1.Introduction

Against the backdrop of global economic integration, the food market, as an essential part of the global economic system, plays a crucial role in the long-term healthy development of national economies. In recent years, the global food market has faced numerous challenges, including geopolitical conflicts, the rise of trade protectionism, and fluctuations in global monetary policies, all of which have posed significant threats to the stability of food supply, trade, and prices [1]. This study aims to delve into the fundamental operational characteristics and major trade trends of the global food market, providing a scientific basis and decision-making support to address current food security challenges. First, this paper analyzes the fluctuations in global food supply, demand, and price, revealing the basic characteristics of rising supply volatility, steady demand growth, and food prices that initially increase before declining. Then, by examining the total volume of global food trade, export concentration, and the importance of major international grain merchants in trade, the paper identifies the main trends in food trade. On this basis, the paper further explores how factors such as geopolitical conflicts, trade protectionism, and global monetary policy affect food market security, and offers corresponding policy recommendations. This research holds both practical and theoretical significance. On one hand, an in-depth study of the operational characteristics and trade trends of the global food market helps governments and enterprises better understand market dynamics, allowing them to formulate scientific and reasonable food production and trade strategies to safeguard national food security. On the other hand, the policy suggestions provided in this paper offer valuable insights for improving global food governance systems and promoting the healthy development of the food market.

2.Global Food Supply and Demand Structure

2.1.Rising Supply Volatility

The unprecedented global changes over the past century, coupled with the pandemic of the century, have been further exacerbated by the outbreak of geopolitical conflicts, leading to greater global instability. The importance of large-scale grain merchants in global food market trade continues to grow. At present, global food security remains a serious concern, with issues such as supply and demand instability and rising price volatility becoming increasingly prominent. Overall, the international food market currently exhibits the following main characteristics:

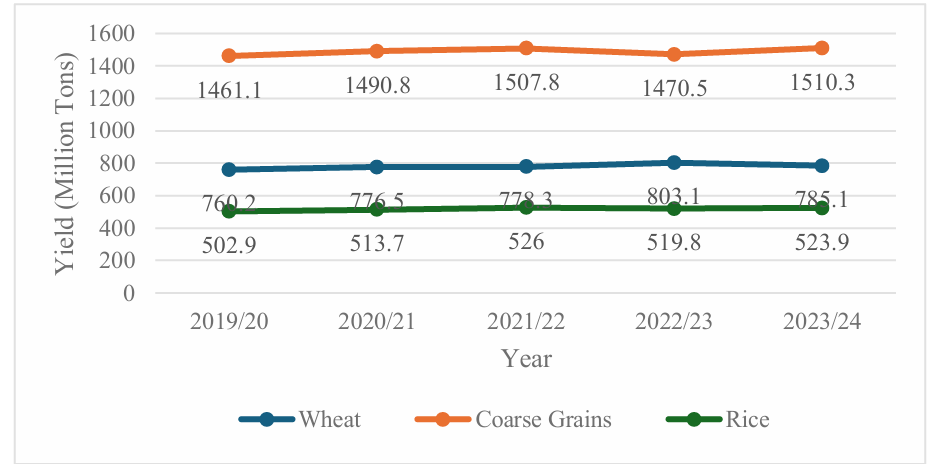

Due to a variety of factors, the global food market shows some volatility, but the total supply continues to increase. Taking major food crops such as wheat, coarse grains, and rice as examples: according to the Food and Agriculture Organization of the United Nations (FAO), wheat, coarse grains, and rice production in 2022/23 reached 803.1 million tons, 1,470.5 million tons, and 519.8 million tons, respectively. Compared to the 2021/22 data, the five-year average annual growth rates for these three major food crops were 1.88% (wheat), 0.02% (coarse grains), and 1.12% (rice). While wheat production increased by 24.8 million tons (+3.19%), the production of coarse grains and rice slightly decreased by 37.3 million tons (-2.47%) and 6.2 million tons (-1.18%) respectively (see Figure 1). According to FAO’s forecast for future food production, the output of rice and coarse grains is expected to rise in 2023/24, with rice production increasing by 0.4 million tons (+0.08%) and coarse grain production rising by 17.3 million tons (+1.12%). However, wheat production may experience a slight decline of 18.0 million tons (-2.24%). The changes in the supply trends of these food crops may be related to improvements in global cultivation levels, such as the promotion of superior varieties and advances in planting techniques. In conclusion, in the long term, the global supply of major food crops may continue to exhibit a trend of volatile growth, reflecting the improvement of global agricultural production levels and the positive impact of agricultural policies, which help alleviate the supply-demand gap.

Source: FAO, Global Food Outlook Report, November 2021-2023

Figure 1: Production of Major Global Food Crops (2019-2024).

2.2.Steady Growth in Demand

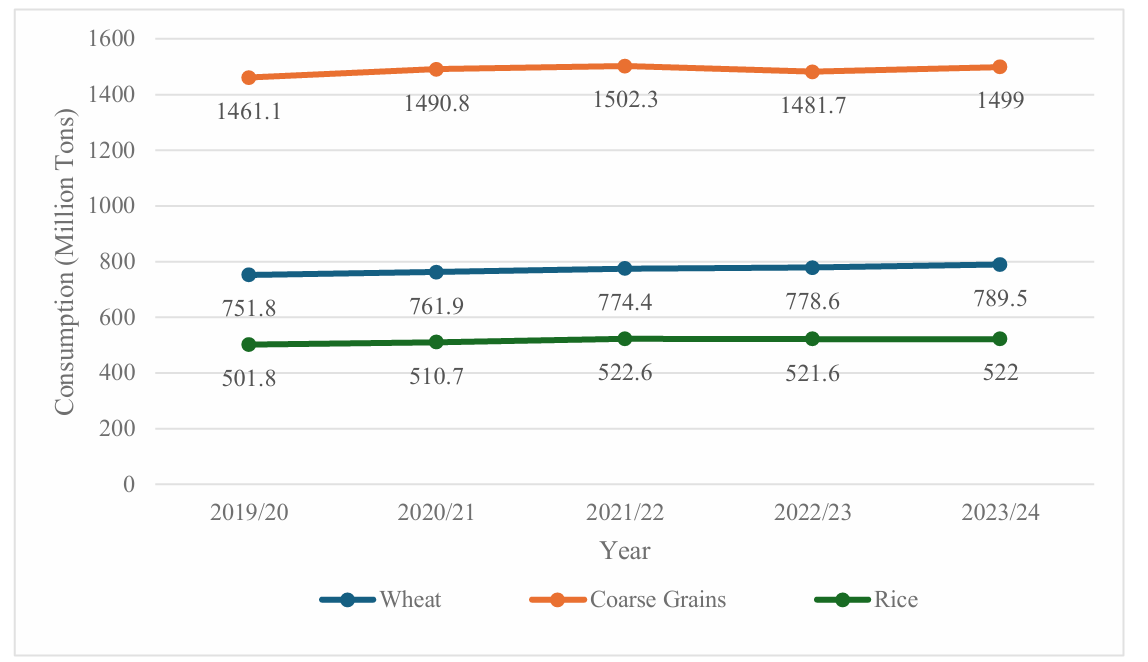

Driven by factors such as population growth, changes in consumption patterns, and urbanization, global food consumption has exhibited stable growth in recent years. Taking the consumption of wheat, coarse grains, and rice over the past five years as an example, their consumption in 2022/23 reached 778.6 million tons, 1,481.7 million tons, and 521.6 million tons, respectively, with an average annual growth rate of 1.19%, 0.47%, and 1.32%. According to the United Nations Food and Agriculture Organization’s (FAO) forecast, the consumption of these three staple crops is expected to increase by 1.40%, 1.17%, and 0.08% in 2023/24 (see Figure 2).

Overall, the consumption of major global food crops has maintained a relatively stable growth trend over the past five years. This growth is closely related to the transformation of economic structures and the upgrading of consumption patterns, which have indirectly increased food demand. People are increasingly inclined toward higher-quality, more nutritious food, including greater consumption of meat, dairy products, and other processed foods. The production of these foods often requires a large amount of raw grains such as wheat and rice, thus driving up food demand [2]. Additionally, improvements in dietary habits have contributed to the rise in consumption. For instance, coarse grains, known for their high dietary fiber and rich nutrient content, are gradually gaining popularity among consumers. Meanwhile, the demand for wheat and rice for industrial use (e.g., brewing, food processing) is also growing, further diversifying the wheat and rice markets.

Source: FAO, Global Food Outlook Reports (November 2021-2023)

Figure 2: Global Major Food Consumption Trends (2019-2024).

2.3.Food Prices: A Rise Followed by a Decline

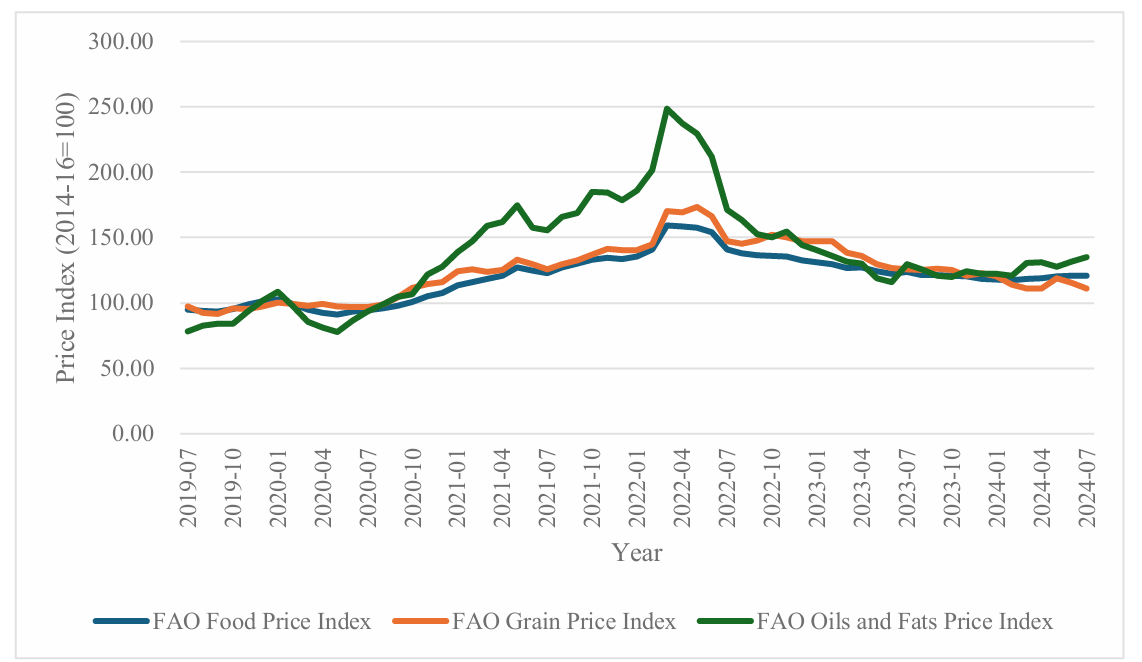

Over the past five years, global food prices have experienced significant fluctuations due to factors such as the COVID-19 pandemic, geopolitical conflicts, and government macroeconomic interventions.

Looking at the period from 2019 to 2022, prices followed an upward trajectory. According to FAO statistics, the FAO Food Price Index rose from 95.1 in July 2019 to a peak of 159.3 in March 2022, representing an increase of 67.5%. The FAO Cereal Price Index increased from 97.3 in July 2019 to a peak of 173.4 in May 2022, a growth of 78.2% [3]. On an individual commodity basis, most food crops reached record-high prices in 2022. For example, the Chicago Board of Trade (CBOT) futures prices for wheat, corn, and soybeans hit historic highs between April and June 2022, reaching 1,223.93 cents/60 pounds, 814.50 cents/bushel, and 1,770.00 cents/bushel, respectively (Source: EDB Economic Data). This sharp rise in food prices, affecting multiple crop categories, was mainly driven by disruptions to global food supply chains caused by the pandemic, including import and export restrictions that led to supply chain interruptions.

However, starting in April-May 2022, food prices began to decline to some extent, though they remained at relatively high levels overall. The FAO Food Price Index fell to 120.8 in July 2024, a decrease of 24.2% compared to the peak in March 2022, but still up by 27.0% compared to the same period five years earlier. The FAO Cereal Price Index dropped to 110.8 in July 2024, down 36.1% from its peak, but still 13.9% higher than in July 2019. This price drop was primarily due to the easing or removal of import and export restrictions following the pandemic and an increase in market supply. For instance, in the first half of 2023, the Black Sea Grain Initiative was extended through July, reducing uncertainty around Ukrainian grain exports, which led to increased supply and downward pressure on food prices [4].

Source: Wind Information

Figure 3: Changes in Global Major Food Price Indices (2019-2024)

3.Global Trends in Grain Trade Development

As populations grow and resources are unevenly distributed, the importance of global grain trade is becoming increasingly prominent. It is not only a vital link for economic cooperation between countries but also key to ensuring global food security. In the context of advancing economic globalization, the smoothness of grain trade directly impacts the long-term stability of a country’s economic and social development. Currently, the development of global grain trade exhibits the following characteristics:

3.1.Trade Volume Continues to Increase

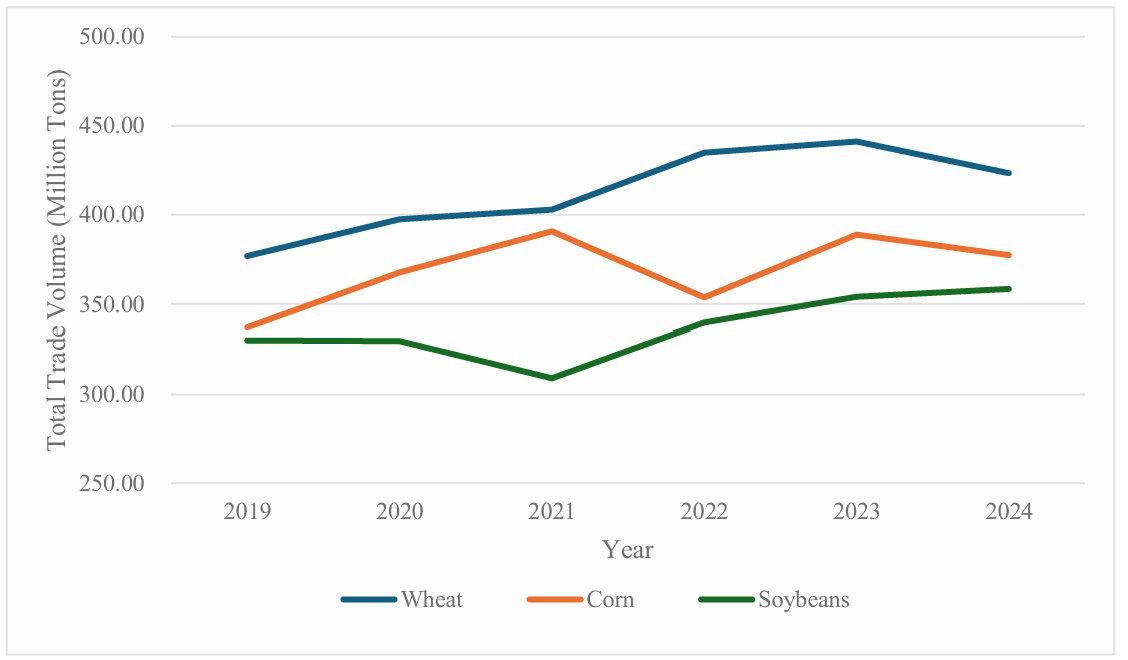

Driven by the increasing global demand for grain and its uneven production distribution, the total volume of global grain trade shows a continuous upward trend. Taking wheat, corn, and soybeans as examples, according to statistics from the United States Department of Agriculture (USDA) (see Figure 4), the production of these three grains has generally exhibited a fluctuating upward trend from 2019 to 2024. Specifically, the global trade volume of wheat increased from 376.94 million tons in 2019 to 423.26 million tons in 2024, with an average annual growth rate of 2.46%. The global trade volume of corn rose from 337.08 million tons to 377.32 million tons, with an average annual growth rate of 2.39%. Meanwhile, the global trade volume of soybeans increased from 330.02 million tons to 358.50 million tons, with an average annual growth rate of 1.73%. This expansion in the scale of grain trade is evident.

The continuous rise in global grain trade volume is mainly associated with factors such as population growth, income growth driving changes in food demand, and adjustments to international trade policies. Population and income growth have, to some extent, increased grain demand, while adjustments to international trade policies and tariff reductions have provided broader and more convenient conditions for grain trade.

Source: Wind Information

Figure 4: Global Trade Volume of Wheat, Corn, and Soybeans (2019-2024)

3.2.Export Concentration May Continue to Increase

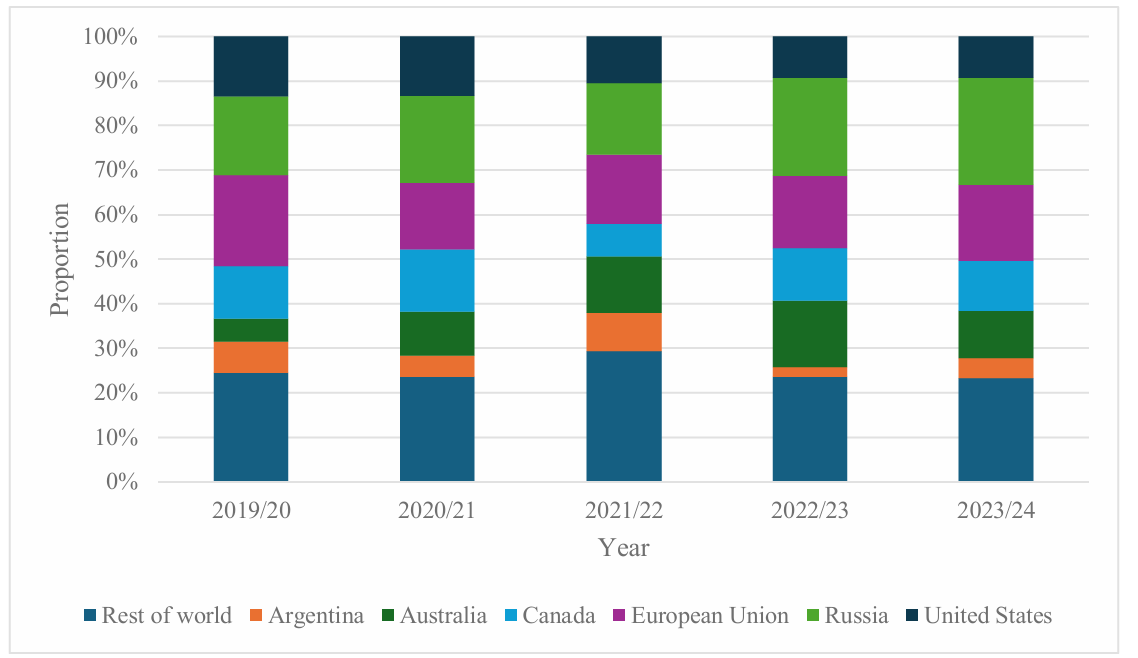

Due to rising international market demand and disparities in resource endowments between countries, the concentration of grain exports tends to rise. Taking wheat exports as an example, the global wheat export market shows a certain degree of concentration. According to statistics from the USDA (see Figure 5), in 2023/24, the world’s major wheat-exporting countries were Russia (23.91%), the European Union (17.12%), Canada (11.25%), Australia (10.55%), the United States (9.38%), and Argentina (4.45%), collectively accounting for 76.67% of global exports, up by 1.13% compared to 2019/20. In contrast, the concentration of wheat imports has remained relatively stable: the major wheat-importing countries globally are Indonesia, China, and Egypt, each accounting for around 5%. Given the current high concentration of major grain exports, the functioning of the global grain market may increasingly depend on the supply-demand dynamics of the primary grain-trading countries.

Source: USDA

Figure 5: Major Global Wheat Exporting Countries and Their Market Shares (2019-2024).

Table 1: Characteristics of Supply and Demand Distribution for Major Global Grains.

|

Major Suppliers |

Major Demanders |

Major Importers |

Major Exporters |

|

|

Wheat |

China (17%), EU (17%), India (13%) |

China (19%), EU (13%), India (13%) |

Africa, Middle East, Southeast Asia |

Russia (20%), EU (16%), U.S. (12%), Ukraine (10%) |

|

Corn |

U.S. (32%), China (23%), Brazil (10%) |

U.S. (26%), China (25%), Japan (4%) |

China (16%), other countries each below 10% |

U.S. (32%), Brazil (21%), Ukraine (15%) |

|

Soybeans |

Brazil (37%), U.S. (31%), Argentina (13%) |

China (30%), U.S. (17%), Brazil (13%) |

China (60%), other countries each below 10% |

Brazil (54%), U.S. (33%) |

Source: Zhang Bin, Characteristics, Potential Impact, and Policy Implications of the Global Grain Market [1]

3.3.Increasing Prominence of International Agribusinesses in Global Grain Trade

As the phenomenon of globalization in grain trade has intensified, multinational agribusinesses have increasingly dominated the global grain trade. According to the research by He Wensi and Tang Zhaohan, the four major grain companies, referred to as “ABCD” (ADM, Bunge, Cargill, and Louis Dreyfus), controlled nearly 80% of the global grain trade at their peak and still controlled more than 60% of global grain trade in 2023 [5]. Against the backdrop of extreme fluctuations in the commodity market in 2023, ADM, Bunge, Cargill, and Louis Dreyfus demonstrated strong resilience, with revenues of $94 billion, $59.5 billion, $177 billion, and $50.6 billion, respectively. Cargill achieved record-high revenues, underscoring its leadership in the industry and adaptability to market conditions. These companies hold significant monopolistic advantages in the global grain market, greatly influencing market trends.

In addition to the grain trading sector, international agribusinesses have extended their reach across the entire value chain, from production, processing, storage, to logistics. Their business operations encompass global markets for food, feed, biofuels, nutrition and health products, industrial goods, and agricultural consulting. For instance, Bunge has revolutionized the traditional logistics process of agricultural products by developing digital tools such as Vector, which optimizes transportation time and digitizes control over the logistics process, thereby improving transportation efficiency. Louis Dreyfus has leveraged financial digital platforms to connect with farmers in California for contract farming or general purchase financing, fostering close partnerships with Californian farmers. This illustrates how international agribusinesses not only control products but also exert control over services throughout the value chain [6].

4.Major Challenges for the Sustainable Development of the Global Grain Market

As global grain trade continues to expand and grain exports become increasingly concentrated, ensuring food security has become more crucial than ever, given its importance to human survival and development. In recent years, several challenges have emerged in global food security, including geopolitical conflicts, trade protectionism, and rising inflation, which have posed real threats to food security, particularly in the following aspects:

4.1.Geopolitical Conflicts Disrupt the Stability of Grain Supply

Geopolitical conflicts have deeply affected global food security, causing disruptions in supply chains and significant fluctuations in food prices. Since February 2022, the conflict between Russia and Ukraine—both major grain producers and exporters—has persisted, with far-reaching impacts on global food security. Agricultural production in Ukraine and exports from both Russia and Ukraine, two of the world’s largest grain-producing nations, were forced to halt. Amid high international food and agricultural input prices, global food insecurity worsened. According to the latest report from Reuters, officials from the United Nations Food and Agriculture Organization (FAO) highlighted at a meeting in Geneva that Ukraine currently has approximately 25 million tons of grain with export potential, yet due to a lack of domestic infrastructure and port blockades caused by the conflict, these grain resources cannot flow smoothly into international markets [7]. Additionally, the Russia-Ukraine conflict has driven up oil prices, increasing the cost of marine fuel and shipping fees, further escalating the cost of international grain transportation. Disruptions to the supply chain have hindered the normal flow of grain trade, thereby threatening global food security.

At the price level, geopolitical conflicts have exacerbated volatility in food prices. As major grain producers, the conflict between Russia and Ukraine has reduced the global volume of tradeable grain, driving prices upward. For example, after the onset of the Russia-Ukraine conflict on February 24, 2022, until June 1, 2022, the prices of wheat and corn futures contracts on the Chicago Board of Trade (CBOT) rose by 11.41% and 5.94%, respectively, while soybean, soybean meal, soybean oil, rice, and palm oil prices increased by 2.19%, -11.23%, 8.53%, 11.15%, and 5.38%, respectively. A significant portion of these price hikes can be attributed to the uncertainty brought about by the Russia-Ukraine conflict, which caused fluctuations and increases in food prices, further threatening global food security.

4.2.The Prevalence of Trade Protectionism Disrupts the Stability of Grain Market Trade

In recent years, affected by the pandemic and regional geopolitical conflicts, countries have enacted trade policies in response to market complexity and uncertainty, with export restriction policies being the most common. Since 2022, the global agricultural trade landscape has undergone significant changes. Kazakhstan and Vietnam led the way by imposing grain export bans, sparking a chain reaction, as more than a dozen countries followed suit, implementing various degrees of restrictions on grain exports [1]. Particularly notable was the exacerbation of this trend following the outbreak of the Russia-Ukraine conflict, prompting over 20 additional countries to impose export restrictions. By the end of 2023, a total of 40 countries had officially announced 94 export ban measures targeting agricultural products, with a focus on key grains and oilseeds.

Under these circumstances, the agricultural trade policies adopted by various governments tend to exhibit an “inward-oriented” adjustment, where they increase agricultural imports to meet domestic demand while strictly limiting or prohibiting the export of agricultural products to ensure domestic market stability. Although these policy choices reflect the importance placed on food security and self-preservation by individual countries, their global impact cannot be ignored. These measures have exacerbated tensions in the global food market, pushed up food prices, and posed new challenges to international food security.

4.3.Fluctuations in Global Monetary Policy Impact the Stability of Food Market Prices

In the long run, changes in monetary policy can influence the volatility of food prices, thereby affecting global food security. For instance, during the pandemic, to quickly restore the economy, central banks around the world initiated interest rate cuts. The U.S. Federal Reserve maintained a long-term loose monetary policy during the pandemic, which increased market liquidity, significantly driving up inflation and accelerating the rise of international food prices [8]. By 2022, global inflation reached a historical high, prompting countries to adopt tightening monetary policies. Major central banks, led by the Federal Reserve, started raising interest rates beyond expectations, resulting in tighter monetary liquidity. This caused a downturn in food prices, increasing price volatility and threatening global food security.

5.Policy Recommendations for Maintaining Global Food Market Stability

In response to the various issues and challenges facing global food security, this paper offers the following policy recommendations to better maintain the stability of the global food market.

5.1.Strengthening Government Macro-Control

Strengthening government macro-control plays a fundamental role in maintaining food market security and stability. It is not only crucial but also an important means to achieve sustainable development in the food industry. First, to effectively respond to fluctuations in both global and domestic food markets, it is urgent to establish a comprehensive and efficient food market monitoring and early warning system. This system aims to collect and analyze supply and demand information, price trends, and potential risk factors in real time, providing timely and scientific data for government decision-making. Second, governments should flexibly implement food storage and procurement policies to effectively regulate supply and demand in the market and stabilize food prices. For example, in years of bountiful harvests, increasing government procurement can help farmers avoid economic losses due to oversupply (“low prices hurt farmers”). Third, optimizing the food distribution system and promoting secure and stable food market transportation is essential. Investment in food distribution infrastructure should be increased to improve the efficiency and service levels of key sectors such as storage and logistics.

5.2.Improving Financial Services and Support

On the global stage of food trade, financial services and support play an indispensable role. First, under government guidance, financial institutions should be encouraged to offer customized financial products for food production, processing, and trading enterprises, such as supply chain financing and food price insurance, to alleviate financial pressures and enhance their ability to withstand market fluctuations. Second, promoting the application of financial technology in food trade, utilizing technologies such as blockchain and big data to enhance trade transparency and reduce transaction costs, is also a crucial pathway to ensuring global food security. Third, developing diversified financing channels for food trade and encouraging private capital investment in the food industry can create a framework for food security that involves participation from governments, enterprises, and financial institutions.

5.3.Cultivating Globally Competitive Large Food Traders

Against the backdrop of global food security, internationally influential large food trading groups are playing an increasingly critical role. First, an improved food reserve and emergency response system can help large food traders cope with market fluctuations and global risks. It is recommended to encourage large food traders and their partners to establish commercial reserves to deal with short-term market fluctuations. Second, research and innovation are the fundamental drivers of enhancing food production efficiency and product quality. Therefore, encouraging large food traders to increase research and development investment, focusing on the development and promotion of new food varieties, technologies, and processes, is an important measure to ensure food security and promote sustainable agricultural development.

5.4.Strengthening International Coordination of Food Regulatory Policies

In the process of building a global food security system, deepening multilateral cooperation mechanisms has become a crucial strategy. Specifically, first, enhancing the coordination among major international institutions such as the United Nations Food and Agriculture Organization (FAO), the World Food Programme (WFP), and the International Fund for Agricultural Development (IFAD) to jointly formulate and implement a more comprehensive and coordinated global food security strategy. Second, establishing a global food security emergency coordination mechanism under the framework of the United Nations to respond promptly to geopolitical conflicts and other emergencies, ensuring the continuity and stability of the food supply chain. Third, optimizing the food trade environment, with a recommendation to promote the establishment of a more just, transparent, and highly predictable set of global food trade rules aimed at eliminating or significantly reducing non-tariff barriers and other restrictive measures in food trade, ensuring the free and smooth flow of food on a global scale.

6.Conclusion

Overall, the operation of the global food market is characterized by fluctuations in supply, steady growth in demand and a trend of rising and then falling food prices. From the perspective of trade trends, the total volume of global food trade continues to rise, and the concentration of exports or continue to rise, and the important position of international grain merchants is becoming more prominent. With this trend, ensuring food security is more important than ever. However, in recent years, global food trade has also seen problems such as geopolitical conflicts, trade protectionism and fluctuations in global monetary policy. To conclude, the government should strengthen the macro-control of the global food market, strengthen the financial support for food trade, and actively cultivate international competitive international grain merchants, as well as strengthen the international coordination and cooperation of national food regulatory policies, so as to better cope with the challenges of international food trade in recent years.

References

[1]. Zhang, B. (2023). Characteristics of the operation of the global food market, potential impacts, and policy implications. Price: Theory & Practice, (1), 36–40.

[2]. Gouel, C., & Guimbard, H. (2019). Nutrition transition and the structure of global food demand. American Journal of Agricultural Economics, 101(2), 383–403.

[3]. Zhu, C., Qu, C., Wang, Y., & others. (2022). The new round of international food price increase: Causes and impact on the Chinese market. China Agricultural Resources and Regional Planning, 43(3), 69–80.

[4]. Lin, X., & Li, X. (2024). Review of international food prices in 2023 and outlook for 2024. China National Conditions and Power, (3), 17–20.

[5]. He, W., & Tang, Z. (2023). International experience and lessons from financial support for building global grain merchants. The Banker, (10), 106–109.

[6]. Deng, S., Wang, Z., Zhao, B., & Li, B. (2024). From product control to service control: Practices, experiences, and lessons of international agricultural service provision by the big four grain merchants from a digital perspective. World Agriculture, (8), 53–65.

[7]. Zhong, Y., Chen, X., & Cui, Q. (2022). The impact of the Russia-Ukraine conflict on global food security. World Agriculture, (10), 18–27.

[8]. Zhang, X. (2022). Global market volatility and its impact on food security: A study of the international food market and its impact on China since 2020. Price: Theory & Practice, (10), 37–41.

Cite this article

Xu,X. (2025). Research on the Characteristics of Global Food Market Operations and Trade Trends. Advances in Economics, Management and Political Sciences,159,1-10.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 4th International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Zhang, B. (2023). Characteristics of the operation of the global food market, potential impacts, and policy implications. Price: Theory & Practice, (1), 36–40.

[2]. Gouel, C., & Guimbard, H. (2019). Nutrition transition and the structure of global food demand. American Journal of Agricultural Economics, 101(2), 383–403.

[3]. Zhu, C., Qu, C., Wang, Y., & others. (2022). The new round of international food price increase: Causes and impact on the Chinese market. China Agricultural Resources and Regional Planning, 43(3), 69–80.

[4]. Lin, X., & Li, X. (2024). Review of international food prices in 2023 and outlook for 2024. China National Conditions and Power, (3), 17–20.

[5]. He, W., & Tang, Z. (2023). International experience and lessons from financial support for building global grain merchants. The Banker, (10), 106–109.

[6]. Deng, S., Wang, Z., Zhao, B., & Li, B. (2024). From product control to service control: Practices, experiences, and lessons of international agricultural service provision by the big four grain merchants from a digital perspective. World Agriculture, (8), 53–65.

[7]. Zhong, Y., Chen, X., & Cui, Q. (2022). The impact of the Russia-Ukraine conflict on global food security. World Agriculture, (10), 18–27.

[8]. Zhang, X. (2022). Global market volatility and its impact on food security: A study of the international food market and its impact on China since 2020. Price: Theory & Practice, (10), 37–41.