1. Introduction

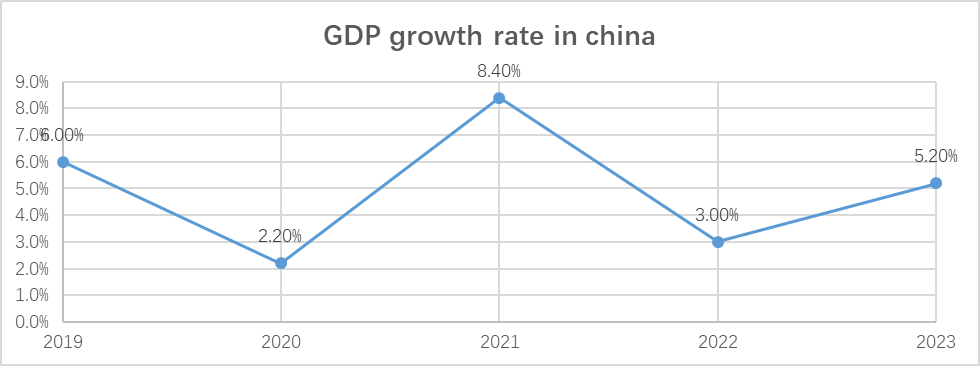

In the past 4 years, China’s economy has been dramatically affected by the COVID-19 epidemic: the threat of the virus and lockdown policy kept people at home, making them unlikely to do much consumption. Firms were also less likely to produce more goods due to a shrink in consumer demand. Thus, consumption and investment, the two main components of a country’s GDP, were greatly reduced by the epidemic’s impact. In the end, despite a sudden increase in GDP growth caused by a short period of retaliatory consumption in 2021, the year of temporary control of COVID-19, China’s GDP growth rate greatly decreased since 2020. The epidemic’s impact still exists even after 2022, the end of China’s epidemic. Such a trend is shown in the figure below[1]:

Figure 1: Trend of GDP growth in China from 2019 to 2023

the Chinese central bank, PBOC, has attempted to use monetary policy to adjust the economy from the COVID-19 depression. Its mechanism and effectiveness will be discussed and evaluated further in this essay.

2. Effectiveness of China’s monetary policy

Monetary policy focuses on changing the interest rate in order to change the aggregate demand, the demand of all final goods and services within a country. As interest rate decreases, consumers will be less likely to save their money but spend it, and firms will be more likely to borrow money because the cost of this action, interest, decreases. A change in AD could change a country’s real GDP and prevent the threat of high inflation from an overheated economy or deflation from a depressed economy.

Since the aim of the central bank is to stimulate the economy, the nature of China’s monetary policy has been mostly expansionary in the past 4 years. From history, PBOC generally used 2 methods to achieve that: 1. Decreasing reserve rate 2. Decrease benchmark interest rate. The reserve rate affects the money supply. It decides how much money the bank will hold instead of lending them. reserve rate could make base currency generate more money supply (M2 by broad definition) due to The monetary multiplier effect. The benchmark interest rate decides the base interest rate in the money market and then affects money demand: as it decreases, people will be less likely to hold their money because it is a sign of a potential decrease in the interest rate in the market.

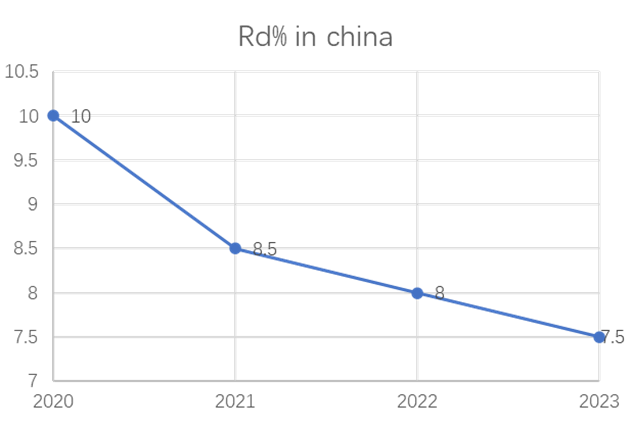

However, since 2015, the PBOC has stopped changing benchmark interest rates but mainly relies on changing the reserve rate to adjust to the economy, the trend of decreasing reserve rates since the pandemic is shown below[2]:

Figure 2: Reserve rate in China

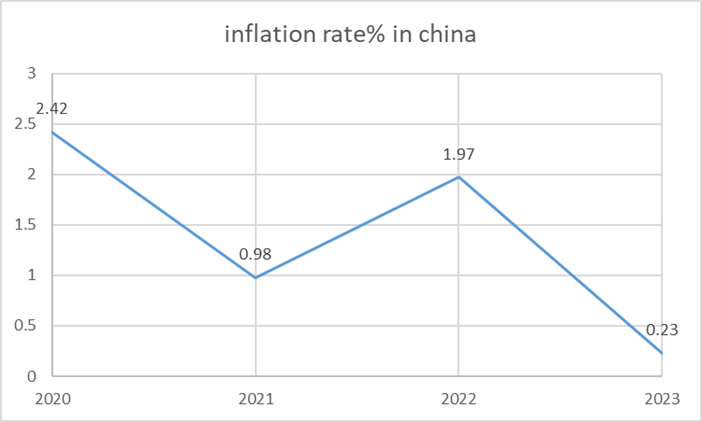

From the data, we can conclude that the PBOC decreased the reserve rate to expand the money supply. As a result, the market interest rate would decrease, China’s economic growth would go back to its normal rate, and China’s economy would work on its potential performance. A stable and proper inflation rate would be the evidence of such a result. However, China’s inflation rate has kept to a very low degree since the epidemic, and it continuously decreased till 2023 with a deflation. Such a tendency could be shown in the figure below[3]:

Figure 3: Inflation rate in China

The fact shows that the effectiveness of China’s expansionary monetary policy might be questionable. It did not cause the inflation rate to return back to the 2% target and it is far below that target. This abnormal phenomenon requires more analysis to figure out.

3. Application of velocity of money

Money velocity is the concept that reflects the fluidity of money. It is defined as the number of transactions per unit of money involved. The formula of this value is:

\( V=\frac{PT=nominal GDP}{M} \)

Where:

V = velocity of money

P = price level

T = amount of transactions

M = money supply

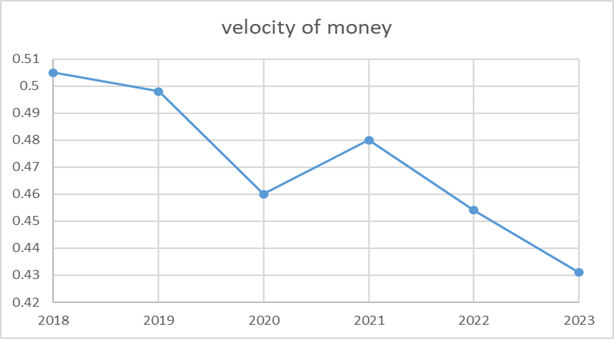

Normally, the velocity of money is considered a constant value. However, recent economic performance in China might not show this nature: though the central bank greatly expands the money supply through expansionary monetary policy, the nominal GDP of China still increases at a very low rate that does not correspond to the change in money supply. The figure below shows the result of the calculation:

Figure 4: Velocity of money in China

The data shows that, although the velocity of money in China generally kept a decreasing trend even before the epidemic, but in 2021, the rate of decrease of velocity dramatically increased after 2020, the beginning of the epidemic. This fact suggests that simply expanding the money supply could not help with Chinese economy as its contribution to the economy, which could be shown by the velocity of money, seems to consistently decrease. In conclusion, money gets stuck in the circulation of the Chinese economy, causing dysfunction of monetary policy. The causes of this phenomenon are meaningful to evaluate in detail.

4. Causations of low velocity of money

To begin with, the composition of China’s GDP is worth mentioning. Generally, consumption and investment are two main components of a country’s GDP, and normally, the value of consumption is larger than the investment. However, in China, the percentage of investment is usually larger than the consumption. For example, in 2020, the percentage of consumption in China’s GDP was 38% while for investment, it is 43%. This could be explained by China’s abnormally high savings rate. In 2023, China’s gross savings rate is 44.3%[4], the highest around the world. Thus, China’s economy is generally investment-oriented: households save the majority of their income in banks, and banks use their savings to invest in firms[5].

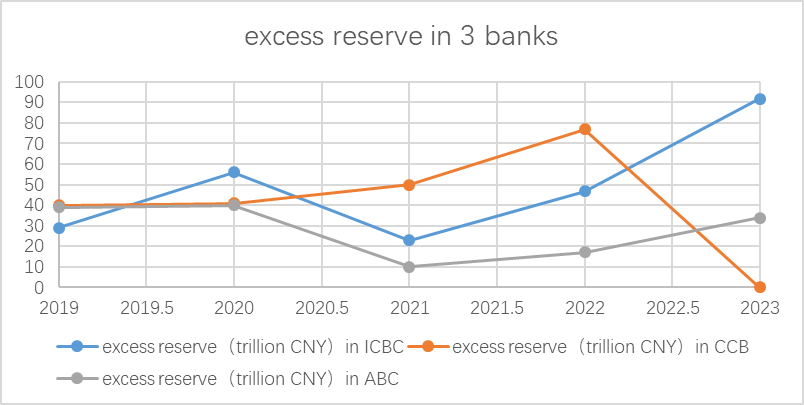

Though such a composition could improve GDP growth as investment to firms makes it possible to produce more goods and make more technological progress in the long run, it might cause insufficient consumption. During the epidemic, this weakness was exposed. At the beginning of COVID, consumers’ confidence hugely decreased: due to uncertainty and panic about the future, they save even more percentage of their income in the bank for precautionary uses and became less likely to consume. As a result, the majority of income flows to the bank. Banks indeed could lend those savings to the firms to make that money return to circulation. However, as firms use that investment to expand production, most products can’t be sold to consumers. Those excessive products could be considered as “inventory investment” and still be counted in GDP. Yet, as the epidemic prolonged, firms couldn’t transfer those products into their revenue. hence, firms will be less likely to ask for investment, and banks will be more cautious about investing firms due to rising risks of potential bankruptcies of those firms. Then, households earn less income as their employers decrease their wages or fire them to decrease the cost, and they would be more likely to save their money. More and more money gets stuck in banks. this could be proved by the dramatic increase in “excess reserves” in the 3 main banks, ICBC, CCB, and ABC in China. Those banks The figure below shows this trend[6]:

Figure 5: Excess reserve in 3 main banks in China(0 in 2023 means this data is not available)[6][7][8]

In short, the epidemic aggravates the problem of overproduction in China caused by its abnormal composition of GDP. Thus, decreasing interest rates can’t really stimulate the economy. low interest rates could not fix consumers’ low confidence, and they simply do not have enough income to consume goods from firms. Then, firms would not borrow money from the bank simply because they do not have incentives to do so: consumers do not buy their products, and they do not get enough revenue to afford the potential risk of investment[7].

5. Possible Solutions to the problem

As discussed above, the root of the problem of the Chinese economy is caused by insufficient consumption and overproduction which is aggravated by the epidemic. therefore, the solutions must focus on increasing the ability of consumers to consume. As households begin to buy more goods and save less income due to the sense of security. Then, firms could sell their goods and get investment. In the end, total amount of savings will decrease, and more savings could be transferred into investment, so money got stuck in banks could flow back to the circulation. In the long run, percentage of consumption in GDP will increase and investment will decrease. This would be beneficial to solve the problem of overproduction in China, and Chinese economy will become more consumption-oriented. Since now firms and consumers are struggling in this problem, we could not damage those two sectors’ interests further, so the government should undertake the cost of solutions.

First, the government could establish better social welfare system. China has very inadequate social welfare for most households. If they get into financial crisis, it will be hard for them to recover from it under aids from the society. Hence, households would be more likely to expand their precautionary savings due to uncertainty to the future. A social welfare system could increase their sense of security and make them be more likely to spend their income.

Second, the government could change the composition of tax. In China, the government heavily relies on indirect tax. for instance, In 2016, 60% percent of tax was indirect tax. [8] though households does not afford indirect tax, firms could easily transfer their indirect tax on households by increasing the price of goods or decreasing wages. Thus, indirect tax finally transmits to consumers and decreases their income. So, the government should gradually decrease the indirect tax in order to increase households’ income to stimulate consumption.

Third, the government could make the tax system more progressive by increasing income tax for wealthy people. In 2023, China’s Gini coefficient is 0.467[9], indicating a very high inequality of income. Wealthy people usually just consume a small percentage of their income compared to people with normal income. As they pay more income taxes to the government, those taxes could be redistributed to people with normal income through social welfare. It generally increases the income of the majority of Chinese people and encourages consumption.

6. Conclusion

In conclusion, the monetary policy in dealing with the impact of the epidemic was dysfunctional in China, and it really exposed the problem of overproduction and insufficient consumption in the Chinese economy. It shows the vulnerability of an investment-oriented economy to severe unpredicted shocks. In order to save the Chinese economy, The Chinese government must have enough patience to conduct systematical reformation to change the structure of the Chinese economy in the long term instead of using some quick solutions in the short run.

However, on no account should we ignore that the analysis in this essay can’t draw a complete picture of the Chinese economy as it does not fully explain the high savings rate of Chinese households and its causes. Such an abnormal phenomenon can’t be attributed to inadequate income only. What’s more, this essay also does not deeply analyze why a high savings rate causes the problem. Thus, more research is required to unveil th1e mechanisms behind the recent problem faced by China and possible solutions to deal with it.

References

[1]. China’s GDP Growth Rates (2019-2023). Retrieved from: https://data.stats.gov.cn/easyquery.htm?cn=C01

[2]. China Reserve Requirement Ratio (1985 – 2024). Retrieved from: https://www.ceicdata.com/zh-hans/indicator/china/reserve-requirement-ratio

[3]. China Inflation Rate 1960-2024 Retrieved from: https://www.macrotrends.net/global-metrics/countries/CHN/china/inflation-rate-cpi

[4]. China Reserve Requirement Ratio(1985 – 2024) Retrieved from: https://www.ceicdata.com/en/indicator/china/reserve-requirement-ratio

[5]. Tao Zha, The Challenging Transition from Investment- to Consumption-Led Growth in China(2024), 24-26, The Reporter, No.2.

[6]. China Construction Bank Financial Report. http://www.ccb.com/cn/investor/report/annual_report_1.html Agricultural Bank of China Financial Report. Retrieved from https://www.abchina.com/cn/AboutABC/investor_relations/report/am/Industrial and Commercial Bank of China Financial Report. Retrieved from https://www.icbc-ltd.com/column/1438058343653851145.html

[7]. LI Yao, China’s Monetary Policy Update: Stronger and More Targeted to Reinforce Recovery, EAI COMMENTARY, No.55 13 July 2022

[8]. Xiang Yan, Measurement and Comparison of China’s Tax Burden in a Global Perspective(2018), 11-12. Retrieved from:https://img3.gelonghui.com/pdf201811/pdf20181114152414792.pdf

[9]. Inequality of income distribution based on the Gini coefficient in China from 2012 to 2022. Retrieved from https://www.statista.com/statistics/250400/inequality-of-income-distribution-in-china-based-on-the-gini-index/

Cite this article

Zhou,L. (2025). A Study on the Effectiveness of Monetary Policy in China During 2020-2023. Advances in Economics, Management and Political Sciences,154,132-137.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. China’s GDP Growth Rates (2019-2023). Retrieved from: https://data.stats.gov.cn/easyquery.htm?cn=C01

[2]. China Reserve Requirement Ratio (1985 – 2024). Retrieved from: https://www.ceicdata.com/zh-hans/indicator/china/reserve-requirement-ratio

[3]. China Inflation Rate 1960-2024 Retrieved from: https://www.macrotrends.net/global-metrics/countries/CHN/china/inflation-rate-cpi

[4]. China Reserve Requirement Ratio(1985 – 2024) Retrieved from: https://www.ceicdata.com/en/indicator/china/reserve-requirement-ratio

[5]. Tao Zha, The Challenging Transition from Investment- to Consumption-Led Growth in China(2024), 24-26, The Reporter, No.2.

[6]. China Construction Bank Financial Report. http://www.ccb.com/cn/investor/report/annual_report_1.html Agricultural Bank of China Financial Report. Retrieved from https://www.abchina.com/cn/AboutABC/investor_relations/report/am/Industrial and Commercial Bank of China Financial Report. Retrieved from https://www.icbc-ltd.com/column/1438058343653851145.html

[7]. LI Yao, China’s Monetary Policy Update: Stronger and More Targeted to Reinforce Recovery, EAI COMMENTARY, No.55 13 July 2022

[8]. Xiang Yan, Measurement and Comparison of China’s Tax Burden in a Global Perspective(2018), 11-12. Retrieved from:https://img3.gelonghui.com/pdf201811/pdf20181114152414792.pdf

[9]. Inequality of income distribution based on the Gini coefficient in China from 2012 to 2022. Retrieved from https://www.statista.com/statistics/250400/inequality-of-income-distribution-in-china-based-on-the-gini-index/