1. Introduction

This study primarily explores the influence of ESG performance on corporate entities, particularly how it supports the development of sustainable business practices. The objective is to assess ESG's role in enhancing enterprise outcomes, providing a framework for companies to refine their ESG strategies and pursue long-term value creation. The paper lays the groundwork for the exploration of ESG behaviors by offering a concise overview of the contemporary corporate environment, underscoring the growing significance of ESG factors in global business decision-making processes [1]. It introduces the methodologies employed in the qualitative research and emphasizing the findings' relevance to both practitioners and academics, suggesting that a grasp of the role of ESG behaviors can lead to more ethical and effective corporate strategies. The study further elucidates how multinational corporations integrate ESG elements into their decision-making frameworks to foster sustainable development and bolster their social responsibility, offering industry professionals and scholars valuable insights through a detailed qualitative research approach and demonstrating ESG’s influence on long-term growth and brand reputation [2].

2. Introduction to ESG Behaviors and Enterprise Performance

ESG practices, encompassing environmental, social, and governance factors, are crucial for assessing a company's long-term viability and ethical conduct. Good ESG performance correlates with increased investor confidence and better brand reputation. Integrating ESG into business strategies can reduce costs, improve employee morale, and drive regulatory compliance, creating new opportunities and fostering innovation. Companies with robust ESG records are often more adaptable and sustainable, gaining a competitive edge as they demonstrate a commitment to long-term success in a dynamic market. Corporate performance evaluation involves a comprehensive analysis of multiple key factors. One of the fundamental factors is financial indicators, which provide a quantitative analysis of the company's profitability, liquidity, and overall financial position. Innovation ability is critical to success, ensuring companies remain competitive and relevant in changing markets. This includes constantly developing new products, services, and processes to drive growth and stand out from competitors. A reasonable portfolio is also necessary for long-term stability and growth, involving strategically allocating resources according to the company's objectives and risk tolerance. Good customer relationships are critical to the continued success of businesses, including building strong connections with customers through excellent customer service, understanding their needs, and consistently meeting or exceeding their expectations. Satisfied customers are more likely to remain loyal, offer repeat business, and recommend companies to others, thereby contributing to a positive reputation and a market share increase. The social and environmental impact of the enterprise is also a part of the performance evaluation. Effective ESG practices enhance relationships with stakeholders, strengthen brand reputation, and contribute to long-term value. In conclusion, ESG is becoming increasingly important, as both investors and consumers require greater corporate transparency and accountability.

3. Specific Impacts of ESG on Enterprise Performance

3.1. ESG’s Impact on Financial Performance

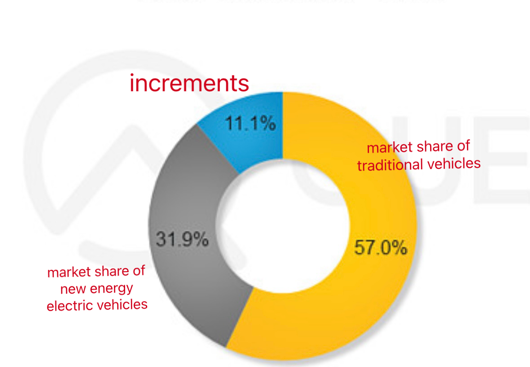

ESG practices can improve financial performance by enhancing resource efficiency and reducing operational costs. Additionally, businesses that are proactive in addressing environmental and social issues tend to attract and retain top talent, as employees increasingly seek to work for organizations that align with their personal values. This can result in a more engaged and productive workforce, which is a critical factor in driving long-term profitability and growth [3]. For instance, in the aftermath of the donation in 2019 and 2020, the Erke brand experienced a notable surge in revenue growth, as depicted in the subsequent graph. Then According to QuestAuto, the sales of new energy resources vehicles increased from 31.9% to 43% of the total sales in September 2024.

Figure 1: the upward trend in Erke's revenue

Figure 2: the market share of vehicles market at 01/09/2024

3.2. ESG’s Influence on Green Innovation

Businesses that prioritize ESG (Environmental, Social, and Governance) principles are generally more prepared to innovate in green technologies and practices. This is because they usually have a culture that encourages sustainability and ethical practices, leading to a more creative and forward-thinking approach to business challenges. As a result, these companies are more likely to develop new products and processes that reduce environmental impact and meet the growing demand for sustainable solutions. Green innovation not only benefits the environment but also opens up new markets and revenue streams, ultimately contributing to the company's competitive advantage and long-term success [4]. The green innovation initiatives of the new energy vehicle industry, for instance, have expanded market share and set transformative industry standards.

3.3. ESG’s Role in Strategic Investment

ESG criteria have become a significant factor in investment decisions, as they provide a framework for assessing a company's commitment to environmental, social, and governance practices. Strong ESG performance is often associated with responsible management, leading to higher valuations and favorable financing [5]. Moreover, integrating ESG considerations into investment strategies can help mitigate risks associated with climate change, resource scarcity, and social unrest, which are becoming increasingly relevant in today's business environment [6]. China Everbright Group has always closely followed the country's strategic deployment, and actively responded to the call for green development. In recent years, Dali Everbright Financial Management Co., Ltd. (00030 .SZ) has not only helped the transformation and upgrading of traditional industries but also actively promoted the development of green industries through effective capital allocation. It has made remarkable achievements in the field of green finance and set a new benchmark for the industry. Dali Everbright Finance has always been in the lead of innovating green financial products.. It has not only launched the first equity wealth management product based on ESG theme in the market, has also laid out low-carbon fields such as clean energy and energy storage, promoting carbon neutral wealth management products. In addition, Dali Everbright Financial Management also launched new energy themed equity financing, focusing on investment in green industries such as new energy vehicles and photovoltaic industry. This not only enriches the choice of investors, but also guides the flow of social funds to green industries.

3.4. ESG’s Effect on Customer Relationships

ESG practices can significantly influence customer loyalty and satisfaction. Companies that demonstrate a strong commitment to environmental stewardship, social responsibility, and good governance often build a positive reputation, which can translate into stronger customer relationships. Increasingly aware consumers prefer brands aligned with their values, and transparent ESG reporting further fosters customer trust [7].JoulWatt, for example persists in enhancing the protection of intellectual property. The company's commitment to innovation and development, as well as the ongoing refinement of its technologies, has always centered on the principle of "quality." A robust quality management system is the cornerstone for ensuring customer satisfaction and for the ongoing enhancement of all processes and aspects. From research and development management to validation, supply chain, and production management processes, JoulWatt has established a world-class quality system. Through comprehensive product testing and stringent production control throughout the entire process, the company achieves a low product failure rate, thereby ensuring a high-quality supply of its products.

4. Macro Environmental Factors Supporting ESG Performance

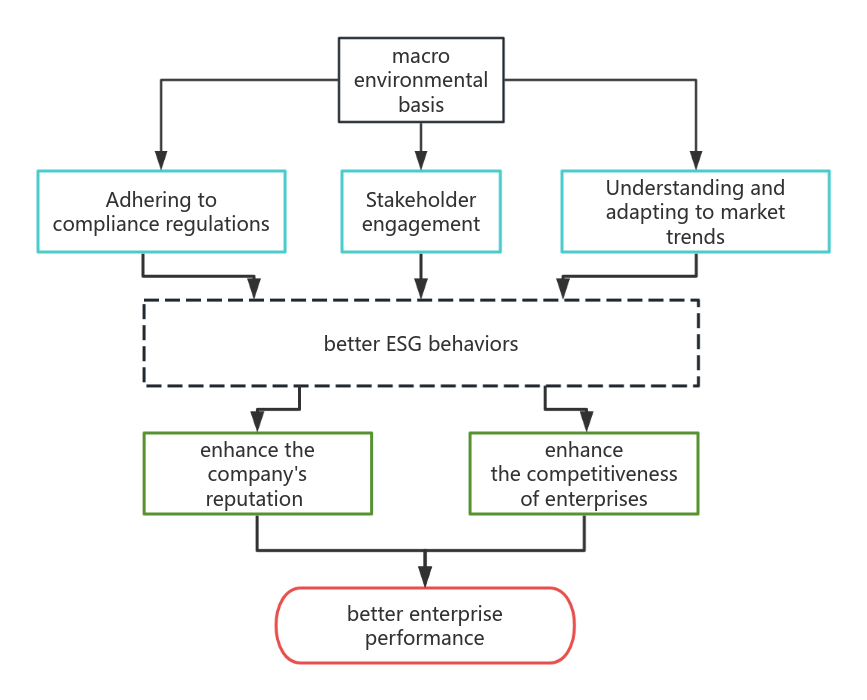

Key factors that play a crucial role in shaping a company's Environmental, Social, and Governance (ESG) strategy encompass adherence to regulatory requirements, active engagement with stakeholders, and a keen awareness of evolving market trends.

Compliance with ESG standards is vital for businesses to avoid legal penalties and maintain their reputation. It reflects a commitment to ethical practices and sustainability, which can build trust and enhance the company's public image. Compliance is a strategic approach that supports the business's long-term success in a changing global environment.

Stakeholder engagement is another pivotal element that involves engaging various groups, including employees, customers, suppliers, and the local community, in the company's ESG programs. Effective stakeholder engagement fosters a sense of ownership and investment in the company's ESG goals. This active involvement can lead to stronger relationships with these groups, as they feel their voices are heard and valued. Consequently, such involvement can enhance the company's reputation and create a more positive public image, which is invaluable in today's socially conscious business environment.

Understanding and adapting to market trends is equally important. As consumers and businesses increasingly demand sustainable products and services, companies must align their strategies with these evolving preferences. Staying attuned to market trends enables a company to anticipate changes and adjust its operations and innovation efforts accordingly. For instance, recognizing a growing trend towards eco-friendly products can guide a company to invest in research and development of greener alternatives, helping it to stay ahead of the competition and meeting consumer expectations.

Regulatory requirements, active participation in stakeholders and a keen awareness of changing market trends for the company can create a meet and exceed expected ESG framework. Integration of these advantages can enhance the company's reputation and the competitiveness of enterprises, eventually enhancing reputation, flexibility, and enterprise performance.

Figure 3: The process by which the macro environment affects ESG behaviors and finally enterprise performance

5. Conclusion

Integrating ESG principles into corporate strategy is essential for sustainable growth. It enhances green innovation, investment optimization, financial performance, and customer relationships. As companies prioritize ESG, they become more adaptable to societal needs and policies, ensuring long-term stability. This focus allows firms to navigate regulatory changes, manage risks, and leverage stakeholder expectations, increasing investor confidence and brand strength. ESG commitment is thus a strategic investment for future business success in a complex global environment.

This study acknowledges certain limitations, such as the lack of detailed case studies to illustrate the impact of ESG on specific companies. Future research could provide more in-depth analysis and practical examples to elucidate how ESG fosters corporate success. Additionally, while the article highlights the importance of ESG for long-term value creation, it does not extensively cover the challenges and barriers that companies may face when integrating ESG practices into their core strategies. Addressing these issues is essencial for businesses looking to embark on their own ESG journeys.

References

[1]. Li Chao,Wu Mian & Huang Wenli.(2023).Environmental, Social, and Governance Performance and Enterprise Dynamic Financial Behavior: Evidence from Panel Vector Autoregression.Emerging Markets Finance and Trade(2),281-295.

[2]. Zuzana Chvátalová & Iveta Šimberová.(2013).Analysis of ESG indicators for measuring enterprise performance.Acta Universitatis Agriculturae et Silviculturae Mendelianae Brunensis(7),2197-2204.

[3]. Yang Qingping & Han Haibo. (2024). Status and outlook of ESG performance research. Financial Management Research (10), 4-14.

[4]. Chen Jing & Luo Yan. (2024). ESG performance, green innovation and corporate financial performance — based on empirical data of listed companies in heavy pollution industries. Science and Technology Entrepreneurship Monthly (09), 67-73.

[5]. Jianqiang Gu,Rong Lu & Juan Xu.(2022).Data element embedding and firm performance: The influence of ESG investment.Frontiers in Environmental Science

[6]. Xin Chunhua, Zhang Xiaoyu, and Wang Xinyi (2024). Does corporate ESG performance contribute to stable supply chain partnerships?Economic and Management Research (01), 35-54.

[7]. Xing Mingqiang,Qi Lili,Hu Dan & Gao Mingwei.(2024).Management short-sighted behavior and enterprise ESG performance — Evidence from listed companies in China.Finance Research Letters106002-106002.

Cite this article

Zhao,K. (2025). ESG Behaviors: The Green Engine for Enterprise Performance. Advances in Economics, Management and Political Sciences,154,32-36.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Li Chao,Wu Mian & Huang Wenli.(2023).Environmental, Social, and Governance Performance and Enterprise Dynamic Financial Behavior: Evidence from Panel Vector Autoregression.Emerging Markets Finance and Trade(2),281-295.

[2]. Zuzana Chvátalová & Iveta Šimberová.(2013).Analysis of ESG indicators for measuring enterprise performance.Acta Universitatis Agriculturae et Silviculturae Mendelianae Brunensis(7),2197-2204.

[3]. Yang Qingping & Han Haibo. (2024). Status and outlook of ESG performance research. Financial Management Research (10), 4-14.

[4]. Chen Jing & Luo Yan. (2024). ESG performance, green innovation and corporate financial performance — based on empirical data of listed companies in heavy pollution industries. Science and Technology Entrepreneurship Monthly (09), 67-73.

[5]. Jianqiang Gu,Rong Lu & Juan Xu.(2022).Data element embedding and firm performance: The influence of ESG investment.Frontiers in Environmental Science

[6]. Xin Chunhua, Zhang Xiaoyu, and Wang Xinyi (2024). Does corporate ESG performance contribute to stable supply chain partnerships?Economic and Management Research (01), 35-54.

[7]. Xing Mingqiang,Qi Lili,Hu Dan & Gao Mingwei.(2024).Management short-sighted behavior and enterprise ESG performance — Evidence from listed companies in China.Finance Research Letters106002-106002.