign crisis, which is the deepening and continuation of the subprime mortgage crisis in the United States, mainly due to the debt beyond the acceptable range of the government. On October 20, 2009, the Greek government announced that its deficit ratio would exceed 12%, 3% higher than the limit stipulated by the European Union. Then, three rating agencies downgraded Greece, and the European debt crisis broke out in Greece. In the first few months of 2010, the European Central Bank and the International Monetary Fund promised to find a solution to the Greek crisis, but the euro area member states worried that their taxpayers would not be satisfied with the unconditional help to Greece, and at the same time, the euro area governing institutions were not functioning well, and the rescue program for Greece could not be carried out quickly, so the European debt crisis continued to worsen, and Spain was also involved in the European debt crisis [3].

The growth of migration leads to an increase in housing demand. In recent years, Spain has received the largest number of immigrants. Between 1998 and 2008, Spain's population increased by 18% and its labor force by 25%. Of these immigrants, 98% came from Eastern Europe or Latin America.

The government designed the real estate industry as a "pillar" industry for the country's economic takeoff, which found an opportunity for banks to pursue profits. Banks competed with each other to lower interest rates, make massive loans to real estate companies, and provide a large number of preferential mortgages to individual home buyers, which directly led to the real estate boom in Spain and drove the doubling of house prices [4]. After the emergence of the euro in 1999, the real interest rate in Spain fell sharply, the competition among banks became increasingly fierce, and loans became more convenient.

3.2.Connection between Real Estate Bubble and Monetary Policy

As a high-value fixed asset, real estate also has investment attributes, and its intrinsic value also depends on the discounted value of future earnings. Following the principle of bond pricing, this study divides real estate into two parts. One is the future rental income of the house, and the other is the future price of the transferred property. Similarly, the intrinsic value of the real estate\( {P_{0}} \)can be expressed as:

\( {P_{0}}=\sum _{i=1}^{n}\frac{{D_{i}}}{{(1+r)^{t}}}+\frac{{P_{n}}}{{(1+r)^{n}}} \)(1)

which\( {D_{i}} \)(I = 1, 2, 3...\( n \)) represents the rental income of the house in the\( i \)th year,\( {P_{n}} \)represents the transfer price of the house in the\( n \)th year,\( r \)represents the expected return rate of holding the property expressed by the market interest rate, and\( n \)represents the number of years of holding the property. From the model (1), it can be found that the real estate price\( {P_{0}} \)is positively correlated with the rental income\( {D_{i}} \); that is, the higher the rental income level is, the higher the real estate price is; otherwise the lower it is. It is also positively related to the price\( {P_{n}} \)of the final transfer. The real estate price level\( {P_{0}} \)is inversely proportional to the market interest rate\( r \); that is, the higher the market interest rate is, the lower the real estate price is [5].

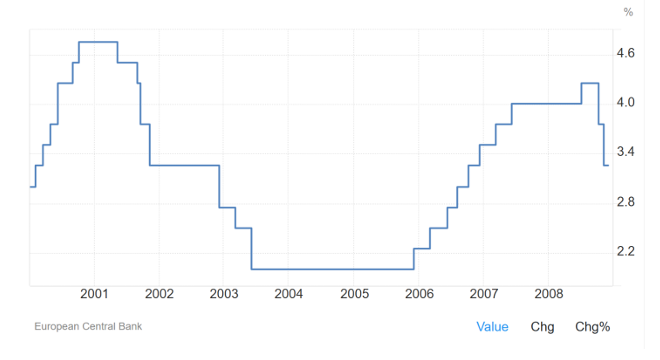

Figure 2: Interest rate movements in Spain [6]

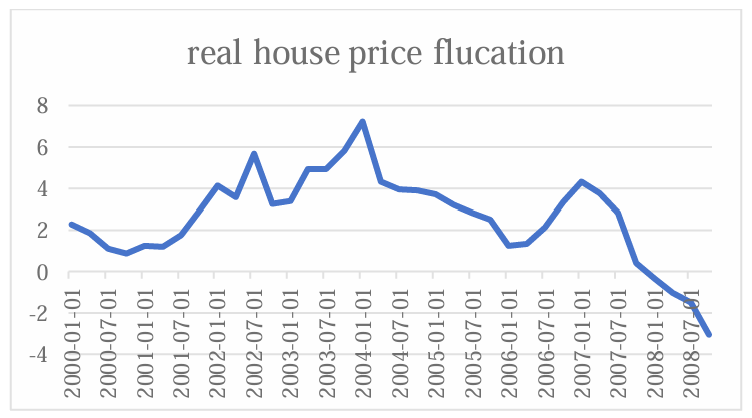

Figure 3: The flow of real house price fluctuations

In 2002, Spain became one of the first countries to join the euro, and the currency change once again stimulated the heating up of the real estate industry in Spain [7], the other moments show an inverse relationship between interest rates and real estate prices. Interest rates rose and house prices fell in 2000-02. From 2002 to 2007, profits first fell and then rose, while housing prices fluctuated but generally rose first and then fell. In 2008 house prices plunged and interest rates soared (Figure 2 and Figure 3). Therefore, it can be assumed that macroeconomic policies will have an impact on real estate bubbles.

4.The Impact of the Real Estate Bubble

4.1.The Surge of Non-performing Assets of Financial Institutions and the Plummeting of their Profitability

The outbreak of the financial crisis has magnified the negative impact of problems existing in the Spanish financial system, such as liquidity shortage and a large number of bad debts of banks. Non-performing loans at the country's banks and regional thrifts accounted for 5% of the total in 2010, up from just 3. 2% a year earlier [8]. According to the Bank of Spain, banks' uncollectable loans rose by 33% in 2011, to 148 billion euros [9]. By the end of 2012, the real estate related assets held by the Spanish banking industry amounted to 300.4 billion euros, accounting for 8.4% of the total assets, among which non-performing assets accounted for 28.2%, an increase of 27.6% compared with the end of 2007. The sharp rise in non-performing assets and non-performing loan ratios led to a decline in bank profitability. In 2012, Spanish banks' return on assets was -1.4% and return on capital was -21.5%, down 2.5% and 41% respectively from 2007.

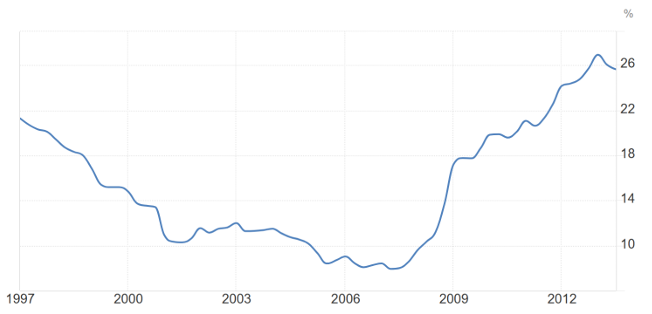

4.2.The Sharp Rise of the Unemployment Rate

As shown in Figure 4, the unemployment rate rose from 8. 3% in 2007 to 20.1% in 2010. In 2011, the youth unemployment rate rose to 45%, bringing the total number of unemployed nationwide to 4.91 million, the highest since such statistics began in 1976. Inflation, which stood at 5. 1% in mid-2008 and at 3. 4% in September 2012, has long been higher than the euro-area average.

Figure 4: Spain unemployment rates from 1997 to 2013 [10]

4.3.The Rise of Fiscal Deficits, Public Debt and Financing Costs

By the end of 2012, the balance of Spanish government debt reached 879.66 billion euros, and the ratio of government debt to GDP was 85.4%, far higher than the standard of 60% stipulated by the European Union (Figure 5).

Figure 5: General government gross debt for Spain [11]

4.4.The Intensity of Social Contradictions

As a result of the economic downturn and high unemployment, mortgage defaults are common across Spain, as are cases of insurance fraud, theft and other crimes. Since June 2010, there has been a steady flow of unemployed workers asking for work across Spain. Many government civil servants also went on strike to oppose the reduction. The policy of increasing taxes on wages. All these seriously affect the stability of Spanish society and harmony.

5.Conclusion

This study shows that the neoliberal market economic policies implemented by the Spanish People's Party after it came to power, including the acceleration of privatization and the relaxation of fiscal and tax restrictions, promoted the rapid development of private enterprise and financial services. These measures, along with lower interest rates, have led to steady economic growth and a boom in tourism.

However, the Law in 1998 and the Labor Reform Act of 2002 failed to achieve their intended goals and instead led to the formation of a real estate bubble. These policies increased competition in the labor market and attracted large numbers of immigrants, which in turn drove up demand for real estate. At the same time, the new land law failed to effectively reduce housing prices, but caused housing prices to continue to rise due to insufficient supply. Spanish house prices reached an all-time high in 2007. Behind this boom, however, are big financial risks. Lower lending thresholds for banks led to a surge in the indebtedness of households, businesses, and public organizations. This model of economic growth based on borrowing eventually led to the outbreak of the global financial crisis in 2008, which hit the Spanish economy hard. The bursting of the housing bubble had a profound impact on the Spanish economy. Financial institutions are faced with a surge in non-performing assets and declining profitability, a sharp rise in unemployment and inflation, a sharp increase in fiscal deficits and public debt, and an intensification of social contradictions. These consequences highlight the serious consequences of overreliance on the housing market and macroeconomic policy mistakes under neoliberal policies. Combining the Spanish data, this study confirms the conjecture that the interest rate element of monetary policy has a large impact on house prices. For Spain, it is the experience of the crisis that has led to huge improvements in legal, accounting and banking supervision.

References

[1]. Chunhua Wang. Spain's property “bubble" [J]. Premises in Shanghai, 2008, (05): 58-59.

[2]. Qingwang Mu, Jie Xv. International comparison of the causes of real estate bubble [J]. Gansu Finance, 2013, (11): 12-15.

[3]. Ting You. Introduction to the economic crisis in Spain [J]. Science and technology and enterprise, 2016, (8) : 73-74. The DOI: 10.13751 / j.carol carroll nki kjyqy. 2016.08.061.

[4]. Jun Han. The causes, consequences and warnings of the bursting of the Spanish real estate bubble [J]. China Real Estate Finance, 2011, (07): 37-41.

[5]. Xu, Y. Research on the influence of bank credit on real estate price [D] Anhui University, 2019.

[6]. European Central Bank. Spain intrest rate. https://tradingeconomics.com/spain/interest-rate

[7]. Baitang Wang. Lessons from the Spanish real estate "bubble" [J]. The Contemporary World, 2007, (03): 43-45.

[8]. Jun Li. The causes of the Spanish economic crisis and related implications [J]. The contemporary world and Socialism, 2013, (01): 80-84. DOI:10.16502/j.cnki.11-3404/d.2013.01.007.

[9]. Jian Zhang. Lessons from the Spanish Housing Bust. In International Data Information, no.6, 2010.

[10]. Trading Economics. Spain Unemployment Rate, 2024. https://tradingeconomics.com/spain/unemployment-rate

[11]. International Monetary Fund, General government gross debt for Spain [GGGDTAESA188N], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GGGDTAESA188N, October 28, 2024.

Cite this article

Zhang,B. (2025). The Link Between Monetary Policy and the Housing Bubble in Spain. Advances in Economics, Management and Political Sciences,152,35-41.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Chunhua Wang. Spain's property “bubble" [J]. Premises in Shanghai, 2008, (05): 58-59.

[2]. Qingwang Mu, Jie Xv. International comparison of the causes of real estate bubble [J]. Gansu Finance, 2013, (11): 12-15.

[3]. Ting You. Introduction to the economic crisis in Spain [J]. Science and technology and enterprise, 2016, (8) : 73-74. The DOI: 10.13751 / j.carol carroll nki kjyqy. 2016.08.061.

[4]. Jun Han. The causes, consequences and warnings of the bursting of the Spanish real estate bubble [J]. China Real Estate Finance, 2011, (07): 37-41.

[5]. Xu, Y. Research on the influence of bank credit on real estate price [D] Anhui University, 2019.

[6]. European Central Bank. Spain intrest rate. https://tradingeconomics.com/spain/interest-rate

[7]. Baitang Wang. Lessons from the Spanish real estate "bubble" [J]. The Contemporary World, 2007, (03): 43-45.

[8]. Jun Li. The causes of the Spanish economic crisis and related implications [J]. The contemporary world and Socialism, 2013, (01): 80-84. DOI:10.16502/j.cnki.11-3404/d.2013.01.007.

[9]. Jian Zhang. Lessons from the Spanish Housing Bust. In International Data Information, no.6, 2010.

[10]. Trading Economics. Spain Unemployment Rate, 2024. https://tradingeconomics.com/spain/unemployment-rate

[11]. International Monetary Fund, General government gross debt for Spain [GGGDTAESA188N], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GGGDTAESA188N, October 28, 2024.