1.Introduction

Both China and Vietnam have a great advantage and influence in the export of electronic manufacturing products in the world, and they each accounts for a significant portion of the world's total exports of such electronic products in many products. In 2023, China held the top position globally for several advanced electronics categories, highlighting its investment in high-tech manufacturing and AI integration to increase production yield and product complexity. For instance, it ranked first in lithium-ion accumulators with an export value of USD 65 billion, capturing 52.1% of the global market share[1]. Meanwhile, Vietnam has established itself in mid-range electronics manufacturing, with a focus on cost-effective, labor-intensive production, supported by its affordable workforce and trade-friendly policies. For example, Vietnam holds the world’s leading position with a 27.2% [2] global share in the export of Headphones. Despite these advances on the study of electronics manufacturing in China and Vietnam, academic research has yet to fully explain how AI has influenced the development of electronics manufacturing in China and Vietnam and the impact on the shift of manufacturing. This paper examines the application and impact of artificial intelligence (AI) on China and Vietnam in the electronics manufacturing industry, focusing on AI technologies are driving trans formative changes within the industry by promoting the comparative advantages of China and Vietnam. Furthermore, the study examines how these advancements contribute to the distinct developmental trajectories of China and Vietnam in the electronics manufacturing sector. The study uses statistical and case study analysis with official data from the World Bank and other official data and industry reports, and the Ricardian Chart model to analyze the comparative advantage of AI for China and Vietnam in the electronics manufacturing industry and validated with the RCA index. This study offers insights into the different impacts of AI on the electronics manufacturing industries in China and Vietnam, and how it accelerates industry chain shifts by promoting the each countries’ unique comparative advantages. It serves as a foundation for future policy and industrial planning in both countries and provides direction for the future development of AI and electronics manufacturing in both countries.

2.Overview of AI Applications in Electronics Manufacturing

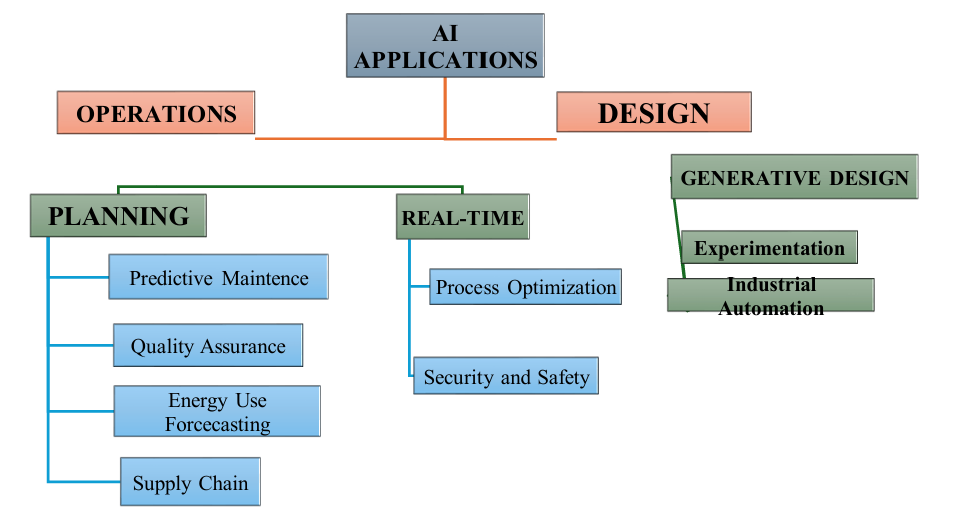

Both China and Vietnam have applied Artificial Intelligence smart technologies in electronics manufacturing. According to Figure1, AI applications including optimization of manufacturing operations, process and product design, scientific machine learning, computational experimentation, and industrial automation, which are widely used in the manufacturing industry. This study divides the application of AI into two aspects according to Figure 1, which are product design and operation. In general, AI improves operations and development in the electronics manufacturing industry in China and Vietnam by analyzing large amounts of data, enabling faster and smarter decision-making, and facilitating the application of automation by improving production processes.

Figure 1: The application of AI into two aspects

2.1.AI-Enhanced Design and Prototyping

Traditional design is a constant iteration of the original model, requiring significant time, labor, and material resources to refine products. Idea generation is a crucial stage in product design, as designers often encounter difficulties in generating innovative ideas due to psychological inertia, commonly known as design fixation [3]. However, with the application of AI, real time data from previous manufacturing and customer interactions can be analyzed automatically. AI systems embedded in products can analyze data automatically and apply problem-solving capabilities such as object recognition, natural language processing, prediction, and decision-making. [4]

In the semiconductor industry, for instance,, AI plays a major role in design section. AI and Machine Learning enable productivity and growth, bringing creativity to product design. For semiconductor designers, this implies the following as the result of their deep understanding of the industry: better, technically superior and high-performance chips in an ever-evolving industry. [5] Chinese semiconductor companies use machine learning technology based on artificial intelligence to simplify prototype design and improve design efficiency. The Chinese semiconductor manufacturing companies first train the AI with existing designs and data and then generate new designs by interpolating or sampling within the space. Therefore, the application of artificial intelligence in design can improve product design efficiency to meet the needs of a rapidly changing market.

2.2.Quality Control and Defect Detection

In the process of electronics manufacturing, due to the variety and complexity of electronic components, minor defects can cause major quality problems and economic losses. For multistage manufacturing systems, undesirable quality deviations might propagate along stages and result in defects of final products. [6] The process of product quality control has been transformed in several ways through the application of artificial intelligence, especially machine learning and computer vision technologies. AI-driven computer vision systems analyze images of products on assembly lines in real time. Training with data related to both defective and normal parts enable AI systems to quickly detect defects in products, such as misalignment, soldering defects, and surface imperfections with a level of accuracy that often surpasses human inspectors. For example, Bosch embedded AI into their manufacturing process, achieving a defect escape rate of 0% and a false alarm rate of less than 0.5%. In contrast, systems relying on human inspectors had error rates ranging from 20% to 30% due to factors such as optical illusions and eyesight limitations [7]. In addition, AI systems can help manufacturers investigate the root causes of quality problems. If an increase in the frequency of a certain defect type is detected, images classified as the detected type will be further classified into more specific sub-categories to identify the root causes of the process failures. [8] For instance, semiconductor manufacturing generally involves several hundred processes that are interrelated and often take months to complete. In semiconductor manufacturing, by analyzing historical and real-time data, AI can identify the causes of product defects that manual inspections may overlook, enabling production designers to avoid the risk of problems from the design stage.

2.3.Predictive Maintenance

Machine-Learning based fault diagnosis represents the earliest adoption of AI in the manufacturing industry.[9] The success of the Machine-Learning techniques is largely attributed to the good understanding of certain machines and processes based on which the physics-informed features from data, such as those in time, frequency, and time-frequency, can be effectively extracted [10]. In electronics manufacturing, equipment reliability is critical and predictive maintenance is essential. Artificial intelligence monitors performance metrics such as vibration, temperature and operating speed through sensors embedded in the machine. By analyzing this data, AI's algorithms can identify changes in equipment before a failure occurs; for example, a sudden increase in a device's vibration level may signal an impending failure. Through historical data analysis and real-time monitoring, AI predicts machine breakdowns, enabling manufacturers to schedule repairs proactively, thus minimizing unplanned downtime.

Additionally, the significance of the AI maintenance system in manufacturing lies in revealing the health state of individual machines and the production system in real-time, providing a diagnosis of the anomaly’s root cause, and preventing the occurrence of a failure. This approach minimizes downtime, extends equipment lifespan, and reduces replacement costs. By addressing potential issues preemptively, manufacturers can allocate resources more efficiently, investing in design and development rather than costly replacements.

2.4.AI Supply Chain Optimization

The integration of AI into supply chain management systems holds significant promise for transforming manufacturing productivity. AI's capabilities in processing, analyzing, and predicting data facilitate accurate demand forecasting, allowing businesses to optimize procurement, reduce transportation and warehousing costs, and streamline supply chain administration [11]. By enabling more accurate demand forecasting, optimizing inventory levels, improving supply chain visibility, and facilitating the seamless integration of various business processes, AI-driven solutions can help manufacturers reduce waste, lower costs, and respond more swiftly to market changes [12]. Artificial Intelligence plays a great role in demand forecasting in the supply chain. Machine learning can predict demands through analyzing large amounts of historical sales data and demand changes in the market. Anticipating the changing market conditions allows businesses to become highly resilient and focus time and resources on the most critical points, adopting a proactive versus reactive strategy[13]. This is particularly important for the electronics manufacturing industry, which has complex production processes, long design and production cycles, and rapid changes. Manufacturers can continuously obtain more accurate and dynamically changing forecasts, adapt to changing trends, adjust production plans and inventory to reduce the risk of overstocking or running out of stock.

3.AI and Comparative Advantage in China and Vietnam:

3.1.China’s AI application in electronic manufacturing

In China, the application of artificial intelligence has improved its competitive edge in high-tech electronics manufacturing. AI in innovative design, quality control, and predictive maintenance has given China a considerable advantage in areas such as batteries and electronic integrated circuits, and has also boosted its manufacturing of both semiconductors and chips. In addition, the use of AI has not only improved production and manufacturing but has also allowed China to favor high-tech electronics manufacturing in its investment and policy planning, facilitating the transformation of China's electronics manufacturing industry to maintain its advantage in the manufacture of labor-intensive electronics while increasing its advantage in emerging high-tech electronics.

3.2.Vietnam’s AI application in electronic manufacturing

Unlike China, which focuses on the competitive advantage of high-tech products through the application of AI, Vietnam's application of AI is mainly reflected in strengthening the comparative advantage of labor-intensive electronic products. Electronics manufacturers in Vietnam have adopted AI technology to optimize the assembly line and inventory management in the supply chain, increasing productivity while reducing the cost of operations. Combined with its lower labor costs, Vietnam has attracted many manufacturing operations from foreign firms, facilitating the transfer of low- and mid-end electronics manufacturing from China to Vietnam. This has enabled Vietnam to continuously gain advantages in producting low-end and mid-range electronics manufacturing, especially in areas such as radio broadcasting or television and cell phone assembly, where Vietnam has a large comparative advantage. Overall, Vietnam's relatively less developed economic and technological foundation compared to China has resulted in a more limited application of AI in the production of technology-intensive products. However, AI has enabled Vietnam to more fully leverage its labor-abundant and low-cost advantage in determining its comparative advantage in the manufacturing of labor-intensive electronic products.

3.3.RCA Analysis

This study uses the calculation method of Revealed Comparative Advantage – RCA to validate the idea that the application of AI gives China an advantage in technology-intensive products and Vietnam an advantage in labor-intensive products. The Revealed Comparative Advantage (RCA) is also known as the Balassa index[14]. The extent of competitive trade is measured by using mathematical calculations to obtain theoretical results for each country's economy. The indicator denoting comparative advantage is calculated as follows.

\( RCAij=\frac{(\frac{Xij}{Xi})}{(\frac{εXwj}{Xw})} \)(1)

RCAij: The comparative advantage indicator of a nation i for product j

Xij: The export value of product j of nation i

Xi= ΣjXij: Total export value of nation i

Xwj= ΣiXij: Total global export value of product j

Xw=ΣiΣjXij: Total global export value

According to Table 1, if the RCA index for a product is greater than 1, it means that the country has a comparative advantage in that product, with higher values signifying stronger advantages. Based on Hinloopen's classification, we can categorize RCA into four grades.

Table 1: The categorization of RCA

|

Group Name |

RCA Range |

Classification |

|

Class a |

0 < RCA ≤ 1 |

No comparative advantage |

|

Class b |

1 < RCA ≤ 2 |

weak comparative advantage |

|

Class c |

2 < RCA ≤ 4 |

Medium comparative advantage |

|

Class d |

RCA > 4 |

High comparative advantage |

According to Table 1, class a capture all those industries without a comparative advantage. The other three classes, b, c, and d, relate to sectors with a comparative advantage, roughly divided into "weak comparative advantage" (class b), "medium comparative advantage" (class c), and "strong comparative advantage" (class d). The characteristics of these classes, and their differences across countries, will become clear as we progress[15].

Table 2: Total export value: China, Vietnam, World (2018-2022) Unit: US Dollar thousand

|

2018 |

2019 |

2020 |

2021 |

2022 |

|

|

World |

19,329,050,174 |

18,761,814,917 |

17,514,968,797 |

22,154,054,456 |

24,719,795,601 |

|

China |

2,494,230,195 |

2,498,334,248 |

2,588,402,392 |

3,361,814,264 |

3,593,601,450 |

|

Vietnam |

243,698,698 |

264,610,323 |

281,441,457 |

335,792,598 |

370,909,157 |

Table 3: Top 5 main export product of China and the total export of World (2018-2022) Unit: US Dollar thousand

|

2018 |

2019 |

2020 |

2021 |

2022 |

||

|

Telephone sets |

China |

240,354,409 |

223,926,831 |

223,208,412 |

257,643,835 |

238,088,761 |

|

World |

579,631,762 |

567,128,798 |

564,581,376 |

643,324,161 |

618,936,221 |

|

|

Electronic integrated circuits |

China |

84,666,601 |

102,102,960 |

116,989,222 |

155,301,817 |

154,524,111 |

|

World |

704,346,425 |

701,612,262 |

784,033,383 |

1,009,026,972 |

1,077,680,803 |

|

|

Electric accumulators |

China |

14,794,343 |

16,871,271 |

20,159,080 |

33,618,467 |

57,227,987 |

|

World |

57,102,921 |

61,928,877 |

70,750,545 |

99,490,983 |

132,068,332 |

|

|

Semiconductor devices |

China |

29,054,830 |

34,562,900 |

35,655,866 |

48,792,510 |

65,880,033 |

|

World |

112,513,610 |

114,333,142 |

117,605,335 |

147,087,027 |

173,507,626 |

|

|

Monitors and projectors |

China |

33,449,973 |

31,207,375 |

31,899,669 |

39,950,805 |

36,211,948 |

|

World |

94,518,708 |

90,910,320 |

90,628,044 |

110,566,287 |

101,473,797 |

Table 4: Top 5 main export product of Vietnam and the total export of World (2018-2022) Unit: US Dollar thousand

|

2018 |

2019 |

2020 |

2021 |

2022 |

||

|

Telephone sets |

Vietnam |

53,858,337 |

56,358,926 |

61,939,036 |

72,697,806 |

78,503,048 |

|

World |

579,631,762 |

567,128,798 |

564,581,376 |

643,324,161 |

618,936,221 |

|

|

Electronic integrated circuits |

Vietnam |

7,891,443 |

11,519,932 |

13,952,339 |

14,493,985 |

13,257,879 |

|

World |

704,346,425 |

701,612,262 |

784,033,383 |

1,009,026,972 |

1,077,680,803 |

|

|

Semiconductor devices |

Vietnam |

2,217,050 |

3,658,783 |

4,565,449 |

4,888,218 |

7,534,412 |

|

World |

112,513,610 |

114,333,142 |

117,605,335 |

147,087,027 |

173,507,626 |

|

|

Microphones and stands therefor |

Vietnam |

2,806,984 |

3,143,633 |

2,762,012 |

2,487,857 |

2,554,782 |

|

World |

43,534,042 |

45,170,093 |

45,194,266 |

51,644,365 |

50,797,780 |

|

|

Transmission apparatus for radio broadcasting or television, |

Vietnam |

2,295,914 |

2,021,226 |

2,098,218 |

2,098,218 |

5,385,309 |

|

World |

40,803,804 |

38,877,014 |

38,203,949 |

48,311,971 |

45,841,418 |

Table 5: RCA Index of top 5 main products from China

|

2018 |

2019 |

2020 |

2021 |

2022 |

|

|

Telephone sets |

3.04 |

2.93 |

2.92 |

2.85 |

2.67 |

|

Electronic integrated circuits |

5.00 |

5.91 |

5.80 |

6.08 |

5.40 |

|

Electric accumulators |

1.99 |

2.10 |

2.27 |

2.67 |

3.06 |

|

Semiconductor devices |

1.85 |

2.03 |

1.94 |

2.06 |

2.06 |

|

Monitors and projectors |

2.56 |

2.42 |

2.35 |

2.76 |

2.55 |

Table 6: RCA Index of top 5 main products from Vietnam

|

2018 |

2019 |

2020 |

2021 |

2022 |

|

|

Telephone sets |

4.23 |

4.12 |

4.12 |

4.09 |

4.19 |

|

Electronic integrated circuits |

0.96 |

1.54 |

1.63 |

0.93 |

0.61 |

|

Semiconductor devices |

0.38 |

0.56 |

0.63 |

0.93 |

0.61 |

|

Microphones and stands therefor |

0.25 |

0.27 |

0.25 |

0.19 |

0.20 |

|

Transmission apparatus for radio broadcasting or television, |

0.28 |

0.19 |

0.20 |

0.14 |

0.52 |

Using data from Table 3, we can figure out the total value of export from China, Vietnam, and the world. Moreover, using data from Table 4 and Table 5, the yearly export value of different types of electronic products from China and Vietnam, we are capable to calculate the RCA Index of each product annually [1, 2].

By calculating the RCA values of the main export products of China and Vietnam in 2018-2022, Table 5 illustrates that China's RCA index is relatively high for Electronic Integrated Circuits, Telephone Sets, and Semiconductor, which are all technology-intensive products. Electronic Integrated Circuits is greater than 5 for several consecutive years, indicating that China has a dominant advantage in this field. For Telephone Sets, the RCA index remains above 2 demonstrating a significant competitive advantage. Meanwhile, Semiconductor Devices shows a growth trend, indicating that China is gradually gaining greater advantages in this field.

Table 6 reviews that for Vietnam, although the RCA index for most products is less than 1, the values in the section of Telephone sets are all greater than 4, presenting Vietnam's great advantage and potential in the manufacturing of telephones. In addition, Vietnam's RCA index for Transmission apparatus for radio broadcasting or television, is increasing gradually, and may exceed 1 in the future.

These findings lead to the conclusion that the application of AI amplifies China's comparative advantage in technology-intensive products, while Vietnam maintains a competitive edge in labor-intensive manufacturing. However, AI primarily enhances production efficiency rather than driving substantial technological innovation. Consequently, its effect on shifting comparative advantage remains moderate.

4.Conclusion

This study explores the application and impact of artificial intelligence in the electronics manufacturing industry in China and Vietnam. The results show that AI greatly enhances China's advantages in technology-intensive products such as electronic integrated circuits and batteries, and at the same time, on increases Vietnam's advantages in labor-intensive products. However, the promotion of the production of technology-intensive products is greater than the promotion of labor-intensive products. Consequently, the advantages of China and Vietnam in the electronics manufacturing industry have been divided, with China focusing more on technology-intensive products and Vietnam focusing more on labor-intensive products, thus leading to the shifting of some of the labor-intensive products in China's electronics industry to Vietnam.

While this study provides valuable insights into the influence of AI on manufacturing and its role in reshaping the industry, it has certain limitations. The analysis relies on data from 2018 to 2023, constrained by limited access to more extensive datasets. This may lead to the exclusion of informal or emerging markets within the industry, potentially overlooking some effects of AI adoption. Future research could benefit from extending the time frame and integrating data from more diverse and comprehensive sources to provide a fuller picture of AI's impact on the electronics manufacturing industry in China and Vietnam. Additionally, future researches could explore more areas such as automotive production, healthcare and other industries, analyzing the application of AI in these industries and the impact on different countries as well as enterprises of different sizes, examining the differences and outcomes. Through these studies, scholars can gain a more comprehensive understanding of the impact of AI on the global economy and various industries, which will ultimately help countries and companies make more informed choices and judgments during technological change.

References

[1]. Trade Map - List of products at 6 digits level exported by China in 2023, Trade Map - List of products exported by China

[2]. Trade Map - List of products at 6 digits level exported by Viet Nam in 2023 (Mirror), Trade Map - List of products exported by Viet Nam

[3]. Han J, Shi F, Chen L, Childs PRN. The Combinator: a computer-based tool for creative idea generation based on a simulation approach. Design Science, 2018, vol. 4, e11, p12/34

[4]. Roberto Verganti, Luca Vendraminelli, and Marco Iansiti, Innovation and Design in the Age of Artificial Intelligence, Journal of Product Innovation Management, 37(3): 212-227, 2020, p216

[5]. Muthukumaran Vaithianathan1, Mahesh Patil2, Shunyee Frank Ng3, Shiv Udkar4, Integrating AI and Machine Learning with UVM in Semiconductor Design, International Journal of Advancements in Computational Technology, Volume 2 Issue 3 July 2024 / Page No: 37-51, P37

[6]. Jorge F. Arinez, Qing Chang, Robert X. Gao, Chengying Xu, Jianjing Zhang, Artificial Intelligence in Advanced Manufacturing: Current Status and Future Outlook, ournal of Manufacturing Science and Engineering, 142(11), 2020-11-01, p4

[7]. Mito Kehayova, Lukas Holdera, Volker Kocha, Application of artificial intelligence technology in the manufacturing process and purchasing and supply management, Procedia Computer Science, 200 (2022) p1213

[8]. Kazunori Imoto , Tomohiro Nakai, Tsukasa Ike , Kosuke Haruki, and Yoshiyuki Sato, A CNN-Based Transfer Learning Method for Defect Classification in Semiconductor Manufacturing, IEEE TRANSACTIONS ON SEMICONDUCTOR MANUFACTURING, VOL. 32, NO. 4, NOVEMBER 2019, p456

[9]. Donald B. Malkoff, 1987, “A Framework for Real-Time Fault Detection and Diagnosis Using Temporal Data,” Artificial Intelligence in Engineering, 2(2), pp. 97-111.

[10]. Liu, R., Yang, B., Zio, E., and Chen, X., 2018, “Artificial Intelligence for Fault Diagnosis of Rotating Machinery: A Review,” Mechanical Systems and Signal Processing, 108, pp. 33-47.

[11]. Rupa Dash, Mark McMurtrey, Carl Rebman, Upendra K. Kar , Application of Artificial Intelligence in Automation of Supply Chain Management, Journal of Strategic Innovation and Sustainability, 14(3), 2019, p45

[12]. Olubunmi Adeolu Adenekan1, Nko Okina Solomon2, Peter Simpa3, & Scholar Chinenye Obasi4, Enhancing manufacturing productivity: A review of AI-Driven supply chain management optimization and ERP systems integration, International Journal of Management & Entrepreneurship Research, Volume 6, Issue 5, p1607-1624, 2024

[13]. Mahya Seyedan and Fereshteh Mafakheri, Predictive big data analytics for supply chain demand forecasting: methods, applications, and research opportunities , Journal of Big Data, Volume 7, article number 53, (2020), p13/22

[14]. Bela Balassa, Trade Liberalisation and “Revealed” Comparative Advantage, 1965, The Manchester School, 33(2), p 99-123

[15]. On the empirical distribution of the Balassa index, Jeroen HINLOOPEN Charles van MARREWIJK, Weltwirtschaftliches Archiv, 137(1), 2001, p1-35

Cite this article

Zhang,K. (2025). Impact of Artificial Intelligence on Comparative Advantages in the Electronics Manufacturing Industry: A Study of China and Vietnam. Advances in Economics, Management and Political Sciences,162,207-214.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 4th International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Trade Map - List of products at 6 digits level exported by China in 2023, Trade Map - List of products exported by China

[2]. Trade Map - List of products at 6 digits level exported by Viet Nam in 2023 (Mirror), Trade Map - List of products exported by Viet Nam

[3]. Han J, Shi F, Chen L, Childs PRN. The Combinator: a computer-based tool for creative idea generation based on a simulation approach. Design Science, 2018, vol. 4, e11, p12/34

[4]. Roberto Verganti, Luca Vendraminelli, and Marco Iansiti, Innovation and Design in the Age of Artificial Intelligence, Journal of Product Innovation Management, 37(3): 212-227, 2020, p216

[5]. Muthukumaran Vaithianathan1, Mahesh Patil2, Shunyee Frank Ng3, Shiv Udkar4, Integrating AI and Machine Learning with UVM in Semiconductor Design, International Journal of Advancements in Computational Technology, Volume 2 Issue 3 July 2024 / Page No: 37-51, P37

[6]. Jorge F. Arinez, Qing Chang, Robert X. Gao, Chengying Xu, Jianjing Zhang, Artificial Intelligence in Advanced Manufacturing: Current Status and Future Outlook, ournal of Manufacturing Science and Engineering, 142(11), 2020-11-01, p4

[7]. Mito Kehayova, Lukas Holdera, Volker Kocha, Application of artificial intelligence technology in the manufacturing process and purchasing and supply management, Procedia Computer Science, 200 (2022) p1213

[8]. Kazunori Imoto , Tomohiro Nakai, Tsukasa Ike , Kosuke Haruki, and Yoshiyuki Sato, A CNN-Based Transfer Learning Method for Defect Classification in Semiconductor Manufacturing, IEEE TRANSACTIONS ON SEMICONDUCTOR MANUFACTURING, VOL. 32, NO. 4, NOVEMBER 2019, p456

[9]. Donald B. Malkoff, 1987, “A Framework for Real-Time Fault Detection and Diagnosis Using Temporal Data,” Artificial Intelligence in Engineering, 2(2), pp. 97-111.

[10]. Liu, R., Yang, B., Zio, E., and Chen, X., 2018, “Artificial Intelligence for Fault Diagnosis of Rotating Machinery: A Review,” Mechanical Systems and Signal Processing, 108, pp. 33-47.

[11]. Rupa Dash, Mark McMurtrey, Carl Rebman, Upendra K. Kar , Application of Artificial Intelligence in Automation of Supply Chain Management, Journal of Strategic Innovation and Sustainability, 14(3), 2019, p45

[12]. Olubunmi Adeolu Adenekan1, Nko Okina Solomon2, Peter Simpa3, & Scholar Chinenye Obasi4, Enhancing manufacturing productivity: A review of AI-Driven supply chain management optimization and ERP systems integration, International Journal of Management & Entrepreneurship Research, Volume 6, Issue 5, p1607-1624, 2024

[13]. Mahya Seyedan and Fereshteh Mafakheri, Predictive big data analytics for supply chain demand forecasting: methods, applications, and research opportunities , Journal of Big Data, Volume 7, article number 53, (2020), p13/22

[14]. Bela Balassa, Trade Liberalisation and “Revealed” Comparative Advantage, 1965, The Manchester School, 33(2), p 99-123

[15]. On the empirical distribution of the Balassa index, Jeroen HINLOOPEN Charles van MARREWIJK, Weltwirtschaftliches Archiv, 137(1), 2001, p1-35