1. Introduction

As the global climate crisis continues to intensify, the urgency of the international community to reduce carbon emissions is becoming increasingly apparent. According to the most recent data available on the country's carbon emissions ranking, it can be found the 100 companies on the list in 2022 totalled about 5.048 billion tonnes, accounting for 43.98% of China's total carbon emissions. As a major contributor to carbon emissions, enterprises generally face challenges such as the constraints of traditional management frameworks and the limitations of technological capabilities in the process of promoting low-carbon transformation. In view of this, how to effectively implement carbon reduction strategies at the micro-production level has become the focus of widespread attention from all sectors of society. The deep integration of digital technology can not only help enterprises get rid of the over-reliance on traditional operation mode, but also may become the key to break through the technical bottleneck of low-carbon transformation, providing strong technical support for the carbon emission reduction practice of enterprises.

Through a thorough review of the literature, this study reveals that previous academic discourse has predominantly centered on the economic-level consequences of enterprise digital transformation, specifically covering such aspects as how digital transformation promotes the growth of company performance [1] and optimises performance in the capital market [2]. In recent years, with the increasing prominence of environmental issues, the environmental benefits of digital transformation have gradually become one of the hot pints for domestic and international scholars to study, although no consensus has been reached in this field yet. On the one hand, certain research findings indicate that digital transformation exerts a notable reduction effect on regional carbon emissions. [3]; on the other hand, there are also studies that point out that the process of building digital infrastructure itself is accompanied by higher resource consumption, which may exacerbate the carbon emission problem [4].

Furthermore, a limited number of studies have made initial attempts to explore the potential influence of digital transformation on corporate carbon emissions from a broader, macro perspective. For instance, an analysis by certain scholars focusing on South Asian countries demonstrates that the utilization of information and communication technology (ICT) can enhance enterprises' energy efficiency, leading to a decrease in carbon emission intensity [5]. This provides fresh insights and evidence for comprehending the environmental ramifications of digital transformation. Despite the literature having examined the influence of digital transformation in firms on carbon performance from various angles, most of these studies have focused on the internal mechanisms of digital transformation, with less exploration of the moderating role of external market structures, especially industry concentration. Industry concentration, as an important indicator of the competitive structure of the market, reflects the number of enterprises in the industry, the size of the scale and the distribution of market share. The level of industry concentration directly affects the market position and competitive strategy of enterprises [6], which in turn affects the motivation and effectiveness of their digital transformation. Thus, the objective of this paper is to address this research void through an empirical analysis of the particular impact mechanisms of corporate digital transformation on carbon performance under different industry concentration levels, with a view to providing policy makers and corporate managers with theoretical basis and practical guidance. The research presented in this paper not only enhances our comprehension of the role digital transformation plays in advancing the green transformation of enterprises, but also offers valuable insights for governmental bodies to devise tailored environmental policies, fostering both fair competition and sustainable enterprise growth.

2. Theoretical analysis and research hypothesis

2.1. Enterprise Digital Transformation and Carbon Performance

Carbon performance, as a core component of environmental performance assessment [7], also known as carbon emission efficiency or emission reduction effectiveness, is a measure of an enterprise's input and output efficiencies in CO2 related activities, reflecting its efforts and results in reducing carbon emissions over a specific period of time [8]. on the other hand, refers to an enterprise's efforts to reshape its production and operation processes by optimising the value creation path [9]. According to stakeholder theory, while pursuing economic profits, enterprises must take into account the needs of various stakeholders, including the public, especially the impact on the environment, and assume social responsibility for pollution prevention and control [7]. Under this theoretical framework, the use and innovation of digital technology by enterprises not only helps to alleviate the information asymmetry problem with stakeholders, but also captures and responds to environmental protection requirements more quickly, which in turn promotes the improvement of carbon performance.

Firstly, digital transformation intensifies environmental monitoring of companies by enhancing information transparency and shortening the distance to stakeholders, incentivising companies to adopt carbon reduction measures to meet stakeholders' environmental expectations.

Utilizing technologies like big data and cloud computing, enterprise digital transformation significantly improves data processing and integration capabilities, facilitates efficient internal and external information exchange, increases transparency, and reduces information asymmetry between enterprises and stakeholders and their interaction costs [10]. Increased information symmetry provides stakeholders with more opportunities to participate in corporate governance and facilitates their expression of environmental demands, thus increasing external monitoring of corporate behaviour [11].

Secondly, digital transformation provides companies with unique and hard-to-replicate digital technological capabilities and resources that offer new technological paths and methods for carbon reduction, enabling them to quickly identify and respond to environmental needs and thus improve carbon performance.

By taking advantage of the dynamic interactive nature of digital technology, enterprise digital transformation effectively improves the efficiency of communication with stakeholders, captures environmental needs instantly, and efficiently solves challenges in environmental governance [9]. Customer consumption to achieve effective allocation and efficient use of raw materials, energy, power, and water resources, and to promote sustainable development [12]. On the flip side, the implementation of digital technology and artificial intelligence facilitates real-time tracking of ecological shifts during the production process through in-depth analysis of information and data in production and operation activities, dynamically collecting information on productivity, cost and energy consumption [13], helping enterprises locate sources of carbon emissions and select renewable resources to reduce resource waste and pollutant emissions [14], thereby optimising carbon performance and actively responding to the stakeholders' environmental demands. Based on this analysis, this study proposes the following hypotheses:

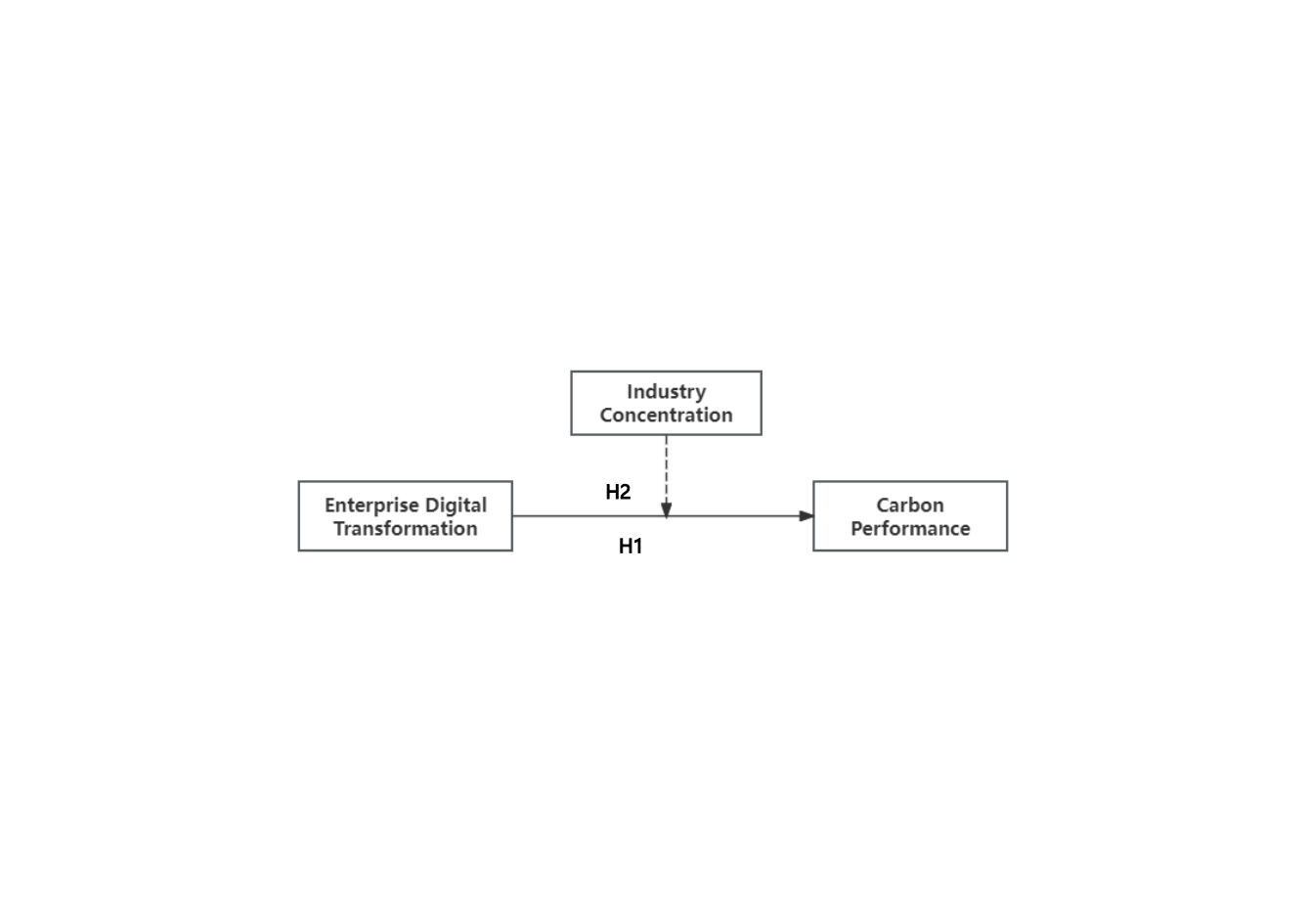

H1: There exists a direct relationship where firms' digital transformation positively correlates with carbon performance.

2.2. The moderating effect of industry concentration on carbon performance

Industry concentration, as an important dimension of market structure, plays a moderating role in the relationship between firms' digital transformation affecting carbon performance by influencing the competitive and collaborative relationships between firms.

On the one hand, an environment of high industry concentration is one in which the market is dominated by a handful of large firms, which tend to have larger market shares and stronger bargaining power. This market structure may weaken the external drivers for firms to improve their carbon performance, as higher market shares mean that firms have a greater buffer against environmental demands from consumers or supply chain partners. Specifically, when industry concentration is high, as the market is largely controlled by a few firms, these firms may not be eager to significantly improve their carbon performance through digital transformation to cater for market demand, as they may not immediately face a significant decline in market share even if they are slow to act. Thus, industry concentration may dampen the potential positive effects of digital transformation on carbon performance in this scenario, manifesting itself as a negative moderating effect.

On the other hand, from the standpoint of environmental constraints, although public concern over environmental issues is growing, the transmission mechanism of environmental pressure may be hindered in markets with high industry concentration. As a small number of large firms control the market, it may be easier for them to influence policy formulation and implementation through lobbying and public relations, or to use their market position to circumvent stringent environmental regulations. In addition, when the public's demand for environmental protection is transformed into monitoring of corporate behaviour, high industry concentration may reduce the effectiveness of such monitoring, as public opinion and market power are difficult to effectively check and balance the behaviour of the dominant players in the market. Therefore, under high industry concentration, firms may reduce their investment,which in turn limits the improvement of carbon performance. Based on the above analyses, this paper proposes the following research hypotheses:

H2: Industry concentration dampens the favorable effect of digital transformation in firms on carbon performance.

In summary, this paper constructs a theoretical framework, as shown in Figure 1.

Figure 1: Theoretical framework

3. Study design

This paper takes Shanghai and Shenzhen A-share listed industrial enterprises as the research sample, considering that China's carbon emissions trading policy started to be implemented in 2013, so the sample period chosen is 2014-2022. In addition, in order to ensure the validity of the data, ST category, financial category and samples with missing data are excluded, and finally unbalanced panel data containing 19,655 observations of 3324 listed companies over 9 years are obtained. In this paper, continuous variables are Winsorised to shrink the tail at the upper and lower 1% level.

3.1. Explained variable: carbon performance (Cp)

In view of the current inability to directly obtain the carbon emission data of domestic enterprises, and considering the practical feasibility of micro-data acquisition, in this study, carbon performance is measured using the ratio of operating income to unit carbon emissions, where the higher the ratio, the better the carbon performance level. In this process, the definition of industry is based on the industry standards updated by the China Securities Regulatory Commission in 2012, the industry carbon emissions are calculated from the industry energy consumption data published in the China Energy Statistics Yearbook and the carbon emission reference coefficients provided by the Carbon Emission Trading Network, and the rest of the financial indicators are derived from the CSMAR database.

Calculation of total emissions:Carbon emissions from listed companies = emissions from combustion and fugitive emissions + emissions from production processes + emissions from waste + emissions from land-use change (conversion of forests to industrial land)

3.2. Explanatory variables Digital transformation of the firm (Digital)

The CSMAR database's methods for assessing the extent of digital transformation in companies all rely on statistical analysis of digital transformation-related terms in companies' annual reports, an approach that dominates the current field of digital transformation measurement. Accordingly, in this study, when measuring the digital transformation of enterprises, the frequency statistics of words about digital transformation in the Cathay Pacific database are selected as the basic data, and processed by taking the natural logarithm of the word frequency values after performing the operation of adding 1 to them.

3.3. Concentration of the moderator variable industry

Industry concentration is a measure of the number of firms and the distribution of their market shares within a market or industry. This paper adopts the Herfindahl-Hirschman Index (HHI) as a measure of industry concentration, which is obtained by calculating the sum of the squares of the market shares of the enterprises in the industry, and can better reflect the degree of competition and monopoly in the market. The data comes from market share information in public industry reports, market research institutes and annual reports of enterprises.

3.4. Control variables

Referring to the previous related studies on carbon performance [8,15], this paper takes into account firm size (natural logarithm of total assets at the end of the current year for Size firms), gearing ratio (Lev total liabilities/total assets), profitability (Roa net profit/average total assets), operating cash flow (Cashflow net operating cash flow/average total assets), inventory ratio ( Inventory ratio (INV net inventory to total assets), operating income growth rate (Growth current year operating income/previous year operating income-1), number of directors (natural logarithm of the number of Board of Directors), shareholding concentration (Top1 largest shareholder shareholding ratio), number of years on the stock market (ListAge), management shareholding ratio (Mshare Directors, Supervisors, and Executives Total/Total Shares), and Management Expense Ratio (Mfee Administrative Expense/Operating Income) are used as control variables, and the effects of industry (Industry) and time (Year) are controlled.

4. Empirical analysis

4.1. Descriptive statistics

Table 1 presents descriptive statistics and correlation analysis. It reveals that the average value of the explanatory variable Carbon Performance (Cp) is 0.490, accompanied by a standard deviation of 0.460, suggesting substantial variation in the carbon performance among the sampled firms. Similarly, the mean for the explanatory variable Digital Transformation of Enterprises (Digital) stands at 1.330, with a standard deviation of 1.240, indicating a range of digitalisation levels among the sample.

Table 1: Descriptive statistics

Variable | Mean | SD | Min | p50 | Max |

Digital | 1.330 | 1.240 | 0 | 1.100 | 4.620 |

HHI | 0.0700 | 0.0600 | 0.0100 | 0.0500 | 0.370 |

Cp | 0.490 | 0.460 | 0.240 | 0.320 | 2.460 |

Size | 22.31 | 1.330 | 20.09 | 22.09 | 26.41 |

Lev | 0.410 | 0.200 | 0.0600 | 0.400 | 0.870 |

ROA | 0.0500 | 0.0600 | -0.180 | 0.0400 | 0.230 |

ATO | 0.620 | 0.360 | 0.0900 | 0.560 | 2.180 |

Cashflow | 0.0500 | 0.0700 | -0.140 | 0.0500 | 0.250 |

INV | 0.140 | 0.120 | 0 | 0.110 | 0.670 |

Growth | 0.160 | 0.350 | -0.490 | 0.110 | 2.030 |

Board | 2.110 | 0.190 | 1.610 | 2.200 | 2.640 |

Top1 | 0.340 | 0.150 | 0.0900 | 0.320 | 0.740 |

ListAge | 2.030 | 0.950 | 0 | 2.200 | 3.370 |

Mshare | 0.150 | 0.200 | 0 | 0.0200 | 0.690 |

Mfee | 0.0800 | 0.0500 | 0.0100 | 0.0600 | 0.310 |

SOE | 0.310 | 0.460 | 0 | 0 | 1 |

4.2. Regression analysis

The test results for the primary effect are displayed in Table 2. Model 2 indicates that the regression coefficient for digital transformation (Digital) is positive and statistically significant at the 1% level, thereby confirming H1, which suggests that digital transformation initiatives by companies positively influence their carbon performance.

Table 2: Main effects test

Cp | |

Digital | 0.00282** |

(0.00123) | |

Size | -0.00223 |

(0.00145) | |

Lev | 0.0335*** |

(0.00961) | |

ROA | -0.00768 |

(0.0294) | |

ATO | -0.0148*** |

(0.00459) | |

Cashflow | -0.0636*** |

(0.0233) | |

INV | 0.0104 |

(0.0152) | |

Growth | 0.0499*** |

(0.00394) | |

Board | 0.00837 |

(0.00706) | |

Top1 | -0.00678 |

(0.00951) | |

ListAge | -0.00570*** |

(0.00180) | |

Mshare | -0.00838 |

(0.00780) | |

Mfee | 0.0171 |

(0.0323) | |

Ind | Yes |

Year | Yes |

_cons | 0.353*** |

(0.0518) | |

N | 19633 |

R2 | 0.848 |

adj. R2 | 0.848 |

Note: * p < 0.1, ** p < 0.05, *** p < 0.01, same as below.

The coefficient of the interaction term between firms' digital transformation and industry concentration (Digital × HHI) is negatively significant, which indicates that industry concentration weakens the positive contribution of firms' digital transformation to carbon performance to a certain extent. Specifically, although firms' digital transformation can significantly improve carbon performance, in the context of high industry concentration, the relatively fixed market competition pattern weakens the external driving force for firms to improve carbon performance, leading to a reduction in firms' investment in digital transformation, which in turn restricts the improvement of carbon performance. Hence, industry concentration, acting as a moderating factor, dampens the positive relationship between firms' digital transformation and carbon performance, a result that supports the establishment of hypothesis H2.

Table 3: Moderating effects test

Cp | Cp | |

Digital | 0.00281** | 0.00580*** |

(0.00123) | (0.00182) | |

HHI | -0.0611 | -0.0278 |

(0.0743) | (0.0758) | |

Size | -0.00221 | -0.00218 |

(0.00145) | (0.00145) | |

Lev | 0.0334*** | 0.0336*** |

(0.00961) | (0.00961) | |

ROA | -0.00793 | -0.00891 |

(0.0294) | (0.0294) | |

ATO | -0.0149*** | -0.0149*** |

(0.00459) | (0.00459) | |

Cashflow | -0.0637*** | -0.0634*** |

(0.0233) | (0.0233) | |

INV | 0.0104 | 0.00873 |

(0.0152) | (0.0152) | |

Growth | 0.0499*** | 0.0501*** |

(0.00394) | (0.00395) | |

Board | 0.00845 | 0.00849 |

(0.00706) | (0.00706) | |

Top1 | -0.00684 | -0.00652 |

(0.00951) | (0.00951) | |

ListAge | -0.00570*** | -0.00579*** |

(0.00180) | (0.00180) | |

Mshare | -0.00838 | -0.00857 |

(0.00780) | (0.00780) | |

Mfee | 0.0168 | 0.0177 |

(0.0323) | (0.0323) | |

Ind | Yes | |

Year | Yes | |

digitalwhhi_zyywsr | -0.0449** | |

(0.0201) | ||

_cons | 0.363*** | 0.360*** |

(0.0532) | (0.0532) | |

N | 19633 | 19633 |

R2 | 0.848 | 0.848 |

adj. R2 | 0.848 | 0.848 |

5. Heterogeneity analysis

This section analyses the effect of heterogeneity in the nature of property rights and the results are shown in Table 4.

Table 4: Heterogeneity analysis

Cp | Cp | |

Digital | 0.00224 | 0.00358** |

(0.00243) | (0.00146) | |

Size | -0.00225 | -0.00239 |

(0.00227) | (0.00198) | |

Lev | 0.0231 | 0.0375*** |

(0.0165) | (0.0121) | |

ROA | -0.123** | 0.0254 |

(0.0574) | (0.0350) | |

ATO | -0.0180** | -0.0111* |

(0.00766) | (0.00597) | |

Cashflow | -0.0535 | -0.0705** |

(0.0416) | (0.0284) | |

INV | 0.0545** | -0.0150 |

(0.0249) | (0.0195) | |

Growth | 0.0504*** | 0.0495*** |

(0.00695) | (0.00484) | |

Board | 0.00588 | 0.00727 |

(0.0128) | (0.00869) | |

Top1 | 0.00549 | -0.0128 |

(0.0177) | (0.0119) | |

ListAge | -0.00396 | -0.00713*** |

(0.00377) | (0.00221) | |

Mshare | 0.122* | -0.00701 |

(0.0642) | (0.00832) | |

Mfee | -0.00543 | 0.0331 |

(0.0617) | (0.0387) | |

_cons | 0.325** | 0.365*** |

(0.134) | (0.0615) | |

Ind | Yes | |

Year | Yes | |

N | 5996 | 13637 |

R2 | 0.841 | 0.852 |

adj. R2 | 0.839 | 0.851 |

Given their special position in China's economic system, state-owned enterprises (SOEs) are more likely to respond swiftly to national policy calls when the state promotes "peak carbon" and "carbon neutral" green development strategies. As a result, SOEs are more likely to adopt digital technologies to reduce pollution and emissions, thereby enhancing carbon performance. Hence, this paper anticipates a more pronounced impact of digital transformation on improving carbon performance within SOEs. Table 4 reveals that the disparity in coefficients among various groups is insignificant. This implies that the beneficial influence of digital transformation on carbon performance is largely unaffected by the ownership type of enterprises. This may be attributed to the fact that many enterprises are still in the nascent phase of their digital and low-carbon transitions, and their adherence to national policies closely mirrors that of SOEs. Consequently, the influence of enterprise ownership on the relationship between digital transformation and carbon performance is insignificant.

6. Robustness Tests

Given that digital transformation's implementation and ultimate success require an extended period, this paper addresses the potential issue of reverse causation by lagging the variable by one period and reassessing its impact on carbon performance. Table 5 demonstrates that the regression coefficient (0.00259) for the lagged digital transformation variable (L. Digital) is statistically significant at the 10% level and positive, suggesting that the findings of this paper are unaffected by reverse causality.

Table 5: Robustness Tests

Cp | |

L. Digital | 0.00259* |

(0.00155) | |

Size | -0.00314* |

(0.00182) | |

Lev | 0.0472*** |

(0.0121) | |

ROA | 0.0157 |

(0.0367) | |

ATO | -0.0152*** |

(0.00587) | |

Cashflow | -0.0941*** |

(0.0295) | |

INV | 0.0206 |

(0.0191) | |

Growth | 0.0546*** |

(0.00501) | |

Board | 0.00727 |

(0.00884) | |

Top1 | -0.00442 |

(0.0120) | |

ListAge | -0.00680** |

(0.00270) | |

Mshare | -0.00881 |

(0.0101) | |

Mfee | 0.0293 |

(0.0414) | |

Ind | Yes |

Ind | Yes |

_cons | 0.371*** |

(0.0637) | |

N | 14385 |

R2 | 0.847 |

adj. R2 | 0.847 |

7. Conclusions and Implications

7.1. Conclusions of the study

Using a sample of Shanghai and Shenzhen A-share listed manufacturing enterprises from 2015 to 2021, this study examines carbon performance, industry concentration, and arrives at the following key findings: (i) There is a significant positive correlation between enterprise digital transformation and the enhancement of carbon performance. (ii) Industry concentration acts as a negative moderator in the relationship between enterprise digital transformation and carbon performance, indicating that in highly concentrated industries, the beneficial impact of digital transformation on carbon performance is diminished.

7.2. Theoretical contributions

First of all, in fact, from the specific article, we can see that this article is mainly aimed at the in-depth carbon performance improvement in the aspect of digital transformation.this paper focuses on digital transformation at the enterprise level, revealing its direct contribution to carbon performance and providing a new micro perspective for the study of carbon performance drivers.

Second, this paper reveals the negative moderating role of industry concentration in the relationship between firms' digital transformation and carbon performance, filling a gap in research in this area. On the effects of corporate digital transformation, and the findings of this paper contribute to a more comprehensive understanding of the mechanism of corporate digital transformation on carbon performance and its differences under different industry structures.

Thirdly, this paper further enriches the boundary conditions for the impact of firms' digital transformation on carbon performance from the dimensions of firms' internal characteristics (e.g., firm size, technological innovation capability) and external environment (e.g., environmental regulation intensity). This not only broadens our perspective on the sophistication of the connection between digital transformation and carbon performance, but also offers additional theoretical perspectives and empirical foundations for future studies.

7.3. Practical Implications

First, for enterprises, Simultaneously, they should be mindful of the obstacles presented by industry concentration, and reduce the negative impact of industry concentration on the effectiveness of digital transformation by strengthening technological innovation and optimising resource allocation. In addition, enterprises should actively respond to environmental regulation policies, strengthen communication and cooperation with the government, the public and other stakeholders, and work together to advance sustainable green and low-carbon development.

Secondly, the government should formulate more precise policy measures to guide and support enterprises in their digital transformation and carbon emission reduction efforts. On the one hand, it should increase support for digital transformation and green innovation, and provide enterprises with more policy concessions and financial support; on the other hand, it should strengthen environmental regulation and industry supervision, promote a fairer and more transparent market competition environment, and mitigate the adverse effects of industry concentration on the outcomes of digital transformation. At the same time, the government should also actively guide the public to participate in environmental governance, enhance the public's awareness of environmental protection and participation, and create a favourable social atmosphere for the digital transformation of enterprises and carbon emission reduction.

7.4. Research limitations and perspectives

This paper still has a few deficiencies. Firstly, in terms of research samples, this paper only selects manufacturing enterprises as the research object, which can be further expanded to other industries or specific segments for in-depth analysis in the future. Second, in terms of the mechanism, the paper primarily examines the immediate effects of enterprise digital transformation on carbon performance, as well as the moderating influence exerted by industry concentration, and other potential mediating variables and moderating factors can be further explored and investigated in future research endeavors. Finally, in terms of data collection and analysis methods, this paper mainly adopts secondary data and statistical analysis methods, and in the future, it may endeavor to employ case studies, field investigations, and alternative methodologies to undertake more profound and meticulous research.

References

[1]. HE Fan, LIU Hongxia. Assessment of the performance improvement effect of digital change in physical enterprises under the perspective of digital economy[J]. Reform, 2019, (04):137-148.

[2]. WU Fei, HU Huizhi, LIN Huiyan, et al. Corporate digital transformation and capital market performance-empirical evidence from stock liquidity[J]. Management World, 2021, 37(07):130-144+10.DOI:10.19744/j.cnki.11-1235/f.2021.0097.

[3]. E Chaturvedi, J Mukherjee, C Sandu. Multibody Dynamics and Terramechanics-based modelling and simulation of Quarter-Car with Suspension[J]. IOP Conference Series: Materials Science and Engineering, 2024, 1311(1):012020-012020.

[4]. S. Zhang, Q. Cui, X. Yu Ma. Energy saving and emission reduction effects of biased technological progress under digital factor empowerment[J]. China Population-Resources and Environment, 2022, 32(07):22-36.

[5]. Usman A, Ozturk I, Hassan A, et al. The Effect of ICT on Energy Consumption and Economic Growth in South Asian Economies:An Empirical Analysis[J]. Telematics and Informatics, 2020, (58).

[6]. Yang Xingquan, Yin Xingqiang. Industry Concentration, Firms' Competitive Position and the Competitive Effect of Cash Holding[J]. Economic Science, 2015, (06):78-91.DOI:10.19523/j.jjkx.2015.06.008.

[7]. Zhou ZF, Li Y, Xiao T, et al. Carbon risk awareness, low carbon innovation and carbon performance[J]. Research and Development Management, 2019, 31(03):72-83.DOI:10.13581/j.cnki.rdm.2019.03.007.

[8]. Yan HH, Jiang J, Wu QF. Research on the impact of carbon performance on financial performance based on the analysis of property rights nature[J]. Mathematical Statistics and Management, 2019, 38(01):94-104.DOI:10.13860/j.cnki.sltj.20180817-003.

[9]. Xiao HJ, Yang Z, Liu MY. The social responsibility promotion effect of corporate digitalisation: a test of internal and external dual paths[J]. Economic Management, 2021, 43(11):52-69.DOI:10.19616/j.cnki.bmj.2021.11.004.

[10]. Y.S. Zhang, S.B. Li, M.Q. Xing. Enterprise digital transformation and audit pricing[J]. Auditing Research, 2021, (03):62-71.

[11]. Duan Huayou, Huang Xuebin. Research on the Influence Mechanism of Digital Transformation and Internal Control Quality on Corporate Innovation Performance--Taking Resource-based Enterprises as an Example[J]. Frontiers of Engineering Management Science and Technology, 2022, 41(06):65-72.

[12]. Siew Peng Lee, Mansor Isa. corporate sustainability practices and financial performance: the moderating role of corporate controversies and Shariah screening[J]. Corporate Social Responsibility and Environmental Management, 2024, 31(4):3651-3667.

[13]. NAYAL K, RAUT R D, YADAV V S, et al. The impact of sustainable development strategy on sustainable supply chain firm performance in the digital transformation er [J].Business Strategy and the Environment, 2022, 31(3):845 - 859.

[14]. Chenyu Zhao. Research on the impact of digital transformation on corporate social responsibility [J]. Contemporary Economic Science, 2022, 44(02):109-116.

[15]. H. Zhang, S. Cai. A study of the relationship between heterogeneous corporate environmental responsibility and carbon performance: the joint moderating effect of media attention and environmental regulation[J]. China Environmental

Cite this article

Gao,S. (2025). Enterprise Digital Transformation, Industry Concentration and Carbon Performance. Advances in Economics, Management and Political Sciences,160,34-45.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 4th International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. HE Fan, LIU Hongxia. Assessment of the performance improvement effect of digital change in physical enterprises under the perspective of digital economy[J]. Reform, 2019, (04):137-148.

[2]. WU Fei, HU Huizhi, LIN Huiyan, et al. Corporate digital transformation and capital market performance-empirical evidence from stock liquidity[J]. Management World, 2021, 37(07):130-144+10.DOI:10.19744/j.cnki.11-1235/f.2021.0097.

[3]. E Chaturvedi, J Mukherjee, C Sandu. Multibody Dynamics and Terramechanics-based modelling and simulation of Quarter-Car with Suspension[J]. IOP Conference Series: Materials Science and Engineering, 2024, 1311(1):012020-012020.

[4]. S. Zhang, Q. Cui, X. Yu Ma. Energy saving and emission reduction effects of biased technological progress under digital factor empowerment[J]. China Population-Resources and Environment, 2022, 32(07):22-36.

[5]. Usman A, Ozturk I, Hassan A, et al. The Effect of ICT on Energy Consumption and Economic Growth in South Asian Economies:An Empirical Analysis[J]. Telematics and Informatics, 2020, (58).

[6]. Yang Xingquan, Yin Xingqiang. Industry Concentration, Firms' Competitive Position and the Competitive Effect of Cash Holding[J]. Economic Science, 2015, (06):78-91.DOI:10.19523/j.jjkx.2015.06.008.

[7]. Zhou ZF, Li Y, Xiao T, et al. Carbon risk awareness, low carbon innovation and carbon performance[J]. Research and Development Management, 2019, 31(03):72-83.DOI:10.13581/j.cnki.rdm.2019.03.007.

[8]. Yan HH, Jiang J, Wu QF. Research on the impact of carbon performance on financial performance based on the analysis of property rights nature[J]. Mathematical Statistics and Management, 2019, 38(01):94-104.DOI:10.13860/j.cnki.sltj.20180817-003.

[9]. Xiao HJ, Yang Z, Liu MY. The social responsibility promotion effect of corporate digitalisation: a test of internal and external dual paths[J]. Economic Management, 2021, 43(11):52-69.DOI:10.19616/j.cnki.bmj.2021.11.004.

[10]. Y.S. Zhang, S.B. Li, M.Q. Xing. Enterprise digital transformation and audit pricing[J]. Auditing Research, 2021, (03):62-71.

[11]. Duan Huayou, Huang Xuebin. Research on the Influence Mechanism of Digital Transformation and Internal Control Quality on Corporate Innovation Performance--Taking Resource-based Enterprises as an Example[J]. Frontiers of Engineering Management Science and Technology, 2022, 41(06):65-72.

[12]. Siew Peng Lee, Mansor Isa. corporate sustainability practices and financial performance: the moderating role of corporate controversies and Shariah screening[J]. Corporate Social Responsibility and Environmental Management, 2024, 31(4):3651-3667.

[13]. NAYAL K, RAUT R D, YADAV V S, et al. The impact of sustainable development strategy on sustainable supply chain firm performance in the digital transformation er [J].Business Strategy and the Environment, 2022, 31(3):845 - 859.

[14]. Chenyu Zhao. Research on the impact of digital transformation on corporate social responsibility [J]. Contemporary Economic Science, 2022, 44(02):109-116.

[15]. H. Zhang, S. Cai. A study of the relationship between heterogeneous corporate environmental responsibility and carbon performance: the joint moderating effect of media attention and environmental regulation[J]. China Environmental