1. Introduction

1.1. What is trading card game

Trading card games are also known as TCGs. In 1993, designed by American mathematician Richard Garfield, Magic: The Gathering (MTG) sold by Wizards of the Coast is regarded as the pioneer of this trend. Because MTG combines strategy, collection and battle, and players can continuously improve their skills, it quickly become a best-selling game. Since then, various TCGs have appeared on the market. For example, in Japan, there were originally card vending machines themed on the Gundam series or Dragon Ball. In 1996, Media Factory released the Pokémon Trading Card Game. In 1997, Fujimi Shobo launched the original character TCG Monster Collection to compete with MTG. There is also the San Guo Zhi trading card game developed in mainland China with the background of the Three Kingdoms culture, and so on.

TCG is a highly commercialized game. In order to stimulate sales, manufacturers often make high-leveled cards limited and difficult to obtain, inducing players to pursue rare cards and spend a lot of money. For example, the level settings of cards (R, SSR, UR,etc).

There are two types of TCG, one is non-competitive and the other is competitive. Among them, non-competitive cards are cards with collection and ornamental value. Competitive cards can participate in TCG battles while having collection and ornamental value. Card game manufacturers also hold official competitions, and some offer prizes or bonuses. Generally, cards with high effects will increase in value due to players targeting competitions. A card priced at less than tens of yuan can rise to thousands or even more than 10,000 yuan due to popularity and strength.

1.2. The current situation of the trading card game market in China

In today’s Chinese trading card game (TCG) market, a wide range of products have appeared, including Ultraman, My Little Pony, Crayon Shin-chan, Harry Potter, Armor Hero, Frieren: Beyond Journey's End, Sanrio Characters, DreamWorks Animation, Identity V, Detective Conan, Kamen Rider, Soul Land, Pleasant Goat and Big Big Wolf, Disney, Naruto, Hatsune Miku, The Founder of Diabolism, Jujutsu Kaisen, Plants vs. Zombies, Eggy Party, The King’s Avatar, and Three Kingdoms (by KAYOU), etc. This broad selection highlights both international IPs and domestic innovations, illustrating the rapid diversification of the market.

Buyers of trading card games span a broad age range, from children and teenagers to young adults and older fans. However, teenagers become the dominant consumer group. The easy accessibility of sales venues—such as small shops near schools and mall stores—further fuels their demand.

The My Little Pony trading cards are priced between 5 to 10 yuan depending on the series, while Ultraman cards cost 10 yuan each. Just looking at the price, it is not high, which makes youth consumers have less financial pressure when purchasing and they are prone to buying without restraint. Additionally, the TCGs set different level for each card (as shown in Table 1), which fuels youth consumers’ desire to collect and compete, further driving their impulse purchases.

In addition, teenagers are easily influenced by the herd effect [1]and follow trends blindly. In order to fit into the social group and not be abandoned by current trends, teenagers will purchase a large number of trading cards and exchange them with classmates at school. Owning a high-level trading card has also become a way for teenagers to show off.

Figure 1. Different types of collectible cards

|

Card type & Probabilities |

|||||||||

|

Contents per Pack |

Random 2 cards |

1 card |

Random 1 card |

||||||

|

Pack Types |

R |

Points card |

SR |

DR |

SSR |

QR |

CPR |

UR |

ER |

|

Card Illustrations |

36 |

1 |

21 |

20 |

12 |

12 |

5 |

4 |

6 |

|

Pull Rates per Pack |

1:2 |

1:20 |

1:1 |

1:2 |

1:7 |

1:20 |

1:32 |

1:60 |

1:480 |

1.3. The development of the trading card game market

Now, the trading card game (TCG) market in China is thriving and developing rapidly. Driven by the simultaneous increase in quantity and price, the market scale is expected to continue its rapid growth. There are four main reasons for this rapid expansion: First, IP appeal drives massive fan purchases. Data shows that 71.3% of users consider IP elements when selecting products, 77.3% have bought IP-related goods in the past six months, and 89.3% are willing to pay a premium for IP. Global TCG giants like Pokémon, Yu-Gi-Oh!, and Magic: The Gathering all rely on renowned IPs. Domestically, the My Little Pony card series has attracted large numbers of youth consumers due to the IP’s popularity. Second, gameplay design strengthens user stickiness. To enhance the excitement of card opening, companies have created unique draw systems. For example, Kayou’s 2020 My Little Pony series introduces different card packs (Rainbow Pack, Lunar Pack, Twilight Pack, Fun Shadow Pack, etc.) priced from 2 to 10 yuan. Cards are divided into 20 tiers (N, R, SR, SSR, UR, CR, etc.), with common cards having an 86.7% drop rate and hidden cards only 0.05%. The allure of rare, beautifully designed, and collectible cards significantly motivates repeat purchases [2,3].

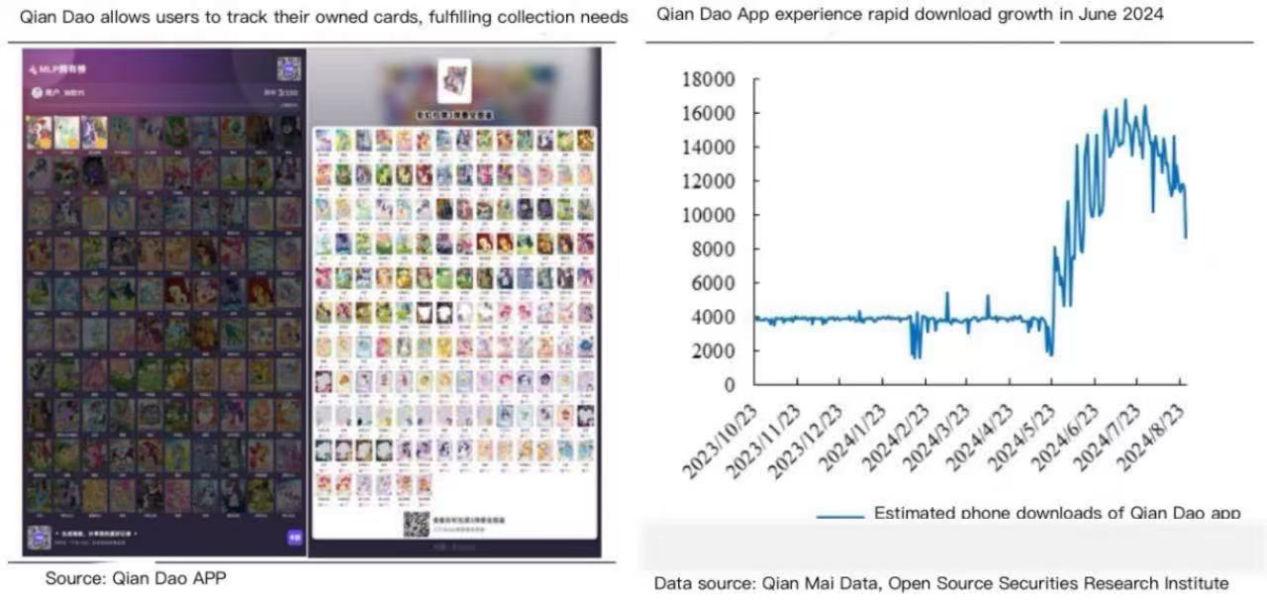

In addition, as the main consumer group of TCGs in China is teenagers, social activities among teenagers have made trading cards an essential part of their social life. The online trading card platform "Qiandao" has created a social platform for teenagers. trendy play community like Qiandao provide functions such as sharing good and bad luck, Q&A, mini— court, and trading areas, which have attracted a large number of people with the same interests, strengthening the sense of belonging of card fans. The "Qiandao Check— in and Ownership Ranking" further meets users' collection needs. Since June 2024, the daily download volume of the Qiandao APP has increased rapidly to more than 10,000, and the active participation of card-playing friends has further promoted the growth of the market scale.

Finally, the unique live-streaming sales model in China's trading card market also drives its expansion. In live-stream card unboxing, users place orders in real-time, hosts open packs and display cards on camera, then mail them to consumers. When rare cards are revealed, viewers often congratulate the buyer. Statistics show that since H1 2024, the search index for "chaika (card unboxing)" on Douyin (tiktok of Chinese version) surges, averaging 442,000 searches with a 390.68% Year to Year increase and 133.83% Month to Month growth. The Douyin account "jiuou chai ka" (1.562 million followers) generated ¥1-2.5 million in live-stream sales from April 30 to May 29, 2024, with over 18.26 million new likes. Guiton data reveals most viewers spend ¥50-100 per purchase. Kayou's sales exceeded ¥75 million in 2024, while Douyin sales hit ¥250 million in H1 2024 (10,380% Year to Year growth). Live-stream margins range from 10-20% for regular hosts (30% for top influencers), as returns are rare and some orders require no shipping. Driven by live commerce, China's TCG market (primary + secondary markets) grew from ¥700 million in 2017 to ¥12.2 billion in 2022 (78.4% compound annual growth rate [4]). With rising user bases and repurchase rates, the market is projected to reach ¥16.5 billion in 2024 and ¥31 billion by 2027 (20.5% CAGR), maintaining steady growth.

However, there are also some challenges hindering the development of China's trading card market. Firstly, the trading card market currently lacks effective regulatory mechanisms. For example, some live-streaming hosts who unbox cards are suspected of piracy, false advertising, and malicious order brushing; some second-hand trading platforms have issues such as counterfeit goods, missing items, and return problems. These issues not only harm consumers' rights and interests but also affect the market's credibility and order.

In addition, the problem of IP licensing plagues many trading card companies. The renewal of expired IP licenses limits the development of card companies. Some card companies are overly reliant on foreign IPs and lack independent innovation capabilities, so issues related to foreign IPs will hold back the development of China's trading card market. Moreover, the trading card market currently needs to assume more social responsibilities in areas such as education and guidance, and environmental protection. There are phenomena among consumers such as excessive consumption, blind pursuit, and irrational investment; some manufacturers and consumers have problems of overproduction, excessive packaging, and excessive waste. Relevant trading card companies need to strengthen the cultivation and practice of social responsibility and public welfare spirit.

1.4. Introduction of research

In recent years, the phenomenon of youth consumers becoming obsessed with purchasing and collecting TCGs emerges as a serious social issue. Many news report that many youth consumers spend tens of thousands of yuan on collecting cards, placing a heavy financial burden on their families and reflecting the spread of irrational consumption behaviors among youth consumers.

Through observation and data collection, I find that, in addition to peer comparison and herd mentality, the pricing mechanism of the cards themselves may be one of the factors contributing to impulsive consumption. Is the current market pricing of these cards reasonable? Does it somehow encourage addictive behaviors among adolescents? Therefore, the questionnaire designed for this study aims to explore, from the perspectives of consumer psychology and behavioral economics, whether the pricing strategies of trading cards influence teenagers' purchasing decisions. By identifying reasonable pricing ranges and sales mechanisms, I hope to mitigate irrational consumption among teenagers and guide them toward healthy spending habits.

To collect data, I distributed questionnaires to friends, family members, and classmates, and also shared them on social media platforms such as Xiaohongshu and Douyin. Data collection was challenging, as some respondents provided careless or invalid responses. To address this issue, I manually reviewed all responses and removed those deemed unreliable. After cleaning the data, a total of 144 valid questionnaires from different regions across China were retained for analysis.

The survey method includes questions covering age, gender, cities types, the proportion of pocket money spent on trading cards, and the maximum price adolescents are willing to pay for one package of trading card game.

2. Research analysis

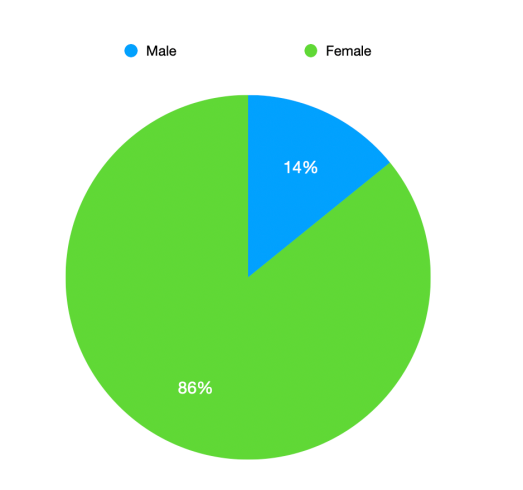

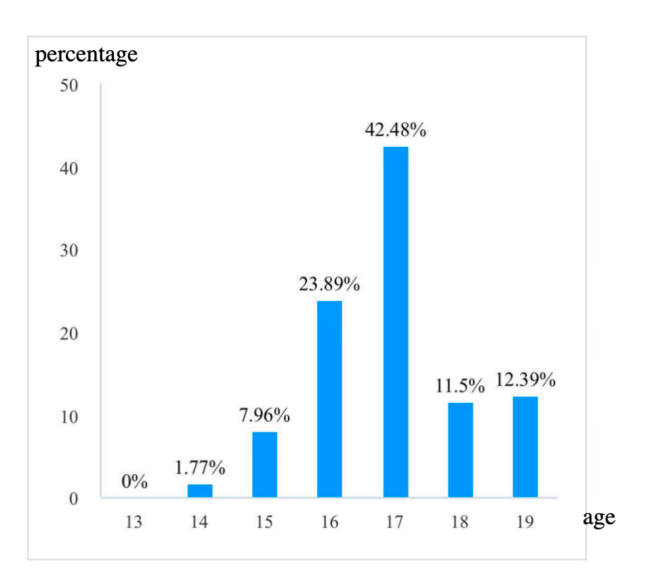

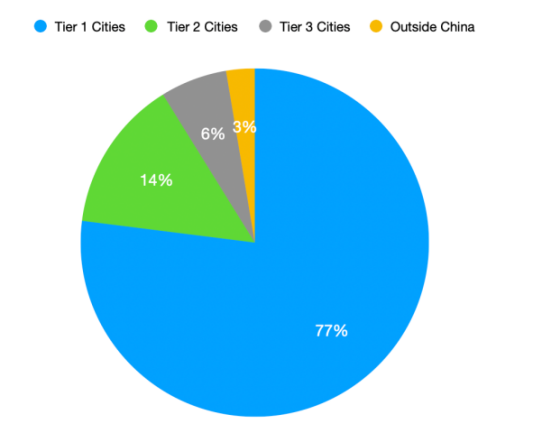

Figures 3,4 and 5 show that the proportion of female respondents is significantly higher than that of males, approximately 86%. Currently, the most popular trading cards are the "My Little Pony" cards, whose primary consumers are female. This is one of the reasons for the higher proportion of female respondents. In terms of age, participants are predominantly concentrated in the 16 and 17 years old groups, which corresponds to the primary age group that purchases trading cards. Geographically, respondents from tier 1 cities account for 77% of the total, while those from tier 2 cities make up 14%, and tier 3 cities contribute 6%. This distribution effectively reflects the behavioral characteristics of adolescents who purchase trading cards.

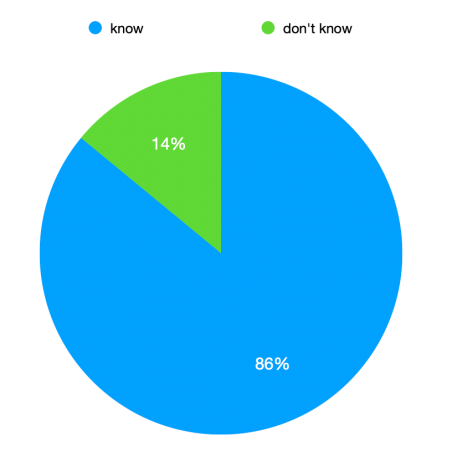

Figure 6 shows that 86% of adolescents know about trading card games, providing valid data for the study.

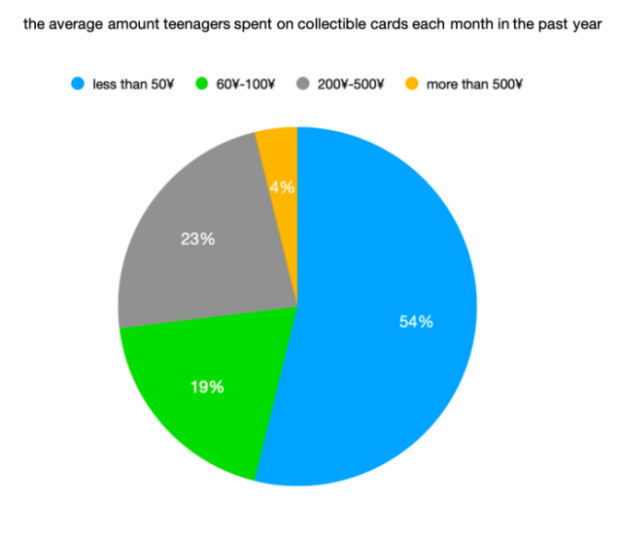

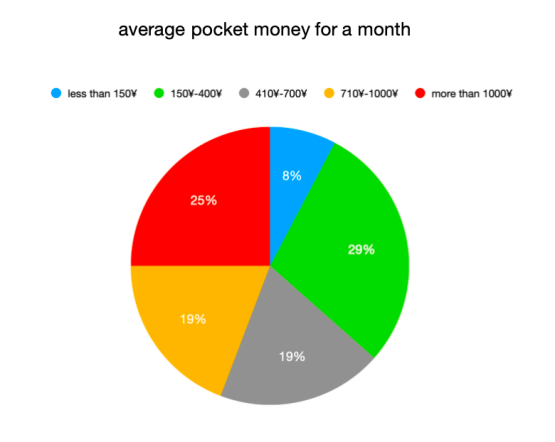

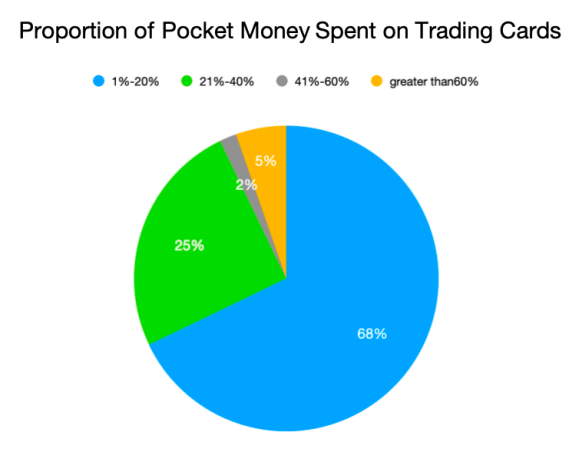

Figures 7-9 show that 68% of respondents spend 1%–20% of their pocket money on trading cards, while 25% spend 21%–40%. A smaller yet notable 5% devote as much as 60% of their allowance. In other words, most teenagers are willing to spend up to half of their pocket money on cards, but a minority channel a disproportionately large share into this hobby.

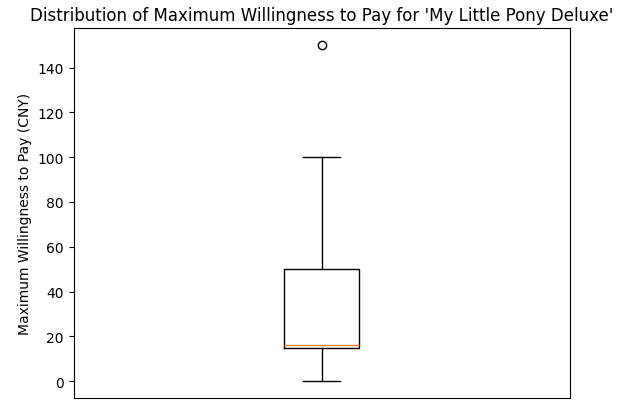

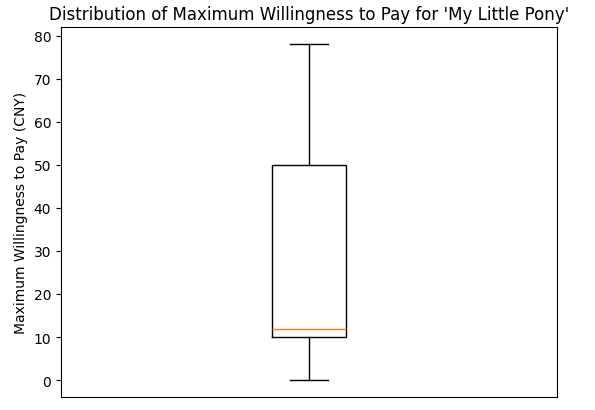

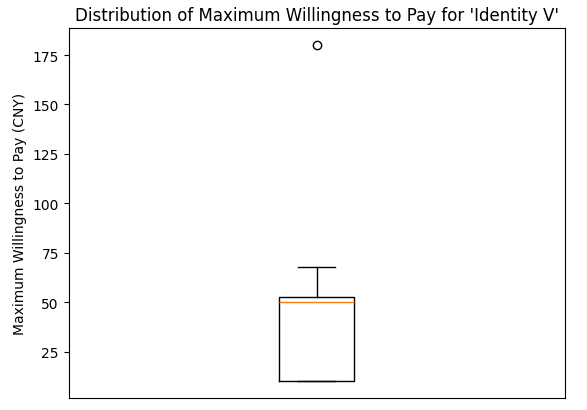

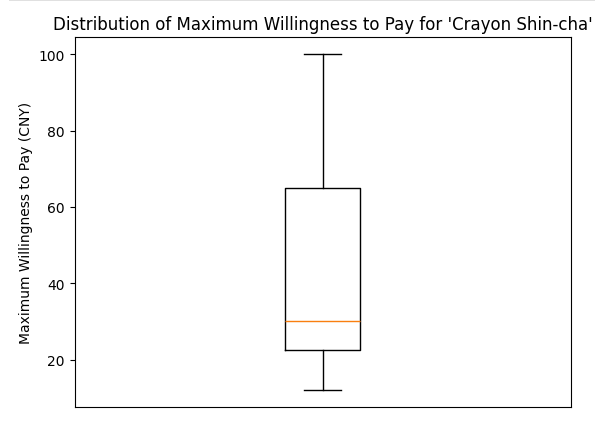

Figure 10. Distribution of maximum willingness to pay for TCGs

Regarding the maximum acceptable price for a single pack of the "My Little Pony Deluxe” (original price: ¥10, approximately $1.4), half of the respondents indicate a willingness to pay no more than ¥17, with an interquartile range of approximately ¥16 to ¥50. Similarly, for the "My Little Pony" pack (original price: ¥5, less than $1), half of the participants are willing to pay up to ¥13, with an interquartile range of ¥12 to ¥50. The same analytical approach applies to the other two figures.

Based on the graphs, approximately 25% of respondents find a price around ¥50 (about $7) acceptable for the four types of trading cards. Raising the price to around ¥50 could relatively alleviate the issue of excessively low prices leading youth consumers to overlook costs and engage in impulsive purchases.

3. Current policy analysis

Currently, China introduces a series of regulations governing the consumption behavior of teenagers. Take the Guidelines on the Standardization of Blind - Box Business Operations (for Trial Implementation) as an example. Article 23 of these guidelines clearly states that blind - box operators are prohibited from selling blind - box products to minors under the age of 8. When selling blind - box products to minors aged 8 and above, operators shall legally obtain the consent of the relevant guardians. Blind - box operators should also adopt effective measures to prevent minors from becoming addicted and protect their physical and mental health.

However, the current legal provisions remain vague in several respects, and the regulation of teenagers’ consumption lacks precision and clarity. For instance, the term “effective measures” in the relevant law is poorly defined and provides little practical guidance for sellers. On social media live-streaming platforms, teenagers can easily purchase trading cards by simply checking a box that reads “I am over 18 years old”—a superficial safeguard that clearly fails to curb addiction to TCGs. More critically, there is no specific legislation in China addressing the purchase of TCGs by minors, which creates significant barriers to resolving this social issue.In addition to the social issue of teenagers becoming addicted to TCGs in China, addiction to purchasing such cards is also a serious social problem in the United States. Many people have commented on Reddit that“I want to make this brief, for the last ~4 years I've been heavily addicted to TCGs. Namely Hearthstone, Gwent & Star Realms have been my poisons of choice.” [5]

Nonetheless, there is no specific federal law in the United States prohibiting minors from purchasing collectible card game products such as Magic: The Gathering. However, retailers may set their own restrictions; According to the Contract Law, the purchase contract of minors is revocable but has a minor impact. Some states have relevant regulations to protect minors. Moreover, such games are not gambling and are not subject to relevant regulations. Overall, minors can generally purchase such products. The restrictions are mostly due to merchant policies or state regulations, not specific laws. Such an uncertain law makes it impossible for the local area to alleviate the social problem of teenage consumers' addiction to collectible cards.

4. Policy suggestion

I believe the most effective measure is to establish a strict purchasing restriction mechanism for trading cards, which can be implemented through the following three approaches: First, online platforms (such as Douyin) should implement a dual verification system requiring both identity card verification and facial recognition. This would technically prevent minors from using their parents’ accounts to buy cards online. Additionally, the government should impose fines to stores that illegally sell trading cards to minors, increasing the cost of violations and strengthening merchants’ sense of responsibility. These two measures form a dual safeguard to more effectively protect minors. Finally, raising the price of a card pack can help raise teenagers’ awareness of rational spending. Currently, the excessively low single-pack price (less than $1) leads young consumers to overlook the cost, resulting in uncontrolled purchases. However, when all these small expenses add up, it is not a small number. Merchants can increase prices (for example, to around ¥50, as supported by the data above) while maintaining their profit margins. This would help reduce impulsive and excessive spending among teenagers.

5. Research limitations

Due to constraints of time and geographical coverage, the survey respondents are primarily adolescents from tier 1 cities such as Beijing and Shanghai, and do not fully represent youth groups across all regions. Additionally, as the data mainly come from local classmates and friends in other cities, the findings may carry certain biases.

6. Research prospect

Future studies would continue to focus on the social issue of adolescents spending on trading cards, with the aim of expanding the sample size and conducting comparative research in overseas regions. Additionally, the effectiveness of multiple policies would be further examined to mitigate this social problem.

7. Conclusion

This study deeply analyze the social phenomenon of adolescents' obsession with purchasing TCGs. The research finds that while the current market price (5-10¥ per pack) seems low, it actually fosters irrational consumption behaviors. Additionally, peer comparison and herd effect among teenagers further exacerbate this phenomenon. Data analysis shows that approximately 25% of surveyed teenagers accept a higher price range around 50¥, suggesting that price adjustment could serve as an effective mechanism to promote more deliberate consumption decisions. combining strict age verification online systems with comprehensive consumer education, such market-based approaches can definitely help guide teenagers and alleviate this social issue.

References

[1]. Michelle Baddeley(2010). Herding, social influence and economic decision-making: socio-psychological and neuroscientific analyses. https: //pmc.ncbi.nlm.nih.gov/articles/PMC2827453/#: ~: text=Herding%20can%20be%20defined%20as, of%20their%20own%2C%20private%20information.

[2]. Guangzhao Fang, Peng Tian(2024). Collectible Card Games: Breaking Boundaries Continuously, Fierce Competition Among Players, and Winning the Game with IP/Channels. https: //mp.weixin.qq.com/s/UAQdzLqwbxQXx3GC1v-3aw

[3]. Pugong Yi.(2023) The Evolution of Collectible Card Games (6) – Chapter 6: Gen Z Economy · Envisioning a Bright Future for the Collectible Card Industry. https: //mp.weixin.qq.com/s/Um2jR5d_Zvrg2ZK2dsfsJw

[4]. Jason Fernando(2024) Compound Annual Growth Rate (CAGR) Formula and Calculation. https: //www.investopedia.com/terms/c/cagr.asp

[5]. Fenexj(2017). Online trading card games and addiction.https: //www.reddit.com/r/truegaming/comments/8bhrhm/online_trading_card_games_and_addiction/.

Cite this article

Cai,Z. (2025). Youth Consumption of Trading Card Games in China. Advances in Economics, Management and Political Sciences,231,50-59.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICEMGD 2025 Symposium: Resilient Business Strategies in Global Markets

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Michelle Baddeley(2010). Herding, social influence and economic decision-making: socio-psychological and neuroscientific analyses. https: //pmc.ncbi.nlm.nih.gov/articles/PMC2827453/#: ~: text=Herding%20can%20be%20defined%20as, of%20their%20own%2C%20private%20information.

[2]. Guangzhao Fang, Peng Tian(2024). Collectible Card Games: Breaking Boundaries Continuously, Fierce Competition Among Players, and Winning the Game with IP/Channels. https: //mp.weixin.qq.com/s/UAQdzLqwbxQXx3GC1v-3aw

[3]. Pugong Yi.(2023) The Evolution of Collectible Card Games (6) – Chapter 6: Gen Z Economy · Envisioning a Bright Future for the Collectible Card Industry. https: //mp.weixin.qq.com/s/Um2jR5d_Zvrg2ZK2dsfsJw

[4]. Jason Fernando(2024) Compound Annual Growth Rate (CAGR) Formula and Calculation. https: //www.investopedia.com/terms/c/cagr.asp

[5]. Fenexj(2017). Online trading card games and addiction.https: //www.reddit.com/r/truegaming/comments/8bhrhm/online_trading_card_games_and_addiction/.