Volume 231

Published on October 2025Volume title: Proceedings of ICEMGD 2025 Symposium: Resilient Business Strategies in Global Markets

This paper aims to explore the dual effects of cultural soft power on empowering grassroots political mobilization. In the context of globalization, culture, as a core political resource, plays an increasingly prominent role in consolidating social consensus and shaping the political ecology. Focusing on the theme of "cultural soft power empowering grassroots political mobilization", this paper integrates and analyzes existing literature, and discusses the ways in which state and non-state actors use cultural soft power to carry out social mobilization. The research results indicate that although cultural soft power has the potential to empower, in practice, forms dominated by external funds or the state tend to make grassroots political participation formalized and lack autonomy, thus losing their community foundation. This not only fails to inspire large-scale public participation but may also turn empowerment into dependence and integration. Therefore, to achieve real grassroots empowerment, it is necessary to guard against power imbalance and agenda dominance in mobilization, and explore a more open, citizen-driven mobilization model that meets local needs.

View pdf

View pdf

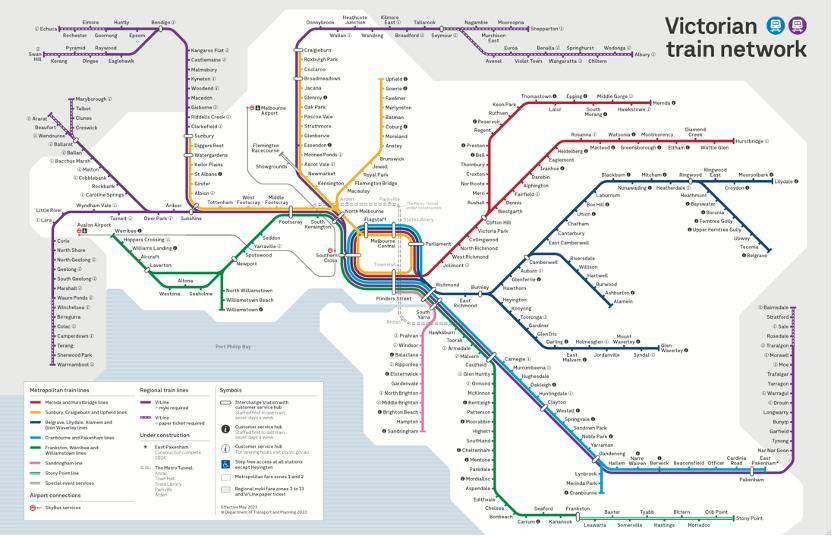

The paper assesses the capitalization of residential unit values along Melbourne's Cranbourne Line route. Beyond station proximity, this paper jointly assesses transportation accessibility, everyday service availability, dwelling attributes, and neighborhood socio-demographics as determinants of price. To enhance cross-sectional comparability in a market characterized by varied lot sizes and layouts, outcomes are assessed based on per-square-meter prices instead of total selling values—an approach that remains underutilized in Australian studies but is immediately beneficial for planners and investors. Utilizing a hedonic pricing framework, this paper estimates a global ordinary least squares (OLS) model and a geographically weighted regression (GWR) to differentiate corridor-wide connections from regionally variable effects. Findings demonstrate that an increase in the number of bedrooms and the availability of on-site parking correlates with elevated unit costs, whereas increased distance from both the nearest rail station and the central business district relates to diminished unit prices. The GWR exhibits significant geographic variation, with the distance-to-station gradient differing markedly among station catchments. The evidence emphasizes the necessity for households to balance housing costs with effective access to the rail network; for policymakers, it illustrates that public transport initiatives influence property values and the distribution of urban opportunities, thereby informing station-area design, last-mile services, and transit-oriented development up-zoning. This method provides a replicable framework for corridor analysis and establishes a foundation for subsequent causal evaluations of specific investment occurrences.

View pdf

View pdf

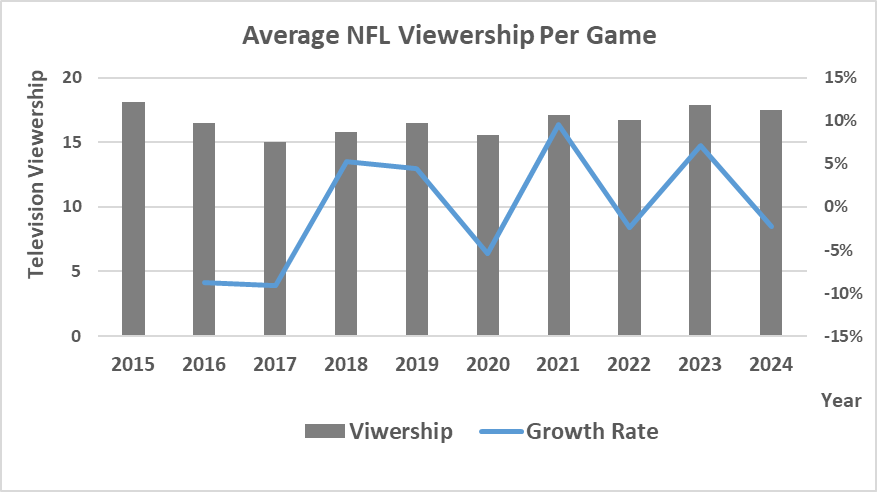

This study explores the relationship between National Football League (NFL) quarterbacks' performance metrics and television viewership trends from 2015 to 2024. Using data from Pro-Football-Reference for quarterback statistics and from Statista, the Ministry of Sports, and The Memo for viewership figures, we analyze variables including passing attempts, completions, touchdowns, interceptions, yards per game, net yards per attempt, and fourth-quarter comebacks. Through descriptive statistics, box plots, and correlation analysis, results reveal weak negative correlations between most quarterback performance indicators and average game viewership, suggesting that higher passing volume or efficiency does not necessarily lead to higher ratings. Conversely, fourth-quarter comebacks exhibit a modest positive correlation, underscoring the role of dramatic game elements in boosting viewer engagement. We also qualitatively analyze non-competitive factors—such as game interruptions, score uncertainty, and celebrity involvement—as complementary influences. These findings provide strategic recommendations for NFL stakeholders to enhance event appeal and commercial value.

View pdf

View pdf

We survey the economic literature on imitation entry and self-preferencing behaviors of dual-role platforms. Existing studies indicate that the impact of imitation entry on markets is twofold: it may enhance consumer welfare in the short term, but suppress the innovation incentives of third-party sellers in the long term. The scope and constraints governing data usage and imitation critically determine these outcomes, necessitating careful consideration within policy development frameworks. Given the lack of systematic synthesis of existing literature on the core mechanisms, motivations underlying the imitation entry of dual-role platforms, and their interaction with self-preferencing behaviors, this literature review aims to systematically organize these aspects and propose potential directions for future research.

View pdf

View pdf

In recent years, trading card games like “My Little Pony” have become increasingly popular among teenagers. This study investigates the factors driving teenagers’ obsessive purchasing behavior towards TCGs, such as My Little Pony cards and analyze irrational consumption behaviors through a questionnaire survey focusing on age, city type, spending patterns, acceptable prices, etc. Results show that the current low per-pack price (¥5-10), though seemingly affordable, actually encourages irrational purchasing behavior. Data analysis reveals that approximately 25% of respondents are willing to pay ¥50 for one pack, suggesting that a strategic price increase may foster greater spending awareness. The study also critiques the inadequacy of existing regulations, such as vague guideline for buying and selling blind-box. Consequently, The findings suggest that excessively low prices encourage irrational purchasing behavior. It is argued that raising card pack prices to more rational levels, combined with stricter purchasing restrictions and platform oversight, could help reduce addictive behaviors and promote healthier consumption.

View pdf

View pdf

Adapting to the tax system is an inevitable requirement for increasing innovation efficiency in the new era. Based on the relevant data given in the annual report of BYD from 2020 to 2023, the impact of taxation on BYD's innovation ability and its improvement ideas are obtained through year by year comparison. Results show that the investment and income of BYD R&D have increased significantly, the number and structure of R&D personnel have changed, the effect of technological innovation is significant, and the tax policy has a positive impact on innovation. In order to further promote the innovation and development of the new energy vehicle industry, it is suggested that the government continue to optimize and improve relevant tax policies, such as increasing the proportion of pre-tax deduction of R&D expenses, implementing preferential tax policies for high-tech enterprises, and optimizing the accelerated depreciation policy of fixed assets. At the same time, the government can also introduce a series of tax policies to encourage the consumption of new energy vehicles, such as purchase tax relief, vehicle and vessel tax incentives, etc., in order to reduce the cost of consumer car purchase and improve the market acceptance of new energy vehicles. The research conclusions have important reference significance for improving innovation-related tax policies and promoting high-quality development of BYD and other new energy vehicle industries.

View pdf

View pdf

Significant differences have been observed in the application effects of Artificial Intelligence technology across industries, which has widened the "Digital divide" among enterprises. Using data from A-share listed companies spanning 2008 to 2023, this study employs the Two-way fixed effects model to examine how AI applications influence Enterprise competitive advantage and to investigate the moderating role of Enterprise attributes (specifically high-tech and technology-intensive industries). The results indicate that AI applications significantly boost Enterprise competitive advantage, with a more pronounced positive impact observed for High-tech enterprises and Technology-intensive enterprises. In terms of mechanism, AI exerts its effects through three channels: enhancing Operational efficiency, driving innovation, and strengthening Market response ability.This study offers a theoretical foundation for enterprises with different attributes to develop tailored AI strategy, which helps reduce the Gap in the distribution of technological dividends.

View pdf

View pdf

In the context of ESG concepts increasingly becoming key indicators for measuring corporate sustainability, this study aims to explore how endogenous business strategy differences within enterprises affect their ESG performance levels. The study takes A-share listed companies in China from 2016 to 2023 as samples and uses quantitative empirical methods to construct panel data models for analysis. The main findings suggest that the strategic choices of companies systematically influence their ESG paths. Specifically, companies that adopt an explorer strategy and a differentiation strategy have significantly better overall ESG performance; Companies that adopt defensive and cost leadership strategies have relatively poor ESG performance. Further mechanism analysis reveals that corporate innovation plays a crucial mediating role between strategy and ESG performance. Furthermore, contextual factors such as the level of digital transformation and the regional institutional environment can significantly moderate the relationship, amplifying the positive impact of innovation-driven strategies on ESG performance.

View pdf

View pdf

As China moves into a stage of deep population aging, demographic transitions are increasingly reshaping patterns of economic development. Drawing on provincial panel data spanning 2013 to 2022, this study employs a panel threshold model to explore the dynamic interactions among aging, digital economy expansion, and human capital accumulation. The results indicate that, in general, population aging exerts a dampening effect on digital economic growth. However, the extent of this impact is contingent upon the level of human capital: inadequate human capital significantly constrains digital progress, while higher levels of human capital can offset demographic pressures and even foster digital development. Moreover, notable regional disparities emerge. In the eastern provinces, the effect of aging on digitalization is statistically insignificant, whereas in the central, western, and northeastern regions, aging generates pronounced negative consequences. These findings suggest that to mitigate demographic challenges and harness the opportunities of an aging society, it is essential to integrate the “silver economy” with digital transformation, enhance digital literacy and adaptability among older populations, and address regional imbalances in digital economy advancement, thereby promoting more coordinated and inclusive growth.

View pdf

View pdf

The current global landscape is characterized by increasing uncertainty, driven by factors such as economic volatility, technological disruptions, environmental challenges, and geopolitical shifts. These forces have rendered traditional strategic frameworks—often reliant on linear and predictable models—ill-suited to the complexities of today's dynamic environment. This paper explores the implications of this uncertainty for business strategy and argues for a more adaptive approach centered on resilience and agility. Drawing on an analysis of key drivers of uncertainty, including fluctuating markets, rapid technological innovation, climate change, and rising geopolitical tensions, the study proposes a comprehensive framework for building resilient business strategies. The framework integrates four core components: continuous environmental scanning and sensing, robust risk management processes, the development of adaptive capacity through organizational learning and innovation, and proactive stakeholder engagement. By embedding these elements into strategic planning, businesses can not only withstand shocks and disruptions but also seize emerging opportunities in turbulent times. Ultimately, this paper contributes to both academic discourse and managerial practice by offering actionable guidance for navigating uncertainty and positioning organizations for sustainable long-term success.

View pdf

View pdf