1. Introduction

In today’s globalized economic environment, an enterprise’s sustainable development capacity has increasingly become a focal point for investors, policymakers, and the public. ESG (Environmental, Social, and Governance) performance, as a critical indicator measuring sustainable development, not only reflects the enterprise’s practice level in environmental protection, social responsibility, and corporate governance but also profoundly impacts its financial performance and stock performance. In recent years, with growing global attention to climate change, social responsibility, and corporate governance transparency, ESG performance has become an important reference for investor decisions. Research indicates that good ESG performance can enhance corporate reputation, reduce operational risks, and strengthen market competitiveness, thereby positively influencing stock prices [1]. However, the specific impact mechanism of ESG performance on stock prices remains unclear, particularly the heterogeneous effects across different industries and enterprise natures require further investigation.

This paper focuses on manufacturing enterprises, aiming to reveal the impact and mechanism of ESG performance on stock prices through empirical analysis. The research concentrates on two core questions: First, does ESG performance exhibit industry and enterprise nature heterogeneity in its impact on stock prices? Second, how does ESG performance indirectly affect stock prices by optimizing corporate financial indicators (such as asset-liability ratio, operating cash flow outlay, and net cash flow)? This study not only helps deepen understanding of the relationship between ESG performance and corporate value but also provides theoretical support for investor decision-making and references for corporate ESG practice strategic planning. By unveiling the multiple impact pathways of ESG performance on stock prices, this paper offers a new perspective and insights for promoting sustainable development and positive interaction between enterprises and capital markets.

2. Theoretical Hypotheses

ESG (Environmental, Social, and Governance) performance, as a critical indicator measuring enterprise sustainable development capabilities, has attracted widespread attention from academic and practical circles in recent years. Existing research indicates that ESG performance can not only enhance corporate financial performance but also positively influence stock prices by improving corporate reputation, reducing risks, and increasing operational efficiency [1]. From an industry heterogeneity perspective, highly polluting industries, facing stricter environmental regulations and higher environmental risks, often achieve greater market returns through ESG performance improvements [2]. Moreover, state-owned and foreign trade enterprises possess unique advantages in ESG practices: state-owned enterprises leverage policy support and resource advantages to excel in environmental governance and social responsibility; foreign trade enterprises demonstrate more concentrated and stable ESG performance due to international operational requirements. Based on this, the paper proposes the following hypothesis:

Hypothesis 1: ESG performance’s impact on stock prices varies significantly across different industries, with particularly notable positive effects in heavily polluting industries, state-owned enterprises, and foreign trade enterprises.

From a financial mechanism perspective, ESG performance indirectly influences stock prices by optimizing corporate financial indicators. Research shows that good ESG performance can lower asset-liability ratios, optimize financing structures; improve operational cash flow structure through strategic investments, enhancing long-term economic benefits; and increase net cash flow from operating activities, thereby improving enterprise financial robustness and market competitiveness [1]. These financial indicator improvements provide crucial support for ESG performance’s positive stock price impact. Based on this, the paper proposes the following hypothesis:

Hypothesis 2: ESG scores strengthen the positive impact on stock prices by optimizing financial indicators such as asset-liability ratio, operational cash flow outlay, and net cash flow from operating activities.

The paper’s innovation lies in systematically revealing the differences and action pathways of ESG performance’s impact on stock prices from dual perspectives of industry heterogeneity and financial mechanisms.

3. ESG and Stock Price Fluctuations

3.1. ESG Trend Analysis

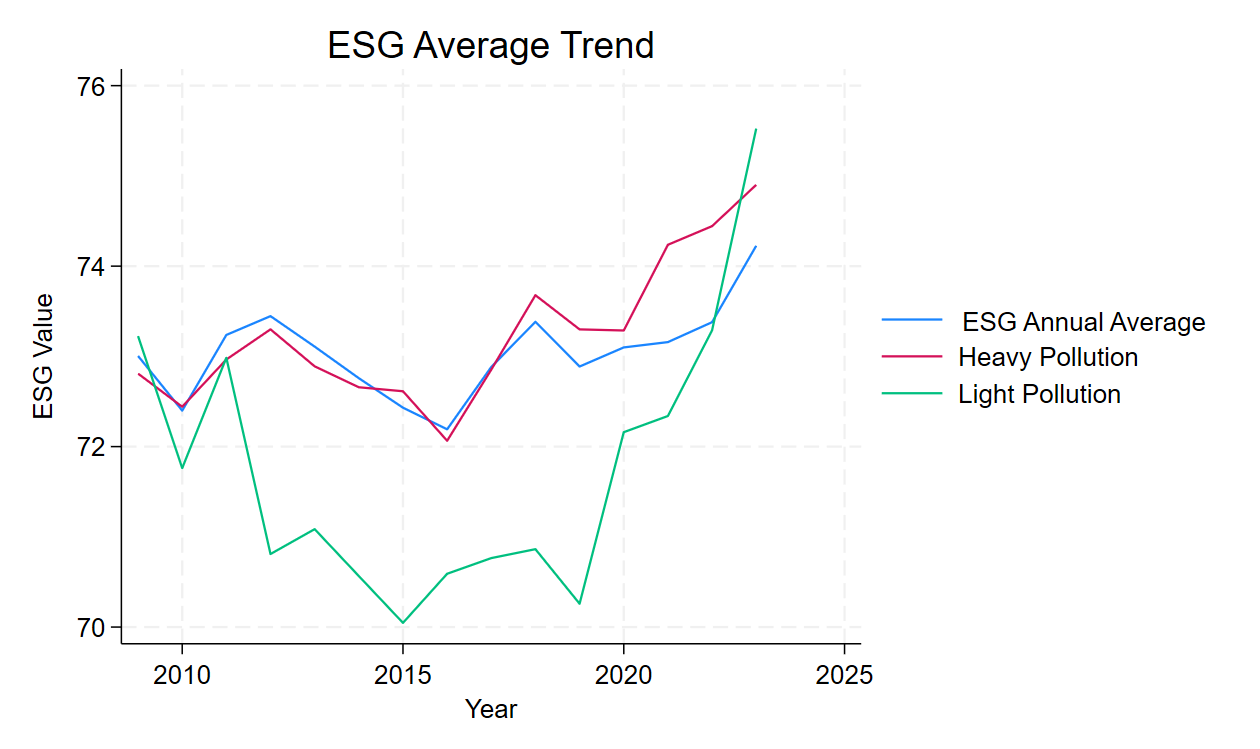

This research reveals the industry heterogeneity of ESG performance’s impact on stock prices through comparative analysis of ESG performance and stock price fluctuations across different industries. Figure 1 displays the dynamic trends of ESG score averages and stock price variations for high-pollution and low-pollution industries from 2015-2022. From a longitudinal perspective, the study period reveals a clear ESG performance differentiation trend. Between 2015-2017, high-pollution industry ESG scores averaged 65-70, significantly higher than low-pollution industries’ 55-60 range. However, from 2018 onward, low-pollution industries demonstrated a steady ESG score increase, with an annual growth rate of 8.2%, overtaking high-pollution industries in 2020 and reaching 78.5 in 2022 - 6.3 points higher than high-pollution industries. This trend transformation stems from three primary factors: stricter environmental policies and increased regulatory intensity driving corporate environmental governance improvements; deepened investor ESG investment concepts enhancing market sensitivity to ESG performance; enhanced corporate sustainable development awareness promoting systematic ESG practices. Notably, ESG score improvements in high-pollution industries show more significant stock price-boosting effects, potentially due to the market’s higher valuation of marginal environmental governance improvements in high-pollution companies.

Figure 1: Annual ESG Trend Diagram

Notes: The horizontal axis represents the year, and the vertical axis represents the ESG value (the blue line indicates the annual average ESG score, red indicates heavily polluting, and green indicates lightly polluting).

3.2. Enterprise Nature Heterogeneity in ESG and Stock Price Fluctuations

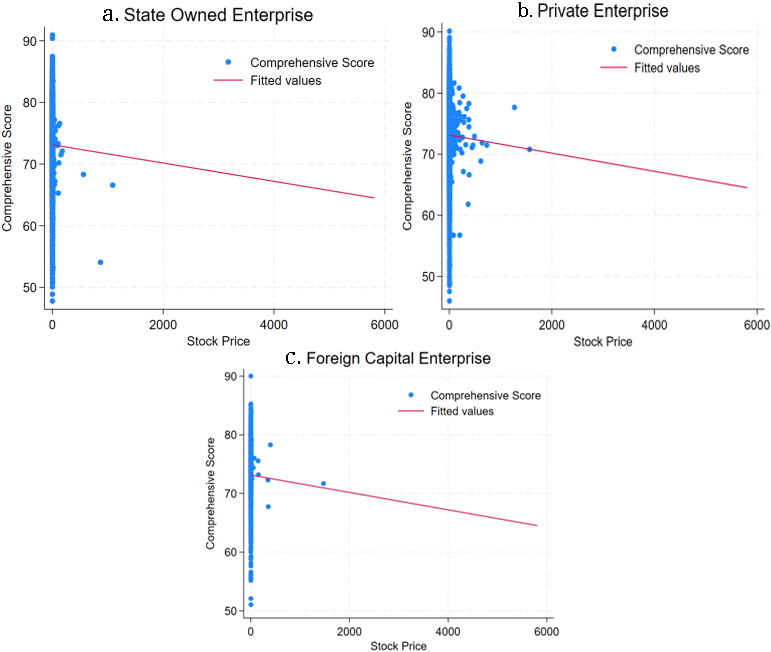

From an enterprise type perspective, significant differences emerge among state-owned, private, and foreign-funded enterprises in ESG performance and stock price fluctuations. State-owned enterprises demonstrate clear ESG practice advantages, with ESG scores significantly higher than private enterprises. This leadership is primarily evident across environmental, social responsibility, and governance dimensions. In the environmental dimension, state-owned enterprises actively respond to “dual carbon” policies, making substantial investments in clean energy, environmental management systems, and low-carbon projects. They have assumed more extensive public service functions, particularly in financial services and public utility sectors, and established relatively comprehensive governance structures. From an industry distribution perspective, state-owned enterprises exhibit notable industry clustering, with consistently high ESG scores in capital-intensive sectors like energy and raw materials, primarily due to their heightened environmental and social responsibilities.

In contrast, although private enterprises have shown ESG score improvements in recent years, they still maintain a significant gap compared to state-owned enterprises [3]. This disparity is most apparent in environmental management system development, social responsibility investment, and governance structures. Private enterprises’ ESG scores are more dispersed, reflecting uneven ESG practices. The primary challenges include limited resources and funding, as well as insufficient environmental and social responsibility awareness, which constrain the stabilizing effect of their ESG performance on stock prices.

Notably, foreign-funded enterprises exhibit high, concentrated ESG scores. This characteristic stems from dual drivers of internationalized operations: strict international market requirements compelling enterprises to enhance ESG practice levels, and global investors’ ESG preferences driving continuous improvement. Particularly in social responsibility and corporate governance dimensions, foreign-funded enterprises have established management systems aligned with international standards, securing more stable stock price performance. Through comparative analysis of these three enterprise types, we observe that state-owned enterprises maintain ESG practice leadership through policy support and resource advantages. Private enterprises show significant progress but still have room for improvement, while foreign-funded enterprises have formed unique ESG advantages driven by internationalization. These differences reflect the intrinsic connections between enterprise attributes, business characteristics, and ESG practices, providing differentiated strategic development path references for various enterprise types.

Figure 2: Enterprise Nature Heterogeneity in ESG and Stock Price Fluctuations.

Notes: The figures are arranged in the order of state-owned enterprises, private enterprises, and foreign-funded enterprises. The horizontal axis represents the stock price, and the vertical axis represents the composite score.

3.3. Enterprise Type Heterogeneity in ESG and Stock Price Fluctuations

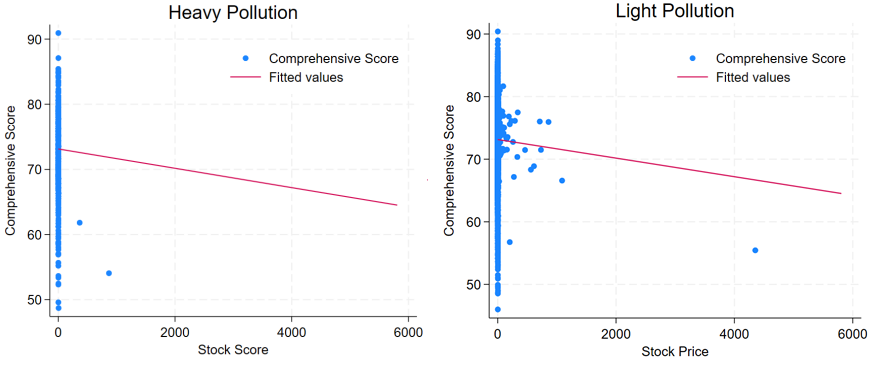

Environmental regulations significantly impact ESG performance, particularly the environmental dimension of high-pollution enterprises. Following the 2014 Environmental Protection Law revision, high-pollution listed companies demonstrated notable ESG score improvements, highlighting the critical role of environmental regulations in promoting corporate environmental and social responsibilities. Specifically, these enterprises significantly enhanced management practices related to climate change, resource utilization, and environmental pollution, directly reflected in their environmental dimension ESG scores.

Figure 3 illustrates the ESG and stock price volatility correlations across different enterprise types. High-pollution and low-pollution enterprises exhibit distinct characteristics in ESG performance and stock price volatility. High-pollution enterprises show a relatively concentrated ESG score distribution, with environmental regulations significantly driving improvements in the environmental dimension [4]. In contrast, while low-pollution enterprises dominate in high-segment ESG scores, they demonstrate notably higher stock price volatility. This difference potentially stems from lower environmental regulatory pressure, resulting in reduced motivation for ESG practice improvements. However, given low-pollution enterprises’ smaller environmental impact, their environmental dimension ESG score improvement still surpasses high-pollution enterprises.

Confronting increasingly stringent environmental regulations and market focus on ESG performance, both high-pollution and low-pollution enterprises must adopt differentiated strategic adjustments. For high-pollution enterprises, the focus lies in further strengthening environmental protection measures, enhancing social responsibility practices, and optimizing corporate governance structures to comprehensively improve ESG performance. Low-pollution enterprises, while maintaining environmental advantages, must prioritize stock price volatility control, actively enhancing ESG performance to strengthen market competitiveness and investor attractiveness. These differentiated strategic adjustments not only help enterprises adapt to market trends but also promote overall enterprise value enhancement.

Figure 3: Enterprise Type Heterogeneity in ESG and Stock Price Fluctuations.

Notes: The figures are arranged in the order of heavily polluting and lightly polluting. The horizontal axis represents the stock price, and the vertical axis represents the composite score.

4. Mechanism Analysis

4.1. ESG and Corporate Financing Structure

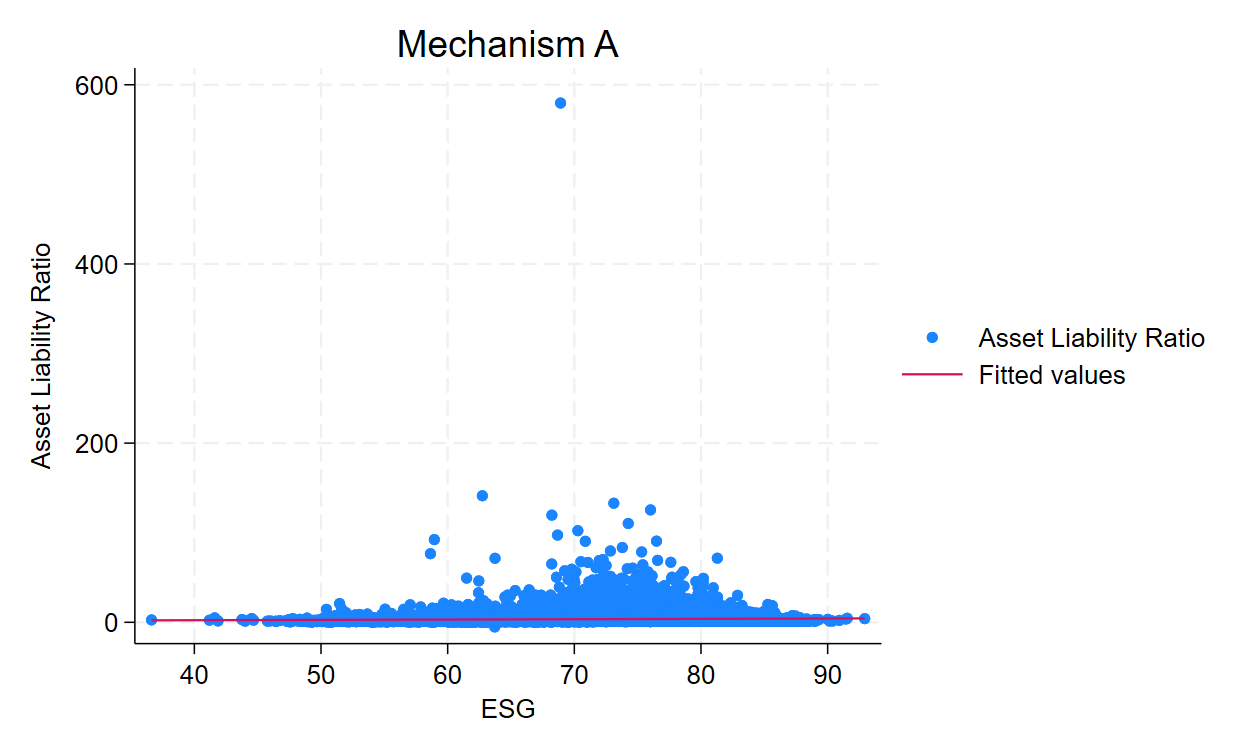

ESG performance demonstrates a significant association with corporate financial risk, with asset-liability ratio serving as a core indicator measuring debt financing and its potential stock price impact. Excellent ESG performance, particularly in corporate governance dimensions, can substantially enhance enterprise transparency and credibility, attracting more equity investors and optimizing financing structures, ultimately reducing asset-liability ratios [5]. Enterprises focusing on environmental and social responsibilities tend to utilize innovative financing methods such as green bonds or socially responsible investment funds, rather than excessively relying on traditional bank loans. This financing strategy helps reduce financial costs, improve market image, and enhance investor confidence, ultimately forming more robust financial structures. Figure 4’s data further supports this perspective, showing enterprises with high or low ESG scores typically maintain relatively low asset-liability ratios. This indicates that superior ESG performance can mitigate financial risks through financing structure optimization, thereby positively influencing stock prices. Consequently, ESG practices not only improve social responsibility performance but also enhance enterprise market resilience and stock price stability.

Figure 4: ESG and Corporate Capital Structure.

Notes: The vertical axis represents the debt-to-asset ratio.

4.2. ESG and Enterprise Cash Outflow

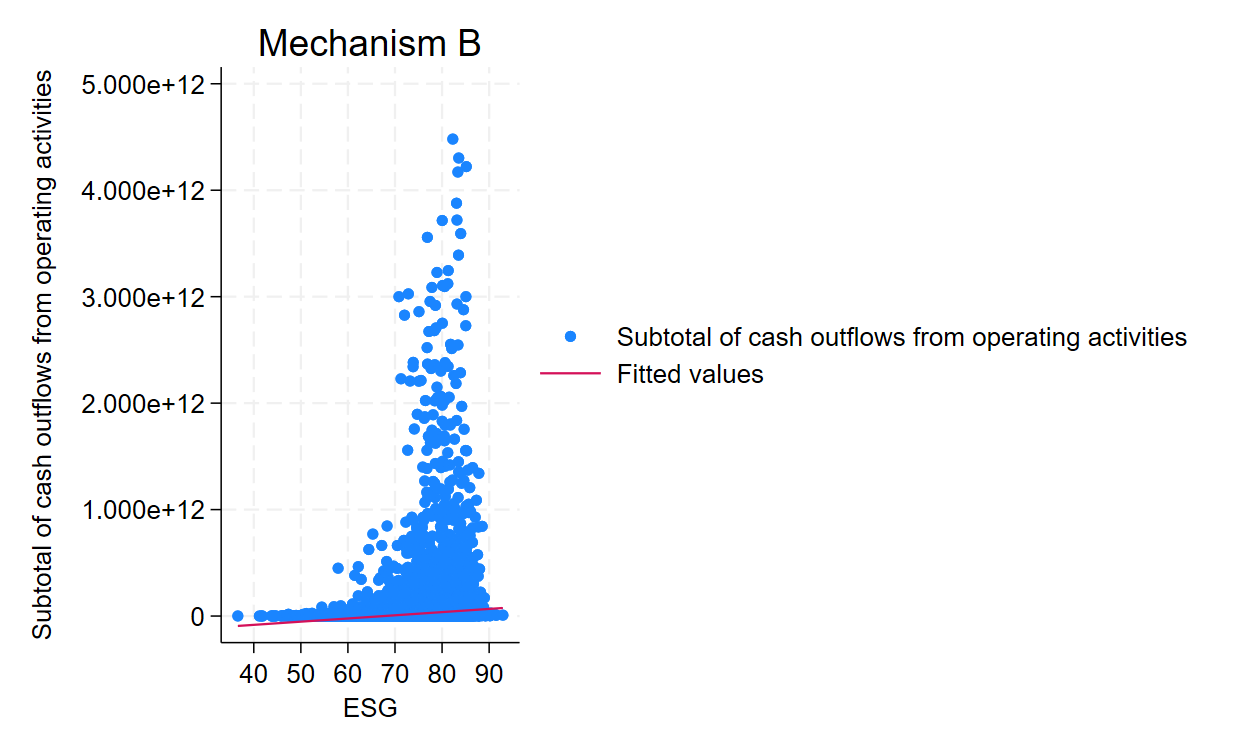

ESG performance shares a close relationship with enterprise cash outflow, with total operating cash outflow serving as a key indicator of daily operational expenses, significantly influenced by ESG performance. Research indicates that while environmental and social responsibility investments may increase short-term cash outflow, these strategic expenditures can generate substantial long-term economic benefits. In the environmental dimension (E), initial investments in energy-saving and emission-reduction technologies and environmental equipment do increase cash outflow pressure. However, these investments offer dual benefits: first, by improving energy efficiency and optimizing production processes, enterprises can achieve sustained operational cost reductions; second, effective environmental management can avoid potential fines and litigation risks associated with environmental pollution, thereby reducing potential cash outflows. In the social dimension (S), investments in employee welfare and community development, despite increasing current cash outflows, generate multiple long-term benefits: improving employee welfare enhances satisfaction and loyalty, reduces turnover rates, and subsequently lowers recruitment and training costs. Additionally, active community participation helps enterprises gain more social resources and support, elevating brand value and social image, thereby attracting more customers and investors and increasing cash inflows. Figure 5’s data analysis further reveals the relationship between ESG performance and cash outflow: high ESG-scoring enterprises typically demonstrate higher total operating cash outflows with a dispersed distribution. This distribution reflects strategic investment focus by high-ESG performance enterprises, ultimately improving financial performance and stabilizing stock prices through optimized operational cost structures and enhanced resource efficiency. Therefore, ESG-related expenditures should be viewed as strategic investments creating long-term value, rather than mere cost burdens.

Figure 5: ESG and Corporate Cash Outflows

Notes: The vertical axis represents the total cash outflows from operating activities.

4.3. ESG and Enterprise Financing Costs

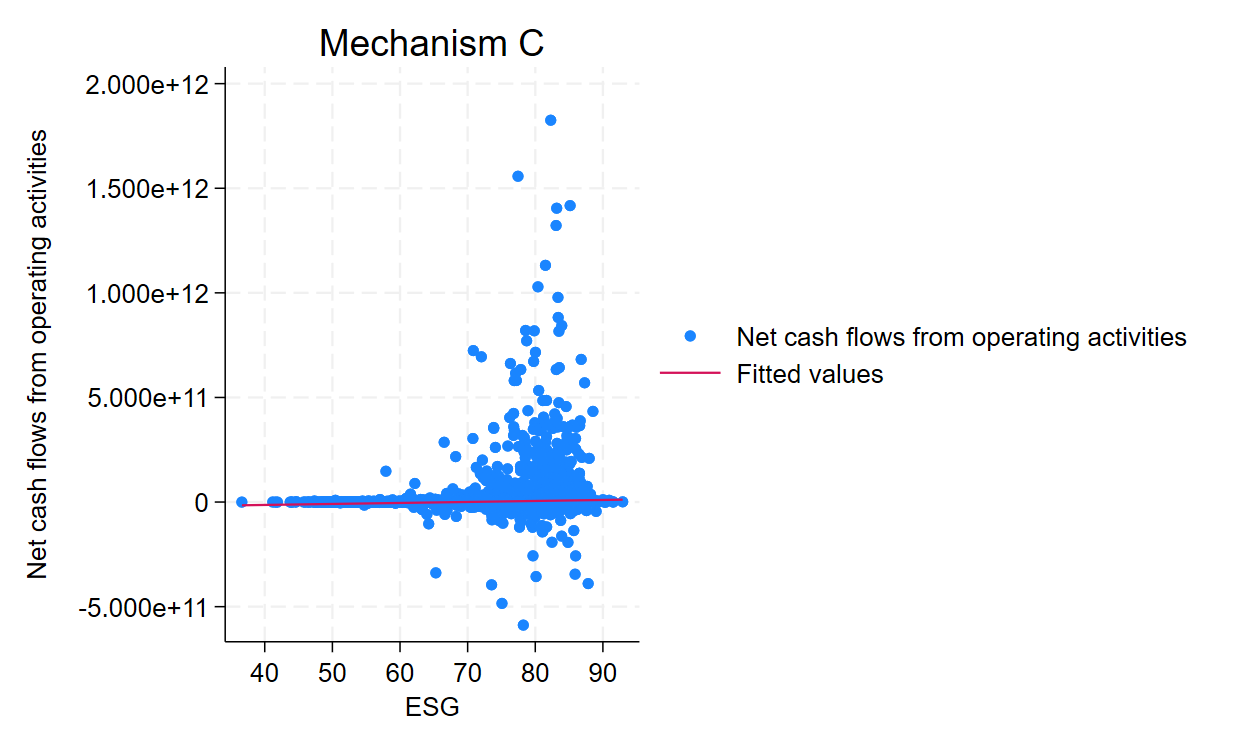

ESG performance is significantly correlated with corporate financing costs, and net cash flow from operating activities, as a core indicator measuring enterprise operational results, is profoundly influenced by ESG performance. Good ESG performance can enhance net cash flow through synergistic effects across three dimensions - environmental, social, and governance: In the environmental dimension (E), enterprises adopting clean energy and resource recycling technologies not only reduce energy consumption and raw material waste but also attract more customers focused on sustainable development through environmental advantages, thereby achieving operational cost reduction and sales revenue increase. In the social dimension (S), enterprises’ attention to employee welfare, community development, and consumer rights significantly improves brand image and market competitiveness, enhances customer loyalty, expands market share, and simultaneously attracts outstanding talent and strategic partners, thereby improving operational efficiency and innovation capabilities. In the corporate governance dimension (G), a sound governance structure increases decision-making efficiency and risk management capabilities. Scientific decision-making mechanisms avoid unnecessary investment risks, while transparent information disclosure and effective internal controls enhance investor confidence and reduce financing costs. Data in Figure 6 further verifies this mechanism, showing that enterprises with higher ESG scores typically demonstrate higher net cash flow from operating activities. This indicates that good ESG performance can significantly improve financial performance through multiple channels such as optimizing operational efficiency, enhancing profitability, and reducing financing costs, thereby positively influencing stock prices. Therefore, ESG practices are not merely an expression of corporate social responsibility but a strategic choice to enhance financial performance and market competitiveness.

Figure 6: ESG and Corporate Financing Costs.

Notes: The vertical axis represents the net cash flow from operating activities.

5. Conclusion

This paper explores the impact of corporate ESG (Environmental, Social, and Governance) performance on the stock prices of manufacturing companies through empirical analysis. It reveals the mechanism through which ESG performance affects stock prices by influencing corporate financial indicators and operational conditions. The study finds that the impact of ESG performance on stock prices exhibits significant industry heterogeneity and firm nature heterogeneity. For heavily polluting firms, improvements in ESG performance have a more pronounced positive effect on stock prices. This is primarily because the market assigns a higher valuation to the marginal improvement in environmental governance of high-pollution enterprises. State-owned enterprises and foreign-funded firms stand out in ESG practices, with significantly higher ESG scores than private enterprises. Moreover, due to the requirements of international operations, foreign-funded enterprises have more focused ESG performance and higher stock price stability. In addition, ESG performance significantly enhances corporate financial performance through multiple channels, such as optimizing capital structure, reducing financial risks, and improving cash flow conditions, thereby exerting a positive influence on stock prices. Specifically, good ESG performance can lower the debt-to-asset ratio, optimize the structure of cash outflows, and increase net cash flow from operating activities, thereby enhancing corporate market competitiveness and stock price stability.

Based on the research findings, the following recommendations are proposed for enterprises, investors, and policymakers: Firms should develop differentiated ESG strategies according to industry characteristics and their own nature. Heavily polluting enterprises should strengthen environmental governance and social responsibility practices, while less polluting firms should focus on optimizing corporate governance structures to enhance stock price stability.When making investment decisions, investors should consider ESG performance as an important reference indicator, paying attention to its industry heterogeneity and long-term value creation potential. Policymakers should strengthen environmental regulations, support corporate ESG practices, and promote the improvement of ESG information disclosure systems. Through the joint efforts of all parties, ESG practices will become an important driving force for enterprises to improve financial performance and market competitiveness, while also promoting the sustainable development of the economy, society, and environment.

References

[1]. Liu, J., Huang, J., Li, T., & Peng, Q. (2024). Can ESG ratings improve the net profit margin of total assets for manufacturing firms?

[2]. Zhou, X., Wang, D., & Zhang, J. (2025). Digital transformation, green innovation sustainability, and corporate ESG performance.

[3]. Yan, E., & He, C. (2025). The impact of state-owned enterprises on employment stability in private firms: A supply chain perspective.

[4]. Lv, S. (2025). The impact of ESG performance of heavily polluting enterprises on green innovation.

[5]. Wang, X. (2025). Suggestions for classified management of debt-to-asset ratios in large state-owned enterprise groups.

Cite this article

Hou,J. (2025). The Impact of Corporate ESG Performance on Stock Prices in the Manufacturing Sector. Advances in Economics, Management and Political Sciences,167,201-209.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 4th International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Liu, J., Huang, J., Li, T., & Peng, Q. (2024). Can ESG ratings improve the net profit margin of total assets for manufacturing firms?

[2]. Zhou, X., Wang, D., & Zhang, J. (2025). Digital transformation, green innovation sustainability, and corporate ESG performance.

[3]. Yan, E., & He, C. (2025). The impact of state-owned enterprises on employment stability in private firms: A supply chain perspective.

[4]. Lv, S. (2025). The impact of ESG performance of heavily polluting enterprises on green innovation.

[5]. Wang, X. (2025). Suggestions for classified management of debt-to-asset ratios in large state-owned enterprise groups.