1. Introduction

Luxury goods have long been associated with wealth, status, and identity. However, their consumption is often driven by irrational behaviors, influenced by emotional, psychological, and social factors. These behaviors are inevitable and can lead to potential financial loss and unsustainable consumption patterns. At the same time, the rise of the secondhand market offers a compelling alternative, allowing consumers to access luxury items more affordably while extending their lifecycle.

This research examines how psychological factors drive human irrational luxury consumption activities and explores the strategies luxury brands use to shape consumer behavior. It also evaluates the role of the secondhand market as a potential solution to mitigate the financial and environmental impacts of such behaviors.

2. Defining Irrational Consumption in Luxury Markets

Rational consumption typically involves decisions based on cost-benefit analysis, prioritizing utility and practical needs. Irrational consumption, on the other hand, deviates from this by being heavily influenced by non-functional factors like emotions or social pressures. In the context of luxury goods, irrational consumption manifests as behaviors like conspicuous consumption, where individuals buy products not for their functional value but to signal wealth and status. For instance, buying a luxury watch for its perceived social status rather than its practical use is a form of conspicuous consumption. Additionally, irrational consumption is closely tied to the concept of symbolic consumption, where luxury goods are used to convey personal identity or social belonging, going beyond their utilitarian purpose [1]. In this section, we will examine some important drivers behind irrational consumption.

2.1. Key Types and Drivers of Irrational Luxury Consumption

2.1.1. Conspicuous Consumption: Status and Wealth Display

Consumers purchase luxury goods to demonstrate wealth and status and seek social approval. This behavior is known as conspicuous consumption and aims to show one's social status through high-priced goods. An example mentioned in Bagwell and Bernheim’s research is that a consumer purchases a Rolls-Royce car not only for its quality but to signal their financial success and social status. The car’s high price and exclusivity make it a visible sign of wealth and elite status [2].

2.1.2. Bandwagon Effect: Conformity and Social Trends

When others buy luxury goods, consumers may follow suit to avoid being seen as outdated or lacking in taste. This conformity is particularly evident in younger age groups. An example is when a new Gucci sneaker becomes popular among celebrities and influencers on social media, younger consumers feel pressured to purchase the same sneakers to avoid being perceived as out of touch with current fashion trends.

2.1.3. Emotional Drivers: Stress and Self-Esteem Boosting

Emotional states, such as stress, anxiety, or low self-esteem, may motivate consumers to seek emotional satisfaction or self-comfort by purchasing luxury goods. Such emotional spending is often devoid of rational judgment [3]. An example is when a stressed professional buys a luxury watch, such as a Rolex, as a reward for enduring a difficult period at work. This purchase serves as a temporary emotional uplift and a symbol of their perseverance.

2.1.4. Identity Signaling: Personal and Social Identity Expression

Consumers may view luxury as an extension of their identity, expressing their personal tastes, values, or lifestyle by owning a particular brand. This behavior reflects consumers' pursuit of self-image. A woman wearing a designer handbag and luxury jewelry at a social event signals to other women that her romantic partner is highly devoted to her. This behavior, as discussed in Wang and Griskevicius' research, reflects how women use luxury goods to communicate personal and relational identity, which effectively deter potential romantic rivals by showcasing the perceived level of commitment from their partners [4].

2.1.5. Scarcity Effects: FOMO and Exclusivity Desires

Luxury goods are often issued in limited quantities or unique designs to create a perception of exclusivity, stimulating consumers' desire to purchase. This sense of scarcity plays on psychological triggers such as the fear of missing out (FOMO), driving consumers to act impulsively to secure items before they become unavailable. Scarcity effects tap into consumer demand for uniqueness and exclusivity [5]. An example is consumers lining up overnight to purchase a limited-edition Louis Vuitton x Yayoi Kusama collection piece, fearing it will sell out quickly. The rarity of the item and its association with a celebrated artist intensifies its appeal.

2.1.6. Cultural Capital: Gaining Prestige Through Luxury

Owning luxury goods is regarded as a symbol of high cultural capital, and consumers buy these goods to enhance their cultural status and social recognition [6]. An example includes a professional who buys a Montblanc pen, not for its functionality but to reflect a cultivated and sophisticated image during business meetings. Owning such a pen suggests a high level of education and cultural sophistication.

3. Drivers of Irrational Behavior

These irrational behaviors emerge from the interplay of sociological, psychological, and economic forces. Sociological theories provide the foundation for understanding the symbolic and social dimensions of consumption; psychological frameworks delve into emotional and cognitive biases; and economic theories reveal the role of scarcity and decision heuristics in shaping behavior. By examining these foundational forces, we can gain insights into why consumers act irrationally and how brands strategically capitalize on these motivations.

3.1. Sociological Foundations: Status and Symbolism

Sociological theories emphasize the role of luxury goods as markers of social status and identity. Thorstein Veblen’s concept of conspicuous consumption highlights how individuals use luxury products to display wealth and elevate their position [7]. Similarly, Pierre Bourdieu’s theory of cultural capital extends this understanding by demonstrating that luxury goods function as tools for asserting cultural sophistication and reinforcing class distinctions [8]. These perspectives underscore the symbolic value of luxury items, suggesting that their appeal lies not in their practical utility but in their ability to signify social prestige and identity.

3.2. Psychological Drivers: Emotions and Identity

Psychological frameworks explore the emotional and cognitive biases underlying luxury consumption. Abraham Maslow’s hierarchy of needs situates luxury purchases within the domains of esteem and self-actualization, where individuals seek recognition and fulfillment through material symbols [9]. Emotional drivers such as stress, anxiety, and low self-esteem further compel consumers to view luxury goods as sources of comfort or validation. Erving Goffman’s theory of symbolic interactionism adds another layer, positing that luxury items serve as “props” for self-presentation in social contexts [10]. Together, these psychological motivations illustrate how emotions and identity construction fuel non-essential yet deeply personal spending habits.

3.3. Economic Influences: Scarcity and Decision Heuristics

Economic theories reveal how scarcity and decision-making heuristics amplify irrational consumption. Kahneman and Tversky’s prospect theory highlights the role of loss aversion, where consumers fear missing out on limited-edition items, leading to impulsive purchases [11]. Scarcity marketing, a hallmark of luxury branding, leverages this bias by creating artificial exclusivity and urgency. The Diderot effect further explains how one luxury purchase cascades into additional consumption as individuals strive for consistency in their possessions and self-image [12]. These economic mechanisms interact with sociological and psychological factors, magnifying the appeal of luxury goods and driving irrational behaviors.

3.4. Understanding the Inevitability of Irrational Consumption

Irrational luxury consumption is largely driven by a convergence of psychological, sociological, and economic factors that compel individuals to prioritize symbolic and emotional gratifications over practical needs. Moreover, this behavior is deeply embedded in the structure of modern society. The intersection of psychological tendencies, social pressures, and economic incentives makes irrational consumption an almost inevitable phenomenon. In today’s hyper-connected world, social media and advertising amplify desires for status and belonging, further entrenching these behaviors. Evolutionary biases like loss aversion and the need for social approval, combined with brand strategies that exploit these vulnerabilities, mean that irrational consumption is both a product of human nature and a reflection of cultural and economic systems.

Recognizing the inevitability of irrational consumption does not imply passivity. Instead, it highlights the need for strategies to mitigate its impact. By fostering consumer education, promoting responsible branding, and shifting societal values towards more meaningful measures of success, it may be possible to reduce the frequency and intensity of irrational consumption without entirely eliminating its emotional and symbolic benefits.

4. How Do Luxury Brands Use Marketing Strategies to Shape Consumer Behavior?

Luxury brands inherently carry an aura of prestige and exclusivity, positioning them as desirable symbols of status and success. This intrinsic allure prompts consumers to purchase luxury goods as a means of shaping and projecting their identities. However, maintaining this perception requires continuous effort from the brands themselves. Luxury companies strategically employ various marketing techniques to reinforce their elite image, sustain the aspirational appeal of their products, and ultimately secure customer loyalty. By fostering a strong emotional connection and a sense of exclusivity, these strategies not only ensure that consumers desire their offerings but also encourage repeat purchases, contributing to increased sales and revenue. Through carefully curated approaches, luxury brands create a virtuous cycle where their exclusivity, desirability, and financial performance are perpetually reinforced, driving consumers to seek inclusion in this prestigious world.

4.1. Scarcity and Exclusivity: Creating Urgency and Rarity

Luxury brands strategically utilize scarcity tactics, such as limited-edition collections and exclusive product lines, to cultivate a sense of urgency and uniqueness. By emphasizing the rarity of their offerings, these brands tap into consumers' fear of missing out (FOMO), motivating impulsive purchases.

4.2. Emotional Branding: Building Deep Consumer Connections

By crafting narratives that emphasize heritage, craftsmanship, and brand values, luxury brands establish deep emotional connections with consumers, aligning products with personal identity and aspirations.

4.3. Celebrity and Influencer Marketing: Driving Aspirations

Associating luxury products with celebrities and social media influencers amplifies brand visibility and desirability. Celebrities embody aspirational lifestyles, while influencers bring relatability and accessibility to targeted audiences. On platforms like Instagram and TikTok, luxury brands leverage these figures to create aspirational content that resonates with younger, tech-savvy consumers, reinforcing the social and cultural status of their products [13].

4.4. Immersive Experiences: Fostering Brand Loyalty

Luxury brands craft highly personalized shopping experiences through dedicated sales associates, exclusive VIP events, and premium gifting services. These tailored interactions create an emotional connection between the consumer and the brand, enhancing the overall shopping experience. VIP customers, for example, may receive early access to collections, personalized recommendations, or bespoke items, fostering a sense of exclusivity and value. By offering such elevated services, luxury brands not only deepen emotional ties but also encourage consumers to make purchases by creating a seamless and memorable journey that reinforces the brand's elite status.

4.5. Pricing Strategies: Positioning Luxury as a Long-Term Investment

Luxury brands increasingly utilize pricing strategies that position their products as long-term investments. By regularly raising prices, brands create the perception of appreciating value, which encourages consumers to view their spending as financially justifiable. This strategy not only increases sales but also enhances consumer loyalty, making ownership of luxury goods a symbol of both wealth and strategic foresight.

5. Chanel's Classic Flap: A Case Study in Luxury Branding

Figure 1: Chanel Medium Classic Flap Bag.

5.1. Chanel's Strategic Increases in Price

The Chanel Classic Flap, introduced in 1983, initially retailed for approximately $1,000 during the 1980s. By 2024, the price for the Medium Chanel Classic Flap had surged to $10,800 following the latest price hike. Since 2016, Chanel has consistently raised the prices of its bags at least once per year, resulting in the Medium Classic Flap more than doubling in price from $4,900 to $10,800 within this timeframe. This pattern of regular price increases extends to other iconic Chanel designs, including the Chanel Reissue, Wallet on Chain, and Boy Bag, although the latter two have experienced slightly slower rates of increase. At the current pace, the Medium Chanel Classic Flap is projected to exceed $20,000 within the next five years [14].

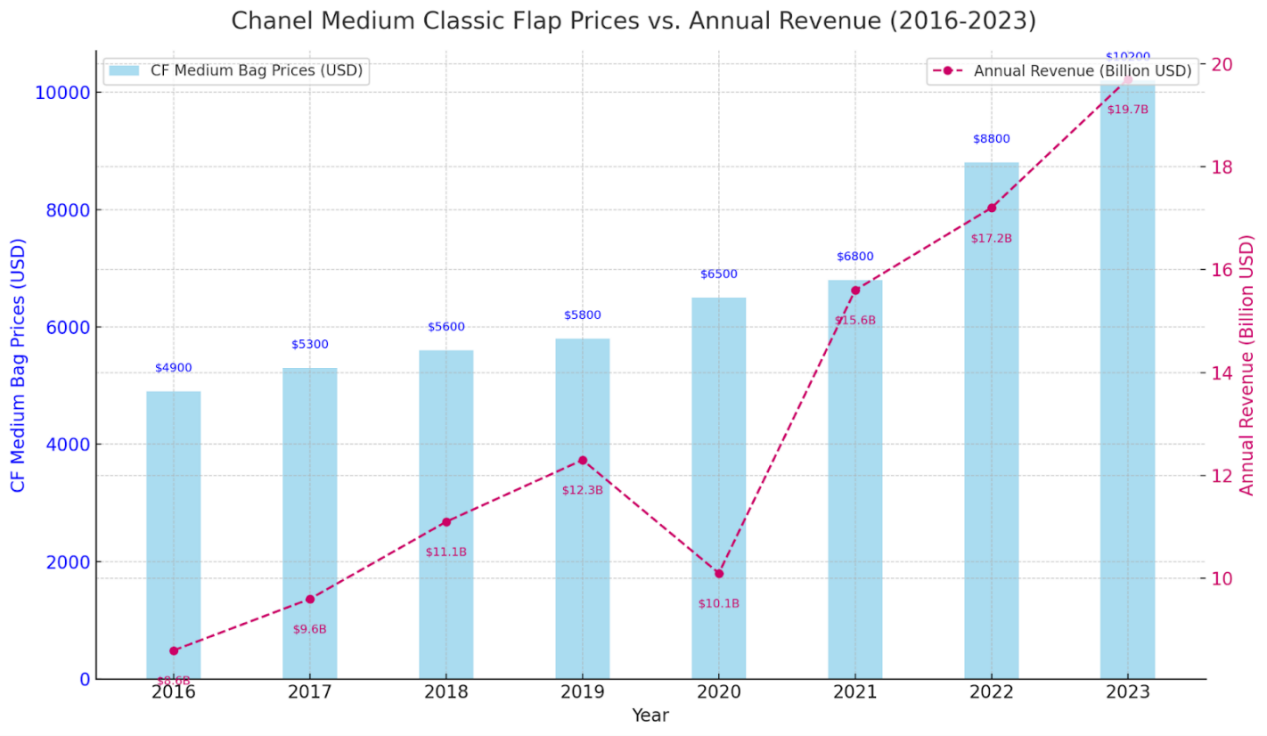

Figure 2: Chanel Medium Classic Flap Prices vs. Annual Revenue (2016-2023).

This chart illustrates the relationship between Chanel Medium Classic Flap Bag prices and Chanel's global annual revenue from 2016 to 2023. The blue bars represent the steady rise in the price of the bag, starting at $4,900 in 2016 and climbing to $10,200 in 2023. The magenta dashed line, showing annual revenue in billion USD, highlights Chanel’s significant financial growth over the same period, increasing from $8.6 billion to $19.7 billion [15]. This parallel trajectory demonstrates how Chanel’s pricing strategy has directly contributed to its annual revenue.

Chanel’s ability to continuously raise prices while maintaining strong consumer demand can be attributed to the immense brand equity it has built over decades. The Classic Flap Bag, one of Chanel’s most iconic products, has transcended being a simple accessory. It has become a timeless symbol of status and luxury. Consumers are drawn not only to the product itself but also to the identity and prestige associated with the Chanel brand. This established brand image gives Chanel the confidence to implement regular price hikes without alienating its loyal customer base.

Moreover, the consistent price increases have transformed the Classic Flap Bag into more than just a fashion item—it has become an investment vehicle. Many buyers view it as a financial asset, knowing that its resale value tends to increase over time due to the brand’s deliberate pricing strategy. The psychology behind this purchase decision is unique to some specific luxury goods; buyers are not merely purchasing for personal use but also with the expectation that the product will hold or even appreciate in value. This perception has added a layer of rationality to what might otherwise be considered impulsive or emotional luxury consumption. The bag’s dual role as a status symbol and an appreciating asset makes it an attractive choice for consumers.

This dynamic also naturally leads to the growth of the secondhand luxury market. As Chanel continues to raise prices, some consumers may opt to buy pre-owned Classic Flap Bags as a more affordable entry point into the brand. Meanwhile, current owners may choose to resell their bags at a profit, benefiting from the brand’s consistent price increases. This has created a robust secondhand market where Chanel products retain their value exceptionally well, further reinforcing the investment appeal of its iconic pieces. The secondhand market not only provides an alternative for consumers priced out of the primary market but also plays a critical role in sustaining the desirability and exclusivity of Chanel’s products. This interplay between primary and secondary markets demonstrates how Chanel’s pricing strategy extends its influence far beyond its retail operations.

6. Secondhand Markets: Solutions for Irrational Consumption

The secondhand market, also known as the resale market, involves the exchange of pre-owned goods between sellers and buyers. This market encompasses a wide range of products, including clothing, electronics, furniture, and vehicles. It operates through various channels such as thrift stores, consignment shops, online platforms, and peer-to-peer transactions.

In the context of luxury goods, the secondhand market plays a significant role in the life cycle of durable consumer products. According to Arthur H. Fox's study, "A Theory of Second-Hand Markets," this market facilitates the redistribution of goods, allowing consumers to access luxury items at reduced prices while enabling sellers to recoup some of their initial investments [16].

According to Bain & Company estimates, the global sales of secondhand luxury goods reached approximately $49.3 billion (€45 billion) in 2023 [17]. Online platforms like The RealReal and Vestiaire Collective have significantly increased the accessibility of pre-owned designer items for a broader audience. Consequently, the resale market has doubled in size over the past four years and now represents 12 percent of the total value of the new luxury goods market, as reported by The Wall Street Journal in January 2024 [18].

6.1. Key Reasons Why Consumers Favor the Secondhand Market

6.1.1. Affordability and Value

The secondhand market enables consumers to purchase high-quality, luxury items at lower prices than retail. This affordability allows a wider audience to experience luxury brands without the substantial financial commitment, democratizing access to luxury goods.

6.1.2. Sustainability

Buying pre-owned items extends the lifecycle of products and minimizes waste, making it an environmentally conscious choice. As consumers, particularly younger generations, become more eco-aware, sustainability has become a critical factor in influencing their shopping habits.

6.1.3. Celebrity Endorsements and Trends

Celebrities played a pivotal role in popularizing the secondhand market by embracing vintage fashion and showcasing it at high-profile events. This visibility has turned secondhand shopping into a fashionable and aspirational trend.

6.1.4. Access to Rare and Limited-Edition Items

The secondhand market offers access to rare, discontinued, or limited-edition luxury goods that are no longer available through official retailers. Collectors and fashion enthusiasts often turn to resale platforms to acquire iconic pieces with historical or sentimental value.

6.1.5. Perceived Rationality and Smart Shopping

For many consumers, purchasing secondhand luxury goods is viewed as a rational and savvy decision. This perception stems from the ability to acquire high-value items at a fraction of their original price, often without compromising quality or brand prestige. Buyers see secondhand purchases as a way to maximize the utility of their spending, obtaining luxury products that retain value over time or even appreciate in certain cases.

6.2. Potential Limitation of Secondhand Market

Irrational consumption is deeply embedded in today’s society, and it is a phenomenon that cannot be entirely eliminated. Social media, advertising, and evolving consumer cultures continuously amplify desires for status and identity, making it nearly impossible for individuals to entirely avoid emotional or symbolic consumption. However, the rise of the secondhand market offers a valuable solution to mitigate the financial repercussions of such behaviors. For first-time consumers, the ability to resell luxury goods provides an opportunity to recoup some of their costs, softening the impact of impulsive purchases. Meanwhile, secondhand consumers benefit from acquiring high-value items at a fraction of their original prices, reducing financial risks from the outset. This dual function of the secondhand market creates a mutually beneficial system, where goods retain their value across multiple ownership cycles, fostering both individual and economic sustainability.

While the secondhand market offers numerous benefits to consumers and the economy, it does have challenges. One potential critique is that the secondhand market might inadvertently perpetuate irrational consumption by normalizing constant buying and reselling. The accessibility and affordability of secondhand luxury goods can encourage overconsumption as consumers may view resale opportunities as a justification for frequent purchases. Though the secondhand market is beneficial for the circular economy, it also reinforces the behaviors it seeks to mitigate.

Secondhand markets benefit not only individual consumers but also the broader economy by facilitating greater economic efficiency and inclusivity. By lowering barriers to ownership, such as high initial costs or liquidity constraints, secondhand markets democratize access to goods, enabling more people to own high-quality products that would otherwise remain out of reach. Moreover, these markets create a redistribution of income within the economy. High-spending first-time consumers can subsidize affordability for secondhand consumers through resale, ensuring that goods continue to generate value across multiple ownership cycles. This dynamic fosters a more balanced and sustainable economic environment, where resources are utilized more efficiently, and consumption patterns are extended to include a broader demographic.

7. Conclusion

Irrational luxury consumption is deeply rooted in today's society due to the affection from psychological, sociological, and economic forces. While often dismissed as impractical or impulsive, this behavior reflects fundamental human desires for status, identity, and emotional gratification. Luxury brands use marketing strategies to amplify these desires. In this context, irrational consumption is not simply a byproduct of individual behavior but a reflection of a broader social and economic system.

The secondhand market provides a win-win solution to challenges of irrational consumption. It gives first-time consumers a way to recover some of their costs through resale while giving secondhand consumers access to high-quality luxury goods at lower prices, also reducing their initial cost of irrational consumption. This creates a system that benefits both sides and helps reduce financial losses and waste. Additionally, the secondhand market supports sustainability by extending the lifecycle of products and promoting more mindful consumption.

In my opinion, irrational consumption is inevitable, but its negative effects can be reduced. By participating in the secondhand market, consumers can make more practical and responsible choices. Promoting awareness of the benefits of secondhand markets could help more people see them as a valuable part of the luxury ecosystem, creating a balance between personal desires and economic and environmental responsibility.

References

[1]. Dubois, D., Jung, S. and Ordabayeva, N. (2021) The Psychology of Luxury Consumption. Current Opinion in Psychology, 39, 82–87.

[2]. Bagwell, L. S. and Bernheim, B. D. (1996) Veblen Effects in a Theory of Conspicuous Consumption. The American Economic Review, 86(3), 349–373.

[3]. Rucker, D. D. and Galinsky, A. D. (2008) Desire to Acquire: Powerlessness and Compensatory Consumption. Journal of Consumer Research, 35, 257–267.

[4]. Wang, Y. and Griskevicius, V. (2014) Conspicuous Consumption, Relationships, and Rivals: Women’s Luxury Products as Signals to Other Women. Journal of Consumer Research, 40(5), 834–854.

[5]. Amaldoss, W. and Jain, S. (2005) Pricing of Conspicuous Goods: A Competitive Analysis of Social Effects. Journal of Marketing Research, 42(1), 30–42.

[6]. Trigg, A. B. (2001) Veblen, Bourdieu, and Conspicuous Consumption. Journal of Economic Issues, 35(1), 99–115.

[7]. Veblen, T. (1899) The Theory of the Leisure Class. New York, Macmillan, 68-102.

[8]. Bourdieu, P. (1984) Distinction: A Social Critique of the Judgement of Taste. Cambridge, Harvard University Press, 207-225.

[9]. Maslow, A. H. (1954) Motivation and Personality. New York, Harper & Row, 26-33.

[10]. Goffman, E. (1959) The Presentation of Self in Everyday Life. Edinburgh, University of Edinburgh Social Sciences Research Centre, 160-162.

[11]. Kahneman, D. and Tversky, A. (1979) Prospect Theory: An Analysis of Decision under Risk. Econometrica, 47(2), 263–291.

[12]. McCracken, G. (1988) Culture and Consumption: New Approaches to the Symbolic Character of Consumer Goods and Activities. Journal of Consumer Research, 13(1), 71–84.

[13]. Pentina, I., Guilloux, V. and Micu, A. C. (2018) Exploring Social Media Engagement Behaviors in the Context of Luxury Brands. Journal of Advertising, 47(1), 55–69.

[14]. Bishop, L. (2024). Understanding the Latest 2024 Chanel Bag Price Hikes and the Resale Market. Sotheby’s. Retrieved December 31, 2024, from Sotheby’s www.sothebys.com/en/articles/understanding-the-latest-2024-chanel-bag-price-hikes-and-the-resale-market.

[15]. Chanel. (2017–2023). Annual Report. Chanel. Retrieved December 31, 2024, from Chanel https://www.chanel.com/us/financial-results/.

[16]. Fox, A. H. (1957) A theory of Second-Hand Markets. Economica, 24(94), 99.

[17]. D'Arpizio, C., Levato, F., Steiner, A. and de Montgolfier, J. (2024). Long Live Luxury: Converge to Expand through Turbulence. Bain & Company. Retrieved December 31, 2024, from Bain & Company https://www.bain.com/insights/long-live-luxury-converge-to-expand-through-turbulence/

[18]. Robb Report. (n.d.). Secondhand Luxury Goods Resale Market Booming. Retrieved December 31, 2024, from Robb Report https://robbreport.com/lifestyle/news/secondhand-luxury-goods-resale-market-booming-1235475186/.

Cite this article

Wu,S. (2025). The Psychology Behind Irrational Luxury Consumption: Impact of Brand Marketing and Secondhand Solutions. Advances in Economics, Management and Political Sciences,164,41-49.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 4th International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Dubois, D., Jung, S. and Ordabayeva, N. (2021) The Psychology of Luxury Consumption. Current Opinion in Psychology, 39, 82–87.

[2]. Bagwell, L. S. and Bernheim, B. D. (1996) Veblen Effects in a Theory of Conspicuous Consumption. The American Economic Review, 86(3), 349–373.

[3]. Rucker, D. D. and Galinsky, A. D. (2008) Desire to Acquire: Powerlessness and Compensatory Consumption. Journal of Consumer Research, 35, 257–267.

[4]. Wang, Y. and Griskevicius, V. (2014) Conspicuous Consumption, Relationships, and Rivals: Women’s Luxury Products as Signals to Other Women. Journal of Consumer Research, 40(5), 834–854.

[5]. Amaldoss, W. and Jain, S. (2005) Pricing of Conspicuous Goods: A Competitive Analysis of Social Effects. Journal of Marketing Research, 42(1), 30–42.

[6]. Trigg, A. B. (2001) Veblen, Bourdieu, and Conspicuous Consumption. Journal of Economic Issues, 35(1), 99–115.

[7]. Veblen, T. (1899) The Theory of the Leisure Class. New York, Macmillan, 68-102.

[8]. Bourdieu, P. (1984) Distinction: A Social Critique of the Judgement of Taste. Cambridge, Harvard University Press, 207-225.

[9]. Maslow, A. H. (1954) Motivation and Personality. New York, Harper & Row, 26-33.

[10]. Goffman, E. (1959) The Presentation of Self in Everyday Life. Edinburgh, University of Edinburgh Social Sciences Research Centre, 160-162.

[11]. Kahneman, D. and Tversky, A. (1979) Prospect Theory: An Analysis of Decision under Risk. Econometrica, 47(2), 263–291.

[12]. McCracken, G. (1988) Culture and Consumption: New Approaches to the Symbolic Character of Consumer Goods and Activities. Journal of Consumer Research, 13(1), 71–84.

[13]. Pentina, I., Guilloux, V. and Micu, A. C. (2018) Exploring Social Media Engagement Behaviors in the Context of Luxury Brands. Journal of Advertising, 47(1), 55–69.

[14]. Bishop, L. (2024). Understanding the Latest 2024 Chanel Bag Price Hikes and the Resale Market. Sotheby’s. Retrieved December 31, 2024, from Sotheby’s www.sothebys.com/en/articles/understanding-the-latest-2024-chanel-bag-price-hikes-and-the-resale-market.

[15]. Chanel. (2017–2023). Annual Report. Chanel. Retrieved December 31, 2024, from Chanel https://www.chanel.com/us/financial-results/.

[16]. Fox, A. H. (1957) A theory of Second-Hand Markets. Economica, 24(94), 99.

[17]. D'Arpizio, C., Levato, F., Steiner, A. and de Montgolfier, J. (2024). Long Live Luxury: Converge to Expand through Turbulence. Bain & Company. Retrieved December 31, 2024, from Bain & Company https://www.bain.com/insights/long-live-luxury-converge-to-expand-through-turbulence/

[18]. Robb Report. (n.d.). Secondhand Luxury Goods Resale Market Booming. Retrieved December 31, 2024, from Robb Report https://robbreport.com/lifestyle/news/secondhand-luxury-goods-resale-market-booming-1235475186/.