1. Introduction

In recent years, global climate change has become increasingly severe, prompting countries to take action to promote green transformation. As a market-oriented mechanism, carbon trading markets have gradually become a critical policy tool for controlling carbon emissions due to their regulatory effects on greenhouse gas emissions. Since 2013, China has been progressively developing its carbon trading market, aiming to guide optimal resource allocation through price mechanisms, promote sustainable economic development, and encourage green innovation. The carbon trading market not only plays a significant role in environmental governance but also profoundly impacts regional industrial economic development. This study is of great significance: on one hand, it theoretically reveals the economic effects and influence pathways of the carbon trading market, addressing the gap in existing literature regarding its quantitative analysis. On the other hand, it provides empirical evidence for policymakers to optimize regionally differentiated policies and promote green economic development.

This paper focuses on the impact of the construction of China's carbon trading market on regional industrial economic development. The research includes the following aspects: Using a baseline regression model, this paper analyzes the direct impact of the carbon trading market on regional economic growth and corporate financial performance. The results show that the carbon trading market significantly enhances regional industrial economic development by reducing carbon emission costs and improving enterprise efficiency. From a regional perspective, this study explores the heterogeneous effects of carbon trading policies. It finds that the central and western regions benefit more significantly, while the eastern region, with its stronger economic foundation, experiences relatively smaller policy effects. This paper delves into the mediating role of green innovation in the implementation of carbon trading market policies. The findings indicate that the carbon trading market incentivizes enterprises to increase investment in green technology research and development, thereby improving resource utilization efficiency and indirectly driving regional industrial economic development. This mechanism significantly supports the effectiveness of the policy. This study not only uncovers the key role of the carbon trading market in regional economic development and green innovation but also provides empirical evidence for improving policy design. Optimizing carbon trading market policies can contribute to balanced regional development, enhance corporate green competitiveness, and achieve coordinated economic and environmental progress.

The remainder of this paper is organized as follows: Section 2 introduces the research hypotheses; Section 3 presents the data sources and model specifications; Section 4 discusses empirical results and analysis; Section 5 examines the mechanisms; and Section 6 provides conclusions and policy implications.

2. Theoretical Hypotheses

The relationship between carbon trading markets, green innovation, and regional industrial economic development has gradually attracted academic attention in recent years[1]. Existing literature generally agrees that carbon trading markets, as a market-oriented mechanism, have a significant positive impact on regional economic development. Li Zuojun et al, in "Establishing Carbon Trading Markets to Promote Green Transformation and Development," pointed out that carbon trading markets reduce carbon emission costs, improve corporate operating performance, and effectively promote green innovation activities[2]. Similarly, Jiang Man, in "The Impact of Carbon Emission Trading on Corporate R&D and Innovation," emphasized that the incentive mechanisms of carbon trading markets encourage enterprises to increase investment in green technology innovation, significantly enhancing corporate performance and thus promoting regional industrial economic development[3]. Based on the above analysis, this paper proposes the following hypothesis:

Hypothesis 1: The establishment of carbon trading markets contributes to the promotion of regional industrial economic development.

Additionally, green innovation is regarded as an important mediating factor through which carbon trading markets enhance corporate operating performance. Chen Xinran, in "The Impact of Green Technological Innovation on Corporate Financial Performance," noted that green technological innovation not only reduces operational costs but also enhances market competitiveness, thereby improving the overall operating performance of enterprises in the region and influencing industrial economic development[4]. Furthermore, Wang Yadan argued that green innovation plays a mediating role in the relationship between corporate ESG performance and operating performance, highlighting the critical importance of green innovation capabilities in improving operational outcomes[5]. The incentive mechanisms of carbon trading markets encourage enterprises to increase investment in green innovation, thereby enhancing corporate performance through technological progress and improved resource utilization efficiency, which in turn influences regional industrial economic development[6]. Based on this analysis, this paper proposes the following hypothesis:

Hypothesis 2: Carbon trading markets promote regional industrial economic development by enhancing green innovation.

The impact of carbon trading markets may vary significantly across different regions and types of enterprises. Large enterprises and economically developed regions, with their abundant resources and technological reserves, may find it easier to benefit from carbon trading policies. In contrast, small and medium-sized enterprises (SMEs) and less developed regions may face greater challenges. Therefore, this paper posits that the economic and financial effects of carbon trading markets exhibit heterogeneity across regions. Based on the above analysis, the following hypothesis is proposed:

Hypothesis 3: The establishment of carbon trading markets has heterogeneous effects on the industrial economic development of different regions.

3. Data Sources and Model Specification

3.1. Data Sources

This study uses panel data spanning from 2013 to 2021 to ensure the richness of the sample data. To distinguish the treatment group from the control group, a binary variable ("pilot city of the carbon trading market") is employed to indicate whether a city has implemented a carbon trading market. This data is sourced from the official announcements of China's State Council regarding the establishment of carbon emission trading markets. To measure the impact of carbon trading markets on regional industrial economic development, industrial added value is used as an indicator of regional industrial development. This data is obtained from the China Regional Statistical Yearbook and the Statistical Yearbooks of Provinces and Cities in China. To explore the mechanism through which carbon trading market implementation influences regional economic development, the green innovation index is used to measure the level of green innovation development in different regions. This data is sourced from the National Intellectual Property Administration.

3.2. Model Specification

This paper employs econometric models to comprehensively analyze the specific impacts of carbon trading market implementation on regional economic development. Specifically, the study focuses on how the establishment of carbon trading markets affects regional industrial economic development and the mediating role of green innovation in this process.

First, a fixed-effects model is constructed to analyze the impact of carbon trading markets on regional economic development:

yi,t=0+1didi,t+i+t+i,t

In the model, yi,t represents the economic development indicator of region i at time t, which primarily refers to industrial added value in this study. didi,t is a dummy variable indicating whether region i has implemented the carbon trading market policy. 0 is the constant term, and 1 is the coefficient of the key explanatory variable, representing the impact of carbon trading market policies on regional economic development. i denotes individual fixed effects, used to control for region-specific unobservable factors. t represents time fixed effects, which control for macroeconomic factors before and after policy implementation. i,t is the random error term.

To enhance the reliability of the model results, the study also employs a multi-period difference-in-differences (DID) method to examine the causal relationship between the implementation of carbon trading markets and regional economic and financial performance. Additionally, mechanism analysis and other analytical methods are used to further quantify the mechanisms through which carbon trading markets influence regional economic development and green innovation.

4. Regression Analysis

4.1. Baseline Regression Results

To examine the impact of the establishment of carbon emission trading markets on regional economic development, this study first conducts baseline regression analysis using the basic econometric model described earlier. The specific results of the baseline regression are presented in Table 1.

Table 1: Baseline Regression Results

(1) | (2) | (3) | |

VARIABLES | POLS | FE | TWFE |

did | 0.827*** | 0.894*** | 0.282*** |

(10.01) | (12.53) | (4.67) | |

Constant | 0.397*** | 0.392*** | 0.033 |

(19.07) | (5.18) | (0.52) | |

Observations | 930 | 930 | 930 |

R-squared | 0.098 | 0.148 | 0.540 |

area | NO | NO | YES |

year | NO | NO | YES |

Numberofid | 31 | 31 | 31 |

t-statistics in parentheses

***p<0.01,**p<0.05,*p<0.1

In Table 1, the dependent variable is regional industrial added value. Models (1), (2), and (3) correspond to regressions using POLS (pooled ordinary least squares), FE (fixed effects), and TWFE (two-way fixed effects), respectively. Across all models, the regression results are significantly positive. These findings provide evidence to support the hypothesis that the construction of China's carbon trading market positively impacts regional industrial economic development, thereby confirming Hypothesis 1.

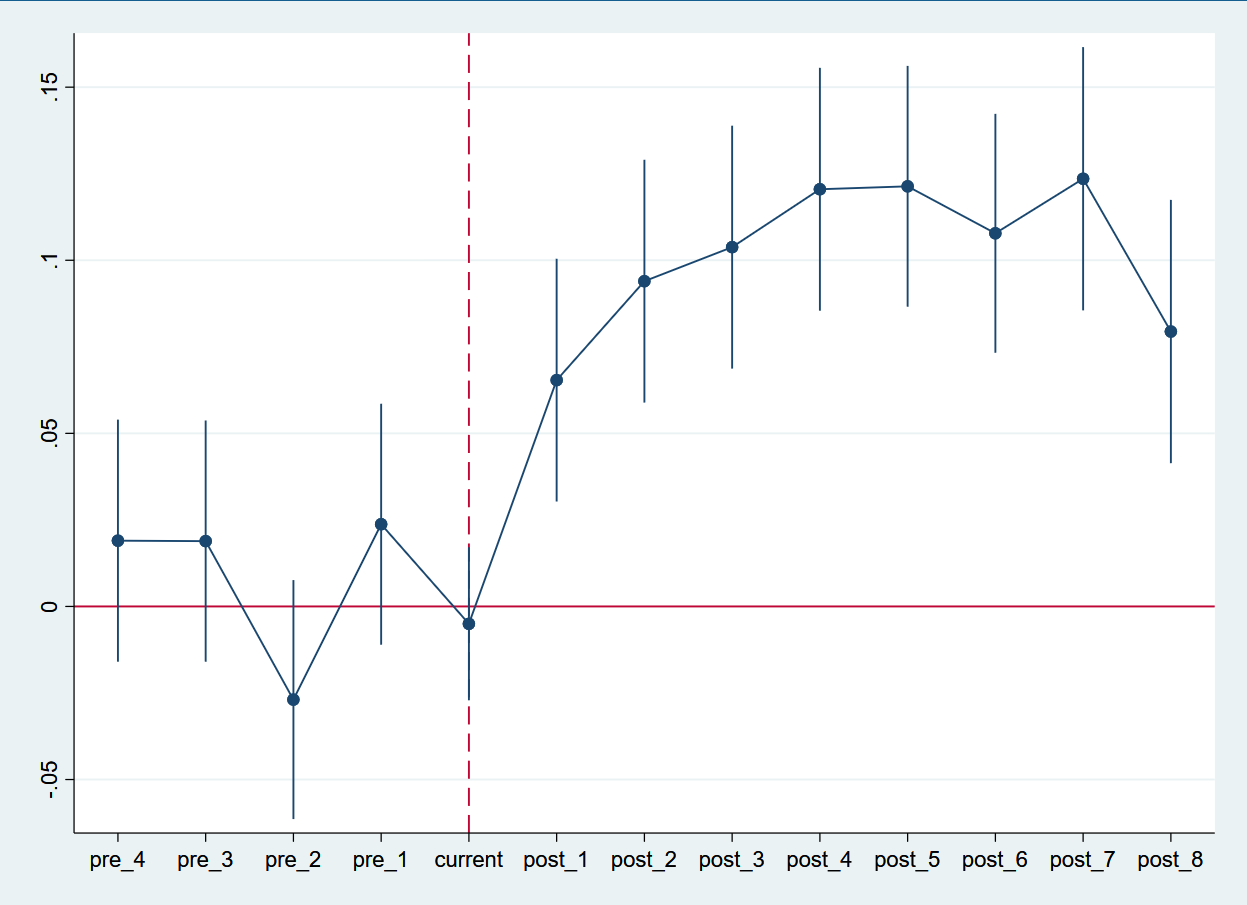

4.2. Parallel Trend Test

A critical assumption for the difference-in-differences (DID) approach is that the treatment and control groups must satisfy the parallel trend assumption. To validate this, various methods were used to test for parallel trends. Specifically, this study employs an event study approach to generate dummy variables for multiple time periods before and after the policy implementation and uses pre1 (the period before the policy) as the baseline period for regression analysis. The results are illustrated in Figure 1.

Figure 1: Parallel Trend Test

By visually examining the trends in the dependent variable (y) for both the treatment and control groups across different years, it is possible to assess whether the parallel trend assumption holds. A comparison reveals that the treatment and control groups exhibit nearly identical trends in y during the baseline period (prior to 2013), with no significant differences. However, following the establishment of carbon emission trading markets in pilot cities (post-2013), the dependent variable (y) begins to diverge between the treatment and control groups. This divergence grows increasingly pronounced over time. The visual evidence confirms that the selected treatment and control cities meet the parallel trend assumption, allowing the use of the DID model for causal analysis.

4.3. Heterogeneity Analysis

To explore potential regional differences in the impact of carbon trading market construction on regional industrial economic development, this study performs heterogeneity analysis using grouped regressions.

Table 2: Heterogeneity Analysis

(1) | (2) | (3) | |

VARIABLES | Eastern Region | Central Region | Western Region |

did | -0.048 | 0.214*** | 0.087* |

(-0.48) | (4.10) | (1.74) | |

gov | -2.963* | -6.363*** | -0.837*** |

(-1.86) | (-12.32) | (-5.54) | |

Constant | 1.050*** | 1.376*** | 0.380*** |

(4.47) | (15.23) | (7.67) | |

Observations | 165 | 120 | 180 |

R-squared | 0.576 | 0.905 | 0.710 |

Number of id | 11 | 8 | 12 |

area | YES | YES | YES |

year | YES | YES | YES |

t-statistics in parentheses

*** p<0.01, ** p<0.05, * p<0.1

Columns (1), (2), and (3) display the regression results for the Eastern, Central, and Western regions, respectively. The regression result in Column (1) is not significant, which may be attributed to the relatively well-developed economic foundation of the Eastern region. This foundation allows the region to exhibit a more stable response to the carbon trading market policies. Furthermore, enterprises in the Eastern region may face fewer constraints and enjoy more market opportunities when adapting to carbon trading market policies, resulting in an insignificant policy effect. In contrast, the regression results in Columns (2) and (3) are significantly positive, indicating that carbon trading market policies have a pronounced positive impact in these regions. Among them, the regression coefficient for did in the Central region is the highest at 0.214, and it is significant at the 1% level, demonstrating that the establishment of the carbon trading market strongly promotes industrial economic development in the Central region. In summary, the implementation effects of carbon trading market policies vary significantly across regions. The Central and Western regions are more strongly affected by the policies, showing significant positive relationships, while the Eastern region exhibits relatively insignificant effects. This suggests that policy implementation should account for regional differences, with region-specific supportive measures designed to maximize the effectiveness of the policies.

4.4. Robustness Tests

To verify the robustness of the baseline regression and heterogeneity analysis results, multiple robustness checks were conducted. These include sensitivity analysis by excluding the COVID-19 pandemic years and regression tests using alternative estimation methods to ensure the reliability of the findings on the impact of carbon trading market policies on regional economic development and financial performance[7].

(1)Robustness Test by Excluding Pandemic Years: Given that the sample period selected in this study includes the years 2020 and beyond, the outbreak of the global COVID-19 pandemic in 2020 introduced an exogenous shock to the macroeconomy. Ignoring this factor could result in an endogeneity problem due to omitted variables. Therefore, to eliminate the potential interference of the pandemic on the regression results and ensure the robustness of the findings, the years 2020 and beyond were excluded from the sample, and the regression analysis was repeated. The results are presented in Table 3.

Table 3: Impact of Excluding Pandemic Years

(1) | (2) | |

VARIABLES | Excluding COVID Impact | Excluding COVID Impact |

did | 0.171*** | 0.141*** |

(3.54) | (3.09) | |

gov | -1.980*** | |

(-7.04) | ||

Constant | 0.374*** | 0.766*** |

(10.36) | (11.76) | |

Observations | 403 | 403 |

R-squared | 0.523 | 0.581 |

Number of id | 31 | 31 |

area | YES | YES |

year | YES | YES |

t-statistics in parentheses

*** p<0.01, ** p<0.05, * p<0.1

Columns (1) and (2) in Table 3 show consistently positive and significant regression results. After excluding the 2020 and later samples, the core explanatory variable did continues to exhibit a significant positive impact on the dependent variable y at the 1% significance level, with coefficients of 0.171 and 0.141, respectively. This indicates that even after accounting for the potential disruptions caused by the pandemic, the construction of carbon trading markets still positively promotes regional economic development and financial performance, thereby confirming the robustness of the results[8].

(3)Robustness Test Using Alternative Estimation Methods: To further validate the robustness of the regression results, this study employs feasible generalized least squares (FGLS) as an alternative estimation method. This approach accounts for heteroskedasticity across groups and autocorrelation within groups. The regression results using FGLS are shown in Table 4.

Table 4: Results Using FGLS Estimation

VARIABLES | (1) | (2) |

did | 0.048* | 0.069** |

(1.84) | (2.05) | |

gov | -0.481*** | |

(-4.35) | ||

Constant | 0.398*** | 0.596*** |

(9.41) | (13.40) | |

Observations | 465 | 465 |

Number of id | 31 | 31 |

area | YES | YES |

year | YES | YES |

z-statistics in parentheses

*** p<0.01, ** p<0.05, * p<0.1

Using the FGLS method, the core explanatory variable did remains significantly positively associated with the dependent variable y at the 5% significance level, with coefficients of 0.048 and 0.069. While the coefficient values are slightly lower than those from the previous regressions, the positive and significant relationship persists. This demonstrates that the positive impact of carbon trading market policies on regional economic development and financial performance is robust. The FGLS results further validate the reliability of the baseline regression and heterogeneity analysis.

In summary, by conducting robustness tests such as excluding the pandemic years, employing FGLS, and applying other verification methods, the robustness checks consistently support the primary conclusions of the baseline regression. The construction of carbon trading markets has a significant positive impact on regional economic development and financial performance. These findings indicate that the positive effects of carbon trading market policies on economic development and corporate financial conditions persist across varying conditions and estimation methods, lending strong credibility and robustness to the model results.

5. Mechanism Analysis

This section investigates the transmission mechanism through which the carbon trading market promotes regional financial performance and economic growth via green innovation[9]. As a market-oriented tool, the carbon trading market not only directly reduces carbon emission costs to impact financial performance but also incentivizes enterprises to engage in green innovation, thereby indirectly driving regional industrial economic development.

The establishment of the carbon trading market provides strong incentives for enterprises to increase their investments in green technology research and development. Green innovation is considered a key strategy for enterprises to adapt to carbon trading policies. The technological progress and improved resource utilization efficiency resulting from green innovation help reduce long-term production costs and enhance corporate profitability. To verify the mediating role of green innovation, this study employs a stepwise approach to test the mediating effect of the variable gpat.

Table 5: Mechanism Analysis

VARIABLES | (1) | (2) | (3) | (4) |

Step 2 | Step 2 | Step 3 | Step 3 | |

gpat | gpat | y | y | |

did | 1.618*** | 1.346*** | 0.238*** | 0.229*** |

(7.99) | (7.44) | (4.66) | (4.56) | |

gov | 9.880*** | -1.035*** | ||

(11.01) | (-3.89) | |||

gpat | 0.185*** | 0.208*** | ||

(16.32) | (16.47) | |||

Constant | 7.157*** | 4.456*** | -0.622*** | -0.504*** |

(133.79) | (17.84) | (-7.59) | (-5.84) | |

Observations | 465 | 465 | 465 | 465 |

R-squared | 0.128 | 0.319 | 0.476 | 0.494 |

Number of id | 31 | 31 | 31 | 31 |

area | YES | YES | YES | YES |

year | YES | YES | YES | YES |

t-statistics in parentheses

*** p<0.01, ** p<0.05, * p<0.1

The first step of this study examines the relationship between the independent variable did and the dependent variable gpat. The baseline regression presented earlier has already established that did is positively correlated with gpat at the 1% significance level. In the second step, the dependent variable is replaced with the mediating variable to investigate whether a significant relationship exists between the independent variable and the mediating variable. The results indicate that did is positively correlated with y at the 1% significance level, confirming the presence of a significant relationship. In the third step, the mediating variable is introduced into the regression model alongside the independent variable to test for the presence of a mediating effect. The results show that gpat is positively correlated with y at the 1% significance level, indicating that green innovation positively impacts financial performance at the 1% significance level and confirming the existence of a mediating effect.

Based on the above mechanism analysis, several policy implications can be derived: Local governments should use policy tools to further incentivize enterprises to engage in green innovation, particularly by providing financial support and technical assistance to small and medium-sized enterprises (SMEs). Local governments should offer more support for green innovation to ensure the long-term effectiveness of carbon trading markets. This would help enhance the overall economic competitiveness and financial performance of the region through green innovation.

6. Conclusion and Implications

This paper analyzes the impact of the construction of China's carbon trading market on regional economic development and financial performance, confirming that the carbon trading market has a significant positive effect on regional economies. The findings are summarized as follows: Significant Positive Impact on Financial Performance: The construction of the carbon trading market has a significant positive effect on regional financial performance. Baseline regression results indicate that the carbon trading market effectively improves regional economic and corporate financial conditions by reducing carbon emission costs and enhancing enterprise efficiency. Heterogeneous Regional Impacts: The impact of the carbon trading market varies across regions. The study finds that the Central and Western regions, with relatively weaker economic foundations, benefit more significantly from the implementation of carbon trading policies. In contrast, the Eastern region, with a higher level of economic development, experiences relatively smaller policy effects. This highlights the need to consider regional differences in policy implementation and to design region-specific supportive policies to maximize policy effectiveness. The Mediating Role of Green Innovation: Green innovation plays an important mediating role in the positive impact of the carbon trading market on financial performance. By incentivizing enterprises to engage in green technological innovation, the carbon trading market not only improves corporate financial performance but also drives the green transformation and sustainable development of regional economies.

The findings of this study provide important insights for the further improvement of the carbon trading market, but certain limitations and directions for future research remain: 1.Sector-Specific Analysis: Future research could delve deeper into the impact of carbon trading markets across different industries. While this study focuses on the economic and financial effects at the regional level, the specific impacts on various industries and types of enterprises require more detailed empirical exploration. 2.Exploration of Additional Mechanisms: The mechanism analysis in this study highlights the mediating role of green innovation, but other potential mechanisms, such as enterprise management efficiency and policy implementation quality, were not examined in depth. Future research could expand on these aspects to provide a more comprehensive understanding of the pathways through which carbon trading markets exert their influence. 3.Support for Small and Medium-Sized Enterprises (SMEs): Policymakers should strengthen support for SMEs, which face significant financial and technical pressures in the carbon trading market. Governments should consider offering subsidies, technical assistance, and other measures to help SMEs better adapt to the requirements of the carbon trading market and enhance their green innovation capabilities. 4.Region-Specific Carbon Trading Policies: Differentiated carbon trading policies tailored to the economic conditions of different regions are essential. In the Eastern region, with its strong economic foundation, policies should focus on encouraging independent green technology innovation. Meanwhile, the Central and Western regions require greater policy support and financial investment to achieve a balance between carbon emission reduction and economic growth.

In conclusion, the carbon trading market, as a market-oriented environmental policy, not only enhances regional economic development and corporate financial performance but also drives sustainable economic development through green innovation. Future policy development and research should place greater emphasis on regional disparities and the characteristics of different enterprise types to ensure the long-term effectiveness of carbon trading markets and the comprehensive realization of economic green transformation.

References

[1]. Yuan, Z. L. K. (2023). Does rising carbon trading prices promote corporate green innovation? [D]. Jiangxi University of Finance and Economics.

[2]. Li, Z. J., Liu, P., & Zhang, L. M. (2016, December 2). Establishing a carbon trading market to promote green transformation and development [N]. China Economic Times, (015).

[3]. Jiang, M. (2022). A study on the impact of carbon emission trading on enterprise R&D and innovation [D]. Central University of Finance and Economics. https://doi.org/10.27665/d.cnki.gzcju.2022.000716

[4]. Chen, X. R. (2023). The impact of green technological innovation on corporate financial performance [D]. Dongbei University of Finance and Economics. https://doi.org/10.27006/d.cnki.gdbcu.2023.000617

[5]. Wang, Y. D. (2023). Corporate ESG performance, green innovation, and financial performance [D]. Henan University of Economics and Law. https://doi.org/10.27113/d.cnki.ghncc.2023.000288

[6]. Liu, P. Z. (2022). The impact of carbon emission trading policy on corporate technological innovation [D]. Hunan University. https://doi.org/10.27135/d.cnki.ghudu.2022.000072

[7]. Li, X. J. (2024). The impact of carbon emission trading policies on corporate green technological innovation [D]. Shandong University of Finance and Economics. https://doi.org/10.27274/d.cnki.gsdjc.2024.000825

[8]. Bi, L. W. (2023). The driving effect of carbon trading markets on corporate energy conservation and emission reduction [D]. North China University of Technology. https://doi.org/10.26926/d.cnki.gbfgu.2023.000902

[9]. Shao, J. Y. (2022). The impact of carbon emission governance on industrial green transformation [D]. Tianjin University of Finance and Economics. https://doi.org/10.27354/d.cnki.gtcjy.2022.000796

Cite this article

Zhang,S. (2025). The Impact of China's Carbon Trading Market on Industrial Economic Development. Advances in Economics, Management and Political Sciences,160,58-67.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 4th International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Yuan, Z. L. K. (2023). Does rising carbon trading prices promote corporate green innovation? [D]. Jiangxi University of Finance and Economics.

[2]. Li, Z. J., Liu, P., & Zhang, L. M. (2016, December 2). Establishing a carbon trading market to promote green transformation and development [N]. China Economic Times, (015).

[3]. Jiang, M. (2022). A study on the impact of carbon emission trading on enterprise R&D and innovation [D]. Central University of Finance and Economics. https://doi.org/10.27665/d.cnki.gzcju.2022.000716

[4]. Chen, X. R. (2023). The impact of green technological innovation on corporate financial performance [D]. Dongbei University of Finance and Economics. https://doi.org/10.27006/d.cnki.gdbcu.2023.000617

[5]. Wang, Y. D. (2023). Corporate ESG performance, green innovation, and financial performance [D]. Henan University of Economics and Law. https://doi.org/10.27113/d.cnki.ghncc.2023.000288

[6]. Liu, P. Z. (2022). The impact of carbon emission trading policy on corporate technological innovation [D]. Hunan University. https://doi.org/10.27135/d.cnki.ghudu.2022.000072

[7]. Li, X. J. (2024). The impact of carbon emission trading policies on corporate green technological innovation [D]. Shandong University of Finance and Economics. https://doi.org/10.27274/d.cnki.gsdjc.2024.000825

[8]. Bi, L. W. (2023). The driving effect of carbon trading markets on corporate energy conservation and emission reduction [D]. North China University of Technology. https://doi.org/10.26926/d.cnki.gbfgu.2023.000902

[9]. Shao, J. Y. (2022). The impact of carbon emission governance on industrial green transformation [D]. Tianjin University of Finance and Economics. https://doi.org/10.27354/d.cnki.gtcjy.2022.000796