1.Introduction

In the global food industry and trade, grain merchants play a crucial role. Faced with the complexities of the international food market and the monopolistic position of transnational grain merchants, countries are actively seeking to cultivate their own international grain giants to safeguard national food security. This not only helps countries better grasp market dynamics and trends in the global food trade, providing robust support for formulating food policies and strategies, but also promotes diversification of food supply sources. By reducing reliance on single-source imports, countries can mitigate risks, enhance the stability of food supply chains, and bolster food security. Furthermore, as economic globalization progresses, transnational operations have become an essential development trend for enterprises. For grain enterprises to establish themselves in the international market, they must actively engage in global operations and enhance their international competitiveness [1]. By collaborating with and learning from advanced international enterprises, grain companies can introduce cutting-edge production technologies and management practices, driving industry upgrades and technological innovation. This approach improves the overall standard and competitiveness of the grain sector. However, in terms of financial support, existing tools and practices for most international grain merchants are relatively insufficient and incomplete, requiring further refinement. Current attempts in financial support have largely focused on the "ABCD" grain giants (ADM, Bunge, Cargill, and Louis Dreyfus), which at their peak controlled approximately 80% of global grain trade and maintained a rapid pace of global expansion. Unfortunately, these practices have not been extended to benefit a wider range of grain merchants [2]. Building on the experiences of international grain merchants, this paper explores viable financial support mechanisms tailored to the international development of grain merchants. Specifically, it proposes incremental innovations in financial support paths to empower the internationalization of grain merchants.

2.Key Characteristics of the Internationalization of Grain Merchants

2.1.Vertical Integration in Full-Industry Chain Operations

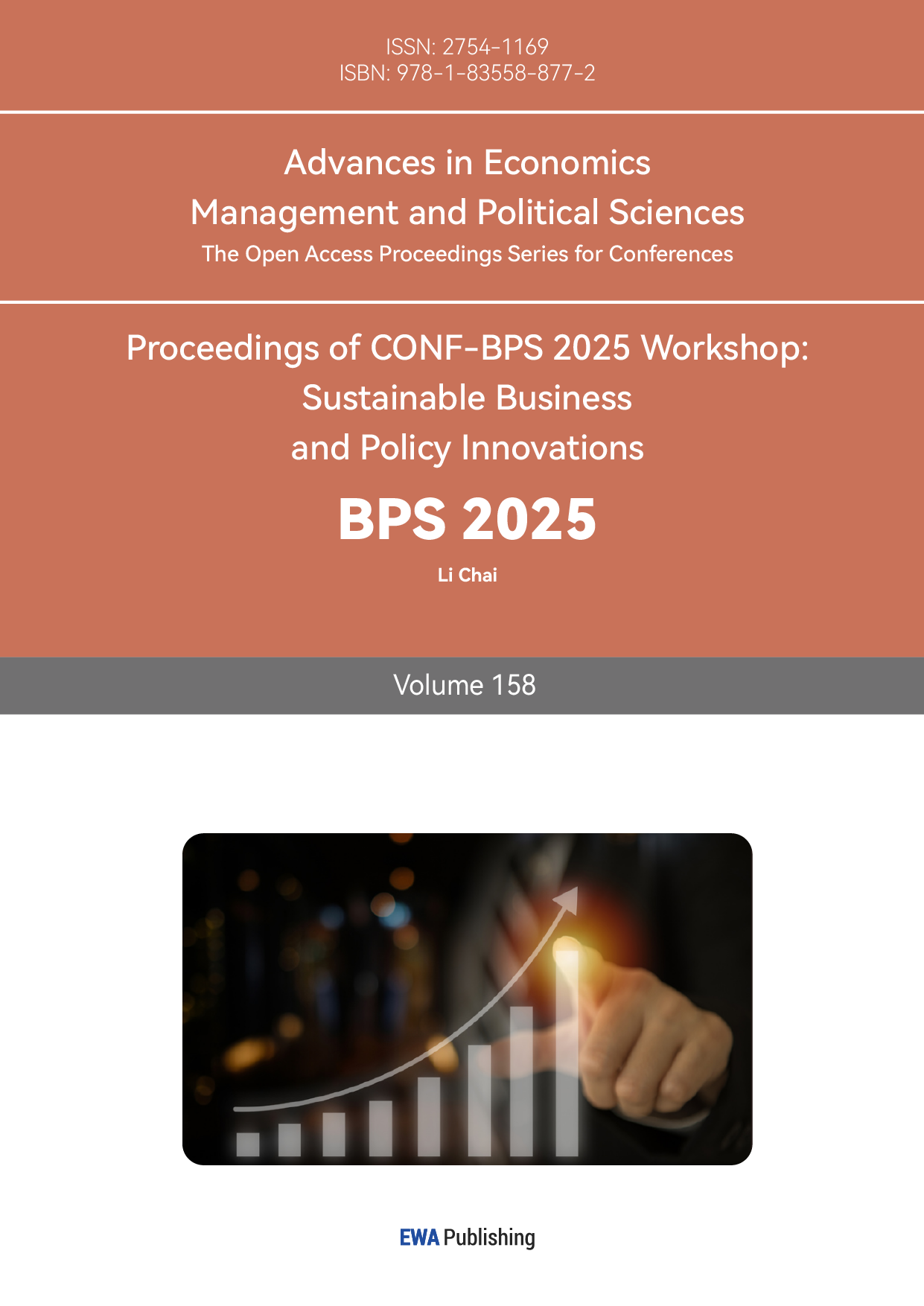

Full-industry chain operations in the grain sector are characterized by integrating production, procurement, storage, processing, and sales under a unified framework. This market-driven approach extends and expands business activities, ensuring coordinated development across various segments of the value chain, including raw material production, crop processing and distribution, and international product trade. It emphasizes achieving high-quality and efficient growth (see Figure 1). For example, ADM, one of the first international grain merchants to adopt a full-industry chain strategy, initially focused on a single product processing field. Through advanced technical means, the company established a cost advantage in processing economic crops, forming a strong competitive foundation. Subsequently, ADM systematically expanded its operations across the value chain, integrating upstream and downstream industries and engaging in critical activities such as production, distribution, and consumption. In addition, ADM established close ties with external international suppliers, traders, and processors. As product offerings expanded, ADM extended its vertical integration model to other agricultural businesses, enabling all business lines to fully leverage the opportunities and benefits arising from corporate growth. This approach not only consolidated its existing advantages and enhanced competitiveness in new markets but also continuously improved its profitability and market share [3].

Figure 1: "Full-Industry Chain" Operating Strategy of International Grain Merchants

Source: Compiled by the author.

2.2.Horizontal Diversification Strategy

Horizontal diversification focuses on expanding operations within the same or related industries by acquiring, merging with, or gaining equity control of other entities. This approach increases the variety of products or services offered, enabling business diversification and market expansion. It emphasizes economies of scale and cost reductions to enhance profitability [4].

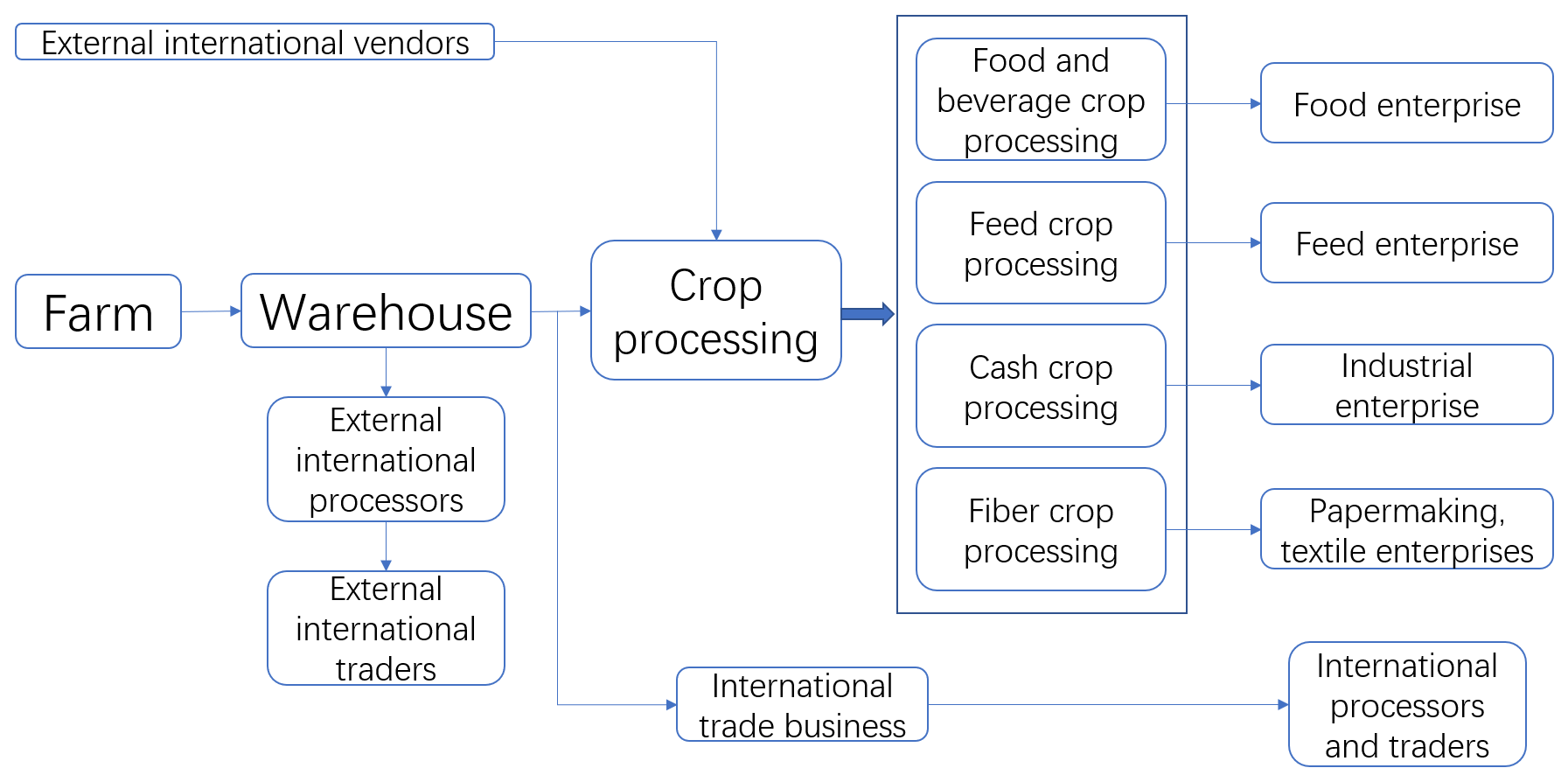

For instance, the "ABCD" quartet of global grain merchants (ADM, Bunge, Cargill, and Louis Dreyfus) collectively executed over 100 strategic mergers and acquisitions in the past decade, including more than 50 acquisition deals (see Figure 2). ADM concentrated on acquisitions in food ingredients and health-related sectors, solidifying its leadership position. Cargill significantly boosted its market influence through extensive acquisitions in grain processing and pet food sectors. Bunge, on the other hand, strengthened its dominance in fertilizers, agriculture, food processing, and edible oils through continuous acquisitions in regions such as Brazil and Europe.

Figure 2: Number of Acquisitions by the "ABCD" Grain Merchants (2014–2024)

Source: https://tracxn.com;Note: Bunge data is excluded due to lack of availability.

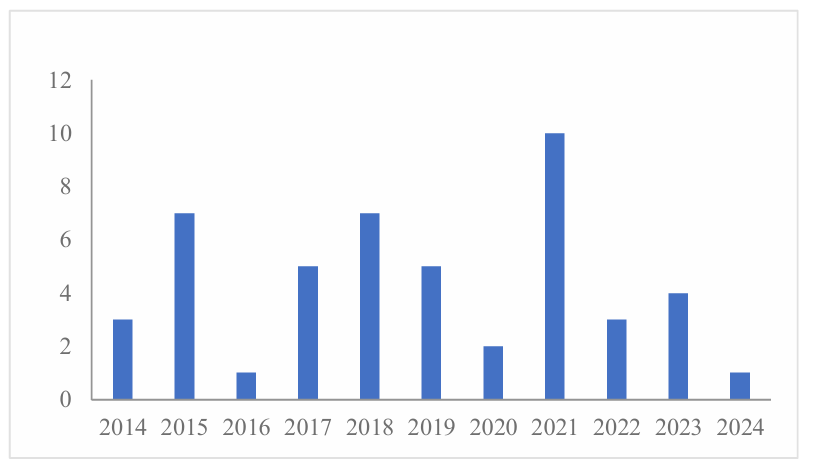

2.3.Digital Transformation Strategy

The global agricultural trade industry is undergoing a digital transformation, with international grain merchants leveraging advanced technologies to upgrade and modernize their operations. For example, Cargill introduced the Ag Digital Platform (Cargill Ag Platform), enabling comprehensive digital integration of services for farmers (see Figure 3). Farmers can use the platform via CargillAg.com to access digital services across various stages of agricultural production and sales. By implementing digital transformation, international grain merchants such as Cargill can integrate services across the grain production chain, financial services, and post-production sales. This integration enhances operational efficiency and service delivery [5-6]. Currently, the technology is continuously improving, with the potential to expand into a global platform offering integrated services in grain production, logistics, and processing trade for more countries and regions in the future.

Figure 3: Digital Service Workflow of Cargill

Source: Compiled by the author.

2.4.Commitment to Production-Research Integration

International grain merchants place significant emphasis on research and development (R&D) innovation to secure technological advantages and enhance core competitiveness. They implement global production-research integration strategies by establishing R&D facilities and production bases worldwide. This approach supports raw material production, processing, and product development while advancing their global strategies [4, 7]. Wilmar International serves as a prominent example of leveraging production-research integration to achieve rapid growth as a leading global grain merchant. In 2009, the company established its Global Research and Development Center in Shanghai with over 300 elite researchers. By 2018, Wilmar collaborated with the National University of Singapore to establish a joint research laboratory focusing on cutting-edge fields and accelerating the commercialization of innovations. These efforts have expanded the company’s global footprint and influence. Wilmar has continually expanded its production-research integration initiatives globally, resulting in a broad business scope (see Table 1). The company has successfully launched initiatives like advanced soybean processing, circular rice economies, and green processing of oil by-products, promoting the transformation of traditional agriculture toward precision and advanced processing. These initiatives have not only enhanced Wilmar’s market competitiveness but also contributed to the sustainable development of the global grain industry.

Table 1: Wilmar International’s Global Production-Research Integration Initiatives

|

Time |

Event |

|

2009 Nov |

Established Global R&D Center in Shanghai, China |

|

2010 Jun |

Established a fine chemical production base in Lianyungang, China |

|

2017 Apr |

Yihai (Jiamusi) Grain & Oil Industries Co., Ltd., a Wilmar subsidiary, designated by the National Development and Reform Commission as a "National Rice Processing Circular Economy Standardization Pilot" unit. |

|

2018 Jun |

Established a joint research laboratory with the National University of Singapore |

|

2021 Jul |

Launched the "Six-Step Fresh Rice Precision Control Technology," recognized by the China Cereals and Oils Association as exceeding international advanced standards |

Source: Official website of Wilmar International

3.Financial Support Demands for Grain Merchants' Globalized Operations

Under the backdrop of global economic integration, grain merchants are accelerating their global operations through transnational expansion and resource integration to secure advantageous positions in the international grain market. Financial support plays a pivotal role in facilitating their global strategies, testing both their economic strength and financial strategies, as well as their risk management capabilities.

3.1.Increased Demand for Mergers, Acquisitions, and Investments

Grain merchants engage in mergers and acquisitions (M&A) to integrate resources and leverage synergies, thereby forming internationally competitive large-scale grain enterprise groups. For instance, ADM partnered with Canada’s IMGS to establish a joint venture in Pakistan, focusing on the transportation and sale of grains, oilseeds, feed, and pulses. Similarly, Bunge collaborated with Pan Ocean, a subsidiary of South Korea’s Harim Group, to establish Export Grain Terminal in the United States. However, the M&A process involves various financial support demands: 1. Pre-M&A Financial Advisory Services: Grain merchants require financial institutions to provide professional services, such as due diligence, asset valuation, and transaction structuring. These services help assess the target company’s financial health, identify potential risks, and determine the true value of the transaction. 2. Tax Optimization During Cross-Border Transactions: Cross-border M&A entails substantial fund transfers across jurisdictions, often involving varying tax policies. Financial institutions must design tailored tax planning strategies aligned with the companies’ operational characteristics to ensure smooth transaction execution. 3. Post-M&A Integration Support: After completing the transaction, financial institutions are expected to assist with integration efforts, including financial management, human resource alignment, and business process optimization. This support enhances the efficiency and success rate of M&A integration, helping companies achieve their strategic goals effectively.

Table 2: Recent Strategic M&A Events by the "ABCD" Grain Merchants

|

Year |

Event |

|

2018 |

ADM: Acquired 50% equity in Russia’s Aston Foods and Food Ingredients' sweetener and starch businesses; acquired vanilla processor Rodelle. Bunge: Acquired Grupo Minsa’s U.S. corn milling business. Cargill: Acquired pet food producer Pro-Pet and Polish value-added food company Konspol. |

|

2019 |

ADM: Acquired Florida Chemical (citrus flavor production), Ziegler Group (German citrus flavor supplier), and Smet (Belgian chocolate decorations). |

|

2021 |

ADM: Acquired Sojaprotein (non-GMO soybean supplier), Deerland Probiotics & Enzymes, Aalst Chocolate Pte. Ltd. (Singapore), and Flavor Infusion International SA (Panama). Cargill: Acquired poultry processor Sanderson Farms via a joint venture with Continental Grain. |

|

2022 |

Cargill: Acquired Owensboro Grain Company, LLC (soybean processing and refining facilities). |

|

2023 |

ADM: Acquired Revela Foods (dairy flavor ingredients) and FDL (UK-based flavor systems producer). Bunge: Through its joint venture with IOI Corporation Berhad (Bunge Loders Croklaan), acquired a newly built port refinery from Fuji Oil New Orleans, LLC. |

Source: https://www.foodbusinessnews.net/

3.2.Accelerated Integration of Grain Merchants’ Cross-Border Industrial Chains and Rising Supply Chain Financing Needs

In the process of promoting the cross-border integration of industrial chains, international grain merchants face various financial support needs and challenges at different stages. In pstream Production Stage, activities such as seed procurement, the purchase of fertilizers and pesticides, and the acquisition of agricultural machinery and equipment require substantial capital investment. Additionally, to address unforeseen risks such as natural disasters, it is necessary to obtain agricultural insurance services provided by financial institutions. However, due to the high uncertainty of agricultural production and the long return cycles, financial institutions adopt a cautious approach to risk assessment for agricultural projects. This makes it significantly challenging for international grain merchants to secure financing during the upstream production stage. In Midstream Processing and Storage Stage, international grain merchants face high fixed asset investments and operational costs. Coupled with lengthy capital recovery cycles, this often leads to tight cash flow. In Downstream Logistics and Sales Stage, international grain merchants must ensure rapid cash flow to support the swift distribution and settlement of their products. This requires financial institutions to provide efficient payment and settlement services, along with financial products such as letters of credit and factoring, to reduce transaction costs and risks. However, in cross-border trade, the differences in payment and settlement systems across countries and regions create additional challenges for international grain merchants in the downstream logistics and sales stage.

3.3.Expansion of Cross-Border Grain Trade and Increased Demand for Trade Financing

Trade financing refers to the use of structured short-term financing tools by banks in commodity transactions—such as those involving crude oil, metals, and grains—based on assets like inventories, prepayments, and accounts receivable. In the process of obtaining trade financing, international grain merchants encounter a range of common financial support challenges: Firstly, compared to large international grain merchants, many small- and medium-sized grain merchants face inadequate financing capabilities. Their weak capital bases make it difficult for them to bear high financing costs, thereby limiting their ability to expand internationally. In addition to traditional bank loan channels, diversified financing methods, such as bond issuance and equity financing, are often constrained by factors such as market volatility and regulatory restrictions. This makes it difficult for grain merchants to obtain sufficient and stable funding support. Furthermore, grain merchants operating in a globalized environment urgently need long-term and stable funding to cope with the complexity and volatility of international trade. However, the current financing structure is overly reliant on short-term loans, which do not align with the actual business needs of grain merchants, exacerbating liquidity pressures. Some grain merchants also overly depend on a single financing tool, leading to a lack of flexibility in their financing strategies, making it harder to adapt effectively to market changes.

3.4.High Uncertainty in Offshore Operations and Elevated Requirements for Cross-Border Risk Management

In the international operations of grain merchants, the demand for cross-border risk management and the associated challenges are unavoidable. First, credit risk: In their global business activities, grain merchants need financial institutions to provide comprehensive credit evaluation services to accurately assess the creditworthiness of trading counterparts and reduce transaction risks. They may also require financial institutions to offer credit guarantees or insurance services. However, due to the complexities of international markets, both financial institutions and grain merchants often face difficulties in fully and accurately understanding the credit status of their trading partners, leading to potential inaccuracies in credit evaluations. Second, exchange rate risk: Exchange rate fluctuations represent a significant challenge that grain merchants must address in international operations. The instability of exchange rates can introduce uncertainties in settlement, financing, and cost control: Settlement: Exchange rate fluctuations may cause dramatic changes in the revenue and costs of grain merchants. Financing: Exchange rate risks can increase financing costs, complicating the allocation of funds. Cost Control: Volatility in exchange rates may increase uncertainties related to raw material and labor costs. To mitigate the impact of exchange rate fluctuations on their business, grain merchants need to closely monitor currency trends and adopt effective exchange rate risk management measures to reduce the adverse effects on their operations.

4.Financial Support Practices for Grain Merchants' Internationalization

4.1.Providing Capital for Cross-Border Mergers and Acquisitions to Support Corporate Restructuring

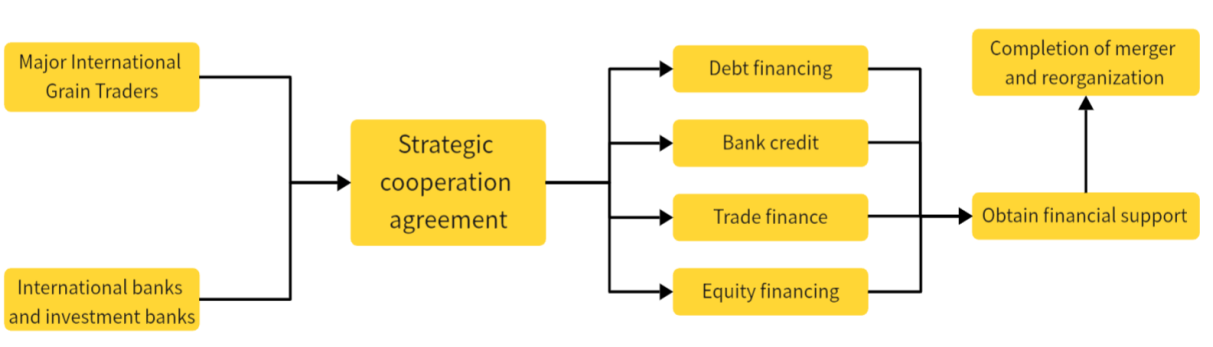

To address the massive demand for funds required for international grain merchants' extensive mergers and acquisitions (M&A) and cross-border trade, financial support has been significantly strengthened. In implementing strategies such as global business expansion, transnational M&A, and international agricultural trade, these large international grain enterprises face enormous funding requirements and diverse financial service needs [4]. Consequently, these enterprises are actively seeking collaboration opportunities with financial institutions to more effectively advance their M&A plans and foster cross-border business growth. Large international grain merchants often collaborate with top global banks and investment banks (e.g., BNP Paribas, Citibank, JPMorgan Chase) by signing strategic cooperation agreements. Through various funding channels, including debt financing, bank credit, trade financing, and equity financing, they secure financial support services on a global scale. These resources enable them to undertake mergers and reorganizations, enhance their resource integration capabilities, and expand their business operations (see Figure 4).

Figure 4: Financing Process for Cross-Border M&A and Restructuring by Large International Grain Merchants

Source: Compiled by the author.

4.2.Supply Chain Finance Empowering Enterprises in Integrated Industrial Chain Operations

In recent years, an increasing number of international grain merchants have focused on vertical industrial chain development strategies, exploring new online and offline supply chain finance models. The development of various stages in the industrial chain of international grain merchants—including production, storage, and logistics—requires strong financial support [8]. Banks and other financial institutions have established close collaborations with international grain merchants, integrating financial services into the entire business process of these merchants and developing innovative products and models for the upstream and downstream sectors of the industrial chain. For instance, Bunge Group partnered with major commercial banks to launch a supply chain finance solution centered on inventory collateral. This solution incorporates upstream cash flow into supply chain management, with banks providing financing to grain producers based on authentic transaction backgrounds. In downstream storage and logistics, Bunge leverages its large-scale origin-based storage systems and proprietary logistics network. With strong credit capabilities, it effectively integrates logistics, commercial flows, financial flows, and information flows to meet banks’ needs for real-time monitoring of physical assets and rapid response. This approach successfully attracts bank funding.

4.3.Innovation in Financial Instruments to Support Enterprises in Mitigating Transaction Risks

To reduce operational risks, international grain merchants widely employ diverse financial instruments to enhance risk management. These enterprises place great importance on risk control, leveraging financial tools to address challenges posed by fluctuations in agricultural product prices and trade, and continuously strengthening their ability to resist risks (see Table 3). For example, Bunge has developed a "futures-spot" integration model. On the spot side, Bunge controls key aspects such as production, storage, and logistics. On the futures side, it uses hedging strategies to mitigate risks, participates in hedging activities related to energy, foreign currency, and interest rates, and employs maritime futures to hedge ship fuel costs, thereby improving its comprehensive risk management system. Similarly, other companies, such as Louis Dreyfus and COFCO Group, enhance the flexibility of transactions through futures and options contracts while effectively managing risks.

Table 3: Risk Management by International Grain Merchants Using Financial Instruments

|

Instrument |

Function |

Application Example |

|

Futures Contracts |

Lock in future prices of commodities or financial assets by buying or selling futures contracts to avoid price volatility risks |

Louis Dreyfus uses futures trading to lock in profits and reduce risks. In its futures operations, Louis Dreyfus strictly follows the principle of "identical positions, opposite directions," conducting 100% hedging without considering market trends. |

|

Options Contracts |

Provide the holder with the right, but not the obligation, to buy or sell assets at a specific price at a future date, offering greater flexibility |

COFCO Futures' risk management subsidiary COFCO Trading designed a "structured cumulative off-market option" plan for sugar producers to customize risk solutions. |

|

Hedging Strategies |

Reduce risks by holding assets or contracts in opposite directions simultaneously |

Bunge uses hedging strategies in futures markets to mitigate risks and achieve flexible transitions between spot and futures markets. |

|

Hedging |

Lock in future prices through futures or options markets to protect spot business |

Bunge participates in hedging activities for energy, foreign currency, and interest rates, and uses maritime futures to hedge ship fuel costs. |

Source: Compiled by the author.

5.Innovative Pathways for Financial Support in the Internationalization of Grain Merchants

5.1.Optimizing the Financial Service Support System for Full Industrial Chain Operations

The core of building a global supply chain network for large international grain merchants lies in establishing long-term and stable cooperation with global farmers, growers, and suppliers. This network should cover major agricultural regions to ensure diversified procurement. Large grain enterprises should provide financial support, such as funding for agricultural input purchases and small agricultural loans, to sustain stable and continuous agricultural production. International grain merchant groups operate across the entire industrial chain, requiring the management of strategies and daily operations for their subsidiary companies. This involves financial demands related to orders, inventory, and financial reconciliation. Member companies often need to expand production lines or scale up operations, but many face difficulties in securing financing due to their small size or limited collateral assets. In such cases, supply chain finance becomes a crucial funding channel. In the future, the global grain industry is expected to trend toward greater industrialization and chain integration. Supporting international grain merchants in integrating industrial nodes and improving supply chain links—achieving an integrated layout from production, processing, and transportation to sales—will be vital for promoting the sustainable and healthy development of the industry. This will enhance the efficiency and competitiveness of the industrial chain while contributing to the stability and development of the global grain market. By building a robust global supply chain network, international grain merchants will be better equipped to tackle market challenges, ensure food security, and promote the sustainable development of global agriculture.

5.2.Strengthening Risk Management Capabilities in Multinational Operations of Grain Merchants

Risk management is the lifeline of international grain merchants, as they face two major types of risks: natural and market risks. Extreme weather events, such as droughts, floods, and hailstorms, not only threaten regional food security but may also trigger global grain market fluctuations. In terms of market risk, the globalization of agricultural product markets exposes international grain merchants to increasingly complex market environments and price volatility, making it imperative to enhance their ability to mitigate risks in multinational operations. First, strengthen the construction of cross-border agricultural infrastructure to improve the resilience of agricultural production against natural disasters. At the same time, develop international agricultural disaster insurance to provide comprehensive risk coverage for agricultural production. Second, utilize financial derivatives such as options and futures for risk management, reducing losses caused by price fluctuations. Promoting the internationalization of agricultural derivative financial markets can attract more international investors, enhance market liquidity and transparency, and help mitigate market risks.

5.3.Increasing Financial Support for Grain Merchants' R&D and Innovation

When expanding in global markets, grain merchants focus on R&D and industrial upgrading, aiming to enhance market share and customer loyalty through technological innovation. However, many grain merchants, especially in their early stages, face challenges such as difficulty accessing financing and high costs. Addressing these practical issues requires a focus on "storing grain in technology" and strengthening financial service support. 1. Targeted Financial Support for Agricultural Innovation: Precisely align financial services with the needs of grain-related technological innovators, particularly in critical areas such as seed production and agricultural machinery. By leveraging banks, securities, and insurance services, meet their funding demands, support agricultural machinery financial leasing, and use modern technology to improve management efficiency, thereby providing long-term and stable financial support for agricultural technological innovation. 2. Lifecycle Financial Services for Grain Science and Technology: Offer comprehensive financial services throughout the lifecycle of agricultural innovation. Deeply integrate innovation chains and industrial chains by providing differentiated financial services for agricultural technology and grain-related sectors. Support every stage, from R&D to the commercialization of outcomes, by innovating financial products to meet the diverse needs of enterprises at different stages. 3. Building a Multi-Level Financial Service System for Grain Science and Technology: Create a stable, continuous, and precise investment and financing ecosystem for the grain sector. Encourage capital to support innovative companies in the grain sector, establish a comprehensive financial service system, and leverage the advantages of capital markets. By channeling long-term funds to high-quality grain science and technology innovation enterprises, this approach enhances operational capabilities and promotes sustainable development.

6.Research Conclusion

In summary, the internationalization of grain merchants is primarily characterized by full industrial chain integration, horizontal diversification, digital transformation, and the integration of production and research. During the process of globalization, grain enterprises often face significant financial support demands in areas such as mergers and acquisitions, supply chain financing, trade financing, and cross-border risk management. From the practices of financial support for international grain merchants, it can be observed that these merchants tend to obtain cross-border M&A funding by signing cooperation agreements with global banks and investment banks. At the same time, they utilize supply chain financial systems to ensure financial support for every link of the industrial chain and comprehensively employ innovative financial tools to mitigate risks. Therefore, in advancing financial support for the internationalization of grain merchants, it is necessary to: 1. Optimize the financial service system for full industrial chain operations. 2. Strengthen the risk management capabilities of grain merchants in cross-border operations. 3. Increase financial support for the R&D and innovation activities of grain merchants. These measures will enable financial support to better cultivate and enhance the global competitiveness of international grain merchants.

References

[1]. Shi, X. (2015). Grain enterprise overseas investment strategies. China Investment, (2), 85–87, 9.

[2]. Ma, J., Li, G., & Han, D. (2023). Empowering grain supply chain resilience through the digital economy: Mechanisms and policy orientations. Xinjiang Social Sciences, (1), 46–54.

[3]. Wei, W., Chen, W., & Wang, Y. (2024). The experiences and insights of the four major grain merchants in overseas investment and global grain resource integration. Globalization, (3), 98–106, 136.

[4]. He, W., & Tang, Z. (2023). International experiences and lessons in financial support for the construction of major international grain merchants. The Banker, (10), 106–109.

[5]. Deng, S., Wang, Z., Zhao, B., et al. (2024). From product control to service control: Practices, experiences, and insights into the digitalized agricultural services of the four major international grain merchants. World Agriculture, (8), 53–65.

[6]. Kilpatrick, C., & Conroy, K. M. (2024). Driving digital sustainability in global value chains: Multinational enterprises as chief orchestrators. Academy of Management Perspectives, Advance online publication. https://doi.org/10.5465/amp.2023.0160

[7]. Li, X. (2021). Insights from the development experiences of international grain merchants for cultivating major Chinese grain merchants. China Trade and Economic Herald (Mid Edition), (4), 29–31.

[8]. O'Keeffe, P. (2016). Supply chain management strategies of agricultural corporations: A resource dependency approach. Competition & Change, 20(4), 255–274.

Cite this article

Han,J. (2025). Research on Financial Support Paths for Cultivating International Grain Merchants. Advances in Economics, Management and Political Sciences,158,22-31.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of CONF-BPS 2025 Workshop: Sustainable Business and Policy Innovations

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Shi, X. (2015). Grain enterprise overseas investment strategies. China Investment, (2), 85–87, 9.

[2]. Ma, J., Li, G., & Han, D. (2023). Empowering grain supply chain resilience through the digital economy: Mechanisms and policy orientations. Xinjiang Social Sciences, (1), 46–54.

[3]. Wei, W., Chen, W., & Wang, Y. (2024). The experiences and insights of the four major grain merchants in overseas investment and global grain resource integration. Globalization, (3), 98–106, 136.

[4]. He, W., & Tang, Z. (2023). International experiences and lessons in financial support for the construction of major international grain merchants. The Banker, (10), 106–109.

[5]. Deng, S., Wang, Z., Zhao, B., et al. (2024). From product control to service control: Practices, experiences, and insights into the digitalized agricultural services of the four major international grain merchants. World Agriculture, (8), 53–65.

[6]. Kilpatrick, C., & Conroy, K. M. (2024). Driving digital sustainability in global value chains: Multinational enterprises as chief orchestrators. Academy of Management Perspectives, Advance online publication. https://doi.org/10.5465/amp.2023.0160

[7]. Li, X. (2021). Insights from the development experiences of international grain merchants for cultivating major Chinese grain merchants. China Trade and Economic Herald (Mid Edition), (4), 29–31.

[8]. O'Keeffe, P. (2016). Supply chain management strategies of agricultural corporations: A resource dependency approach. Competition & Change, 20(4), 255–274.