1. Introduction

With increasing competition and slowing subscriber growth in the global telecommunications market, customer churn has become a key challenge affecting the profitability and sustainability of organizations [1]. Customer churn not only means loss of revenue, but its economic impact is particularly significant. The cost of retaining existing customers is usually much lower compared to acquiring new ones, which can cost 5 to 20 times more [2]. Therefore, the ability to effectively predict customer churn has become a key tool for organizations to remain competitive in a highly competitive market.

Research has shown that key patterns of customer behavior are revealed through contract type and monthly spending levels, variables that have a significant impact on whether or not a customer continues to use the service [3]. By analyzing these factors in depth, companies are able to more accurately identify churn-prone customer segments and thus develop effective customer retention strategies.

However, the telecommunication industry suffers from a general data imbalance in customer churn data, which is usually characterized by a much larger number of active customers than churned customers. This data imbalance can lead to predictive models that are biased toward most classes of customers, affecting the predictive performance of the models. Therefore, how to improve prediction accuracy by balancing data distribution has become an important research direction [4]. In addition, most of the traditional customer churn studies focus on the overall customer population, ignoring the impact of individual characteristics, especially age differences, on churn behavior. Zhang et al. demonstrated that segmentation by characteristics can significantly improve prediction accuracy through a customer segmentation model, showing the value of the segmentation strategy in prediction and intervention [5]. However, existing studies lack in-depth analysis on the churn behavior of customers of different age groups under the influence of contract type and monthly consumption level, and this gap restricts enterprises from making further breakthroughs in refined customer management.

Therefore, the study is concerned with exploring the impact of contract type and monthly consumption on customer churn in different age groups through regression analysis, and identify the customer groups most vulnerable to these factors. By filling the gap in customer churn research in terms of differences in individual characteristics, this study will provide theoretical support and practical references for telecommunication companies to develop differentiated and precise customer retention strategies.

2. Methodology

2.1. Methodology

This study used regression analysis to explore the effect of contract type and monthly spending amount on customer churn. Regression analysis is a common statistical method widely used in customer churn prediction to identify and quantify factors that influence customer behavior [6]. The logistic regression model was chosen for this study because it is suitable for dealing with dichotomous problems, i.e., predicting whether a customer will churn or not.

In this model, monthly consumption amount and contract type (including monthly, one-year and two-year contracts) are used as independent variables and customer churn status is used as dependent variable. The sensitivity of different age groups to these factors is further analyzed by dividing the data into two groups, younger and older customers, to identify differences between the groups and provide support for customer retention strategies.

2.2. Data Description

The dataset used in this study is from the WA_Fn-UseC_TelcoCustomerChurn dataset on the Kaggle platform, and includes 21 attributes related to churn, such as gender, age, family status, and service usage, for 7,043 telecom customers [7]. The key variables for this analysis are contract type, which includes monthly, one-year, and two-year contracts, and monthly consumption amount, which represents the amount each customer pays per month. The target variable is churn status, which is used to indicate whether or not a customer terminates the service, while age categorization is determined by an age indicator, where 0 represents younger customers and 1 represents older customers. This dataset provides a sufficient basis for the regression analysis in this study and is suitable for exploring the effects of contract type and monthly spending on customer churn.

2.3. Data Cleaning

During the data cleaning process, it filled in the missing values in the total consumption column with mean values and transformed churn status into binary variables. Relevant variables including monthly consumption, contract type (one-year contract vs. two-year contract), churn status, and age category (younger vs. older customers) were selected for the regression analysis to ensure data completeness and provide a solid foundation for subsequent analyses.

3. Hypothesis

This study aims to investigate the effect of contract type and monthly spending amount on customer churn by formulating the following hypotheses:

• Hypothesis 1: The likelihood of customer churn increases as the monthly consumption amount increases. This hypothesis is based on the presumption that customers are more likely to be price sensitive for services with higher consumption amounts, which in turn increases the risk of churn.

• Hypothesis 2: Long-term contracts (e.g., one or two years) are effective in reducing churn. Long-term contracts usually increase customer stickiness and loyalty compared to short-term contracts, thus reducing churn.

• Hypothesis 3: Age moderates the effect of contract type and monthly spending on churn. Specifically, younger customers are more likely to be influenced by monthly spending amount, while older customers are likely to have a stronger preference for long-term contracts and therefore a lower risk of churn.

Through logistic regression analysis, this study will test the above hypotheses and further explore the differential performance of these factors among customers of different age groups.

4. Overall Regression Analysis Description

Table 1: Regression Analysis Results of Monthly Charges and Contract Type on Customer Churn

No. Observations | 7043 | |||||

Df Residuals | 7039 | |||||

Df Model | 3 | |||||

Pseudo R-squ. | 0.204 | |||||

Log-Likelihood | -3242.0 | |||||

LL-Null | -4075.1 | |||||

LLR p-value | 0.000 | |||||

coef | std err | Z | P>|z| | [0.025 | 0.975] | |

Const | -1.545 | 0.086 | -17.918 | 0.000 | -1.714 | -1.376 |

Monthly Charges | 0.019 | 0.001 | 16.048 | 0.000 | 0.016 | 0.021 |

Contract One year | -1.852 | 0.091 | -20.411 | 0.000 | -2.030 | -1.674 |

Contract Two year | -3.305 | 0.152 | -21.811 | 0.000 | -3.602 | -3.008 |

Table 1 demonstrates the overall effect of monthly spending amount and contract type  on customer churn. The constant term (-1.5451) provides the base reference for the model and represents the baseline probability of customer churn with all independent variables at zero.

on customer churn. The constant term (-1.5451) provides the base reference for the model and represents the baseline probability of customer churn with all independent variables at zero.

Among the main variables, the coefficient of monthly spending amount is 0.0185, which shows a positive correlation between monthly spending amount and customer churn, which means that the higher the monthly spending amount, the higher the likelihood of customer churn (p < 0.001). The coefficient for one-year contracts is -1.8521, indicating that customer churn is significantly lower with one-year contracts. The coefficient for two-year contracts is even larger at -3.3050, indicating that two-year contracts are more effective in reducing churn (both p < 0.001). Therefore, it can be concluded that both one-year and two-year contracts significantly reduce the probability of customer churn, with two-year contracts being particularly effective.

The log-likelihood value of the model is -3242.0 and the pseudo R² is 0.2044, which shows the reasonableness of the model in explaining customer churn. The LLR p-value is close to 0, which further confirms the significance of the model.

Table 2: Regression Analysis Results for Younger Customers

No.Observations | 5901 | |||||

Df Residuals | 5897 | |||||

Df Model | 3 | |||||

Pseudo R-squ. | 0.205 | |||||

Log-Likelihood | -2565.3 | |||||

LL-Null | -3224.9 | |||||

LLR p-value | 0.000 | |||||

coef | std err | Z | P>|z| | [0.025 | 0.975] | |

Const | -1.676 | 0.094 | -17.915 | 0.000 | -1.859 | -1.492 |

Monthly Charges | 0.019 | 0.001 | 15.042 | 0.000 | 0.017 | 0.022 |

Contract One year | -1.796 | 0.100 | -17.908 | 0.000 | -1.992 | -1.599 |

Contract Two year | -3.251 | 0.163 | -19.980 | 0.000 | -3.570 | -2.932 |

Table 2 presents the results of the regression analysis for younger customers, revealing the effect of monthly spending amount and contract type on churn. The regression results show that the coefficient of monthly consumption amount is 0.0193, indicating that an increase in consumption amount significantly increases the probability of churn (p < 0.001). That is, younger customers are more likely to stop the service when the monthly consumption amount rises.

In terms of contract type, the coefficient on one-year contracts is -1.7957, indicating that signing a one-year contract significantly reduces churn compared to monthly contracts. The coefficient for two-year contracts is more negative at -3.2514, indicating that two-year contracts are more effective in reducing churn compared to one-year contracts. These results suggest that longer contract durations have a stronger effect on retaining younger customers.

Table 3: Regression Analysis Results for Older Customers

No.Observations | 1142 | |||||

Df Residuals | 1138 | |||||

Df Model | 3 | |||||

Pseudo R-squ. | 0.150 | |||||

Log-Likelihood | -659.65 | |||||

LL-Null | -775.69 | |||||

LLR p-value | 0.000 | |||||

coef | std err | Z | P>|z| | [0.025 | 0.975] | |

Const | -0.331 | 0.248 | -1.331 | 0.183 | -0.817 | -0.156 |

Monthly Charges | 0.007 | 0.003 | 2.170 | 0.030 | 0.001 | 0.012 |

Contract One year | -1.942 | 0.215 | -9.011 | 0.000 | -2.364 | -1.519 |

Contract Two year | -3.357 | 0.424 | -7.923 | 0.000 | -4.188 | -2.527 |

Table 3 presents the results of the regression analysis for older customers, revealing the effect of monthly consumption amount and contract type on the probability of churn. The regression results show that the coefficient of monthly consumption amount is 0.0066, indicating that an increase in monthly consumption amount slightly enhances the probability of churn for older customers, but the effect is small (p = 0.030), suggesting that older customers are not as sensitive to changes in consumption amount as younger customers.

For contract type, the coefficient on one-year contracts is -1.9418, suggesting that having a one-year contract significantly reduces the risk of churn among older customers. In contrast, the coefficient of -3.3574 for two-year contracts shows a stronger negative effect, implying that two-year contracts are more effective in reducing churn than one-year contracts. This result is similar for younger customers, but the effect of long-term contracts is more significant among older customers.

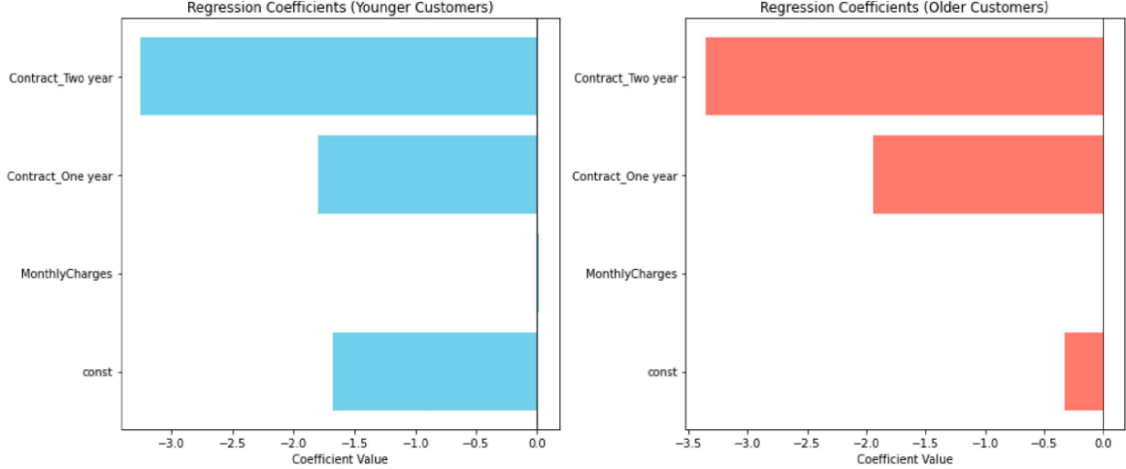

Figure 1: Comparison of Regression Coefficients for Younger and Older Customers on Churn Factors (Photo/Picture credit: Original).

This study reveals the effects of monthly spending amount and contract type on customer churn through regression analysis and compares the responses of customers of different age groups. The results show that the churn rate of younger customers increases significantly with increasing monthly consumption amount, while older customers are less sensitive to this. Figure 1 visualizes this difference, with younger customers having a significantly higher monthly consumption factor than older customers. As for contract type, longer contracts (especially two-year) have a significant dampening effect on churn risk for all customer groups. Specifically, younger customers experience a significant decrease in churn when on a two-year contract, while older customers have a more negative coefficient on two-year contracts, showing a stronger retention effect. These findings highlight the importance of contract duration in churn management and the greater reliance of older customers on long-term contracts.

5. Discussion

Regression analysis shows that monthly consumption and contract type have a significant effect on customer churn. The higher the monthly consumption of young customers, the higher the probability of churn. Older customers tend to choose long-term contracts, especially two-year contracts, which help reduce churn. Based on this, four customer retention recommendations are proposed:

First, optimize consumption packages for younger customers. Flexible payment plans and personalized pricing can reduce churn, for example by offering more attractive services through customized options, especially in highly competitive markets [8]. Second, promote long-term contracts for repeat customers. Combined with value-added services such as health support, the loyalty of elderly customers can be enhanced through favorable promotions. Thirdly, improve customer experience. Premium service quality, reward programs, and value-added services can increase satisfaction and avoid churn due to poor service, while short-term contract customers can be offered discount incentives to promote contract renewal [9]. Finally, establish customer loyalty programs. Extending contract lengths and offering discounts or value-added services, especially for customers at high risk of churn, can help boost retention and penetration pricing strategies also show a positive correlation in customer retention [10].

6. Conclusion

This study examines the effects of monthly consumption amount and contract type on telecom customer churn through regression analysis, with particular attention to differences in the responses of younger and older customers to these factors. The results show that consumption amount and contract type have a significant effect on customer churn, but differ between age groups. Specifically, younger customers are more sensitive to monthly spending amount, which is positively correlated with churn probability, while older customers are more susceptible to the type of contract, and in particular, long-term contracts have a significant dampening effect on churn among older customers. This finding provides an important basis for telecommunication companies to formulate customer retention strategies. Companies can implement diverse and differentiated measures to reduce the risk of customer churn based on the characteristics of customers in different age groups. Overall, this study emphasizes the necessity of segmentation management based on customer age characteristics, and these results provide new ideas and practical references for the telecom industry and other service-oriented companies in their customer retention strategies.

References

[1]. Pinheiro, P., & Cavique, L. (2022, April). Telco customer churn analysis: Measuring the effect of different contracts. In World Conference on Information Systems and Technologies (pp. 112-121). Cham: Springer International Publishing.

[2]. Saleh, S., & Saha, S. (2023). Customer retention and churn prediction in the telecommunication industry: a case study on a Danish university. SN Applied Sciences, 5(7), 173.

[3]. Barsotti, A., Gianini, G., Mio, C., Lin, J., Babbar, H., Singh, A., ... & Damiani, E. (2024). A Decade of Churn Prediction Techniques in the TelCo Domain: A Survey. SN Computer Science, 5(4), 404.

[4]. Sharma, V., Rani, L., Sahoo, A. K., & Sarangi, P. K. (2023, June). Customer Churn in Telecom Sector: Analyzing the Effectiveness of Machine Learning Techniques. In International Conference on Data Analytics & Management (pp. 677-691). Singapore: Springer Nature Singapore.

[5]. Zhang, T., Moro, S., & Ramos, R. F. (2022). A data-driven approach to improve customer churn prediction based on telecom customer segmentation. Future Internet, 14(3), 94.

[6]. Lalwani, P., Mishra, M. K., Chadha, J. S., & Sethi, P. (2022). Customer churn prediction system: a machine learning approach. Computing, 104(2), 271-294.

[7]. Fendarkar, P. (2023). WA_Fn-UseC Telco Customer Churn [Data set]. Kaggle. Retrieved from https://www.kaggle.com/datasets/palashfendarkar/wa-fnusec-telcocustomerchurn

[8]. Faisal, M., & Hamdan, A. (2021). Effect of pricing in digital markets on customer retention. In Applications of artificial intelligence in business, education and healthcare (pp. 423-441).

[9]. Becker, J. U., Spann, M., & Schulze, T. (2015). Implications of minimum contract durations on customer retention. Marketing Letters, 26, 579-592.

[10]. Arif, S. A. F., & Subrahmanyam, S. (2022). Penetration Pricing Strategy and Customer Retention–An Analysis. Journal of Positive School Psychology, 7058-7072.

Cite this article

Zheng,P. (2025). The Impact of Contract Type and Monthly Charges on Customer Churn: Comparative Analysis Across Age Groups. Advances in Economics, Management and Political Sciences,153,22-27.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Pinheiro, P., & Cavique, L. (2022, April). Telco customer churn analysis: Measuring the effect of different contracts. In World Conference on Information Systems and Technologies (pp. 112-121). Cham: Springer International Publishing.

[2]. Saleh, S., & Saha, S. (2023). Customer retention and churn prediction in the telecommunication industry: a case study on a Danish university. SN Applied Sciences, 5(7), 173.

[3]. Barsotti, A., Gianini, G., Mio, C., Lin, J., Babbar, H., Singh, A., ... & Damiani, E. (2024). A Decade of Churn Prediction Techniques in the TelCo Domain: A Survey. SN Computer Science, 5(4), 404.

[4]. Sharma, V., Rani, L., Sahoo, A. K., & Sarangi, P. K. (2023, June). Customer Churn in Telecom Sector: Analyzing the Effectiveness of Machine Learning Techniques. In International Conference on Data Analytics & Management (pp. 677-691). Singapore: Springer Nature Singapore.

[5]. Zhang, T., Moro, S., & Ramos, R. F. (2022). A data-driven approach to improve customer churn prediction based on telecom customer segmentation. Future Internet, 14(3), 94.

[6]. Lalwani, P., Mishra, M. K., Chadha, J. S., & Sethi, P. (2022). Customer churn prediction system: a machine learning approach. Computing, 104(2), 271-294.

[7]. Fendarkar, P. (2023). WA_Fn-UseC Telco Customer Churn [Data set]. Kaggle. Retrieved from https://www.kaggle.com/datasets/palashfendarkar/wa-fnusec-telcocustomerchurn

[8]. Faisal, M., & Hamdan, A. (2021). Effect of pricing in digital markets on customer retention. In Applications of artificial intelligence in business, education and healthcare (pp. 423-441).

[9]. Becker, J. U., Spann, M., & Schulze, T. (2015). Implications of minimum contract durations on customer retention. Marketing Letters, 26, 579-592.

[10]. Arif, S. A. F., & Subrahmanyam, S. (2022). Penetration Pricing Strategy and Customer Retention–An Analysis. Journal of Positive School Psychology, 7058-7072.