1. Introduction

China's economy is in a stage of transformation from high -speed growth to high -quality development, and consumption has become an important driving force for economic growth. The retail industry is also constantly adapting to this change, emphasizing quality and services. However, with the rapid development of e -commerce and the influence of factors such as online shocks, the development of offline retail companies is facing huge challenges. Many of the formerly unlimited foreign retail companies have poor operating conditions in China to become the norm, or withdraw from the Chinese market or withdraw from the Chinese market or withdraw from the Chinese market or withdrawn from the Chinese market or Seller to stop loss [1].

As a company that started with e -commerce, Suning is committed to achieving online and offline omni -channel layout. By mergers and acquisitions of Carrefour, it integrates its offline resources and enhance its market competitiveness. In addition, consumers have improved quality and service requirements, and acquisition of Carrefour to enrich the product line and meet diversified consumer needs, thereby improving the user experience. This M&A reflects the integration trend of the retail industry under the background of digital transformation. Traditional retailers have enhanced their competitiveness through mergers and acquisitions and optimized resource allocation.

Through the acquisition of Carrefour, Suning has promoted the development of omni -channel retail, and it also provides a successful case for other companies. M&A will change the competitive pattern of China's retail market and help analyze the dynamics and evolution of the future retail market. In -depth discussions, the cause, process and results, provide empirical support for the theory of mergers and acquisitions, and enrich existing documents. Analysis of how Suning's rapid expansion and resource integration through mergers and acquisitions in market competition are of great significance to the improvement of corporate strategic management theory. Provide case reference for other retail companies' mergers and acquisitions to help formulate more effective M&A strategies and integration plans. Although there are many research on the performance of corporate mergers and acquisitions at home and abroad, there are fewer research cases for the Internet industry and offline retail industry. Especially in today's consumption upgrade, the Internet digitization is constantly developing [2]. There is still a lot of research space for seeking mergers and acquisitions and performance evaluations of the mergers and acquisitions of e -commerce companies, especially the mergers and acquisitions of e-commerce companies, and the relevant suggestions after the mergers and acquisitions [3]. Therefore, it can enrich and improve academic research on the retail industry mergers and acquisitions, market competition and consumer behavior, and provide new perspective and theoretical framework. Provide practical lessons for other retail companies in the process of mergers and acquisitions and integration to help them formulate more effective business strategies.

2. Literature Review

Kirikova and Marite believe that the purpose of the merger of many companies is to gain competitive advantages. The integration after mergers and acquisitions needs to be viewed from different related aspects, such as personnel, culture, infrastructure, product portfolio, process, etc. [4]. Grigorieva, Svetlana and Troitsky, Pavel, after studying the impact of the M&A in 2005-2009 Golden Brick Four Kingdoms on the company's performance, found that the company's business management and financial performance have been greatly improved after mergers and acquisitions [5].

In the Western mature capital market, Bradley et al. found that the short -term excess income obtained by the shareholders of the two parties in the merger and acquisition of the two parties can form a profit -making mechanism for mergers and acquisitions coordinated effects, and promote the formation of synergy effects in the merger and acquisition integration in the merger and acquisition integration [6].In the emerging Chinese capital market, scholars study the coordinated effects of mergers and acquisitions from the three elements of efficiency, cost, and profit [7].

For the control of M&A payment risks, scholars mainly put forward risk control suggestions from the aspects of payment methods and payment of consideration. Nguyen studies found that in the selection of payment methods, the combination of cash and stock is the most effective payment method. As far as the type of mergers and acquisitions is concerned, the net assets generated by diversified mergers and acquisitions are the highest yields [8]. Bauer believes that corporate managers should seek the goal of mergers and acquisitions with strategic guidance. Strategic fit is an important source of M&A coordinated effects. In order to reduce the impact of potential conflicts in mergers and acquisitions, managers need to realize that strategic fit in the industry and cross The different consequences of industry mergers and acquisitions to help companies become more efficient after integration [9]. Jiang’s study shows that if the two parties in the merger and acquisition are huge in terms of culture, brand and operation models, and the experience of mergers and acquisitions in integration in integration is insufficient. In order to reduce conflicts, it is necessary to maintain the independence of the leading enterprises in some advantages. At the same time Establish a mechanism for communication and adjustment, soothe the emotions of mergers and acquisitions, and prevent the loss of key talent [10].

The "new retail" background was born in 2016. It belongs to a newer field. There are fewer related theories. There is no definition and characteristics for the time being. The academic community is still being further explored and studied for its related theories. In addition, the current research of academic circles is also concentrated in the future development trend and possible problems in the new retail, and there are fewer research on the causes and economic consequences of the mergers and acquisitions in the new retail industry. In general, the results of the industry's mergers and acquisitions in the background of China's new retail still need to be enriched.

3. Acquisition Side Description

Under the influence of the new crown pneumonia's epidemic and the severe economic situation at home and abroad in 2020, in recent years, China's Internet retail industry has been impacted. However, according to data from the State Bureau of Statistics, China's Internet retail market has remained relatively stable. The growth of the market has gradually expanded. As of the end of 2023, China’s Internet online retail sales exceeded 15 trillion yuan, an increase of 1.6 trillion yuan from last year and an increase of 11.60%year-on-year (see Figure 1).

Figure 1: National online sales from 2018 to 2023.

Suning Tesco is currently a large comprehensive e -commerce platform in China. It was established in 1990. It is headquartered in Nanjing, China. Its branches are located in major cities and regions across the country. However, when it started, Suning Tesco was just an air -conditioning store in Nanjing Xinjiekou, which slowly transformed into a shopping platform with online and offline dual channels that covered the comprehensive categories of traditional home appliances, digital products, department store super -daily necessities, and daily necessities. On the Internet, the retail sales of Suning Tesco in 2023 ranked among the top five on Internet online sales in China. In terms of offline channels, as of 2024, Suning Tesco’s entire scene in the country covers more than 50 cities across China, and there are nearly 30,000 online stores, including Suning Plaza, Carrefour Community Center, Suning Store, Su Xiansheng, Suning Life Supermarkets, Suning Plaza Shopping Center, etc.

4. Description of the Acquired Company

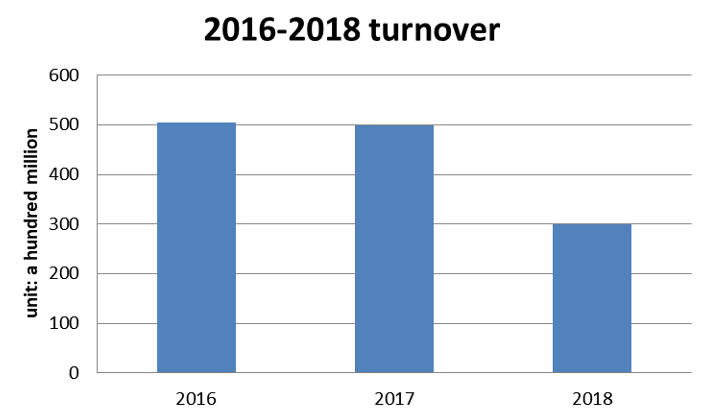

Carrefour was founded in France in 1959. After its establishment, it quickly expanded in the European market. After merging with Promodes in 1999, it gradually became the first and the world's second largest retail group in Europe. Carrefour officially entered the Chinese market in 1995 and quickly spread to major cities across the country. There are 210 large chain supermarkets and 24 convenience stores in major cities across the country. Carrefour China ranked seventh among the national fast-moving consumer goods chain in 2018. However, due to the competition of some large chain supermarkets at home and abroad and the hit by Internet online shopping, Carrefour's competitive advantage is not obvious, and it has suffered serious losses since the second half of 2018. Its turnover and sales volume decreased significantly, and the operating conditions were very bleak (see Figure 2).

Figure 2: Turnover from 2016 to 2018.

Suning International's wholly -owned subsidiary Suning International proposed on June 23, 2019 that it is planned to acquire 80% of Carrefour (China) Co., Ltd. at a price of 4.8 billion yuan. This merger and acquisition is based on the strategic cooperation between the two parties. It aims to achieve complementary advantages, jointly promote the construction of the supply chain and logistics system, and enhance the coordinated development capabilities of both parties. On November 28, 2018, Suning Holding Group signed an agreement with French Hutchs. After the transaction is completed, Suning will become the largest controlling shareholder of Carrefour China.

5. Acquisition Case Analysis

Suning Tesco's mergers and acquisitions of Carrefour China are horizontal mergers and acquisitions, mainly because Suning Tesco itself also has the related business of fresh and offline merchants. M&A is one of the effective ways for enterprises to achieve rapid expansion. Horizontal mergers and acquisitions can improve the competitiveness and industry status of enterprises. Integrate the technical capabilities of the company in the same industry. Through this merger and acquisition, the competition between retail companies has been eliminated, and the market share of Suning Tesco in retail supermarkets has been expanded, and the integration and upgrading of the upstream and downstream industrial chains has been achieved. Profit.

5.1. Scale Increase

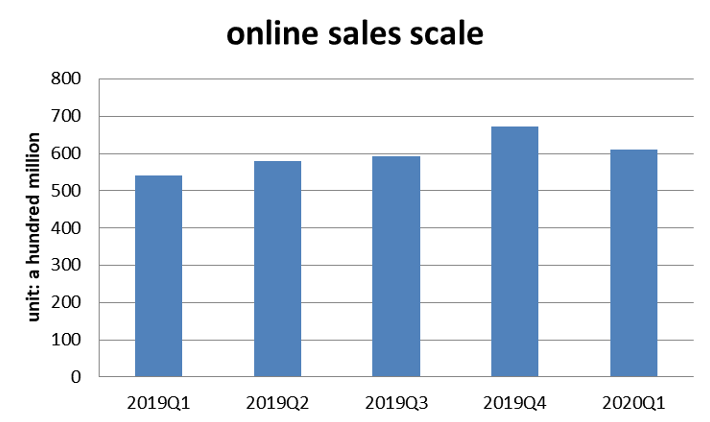

In terms of business scale, as shown in Figure 3, after the completion of mergers and acquisitions in the third quarter of 2019, the scale of online sales has increased to varying degrees, especially in the fourth quarter of 2019. It is also because Suning Tesco has been fully improved after the merger of the Carrefour and the Da Calf System, and its operating efficiency has been continuously improved. In the first quarter of 2020, Suning Tesco's online platform commodity transaction scale was only 61.04 billion yuan, a significant decline in the growth rate. This was also due to the epidemic. Far -0.8%higher than the industry average. In fact, after completing the mergers and acquisitions, the competitive weapon of Suning Tesco is to go to the home business. The arrival of the epidemic has brought Suning a greater opportunity. It means that Suning and Carrefour work together, and the business scale has increased, which has produced a good synergy effect.

Figure 3: Online Sales Scale from 2019 Q1 to 2020 Q1.

5.2. Efficiency Improvement

After the mergers and acquisitions, Suning Tesco integrates services and technology. Because Suning Tesco has a huge member system, it is not appropriate to violate the interests of one party. Share all membership rights and resources. In terms of site selection and selection, Suning's advantage over Carrefour is the massive data resources accumulated in the early stage, and Carrefour lacks customers. So Suning thoroughly analyzed consumer groups, commodity attributes, consumer scenarios, and consumer preferences in different regions, so that Carrefour caters to consumers to make changes and improve internal operating efficiency. The combination of the two has increased its online market share.

5.3. Risk

While the mergers and acquisitions bring an advantage, they must also consider their risks. The integration risk is that both parties to the acquisition must not collaborate or even conflict in finance, personnel, and cultural resources, so that M&A transactions cannot reach the risk of expected goals. There are mainly financial integration risks, cultural, personnel integration risks, and online and offline integration risks. The risk of financial integration is due to the differences in the concept of financial management, financial systems, financial institutions and personnel, and the risks that cannot be effectively promoted by financial work. The risk of cultural integration refers to the risks caused by cultural differences to mergers and acquisitions, which will lead to a reduction in the cohesion of enterprises and is not conducive to the continuous development of enterprises. The risk of personnel integration is mainly due to the adverse effects of the staff caused by mergers and acquisitions to the efficiency of employees' work, and the risk of the loss of key talents after the acquisition of employees after mergers and acquisitions.

In response to the characteristics of retail companies, the risk of integration of online and offline integration has been compiled. Because the two parties in the mergers and acquisitions have differences in operating business, customer data and technology, whether the mergers and acquisitions can efficiently cooperate with high uncertainty after the merger and acquisition. First of all, because the two parties operate different businesses in both parties, can the newly incorporated business segments form an interconnection with the current development of the merger and acquisition company, and whether the part of the business cross is arranged and adjusted. Whether the customer group can become its own resources is the challenges facing the acquisition of the acquisition of the acquisition, so there will be risks of business integration; second, whether it can effectively integrate the massive data of online and offline, and then there is a large existence of synergy. Uncertainty, if it is not integrated with effective integration, it may lead to the loss of users and the waste of resources. Therefore, there is a risk of data integration. Finally, digital technology provides a strong support for online and offline integration, but at the same time, it will also be There are risk of digital technology leakage.

All cash mergers and acquisitions make financial risks too high. Suning's mergers and acquisitions of Carrefour this time spent a lot of cash. And use cash payment as a single payment method. The mergers and acquisitions of this single payment method have reduced Suning's short -term debt capacity, which has hindered the future operations of the enterprise. At the same time, the amount of mergers and acquisitions has increased, which increases Suning's financial burden and increases the risk of capital, causing the company's financial risks to be too high.

A variety of payment methods are used to reduce the financial risks of enterprises. In this merger, Suning Tesco spent 4.8 billion yuan in cash for the acquisition of 80%of Carrefour China. On the one hand, Suning's choice is because he has sufficient mobile funds on the one hand, and on the other hand, because Carrefour has also discussed cooperation with Tencent before, hoping to accelerate the process of mergers and acquisitions. However, Suning Tesco has decreased rapidly after the mergers and acquisitions of Carrefour, and the low level has been maintained for a long time, and it is far lower than the industry average level. Although the cash payment is flexible and convenient, it can also speed up the merger and acquisition process, but it will also affect the future operation of the company due to a large amount of cash loss and increase the financial risk of the enterprise. Therefore, for other enterprises, it must understand that in addition to cash payment and stock payment, corporate mergers and acquisitions also include transaction methods such as stock exchange and debt. When the enterprise occurs, the choice of payment methods will be used to use multiple means mixed payment. The current concept of new retail concepts allows retail companies to make every effort to seize the market. In this way, it will also consume a lot of financial resources in high -frequency investment and mergers and acquisitions activities. Therefore, retail companies must consider with their own development conditions. Council to complete mergers and acquisitions.

6. Revelation Suggestion

The new retail model has redefined traditional retail models, which inspires the innovation and transformation of retail companies. Many online retail companies explore the new retail model and improve the layout of the retail format through mergers and acquisitions. Therefore, such mergers and acquisitions have more mature considerations in terms of strategic purposes and industrial collaboration, so strategic mergers and acquisitions have become the main way for retail companies to mergers and acquisitions.

From the perspective of regulatory agencies, it is necessary to standardize corporate mergers and acquisitions. Enterprises will adopt different payment methods and property rights transactions, especially involving different industries. At present, the retail industry includes an online and offline market, and its market environment is more complicated. It can be seen that it is particularly necessary to formulate substantial and targeted laws and regulations to standardize the mergers and acquisitions of retail enterprises. At the same time, it is also necessary to rely on relevant departments such as the government industry and other relevant departments to increase the supervision and crackdown on corporate mergers and acquisitions, fundamentally rectify and acquisition of unreasonable behaviors, and promote the balanced development structure of the retail industry. In order to improve the performance of the mergers and acquisitions of the retail industry, it is necessary to merge and acquisition in a fair and fair market environment, thereby forming a virtuous circle and promoting the healthy and effective development of the merger and acquisition market.

The times are constantly changing, and the trend is constantly changing, and the development of enterprises is not static. Instead, it is necessary to continue to reform and innovate and conform to the times in order to develop enduring. The development of the Internet has penetrated into all corners of people's lives. Online shopping has also changed people's traditional shopping models. However, Internet competition is becoming increasingly fierce, and problems such as long time and virtualization cannot completely replace offline stores. The cost of offline stores is high, and issues such as the advantage of prices have gradually lost some markets. Therefore, the development of online and offline integration can combine the advantages of both parties to make up for the defects of both parties. Realize the in -depth development of services, experience, logistics, and technology. In addition, digital operation can better serve customers, use online sales + online store operation methods, analyze the large amount of data of customers online shopping, and make better choices for customers' shopping behavior according to the needs and preferences of customers. The new retail industry will enter the new era of development, which will help people break through the slow bottleneck period of the slow development of traditional retail. Today's community retail, AI shopping, virtual space, etc. will be closely related to the daily life. In the process of development, it must learn to use the advantages of technology, actively grasp the trend of the times, be brave to change, and be good at changing. Fully study the future development trends, grasp the wind and keep pace with the times.

7. Conclusion

Facing the severe domestic and foreign economic situation and intricate market environment, China's retail industry situation has been changing. The acquisition of Carrefour China in Suning Tesco not only helps the two parties formed a synergistic effect in the retail field, but also promoted the development of traditional retail and e -commerce integration. Through this merger and acquisition, Suning can further strengthen offline layout, enhance online and offline integration operating capabilities, and expand market share. Carrefour uses Suning's technology and logistics advantages to improve business conditions and achieve localized transformation. From a macro perspective, this measure reflects the reform trend of China's retail industry in the context of fierce competition and consumption upgrade. The business model of online and offline integration will become the core competitiveness of the development of retail companies in the future. Big data, intelligence and supply chain efficiency improvement.

References

[1]. Teng, M. Y. (2022). Research on the risks of Suning.com’s strategic acquisition of Carrefour China [Doctoral dissertation, Shandong Normal University].

[2]. Hao, J. W. (2022). Performance evaluation research of Suning.com’s acquisition of Carrefour China [Doctoral dissertation, East China Normal University].

[3]. Tan, S. (2022). Research on the motives and economic consequences of Suning.com’s acquisition of Carrefour [Doctoral dissertation, Chongqing Technology and Business University].

[4]. Kirikova, M. (2020). Importance of IS in mergers and acquisitions. CEUR Workshop Proceedings, 9(13), 127-132.

[5]. Grigorieva, S., & Troitsky, P. (2012). The impact of mergers and acquisitions on company performance in emerging capital markets. (3), 31-43.

[6]. Bradley, M., Desai, A., & Kim, E. H. (1988). Synergistic gains from corporate acquisitions and their division between the stockholders of target and acquiring firms. Journal of Financial Economics, 21(1).

[7]. Zheng,B., Shi, H. (2020). Research on the Method of Enterprise Mergers and Acquisitions Decision Considering Synergy Effect: Taking 63 Biological and New Pharmaceutical Enterprises in Fuzhou City as Examples. Southeast Academic, (02), 207-216.

[8]. Nguyen, C. A. (2013). Factors of success and failure in mergers and acquisitions. Dissertations & Theses - Gradworks.

[9]. Bauer, F., Strobl, A., Mai, A. D., et al. (2016). Examining links between pre- and post-M&A value creation mechanisms: Exploitation, exploration, and ambidexterity in Central European SMEs. Long Range Planning, 51(2), 185-203.

[10]. Jiang, Y. J. (2017). Post-merger integration models of Chinese enterprises: A case study of Geely Group’s acquisition of Volvo Cars. Research on Economics and Management, 38(07), 126-132.

Cite this article

Zhao,J. (2025). An Evaluation Research of Suning Tesco Merchants Carrefour. Advances in Economics, Management and Political Sciences,162,23-30.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 4th International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Teng, M. Y. (2022). Research on the risks of Suning.com’s strategic acquisition of Carrefour China [Doctoral dissertation, Shandong Normal University].

[2]. Hao, J. W. (2022). Performance evaluation research of Suning.com’s acquisition of Carrefour China [Doctoral dissertation, East China Normal University].

[3]. Tan, S. (2022). Research on the motives and economic consequences of Suning.com’s acquisition of Carrefour [Doctoral dissertation, Chongqing Technology and Business University].

[4]. Kirikova, M. (2020). Importance of IS in mergers and acquisitions. CEUR Workshop Proceedings, 9(13), 127-132.

[5]. Grigorieva, S., & Troitsky, P. (2012). The impact of mergers and acquisitions on company performance in emerging capital markets. (3), 31-43.

[6]. Bradley, M., Desai, A., & Kim, E. H. (1988). Synergistic gains from corporate acquisitions and their division between the stockholders of target and acquiring firms. Journal of Financial Economics, 21(1).

[7]. Zheng,B., Shi, H. (2020). Research on the Method of Enterprise Mergers and Acquisitions Decision Considering Synergy Effect: Taking 63 Biological and New Pharmaceutical Enterprises in Fuzhou City as Examples. Southeast Academic, (02), 207-216.

[8]. Nguyen, C. A. (2013). Factors of success and failure in mergers and acquisitions. Dissertations & Theses - Gradworks.

[9]. Bauer, F., Strobl, A., Mai, A. D., et al. (2016). Examining links between pre- and post-M&A value creation mechanisms: Exploitation, exploration, and ambidexterity in Central European SMEs. Long Range Planning, 51(2), 185-203.

[10]. Jiang, Y. J. (2017). Post-merger integration models of Chinese enterprises: A case study of Geely Group’s acquisition of Volvo Cars. Research on Economics and Management, 38(07), 126-132.