1. Introduction

With the coming of the era of the network economy, e-commerce has developed rapidly. Under the background of the accelerated development of economic globalization, multinational enterprises begin to expand in the world in order to seek new markets and resources. As one of the most dynamic and potential e-commerce markets with the world's largest market of Internet users, China has undoubtedly attracted extensive attention from many international e-commerce giants. However, although the Chinese market offers a broad space for the development of multinational e-commerce companies, its strict regulatory environment, differences in culture and consumption habits, and fierce local competition also pose many challenges for them. As the leader in the field of global e-commerce, Amazon's every move in China has attracted wide attention around the world, and has also brought far-reaching influence. It not only changes the competitive pattern of the Chinese market, but also brings opportunities to other multinational enterprises, playing a good example.

This paper mainly focuses on Amazon's internal structure, business layout, competitive strategy, policies and regulations, and exit and transformation in the Chinese market. This paper aims to reveal the opportunities and challenges faced by multinational enterprises in emerging markets by analyzing the process of Amazon's entry, development, competition and final exit in the Chinese market. The research will not only help to sum up Amazon's experience and lessons, but also provide references for other multinational enterprises to enter the Chinese market.

2. Overview of China's E-commerce Market

2.1. Market Size and Potential

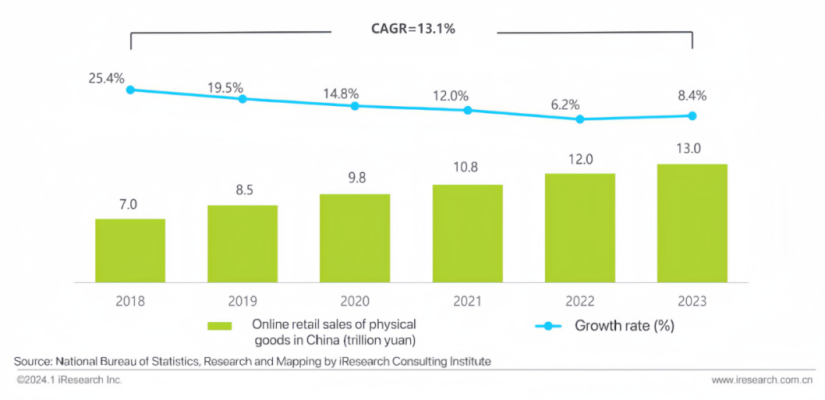

China's e-commerce market has developed rapidly in the past few decades. As shown in Figure 1, from 2018 to 2023, the scale of China's online retail market of physical commodities has continuously expanded. As mentioned in the report published by the United Nations, among the countries of focus, China's B2C online retail scale still occupies a large advantage, reaching 1,414.3 billion US dollars (more than 1.4 trillion) in 2020, which is the only country in the world with an online retail scale of more than one trillion US dollars [1]. With the improvement of Internet penetration and the popularity of mobile payment, the penetration rate of e-commerce in China is still on the rise, and its market potential is huge.

Figure 1: Size and growth rate of online retail market of physical goods in China, 2018-2023 [2]

2.2. Limitations of Infrastructure

Despite the huge market size of China's e-commerce market, there are still limitations in terms of infrastructure. Consumer concerns about privacy protection are common. Although China has made some progress in network construction, the overall quality and coverage still need to be improved. In addition, credit is the cornerstone of e-commerce development, and China currently lacks a perfect credit mechanism; the security of the payment system also needs to be improved. All these factors have limited the development of e-commerce to some extent.

2.3. The Rise and Development of E-commerce

With the development of the information age, the proportion of the tertiary industry in all countries is increasing, especially the service industry. The information service industry has become the leading industry in the 21st century, which also leads to the emergence and development of e-commerce [3]. With the popularization of Internet technology, e-commerce platforms such as Alibaba and Jingdong have risen rapidly. These platforms have met consumers' growing shopping needs through innovative business models and strong technical support. In recent years, emerging models such as social e-commerce and live streaming of goods have also injected new vitality into the development of e-commerce.

3. Amazon Enters the Chinese Market

3.1. Amazon's Business Layout in China

On August 19, 2004, Amazon officially entered the Chinese market and began its operation in the Chinese market through the acquisition of Joyo.com. After a short transition period in the Chinese market, Amazon began to build its own unique business system. In addition to developing B2C self-operated e-commerce with reference to the American model, it also invested heavily in professional equipment and technology.

Technology to build its own logistics system. In 2007, Amazon completed the integration with the original Joyo.com database and changed its name to "JoyoAmazon". In 2008, Amazon won 15.6 percent of the Chinese market share, ushering in a highlight moment after coming to China. In 2011, Amazon was completely removed from "excellence", changed its name to "Amazon China" and used the short domain name "z.cn". At the same time, it completed the replacement of its data system and presented it to Chinese consumers in a completely American model [4].

3.2. Amazon's Cooperation in China

(1) Cloud Computing Services: Amazon Cloud Computing Services (AWS) works with Chinese companies to promote the adoption of cloud computing in various industries.

(2) Logistics and Warehousing: Amazon has partnered with local logistics companies in China to improve its delivery efficiency.

(3) Technology and R&D: Amazon works with Chinese universities and research institutions to promote technological innovation.

(4) Payment cooperation: Amazon cooperates with Alipay, Wechat Pay and others to make it easier for Chinese users to pay.

(5) Amazon launched its Kindle e-book service and partnered with Chinese publishing houses.

3.3. Early Market Feedback

The period from 2004 to 2005 is the transition period of Amazon's development in the Chinese market, and the period from 200 to 2011 is its growth period. In 2008, Amazon took 15.6% of the Chinese market share, ushering in the highlight moment after coming to China [4]. However, due to its lack of understanding of the needs of Chinese consumers and fierce competition with local competitors, Amazon's market share in the Chinese market began to decline from 2012.

4. Amazon's Competitive Strategies in China

4.1. Distribution of Amazon's Business in China

In addition to Kindle e-book business, Amazon's business in China also includes the following six core segments: Amazon Global Store, Amazon Advertising, Amazon Global Logistics, Amazon Cloud technology, Amazon Overseas Purchase, and Amazon Smart Hardware and Services.

4.2. Competitors

4.2.1. Taobao

In 2003, a year before Amazon entered the Chinese market, Taobao was officially established as a Chinese digital retail platform by Alibaba Group Holding LTD. It reached strategic cooperation with Baidu, Alipay, Tencent and others, which not only attracted a large number of users, facilitated the payment process for users, diversified the payment methods, and promoted the development of mobile e-commerce. In 2008, the online retail market share of Taobao.com exceeded 70%, making the brand deeply rooted in people's hearts [5]. In 2016, the market share of Taobao + Tmall reached 85.6%, far exceeding the followers [6].

4.2.2. Tmall

In 2012, the former "Taobao Mall" officially changed its name to "Tmall" and launched a new logo. On November 11 of that year, Tmall cashed in on Singles' Day, claiming to have sold 10 billion yuan in 13 hours, setting a world record. According to the "2015 (first) China Online Retail Market Data Inspection Report" released by China E-commerce Research Center, a well-known domestic e-commerce research institution, in the first half of 2015, China's B2C online retail market (including network open platform and self-sales, excluding brand e-commerce) saw, Tmall ranked first, accounting for 57.7% of the market share. Jingdong ranked second, accounting for 25.1% of the market share, while Amazon China only ranked seventh, accounting for 1.2% [7].

4.2.3. Jingdong

Liu Qiangdong founded JD.com in Zhongguancun in 1998. The company posted a net profit of 83.8 million yuan in the same period last year, and its turnover for the year was 228.9 billion yuan, according to its financial statement.

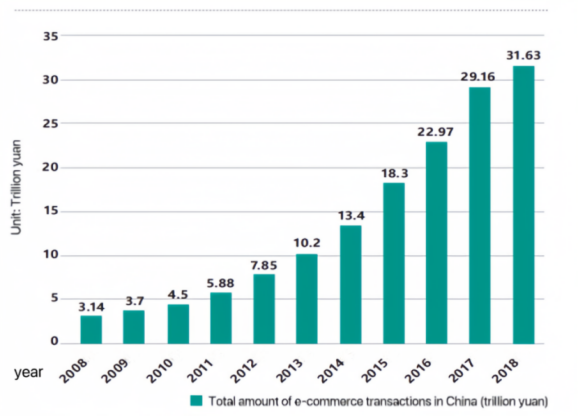

4.3. Competitive Strategy and Marketing Promotion

As shown in Figure 2, from 2008 to 2018, the total sales volume of e-commerce grew from 3.14 trillion yuan at the beginning to 31.63 trillion yuan, a 10-fold increase in 10 years. In the past 10 years, Amazon's market share in China declined from 15.4% to less than 1% [8]. With the continuous rise and rapid development of competitors, Amazon's market share in China is shrinking. Among many influencing factors, the rise of competitors is an important factor affecting its market share. In the fourth quarter of 2016, the market share of Amazon's overseas shopping only accounted for 6.6%, ranking sixth after Tmall International, Taobao Global shopping, JD Global shopping and other platforms. In the same year, Amazon's overall market share in China dropped dramatically to 1.3% [4]. With its market share in China declining all the way, Amazon China began a tense and long period of strategic adjustment. As far as competitors were concerned, it adopted a series of competitive strategies.

Figure 2: Total e-commerce transactions in China [8]

4.3.1. Competitive Strategy

(1) Discount strategy

Amazon is sticking to its "genuine, low price, convenient" strategy. In terms of self-operation, Amazon adopts the discount strategy to increase sales and profits by offering discounts. Amazon records the price information of customers' shopping websites and then automatically recommends price changes to customers. These changes are usually based on price-matching rules set by customers, so as to adjust commodity prices and increase sales volume or profit margin [9].

(2) "Dang Ridai" business

To address Chinese customers' complaints about slow delivery, Amazon has developed a same-day delivery service for the first time in China, but unfortunately only for sellers who participate in specialized sales programs.

5. Policy Environment and Regulatory Challenges

5.1. China's Policy Attitude towards E-commerce

China supports and actively promotes the development of e-commerce. With the progress and rapid development of the Internet, e-commerce has become an important driving force for economic development. Since 2015, the export growth rate of cross-border e-commerce has exceeded 30%. As an important economic growth point of foreign trade [10], it is of great significance to China's opening up. The Chinese government has also introduced a series of policies to encourage and promote the development of e-commerce, but at the same time, it has also put forward higher regulatory requirements for e-commerce platforms in terms of data security, consumer protection and taxation.

5.2. Policy and Regulatory Challenges Faced by Amazon

Amazon China e-commerce requires sellers to register in the name of the company, and individuals cannot apply for entry. At the same time, sellers must have a legal and valid business license, tax registration certificate and other relevant certificates. Secondly, foreign trade dealers must go through business registration or other professional procedures in accordance with the law. In addition, the imported and exported goods belong to existing import and export technologies, and the contract registration shall be filed with the department in charge of foreign trade under. The State Council or the institution entrusted by it. In addition, based on some specific reasons, China may restrict or prohibit the relevant international trade in services [11].

6. Amazon's Failure in the Chinese Market

6.1. Amazon's Strategic Adjustment in China

In 2014, Amazon China began to launch the "overseas purchase" business, taking cross-border e-commerce as its main business focus. However, in the face of fierce competition from Chinese local e-commerce enterprises, Amazon China's "overseas purchase" business performance is not satisfactory. According to statistics, in the fourth quarter of 2016, Amazon's overseas purchase market share only accounted for 6.6%. Ranked sixth after Tmall International, Taobao Global Purchase, JD Global Purchase and other platforms. In the same year, Amazon's overall market share in China plummeted to 1.3%. With the declining market share in China, Amazon China began to comprehensively shrink its layout in China from 2017. The number of operation team members and warehouse area were halved. By the end of 2018, there were only three operation centers in Beijing, Kunshan and Guangzhou [4]. In 2019, Amazon announced the closure of its local e-commerce business in China, and instead focused on cross-border e-commerce business and cloud computing services.

6.2. Reasons for Exiting its Local Business

6.2.1. Unreasonable Management Mode and Organizational Structure

In the 14 years since Amazon entered China, its market share has fallen from as high as 20% to 0.6%, according to Caitianxia. The failure of the Chinese market shows the obvious problem of insufficient localization [12]. Localization is the lifeblood for multinational enterprises to enter overseas markets. Amazon China, [4] affected by Amazon's business philosophy of "implementation" rather than "adjustment", the management team of Amazon China should "follow the command of all actions" more often, and report personnel recruitment, finance, promotion plans, technology and other major and minor matters to the US headquarters. The senior executives of Amazon China who have lost the initiative and decision-making power cannot even decide on the packaging design of a product. When they encounter problems, they need to go through a series of cumbersome procedures, such as declaration, approval and repeated communication and demonstration with the US headquarters. The Chinese branch is more like an operation center than a decision-making center. As a result, all decisions are delayed. The management team of the Amazon China cannot immediately adjust its business strategies and countermeasures according to the rapidly changing market, and the inefficient management mode leads to its lagging development. In terms of hiring the senior management team, the Amazon China management team lacks local management talents, but mostly consists of foreigners or Chinese foreigners who can't even speak Chinese. As a result, the team cannot fully understand China's politics, economy, culture and other aspects. At the same time, it cannot keep up with users' consumption habits and market consumption trends, which seriously hinders Amazon's development in China.

6.2.2. Lack of Network Marketing

Amazon has always adhered to the concept of "attracting customers by improving its own brand value and influence", and has done almost no brand marketing and promotion, resulting in Chinese users feeling unfamiliar with the Amazon brand. In contrast to other local competitors, such as JD.com and Alibaba Group Holding LTD's Taobao and Tmall, they have made full use of their media advantages to advertise and promote through television and other online platforms, attracting the attention of a large number of users.

6.2.3. Unreasonable Platform Interface Design

The interface of Amazon's e-commerce platform is too simple, with only the simplest product map and brief introduction, and it fails to give a comprehensive and prominent introduction to the product, which is not in line with the consumption habits of Chinese consumers. In addition, the page design is unreasonable, which makes consumers have to spend a lot of time to find the products they need, which brings bad shopping experiences to users, and reduces users' expectations of the Amazon platform.

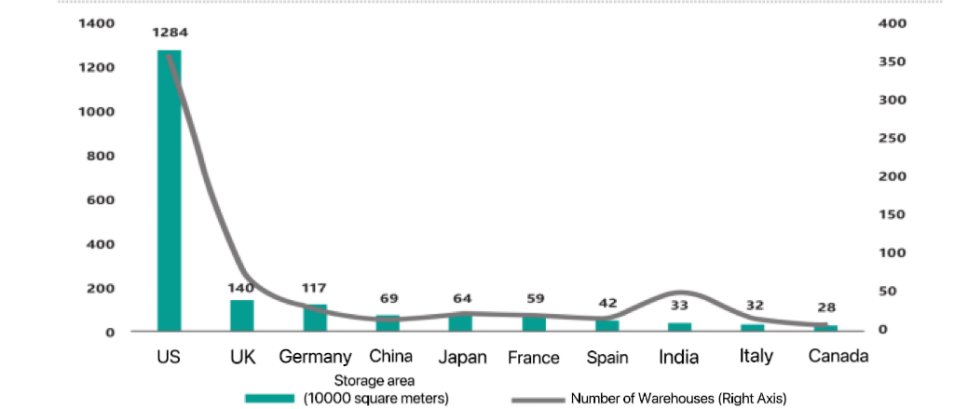

6.2.4. Slow Logistics

In warehousing, as shown in Figure 3, Amazon's warehouse distribution in China is relatively small in scale and coverage compared to its layout in other countries. In China, Amazon has opted to limit the amount of inventory it has and to allow a small number of sellers to make their own shipments. With the rapid development and gradually high efficiency of China's logistics industry, Amazon's third-party logistics is relatively slow compared with Jingdong's self-run logistics. Since logistics service is an important part of consumers' shopping experience, too slow logistics delivery speed will reduce consumers' shopping experience and gradually lose their patience in waiting for logistics delivery. Consumers then choose the e-commerce platform with more convenient and efficient logistics services for shopping, and give up Ma Yasun with relatively slow logistics delivery speed [10].

Figure 3: Warehouse distribution of Amazon [8]

6.2.5. There are Problems in Strategic Adjustment

In the face of fierce competition from e-commerce enterprises, Amazon's market share in China has been declining all the way, and its competitiveness is getting smaller and smaller. In the face of such a severe situation, Amazon did not quickly adjust its strategy to improve its market share, but began to expand high-end products and cut down some low-profit products and businesses, resulting in a continuous decrease in traffic.

6.2.6. Poor User Service Experience

As shown in Table 1, it can be seen that the Amazon platform has many problems in user registration, the purchase process and communication with sellers. In addition, service personnel have serious shortcomings in re-communication skills, which may not solve user problems well and reduce user satisfaction and experience.

Table 1: Satisfaction Index of various types of service content of Amazon export cross-border e-commerce in 2019 [13]

Question Type | The Number of "Yes" Replies | The Number of "No" Replies | Total Number of Replies | Satisfaction Index (SSR) |

Registration | 18421 | 5583 | 21004 | 87.70% |

Product Listing | 49289 | 26123 | 75412 | 65.36% |

Warehouse Logistics | 53145 | 23401 | 71546 | 74.28% |

Lost Goods | 17256 | 5889 | 23145 | 74.56% |

Accounting Payment | 22124 | 7021 | 32145 | 68.83% |

Other | 37611 | 8708 | 52319 | 73.29% |

6.2.7. The Rise of Competitors

The rise of competitors, such as Taobao, Tmall and Jingdong, has not only launched a series of strategies suitable for the characteristics of the Chinese market, but also introduced new sales methods and promotion strategies to attract a large number of users, used the advantages of localization to launch a series of strategies suitable for the characteristics of the Chinese market, and quickly occupied half of the Chinese e-commerce market.

6.2.8. Departure from Local Characteristics Consumption Day

Amazon China has never participated in special consumption day activities such as "618" and "Double 11". On the contrary, competitors, such as Taobao, JD.com and Tmall have actively prepared, based on a large number of discounts and surprise activities from customers, which not only increased traffic and profits, but also won a good reputation for the brand, increased market share and attracted a large number of users to register for the platform.

6.3. Exit from Local Business Impact

For consumers, the selectivity of e-commerce platforms is decreasing, especially for users who like to buy overseas goods. For competitors, the competitive pressure is reduced, and the market share is increased. For suppliers, sellers who rely on Amazon China need to find new sales channels and may face a sharp decline in sales, which is undoubtedly a challenge for them. For other multinational enterprises, Amazon's development in the Chinese market not only provides experience, but also has a reference significance, which helps other multinational enterprises to learn lessons, develop their strengths and avoid weaknesses, and continue to explore emerging markets.

7. Enlightenment and Reflection on the Case

7.1. Lessons from Amazon's Experience in the Chinese Market

For multinational enterprises, when entering an emerging market, they should fully understand the local politics, economy, culture and market demand, so as to better meet the needs of local customers and promote their own development in the emerging market. Secondly, in the face of fierce market competition and a complex market environment, enterprises should be flexible and adjust their strategic policies actively. Finally, localization of the brand should be made to enhance the user experience.

7.2. Implications for Multinational Enterprises

The development of Amazon China not only provides experience for other multinational enterprises, but also provides lessons for reference. In the development of the Chinese market, multinational enterprises should pay attention to compliance experience and actively adapt to policy changes. At the same time, multinational enterprises should strengthen cooperation with local enterprises and achieve common development through complementary advantages.

7.3. Development Trend of E-commerce

With the continuous development and progress of Internet technology, the industry has the following trends: live streaming with goods is rising step by step, becoming a new growth point; the omni-channel retail model that fully integrates online and offline is reshaping the shopping experience; big data and artificial intelligence are widely used, making marketing more accurate and efficient. These trends are not only changing the way consumers shop, but also creating new opportunities and challenges for businesses.

8. Conclusion

Through the case analysis of Amazon in the Chinese market, this paper deeply discusses the opportunities and challenges faced by multinational enterprises in emerging markets. The study found that Amazon's failure in the Chinese market was mainly attributed to the fierce market competition, the restrictions of policies and regulations, the lag of strategic challenges, and the inadaptability and incoordination of the management model and organizational structure. In addition, Amazon has not really fully integrated into the Chinese market. For example, the Amazon platform page design has not met the needs of Chinese users; it has never participated in the "Double Eleven" and other Chinese characteristics of the activity day, resulting in a large number of Chinese users lost to competitors. Through these experiences and lessons, this paper not only explores the reasons for Amazon's withdrawal from the Chinese market, but also provides valuable thinking for other multinational enterprises to enter the Chinese market.

Due to limited access to data, not all relevant factors are fully covered. Future studies can further focus on the strategic adjustment mechanism of emerging market MNCS and the far-reaching impact of the policy environment on their long-term operations, so as to provide more targeted analysis for MNCS. In addition, Amazon's supply chain management in the Chinese market is also weak; compared with local e-commerce, Amazon's logistics delivery service has experienced many twists and turns, and has always failed to meet consumers' expectations for rapid and high-quality service. This neglect of consumer rights and interests is undoubtedly one of the important reasons for the failure of its e-commerce business.

References

[1]. Anonymous. China's B2C market size ranks first in the world, but B2B is lower than the United States, Japan and South Korea, ranking only fourth? Baidu.com, 6 May 2021, baijiahao.baidu.com/s?id=1699003174428298262&wfr=spider&for=pc.

[2]. TMT E-commerce and Logistics Group. Iresearch. Www.iresearch.com.cn, 26 Jan. 2024, www.iresearch.com.cn/Detail/report?id=4302&isfree=0.

[3]. Qiang Song. Zhihu Yanxuan | the current situation and development trend of e-commerce in China. Zhihu.com, 2011, www.zhihu.com/market/paid_magazine/1645539965512802304/section/1645540011268341760?origin_label=search.

[4]. Bo Wang, An Guo. The Implications of Amazon's Failure in China's Retail E-commerce Market. Weifang, Shandong: Weifang New Economy Research Society, 202:20-25.

[5]. Piao Yan. China's entry into mobile e-commerce retail market share exceeds 70%. China New Communications, 2008:37.

[6]. China Report Hall. 2016 China Online Shopping Consumption Analysis: Tmall Taobao Market share Leading _ Report Hall. Chinabgao.com, 2016, m.chinabgao.com/freereport/75421.html.

[7]. Daiqing Mo. Tmall monopolizes B2C trading market share of 57.7% followed by Jingdong Suning. Computer and Network, 2015:13.

[8]. Xing Meng. Amazon's e-commerce withdrawal from China: Market failure or strategic Adjustment. China Industry and Information Technology, 2019:26-33.

[9]. Yaning Shao, Meidai Chen, Xiaojun Sheng. Comparative analysis of e-commerce enterprises' competitive strategies based on SCP perspective: A case study of Dangdang and Amazon (China). Economic and Trade Practice, 2016:208-211.

[10]. Shujie Yao, Yongyao Chen. Research on Price Competition, Differentiation Competition and Competitive Strategy Decision of Chinese E-commerce Platform -- Game Analysis based on Amazon's “losing” Chinese market. Journal of Honghe University, 2022:101-107.

[11]. National Laws and Regulations Database. Foreign Trade Law of the People's Republic of China-Related Laws to Promote high-quality Development Laws and Regulations _ Quanzhou Bureau of Justice. Quanzhou.gov.cn, 2024, sfj.quanzhou.gov.cn/xxgk/ztzl/ldgbyzh/flfg/gzlfz/202410/t20241031_3099768.htm.

[12]. Jinyuan Lu. SWOT Analysis of Amazon's cross-border e-commerce platform development in China. China Storage and Transportation, 2022:160-161.

[13]. Qiaoqin Su, Xiuyue Tan, Mengting Zhao. Research on the status quo and improvement strategy of Chinese sellers' satisfaction in Amazon cross-border E-commerce. Business Situation, 2025:41-43.

Cite this article

Tan,W. (2025). Amazon's Collapse in the Chinese Market: Reasons and Implications. Advances in Economics, Management and Political Sciences,171,58-67.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Anonymous. China's B2C market size ranks first in the world, but B2B is lower than the United States, Japan and South Korea, ranking only fourth? Baidu.com, 6 May 2021, baijiahao.baidu.com/s?id=1699003174428298262&wfr=spider&for=pc.

[2]. TMT E-commerce and Logistics Group. Iresearch. Www.iresearch.com.cn, 26 Jan. 2024, www.iresearch.com.cn/Detail/report?id=4302&isfree=0.

[3]. Qiang Song. Zhihu Yanxuan | the current situation and development trend of e-commerce in China. Zhihu.com, 2011, www.zhihu.com/market/paid_magazine/1645539965512802304/section/1645540011268341760?origin_label=search.

[4]. Bo Wang, An Guo. The Implications of Amazon's Failure in China's Retail E-commerce Market. Weifang, Shandong: Weifang New Economy Research Society, 202:20-25.

[5]. Piao Yan. China's entry into mobile e-commerce retail market share exceeds 70%. China New Communications, 2008:37.

[6]. China Report Hall. 2016 China Online Shopping Consumption Analysis: Tmall Taobao Market share Leading _ Report Hall. Chinabgao.com, 2016, m.chinabgao.com/freereport/75421.html.

[7]. Daiqing Mo. Tmall monopolizes B2C trading market share of 57.7% followed by Jingdong Suning. Computer and Network, 2015:13.

[8]. Xing Meng. Amazon's e-commerce withdrawal from China: Market failure or strategic Adjustment. China Industry and Information Technology, 2019:26-33.

[9]. Yaning Shao, Meidai Chen, Xiaojun Sheng. Comparative analysis of e-commerce enterprises' competitive strategies based on SCP perspective: A case study of Dangdang and Amazon (China). Economic and Trade Practice, 2016:208-211.

[10]. Shujie Yao, Yongyao Chen. Research on Price Competition, Differentiation Competition and Competitive Strategy Decision of Chinese E-commerce Platform -- Game Analysis based on Amazon's “losing” Chinese market. Journal of Honghe University, 2022:101-107.

[11]. National Laws and Regulations Database. Foreign Trade Law of the People's Republic of China-Related Laws to Promote high-quality Development Laws and Regulations _ Quanzhou Bureau of Justice. Quanzhou.gov.cn, 2024, sfj.quanzhou.gov.cn/xxgk/ztzl/ldgbyzh/flfg/gzlfz/202410/t20241031_3099768.htm.

[12]. Jinyuan Lu. SWOT Analysis of Amazon's cross-border e-commerce platform development in China. China Storage and Transportation, 2022:160-161.

[13]. Qiaoqin Su, Xiuyue Tan, Mengting Zhao. Research on the status quo and improvement strategy of Chinese sellers' satisfaction in Amazon cross-border E-commerce. Business Situation, 2025:41-43.