1.Introduction

Although China is a major grain producer, it is also a significant grain importer, with a grain self-sufficiency rate of around 75%. Chinese grain enterprises play an important role in global grain trade and have a considerable impact on trade volume. Despite importing large quantities of grain, China remains relatively passive in terms of grain pricing power and supply sources. In 2020, President Xi Jinping emphasized, "We must not take food security lightly. We need to ensure basic self-sufficiency in grain and absolute security in staple foods, making sure that the rice bowl of the Chinese people remains firmly in their own hands." As global market integration for major grain enterprises deepens, actively fostering large international grain groups is of paramount importance for safeguarding food security. In 2021, the objective of "cultivating large international grain and agricultural enterprise groups" was further incorporated into the "14th Five-Year Plan." Although China has some competitive grain enterprises, their overall scale remains limited, and most Chinese grain companies lack international influence, with underdeveloped and single-dimensional industrial chains. Furthermore, Chinese grain enterprises face several challenges in international operations, including limited pricing power in grain trade, incomplete grain trade industrial chains, and insufficient innovation in green technology. This paper focuses on analyzing the development status of Chinese grain enterprises in international operations, reviewing the development experiences of domestic and foreign international grain enterprises, and, based on the current situation of Chinese grain enterprises, proposing relevant policy recommendations to accelerate the cultivation of internationally competitive, large-scale grain enterprises.

2.The Competitive Landscape of Chinese Grain Enterprises in Global Grain Trade

2.1.The Importance of Cultivating International Grain Enterprises

Human survival and development are inseparable from food, with grain being one of the most fundamental food sources, including wheat, soybeans, rice, and coarse grains. Ensuring a stable food supply is crucial to the health of the population, social stability, and national security. Currently, China faces a significant gap between grain supply and demand. According to customs data, grain imports accounted for approximately 11% of China’s total domestic grain production in 2023. Specifically, imports of soybeans, barley, and wheat increased by 11.4%, 96.6%, and 21.5% year-over-year, respectively, indicating a high dependency on imports for key grain crops.

Data from the Food and Agriculture Organization (FAO) indicate that global grain trade in 2023 reached 496 million tons, accounting for about one-fifth of global grain production. International grain trade involves numerous stages and has a high concentration of industry players. Major international grain enterprises play an irreplaceable role in this market, with the "Big Four" international grain companies—ADM, Cargill, Bunge, and Louis Dreyfus—accounting for approximately 70% of global wheat and corn trade and about 60% of soybean trade. To further enhance China’s influence in global grain trade, there is an urgent need to cultivate domestic international grain enterprises with substantial global presence and influence.

2.2.Competitive Landscape of Chinese Grain Enterprises in the International Market

2.2.1.Macro Level

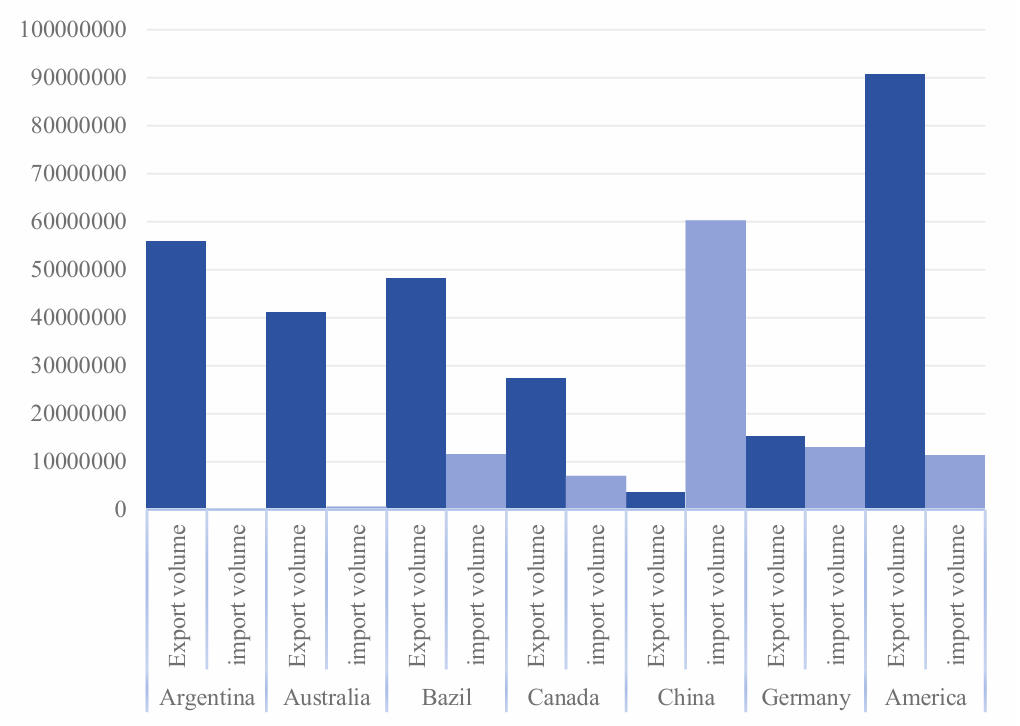

The scale of global grain trade has shown an annual growth trend in 2023. According to the 2023 World Food and Agriculture Statistical Yearbook, a comparison of the total import and export volumes of grain and grain products for the top seven countries shows that the main grain-exporting countries are the United States, Argentina, and Brazil, while the primary importing countries include China and Germany. As illustrated in Figure 1, China has the highest demand for grain and grain products globally, with relatively low export volumes and a high reliance on imports. This indicates that China’s import volume is substantial, with Chinese grain enterprises playing a significant role in global grain trade and exerting considerable influence on global trade volumes.

Figure 1: Import and Export Volumes of Major Grain Trading Countries in 2023 (Data sourced from the Food and Agriculture Organization of the United Nations. Unit: Tons)

2.2.2.Enterprise Level

Grain and agricultural enterprises play an increasingly prominent role in the globally integrated grain trade market. International grain enterprise groups serve as key carriers of grain trade, and the competitiveness of grain enterprises reflects, to some extent, a country’s competitive strength in the global market. Although China has several relatively competitive grain enterprises, they still lag behind large international grain groups in overall performance.

First, compared with major international grain enterprises, Chinese grain companies have fewer global offices and cover fewer countries. The depth of international business penetration and scope of operations are critical measures of international competitiveness. As shown in Table 1, competitive international grain enterprises such as Wilmar International, ADM, and Marubeni have a substantial number of global subsidiaries, branches, and offices, along with a broad reach across many countries. In contrast, most Chinese grain enterprises do not hold an advantage in these two metrics.

Table 1: Overview of International Business for Global Grain Enterprises.

|

Enterprise |

Number of Global Subsidiaries, Branches, and Offices |

Number of Countries Covered |

Country |

|

Wilmar International |

400 |

50 |

Singapore |

|

ADM |

150 |

190 |

United States |

|

Marubeni |

131 |

68 |

Japan |

|

Mitsui & Co. |

110 |

65 |

Japan |

|

COFCO Group |

17 |

140 |

China |

|

Xiamen Xiangyu |

7 |

120 |

China |

|

Yihai Kerry |

7 |

18 |

China |

|

Beidahuang |

9 |

1 |

China |

Note: Data sourced from company websites.

Second, Chinese grain enterprises have a low market share in the global grain trade, indicating a need to expand their market scale. Analyzing the top eight grain enterprises by transaction volume in China, only two Chinese enterprises are among the top ten globally, holding a combined market share of 18.07%. Market share refers to the revenue of a single grain enterprise as a proportion of total market revenue, reflecting the company's strength in grain trade. The remaining Chinese enterprises each hold less than 0.1% of market share. Excluding the privately held Cargill, the top six global publicly traded grain enterprises are foreign companies.

Table 2: Market Share of Prominent Domestic and International Grain Enterprises.

|

Enterprise |

Country |

Market Share |

Publicly Listed |

|

Cargill |

United States |

20.09% |

No |

|

Mitsui & Co. |

Japan |

12.01% |

Yes |

|

ADM |

United States |

11.56% |

Yes |

|

COFCO Group |

China |

10.86% |

Yes |

|

Wilmar International |

Singapore |

8.34% |

Yes |

|

Marubeni |

Japan |

7.71% |

Yes |

|

Xiamen Xiangyu |

China |

7.21% |

Yes |

|

Bunge |

United States |

6.76% |

Yes |

|

Louis Dreyfus |

France |

5.74% |

Yes |

|

CHS Inc. |

United States |

5.43% |

Yes |

|

Yihai Kerry |

China |

3.95% |

Yes |

|

Dao Dao Quan |

China |

1.09% |

Yes |

|

Shen Nong Holdings |

China |

0.01% |

Yes |

|

Kemen Noodles |

China |

0.01% |

Yes |

Note: Data sourced from 2023 annual reports of each enterprise.

3.Current Status and Challenges of International Operations for Chinese Grain Enterprises

3.1.Current Status of International Operations

In terms of foreign investment, Chinese grain enterprises have seen a gradual increase in their foreign investment amounts over the years; however, they still hold a relatively small share internationally and have modest investment amounts. According to the 2023 Statistical Bulletin of China’s Outward Foreign Direct Investment, in 2023, the direct foreign investment of Chinese grain enterprises reached $510 million, accounting for 0.3% of the entire industry’s investment. This represents an increase compared to the $450 million investment and 0.18% industry share in 2020. However, this figure remains low compared to the 2023 total foreign direct investment by U.S. grain enterprises, which stood at $13.676 billion, accounting for 4.945% of the total industry investment.

In terms of import structure, Chinese grain enterprises exhibit high import concentration and an imbalanced structural ratio. For example, from 2015 to 2023, China’s soybean imports increased from 83 billion jin to 99.4 billion jin, making up 83% of total grain imports. In terms of country distribution, China’s soybean imports primarily come from the United States, Brazil, and Argentina, with the combined share from these three countries rising from 95% in 2022 to 98% in 2023. Additionally, the concentration of corn imports is similarly high. In 2022, 92.1% of China’s corn imports came from Ukraine and the United States, while in 2023, imports from Brazil, the United States, and Ukraine comprised 93.7% of total corn imports. This indicates a high level of dependency on foreign sources for these two types of grains.

In terms of trade financing, Chinese international grain enterprises need to improve their financing capabilities. According to Kong Xiangzhi et al. [1], international grain giants typically engage in diverse financial investments, such as cash flow hedging and interest rate derivative instruments. However, in practice, most Chinese grain enterprises with experience in derivative investments have underutilized these tools. COFCO Group, for instance, has made extensive use of all available derivative instruments, while in comparison, Japan has two international grain enterprises, Marubeni and Mitsui & Co., and the U.S. has three—ADM, Bunge, and Cargill—all of which fully utilize financial derivatives.

3.2.Challenges in International Operations

3.2.1.Lack of Pricing Power in Grain Trade

Pricing power refers to the ability to influence prices and is crucial for exerting a decisive influence on prices in the global grain market. Currently, Chinese grain enterprises have limited pricing power in the global grain market, as reflected in three main aspects.

First, Chinese grain enterprises have limited influence in the international grain market and engage in few mergers and acquisitions (M&As). Since 2014, COFCO Group has completed only ten M&As, mostly in South America, a region where the "ABCD" international grain giants (ADM, Bunge, Cargill, and Louis Dreyfus) operate heavily, holding approximately 50% of the total market share. As a result, COFCO’s development in the region is constrained. In contrast, the "ABCD" grain giants have implemented horizontal integration strategies internationally to achieve economies of scale. In the past decade, the four companies have acquired 112 international enterprises, including joint ventures with Monsanto and DuPont to control global pricing in seeds and agricultural fertilizers, each holding over 50% of these markets.

Second, the Chinese domestic grain market faces significant penetration by international grain enterprises. Wei Wei [2] states that when international grain enterprises gain a foothold in a country through investment and acquisition across the complete grain industry chain, they can use capital to disrupt domestic operations, leading to foreign control over the entire grain production process in that country. This limits the independence of domestic grain enterprises, preventing them from gaining a competitive edge in international grain pricing power. Since the 2004 soybean crisis in China, the "ABCD" grain giants have aggressively acquired assets, successfully controlling three-quarters of China’s soybean processing capacity. Although domestic capabilities have grown in recent years, Chinese grain enterprises still face significant constraints in the soybean industry, leaving them disadvantaged in international soybean pricing.

Third, Chinese grain enterprises have limited operational capacity in logistics and transportation, hindering their ability to negotiate in grain trade. For example, Cargill owns the world’s largest inland and maritime transport fleet, conducting approximately 4,500 grain shipments annually and operating around 650 vessels at any given time. In contrast, COFCO Group only conducts about 800 annual grain shipments with a fleet of approximately 200 vessels, resulting in much lower transportation efficiency and volume than Cargill. Due to lower transportation efficiency, Chinese grain enterprises have weaker capabilities in cross-border grain transport and smaller business volumes, which restricts market share growth, lowers market presence, and weakens pricing power.

3.2.2.Incomplete Grain Trade Industry Chain

A horizontal comparison was conducted between COFCO Group (China’s largest state-owned grain enterprise), Xiamen Xiangyu Group (a private Chinese grain enterprise), ADM, and Cargill. Chinese grain enterprises show a relatively narrow industry chain layout in overseas grain trade, with limited synergy between industry chain segments. This is reflected in two main aspects:

First, Chinese grain enterprises lack multinational integration capabilities. The capacity of an enterprise for multinational operations is often measured by the transnationality index, which averages the proportion of foreign revenue, total assets, and number of employees relative to total data. This index reflects the level of coordination in a multinational company’s strategy and decision-making, as well as its influence and operations in overseas industry chains. An analysis of the scope of operations across the four companies shows that the transnationality index of the two Chinese grain enterprises is lower than that of Cargill and ADM, indicating weaker international influence (see Table 3).

Second, Chinese grain enterprises are at a disadvantage in terms of industry coverage and business expansion. Li Xigui [3] states that higher industry coverage and vertical integration levels enable grain enterprises to better consolidate internal resources across multiple industries and strengthen their advantages across the entire industry chain. Compared to domestic companies, leading international grain conglomerates have significant advantages in resource integration and business coverage. For example, Cargill and ADM are involved extensively in grain acquisition, processing, and transportation, while COFCO Group’s activities are mainly limited to grain acquisition and transport, with weaker capabilities in production and R&D than the major international grain conglomerates. Xiamen Xiangyu Group’s operations are limited to grain supply chain services, indicating that Chinese grain enterprises have a lower degree of vertical integration in the global grain market and are disadvantaged in terms of business expansion (see Table 3).

Table 3: Comparison of Industry Chain Influence Factors for Domestic and International Grain Enterprises.

|

Name |

Transnationality Index |

Scope of Operations |

|

Cargill |

65% |

Food ingredients and bioproducts, animal nutrition feed research, grain deep processing and sales, grain acquisition, transportation |

|

ADM |

70% |

Agricultural services, oilseed processing, corn processing, grain acquisition, transportation |

|

COFCO Group |

9.15% |

Grain, oilseed, coffee acquisition, and maritime transport |

|

Xiamen Xiangyu |

9.6% |

Grain procurement and supply, integrated logistics services |

Note: The transnationality index was calculated by the author based on company website information; scope of operations sourced from company websites.

3.2.3.Insufficient Green Technology Innovation Capacity

Green technology innovation supports the green, low-carbon transformation of grain enterprises and enhances their long-term sustainability, with broad application prospects across the entire grain industry chain. It is a critical component of the sustainable development strategies of major international grain enterprises, which are currently focused on advancing their green technology innovation capacities. However, compared to international grain giants, Chinese grain enterprises lag in green technology innovation in the following ways:

On one hand, Chinese international grain enterprises have insufficient investment in green research and development (R&D). In 2023, ADM invested $822 million in scientific research, 6.57 times the R&D investment of COFCO Group and 37.89 times that of Xiamen Xiangyu. ADM's R&D expenditure as a percentage of sales revenue is also significantly higher than that of COFCO Group and Xiamen Xiangyu Group, at twice and ten times the levels of Chinese international grain enterprises, respectively. This demonstrates that Chinese international grain enterprises have a lower investment in green technology R&D compared to their international counterparts.

On the other hand, the methods used to promote green development in China are relatively traditional. Cargill, for instance, actively incorporates green technological innovations in carbon reduction and has pioneered the application of advanced wind propulsion technology in commercial shipping (see Table 4). This revolutionary technology can reduce carbon emissions from existing bulk carriers by up to 30%. In contrast, COFCO International primarily employs conventional measures to reduce carbon emissions, with limited effectiveness. As a result, COFCO International's transportation methods emit more greenhouse gases during grain transport, causing greater environmental pollution.

Table 4: Specific Carbon Reduction Measures of Domestic and International Grain Enterprises

|

COFCO International |

Cargill |

|

|

Specific Carbon Reduction Measures |

Improved monitoring of fuel emissions from leased vessels Optimized ship speed and routing Financial support to help producers transition to climate-smart agriculture Financial support to prevent deforestation in Brazil's soybean production areas |

Innovative wind-assisted propulsion Development of green methanol fuel "Second-generation" biofuels made from waste cooking oil and food waste Promotion of regenerative agriculture practices |

Note: Carbon reduction measures sourced from company websites.

4.Development Experience in the International Operations of Grain Enterprises

Analyzing the development experiences of domestic and international multinational grain enterprises reveals practices that have contributed to their growth and success. These experiences provide valuable insights for cultivating large international grain enterprises in China. Currently, the development strategies of domestic and international grain enterprises can be summarized as follows:

4.1.Vertical Integration of the Industry Chain

Vertical integration of the industry chain refers to international grain giants implementing coordinated development plans across the upstream and downstream segments of the grain industry once they reach a certain level of strength. By sharing information and resources internally, they expand their product or service range to capture a greater market share and enhance their industry standing. Li Shengjun [4] noted that traditional international grain giants focused on single operations; however, after the 1990s, they began pursuing vertical integration of the industry chain to establish a global presence.

Full Industry Chain Layout. To expand market share and increase competitiveness, international grain giants consistently broaden their product and service categories, enhance their logistics and transportation systems, and expand the agricultural industry chain. They are actively committed to building a full industry chain layout, bridging front-end and back-end operations, and establishing a complete chain from research and development, planting, harvesting, transportation, and processing to sales. This facilitates the coordination of logistics, information flow, and capital flow, promoting comprehensive enterprise development while reducing costs and improving efficiency. For example, Cargill has developed a full industry chain in grain, established a risk management company in finance, and integrated agricultural raw materials processing and product sales, achieving a fully integrated industry chain.

Vertical Integration. Upstream and downstream integration within the industry chain is essential for ensuring stable grain supply, serving as a critical indicator of the degree of industry chain completeness for international grain enterprises. International grain enterprises achieve vertical integration by engaging in mergers and acquisitions, which optimizes resource allocation and reduces production costs within the company. In 2022, the well-known international grain enterprise Louis Dreyfus Company (LDC) acquired Australia’s Emerald Grain, gaining access to seven domestic grain storage networks with a total storage capacity of approximately one million tons. The acquisition also granted LDC ownership and operation of Melbourne's only grain terminal, achieving internal vertical integration and fostering mutually beneficial partnerships.

4.2.Enhancing Influence in Pricing

Influence in agricultural product pricing refers to the power and authority within the price formation process. International grain giants, with their mature management systems, advanced technology, robust financial support, and long-standing development foundations, control resources from the origin, processing, to trading stages of agricultural products and serve as the rule-makers for international agricultural trade and division of labor, thereby continuously expanding their influence. The pricing influence of international grain giants arises from the following two factors:

Leveraging the Futures Market to Expand Influence. The prices of agricultural products on the spot market are closely linked to futures market prices. When a futures exchange exerts substantial influence, the prices of certain primary products may be set in reference to that exchange. Developed futures financial markets serve as indicators of price fluctuations for certain agricultural products. Li Guangsi and Han Dong [5]argue that soybean futures and derivatives prices on the Chicago Board of Trade (CBOT) are the primary factors driving international soybean price trends. For instance, China’s imported soybean prices from Brazil and Argentina are referenced against CBOT, where international grain giants like ADM and Bunge directly or indirectly influence pricing through capital operations.

Controlling the Agricultural Product Supply Chain. The control of an agricultural product’s supply chain by international grain giants is crucial for influencing pricing. Through strong partnerships, providing financing to regional farmers as an opportunity to monopolize agricultural procurement, and enhancing supply chain dominance by improving the industry chain, international grain enterprises maintain control over supply chains. For example, ADM, Bunge, Cargill, and Louis Dreyfus collectively control the international soybean supply chain. By offering favorable loans to impoverished soybean farmers in Latin America and partnering with large local farms, they secure control over soybean purchases. Additionally, they establish comprehensive systems for procurement, processing, and transportation at their ports and operation sites, consolidating their competitive advantage.

4.3.Green and Low-Carbon Transformation

The transition to green and low-carbon practices is a critical strategy for international grain giants to enhance production capacity, eliminate developmental obstacles, and capture market share. This transformation spans multiple aspects of enterprise operations, including energy consumption in the grain industry chain, production processes, product development, and waste management. The green, low-carbon transformation strategies of international grain enterprises focus on the following two aspects:

Integration of Green Transformation and Digitalization. In recent years, international grain giants have increasingly recognized green transformation as a necessary path to achieve sustainable development. With the advancement of technology, more digital intelligent technologies are being incorporated into industry development, making the integration of green practices and digitalization a key strategy for grain enterprises. COFCO Group, for example, emphasizes the application of digital technology in production and processing. COFCO has undertaken a comprehensive green digital transformation of the grain industry chain, utilizing big data to monitor and adjust the entire production process. This approach has achieved a 100% utilization rate of green materials and comprehensive industrial solid waste utilization, integrating production processes with digitalization. Only a few international grain giants have implemented full-chain green digital transformation, which helps reduce carbon emissions, promotes green and low-carbon transitions, and enables COFCO to increase production efficiency, lower production costs, and lay a foundation for future global sustainable business development.

Leveraging Green Finance for Low-Carbon Transformation. Grain enterprises are advancing their low-carbon agricultural development by leveraging a comprehensive financial policy system and robust macroeconomic financial policies. Domestic grain enterprises are using commercial financial policies to finance their low-carbon transformations. For instance, in 2023, the Harbin branch of Industrial Bank provided Beidahuang Group with 400 million yuan in green loans. These funds support Beidahuang’s research and application of clean energy in grain transportation and its research into energy-saving technologies, fostering green scientific research, green infrastructure upgrades, and ecological industry transformation. Internationally, these efforts use advanced low-carbon green technologies to expand market reach, improve efficiency, and boost market share in the global grain market.

5.Recommendations for Cultivating Large International Grain Enterprises in China

5.1.Integrate Vertical Resource Advantages to Strengthen Control over Key Industry Chains

Chinese grain enterprises face challenges such as limited influence in overseas markets and a lack of critical industry chains. Given their relatively weak foundation, it is difficult for Chinese grain companies to expand in international markets on their own. The dominant position of international grain giants in the global grain market has largely been built through alliances, mergers, and acquisitions to expand operational scope and achieve monopolies over key segments of the grain industry chain. The recommendations are as follows: 1. Actively expand in countries and regions with advantageous production factors, establish grain production channels in these countries, form grain production and trade partnerships, and strengthen control over key industry chain segments through joint ventures, acquisitions, and alliances. 2. Leverage core technologies and market resources within corporate alliances. By exploiting economies of scale in germplasm preservation, logistics and warehousing, and processing trade, Chinese grain enterprises can grow into more influential bulk international grain traders. 3. Ensure coordinated development among alliance partners. Clearly define mechanisms for profit distribution and risk-sharing between companies, share resources and effective information, and foster synergy.

5.2.Enhance Financial Support for Expanding and Strengthening Multinational Grain Enterprises

China’s large international grain enterprises currently have limited pricing power in the global grain market, face pressure from large multinational grain corporations in the futures market, and are heavily penetrated by the "ABCD" grain giants in the domestic grain market. This results in market share and industry chains being controlled by foreign capital, making it difficult for domestic grain enterprises to secure stable financial backing.

Broaden Trade Financing Sources. Addressing the financing difficulties of Chinese grain enterprises can involve expanding sources of trade financing. As international grain giants frequently engage in cross-border transactions, using foreign exchange to hedge assets can reduce transaction costs. These enterprises often rely on foreign exchange services from financial institutions for currency exchange and funds settlement and should explore new trade financing options, such as remittances, collections, letters of credit, and advance financing, to ensure smooth cross-border capital flows. Establishing partnerships with major global banks, such as BNP Paribas, Credit Suisse, and Standard Chartered, for in-depth cooperation in trade financing and international finance could broaden financing channels.

Use Financial Derivatives for Hedging. Hedging through the futures market is a risk management approach to mitigate market risks. Companies should conduct comprehensive market analysis to identify key factors affecting price changes, formulate hedging strategies based on these factors, set future prices, and strictly control the effectiveness of these measures.

5.3.Increase Investment in Green Technology R&D and Enhance Innovation Capacity

Green technology innovation is essential for the sustainable development of grain enterprises. It can promote efficient resource utilization in grain production, transportation, and processing, providing new momentum for enterprise growth. Chinese grain enterprises currently face challenges such as insufficient investment in green R&D and reliance on traditional methods to support green development. The recommendations are as follows:

Allocate More Research Funding to Green Innovation and Cultivate Relevant Talent. Chinese grain enterprises should establish close collaborations with domestic research institutes and universities, investing in the joint training of green technology innovation talent. This would help reduce energy consumption in grain transport and automated farming, update equipment, increase production efficiency, and lower energy usage in storage and production processes.

2.Engage in International Technology Trade and Learning. The United States, France, and other developed countries, where the "ABCD" grain giants operate, lead in green technology. Chinese grain enterprises should conduct international technology trade and acquire advanced technologies. Establishing global R&D networks and conducting innovation research in resource-rich regions would allow enterprises to leverage local resources, access cutting-edge green technology insights, and drive green technology development.

5.4.Define Regional Layout and Key Areas for International Expansion

According to projections from the United Nations Food and Agriculture Organization and other institutions, global agricultural trade volume and related investments are expected to continue increasing. This trend presents new opportunities for Chinese international grain enterprises to reshape the existing market landscape. Moreover, the current global economic growth is relatively slow, with regions like Latin America and Central Asia facing economic stagnation and insufficient investment to drive growth. This has led to delays or suspensions in established infrastructure projects, including those in the grain sector. Chinese grain enterprises could seize this opportunity by clearly defining regional layouts and key areas for expansion, providing aid to relevant countries while strengthening their own enterprises and enhancing international influence. The recommendations are as follows:

1.Identify Key Investment Sectors. Analyze and identify areas in each country that require external assistance, such as the need for investment in grain logistics infrastructure in South America. Chinese grain enterprises could target these needs with focused partnerships.

2.Specify Appropriate Investment Methods. Tailor investment methods to the specific conditions of each country. Depending on the circumstances, Chinese grain enterprises could pursue mergers and acquisitions, agricultural investment cooperation, or integration into regional economic organizations such as the Belt and Road Initiative, selecting suitable investment approaches accordingly.

6.Conclusion

Overall, the characteristics of Chinese grain merchants worldwide are that China's major grain crops are highly dependent on imports and play an important role in world grain trade. They have a significant impact on the world grain trade volume and have a low market share in the world grain trade market. To address the current issues of lack of pricing power in grain trade, incomplete grain trade industry chain, and insufficient green technology innovation capability, combined with domestic and international experience, and successful measures such as vertical integration of the industry chain, enhancing pricing influence, and green low-carbon transformation, and taking into account the situation of grain merchants themselves, it is recommended to integrate the advantages of vertical integration resources to strengthen control over key industry chains, enhance financial support for multinational grain enterprises to grow and strengthen, increase investment in green technology research and development and enhance innovation capabilities, clarify the regional layout and key areas for grain merchants to go global, and better respond to changes in the international grain trade pattern.

References

[1]. Kong, X., Gu, S., & Chen, T. (2023). An analysis of the concept, current situation, and recommendations on pricing power in global grain trade. Rural Economy, (9), 40-49.

[2]. Wei, W., Chen, W., & Wang, Y. (2024). Experience and lessons from the foreign investment and global grain resource integration of the “Big Four” grain enterprises. Globalization, (3), 98-106, 136.

[3]. Li, X. (2021). Insights from the development experience of international grain enterprises for cultivating major Chinese grain enterprises. China Economic and Trade Herald (Middle Edition), (4), 29-31.

[4]. Li, S. (2023). Analysis of control models of major international grain enterprises. Grain and Oil Food Technology, 31(4), 42-47.

[5]. Li, G., & Han, D. (2020). Competitive structure, market power, and pricing power in the international grain market: An analysis based on the international soybean market. Journal of International Trade Issues, (9), 33-49.

Cite this article

Wang,P.;Wang,X. (2025). Research on the Development Status and Policy Support Pathways for the Internationalization of Chinese Grain Enterprises. Advances in Economics, Management and Political Sciences,158,32-42.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of CONF-BPS 2025 Workshop: Sustainable Business and Policy Innovations

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Kong, X., Gu, S., & Chen, T. (2023). An analysis of the concept, current situation, and recommendations on pricing power in global grain trade. Rural Economy, (9), 40-49.

[2]. Wei, W., Chen, W., & Wang, Y. (2024). Experience and lessons from the foreign investment and global grain resource integration of the “Big Four” grain enterprises. Globalization, (3), 98-106, 136.

[3]. Li, X. (2021). Insights from the development experience of international grain enterprises for cultivating major Chinese grain enterprises. China Economic and Trade Herald (Middle Edition), (4), 29-31.

[4]. Li, S. (2023). Analysis of control models of major international grain enterprises. Grain and Oil Food Technology, 31(4), 42-47.

[5]. Li, G., & Han, D. (2020). Competitive structure, market power, and pricing power in the international grain market: An analysis based on the international soybean market. Journal of International Trade Issues, (9), 33-49.