1. Introduction

With the rapid development of science and technology, digital transformation has become an important direction for both national strategy and corporate development. Countries around the world have introduced related policies to encourage enterprises to leverage advanced technologies such as big data, cloud computing, and artificial intelligence to face the new challenges and opportunities. According to the “China Digital Economy Development White Paper” published by the China Academy of Information and Communications Technology, by 2023, China’s digital transformation expenditure has reached 2.3 trillion yuan, a year-on-year increase of 9.5%, and it is expected to reach 3.1 trillion yuan by 2026. This trend highlights the positive attitude and actions of Chinese enterprises toward digital transformation.

In the wave of digital transformation, audit environment has also undergone significant shifts. Audit costs, as an important component of business operating costs, are directly related to a company’s economic benefits and reflect the complexity and quality requirements of audit work. Therefore, in-depth research on the impact of digital transformation on audit costs not only helps to reveal the economic consequences of digital transformation but also provides theoretical support and practical guidance for the development of the audit industry. However, despite the increasing importance of digital transformation, research on its specific impact on audit costs remains insufficient. Therefore, this paper aims to fill this research gap by exploring the mechanisms and practical effects of digital transformation on audit costs.

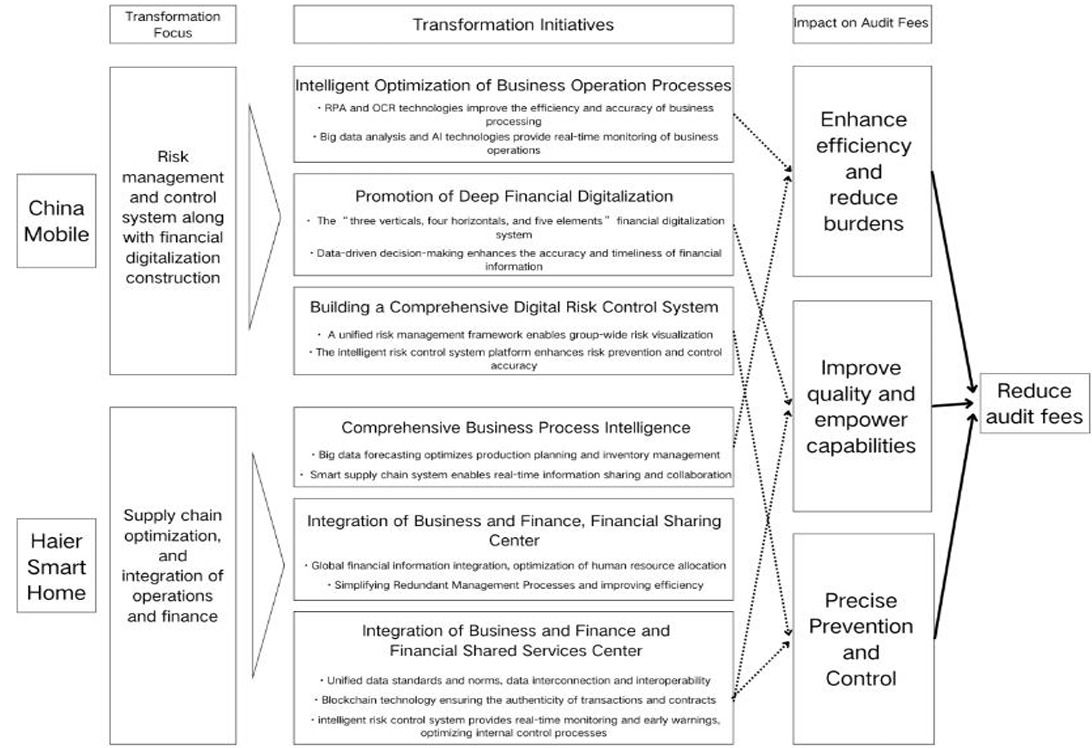

To achieve the above research objectives, this paper will adopt a combination of theoretical analysis and case study methods. At the theoretical level, the study finds that digital transformation optimizes resource allocation and improves operational efficiency, thereby helping reduce audit costs. From a practical perspective, China Mobile and Haier Smart Home are frontier enterprises in digital transformation. However, China Mobile places more emphasis on risk management systems and financial digitalization, while Haier Smart Home focuses more on supply chain optimization and business-finance integration. These measures have had a positive impact on the audit environment of both companies, leading to a reduction in audit costs.

2. Literature Review

2.1. Review of Literature on Cost Reduction and Efficiency Improvement

2.1.1. Cost Reduction and Efficiency Improvement: Importance

Cost reduction and efficiency improvement (CR&E) aim to effectively control costs, enhance profitability, and optimize resource allocation through reduced production costs, increased operational efficiency, and streamlined resource usage. In a globally complex and ever-changing economic environment, CR&E has become a critical strategy for boosting corporate competitiveness. During this process, digital-intelligent transformation, as an emerging force, not only reshapes business models and industry boundaries but also injects new momentum into high-quality economic development in China.

2.1.2. The Role of Digital-Intelligent Transformation in CR&E

With the rapid advancement of 5G, cloud computing, artificial intelligence, and other digital technologies, digital transformation has become a vital means for achieving CR&E. Zhang et al. demonstrate that digital technologies significantly enhance production efficiency by reducing costs, improving efficiency, and driving innovation [1]. Specifically, the zero-cost replication and dissemination of digital technologies substantially lower production, transaction, and management costs. The application of intelligent decision-making and control systems boosts operational and managerial efficiency, while digital platforms facilitate resource optimization and the fulfillment of personalized demands, further spurring business model innovation.

2.1.3. The Role of Auditing in CR&E

Auditing also plays an essential role as a management tool in the CR&E process. The full-process auditing framework proposed by Guo Zhifang achieves CR&E goals by effectively controlling project costs and ensuring project quality [2]. Liu Min et al. propose the value-added internal audit model, which supports CR&E by optimizing internal controls and improving operational efficiency [3]. Moreover, companies are actively exploring ways to reduce audit fees, such as optimizing audit processes and enhancing audit efficiency, to save costs while maintaining audit quality.

3. Theoretical Analysis of the Impact of Digital-Intelligent Transformation on Audit Fees

Digital-intelligent transformation, as a critical aspect of corporate strategic transformation, is gradually permeating and profoundly influencing the field of auditing. This transformation not only alters corporate operational models but also poses new challenges to audit processes, risks, and efficiency. Based on recent research findings, this section provides an in-depth analysis of how digital-intelligent transformation affects audit fees through its direct impacts and indirect impacts on audit risk, audit efficiency, and heterogeneity.

3.1. Direct Impact of Digital-Intelligent Transformation on Audit Fees

Multiple studies indicate that digital-intelligent transformation directly affects corporate audit fees. Sun Zefang identifies an inverted U-shaped relationship between digital-intelligent transformation and audit fees, where audit fees initially increase and subsequently decrease as the degree of transformation progresses [4]. This relationship likely stems from the incomplete nature of information systems during the early stages of digital-intelligent transformation, leading to increased audit complexity. As systems mature, audit efficiency improves, resulting in reduced audit fees. Research by Deng Fang et al. and Brazel and Dang similarly highlights the significant influence of corporate informatization levels on audit fees [5][6].

3.2. Impact of Digital-Intelligent Transformation on Audit Risk

Digital-intelligent transformation reduces audit risk in several ways, thereby influencing audit fees. Dong and Jiang demonstrate that digital-intelligent transformation enhances the quality of internal controls and increases information transparency, making it easier for auditors to obtain sufficient audit evidence, thereby lowering audit risk [7]. Reduced audit risk allows auditors to minimize additional audit procedures and associated costs, ultimately decreasing overall audit fees.

3.3. Impact of Digital-Intelligent Transformation on Audit Efficiency

Digital-intelligent transformation improves audit efficiency by incorporating advanced technologies such as big data and artificial intelligence. Fang et al. reveal that digital-intelligent transformation automates and streamlines the auditing process, reducing manual intervention and enhancing efficiency [8]. Improved audit efficiency shortens the audit cycle, reduces audit costs, and positively impacts audit fees.

3.4. Heterogeneous Impacts of Digital-Intelligent Transformation

The impact of digital-intelligent transformation on audit fees varies across different types of enterprises and environments. Dong and Jiang observe that this impact is more pronounced in industries with lower levels of marketization, non-state-owned enterprises, and highly competitive sectors. These variations may be attributable to the greater challenges and higher risks faced by these enterprises during the digital-intelligent transformation process [1].

4. Typical Cases of Digital-Intelligent Transformation Impacting Audit Fees

4.1. Comparison of the Digital and Intelligent Transformation of Two Companies and Its Impact on Audit Fees

Both China Mobile and Haier Smart Home have actively responded to national policies, leveraging advanced technologies to promote their digital and intelligent transformation. This reflects the emphasis and application of digital transformation by large enterprises in the context of technological advancements. Both companies highlight the importance of risk management and internal control, aiming to reduce costs and improve efficiency through digital transformation. However, significant differences exist in their specific implementations.

Table 1: Comparative Analysis of Digital Transformation of China Mobile and Haier Smart Home

Similarities | Differences | |

China Mobile | 1. Leveraged big data, cloud computing, and AI for transformation. 2. Strengthened risk management and internal controls, emphasizing data-driven operations and transparency while optimizing processes with intelligent technologies. 3. Shared the goal of cost reduction and efficiency improvement through digital transformation. | Focuses more on building a risk management system and digital financial integration. |

Haier Smart Home | Places greater emphasis on supply chain optimization and business-finance integration. |

China Mobile places greater emphasis on establishing a robust risk management system and leveraging financial data in its digital transformation. By developing a comprehensive risk management framework, the company effectively identifies, assesses, and mitigates potential risks, ensuring steady growth. Additionally, China Mobile emphasizes the application of financial data, using data analysis and mining to enhance the accuracy and efficiency of financial decision-making. These measures are instrumental in reducing audit fees. During 2021–2023, these initiatives enabled China Mobile to reduce its audit fees year by year, from 98 million yuan to 86 million yuan, cutting management costs and financial expenditures.

In contrast, Haier Smart Home focuses more on supply chain optimization and the intelligentization of business processes. By integrating advanced digital technologies, Haier Smart Home deeply optimizes its supply chain, enhancing response speed and collaborative efficiency. Simultaneously, the company has actively advanced the intelligentization of its business processes, leveraging automation and intelligent methods to improve operational efficiency and accuracy. These efforts resulted in a substantial reduction in Haier Smart Home’s audit fees, which dropped from 7.15 million yuan in 2021 to 6.55 million yuan in 2022. This not only optimized audit processes but also reduced costs.

While both companies aim to reduce costs and improve efficiency through digital transformation, their approaches differ significantly. These distinctions have led them to take divergent paths in digital transformation, but both have successfully achieved reductions in audit fees.

Table 2: Audit Fees of China Mobile and Haier Smart Home (2021–2023).

Year/Audit Fees (10,000 Yuan) | 2021 | 2022 | 2023 |

China Mobile | 9,800.0000 | 9,300.0000 | 8,600.0000 |

Haier Smart Home | 715.0000 | 655.0000 | 655.0000 |

From 2021 to 2023, China Mobile’s audit fees decreased annually, while Haier Smart Home experienced a significant reduction in audit fees between 2021 and 2022. This demonstrates the significant impact of their digital transformation measures on reducing audit fees. The following sections will conduct an in-depth analysis of the impact of the digital transformation measures of China Mobile and Haier Smart Home on their audit fees.

4.2. Mechanism Analysis of the Impact of Digital and Intelligent Transformation on Audit Fees

To explore the mechanisms through which digital and intelligent transformation affects corporate audit fees, this section provides an in-depth analysis of the specific impacts of the transformation measures adopted by China Mobile and Haier Smart Home on their audit fees.

4.2.1. Impact Analysis of China Mobile’s Digital Transformation on Its Audit Fees

First, by optimizing business operation processes and utilizing advanced technologies such as RPA (Robotic Process Automation) and OCR (Optical Character Recognition), China Mobile significantly improved the efficiency and accuracy of business handling. These measures effectively reduced manual intervention and error rates, thereby lowering audit risks arising from irregular business operations.

Second, the “three verticals, four horizontals, and five elements” financial digital system developed by China Mobile greatly enhanced the accuracy and timeliness of financial information. This system provided auditors with more reliable and accurate data support, making audit processes more efficient and precise.

Finally, China Mobile’s intelligent risk control platform strengthened the company’s risk prevention capabilities. By enabling real-time monitoring and early warning of various risk events, the platform allowed the company to promptly address and manage potential issues. Consequently, the platform reduced the audit focus and effort required to address risk-related incidents.

4.2.2. Impact Analysis of Haier Smart Home’s Digital Transformation on Its Audit Fees

First, Haier Smart Home achieved comprehensive intelligentization of its business processes by leveraging big data analytics and AI technologies for real-time monitoring of business operations. This optimization enhanced overall operational efficiency and audit efficiency. Additionally, the establishment of an intelligent supply chain system improved the collaborative efficiency and responsiveness of the supply chain, further promoting operational and audit efficiency improvements [9].

Second, regarding information transparency and internal control enhancement, Haier Smart Home established unified data standards and norms to increase information transparency and reduce audit risks. The application of blockchain technology ensured the authenticity and integrity of critical transactions and contracts, enhancing information reliability. Meanwhile, the intelligent risk control system’s real-time monitoring and early warning capabilities optimized internal control processes and systems, achieving comprehensive coverage and refined management of business processes. These measures not only improved the quality of internal controls but also provided auditors with more reliable and accurate bases for audit work, thereby reducing audit difficulty and costs [10].

Third, the establishment of a financial-business integration framework and a financial shared service center enhanced the efficiency and accuracy of financial operations. By addressing inconsistencies or errors in financial information, these initiatives reduced the additional audit costs caused by such issues. The integration of financial and business operations strengthened the connection between the two, providing auditors with more comprehensive and accurate financial data for audit purposes.

Figure 1: Impact of Digital Transformation Measures of China Mobile and Haier Smart Home.

5. Conclusion and Implications

Based on the theoretical analysis and case studies of China Mobile and Haier Smart Home, this study provides a deeper understanding of the mechanisms by which digital and intelligent transformation influences audit fees. The findings reveal the following: First, on a theoretical level, the complexity of audits may initially increase during the early stages of digital transformation due to the need for system development and process adjustments, leading to higher audit fees. However, as digital systems mature and processes are optimized, audit efficiency improves significantly, audit risks decrease, and audit fees gradually decline. Second, on a practical level, the cases of China Mobile and Haier Smart Home offer concrete evidence. China Mobile reduced its audit fees by optimizing business operation processes, advancing financial digital transformation, and establishing a digital risk control system. Similarly, Haier Smart Home achieved effective reductions in audit fees through comprehensive business process intelligentization, enhancement of information transparency and internal controls, as well as the integration of business and finance operations alongside the establishment of a financial shared service center. Third, the mechanisms through which digital transformation impacts audit fees can be summarized as follows: efficiency enhancement and burden reduction, quality improvement and empowerment, and precision risk control. These mechanisms elevate the level of enterprise operational management, create a more reliable and efficient environment for audit work, and consequently reduce audit costs.

For listed companies, it is crucial to actively promote digital and intelligent transformation. Enterprises should fully leverage advanced technologies such as big data and cloud computing to optimize business processes, enhance operational efficiency, and strengthen internal controls and risk management to lower audit fees and other operational costs. Additionally, listed companies should continually update audit models to align with the digital era, exploring new paths to reduce costs and improve efficiency. For regulatory authorities, close attention should be paid to the trends and impacts of corporate digital transformation. Timely updates and refinements to relevant regulations are necessary to ensure the quality and efficiency of audit work. Furthermore, regulators should encourage and support technological innovation and talent development to enhance the competitiveness and service standards of the auditing industry in the digital age.

References

[1]. Zhang, T., Shi, Z. Z., Shi, Y. R., & others. (2022). Enterprise digital transformation and production efficiency: Mechanism analysis and empirical research. Economic Research-Ekonomska Istraživanja, 35(1), 2781–2792.

[2]. Guo, Z. F. (1997). Implementing an all-process audit framework is the fundamental measure to reduce costs and increase efficiency in infrastructure projects. Guangxi Audit, 1997(4), 33–35.

[3]. Liu, M., Guo, Q., & Wang, X. L. (2014). Preliminary exploration of a value-added internal audit model focused on “cost reduction and efficiency improvement”: A case study of Guangzhou Mobile’s internal audit practice. Enterprise Research, 2014(14), 102–103.

[4]. Sun, Z. F. (2024). A study on the impact of digital transformation on audit fees [Doctoral dissertation, Beijing University of Chemical Technology]. https://doi.org/10.26939/d.cnki.gbhgu.2024.000952.

[5]. Deng, F., You, B. X., & Chen, P. R. (2017). A study on the impact of enterprise informatization level on audit fees. Audit Research, 2017(1), 10. https://doi.org/CNKI:SUN:SJYZ.0.2017-01-012.

[6]. Brazel, J. F., & Dang, L. (2008). The effect of ERP system implementations on the management of earnings and earnings release dates. Journal of Information Systems, 22(2), 1–21. https://doi.org/10.2308/jis.2008.22.2.1.

[7]. Dong, X. H., & Jiang, Y. W. (2024). Does enterprise digital transformation affect audit opinion type?—Based on business evidence of Chinese listed companies. Economics & Politics.

[8]. Fang, F., Mo, D., & Chen, R. (2024). Enterprise digital transformation and audit quality: Empirical evidence from annual reports of Chinese listed companies. Economics & Politics.

[9]. Mao, J. R. (2023). Research on the digital ecosystem value creation of Haier Smart Home [Master’s thesis, Harbin University of Commerce]. https://doi.org/10.27787/d.cnki.ghrbs.2023.000140.

[10]. Li, H. G. (2022). Digital platform transformation of Haier. Entrepreneurs, 2022(10), 49–52.

Cite this article

Xiong,L. (2025). Analysis of the Impact of Enterprise Digital-Intelligent Transformation on Audit Fees. Advances in Economics, Management and Political Sciences,163,16-22.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 4th International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Zhang, T., Shi, Z. Z., Shi, Y. R., & others. (2022). Enterprise digital transformation and production efficiency: Mechanism analysis and empirical research. Economic Research-Ekonomska Istraživanja, 35(1), 2781–2792.

[2]. Guo, Z. F. (1997). Implementing an all-process audit framework is the fundamental measure to reduce costs and increase efficiency in infrastructure projects. Guangxi Audit, 1997(4), 33–35.

[3]. Liu, M., Guo, Q., & Wang, X. L. (2014). Preliminary exploration of a value-added internal audit model focused on “cost reduction and efficiency improvement”: A case study of Guangzhou Mobile’s internal audit practice. Enterprise Research, 2014(14), 102–103.

[4]. Sun, Z. F. (2024). A study on the impact of digital transformation on audit fees [Doctoral dissertation, Beijing University of Chemical Technology]. https://doi.org/10.26939/d.cnki.gbhgu.2024.000952.

[5]. Deng, F., You, B. X., & Chen, P. R. (2017). A study on the impact of enterprise informatization level on audit fees. Audit Research, 2017(1), 10. https://doi.org/CNKI:SUN:SJYZ.0.2017-01-012.

[6]. Brazel, J. F., & Dang, L. (2008). The effect of ERP system implementations on the management of earnings and earnings release dates. Journal of Information Systems, 22(2), 1–21. https://doi.org/10.2308/jis.2008.22.2.1.

[7]. Dong, X. H., & Jiang, Y. W. (2024). Does enterprise digital transformation affect audit opinion type?—Based on business evidence of Chinese listed companies. Economics & Politics.

[8]. Fang, F., Mo, D., & Chen, R. (2024). Enterprise digital transformation and audit quality: Empirical evidence from annual reports of Chinese listed companies. Economics & Politics.

[9]. Mao, J. R. (2023). Research on the digital ecosystem value creation of Haier Smart Home [Master’s thesis, Harbin University of Commerce]. https://doi.org/10.27787/d.cnki.ghrbs.2023.000140.

[10]. Li, H. G. (2022). Digital platform transformation of Haier. Entrepreneurs, 2022(10), 49–52.