1. Introduction

The Chinese pension system is triple-layered in theory. The three layers are public pension schemes, occupational pensions sponsored by enterprise and occupational annuity, and individual pensions based on personal savings and commercial insurance [1]. The first layer covers the majority of the Chinese population, and the second layer is only under the sponsor of less than 0.5% of all firms in China (Ministry of Human Resources and Social Security (MOHRSS) of China). At the same time, the third layer is still in the implementation phase, with 40.3 million people, less than 0.3% of the Chinese population, who opened individual pension accounts in the country's 36 cities. This paper will focus on the first layer, public pension schemes, which are further classified into four types and two tracks; after the reform executed in January 2015, nominally, the two pensions under the first track combined into one. In addition, a basic, government-sponsored universal basic pension was added to both rural and urban residents in 2014 [2].

Under the first track, basic Old Age Insurance (BOAI), two types of pensions joined this track gradually in 2015. The first type is Basic Old Age Insurance. This insurance is for employees working in for-profit enterprises, including both private businesses and public profit-oriented entities, as well as other sectors of the private economy. To fulfill the requirement for BOAI, an individual's employer had to contribute 20% of wages paid, and the individual had to contribute 8% of their wages for at least 15 years. The replacement rates of individuals are equivalent to the length of contribution history of the individuals in years. The second type is the Public Employee Pension. This pension plan covers civil -servants and workers employed by nonprofit government institutions, including those in schools, cultural, and healthcare facilities.

Under the second track, Urban-Rural Residents Social Pension (URRSP), there is Urban Resident Pension (URP). This scheme is designed for urban residents aged 16 and above who do not have formal nonagricultural employment. The second scheme, New Rural Resident Pension (NRP) is aimed at rural residents aged 16 and older who are not formally employed in nonagricultural jobs.

Table 1: Chinese pension reforms

Year | Pension plan | Targeted group |

1955 | Regulations for civil servant retirement | Civil servants and public sector employees |

1991 | Extending the reform of the old-age pension system to employees in enterprises | Employees in enterprises |

2009 | New rural social pension system | Rural residents |

2011 | Basic insurance for non-employed urban residents | Non-employed urban residents |

2014 | Establishing a unified basic pension system for urban and rural residents | Urban and rural residents |

2015 | Combining government and public institutions pensions with private enterprise pensions | Civil servants and public sector employees |

As shown in Table 1, the Chinese pension system has always been characterized by gradualism. Since 1950, a Soviet-style pension system has been established, characterized by pay-as-you-go (PAYG) and single-tier and closed operation [3]. This system is under gradual change. For instance, the PAYG approach was combined with public funding in 2012, where BOAI drew its funds from both the social pooling account and individual accounts.

The pension system in China had a "double-track" approach in which the private enterprise workers (BOAI) and government workers (PEP) are divided into two primary tracks, with government workers continuing the retirement system that existed before the 1980s, where public employees, before 2014, do not have to contribute to the pension insurance but enjoy generous pensions after retirement. In terms of replacement rate, the pension replacement rate for corporate employees is just over 40%, while the replacement rate for public sector employees is around 100% [1]. In 2013, 75.4% of employees' pensions were no higher than 2,000 yuan, and 92.3% of institutional retirees' pensions were higher than 4,000 yuan [4].

The Chinese pension reform in 2014 merged BOAI with PEP and NRP with URP, and a ten-year transitional period from October 2014 to September 2024 is set for the implementation of the reform. The public employees were further separated into three types of different pension treatment for the transition: employees who retired before October 2014 will keep the same pension plan before merging, employees who joined before October 2014 but retired after October 2014 will adhere to the plan with better treatment, and employees who joined after October 2024 will follow the new pension plan.

2. Evaluations

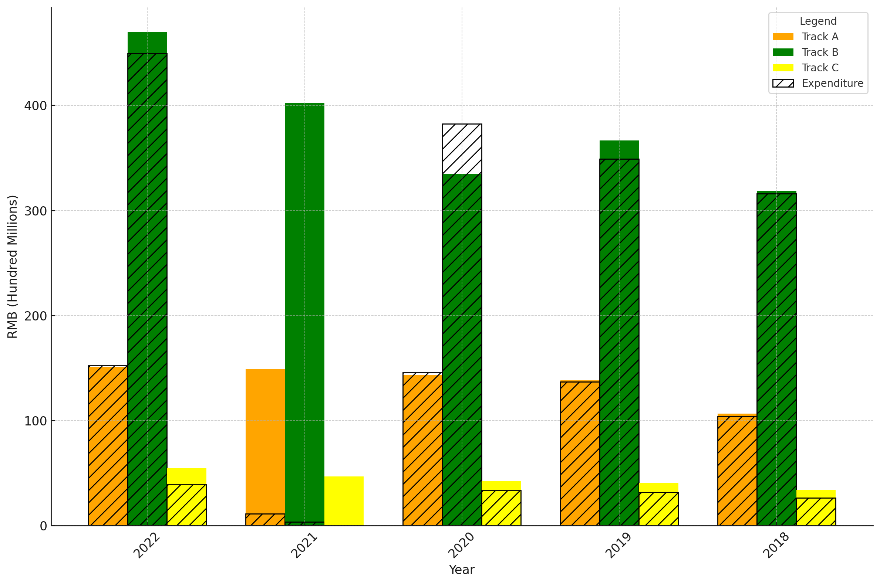

For the convenience of discussion, this paper classifies the current Chinese pension system into three tracks. Track A includes public employees that previously fell under the PEP; Track B includes enterprise employees that previously fell under BOAI, and track C includes rural residents included in NRP and excluded from any pension for urban residents. Track A and track B both fall under the BOAI, and Track C falls under URRPS, as stated above.

In this part, this paper will analyze the issues that persist in the pension system after reform and explain why these issues are problematic and even detrimental to the current Chinese economy and society. After the analysis, the following part will suggest possible policy improvements to tackle the existing issues.

2.1. Internal Inequalities

As shown in Fig 1, track A and B vastly exceed track B in the Figure. However, the population under Track C (URRPS) has constantly exceeded Track A and B (BOAI) together (shown in Figure 2), the number of participants under BOAI and URRPS from 2019 to 2023 was 43488. The smaller sum of pensions allocated to most of the population, creating a vacuum in the system. Despite the cost of living and average wage differences in rural and urban parts of China, such a mismatch in pensions must have led to a low replacement ratio for populations in track C.

Figure 1: Pension incomes and expenditures by track (Chinese Ministry of Finance)

Figure 2: Number of participants in BOAI and URRPS from 2019-2023 (MOHRSS)

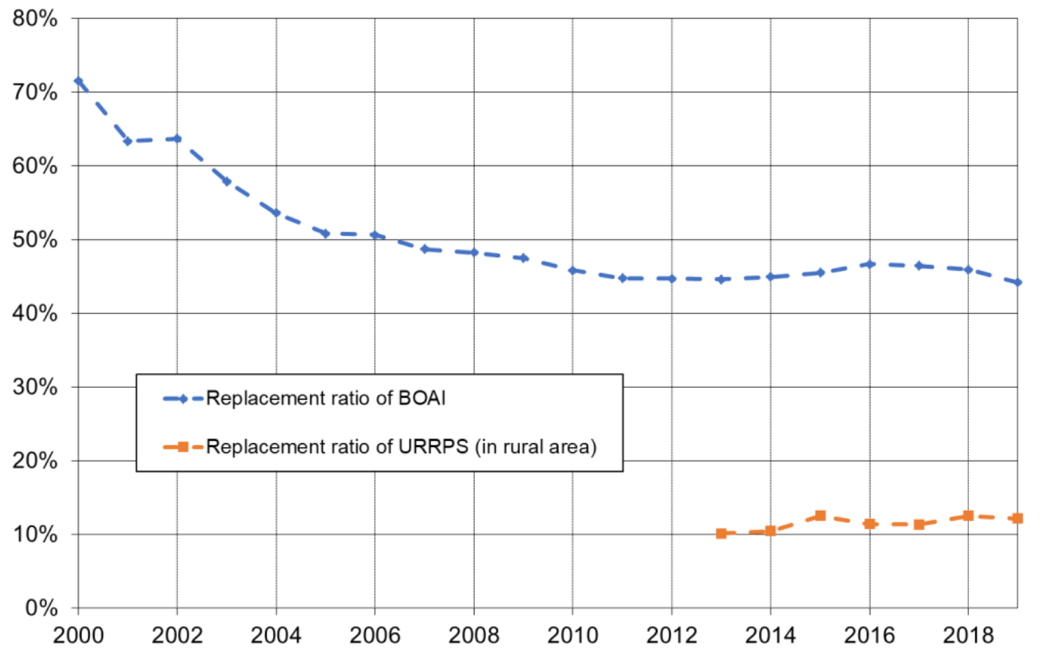

Figure 3: Replacement ratio of BOAI and URRPS from 2000 to 2018 [5]

In fact, as shown in Figure 3, the replacement ratio for rural populations in China is constantly around 10%, while the replacement ratio for public employees and enterprise employees is, in aggregate (merged to BOAI after 2014), around 45%, respectively. The 2014 reforms focus on merging track A and track B, which are both better off in the system despite still being under the suggested standard, while did not effectively address the old-age care of the rural population, leaving vacuums in the policy.

Furthermore, not only did the reform not effectively cover the vacuum of the policy, but the revised system is also still tilted toward track A, which contains the policymakers themselves. The current pension system still has to carry the burden of the "old people" who joined government institutions before 2024. On top of this, in 2015, the occupational annuity was added to track A, with its correspondents in track B, enterprise annuity. In 2020, the coverage rate of occupational annuities was 68.5%, while for enterprise annuities, it was 6.8% [6]. One of the reasons behind the coverage rate is that the occupational annuity is financed by the government both directly and indirectly: the annuity requires the government organization to pull 4% from the income of its employees and pay an extra 8% of the income of its employees, which both are parts of the governmental expenditure. At the same time, the enterprise annuity directly falls on the labor cost of private enterprises. Suppose the coverage rate of the enterprise annuity is increased by requiring more enterprises to pay for the annuity, and the rising cost of labor must cause a reduction in employment and employee income. A reduction in the amount of jobs and income would then lead to a decrease in government tax revenue, squeezing funding for welfare programs, including enterprise annuities. Thus, the inequalities between tracks A and B persist in the forms of the annuity system, while track A contains the "Old people" whose welfare is still the more significant part of the pension pool.

The employment within track A is non-cyclical mainly, along with the stable and ample retirement protection. Labors, especially knowledge-equipped young labor, will be siphoned to track A, increasing voluntary unemployment. As in recent years, the Chinese GDP growth rate decreased from 6.5% to 4.6%, and unemployment hiked from around 12% to 20% from 2019 to 2023 [7].

2.2. Low Replacement Ratios

As previously mentioned, the replacement ratios in the current Chinese pension system vary across different literature and sources due to differing estimation methods and datasets, and all estimation and data fall far behind the world standard. The average net replacement ratio is 75.5% for EU countries, 73.2% for OECD countries, and 52.8% for high earners in OECD countries [8]. Noticeably, no matter whether in EU countries or OECD countries, a typical pattern is that the replacement ratios for high earners are lower than the replacement ratios for low earners.

That situation is reversed in China. The rural population generally has a lower income and receives lower pensions. This poses a problem for their quality of life after retirement. The concentration of financial wealth and assets around the high-income group limits the ability of most households to maintain their standard of living in retirement, as the wealthier households could save a more significant portion of their income to purchase more stable assets with higher rates of return [9]. Although welfare reforms have often been launched under the banner of equality, the core aim of all welfare states is social protection and income maintenance, not altering the existing social class structure [10]. Under the current Chinese pension system, the retirement income of rural households and low-income groups is barely maintained, and it further entrenches wealth inequality.

Lower- and middle-income groups will increase their precautionary savings if they recognize that pensions alone are inadequate to sustain their quality of life after retirement [11]. Multiple studies have examined the inverse relationship between individual savings and social welfare, including pensions [12]. In another sense, the pension serves as a substitute for personal savings [13]. As it remains clear that there is a clear inverse relationship between pension and saving rates, the problem remains whether China's individual savings are excessive. Indeed, high personal savings could be beneficial for a country's economic growth. An econometric study in 2016 verified this empirically with Australia's data from 1971 to 2014 that by the classical Solow-Swan models, investment in productive capital is an important determinant for economic growth before the country reaches a steady state [14]. Savings allow for capital accumulation, which enhances an economy's productive capacity over time [15]. On the other hand, when the financial systems have internal problems and are ill-functioned, the excessive savings in China failed to be effectively directed to investments, and these excessive individual savings arose partly due to insufficient social safety nets [16]. The low propensity to consume, which resulted from high individual savings, made China's economy primarily rely on external demands. Such reliance has rendered China's economy particularly vulnerable to external demand shock [15].

With the upcoming return of the Trump administration that previously pursued and likely pursues strict protectionist policies with China and as the US had been the most significant trade partner of China [17, 18]. If the abnormal trade surplus cannot be replaced by domestic demands, there will be detrimental consequences on China's export-based economy. The current Chinese pension system, encouraging the majority of the population to save rather than consume, serves as a friction in the transition of the Chinese economy for the upcoming geopolitical tensions.

2.3. Debt and Deficit within the Pension System

Under the premise of maintaining the current fiscal subsidies, the accumulated balance of China's personal pension coordinated accounts will peak in 2027, exceed its income in 2028, and there may be a funding gap of $11.28 trillion in 2050. In addition to the visible deficit, there is an invisible deficit arising from Track A, whose "contribution" to the pension pool is funded through government expenditure. The aging population is the leading cause of this account imbalance. The dependency ratio for the eligible population will rise from 47% in 2019 to 96.3%, according to the projection. The account balance will be exhausted in 2035. The number of provinces with pension savings that can sustain more than three months of pension expenditure will increase from 5 to 13 [19]. While the domestic population tends to age and the working population has to pay for the rising retired population, the regional inequality is aggravated.

With the status quo and lessons from Western countries, a national social security program operating under a PAYGO system is unsustainable due to declining fertility rates, an aging population, and the incentive issues inherent in the PAYGO structure, which have and will result in significant unfunded liabilities if the status quo remains unchanged [20].

3. Policy Recommendation

This section of the paper will present several proposed solutions for China's pension reform, drawing on insights from existing studies and drawing reference from Japan's response to economic slowdown and aging population. It will also critically evaluate the limitations, benefits, and potential drawbacks of each recommended approach.

3.1. Raising Pension Eligibility Age

China and Japan are very similar in terms of the aging problem. Both China and Japan have experienced rapid transitions to aging societies. The threshold percentage of the aging population for an aging society is 7%; Japan crossed that threshold in 1970, while China crossed that threshold in 2000 [21]. Both China and Japan have experienced advances in life expectancy due to rapid healthcare improvement. From 1950 to 2000, China's average life expectancy has improved from 43.83 to 70.58, and Japan's average life expectancy has improved from 62.80 to 80.51 [22]. Both countries also experienced rapid fertility declines, albeit at different times [22]. Due to that similarity, Japan's scenario and its policy in response to aging are ideal references for China.

The 1994 and 2000 pension reforms in Japan gradually raised the pensionable age from 60 to 65 for Employee Pension Insurance beneficiaries [23]. This would release pressure on the pension system by increasing the size of the working population, contributing to pensions while reducing the number of people receiving them. China, too, can take a similar approach. However, there may be several consequences for this measure. Increased pensionable age may raise concerns about potential reductions in pension benefits, which significantly increase private savings. A 10% increase in the perceived probability of a benefit reduction may result in an approximately 11% increase in private savings [24]. On top of this, another simulation done based in China indicates that raising the pension eligibility age to 65 would increase labor supply for both high-skilled and low-skilled workers; nonetheless, welfare losses are observed for both groups, with low-skilled workers facing more significant welfare losses caused by higher disutility of work [24]. Considering the potential drawbacks of increasing pension eligibility ages, namely reducing welfare for those already disadvantaged in the welfare system and increasing precautionary saving, other measures, such as the recommendation in part 3.2, improvement in retirement welfare, should be done at the same time to compensate for the welfare loss. On the flip side, raising the pension eligibility age may boost GDP, as observed in Japan, and reduce the financial pressure on the pension system [25, 26].

3.2. Rebalancing Retirement Welfare

In 2023, the national average annual wages of urban public sector and private sector employees were 120,698 yuan and 68,340 yuan, respectively (National Bureau of Statistics). Excluding government subsidy, the account balance for pensions of urban private employees, public employees, and rural residents in 2023 were -2955, -5955, and -1659, in hundred million RMB, respectively (Ministry of

Finance). Due to the absence of publicized data after 2021, the proportion of retired public employees among the total retired population in 2021 was approximately 12%, according to MOHRSS. The lowest portion of the retired population with the highest average income is responsible for the most significant deficit in the current system. The current system urgently needs a rebalance in expenditure: a reduction in public sector employees' pensions and an increase in both the coverage and the number of pensions for public employees and rural residents in the other two tracks.

3.3. Institutional Improvement in the Current Pension System

Unlike most nations, China has a non-mean-tested pension system where there is a universal basic pension for all. Under the current situation, it may be more suitable for China to transform to a mean-tested pension system, where the benefits for rural residents should increase at the expense of cutting the coverage of universal pensions for high-income groups.

On the other hand, individual pension accounts have taken an increasingly important role in many European countries' pension systems [27]. At the same time, in China, the penetration rate of individual pension accounts is negligible. Despite the recent announcement by MOHRSS in December 2024 that the personal pension pilot period has ended, and full implementation has begun, individual pension accounts still require more attention and participation. The current 12,000 RMB personal limit may be expanded in the future after the individual pension account has more extensive scale implementation and more participation.

Noticeably, lack of financial literacy and failure to make correct investment decisions are key problems for individuals in countries that are practicing personal pension accounts [28]. Not to mention the rural residents who lacked educational resources. Therefore, it is only practical to expect individual pension accounts, in the short term, to be expanded among urban residents, yet that still requires additional policy responses to improve individual decision-making capabilities.

4. Conclusion

This paper begins by summarizing the history of pension reforms and then introduces the current pension system following the reforms implemented in 2014 and 2015. It then analyzes and points out three issues in the Chinese pension system. First are the inequalities in welfare between the three tracks, with the policies heavily tilted toward Track A while Track C is put in a policy vacuum. This inequality seriously affected the quality of life for rural residents after retirement while driving the labor force to the civil service system. Second, the replacement ratio under the current policy remains low, and the replacement ratio is inversely proportional to income. The higher-income group in Track A and Track B had a higher replacement ratio, while the lower-income group in Track C had a much lower replacement ratio. Such a pattern stands in stark contrast to most EU countries and OECD countries, where replacement ratios favor lower-income groups to ensure more equitable retirement outcomes. Third, the current fiscal balance in the pension system is not sustainable. The current account balance will turn into a deficit after 2035. With few regions that are developed or inclined by fiscal policies like Guangdong and Beijing able to pay the pension expenditures for more than 9 months, most regions, even developed ones like Zhejiang, are unable to afford pension expenditures for more than 3 months without transfer payments.

Last, the paper proposes three policy recommendations drawing on Japan's experience with aging society and pension reforms made in European nations. Raising the pension eligibility age, as Japan did (from 60 to 65), could reduce financial strain and boost GDP but may cause welfare losses for low-skilled workers and increase precautionary savings. To mitigate these effects, complementary measures like improved retirement welfare are essential. Rebalancing retirement spending is critical: public sector pensions, which represent the most significant deficit, should be reduced, while private sector and rural pensions need increased coverage. Additionally, transitioning to a mean-tested pension system would prioritize low-income groups, and expanding individual pension accounts (IPAs) with greater tax incentives could fill funding gaps. However, improving financial literacy is necessary for successful IPA adoption, especially among urban residents initially, while rural inclusion requires long-term policy support. These reforms aim to ensure fiscal sustainability, equity, and adequacy in China's pension system.

Overall, this paper highlights the urgent need for comprehensive reforms in China's pension system to address inequalities, ensure fiscal sustainability, and promote equitable retirement outcomes for all citizens. Aside from solutions based on policy combo, it is worth noting that the lack of retirement welfare and internal inequalities within the pension system stem from structural problems in institutions and mechanisms.

References

[1]. Fang, H., Feng, J. (2020). The Chinese Pension System. In The Handbook of China's Financial System. Princeton: Princeton University Press, 16, 421-444.

[2]. Liu, T., Sun, L. (2016) Pension Reform in China. Journal of Aging & Social Policy, 28(1), 15-28.

[3]. Zhu, H., Walker, A. (2018) Pension System Reform in China: Who Gets What Pensions? Social Policy and Administration, 52(7), 1410–1424.

[4]. Wang, Y.Z. (2013) Survey on Redistribution of Social Security Income in China. China Social Science Literature Publishing House.

[5]. Yang, L. (2018) Towards Equity and Sustainability? China’s Pension System Reform Moves Center Stage. SSRN Electronic Journal.

[6]. China Insurance and Social Security Research Center, Peking University. (2021) Pku.edu.cn. https://econ.pku.edu.cn/ccissr/zxdt/358321.htm#:~:text=%EF%BC%88%E4%BA%8C%EF%BC%89%E4%BC%81%E4%B8%9A%E5%B9%B4%E9%87%91% E6%98%AF%E7%AC%AC,%EF%BC%8C%E8%A6%86%E7%9B%96%E7%8E%87%E9%AB%98%E8%BE%BE68.5%25%E3%80%82

[7]. Eichengreen, B. (2024) China’s Slowdown. Ssrn.com. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4763028#paper-citations-widget

[8]. Kathrin Rochlitz (2015). Net Pension Replacement Rates. CESifo DICE Report, 2/2015, from https://www.ifo.de/DocDL/dice-report-2015-2-rochlitz-pension-replacement-june.pdf

[9]. Bond, T., Rhee, N.Q. (2019) Financial Asset Inequality and Its Implications for Retirement Security.

[10]. Esping-Andersen, G. (2015). Welfare regimes and social stratification. Journal of European Social Policy, 25(1), 124-134.

[11]. Gu, X., Tam, P.S., Li, G., Zhao, Q. (2018) An Alternative Explanation for High Saving in China: Rising Inequality. International Review of Economics & Finance, 69, 1082–1094.

[12]. Hubbard, R.G. (1986) Pension Wealth and Individual Saving: Some New Evidence. Journal of Money, Credit and Banking, 18(2), 167–178.

[13]. Bosworth, B., Burtless, G. (2004) Pension Reform and Saving. National Tax Journal, 57(3), 703–727.

[14]. Uddin, G.A., Alam, K., Gow, J. (2016) Population Age Structure and Savings Rate Impacts on Economic Growth: Evidence from Australia. Economic Analysis and Policy, 52, 23–33.

[15]. Liu, M., Ma, Q.P. (2022). The Impact of Saving Rate on Economic Growth in Asian Countries. National Accounting Review, 4(4), 412–427.

[16]. Yang, D.T. (2012) Aggregate Savings and External Imbalances in China. Journal of Economic Perspectives, 26(4), 125–146.

[17]. Sankoh, S. (2024). Overview of U.S. Foreign Policy towards China and Uncertainty under Donald Trump and Joe Biden Administrations. Open Journal of Political Science, 14, 720-730.

[18]. Bosworth, B., & Collins, S. M. (2008). United States-China Trade: Where are the Exports? Journal of Chinese Economic and Business Studies, 6(1), 1–21.

[19]. Zheng, B. (2019) China Pension Actuarial Report, 2019-2050. China Labor and Social Security Publishing House.

[20]. Li, D. D., Li, L. (2003) A Simple Solution to China’s Pension Crisis. Cato Journal, 23 (2), 281–89.

[21]. Lu, J., Liu, Q. (2019). Four Decades of Studies on Population Aging in China. China Population and Development Studies, 3(1), 24–36.

[22]. Chen, R., Xu, P., Song, P., Wang, M., He, J. (2019) China has Faster Pace than Japan in Population Aging in Next 25 Years. BioScience Trends, 13(4), 287–291.

[23]. Tsunao, O., Emiko, U. (2014) The Effect of Pension Reform on Pension-benefit Expectations and Savings Decisions in Japan, Applied Economics, 46(14), 1677-1691.

[24]. Deng, Y., Fang, H., Katja Hanewald, Wu, S. (2023) Delay the Pension Age or Adjust the Pension Benefit? Implications for Labor Supply and Individual Welfare in China. Journal of Economic Behavior & Organization, 212, 1192–1215.

[25]. Clark, R., Ogawa, N., Lee, S.-H., & Matsukura, R. (2008) Older Workers and National Productivity in Japan. Population and Development Review, 34, 257–274.

[26]. Clark, R., Ogawa, N., Kondo, M., Matsukura, R. (2010) Population decline, labor force stability, and the future of the Japanese economy. European Journal of Population, 26, 207– 227.

[27]. Hinrichs, K. (2021) Recent Pension Reforms in Europe: More Challenges, New Directions. An Overview. Social Policy and Administration, 55(3), 409–422.

[28]. Tapia, W., Yermo, J. (2007) Implications of Behavioural Economics for Mandatory Individual Account Pension Systems.

Cite this article

Peng,Z. (2025). Evaluation on the Pension System Reforms in China. Advances in Economics, Management and Political Sciences,163,1-9.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 4th International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Fang, H., Feng, J. (2020). The Chinese Pension System. In The Handbook of China's Financial System. Princeton: Princeton University Press, 16, 421-444.

[2]. Liu, T., Sun, L. (2016) Pension Reform in China. Journal of Aging & Social Policy, 28(1), 15-28.

[3]. Zhu, H., Walker, A. (2018) Pension System Reform in China: Who Gets What Pensions? Social Policy and Administration, 52(7), 1410–1424.

[4]. Wang, Y.Z. (2013) Survey on Redistribution of Social Security Income in China. China Social Science Literature Publishing House.

[5]. Yang, L. (2018) Towards Equity and Sustainability? China’s Pension System Reform Moves Center Stage. SSRN Electronic Journal.

[6]. China Insurance and Social Security Research Center, Peking University. (2021) Pku.edu.cn. https://econ.pku.edu.cn/ccissr/zxdt/358321.htm#:~:text=%EF%BC%88%E4%BA%8C%EF%BC%89%E4%BC%81%E4%B8%9A%E5%B9%B4%E9%87%91% E6%98%AF%E7%AC%AC,%EF%BC%8C%E8%A6%86%E7%9B%96%E7%8E%87%E9%AB%98%E8%BE%BE68.5%25%E3%80%82

[7]. Eichengreen, B. (2024) China’s Slowdown. Ssrn.com. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4763028#paper-citations-widget

[8]. Kathrin Rochlitz (2015). Net Pension Replacement Rates. CESifo DICE Report, 2/2015, from https://www.ifo.de/DocDL/dice-report-2015-2-rochlitz-pension-replacement-june.pdf

[9]. Bond, T., Rhee, N.Q. (2019) Financial Asset Inequality and Its Implications for Retirement Security.

[10]. Esping-Andersen, G. (2015). Welfare regimes and social stratification. Journal of European Social Policy, 25(1), 124-134.

[11]. Gu, X., Tam, P.S., Li, G., Zhao, Q. (2018) An Alternative Explanation for High Saving in China: Rising Inequality. International Review of Economics & Finance, 69, 1082–1094.

[12]. Hubbard, R.G. (1986) Pension Wealth and Individual Saving: Some New Evidence. Journal of Money, Credit and Banking, 18(2), 167–178.

[13]. Bosworth, B., Burtless, G. (2004) Pension Reform and Saving. National Tax Journal, 57(3), 703–727.

[14]. Uddin, G.A., Alam, K., Gow, J. (2016) Population Age Structure and Savings Rate Impacts on Economic Growth: Evidence from Australia. Economic Analysis and Policy, 52, 23–33.

[15]. Liu, M., Ma, Q.P. (2022). The Impact of Saving Rate on Economic Growth in Asian Countries. National Accounting Review, 4(4), 412–427.

[16]. Yang, D.T. (2012) Aggregate Savings and External Imbalances in China. Journal of Economic Perspectives, 26(4), 125–146.

[17]. Sankoh, S. (2024). Overview of U.S. Foreign Policy towards China and Uncertainty under Donald Trump and Joe Biden Administrations. Open Journal of Political Science, 14, 720-730.

[18]. Bosworth, B., & Collins, S. M. (2008). United States-China Trade: Where are the Exports? Journal of Chinese Economic and Business Studies, 6(1), 1–21.

[19]. Zheng, B. (2019) China Pension Actuarial Report, 2019-2050. China Labor and Social Security Publishing House.

[20]. Li, D. D., Li, L. (2003) A Simple Solution to China’s Pension Crisis. Cato Journal, 23 (2), 281–89.

[21]. Lu, J., Liu, Q. (2019). Four Decades of Studies on Population Aging in China. China Population and Development Studies, 3(1), 24–36.

[22]. Chen, R., Xu, P., Song, P., Wang, M., He, J. (2019) China has Faster Pace than Japan in Population Aging in Next 25 Years. BioScience Trends, 13(4), 287–291.

[23]. Tsunao, O., Emiko, U. (2014) The Effect of Pension Reform on Pension-benefit Expectations and Savings Decisions in Japan, Applied Economics, 46(14), 1677-1691.

[24]. Deng, Y., Fang, H., Katja Hanewald, Wu, S. (2023) Delay the Pension Age or Adjust the Pension Benefit? Implications for Labor Supply and Individual Welfare in China. Journal of Economic Behavior & Organization, 212, 1192–1215.

[25]. Clark, R., Ogawa, N., Lee, S.-H., & Matsukura, R. (2008) Older Workers and National Productivity in Japan. Population and Development Review, 34, 257–274.

[26]. Clark, R., Ogawa, N., Kondo, M., Matsukura, R. (2010) Population decline, labor force stability, and the future of the Japanese economy. European Journal of Population, 26, 207– 227.

[27]. Hinrichs, K. (2021) Recent Pension Reforms in Europe: More Challenges, New Directions. An Overview. Social Policy and Administration, 55(3), 409–422.

[28]. Tapia, W., Yermo, J. (2007) Implications of Behavioural Economics for Mandatory Individual Account Pension Systems.