1. Introduction

The development of information technology has profoundly changed the core technological foundation upon which capital markets operate. The globalization of investment and the integration of global exchanges have posed significant challenges to traditional capital market technological systems and operational models, also greatly influencing the characteristics and patterns of competition among stock exchanges. Simultaneously, technology and innovation enterprises have been proliferating like mushrooms after rain. As key drivers of economic growth and industrial upgrading, the development of these enterprises not only depends on technological innovation itself but is also closely tied to diversified support from the capital market. In recent years, the digital economy has emerged rapidly, becoming a new momentum and engine for stable economic growth, deeply transforming the modes of production, lifestyles, and governance structures of society and the economy. The continuous emergence of corporate governance innovation practices in the digital economy era has also pushed the governance model from being shareholder-centric to entrepreneur-centric [1].

To better support the development of technology and innovation enterprises in the digital economy era, the China Securities Regulatory Commission (CSRC) officially issued regulations for the full implementation of the stock issuance registration system in February 2023, marking the beginning of a transformation in China's capital market. Systems such as dual-class shares, partnership mechanisms, and the principle of concerted action have subsequently developed steadily, enhancing legal protections and improving the institutional ecosystem of the capital market.

Figure 1: Structure of the Main Body of This Paper.

The following sections of this paper will review and analyze the literature on the stock issuance registration system, dual-class share structures, and partnership systems from both macro-market and micro-enterprise perspectives. On this basis, the paper will look toward the future, evaluating innovative arrangements in various capital market systems and exploring which systems are more suitable for China’s capital market. By providing an in-depth analysis of existing literature and practices, the aim is to present readers with a clear research framework, offering theoretical and practical guidance for the positive interaction between technology innovation enterprises and the capital market. Additionally, the paper aims to provide new perspectives and ideas for global capital markets in serving technology and innovation enterprises.

2. Literature Review and International Comparison of Capital Market Systems for Technology and Innovation Enterprises

2.1. Stock Issuance Registration System

2.1.1. Literature Review

The stock issuance registration system requires issuers to legally disclose all relevant information accurately and completely to the securities regulatory authorities when applying to issue stocks. The responsibility of the securities regulatory body is to conduct a formal review of the comprehensiveness, accuracy, authenticity, and timeliness of the submitted documents without making substantive assessments of the issuer's qualifications or judgments on the value of the offering, leaving the market to determine the quality of the issuing company’s stock.

Existing literature indicates that the registration system can improve the efficiency of financing in the capital market and increase the proportion of direct financing. Zhang Fan and Wang Wenjun’s research shows that the number of newly listed companies in the U.S. stock market increased from 71 in 1980 to a peak of 677 in 1996, and since 2010, it has generally remained between 100 and 200 companies per year. From 2001 to 2022, the total scale of initial public offering (IPO) financing in the U.S. stock market reached 718.36 billion USD, which is 13.3 times the amount during 1980–1989. If the ratio of stock market value to GDP is used to measure the securitization rate, by the end of 2021, the U.S. securitization rate was 244.4%, five times that of 1980 (47.6%).

At the same time, the proportion of non-profitable companies going public has also been increasing. Between 1980 and 1989, 19% of the 2,047 IPO companies in the U.S. stock market were unprofitable at the time of their listing. From 2011 to 2022, this proportion rose to 72% among the 1,597 IPO companies. This phenomenon is catalyzed by a combination of factors, including changes in listing rules, industry structure, and the market environment. First, the U.S. stock market listing rules do not make profitability a sole requirement. Exchanges like the NYSE and NASDAQ provide multiple parallel listing standards covering revenue, market capitalization, and profits, establishing a multi-dimensional evaluation system that lays the institutional foundation for non-profitable companies to go public. Second, the rise of the new economy, particularly in sectors like the internet and biopharmaceuticals, has generated a large number of innovative companies. Both primary and secondary markets have shown significant enthusiasm for emerging industries, and most unprofitable IPO companies originate from these sectors [2].

Additionally, the stock issuance registration system creates a fairer market environment. Whether the registration system reform can reduce administrative intervention and foster a fair market environment has been a focal point of social concern in China. Examining this issue from the perspective of IPO preferences reveals that under the traditional approval system, there is a bias favoring IPO approvals for state-owned enterprises (SOEs) over privately-owned enterprises (POEs). The registration system reform significantly alters this bias, particularly benefiting private enterprises without political connections. Furthermore, under the approval system, SOEs tend to perform worse in the market post-listing compared to POEs, debunking the view that "SOEs are approved first due to superior performance." Y. Chen, D. Zheng, and L. Li found that private enterprises could increase the likelihood of IPO approval by leveraging social connections between intermediary agencies and the IPO review committee. Similarly, L. Huang and D. Xie, as well as J. Huang and T. Li, observed that underwriters could increase the likelihood of IPO approval by building indirect relationships between other IPO audit clients and IPO review committee members. Q. Liu, J. Tang, and G. Tian discovered that the involvement of politically connected venture capital firms increased the probability of IPO approval for private enterprises. These findings suggest that the IPO process under the approval system is subject to significant administrative intervention [3].

2.1.2. Comparison of the Registration Systems in the United States and China

The U.S. capital market has implemented the securities issuance registration system for 91 years, starting in 1933. The Securities Act of 1933 mandates that companies issuing securities publicly must submit a registration application to the U.S. Securities and Exchange Commission (SEC). Companies can only qualify for issuance once the registration becomes effective. The U.S. operates a "dual" registration system, requiring registration at both the federal and state levels. The federal registration primarily focuses on information disclosure, while the states conduct substantive reviews to control securities investment risks.

In China, the Science and Technology Innovation Board (STAR Market) was established in 2019, piloting the stock issuance registration system for the first time. The system was fully implemented in 2023. Under the previous approval system, companies' profits, assets, and revenues were rigid standards for stock issuance. In contrast, the registration system places more emphasis on a company’s core technology, patents, and R&D investment, highlighting technological innovation capabilities. The primary goal is to leverage the capital market's support for technological innovation and the competitiveness of the real economy, with the fundamental principle of enhancing the market-oriented nature of new stock issuances. Compared to the approval system, the implementation of the registration system has increased financing amounts for startup technology enterprises and accelerated their financing timelines. The registration system reform has intensified competition among venture capital firms, thereby promoting financing for startup technology enterprises. The impact of the reform is more significant for companies with stronger technological innovation capabilities or venture capital firms with more relevant investment experience [4].

Table 1: Comparison of Stock Issuance Registration Systems between the United States and China.

The United States | China | |

Time | Since 1933 | Since March 2016 |

Profitability Requirements | Divided into profit standards, market value + cash flow standards, asset and equity standards, and issuance indicators. | Primarily involves financial indicators, including market value, net profit, and revenue. Different boards have varied financial criteria for listing, tailored to accommodate companies at different growth stages and types. |

Issuance System | Aims to provide investors with sufficient information, with the SEC allowing investors to make value judgments without guaranteeing the accuracy of the information. | The China Securities Regulatory Commission (CSRC) focuses on a company’s sustained profitability, effectively endorsing listed companies. |

Information Disclosure | Sufficient budget, with extensive descriptions of risk factors, and broad participation from self-regulatory organizations and whistleblower systems. | Limited budget, with shorter descriptions of risk factors, weaker independence of self-regulatory organizations, and insufficient social oversight. |

Delisting Mechanism | Based on trading indicators such as closing price and trading volume, which are high-frequency and less prone to manipulation; delisting process is short and simple. | Relies on financial indicators, some of which can be manipulated by companies; delisting process can take up to 4 years, with transitional measures such as delisting risk warnings and suspension of listing in the A-share market. |

2.2. Dual-Class Share Structure

The prototype of the dual-class share structure originated from the International Silver Company. In 1898, the company divided its shares into two categories: preferred shares with voting rights and common shares without voting rights. Four years later, the common shares were granted half the voting rights of preferred shares, pioneering the dual-class share system [5].

2.2.1. Literature Review

Globally, there are numerous publicly traded companies with dual-class share structures in securities markets such as the United States and Canada. However, traditional civil law countries like Germany still reject the dual-class share structure. In China, the concept of corporations is an imported one, formed through legal transplantation. The content of China's Company Law is influenced by countries like Germany and Japan, following the regulations of these civil law systems in terms of corporate governance structures. The introduction of special voting rights on the STAR Market represents a breakthrough from the existing "one share, one vote" and "same share, same rights" structures [6].

In China, since July 2019, the STAR Market has allowed companies with dual-class shares to be listed, and in August 2020, the ChiNext Market also permitted listed companies to implement differentiated voting rights arrangements. This development is undoubtedly beneficial for many technology and innovation enterprises, leading some companies previously listed overseas to return to the A-shares and H-shares markets. Under the policy allowing companies with special voting rights to go public on the STAR Market, China's dual-class share companies have shown a clear industry concentration, predominantly in software and services, diversified financials, retail, and consumer services sectors.

The adoption of special voting rights allows technology and innovation enterprises to secure external financing while maintaining the founders’ control over the company. This not only does not harm company performance but, to some extent, enhances it, making it beneficial for external shareholders. The impact of dual-class share structures on company performance is particularly significant in the software and services, diversified financials, retail, and consumer services sectors, all showing positive effects on performance. Regarding the effect of each unit of voting rights on company performance, an increase in each voting unit boosts both Return on Assets (ROA) and Earnings Per Share (EPS). Specifically, every additional unit of voting rights leads to a 0.4% increase in ROA and an 11.1% increase in EPS [7].

However, there are traditional criticisms of dual-class share structures. The separation of cash flow rights and control rights may allow the actual controllers to entrench themselves, reducing the external takeover threats that play a vital role in corporate governance. This separation could potentially harm the interests of dispersed external shareholders. Therefore, the implementation of dual-class share structures requires a careful balance between benefits and costs. Unlike early designs of dual-class shares, in the past decade or so, companies issuing such shares often introduce strict sunset clauses as an “implicit constraint” on founders. These clauses ensure that control remains dependent on the state between the entrepreneurial team and major shareholders, striking a balance between encouraging the entrepreneurial team’s human capital investment, leading business model innovation, and protecting the rights of external investors. The "sunset clauses" refer to provisions in the Articles of Association that govern the transfer and conversion of Class A shares held by the founding team, which carry a weighted voting advantage, into Class B shares, as well as various restrictions on the entrepreneurial team's power. The introduction of sunset clauses indicates that giving the entrepreneurial team the authority to lead business model innovation does not mean that major shareholders completely relinquish control.

On one hand, the introduction of sunset clauses can leverage the advantages of the dual-class share structure by tilting the distribution of control in favor of the entrepreneurial team, ensuring that they maintain a leading role in business model innovation. On the other hand, the introduction of sunset clauses indicates that external shareholders have not completely relinquished control; rather, control can revert to a "one share, one vote" structure when the founding team’s influence "sunsets," preventing minority shareholders from encroaching on the interests of other external shareholders. Incorporating sunset clauses as an "implicit constraint" in the company’s articles of association helps enhance internal supervision by restraining high-voting-power shareholders, thereby balancing the competition of interests between high-voting-power and low-voting-power shareholders [8].

2.2.2. The Dual-Class Share Structures of Snap and Xiaomi

In a typical dual-class share system, shares are usually divided into Class A and Class B. Class A shares are highly liquid and generally offered to ordinary investors, while Class B shares are reserved for founders and other special shareholders. Founders, through the super voting rights attached to Class B shares, can achieve substantial control with a smaller equity stake, securing an absolute voting advantage without needing to pre-establish a management team or impose extensive rules and structures. Additionally, there are multiple-class share structures in the market. To compare the dual-class and multiple-class share structures, this paper takes Xiaomi and Snap as two well-known examples for detailed analysis.

Before its IPO, Xiaomi went through six rounds of financing, raising substantial funds to meet the company’s operational needs but also resulting in equity dilution. After these rounds of financing, Lei Jun's shareholding ratio dropped to 31.41%, and Lin Bin's shareholding ratio dropped to 13.33%. Combined, their shareholding ratio was significant but not enough to achieve control over the company. To address this issue, Xiaomi adopted a dual-class share structure. According to Xiaomi’s prospectus, after implementing the dual-class share structure, Lei Jun’s shareholding remained at 31.41%, but the voting rights associated with his Class A and Class B shares accounted for 55.7% of the company’s total voting rights. In addition, Lei Jun, as a trustee, could control an additional 2.2% of the voting rights, bringing his total to 57.9%. Meanwhile, Lin Bin’s actual shareholding ratio remained at 13.33%, but with the voting rights of his Class A shares, his total voting power reached 30%. Together, Lei Jun and Lin Bin held 85.7% of the company’s voting power, allowing them to maintain control over the company. As a result, Xiaomi’s decision-making power firmly remained in the hands of the founders, ensuring their rights while issuing additional shares for financing [9].

Table 2: Xiaomi's Dual-Class Share Structure.

Category | Voting Rights | Holder | Shareholding Ratio | Decision-Making Power Ratio | |||

Class A | 10 votes per share |

| 31.41% and 13.33% | 85.7% | |||

Class B | 1 vote per share | Investors and shareholders | 55.26% | 14.3% | |||

When Snap Inc. went public in the United States, it adopted an ABC three-class share structure, enabling its founders to secure significant financing without losing control of the company. In Snap's IPO, the publicly offered Class A shares carried no voting rights on shareholder matters; Class B shares carried one vote per share, and Class C shares carried ten votes per share. Under Snap's multi-class share structure, the holders of Class B and Class C shares act as a concerted group to exercise voting rights. Apart from voting rights, conversion rights, and transfer rights, all classes of common shares have the same rights.

According to the registration documents Snap submitted to the SEC, the company disclosed that apart from voting rights, conversion rights, and transfer rights, the rights of Class A, Class B, and Class C common shareholders are identical. The registration documents also reveal strict restrictions on shareholders holding Class C shares with super voting rights:

Conversion of Class C to Class B Shares: Class C shares can only be converted to Class B shares when the founder’s holdings of Class C shares fall below 30% of the quantity held at the end of the IPO.

Automatic Conversion upon Death: If a Class C shareholder passes away, Class C shares will automatically convert to Class B shares only nine months after the shareholder's death.

Conversion Restrictions: Class C shares can be converted into Class B or Class A shares, while Class B shares can only be converted into Class A shares. Shares with lower voting rights (Class A) cannot be converted into shares with higher voting rights (Class B or C).

From the perspective of shareholder identity, Snap's two founders, Evan Spiegel and Robert Murphy, equally split all the Class C shares. Along with each holding an additional 2% of Class B shares, each founder controls 44.3% of the voting power. This structure is designed to ensure that Snap's decision-making power remains in the hands of the founders and is not diluted by external investors. Compared to Facebook’s dual-class share structure, Snap’s triple-class structure has similarities: Snap’s Class B and Class C shares are analogous to Facebook’s Class A and Class B shares, respectively. In Facebook’s 2012 IPO in the U.S., founder Mark Zuckerberg and other early investors held Class B shares, each carrying 10 votes per share. Zuckerberg owned 28% of the shares but controlled 58% of the voting power, while the Class A shares offered to the public had one vote per share [10].

Table 3: Snap's Multi-Class Share Structure.

Category | Voting Rights | Holder | Shareholding Ratio | Decision-Making Power Ratio |

Class A | 0 votes per share | Directors, Executives | 58.7% | |

Class B | 1 vote per share | Directors, Executives | 30.8% | 11.4% |

Class C | 10 votes per share | Even Spiegel Robert Murphy | 50% 50% | 44.3% 44.3% |

2.3. Partnership System

2.3.1. Control Arrangement under the Partnership System

The partnership system is essentially an innovative form of the dual-class share structure. While it belongs to the same category of control arrangements, it differs in specific aspects. The "partnership" in the partnership system does not refer to a legal partnership; rather, it grants founders certain special rights, such as the right to nominate board members and participate in corporate management decisions. The partnership system does not distinguish between different types of shares; instead, it maintains control through special rights like board nomination. Notable companies that have adopted the partnership system include Alibaba and Pinduoduo [11].

By comparing the partnership system with the dual-class share structure, two key innovations of the partnership system can be identified:

Control can be achieved in a more discreet manner while enhancing the attractiveness of the stock. Under the partnership system, apart from the special privileges related to board nomination and appointment, partners hold equal voting rights on other matters, just like other shareholders. This is a cleverly designed mechanism.

Control by the dominant shareholders is not influenced by their shareholding ratio. In a dual-class share structure, the voting rights of each Class A and Class B share usually follow a ratio, commonly one-to-ten or one-to-twenty. A specific voting ratio corresponds to a threshold; only when the founders or management team’s shareholding ratio exceeds this threshold can they secure a majority of the voting power and maintain absolute control over the company [12].

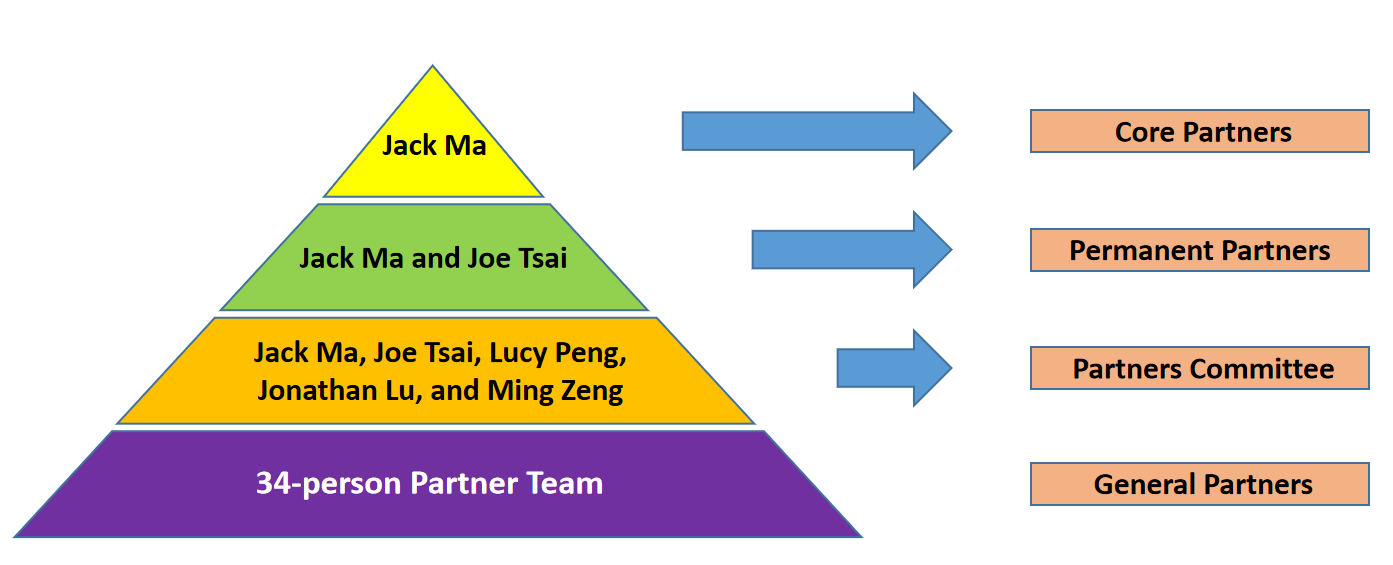

2.3.2. Alibaba's Partnership System

Despite holding a relatively small percentage of shares, Jack Ma and his partnership team have managed to maintain control over Alibaba Group through the partnership system. In terms of shareholding, SoftBank and Yahoo hold 31.8% and 15.3%, respectively, making them Alibaba’s largest and second-largest shareholders. In contrast, Alibaba’s permanent partners Jack Ma and Joseph Tsai hold 7.6% and 3.1%, respectively, while other executives and directors individually hold less than 1%. In total, the partnership team holds 13.1% of shares. Although their shareholding is much lower than that of SoftBank and Yahoo, an agreement reached before Alibaba's IPO ensures that Jack Ma and his permanent partner Joseph Tsai retain control. According to this agreement, any voting rights exceeding 30% held by SoftBank will be delegated to Jack Ma and Joseph Tsai, while the voting rights within the 30% threshold will support the board candidates nominated by Alibaba’s partners.

As stipulated in Alibaba’s Articles of Association, the partnership team led by Jack Ma holds special nomination rights for the board and can appoint the majority of board members. Furthermore, these provisions can only be amended if more than 95% of shareholders' votes (in person or by proxy) approve the change [13].

Figure 2: Composition of Alibaba's Partnership Team.

Through these institutional arrangements, Alibaba has established the partnership team led by Jack Ma as a major influence over the board's composition, thereby ensuring Alibaba’s legal standing and shareholder alignment under their control. This effectively forms the institutional foundation for the operation of Alibaba's partnership system.

3. Conclusion

This study reveals the significant role and potential limitations of the stock issuance registration system, dual-class share structures, and partnership systems in supporting technology and innovation enterprises. The registration system, by simplifying the listing process and reducing administrative intervention, enhances the financing efficiency of the capital market, particularly benefiting unprofitable innovative companies. However, it may also lead to insufficient market assessment of company quality, necessitating improved information disclosure and regulatory mechanisms to protect investor interests. The dual-class share structure and partnership system help founders and core teams maintain control over the company, thereby promoting long-term development and innovation, but they may also cause imbalances in governance structures and harm the interests of minority shareholders. Therefore, future research needs to further explore the adaptability of these systems in different market environments, evaluate their long-term effects, and investigate how to optimize regulatory frameworks to balance innovation incentives with investor protection.

Based on this study, we propose the following recommendations: 1. Improve the Delisting System: While advancing the registration system, there should be a focus on enhancing the delisting mechanism, especially concerning companies with inadequate information disclosure, poor corporate governance, or shareholder rights violations. 2. Increase Tolerance for Innovative Systems: The capital market should increase its tolerance for innovative systems like dual-class share structures and partnership systems to attract more high-quality technology companies to list on the A-shares market. 3. Enhance Soft Management Capabilities: Technology enterprises, while strengthening their technological capabilities, should also focus on improving management skills, adopting suitable institutional arrangements to protect human capital and maintain innovative capacity.

References

[1]. Chen, D., & Hu, Q. (2022). Research on corporate governance in the digital economy era: Paradigm innovation and practical frontiers. Management World, 38(6), 213-240. https://doi.org/10.19744/j.cnki.11-1235/f.2022.0088

[2]. Zhang, F., & Wang, W. (2023). China's comprehensive registration system reform from an international perspective. China Finance, (18), 62-64.

[3]. Wu, X., Zhang, D., & Wu, Z. (2024). Registration system reform and initial public offering ownership preference: Evidence from China. Journal of Accounting Research, 17(1), Article 100343.

[4]. Peng, T., Li, Z., Wang, J., et al. (2024). Spillover effects of the registration system reform: Evidence from the financing of start-up tech enterprises. International Finance Research, (2), 85-96. https://doi.org/10.16475/j.cnki.1006-1029.2024.02.004

[5]. Lease, R. C., McConnell, J. J., & Mikkelson, W. H. (1983). The market value of control in publicly-traded corporations. Journal of Financial Economics, 11(1), 439-471.

[6]. Hu, Y., & Ma, G. (2021). Study on the dual-class share structure system under the STAR Market context. Journal of Jiangxi University of Finance and Economics, (2), 140-148. https://doi.org/10.13676/j.cnki.cn36-1224/f.2021.02.013

[7]. Grossman, S. J., & Hart, O. D. (1988). One share-one vote and the market for corporate control. Journal of Financial Economics, 20(1), 175-202.

[8]. Zheng, Z., Zhu, G., Li, Q., et al. (2021). Dual-class share structures, sunset clauses, and corporate innovation: Evidence from U.S.-listed Chinese companies. Economic Research Journal, 56(12), 94-110.

[9]. Yang, G., & Xie, D. (2024). The impact of dual-class share structures on Xiaomi's corporate governance. Modernization of Shopping Malls, (11), 23-25. https://doi.org/10.14013/j.cnki.scxdh.2024.11.042

[10]. Cai, Z. (2018). Study on multi-class share structures in high-tech companies based on control rights (Doctoral dissertation). Guangxi University.

[11]. Zhou, Y. (2022). Evaluation of the corporate governance effects of Alibaba's partnership system (Doctoral dissertation). Sichuan Normal University. https://doi.org/10.27347/d.cnki.gssdu.2022.000734

[12]. Luo, X. (2015). Research on control arrangements in listed companies (Doctoral dissertation). Jinan University.

[13]. Zheng, Z., Zou, Y., & Cui, L. (2016). Partnership system and entrepreneurial team control arrangements: A case study of Alibaba. China Industrial Economics, (10), 126-143. https://doi.org/10.19581/j.cnki.ciejournal.2016.10.009

Cite this article

Wu,Y. (2025). A New Capital Market System for Serving Technology and Innovation Enterprises - Literature Review and International Comparison. Advances in Economics, Management and Political Sciences,152,99-107.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Chen, D., & Hu, Q. (2022). Research on corporate governance in the digital economy era: Paradigm innovation and practical frontiers. Management World, 38(6), 213-240. https://doi.org/10.19744/j.cnki.11-1235/f.2022.0088

[2]. Zhang, F., & Wang, W. (2023). China's comprehensive registration system reform from an international perspective. China Finance, (18), 62-64.

[3]. Wu, X., Zhang, D., & Wu, Z. (2024). Registration system reform and initial public offering ownership preference: Evidence from China. Journal of Accounting Research, 17(1), Article 100343.

[4]. Peng, T., Li, Z., Wang, J., et al. (2024). Spillover effects of the registration system reform: Evidence from the financing of start-up tech enterprises. International Finance Research, (2), 85-96. https://doi.org/10.16475/j.cnki.1006-1029.2024.02.004

[5]. Lease, R. C., McConnell, J. J., & Mikkelson, W. H. (1983). The market value of control in publicly-traded corporations. Journal of Financial Economics, 11(1), 439-471.

[6]. Hu, Y., & Ma, G. (2021). Study on the dual-class share structure system under the STAR Market context. Journal of Jiangxi University of Finance and Economics, (2), 140-148. https://doi.org/10.13676/j.cnki.cn36-1224/f.2021.02.013

[7]. Grossman, S. J., & Hart, O. D. (1988). One share-one vote and the market for corporate control. Journal of Financial Economics, 20(1), 175-202.

[8]. Zheng, Z., Zhu, G., Li, Q., et al. (2021). Dual-class share structures, sunset clauses, and corporate innovation: Evidence from U.S.-listed Chinese companies. Economic Research Journal, 56(12), 94-110.

[9]. Yang, G., & Xie, D. (2024). The impact of dual-class share structures on Xiaomi's corporate governance. Modernization of Shopping Malls, (11), 23-25. https://doi.org/10.14013/j.cnki.scxdh.2024.11.042

[10]. Cai, Z. (2018). Study on multi-class share structures in high-tech companies based on control rights (Doctoral dissertation). Guangxi University.

[11]. Zhou, Y. (2022). Evaluation of the corporate governance effects of Alibaba's partnership system (Doctoral dissertation). Sichuan Normal University. https://doi.org/10.27347/d.cnki.gssdu.2022.000734

[12]. Luo, X. (2015). Research on control arrangements in listed companies (Doctoral dissertation). Jinan University.

[13]. Zheng, Z., Zou, Y., & Cui, L. (2016). Partnership system and entrepreneurial team control arrangements: A case study of Alibaba. China Industrial Economics, (10), 126-143. https://doi.org/10.19581/j.cnki.ciejournal.2016.10.009